Unit Protocol: The Asset Tokenization Layer on Hyperliquid

Introduction

Unit is a protocol that enables non-native asset issuance on the Hyperliquid chain through a lock-and-mint based bridging system. Its primary function is to allow users to deposit and withdraw assets like Bitcoin, Ethereum, and Solana directly to and from Hyperliquid.

The protocol's architecture is built around two main components: the Guardian Network and the Agent system. The Guardian Network consists of distributed operators running nodes on each supported blockchain, processing deposits and withdrawals through a leader-based consensus mechanism. The Agent component implements the core protocol functionality and manages the MPC TSS wallet that distributes private key shares across multiple parties, enhancing security by eliminating single points of failure.

Unit allows users to trade non-Hyperliquid native spot tokens through a lock-and-mint based system. Users can deposit their assets into designated addresses generated by the Guardian network, which then mint equivalent spot assets on the Hyperliquid chain after transaction verification.

The relationship between Unit and Hyperliquid is symbiotic. Unit serves as the critical infrastructure that enables Hyperliquid to expand beyond perpetual futures trading into spot markets. This expansion is crucial as it allows Hyperliquid to offer a complete trading ecosystem where users can engage in both spot and derivatives trading within a single platform.

Therefore, Unit is particularly important for Hyperliquid. Based on analysis of major centralized exchanges (covered in detail below), spot trading typically accounts for approximately 18% of perpetual futures volume for major assets like Bitcoin and Ethereum. This suggests that Unit's integration could lead to a significant increase in Hyperliquid's trading volume. Moreover, the ability to offer spot trading opens up new possibilities for sophisticated trading strategies such as funding rate arbitrage and delta-neutral strategies.

The protocol's architecture emphasizes security and reliability through multiple layers of verification. Transactions are processed through a deterministic state machine, ensuring predictable and auditable outcomes.

The consensus mechanism requires a threshold of 2 out of 3 Guardians (for now) to agree on critical operations, while the MPC wallet system enhances security by distributing key management across multiple parties. These security measures are further strengthened by the use of secure enclaves and encrypted communications between network operators.

In essence, Unit is crucial for Hyperliquid's future development, enabling it to compete more effectively and efficiently with centralized exchanges while maintaining the benefits of decentralization and self-custody. Understanding Hyperliquid's framework is essential to understanding how Unit can effectively integrate with both the CLOB and EVM systems to enable spot asset issuance.

Hyperliquid Overview

Hyperliquid is a perpetual trading protocol built on its own L1 that aims to replicate the user experience of centralized exchanges while offering a fully onchain order book and decentralized exchange to trade spot, derivatives and prelaunch markets.

Hyperliquid announced in May 2024 its planned support for a native EVM, enabling direct compatibility with Ethereum smart contracts, wallets, and bridges. While Hyperliquid operates its own network and Rust-based virtual machine—the Hyperliquid L1—this system specifically handles perpetual trading and lacks the programmability and generalization of an EVM.

The EVM integration will create a symbiotic relationship between these systems. Hyperliquid will feature two distinct virtual machines operating on a single consensus layer, HyperBFT. The Hyperliquid L1 will continue managing core trading functions, including perpetual and spot order books, while the EVM will serve as a separate layer for auxiliary applications that prioritize flexibility over performance.

The enhanced EVM will integrate with native Hyperliquid L1 components—including HIP-1 assets, spot trading, perpetual trading, and DeFi primitives—enabling atomic composition and seamless value transfer between environments.

With the EVM launch, Hyperliquid will expand into a more generalizable chain, requiring robust bridging capabilities for non-native assets to support trading, custody, borrowing, lending, and DeFi applications. A diverse pool of high-liquidity assets like BTC, SOL, and ETH is essential for DeFi functionality. Unit addresses this need by enabling users and institutions to bridge non-native assets to the Hyperliquid EVM for DeFi integration and trading.

To build a perpetual DEX capable of matching the speed and user experience of CEXs, Hyperliquid designed a high-performance Layer 1 blockchain from the ground up. This L1 utilizes a Proof-of-Stake (“PoS”) model combined with Hyperliquid’s proprietary HyperBFT consensus algorithm to deliver low latency and high throughput. Several core components of the L1 architecture are crucial to achieving CEX-level UI/UX, speed, and transaction throughput.

The perpetual platform has become widely successful, trading over $888,044,442,040 from 360,000 traders. In recent weeks, the platform is averaging over 1.45 billion in daily volume and commands 70% of DeFi derivative volume. The creation of new perpetual markets on the Hyperliquid L1 is trivially easy with the only prerequisite being that a suitable oracle price feed can be referenced to keep the perpetual future in line with the index price. This has enabled Hyperliquid to move at breakneck speed when adding perpetual markets to their platform. However, non-native spot markets on Hyperliquid present a whole new challenge, with considerable security and UX considerations. Unit aims to solve these problems.

Hyperliquid Protocol Mechanics

Before we explore Unit’s design and the trends we are seeing in the CEX space, it makes sense for us first to explore the core component of Hyperliquid and how it functions from both a perpetual and native spot market standpoint:

Orderbook & Clearing House

The L1 state includes both margin and matching engine data, ensuring complete transparency across the exchange. A key feature of Hyperliquid is that the L1 state also maintains an order book for each asset, operating much like those on centralized exchanges, with orders matched based on price-time priority.

The order book interacts with the clearing house, which manages all positions and margin checks. Margin checks occur when a new order is placed and again for the resting side when an order is matched, ensuring consistency in the margin system, even if the oracle price fluctuates after the resting order is placed.

Deposits are initially credited to an address's cross-margin balance, and by default, positions are opened in cross-margin mode. However, isolated margin is also available, allowing users to allocate specific margin to a single position, reducing the risk of liquidation for that position without affecting others. Similarly, the spot clearinghouse manages the spot user state for each address, including token balances and any holds.

Oracle Pricing

Hyperliquid makes use of custom built oracles as part of the consensus of the chain so that prices are accurate on the exchange, even in the absence of deep liquidity. Validators update spot oracle prices every 3 seconds, which are used to calculate funding rates and the mark price. The mark price, critical for margin calculations, liquidations, and triggering TP/SL orders, is determined by combining the oracle price with a 150-second exponential moving average (EMA) of the difference between Hyperliquid's mid-price and the oracle price. To ensure accuracy, the oracle prices are based on a weighted median of major exchange spot prices, including Binance, OKX, Kraken, Bybit, and Kucoin. The final oracle price is further refined by weighting validators' submissions according to their stake.

This system provides an unbiased and resilient price estimate, independent of Hyperliquid's internal markets. In cases of extreme volatility or disruptions in CEX data, a price protection mechanism is activated, relying on the median of the best bid, best ask, and last trade prices until normal conditions return.

Maintenance Margin

Users can set leverage to any integer between 1 and the asset's max leverage (3x-50x). The required margin to open a position is calculated as position_size * mark_price / leverage.

For cross-margin positions, the initial margin is locked and cannot be withdrawn, while isolated positions allow margin adjustments after opening. Unrealized PnL for cross-margin positions automatically contributes to the margin for new positions, whereas for isolated positions, unrealized PnL increases the margin for the existing position. Users can increase leverage on open positions without closing them, but leverage is only checked when opening a position.

If a position has negative unrealized PnL, possible actions include partially or fully closing the position, adding margin (for isolated positions), or depositing USDC (for cross-margin positions).

Liquidations

Liquidations on Hyperliquid are based on the mark price, which integrates external CEX prices with Hyperliquid's order book state. This approach ensures liquidations are more reliable and less susceptible to manipulation compared to relying solely on a single, instantaneous book price.

A liquidation event occurs when a trader's positions move against them to the point where the account equity falls below the maintenance margin. For more information on Hyperliquid’s mechanics you can read our full research report.

Native Spot Markets

On April 16th, the Hyperliquid team expanded their ecosystem to include native spot assets alongside their perpetual orderbook. HIP-1: Hyperliquid Spot Deployments created the native token standard on the L1, similar to the ERC20 standard on Ethereum. HIP-1 allows for the deployment of a capped supply of fungible tokens, alongside a native onchain orderbook. The first coin launched with this standard was PURR, a cat-themed memecoin deployed by the Hyperliquid team.

Token deployment occurs on-chain and is a 5 step process, requiring 5 transactions to be made by the deployer on the L1. Those transactions will specify the following:

Name: human readable, maximum 6 characters, no uniqueness constraints.

weiDecimals: the conversion rate from the minimal integer unit of the token to a human-interpretable float. For example, ETH on EVM networks has `weiDecimals = 18` and BTC on Bitcoin network has `weiDecimals = 8`.

szDecimals: the minimum tradable number of decimals on spot order books. In other words, the lot size of the token on all spot order books will be `10 ** (weiDecimals - szDecimals)`. It is required that `szDecimals + 5 <= weiDecimals`.

Max Supply: the maximum and initial supply. The supply may decrease over time due to spot order book fees or future burn mechanisms.

initialWei: optional genesis balances specified by the sender of the transaction. This could include a multisig treasury, an initial bridge mint, etc.

anchorTokenWei: the sender of the transaction can specify existing HIP-1 tokens to proportionally receive genesis balances.

hyperliquidityInit: parameters for initializing the Hyperliquidity for the USDC spot pair. See HIP-2 section for more details.

Users can transfer USDC from the perpetual subaccount into their spot account to trade any HIP-1 asset. All spot markets trade against USDC and since they are native spot tokens, they reside on the Hyperliquid L1.

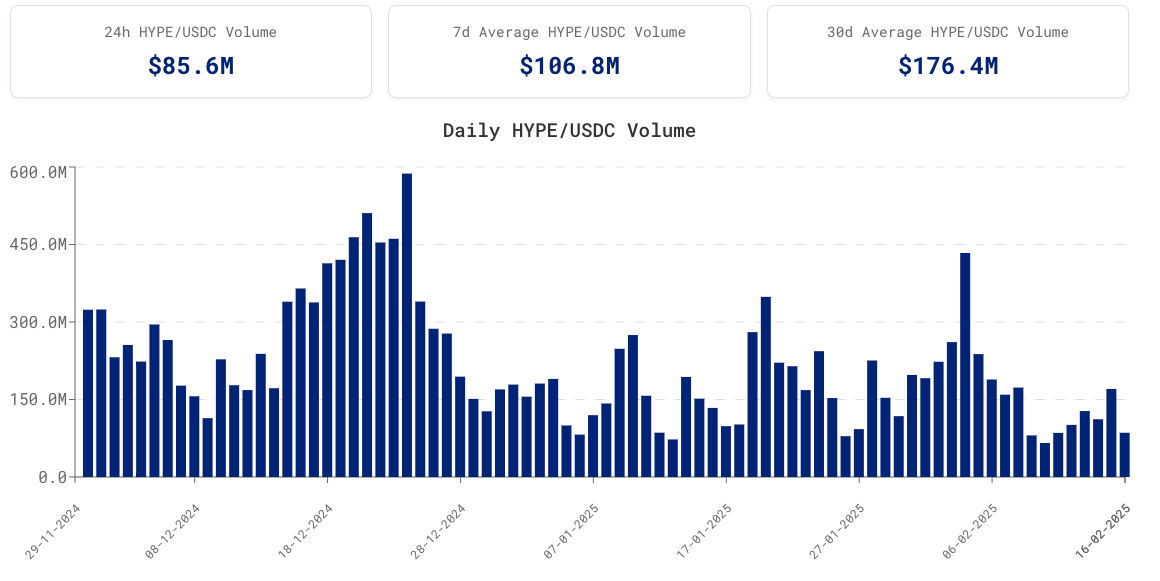

These spot markets have performed extremely well post HYPE TGE, both in terms of returns but also volume. The HYPE/USDC pair has averaged $240.3M daily volume since launch, generating both significant fees for the platform as well as permanently burning HYPE.

However, the current universe of tradeable spot assets on Hyperliquid is very limited, with tokens only tradeable if they launch via the auction mechanism and deploy directly onto the Hyperliquid L1. Taking a look at the spot ecosystem, we see that HYPE currently makes up 90.3% of the total circulating market capitalization of tokens trading and over 85% of the daily volume.

In order for the Hyperliquid spot markets to supercharge their growth, non-native assets must be tradeable on the exchange such as Bitcoin, Ethereum & Solana. This would greatly increase the spot volume Hyperliquid processes and would enable a decentralized, self-custodial way for users to trade core crypto assets, as well as enabling interesting unlocks for traders in the form of cross collateral & margin utilization.

CEX Industry Overview

It is well known that In traditional stock markets, derivatives trading volumes often far exceed spot market volumes. Derivatives provide traders with leverage, enabling them to control larger exposures with smaller capital, while also offering tools for speculation and hedging that require less upfront investment and greater flexibility, such as shorting and combining complex strategies. When we look at U.S. Markets (e.g., NYSE, CME), derivatives trading volume can be 10–20 times higher than the spot market volume.

This fact remains true in crypto as we see perpetual futures volumes trade at an average of 3.69x more than spot. However, spot markets are extremely important for a number of reasons:

Price Discovery - The spot price acts as the benchmark for all derivative products, including futures, options, and perpetual swaps. Spot prices are used to calculate the index price, which ensures perpetual futures and other derivatives stay aligned with the actual market value.

Liquidity - They enhance liquidity, which is critical for price stability and efficient market functioning.

Settlement - Many derivatives contracts (e.g., physically settled futures) require actual delivery of Bitcoin, which is facilitated through the spot market.

Hedging / Arbitrage - Traders use spot markets to hedge risk from derivative positions, minimizing exposure to price volatility. Arbitrageurs rely on price discrepancies between spot and derivatives markets to maintain market efficiency.

DeFi - Having the non-native majors major crypto assets with spot orderbooks will enable the seamless interaction with HyperEVM for collateralized lending projects or Ethena style decentralised stablecoins, amongst other things.

Long Term Holdings - Spot markets are essential for long-term investors who prefer holding actual Bitcoin as a store of value over speculative positions in derivatives.

Capital Efficiency - Usage of cross-collateral and the introduction of coin-margined positions would allow traders and market makers to achieve significantly higher capital efficiency.

Oracle Truth Pricing - Binance currently serves as the benchmark for the 'fair price' of most crypto assets, particularly major ones, due to its deep liquidity and dominance among market makers. As a result, Binance pricing plays a crucial role in ensuring market efficiency across exchanges. Historically, price discovery has primarily occurred on Binance. However, for the first time, there is an opportunity to shift fair pricing and price discovery to a fully decentralized exchange.

We can now explore how Unit is bringing these native assets to Hyperliquid, taking a look at the protocol mechanics and user workflow.

Protocol Mechanics

Asset Issuance vs. Bridging

Typically, when we think of bridging across chains and networks, we think of two different types of bridging. The first involves non-native asset issuance, where users or institutions issue assets on chains where they did not originate. This process introduces new non-native assets, requiring underwriters to manage risk and handle asset custody through locking/burning on the source chain and issuing/minting on the destination chain. Common implementations include:

Lock-and-mint systems: assets are locked in smart contracts on the native chain and minted on the destination chain.

Burn-and-mint systems: assets are burned on the native chain and minted on the destination chain This approach typically requires new token or asset standards.

The second category, intents-based bridging, functions more like crosschain trading, where users sell assets on one chain and purchase them on another.

Unit allows users to deposit and withdraw non-native spot assets to Hyperliquid through a lock-and-mint based system. Deposits and withdrawals are handled by a Guardian/Agent Network.

Transaction Flow

When users deposit non-native spot assets to Hyperliquid through Unit, the Guardian network generates or assigns a deposit address. For example, for SOL deposits, the Guardian network creates or provides an existing SOL deposit address on the Solana blockchain. Each deposit address generated by the Guardian Network is permanently and uniquely tied to a specific Hyperliquid address. Any future transfers made to this deposit address will always be credited to the same destination address on Hyperliquid.

Users transfer their spot assets to this designated deposit address. Once the transaction finalizes, the Guardian network mints the equivalent native asset on the Hyperliquid chain and transfers it to the user's wallet. This transfer transaction requires validation from the Hyperliquid network. Importantly, Unit does not collect revenue from deposits or withdrawals. The only fees associated with operations are those required to process transactions on their respective native networks.

For withdrawals, the process is the same as deposits, except the Guardian network creates a withdrawal address, and users specify a destination address to receive their withdrawn assets.

Below is an example of a user depositing and withdrawing native SOL to/from Hyperliquid:

Deposits:

Address Generation: The Guardian Network generates or assigns a dedicated SOL deposit address and provides it to the user

Transfer: User sends SOL from their external wallet to the provided deposit address.

Verification: Guardian Network monitors the transaction until it achieves finality

Settlement: Guardian Network signs a spot transfer for the deposited amount, Hyperliquid network validates the transaction and the equivalent native SOL is credited to user's Hyperliquid wallet

Source: Hyperunit

Withdrawals:

Destination Setup: User provides their external SOL destination address where the withdrawn funds will be sent

Address Generation: Guardian Network generates a Hyperliquid withdrawal address and provides it to the user

Transfer: User sends their Hyperliquid SOL to the provided withdrawal address

Verification: Guardian Network monitors the Hyperliquid transaction until it achieves finality

Settlement: Guardian Network signs and broadcasts the SOL transaction to the Solana network, and funds are credited to user's specified destination address

Source: Hyperunit

Unit consists of two core components:

The Guardian Network: a network of operators running nodes on each chain enabling deposits and withdrawals through Unit

Agent: the core protocol implementation containing both the fundamental logic and MPC TSS wallet that distributes private key shares across multiple parties rather than using a single private key

The protocol depends on nodes and indexers to verify transaction inclusions, alongside a compliance layer.

Guardian Network

The Guardian network functions as a distributed network of operators running nodes on each chain that processes deposits and withdrawals through Unit. These operators also run an Agent, which implements the core Unit protocol functionality.

The Guardian network operates through a leader-based consensus mechanism. The designated leader coordinates guardians and executes the state-transition function, managing transaction flow, while other guardians serve as verifiers. These verifier guardians (followers) monitor sign requests from the leader, independently verify them, and return signatures to the leader.

All guardians must operate both nodes and indexers on every chain that supports Unit deposits and withdrawals. Leaders have additional responsibilities, including running the relay server to coordinate MPC operations with other guardians (verifiers/followers).

The relay server functions solely as a message-passing mechanism and does not introduce additional cryptographic assumptions or security risks. Importantly, no key material resides on the relay server, ensuring that even if compromised, it cannot impact the security of private keys or signing operations.

Additionally, Guardians collectively maintain circuit-breaker policies that can automatically pause operations if suspicious or malicious activity is detected. This emergency safeguard allows the network to halt processing until security concerns are resolved, providing an additional layer of protection against attacks.

Agent

Agent is the core protocol implementation containing both the fundamental logic and MPC TSS wallet that distributes private key shares across multiple parties rather than using a single private key.

Each guardian has to run an independent Agent instance, which participates in a 2 of 3 MPC setup. This setup will be expanded in the future.

The agent instance is made up of four key components:

Chain Services

Flow Manager

Consensus Service

Wallet Manager

Chain Services

Chain services enable chain-specific interfaces for monitoring and tracking network activity and transaction management. Through these interfaces, guardians can track user deposits and relevant transactions, verify when transactions reach finality, confirm necessary transaction validations, and manage the building, signing, and broadcasting of transactions across their respective blockchains.

Flow Manager

The flow manager uses deterministic state machines for crosschain asset transfers. Deterministic state machines in this context refer to how the system can only be in one state at a time and each transition to a new state is completely predictable based on the current state and input. They allow the protocol to ensure that every transfer follows a predetermined path.

For example, when/if moving BTC to HYPE, the transfer can only be in one state at a time (like AWAITING_DEPOSIT, CONFIRMING_BITCOIN, or MINTING_HYPE) and when Bitcoin is detected in the deposit address while in AWAITING_DEPOSIT state, it will always predictably transition to CONFIRMING_BITCOIN state to wait for network confirmations. For Bitcoin deposits specifically, the protocol requires 2 block confirmations on the Bitcoin network before considering the transaction finalized and proceeding with the settlement process.

The system implements rigorous auditability measures where all state transitions are stored and logged, creating comprehensive audit trails for transparency. Chain-specific verification processes ensure cross-chain transaction finality through specialized validation mechanisms for each supported blockchain.

The flow manager validates transactions (by checking deposit and withdrawal addresses and transaction/payload parameters), ensures proper transaction ordering, coordinates with the consensus service and oversees asset transfers.

Consensus Service

The consensus service ensures that Guardians come to consensus regarding protocol operations, deposits, and withdrawals, and enables the protocol to synchronize state across Guardians. It uses a leader-based model, where leaders must go through the transaction flow while the rest of the Guardians act as verifiers/followers. Initially, there will be a single leader - eventually the protocol will implement a leader election process. Additionally, the consensus service requires a threshold of 2 out of 3 Guardians to come to consensus for critical network operations.

The protocol employs rate-limited endpoints to prevent denial-of-service attacks and includes circuit-breakers which can halt operations if a Guardian is compromised.

Wallet Manager

The wallet manager generates keys through an MPC setup with a threshold signature scheme, where no single party has access to the complete private key. This system splits the private key into multiple shares distributed across different parties or devices, instead of using a single private key. In addition to storing and generating keys, the MPC setup allows guardians to sign transactions and manage addresses across different chains. The MPC setup is executed in secure enclaves - specifically AWS Nitro Enclave.

The MPC operations are executed within Secure Enclaves for enhanced runtime security. Secret shares are encrypted using native KMS (“Key Management Service”) features for storage, while all communications between network operators are secured through end-to-end encrypted channels.

The Future of Hyperliquid Spot

The introduction of native spot assets in a trustless and decentralized way is the evolution of on-chain trading and the endgame for crypto trading. Unit will enable any user around the world to buy and sell native crypto assets whilst enjoying the benefits of self-custody and superior UX coming from Hyperliquid performant orderbook. To take a quote from Satoshi “I think this is the first time we’re trying a decentralized, non-trust-based system” and I would add, with comparable UX to centralized competitors.

What does spot do in terms of truly unifying the experience of trading in a single place?

Trading venues which offer both spot and derivatives markets offer a more unified trading experience, which can enhance capital efficiency (allowing cross-margining), risk and order management, and trading opportunities (in particular for basis trading and funding rate arbitrage):

Position and Order Management

There's a single source of truth for positions, meaning that users don't have to reconcile their positions across multiple exchanges. Complex order types are easier to manage, orders are easier to cancel, modify and manage, and traders experience lower latency since they do not have to deal with multiple exchanges.

In addition, traders only need to learn and integrate one API, which simplifies order management, key management and further reduces complexity.

Capital Efficiency and Cross-Margining

Users can use their spot holdings as collateral for futures positions, reducing the total capital needed and increasing capital efficiency. In an EVM environment, this can also allow for users/traders to earn yield on spot holdings while they serve as collateral - and allows traders to not have to sell to get futures exposure.

Exchanges typically consider the entire portfolio (spot + futures) when calculating margin requirements, where long spot positions can offset short futures positions in margin calculations. This reduces total collateral needed, compared to having separate accounts on different exchanges.

Arbitrage Opportunities

Having both markets on one platform allows users to capitalize on price discrepancies between spot and futures markets more efficiently, with lower transaction costs and no need to transfer funds between exchanges.

For basis trading, when price discrepancies arise, traders can execute both legs of the trade quickly on a single exchange, without delays from transferring funds between platforms. Additionally, the lower transaction costs from trading on one exchange make it profitable to capture smaller spreads.

For funding rate arbitrage, including cash and carry trades, traders can maintain spot positions while simultaneously shorting perpetual futures, allowing them to collect funding payments while remaining delta neutral. Having both positions on the same exchange significantly streamlines position management and monitoring.

Market making becomes more effective when operating across both spot and futures markets on a single exchange. Traders can provide liquidity in both markets while performing real-time arbitrage between order books. The unified view of their inventory makes position management more efficient, and spot holdings can serve as backing for futures market making activities.

Flash arbitrage opportunities can be captured more effectively when trading both spot and futures on one exchange. Traders can quickly act on momentary price dislocations between these markets without worrying about cross-exchange transfer delays. The single fee structure lowers the minimum profitable spread for these trades, while the unified execution environment ensures better fill rates.

Lower transaction costs

Most exchanges offer fee discounts based on total trading volume. Consolidating spot and futures trading on one platform helps reach higher volume tiers for better rates for users and traders.

Simplified accounting and tax reporting

Having all trades on one platform makes it easier to track positions, calculate P&L, and prepare tax documentation.

Volume Implications

From a volume standpoint, the introduction of native spot markets is expected to provide an immediate boost to Hyperliquid’s daily trading volume and, consequently, the fees it generates. Analyzing the spot-to-perpetual volume ratios observed on leading centralized exchanges such as Binance, Bybit, and OKEx, we find that spot volumes, on average, account for approximately 27.02% of perpetual futures volumes. While this highlights the stronger preference for trading perpetuals, it may also be influenced by the disparity in the number of spot markets listed compared to perpetual markets.

It would make sense that the volume on Hyperliquid would increase by at least 25% if they were able to list a similar number of non-Hyperliquid native spot markets as they have done for perpetuals. This is something Unit aims to do over the long term, however, we imagine there will be a gradual rollout of non-Hyperliquid native assets, starting with BTC, ETH and SOL, as there is significant lead time required to build the infrastructure to onboard various assets.

If we look at just BTC and ETH spot and perpetual futures volume on some of the largest CEX’s, we see that spot volume runs at roughly 10-20% of perpetual volume. Taking a volume weighted average, we find that spot volumes are roughly 18% of perpetual volumes for both BTC & ETH.

It makes sense therefore that if Unit added spot BTC and ETH to Hyperliquid, we would see at least an 18% increase in the total BTC and ETH volume on Hyperliquid (i.e 18% of BTC Hyperliquid perpetual volume).

Over the past month, the Hyperliquid BTC perpetual market has averaged a daily trading volume of 21,413 BTC. Assuming the current spot-to-perp volume ratio of 18% holds, this implies an immediate increase in BTC trading volume on Hyperliquid's spot market (BTC/USDC) by approximately 3,854.34 BTC per day, equivalent to ~$350M at current prices.

Similarly, the ETH perpetual market on Hyperliquid has recorded an average daily volume of 550,136 ETH over the past month. Extending the same 18% ratio, we estimate that Hyperliquid’s ETH spot markets could see a daily trading volume of roughly 99,024 ETH, or ~$272M at current prices.

Whilst this approach compares centralised exchange spot and perpetual volume and makes a simple comparison to where Hyperliquid perpetual volumes are currently at, it fails to recognise that Hyperliquid may not be at feature parity with say Binance in terms of cross collateral and margin utilization. The next section will explore how the integration of native spot assets on Hyperliquid can create a multiplicative effect on both perpetual and spot volume.

Collateral & Margin Implications

When opening a position, the default setting is cross margin, which maximizes capital efficiency by sharing collateral across all other cross margin positions. Currently, perpetual contracts on the platform utilize a single primary margining style: USDC margining for USDT-denominated linear contracts. In this setup, the oracle price is based on USDT, while collateral is held in USDC. This approach balances liquidity and accessibility effectively.

For assets whose primary source of liquidity is denominated in USDC, the oracle price is also based on USDC. At present, the only USDC-denominated perpetual contracts are PURR-USD and HYPE-USD, both of which use Hyperliquid spot markets as their most liquid oracle source.

There exists a few ways for Hyperliquid to reach feature parity with CEX’s in terms of collateral & margin mechanisms:

Cross-margin using spot holdings, as well as a user's perpetual positions.

Expanding the margin collateral beyond just USDC.

The addition of non-Hyperliquid native spot assets and these two margin mechanisms would enable coin-margined perpetual trading. The underlying crypto spot asset (e.g., Bitcoin) would serve as both the margin and settlement currency. In these contracts, traders must provide the crypto as collateral, and all profits and losses are settled in the same crypto asset. This structure is particularly appealing to investors with a strong conviction in the long-term value appreciation of their spot holdings. By using spot Bitcoin as collateral for perpetual positions—rather than converting to stablecoins—traders can capitalize on the PnL generated from these positions, effectively increasing their crypto holdings and enhancing their long-term portfolio. Additionally, coin-margined contracts enable long-term holders to hedge against price declines without liquidating their assets or converting to fiat or stablecoins.

The popularity of coin-margined derivatives becomes evident when examining the relative open interest of stablecoin-margined and coin-margined products across major exchanges, including Binance, OKEx, Bybit, Deribit, and Huobi. As of today, stablecoin-margined perpetuals account for 220k BTC (>$20.04 billion) in open interest, compared to 71k BTC ($7.54 billion) for coin-margined products.

Over the past year, Bitcoin coin-margined contracts have maintained a consistent open interest, ranging between 35% and 45% of the open interest in Bitcoin stablecoin-margined contracts. This steady demand underscores the market's appetite for coin-margined derivatives. With this context, the introduction of coin-margined derivatives on Hyperliquid is likely to drive a meaningful increase in open interest, liquidity, and trading volume. If we assume similar open interest and volume ratios to those observed on centralized exchanges, Hyperliquid could experience approximately a 40% uplift in both metrics, significantly enhancing its market depth and activity.

Although coin-margined contracts have maintained consistent open interest, we typically see them continue to exist for only a few tokens, usually large assets such as BTC and ETH, and sometimes BNB and TRX, as well as a handful of large caps for isolated instances (e.g. SHIB/DOGE pairs).

Major exchanges like Binance, OKX, and Bybit have developed sophisticated risk models over years, which they use to assess collateral value based on:

- Liquidity: How easily can the asset be sold in large amounts

- Historical volatility: How much does the price swing

- Market depth: How much slippage in big moves

- Market capitalization and trading volume

Large-cap assets such as BTC and ETH typically receive preferential trading terms (higher LTV) due to their superior liquidity profiles and price stability characteristics. Secondary tier assets like BNB, while maintaining significant market capitalization, are subject to more conservative parameters (lower LTV) given their elevated volatility metrics, reduced market depth, and lower trading volumes.

Despite the inclusion of assets like BNB as the quoted asset in coin-margined markets, adoption has been limited. For example, USD perpetuals show strong volume for Avalanche (433.1M), while USDT perpetuals demonstrate highest adoption in Sui (7.8B) and Tron (25.4B) trading. USDC perpetuals consistently demonstrate lower volumes across all assets.

The volumes are notably small - Solana leads with just 690.3K in BNB volume compared to its total USD-stablecoin volume of 12.5B, followed by Sui (3.2M vs 12.7B total), Tron (20M vs 50.7B total), and Avalanche (155.2K vs 834.5M total). This represents less than 0.0002% of trading activity across all assets, indicating extremely limited market interest in BNB coin-margined contracts in their current form.

Funding Arbitrage

The addition of spot trading introduces several unique opportunities for users. Specifically, the inclusion of non-native Hyperliquid spot assets will allow seamless execution of futures basis trades. For example, a user can go long spot Bitcoin while shorting the BTC perpetual contract, earning hourly funding payments when the funding rate is positive. Enabling this strategy in a decentralized and self-custodial environment could attract significant trading volume to the platform, while also helping to moderate funding rates and promote more efficient market dynamics.

Furthermore, if Hyperliquid were to enable cross-collateral functionality and coin-margined contracts, users could leverage their spot BTC holdings as collateral while shorting the perpetual contract. This setup would significantly reduce the risk of liquidation on their short hedge, as the collateral value and the PnL from the short position would largely offset each other, providing a more stable and secure hedging mechanism.

Funding Arbitrage Vaults

Hyperliquid could introduce the ability to trade spot HIP-1 and select non-native spot assets directly from within vaults, potentially starting with a whitelist of approved assets. This functionality would pave the way for fully onchain, verifiable delta-neutral funding arbitrage vaults, offering a new level of transparency and efficiency for traders and investors.

Reverse Funding Arbitrage

The implementation of the EVM could unlock reverse funding arbitrage strategies during periods of negative funding rates on Hyperliquid perpetuals. Users could deposit USDC into a lending market on the EVM—or on the L1 if Hyperliquid introduces a native borrowing mechanism—borrow a spot asset, and short it on the spot order book. Simultaneously, they could take a long position on the perpetual contract, allowing them to capitalize on the funding payment generated by the negative funding rate.

Structured Products & Tokenized Vaults

The platform has the potential to attract substantial volume and OI through structured products, such as Ethena’s delta-neutral stablecoin. Notably, Shoku has already proposed designating Hyperliquid as an “eligible venue for a portion of its hedging flow,” which could significantly boost OI and trading volume as Ethena’s USDe stablecoin has grown to $5.9 billion in TVL. Additionally, several other teams are actively developing similar structured products, further amplifying the opportunity.

The launch of the EVM is also expected to bring new utility to vaults through the tokenization of assets. Funding vaults, the HLP vault, and user-created vaults can be tokenized, enabling trading and exchange on the HyperEVM. This innovation could spark the development of DeFi strategies centered around leveraging tokenized vaults, unlocking even greater flexibility and opportunity for users within the ecosystem.

Market Making

Currently, most top market makers leverage prime brokerage firms like FalconX, which enable cross-margining and collateralization across multiple exchanges. This approach allows for high capital efficiency, boosting trading volumes and improving the pricing they can offer on trades. When Hyperliquid enables collateralization of spot assets, it is likely to drive a substantial increase in open interest, liquidity, and trading volume, as market-making on both spot and perpetual markets becomes significantly more capital-efficient. Users can also benefit from tighter spreads as a result.

Options

Following their integration of spot and futures markets, it would make sense for Hyperliquid to integrate options trading (or for a protocol to build options trading atop Hyperliquid/HyperEVM), given that they already have a CLOB built to trade through - even though we've seen decentralized options volumes perform poorly in crypto compared to the giant in the room, Deribit.

Bringing in spot markets would help options trading on Hyperliquid by improving capital efficiency and execution speed. Additionally, it would allow traders to delta-hedge options using spot markets and enable real-time settlement.

On the other hand, options can be fully built on perpetual futures (like Deribit's model), as market makers can perfectly hedge using perps instead of spot, and settlement can be cash-based through the perps markets. Given that the dominant crypto options venues (Deribit, OKX, Binance) all function perfectly well without requiring spot for their options, the market has evolved around cash-settled derivatives, with most crypto options market making infrastructure and systems already built around futures/perps hedging. Despite the crypto derivatives market evolving to coalesce around cash-settled derivatives, some traders prefer spot markets over futures markets, especially if they may want exposure to the underlying asset.

Spot Delta Hedging

Delta-hedging options do not require spot markets. Traders can choose to delta hedge using futures/derivatives contracts instead of spot exposure, and may even be at an advantage since they can use less capital (through leverage). Despite this, spot markets can be helpful, given that some traders prefer them, and could benefit from the capital efficiency that comes with spot market integrations.

Delta refers to how much the price of an option changes in response to a $1 move in the underlying asset. For example, if an option has a delta of 0.5, its price will theoretically change by $0.50 when the underlying moves $1. To delta hedge, you take the opposite position in the underlying to offset this risk. For a long call with 0.5 delta, you'd short 0.5 units of the underlying. For a short call with 0.5 delta, you'd long 0.5 units of the underlying.

For example, if a user sells 1 BTC call option with 0.6 delta, they can buy 0.6 BTC immediately to spot delta hedge. If price rises and delta becomes 0.7, they can buy additional 0.1 BTC to remain delta neutral and can keep adjusting as market moves.

Spot markets allow for traders to use collateral across both spot and options positions, reducing the need for excess margin. In addition, if delta changes due to price movements, users who prefer hedging through spot markets can immediately execute hedge adjustments in the spot market, without the need to route orders through external venues, reducing slippage and execution risk.

Real-Time Spot Settlement

While crypto options are typically cash-settled through derivatives markets, having spot assets on the platform could enable the choice of "physical" settlement, where actual spot asset delivery occurs upon exercise.

For calls: The platform can transfer the underlying spot asset from the seller to the buyer

For puts: The platform can execute the spot sale at the strike price

Model growth in HL volume

Estimating the additional trading volume that Hyperliquid may process following the introduction of Bitcoin and Ethereum spot trading is challenging for several reasons. For one, drawing a direct comparison between CEX spot volume and perpetual volume fails to account for the differences in product offerings between Hyperliquid and traditional CEX platforms, as well as Hyperliquid’s current position in its development roadmap. We regard Hyperliquid as being in its early stages; at present, it still lacks key features—such as margining and cross-collateralization—that are essential for delivering a comparable experience to platforms like Binance, particularly for market makers and thus volume / liquidity.

However, we can develop a straightforward model to estimate Hyperliquid's volume following the addition of spot BTC and ETH, as well as coin-margined positions and cross-collateralization. This can be achieved by analyzing the current spot-to-perpetual volume ratios on CEXs.

First, we look at the average daily BTC perp volume on Hyperliquid and apply the 18% spot/perp volume ratio that we calculated earlier from averaging the spot/perp volumes of BTC and ETH and Bybit, Binance & Okex. This would generate an additional 3,854 BTC in daily volume for the BTC spot markets and 99,024 ETH for an annualized additional $231B of volume. We do however expect this to be the “end state”, with a significant lead time as people onboard native assets, MM’s get acquainted with the system and Hyperliquid roll out cross-margining and coin-margined positions.

Case study of FTX growth - using alts, margin / borrow in app

Despite its failure, FTX had a margin system where users could use spot alts, margin and borrowing, effectively and efficiently in app - which propelled the platform's growth. In general, FTX introduced two interesting margin mechanisms: a unified margin system and automated cross-margining, which both worked towards increasing trading volume and improving market depth on the exchange.

The unified margin approach puts all assets into a single collateral pool instead of separate wallets. When a trader held USD, BTC, and ETH, they could use all of these assets together as collateral for any position. This eliminated the problem of having capital stuck in different wallets or locked to specific trades.

The cross-margin system extended this by applying the same risk calculations across spot and futures positions. Instead of having different margin requirements for each type of trade, the system looks at the total position value. For example, a short position of 2 BTC at a $15,000 Bitcoin price counts as a $30,000 position, whether it's spot or futures. The margin requirements followed a standard calculation: initial margin is [(1.1/Collateral Weight) - 1] times the position size, with maintenance margin at [(1.03/Collateral Weight) - 1].

The automation of this system increased market activity. The automatic cross-margin system handles borrowing and collateral without requiring traders to manage it manually. When someone places an order or wants to withdraw, the system calculates needed borrowing, executes lending orders, and updates collateral requirements instantly. If a trader with $50,000 USD wants to sell 1 BTC without owning it, the system borrows the BTC and manages the new position (+$65,000 USD, -1 BTC) automatically.

This automation led to increased trading volume. When traders can use their assets as collateral while earning lending yields, they're more likely to keep assets on the platform and actively trade with them. This can create a feedback loop: more deposits increase the lending pool size, which enables more trading, which brings in more market makers and increases volume.

The capital efficiency improvements can also drive volume. Using a single collateral pool and automated borrowing means traders can use their capital more actively. They can trade multiple markets without moving funds around, and the system optimizes their margin usage continuously.

These mechanisms working together could lead to increased trading volume and market depth for assets. When unified margin and automatic cross-margin reduce trading friction, more trades tend to happen. Better liquidity and lending yields can attract more traders, and more traders typically mean more volume. This pattern of growing volume and market participation could help assets develop more mature, active markets.

What does spot do in terms of truly unifying the experience of trading in a single place?

Trading venues which offer both spot and derivatives markets offer a more unified trading experience, which can enhance capital efficiency (allowing cross-margining), risk and order management, and trading opportunities (in particular for basis trading and funding rate arbitrage):

Position and Order Management

There's a single source of truth for positions, meaning that users don't have to reconcile their positions across multiple exchanges. Complex order types are easier to manage, orders are easier to cancel, modify and manage, and traders experience lower latency since they do not have to deal with multiple exchanges.

In addition, traders only need to learn and integrate one API, which simplifies order management, key management and further reduces complexity.

Capital Efficiency and Cross-Margining

Users can use their spot holdings as collateral for futures positions, reducing the total capital needed and increasing capital efficiency. In an EVM environment, this can also allow for users/traders to earn yield on spot holdings while they serve as collateral - and allows traders to not have to sell to get futures exposure.

Exchanges typically consider the entire portfolio (spot + futures) when calculating margin requirements, where long spot positions can offset short futures positions in margin calculations. This reduces total collateral needed, compared to having separate accounts on different exchanges.

Arbitrage Opportunities

Having both markets on one platform allows users to capitalize on price discrepancies between spot and futures markets more efficiently, with lower transaction costs and no need to transfer funds between exchanges.

For basis trading, when price discrepancies arise, traders can execute both legs of the trade quickly on a single exchange, without delays from transferring funds between platforms. Additionally, the lower transaction costs from trading on one exchange make it profitable to capture smaller spreads.

For funding rate arbitrage, including cash and carry trades, traders can maintain spot positions while simultaneously shorting perpetual futures, allowing them to collect funding payments while remaining delta neutral. Having both positions on the same exchange significantly streamlines position management and monitoring.

Market making becomes more effective when operating across both spot and futures markets on a single exchange. Traders can provide liquidity in both markets while performing real-time arbitrage between order books. The unified view of their inventory makes position management more efficient, and spot holdings can serve as backing for futures market making activities.

Flash arbitrage opportunities can be captured more effectively when trading both spot and futures on one exchange. Traders can quickly act on momentary price dislocations between these markets without worrying about cross-exchange transfer delays. The single fee structure lowers the minimum profitable spread for these trades, while the unified execution environment ensures better fill rates.

Lower transaction costs

Most exchanges offer fee discounts based on total trading volume. Consolidating spot and futures trading on one platform helps reach higher volume tiers for better rates for users and traders.

Simplified accounting and tax reporting

Having all trades on one platform makes it easier to track positions, calculate P&L, and prepare tax documentation.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services