Hyperliquid: The Hyperoptimized Order Book L1

Introduction

Hyperliquid is a perpetual trading protocol built on its own L1 that aims to replicate the user experience of centralized exchanges while offering a fully onchain order book and decentralized exchange to trade spot, derivatives and prelaunch markets. Currently, it has over 200K users and a cumulative transaction volume exceeding $300B. Over the past month, daily volume has consistently exceeded $1B with over 8,000 unique traders.

Industry Overview

Hyperliquid allows users to trade both perpetual futures (up to 50x leverage) and spot markets through its fully onchain order book.

Over the past 6 years - since the launch of Uniswap V1 in 2018 - onchain trading has evolved and changed drastically, both for futures and derivatives markets, as well as for spot assets.

The following section discusses the advantages and disadvantages of decentralized spot and derivative trading venues across crypto, including:

AMMs

vAMMs

Peer-to-Pool

Intents

Hybrid orderbook-AMM

offchain order books

onchain order books

If you are already familiar with how these models work, you can skip forward to the ‘Protocol Mechanics’ section.

Spot Trading

AMMs

The majority of spot trading onchain is facilitated through AMMs. AMMs are smart contracts that hold liquidity reserves, which rely on formulae (often xy=k, but can differ depending on the purpose of the AMM) to determine asset prices. They rely on liquidity pools as opposed to traditional order books, and allow for permissionless trading and asset listing.

AMMs automate the market making process. Traditional market makers actively manage their inventory and risk. In contrast, AMMs have predefined rules (e.g. xy=k), while traditional market makers can and should adjust strategies in real-time.

At a high-level, they have been extremely successful in what they offer: the ability to permissionlessly launch markets, list assets and trade illiquid, high-risk assets that market makers might not want to market make due to inventory risk. They often act as the initial trading venue for new, illiquid tokens, for which they allow price discovery.

They are designed intentionally to be simple, and are not meant to be sophisticated vehicles for professional market makers, investors or traders. They are more efficient compared to order books, since they have minimal storage needs, can perform order matching computations quickly and cheaply through their constant function market maker formulae. In addition, compared to more complex alternatives - such as offchain order books, AMMs offer transparent order matching.

The key problem with AMMs is how liquidity providers are treated and rewarded. LPs need to provide liquidity to pools for assets to be traded. These LPs need to be incentivized, through some form of yield, either in the form of fees or through token rewards.

Unfortunately, despite rewards and fees that LPs receive, they by-and-large lose money by provisioning liquidity in AMMs and liquidity pools, primarily because of LVR and IL.

LVR

LVR stands for "loss-versus-rebalancing". It's the difference between the profits of an AMM LP position and the returns from a trading strategy that perfectly mimics the AMM's position in the risky asset but performs all trades at market prices.

Price slippage is the primary source of LVR. This slippage occurs because AMMs, by design, are passive liquidity providers that don't proactively update their prices. Whenever asset prices move, AMMs trade at stale, worse-than-market prices - which leads to the AMM executing trades at prices that are worse than the current market price, resulting in slippage. Arbitrageurs are able to arbitrage prices between the AMM and CEXs until AMM prices are equal to CEX prices.

AMMs lose money, as trades are executed at worse, stale prices, compared to a constant rebalancing strategy. With CEXs, market makers can update their quotes constantly and trade at market prices, avoiding the slippage losses that AMM LPs face. The cumulative losses incurred through the price slippage on AMMs is referred to as LVR.

IL

While LVR measures the difference in value between an LP portfolio and a rebalancing portfolio that trades along with price movements, impermanent loss (“IL”) compares the value and performance of a liquidity providers LP position in an AMM pool to the value of simply holding those assets separately.

Prices do not automatically update on AMMs. LPs are passive and AMMs don't proactively update their prices, they update prices if trades happen and the ratio of the pool changes (based on xy=k). Arbitrageurs are able to exploit stale prices, and are able to rebalance the pools by buying cheap, below-market-price tokens.

This can lead to ratios where LPs positions are rebalanced according to the new weights of the pool, leading to scenarios where the LP could’ve simply had higher returns if they had held the tokens, without providing liquidity, in a separate wallet.

In practice, fees and rewards from pools might help offset some of the impermanent loss, while larger position sizing or more volatile price changes would result in greater impermanent loss.

For both IL and LVR, LPs and AMMs struggle due to lack of proactively quoted and updated prices, which lead to stale, worse-than-market pricing. Given that, non-atomic, CEX-DEX arbitrage represents a significant portion of DEX volume and block value on Ethereum, stale AMM pricing leads to significant cumulative losses due to slippage and rebalancing.

The above chart shows the effect of toxic flow by market takers on Uniswap v3 LPs. Markout compares the execution price of a trade to a future reference price. Therefore, toxic flow in this case refers to when the price marked to the future is worse than the execution price after accounting for fees and price impact.

It occurs when market takers have better or faster information about future price movements, compared to market makers (LPs in the case of Uniswap v3). They can use this information to make trades that will likely be profitable for them but unfavorable for the liquidity providers.

As it can be seen, Uniswap v3 LPs typically lose money due to toxic flow - as sophisticated market takers are able to exploit stale prices for profit.

Spot assets can also be traded in offchain order books and intent-based systems. The mechanics, advantages and disadvantages of offchain order books and intent-based systems are discussed below.

Derivatives Trading

Peer-to-Pool Style

Initially popularized by platforms like GMX, peer-to-pool style derivatives exchanges have experienced a decrease in trading volumes compared to their initial period of adoption in the cryptocurrency market.

They rely on proprietary liquidity pools, i.e. GMX’s GLP or MUX’s MUXLP, where traders trade against a basket of assets or pools which are made up of individual assets.

If it’s a basket of assets, they are typically made up of large-cap assets, such as ETH and BTC, as well as a selection of mid-cap assets, of varying portions. Traders trade against this basket.

If they are individual asset liquidity pools, traders trade against these individual pools instead.

When a trader decides to open a position (long or short) or perform a swap they interact directly with pools instead of being matched with other traders. If traders profit, the pools must pay out to the trader. If traders lose, their losses go to the pool.

For example, under a model where asset baskets are used, a trader A trading ETH and a trader B trading BTC would both trade against the same basket. Under the individual asset liquidity pool model, trader A would trade against the ETH pool, while trader B traded against the BTC pool.

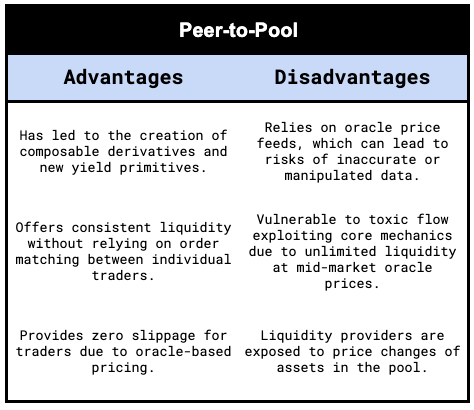

The main advantage of peer-to-pool style trading is that it allows an entire new ecosystem of composable derivatives to be built on top of the pools. Over the course of 2022 and 2023 we saw significant innovations across DeFi, primarily on Arbitrum, of new yield primitives being built on top of the GLP. In addition, it offers the ability to provide consistent liquidity without relying on order matching between individual traders. Lastly, oracle-based pricing (as opposed to AMM-style pricing mechanics) reduces impermanent loss and allows traders to experience zero slippage.

Despite these advantages, peer-to-pool models also come with significant risks and inefficiencies. They typically rely on oracle price feeds. This means that unlike AMM models, which need for trades to happen for prices to update, peer-to-pool models are able to update prices and keep up-to-date with the market pricing of assets through oracles.

However, this approach can lead to its own set of challenges, particularly related to the reliability and integrity of prices from oracles. Inaccurate or manipulated oracle data can result in wrongful liquidations. In addition, reliance on oracle pricing does not represent the actual market conditions, which can lead to toxic flow exploiting core mechanics. For example, back in 2022 GMX on Avalanche suffered an exploit due to its reliance on oracles. GMX doesn't take into account liquidity and its impact on price, and offers unlimited liquidity at a mid-market oracle price - which isn't how markets typically work. This led to a trader profiting by opening large positions (at zero slippage) on GMX for AVAXUSD, and moving prices on AVAXUSD on other venues in their favour.

Furthermore, although liquidity providers benefit from constantly updated quotes and market prices (through oracles), which allow them to not suffer from IL, they are still exposed to price changes of the assets in the pool. If the value of these assets decreases relative to each other or to stablecoins, LPs can experience losses. Lastly, Since liquidity pools act as the counterparty to traders, if traders are consistently profitable, it can negatively impact the pool's value.

vAMMs

vAMMs, initially introduced by Perpetual Protocol, have decreased in popularity over the past year. They work similarly to AMMs, and use a constant product formula (i.e. xy=k). Unlike traditional AMMs, the assets do not exist in a pool. Both tokens are virtual and exist in a virtual AMM, which is a replica of the AMM liquidity curve. These virtual assets are minted solely by the protocol itself, while real assets are stored in a separate smart contract vault.

They come with a few benefits: they artificially control and limit slippage and do not have LPs who face impermanent loss or LVR. In addition, they are relatively more capital efficient compared to AMMs.

On the other hand, they struggle with reflecting true market prices, especially in their initial implementation. There are broadly two forms of vAMMs:

Static K factor vAMMs

Dynamic K factor vAMMs

Static k factor vAMMs do not adjust or update the product of xy=k (the k). With traditional AMMs the K dynamically adjusts, as liquidity for the two assets in the pools is removed and added continuously by liquidity providers.

Since the K remains unchanged, liquidity depth throughout the curve remains the same. Even if the price of an asset moves drastically, the curve and depth do not adjust - which leads to market prices and liquidity conditions not being reflected adequately. Instead, prices are kept in line with market prices by arbitrageurs. If positions were closed, prices would go back to their initial level, therefore arbitrageurs are encouraged to keep them in line. vAMM based perpetual protocols typically ran arbitrage bots internally to keep the markets in line.

For example, if Asset A is at 2000 USD, and increases by 50% to 3000 USD:

If the vAMM price has not updated from 2000 USD to 3000 USD, arbitrageurs are encouraged to open positions and increase the price of Asset A until it is in line with the true market price (3000 USD)

Arbitrageurs (who in this case are long) are paid by shorts since the price on the vAMM is lower than the index price.

However, since the liquidity is static and does not coalesce around the true market price based on liquidity providers, if the positions on the vAMM were closed out, the price of Asset A would revert to 2000 USD, since arbitrageurs are not holding it close to the initial price any longer.

With dynamic K factor vAMMs, the K was adjusted to ensure that the market stayed healthy, and was used to optimize liquidity depth and minimize the discrepancy between the oracle price and the vAMM's mark price. By adjusting the K, the protocol attempted to ensure that the price did not drift further and further away from the initial price, such that when positions were closed out, the price of the asset didn’t revert dramatically.

vAMMs struggled with deep liquidity, and required position liquidations and constrained open interest to ensure the internal futures contracts and markets stay in line with true prices. vAMM based protocols struggled with reflecting true market prices, especially in times of heightened volatility.

Hybrid Model

Hybrid models typically rely on having both an order book and an AMM, where the AMM is the fallback option or used to source liquidity. Two prominent protocols that employ a hybrid model are Drift and Vertex.

The goal with combining an AMM with an order book to get all of the benefits of the orderbook, including efficient price discovery, capital efficiency and reduced slippage, while also having constant liquidity. Since these protocols typically run an offchain order book and matching engine with an AMM, they suffer from the issues that come with these two systems, which are mainly:

Offchain order books are not transparent and can lead to protocol insiders frontrunning orders.

vAMMs struggle to reflect true market prices, especially when there’s high volatility.

AMMs suffer from LVR and IL due to toxic flow and passive, inefficient, worse-than-market pricing.

Drift AMM and Order book

Drift's order book (called DLOB - Decentralized Limit Order Book) relies on keeper bots. Traders can place limit orders onchain. Keeper bots compile and sort onchain orders into an offchain order book, where orders are sorted by price, age and position size. Orders are matched offchain by keepers who monitor trigger conditions and prices (based on oracles).

Matching orders are filled against each other onchain. If an order is not matched in the order book, orders are instead routed through the AMM. Additionally, large orders might be partially filled in DLOB and partially by AMM.

Drift's AMM is a virtual AMM which uses the constant product formula, XY=K and liquidity pools to price assets. Additionally, the AMM can influence DLOB prices, especially in low liquidity situations. Drift additionally allows users to deposit liquidity to back the vAMM through the BAL (Backstop AMM Liquidity). LPs of the BAL take on a share of the AMM's positions as counterparties, and can choose to provide liquidity to only selected assets and markets. Drift's AMM is a dynamic K factor vAMM, which adjusts the K based on market volatility and inventory levels to ensure healthy markets.

Vertex AMM and Order book

Vertex's hybrid order book-AMM design combines an offchain sequencer with an onchain AMM. The sequencer functions as an order book, matching incoming orders from the protocol layer. It handles trade ordering and routing with exceptional speed, achieving 5-15 milliseconds execution time and supporting up to 15,000 transactions per second.

Traders can place orders through the Vertex interface. The sequencer receives these orders and attempts to match them against existing liquidity in the order book and AMM. If a match is found, the sequencer executes the trade, utilizing available liquidity from either limit orders or the AMM. The trade is then settled onchain, with smart contracts updating balances and positions accordingly.

Vertex's AMM provides pooled liquidity that aims to complement the orderbook (similar to Drift). It acts as an additional market maker through smart contracts, contributing to the bids and asks on the Vertex orderbook. This ensures a baseline of liquidity is always available, even when order book depth might be insufficient. If the sequencer fails for any reason, the system falls back to a traditional AMM model called "Slo-Mo Mode," ensuring continued functionality.

Intents

Intent-based trading refers to a system of traders expressing their intentions and solvers (market makers) fulfilling them. Intents are a type of order in which users specify a desired outcome rather than a specific execution path. Instead of detailing every step of a transaction, users simply state what they want to achieve. Solvers then compete to find the most efficient way to fulfill this intent, usually for a fee.

If a solver finds a market order-style of intent or open position that they would like to fulfill, they can do so. The open position typically includes parameters such as the intent ID, fill amount, average fill price, and an oracle signature verifying both parties' solvency. The solver then has the option to hedge the position on a secondary market. Solvers and fillers monitor intents using subgraphs, event-listeners etc. across various intent networks. If the intent is interesting, solvers/fillers can choose to resolve it. It's helpful to think of solvers as market makers and intents as limit and market orders.

Depending on the protocol, intents-based trading typically allows sourcing liquidity from both CEXes as well as DEXs. This enables solvers and traders to benefit from deep liquidity, tight spreads and competitive fees (especially when compared to AMM and pool-based systems) since almost all liquidity venues can be used to fulfill orders.

However, intent-based trading is not without drawbacks. The system relies heavily on solver participation and efficiency. If there are insufficient or unresponsive solvers, it could lead to poor execution or unfilled orders. Additionally, the system's complexity might make it less intuitive for some traders compared to traditional order book systems.

Offchain Order Books

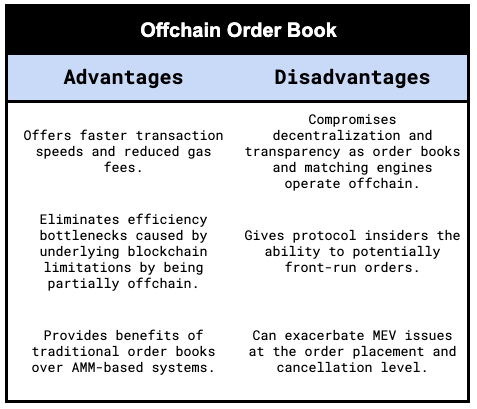

An offchain order book moves trading activity offchain, specifically the matching engine and order book components. Order matching, storage of trade-related information such as asset positions and prices occur offchain, as these are typically computationally expensive. Most protocols choose to only settle trades onchain.

This offchain shift is due to restricted processing capabilities of some chains. Consequently, many derivatives protocols have moved components like order books and risk systems offchain. dYdX V4 keeps its order book offchain and its margin system as well. Aevo, an options exchange, maintains its order book and risk engine offchain.

When a protocol runs an offchain system, it becomes opaque to users, requiring trust that the system operates as claimed. Verifiable computation eliminates trust assumptions, allowing protocols to perform offchain computation without introducing trust factors.

Costs are too restrictive for complex onchain applications. This has led various protocols to keep parts of their systems offchain, with each offchain model introducing certain risks.

Offchain systems are faster, enhance transaction speed, and reduce gas fees, making them more attractive for traders seeking swift execution. They offer benefits of order books over systems based on AMM, vAMM, or peer-to-pool trading.

This approach eliminates bottlenecks caused by the underlying chain. Trades can be "confirmed offchain" before settlement, bypassing chain block times.

However, since order books and matching engines operate offchain, they might be controlled by a single entity or a few entities, compromising the decentralized nature of DEXs. They also lack transparency. It can lead to situations similar to those between Alameda and FTX, where Alameda had non-liquidatable accounts, which were hidden because they were offchain.

Off-loading matching to a "private blockchain" is comparable to running a centralized exchange order book, giving protocol insiders the ability to front-run orders.

Minimizing trust in a central authority is crucial. The argument can be made that if trust isn't a concern, trading perpetuals on a centralized exchange suffices; blockchain's value lies in its transparency and permissionlessness, both compromised when one party matches orders behind closed doors.

A specific issue relates to MEV. While offchain solutions can be more performant and easier to manage, they can exacerbate MEV issues significantly. With an offchain order book, MEV occurs at the order placement and cancellation level. An order book operator could manipulate matching, resulting in worse execution for users - a toxic behavior impossible with onchain order books.

Protocol Mechanics

Overview

To build a perpetual DEX capable of matching the speed and user experience of CEXs, Hyperliquid designed a high-performance Layer 1 blockchain from the ground up. This L1 utilizes a Proof-of-Stake (“PoS”) model combined with Hyperliquid’s proprietary HyperBFT consensus algorithm to deliver low latency and high throughput. Several core components of the L1 architecture are crucial to achieving CEX-level UI/UX, speed, and transaction throughput:

Team & Origin Story

The Hyperliquid team is composed of 5 engineers and 10 employees in total, led by Jeff Yan and Iliensinc at Hyperliquid Labs. Jeff earned both a gold and silver medal at the International Physics Olympiad before meeting Iliensinc while studying Mathematics and Computer Science at Harvard. He later worked at Google and Hudson River Trading. Other team members come from prestigious institutions like Caltech and MIT, with professional experience at firms such as Airtable, Citadel, Hudson River Trading, and Nuro.

The team initially engaged in proprietary crypto market making in 2020, expanding into DeFi in the summer of 2022. Jeff has also written extensively on some of the innovative strategies the team employed to extract alpha in these markets:

Trading on RFQ’s - Picking off MM’s with stale RFQ’s.

Reverse engineering API OKX’s API for latency improvements.

Coinbase - Improving Coinbase latency & viewing retail stops.

When the team ventured into DeFi in 2022, they quickly recognized the flaws plaguing existing platforms—ranging from poor market design and outdated technology to clunky user interfaces. While these issues made it easy to profit from trading on such protocols, it was frustrating to see how far behind DeFi was compared to its centralized counterparts. Determined to bridge this gap, the team set out to create a product that would address these shortcomings and deliver a seamless trading experience. Building a high-performance decentralized Layer 1 with a perpetual order book DEX required deep expertise in quantitative trading, advanced blockchain technology, and intuitive UX—all areas in which the team excelled.

The urgency to develop a fully decentralized perpetual DEX intensified in November 2023 when FTX, the leading "built by traders, for traders" exchange, collapsed. This event underscored the need for decentralized alternatives, prompting Jeff, Iliensinc, and their team to accelerate development.

While pushing ahead with their vision, they placed their market-making strategies into "maintenance mode," generating semi-passive income. This allowed Hyperliquid Labs to remain entirely self-funded, without the need for external capital. By avoiding outside pressures, the team is able to focus on building a product they believe in, fostering an "immaculate conception" similar to Bitcoin and other fair-launched projects.

HyperBFT

The consensus mechanism is the cornerstone of any blockchain, enabling all nodes in a decentralized network to agree on the state of the chain. When Hyperliquid launched in late 2023, it initially used Tendermint as its consensus protocol—a popular choice for new chains due to its seamless integration with the Cosmos app-chain ecosystem and ease of deployment. While Tendermint, developed by Jae Kwon in 2014, is known for its reliability and consistent transaction ordering, it is no longer considered optimal for high-throughput performance. With Tendermint, Hyperliquid was limited to processing 20,000 orders per second—a respectable figure, but far below Binance’s capability of handling 1.4 million operations per second.

To address this limitation, the Hyperliquid team set out to develop a low-latency, high-throughput consensus mechanism, building on advancements from the leading research in the field. The result of this effort was HyperBFT, a consensus protocol inspired by the Hotstuff algorithm created by VMresearch and further enhanced by LibraBFT from Meta’s former blockchain team. Written entirely in Rust, HyperBFT is capable of theoretically processing 2 million orders per second—a 100x improvement over Tendermint. This breakthrough means that the primary bottleneck is now execution, not consensus. As HyperBFT’s algorithm and networking stack are designed to scale with execution, they can handle millions of orders per second once execution throughput catches up.

The switch from Tendermint to HyperBFT in May 2024 led to a 3x improvement in median order placement latency and we now see ror orders placed by geographically co-located clients, median end-to-end latency is now just 0.2 seconds, with 99th percentile latency at 0.9 seconds. This shift represents a significant leap in Hyperliquid’s performance and scalability, enabling a user experience comparable to CEXs. The enhanced performance allows users to seamlessly migrate automated trading strategies / HFT from other crypto platforms with minimal adjustments, while retail traders benefit from near-instant feedback through the platform’s interface.

Whilst details about Hyperliquid’s specific implementation are sparse, since a number of high throughput chains have built upon the work of Hotstuff and LibraBFT, we can walk through a generalized consensus framework for Hotstuff derivatives:

Generalized BFT Consensus Mechanisms

HyperBFT likely achieves consensus under partially synchronous conditions, even in the presence of Byzantine actors. As a derivative of the HotStuff protocol, it reduces the traditional three-phase process to two rounds, similar to protocols like Joltean, DiemBFT, and Fast HotStuff. This streamlined process introduces quadratic communication complexity in the event of a leader timeout. Here’s a simplified breakdown:

When transactions occur—such as opening or canceling positions—they are sent to one of the network’s validators, known as the leader. The leader compiles these transactions into a block and broadcasts it to the other validators in the network. The validators then verify the block by casting their votes, which are sent to the leader of the next block.

To safeguard against malicious actors or communication failures, the block must undergo multiple rounds of voting before the state is finalized. Depending on the specific implementation of HyperBFT, the block is only committed after successfully passing through two or three consecutive rounds, ensuring consensus is robust and secure.

A more complex dive into these consensus mechanisms:

HyperBFT, similar to protocols like Aptos v1, LibraBFT, and MonadBFT, is likely a two-phase, pipelined Byzantine Fault Tolerant (BFT) algorithm that utilizes optimistic validator responsiveness. Under normal conditions, it operates with linear communication overhead, switching to quadratic communication in the event of a validator timeout. Like most BFT systems, it organizes communication into distinct phases.

In each phase, the leader sends a signed message to the validators (voters), who then respond with their attestations to the next designated leader. This process, known as pipelining, allows multiple blocks to be processed simultaneously, as the quorum certificate (QC) or timeout certificate (TC) for a block can be included with the proposal for a different block. This overlapping mechanism ensures that multiple blocks are in the proposal and attestation phases at once, increasing efficiency.

A quorum certificate signals that the network’s validators have reached consensus to append the block, while a timeout certificate indicates that the consensus round failed and needs to be restarted. The process therefore looks something like this:

Users interact with the Hyperliquid chain by making transactions (e.g., opening or closing positions). These transactions are sent to the current leader, who then broadcasts a new block along with either a quorum certificate (QC) or timeout certificate (TC) from the previous round.

Validators review the new block to decide if it should be added to the chain. Once they agree, validators send a signed YES vote to the leader of the next round. This leader aggregates the YES votes from at least two-thirds of the validators to create a quorum certificate (a confirmation that the block has been approved). Communication is straightforward: the leader sends blocks to validators, and validators send their votes to the next leader.

Block finalization happens in the next rounds. Each validator finalizes the block proposed in round 1, once they receive a quorum certificate (QC) from round 2 through the leader of round 3. The process looks like this:

In round 1, the leader A sends a new block to the validators. If at least two-thirds of validators vote YES, they send their votes to the next leader B, in round 2. Leader B includes a quorum certificate for round 1’s block in his proposal.

Validators voting in round 1 can’t be sure the block from round 1 is fully committed just by seeing the QC from round 1 (from leader B). This is because leader B could behave maliciously and only send the QC to a single validator from the round 1 vote, leaving other validators out. These validators must vote on round 2’s block and send their vote to leader C, the leader in round 3.

If two-thirds of validators approve the block from round 2, leader C will send out a quorum certificate for round 2’s block along with his own block proposal. Once each voting validator from round 1 receives this, they know that leader A’s block from round 1 is fully finalized.

If leader B acts maliciously—by proposing an invalid block or failing to send it to enough validators—then at least one more validator than the maximum number of allowed byzantine nodes will time out. This will trigger other honest validators to also time out. In this case, a timeout certificate (TC) for round 2 is generated. Leader C will include the TC in his proposal since there won't be a quorum certificate for round 2.

This process is known as the 2-chain commit rule, which means that once a validator sees two consecutive certified blocks (round 1 and round 2), they can commit the first block and its ancestors.

By pipelining block proposals and attestations, along with cumulative small code changes from the Hyperliquid team, HyperBFT has become an exceptionally performant consensus mechanism.

Bridging

The first interaction a user has with Hyperliquid is through the bridging process, enabling immediate trading by onboarding USDC as collateral. Hyperliquid uses an EVM-compatible bridge, secured by the same validators that support its Layer 1 (L1) network. Deposits to the bridge are validated when over two-thirds of the staking power has signed off, at which point the USDC is credited. Withdrawals from the L1 are first escrowed on the L1, and once two-thirds of the validators approve the transaction, an EVM withdrawal request can be submitted to the bridge.

After a withdrawal request, there’s a dispute period to guard against malicious withdrawals that don’t match the L1. In such cases, the bridge can be locked, and it requires cold wallet signatures from two-thirds of the validator set to unlock it. Once the dispute period ends, finalization transactions are sent to distribute the USDC to the destination addresses. While users enjoy gas-free trading, a withdrawal fee of 1 USDC is charged to cover Arbitrum gas costs incurred by the validators.

For less technical users, Hyperliquid offers easy onboarding with email sign-in through its integration with Privy, allowing them to seamlessly transfer USDC from centralized exchanges to the provided address.

Once on the exchange, there are a few core components that enable the perpetual order book to function efficiently:

Order Book & Clearing House

The L1 state includes both margin and matching engine data, ensuring complete transparency across the exchange. A key feature of Hyperliquid is that the L1 state also maintains an order book for each asset, operating much like those on centralized exchanges, with orders matched based on price-time priority.

The order book interacts with the clearing house, which manages all positions and margin checks. Margin checks occur when a new order is placed and again for the resting side when an order is matched, ensuring consistency in the margin system, even if the oracle price fluctuates after the resting order is placed.

Deposits are initially credited to an address's cross-margin balance, and by default, positions are opened in cross-margin mode. However, isolated margin is also available, allowing users to allocate specific margin to a single position, reducing the risk of liquidation for that position without affecting others. Similarly, the spot clearinghouse manages the spot user state for each address, including token balances and any holds.

Oracle Pricing

Hyperliquid makes use of custom built oracles as part of the consensus of the chain so that prices are accurate on the exchange, even in the absence of deep liquidity. Validators update spot oracle prices every 3 seconds, which are used to calculate funding rates and the mark price. The mark price, critical for margin calculations, liquidations, and triggering TP/SL orders, is determined by combining the oracle price with a 150-second exponential moving average (EMA) of the difference between Hyperliquid's mid-price and the oracle price. To ensure accuracy, the oracle prices are based on a weighted median of major exchange spot prices, including Binance, OKX, Kraken, Bybit, and Kucoin. The final oracle price is further refined by weighting validators' submissions according to their stake.

This system provides an unbiased and resilient price estimate, independent of Hyperliquid's internal markets. In cases of extreme volatility or disruptions in CEX data, a price protection mechanism is activated, relying on the median of the best bid, best ask, and last trade prices until normal conditions return.

Margin Maintenance

Users can set leverage to any integer between 1 and the asset's max leverage (3x-50x). The required margin to open a position is calculated as position_size * mark_price / leverage.

For cross-margin positions, the initial margin is locked and cannot be withdrawn, while isolated positions allow margin adjustments after opening. Unrealized PnL for cross-margin positions automatically contributes to the margin for new positions, whereas for isolated positions, unrealized PnL increases the margin for the existing position. Users can increase leverage on open positions without closing them, but leverage is only checked when opening a position.

If a position has negative unrealized PnL, possible actions include partially or fully closing the position, adding margin (for isolated positions), or depositing USDC (for cross-margin positions).

Liquidations

Liquidations on Hyperliquid are based on the mark price, which integrates external CEX prices with Hyperliquid's order book state. This approach ensures liquidations are more reliable and less susceptible to manipulation compared to relying solely on a single, instantaneous book price.

A liquidation event occurs when a trader's positions move against them to the point where the account equity falls below the maintenance margin. The maintenance margin is half of the initial margin at max leverage, which varies from 3-50x (each asset has a max leverage implemented by Hyperliquid). In other words, the maintenance margin is between 1% (for 50x max leverage assets) and 16.7% (for 3x max leverage assets) of the initial margin.

Maintenance margin = 0.5 * Initial Margin / Max Leverage

For cross margin positions, to avoid liquidation, a user must maintain greater than the maintenance margin * total notional position in account equity. Unrealised PnL counts toward account equity in this case. Isolated positions are liquidated by the same maintenance margin logic, but the only inputs to the computation are the isolated margin and the notional value of the isolated position.

After a traders account equity drops below the maintenance margin, there are two ways in which Hyperliquid ensures it doesn’t accrue bad debt:

Firstly, once a traders account equity first drops below the maintenance margin, the traders positions are attempted to be closed by sending market orders to the book. The orders are for the full size of the position, and may be fully or partially closed. If the positions are entirely or partially closed such that the maintenance margin requirements are met, any remaining collateral remains with the trader.

Hyperliquid ensures efficient and timely liquidations through a second method: backstop liquidations, which are handled by the HLP (discussed later). If an account’s equity falls below 2/3 of the maintenance margin and the position isn’t liquidated via the order book (method 1), the liquidator vault steps in for a backstop liquidation. Since August 12th, this vault has been part of the HLP’s component strategy. In a backstop liquidation, all of a trader's cross positions and cross margin are transferred to the liquidator. The maintenance margin is not returned to the user, as the liquidator vault requires a buffer to ensure that backstop liquidations remain profitable on average.

Hyperliquid Liquidity Provider (HLP)

Market Making Overview

A notable trend in crypto market making has been the rise of custom agreements between token projects and market makers aimed at bootstrapping liquidity. Market makers play a crucial role by providing continuous buy and sell orders, ensuring that a token remains actively tradable by acting as the primary counterparty for most transactions. Building on 0xLouis’ extensive research, there are a few key reasons why token projects pursue these partnerships:

Price Stability: Market makers tighten bid-ask spreads, enhancing price stability and reducing the risk of manipulation.

Liquidity: They provide balanced liquidity on both sides of the order book, allowing for easier trade execution.

Cross-Exchange Arbitrage: Market makers align token prices across CEXs, ensuring consistency across platforms.

Market making is a critical service for token projects, ensuring token distribution at the time of the TGE, accurate pricing, and smooth trading. Given the pivotal role this service plays—often determining the success or failure of a project—market makers, wielding significant pricing power, have increasingly taken advantage of inexperienced teams, overcharging them through two common deal structures:

Retainer Model - In this structure, the project provides a combination of cash and tokens to make the markets. The costs generally range from $2,000 to $20,000 per month, but the project retains all PnL from the market-making activity.

Loan & Call Option Model - Here, the market maker takes a loan from the project to provide liquidity, with no monthly fees. The project lends a portion of its token supply to the market maker, who pairs it with their own stablecoins to MM. Loan sizes typically range from 0.5% to 1.5% of the total token supply, with a maturity period of 12 to 18 months. To limit risk in case the token’s value surges and the loan becomes significantly more expensive to repay, call options are introduced. These allow market makers to repurchase the loan at a fixed price anytime during the loan term. However, if poorly structured, these call options can enable market makers to acquire tokens at unfairly low prices, disadvantaging the project.

The current state of crypto market making often results in poor outcomes for project teams. They are either burdened with high monthly fees or find themselves at a disadvantage in structuring deals, particularly when it comes to setting the strike price on call options. Many teams, lacking expertise in derivatives, options, and financial instruments, are frequently outmaneuvered by more experienced market makers, leading to unfavorable terms. For more on this, see 0xLouis’ research.

HLP Overview

Hyperliquid Liquidity Provider (HLP) aims to democratize market-making strategies by allowing everyday users to participate in providing liquidity to token projects. This creates a win-win situation: users gain access to the returns typically reserved for highly technical teams or privileged players on centralized exchanges, while emerging projects secure liquidity without falling victim to predatory market-making agreements.

HLP is a protocol vault that engages in market making and liquidations, earning a share of trading fees. Anyone can contribute liquidity in the form of USDC to HLP and participate in the profit and loss (PnL). The vault does not charge any fees, and PnL is distributed proportionally according to each depositor's share of the total liquidity.There is a deposit lock-up period of 4 days.

HLP Mechanics

At a high level, HLP operates by calculating a fair price using tick data from both Hyperliquid and major CEXs. It then executes market making and taking strategies around this fair price, aiming to provide profitable, 24/7 liquidity. The specific strategies of course run off-chain so as not to dilute the alpha, however, users can verify all the trades, open positions and account deposits/withdrawals onchain. We have made that easy with our HLP dashboards - Strategy B, HLP old liquidator vault, Strategy B.

HLP's primary sources of alpha so far have been market making, funding, and fee accrual. Trading fees, introduced on June 13, 2023, started accruing fully to HLP. Beginning on August 12th however, these fees were also directed to the insurance fund and the open interest incentive program. The Fees generated by the protocol are split between HLP and the insurance fund.

Additionally, HLP began executing backstop liquidations on August 9, as previously mentioned, when an account’s equity falls to ⅔ of its maintenance margin. Both market making and liquidation strategies now operate under the same protocol vault.

Vaults

Hyperliquid initially built vaults as a core primitive of their L1, encoded into the consensus of the chain so that they could run the vaults created by the team such as the original HLP and liquidator vault. After creating this primitive they realized vaults could be generalized so that anyone could manage a vault with the same advanced features as the DEX, whether that be a market making vault or a discretionary trading vault.

Anyone can deposit into a vault to earn a share of the profits, like a traditional hedge fund. In exchange, the vault owner receives 10% of the total profits, similar to a performance fee in the traditional hedge fund structure. To ensure incentive alignment, vault leaders must maintain ≥5% of the vault TVL at all times.

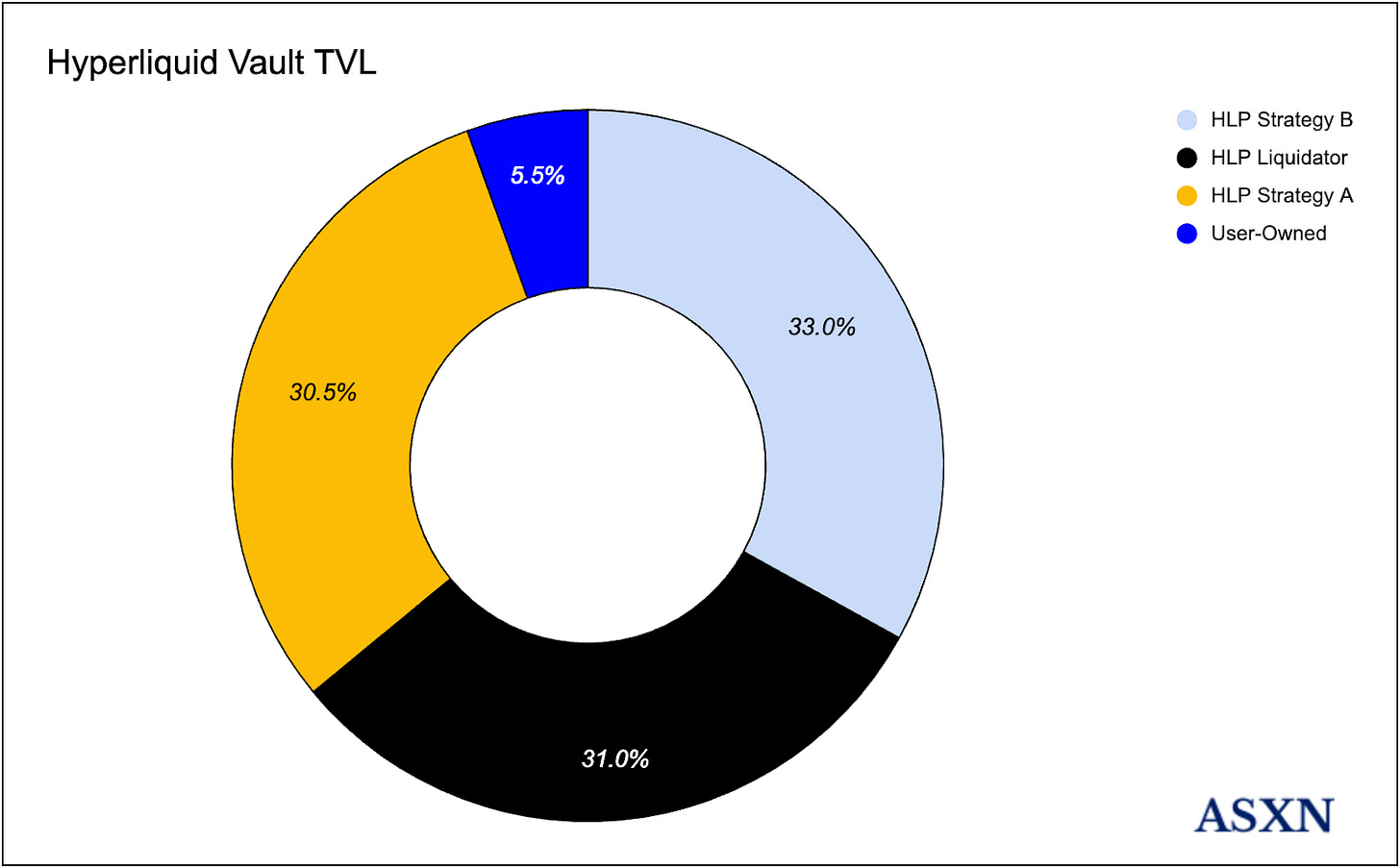

User-owned vaults have gained traction, with over 89 deployed so far. However, when analyzing the TVL across all vaults, it’s clear that deposits are heavily concentrated in HLP and thus its component strategy vaults. Despite the large number of user-owned vaults, they account for just 5.5% of the total vault TVL. Further, there are significant power laws within the user-owned vaults themselves with over 80% of user-owned TVL in the top 10 vaults.

Our hyperliquid vault screener tracks 22 different metrics and allows users to find the best vault to deposit into. You can screen for top vaults here.

We have also created a detailed portfolio dashboard for each vault, including all the HLP component vaults. Strategy B, HLP old liquidator vault, Strategy B.

Funding

The funding rate on Hyperliquid, like on most CEXs, is a periodic peer-to-peer fee paid between long and short positions, with no fees collected by the platform. It fluctuates based on the difference between the perpetual contract price and the underlying spot oracle price. When the contract price exceeds the oracle price, the funding rate is positive, and longs pay shorts, and vice versa.

Hyperliquid calculates the funding rate to match the anchor rate used by CEXs, which is set at 0.01% every 8 hours (11.6% APR paid to shorts), reflecting the difference between borrowing USD and holding spot crypto. However, unlike most CEXs, Hyperliquid applies funding payments hourly instead of the standard 8-hour interval, adding or subtracting the amount from the contract holders' balances at each interval.

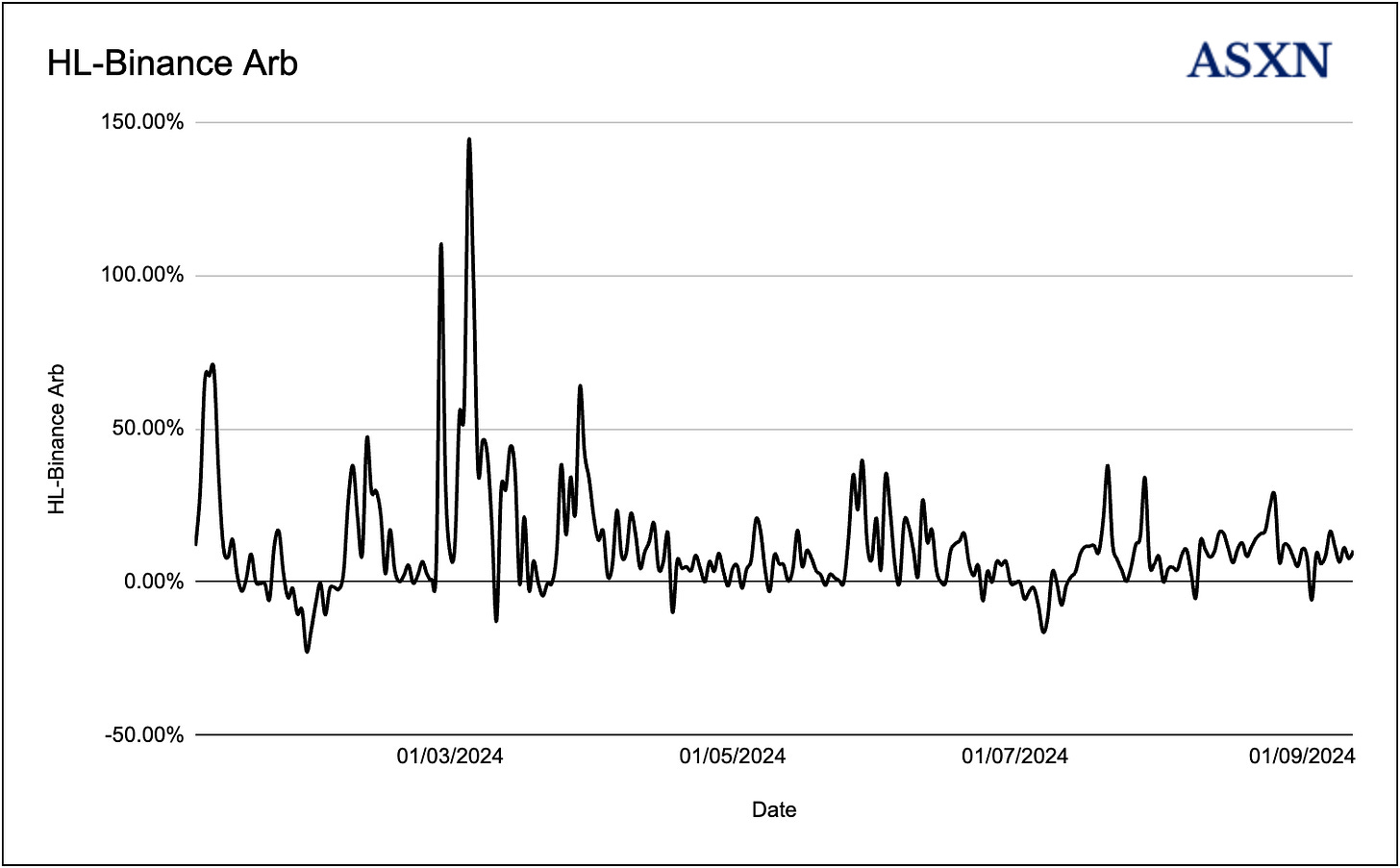

Being relatively new, lower OI and less market makers willing and ready to arb the funding rate, we have seen multiple times how a single / a few large parties can enter into a position on Hyperliquid and skew funding away from other CEX’s. For those willing and able, Hyperliquid presents a great venue to run funding arbitrage strategies.

For example, if we average out Binance’s 8 hour funding window and Hyperliquid’s 1 hour funding window into a daily average, we can see how the historical Hyperliquid funding on BTC has varied from Binance.

The annualized HL-Binance funding arb on BTC nearly reached 150% in March!

Fees

During the first three months of the mainnet closed alpha, trading was completely free, with zero gas costs and no fees. In June 2023, trading fees were introduced, set at a flat 2.5 bps for takers and a 0.2 bps rebate for makers. However, starting on March 11th, a tiered fee structure based on a wallet's rolling 14-day trading volume was implemented, similar to a standard CEX fee system whereby the more volume you do, the lower your maker / taker fee. Vault volume is tracked separately from the master account.

Unlike most protocols and CEXs, where fees mainly benefit the team or insiders with large token holdings, Hyperliquid directs all fees to the community, including HLP and the insurance fund.

Whilst there is no direct MM program, special rebates / fees, or latency advantages, large MMs collect rebates on maker orders. For example, if an MMs volume is >3% of rolling 14D maker volume, each trade collects a 0.003% rebate.

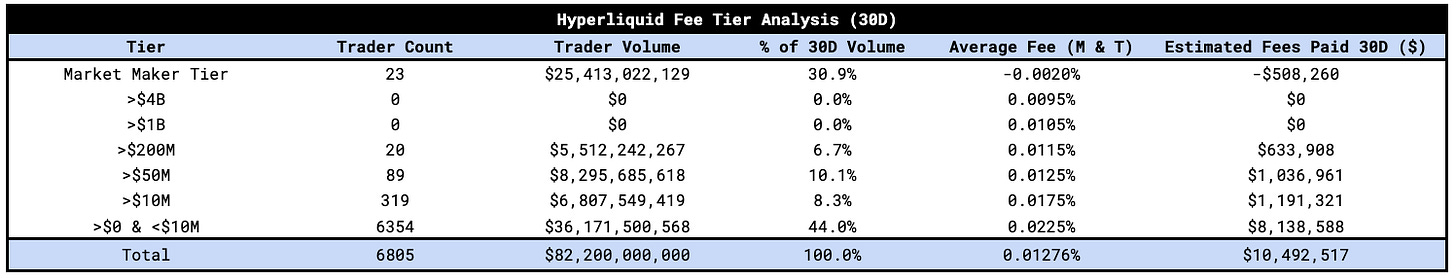

We conducted a comprehensive analysis of the past 30 days of Hyperliquid volume to work out an estimated breakdown of volume and user counts by fee tier. We first take a look at the ‘Market Maker Tier’, whereby any address is eligible for fee rebates is they do >0.5% of 14D maker volume. We look at past 30D (not 14D) and we don’t distinguish between maker / taker:

In the past 30 days, just 23 wallets are doing greater than 0.5% of total Hyperliquid volume equating for 30% of all 30D volume. We don’t know the split between maker / taker, so therefore a maximum of 30.92% of all Hyperliquid volume could be non-fee paying volume, in reality some of these wallets will have volume comprised of maker and taker flow so the real % of volume earning rebates is lower than this.

Taking data from every wallet that transacted >$0 of volume in the past 30 days, we can breakdown what fee tier they would be likely be in. Since fee tiers are based on 14D volume and we are taking 30D volume, the volume requirement for each fee tier is doubled. We are also being conservative in the sense that if a wallet has done >$2B of volume, we assume they are in the market maker tier fee instead of the >$2B fee tier (this is very unlikely due to the split of maker/taker orders). Therefore, what we paint with this data is a worst case scenario for Hyperliquid fee generation. The results are as follows:

30.9% of 30D volume could potentially qualify under the MM fee tier, paying between -0.001% and 0.003%.

44% of volume is from users doing less than $10M in 30 days, putting them into the bottom fee tier bucket.

93% of traders are in the bottom fee tier.

The worst case Volume-weighted average fee is 12.76bps

The worst case 30D fee generation is $10.49M

Spot Conversions

Another feature Hyperliquid implemented in July was Spot dusting. This happens daily at 00:00 UTC. Any spot balance with a notional value of $1 or less will be subject to dusting. All users' dust for a given token is combined, and a market sell order is automatically placed on the order book.

We can see this implementation with the spike in USDC holders and reduction in PURR & HFUN holders.

Exotic Derivatives

Index Perpetual Contracts

Index perpetual contracts are based on a formula rather than the price of a specific spot asset, but otherwise function identically to standard perpetual contracts.

NFTI-USD - NFTI-USD is an index composed of leading blue-chip NFT collections, such as Bored Ape Yacht Club, Mutant Ape Yacht Club, Azuki, DeGods, Pudgy Penguins, and Milady Maker. The index is calculated as a 3-minute exponential moving average (EMA) of the aggregate floor prices from Blur and OpenSea.

FRIEND-USD - Starting October 4, the FRIEND-USD index will track the average one-share buy price of the middle 8 subjects among a curated group of 20 prominent accounts, including: 0xCaptainLevi, Dingalingts, 0xRacerAlt, HsakaTrades, HerroCrypto, HanweChang, Christianeth, 0xLawliette, CL207, Cryptoyieldinfo, CapitalGrug, iloveponzi, cobie, sayinshallah, pokeepandaa, pranksy, VentureCoinist, 0xBreadguy, saliencexbt, and blknoiz06.

Uniswap Perpetuals

Certain perpetual contracts on Hyperliquid use Uniswap V2 or V3 Automated Market Maker (AMM) prices as the underlying spot asset. These contracts are limited to isolated margin only, meaning cross-margining is not allowed, and users cannot manually withdraw margin from an open position.

The current Uniswap pools used as price oracles for these contracts include: RLB, OX, UNIBOT, HPOS, and SHIA.

Hyperps

Hyperps are Hyperliquid-exclusive perpetual contracts that do not require a traditional spot or index oracle price. Instead, Hyperps rely on an 8-hour exponentially weighted moving average (EWMA) of the previous day’s minutely mark prices. The funding rate is calculated relative to this moving average mark price rather than a conventional spot price.

This innovative derivative design does not depend on an underlying asset or index being available at all times during the Hyperp’s lifespan—only that the asset or index exists eventually for settlement or conversion. For example, once ABC/USDT is listed on spot markets like Binance, OKX, or Bybit, the ABC-USD Hyperp will convert to a standard ABC-USD perpetual contract.

Spot Ecosystem

HIP-1

On April 16th, the Hyperliquid team expanded their ecosystem to include spot assets alongside their perpetual orderbook. HIP-1: Hyperliquid Spot Deployments created the native token standard on the L1, similar to the ERC20 standard on Ethereum. HIP-1 allows for the deployment of a capped supply of fungible tokens, alongside a native onchain orderbook. The first coin launched with this standard was PURR, a cat-themed memecoin deployed by the Hyperliquid team.

Token deployment occurs onchain and is a 5 step process, requiring 5 transactions to be made by the deployer on the L1. Those transactions will specify the following:

Name: human readable, maximum 6 characters, no uniqueness constraints.

weiDecimals: the conversion rate from the minimal integer unit of the token to a human-interpretable float. For example, ETH on EVM networks has `weiDecimals = 18` and BTC on Bitcoin network has `weiDecimals = 8`.

szDecimals: the minimum tradable number of decimals on spot order books. In other words, the lot size of the token on all spot order books will be `10 ** (weiDecimals - szDecimals)`. It is required that `szDecimals + 5 <= weiDecimals`.

Max Supply: the maximum and initial supply. The supply may decrease over time due to spot order book fees or future burn mechanisms.

initialWei: optional genesis balances specified by the sender of the transaction. This could include a multisig treasury, an initial bridge mint, etc.

anchorTokenWei: the sender of the transaction can specify existing HIP-1 tokens to proportionally receive genesis balances.

hyperliquidityInit: parameters for initializing the Hyperliquidity for the USDC spot pair. See HIP-2 section for more details.

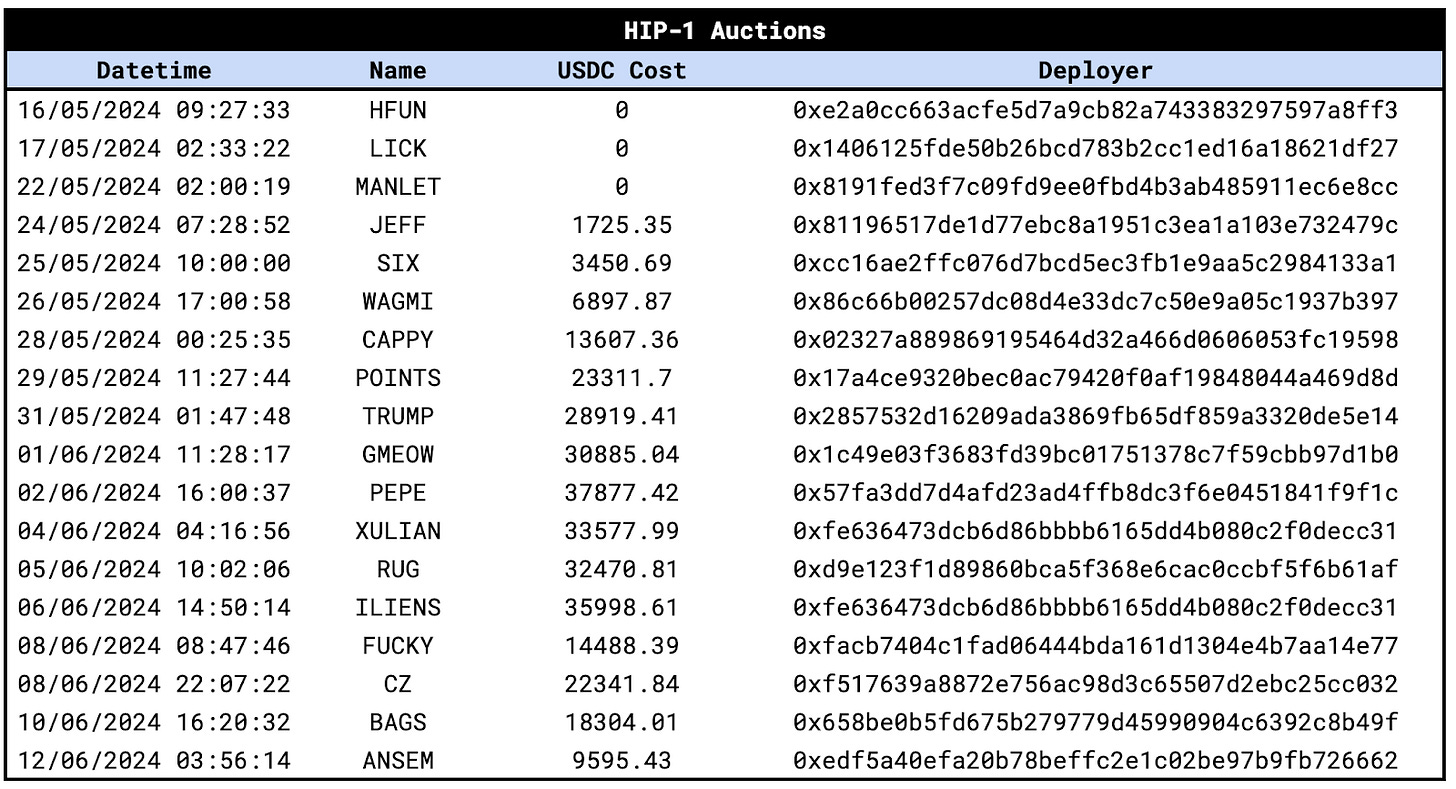

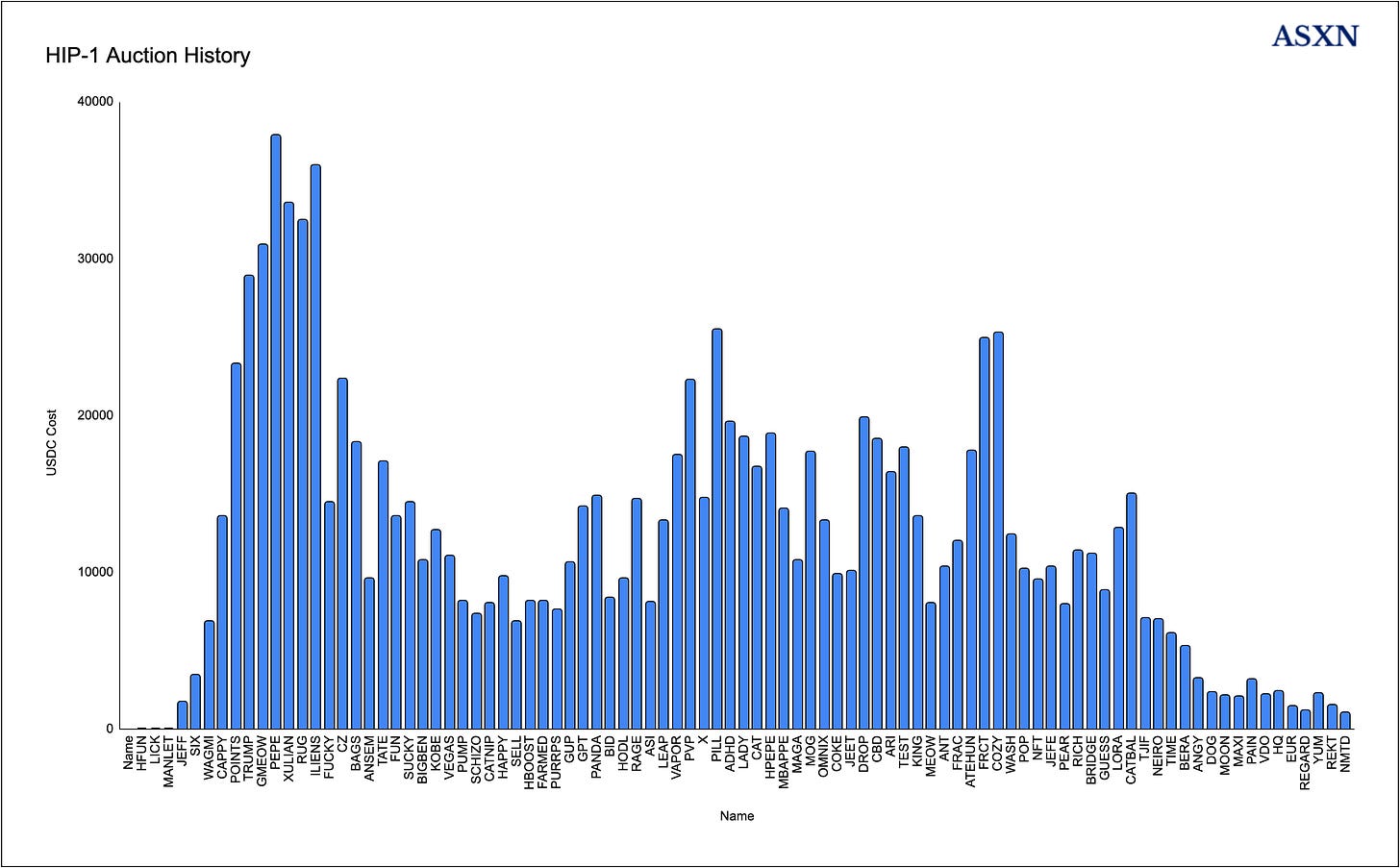

Auctions

In sharp contrast to the opaque, costly, and often exploitative token listing processes on CEXs—where projects are forced to pay large sums or surrender a portion of their token supply—Hyperliquid offers a streamlined, permissionless spot listing mechanism. The acquisition of the tokens name is required before completing the 5 step process as outlined above.

Hyperliquid has implemented a 31-hour Dutch auction to allocate token tickers. During the auction, the gas cost for deployment decreases linearly from the initial_price to a minimum of 100 USDC. If the previous auction did not complete, the initial price starts at 100 USDC; otherwise, it begins at twice the final gas price of the last auction. For example, if the last ticker was auction for 3,170 USDC, the next auction will launch at 6,340 USDC and will then linearly decrease until 100 USDC over 31 hours.

Since the auction occurs every 31 hours, the number of tickers launching on the Hyperliquid spot market remains relatively constrained, with only 282 new token listings a year. In the era of Pump fun and one-click token deployments it’s refreshing to have a structured and controlled roll out of new spot tokens. The auction cost has worked to disincentivise cash grab teams from deploying low effort tokens onto the platform.

HIP-2

Whilst order books are undeniably more capital efficient, more sustainable for market makers and provide a better UX for traders, one thing AMMs have enabled at scale is permissionless liquidity and the ability for a project to instantly enable trading of its token without entering into the aforementioned market making deals. Uni v2 full range style liquidity has become the most common method used to deploy liquidity for high volatility tokens, whilst some teams have utilized Uni v3 concentrated protocol owned liquidity to enable trading of their token. We can see this in action with Uni v2 still taking the lions share in terms of unique traders and with the number of tokens first traded on a DEX increasing by 1400%.

HIP-2: Hyperliquidity is Hyperliquid's innovative solution for permissionless liquidity provision, designed for projects that may lack the expertise or resources to market-make their tokens on the spot order book. As an optional final step in the five-stage deployment process, token deployers can execute the ‘hyperliquidityInit’ function, which permanently commits liquidity to the spot order book for HIP-1 tokens, drawing inspiration from Uniswap’s model. HIP-2 is a fully decentralized, onchain strategy embedded within the block transition logic of the Hyperliquid L1. Unlike traditional automated order book strategies, HIP-2 requires no operators—the strategy is secured by the same consensus mechanism that powers the order book itself. Initiating Hyperliquidity works as follows:

Spot: A user / token deployer selects which HIP-1 spot order book asset with USDC quote to provide liquidity to.

Start Price: A user selects the initial start price of the range.

Number of Orders: A user selects the number of orders in the range.

Order Size: A user selects the size of a full order in the range.

Number of Seeded Levels: A user can select the number of levels in the range that begin as bids instead of asks. Note that for each additional bid level added by incrementing `Number of Seeded Levels` the deployer needs to fund Hyperliquidity with Price * Order Size worth of USDC.

We can see some of the raw transactions from spot projects initializing Hyperliquidity:

Hyperliquidity is an automated trading strategy that operates by setting price points in a sequence, with each one increasing by 0.3% from the previous price. This sequence is updated every 3 seconds or more, ensuring that the strategy stays active and adapts to current market conditions. The price for each step is determined by multiplying the previous price by 1.003, which guarantees a 0.3% price spread between each new step.

When it updates, the strategy calculates how many full orders it can place based on the available balance. These are called "full ask orders," which aim to sell a fixed amount of an asset. If there’s a remainder after placing these full orders, a smaller "partial order" is created for the leftover balance. The strategy ensures that these orders are placed automatically, as long as there are no rejections from the system.

Once a full order is completely filled (meaning it has been fully sold), the strategy automatically places a new limit order for the same amount on the opposite side (buy or sell), depending on the available balance. However, the partial order remains untouched if it still exists. This setup ensures that the system maintains a continuous trading process.

The strategy guarantees a consistent 0.3% difference between the buying and selling prices (known as the spread) every 3 seconds. Like other smart-contract-based systems, Hyperliquidity runs automatically without the need for manual transactions or user intervention. Additionally, the strategy is part of a general-purpose order book, meaning that other active liquidity providers can join in at any time, contributing to the liquidity in the market and helping the system adapt to changes in demand for liquidity.

As an example, we can look at the orderbook for a HIP-2 initialization with the following parameters:

Start Price = 150

Number of Orders = 15

Order Size = 2

Number of Seeded levels = 5

Hyperliquidity offers the best of both worlds: a seamless, permissionless, and passive liquidity provision system combined with the benefits of an active order book. A key advantage is its integration with a general-purpose order book, which enables smooth participation from other liquidity providers. These participants can join the liquidity provision alongside Hyperliquidity at any time, allowing the market to adapt more effectively to rising demand for liquidity and enhancing overall market efficiency and responsiveness.

EVM

In May, Hyperliquid announced plans to launch support for a native Ethereum Virtual Machine (EVM), which will allow it to natively support Ethereum smart contracts and tools like wallets and bridges right out of the box. While Hyperliquid already operates its own network and rust-based virtual machine — the Hyperliquid L1 — this system is purpose-built for trading perpetuals and isn’t arbitrarily programmable and generalizable like an EVM.

The addition of the EVM will therefore create a symbiotic relationship between the two systems. Unlike most Layer 1 blockchains, Hyperliquid will therefore have two distinct virtual machines running atop a single consensus layer, HyperBFT. As mentioned in the HyperBFT section, the current bottleneck lies in execution rather than consensus, which can handle up to 2 million TPS.

The Hyperliquid L1 will remain dedicated to core trading functions, such as perpetual and spot order books, while the EVM will operate as a separate layer for developing auxiliary applications that don't always require ultra-low latency or high performance. By channeling high-throughput transactions through Hyperliquid's optimized native infrastructure, the EVM will benefit from ample blockspace, allowing for a broader range of applications.

However, without effective mechanism design, operating two VMs could lead to fragmented liquidity, challenges in seamless communication and contract execution between the VMs, and complications in asset transfers and management across the two systems. The EVM will therefore be enhanced to work seamlessly with native components on the Hyperliquid L1—such as HIP-1 assets, spot trading, perpetual trading, and other DeFi primitives—allowing for atomic composition and smooth exchange of information and value between the two environments. To do this Hyperliquid have implemented a few key features on their testnet EVM (note - this EVM is still in beta & things may change):

The System Contract - The testnet EVM includes a system contract that acts as an oracle for Hyperliquid L1 data, allowing developers to query native L1 information directly. This gives EVM developers access to critical data, such as L1 block height, along with mark, oracle, and spot prices for all assets—essential for building applications. The L1 block production logic continuously updates the system contract’s values, ensuring they match the L1 state at the moment the EVM block is created. The system contract can be found here: 0x1111111111111111111111111111111111111111

Native Token Transfers - A key design feature of the EVM is its ability to enable atomically composable native token transfers between the EVM and Hyperliquid L1. For a blockchain aiming to be the home of global finance, a unified state machine with seamless asset composability is essential. To achieve this, Hyperliquid has empowered the HIP-1 asset deployer to designate any ERC-20 contract on the EVM as the canonical representation of a spot asset. Once linked, users can seamlessly convert between native L1 and EVM spot assets by sending the token to the system address: 0x2222222222222222222222222222222222222222. This can be done on the L1 using a spotSend action (or via the frontend) and on the EVM through an ERC-20 transfer.

As demonstrated by PURR on the testnet, the spot asset is assigned a tokenID that represents the L1 contract address and a corresponding EVM contract.

One point that resonated with us about Multicoin’s Drift thesis was the tradeoffs between performance and composability / ecosystem flywheels. Multicoin write “We believe that the most successful derivatives DEX needs to be built on an L1 that has other assets issued on the chain. We do not think that appchain derivatives DEXs will win because they will never be as performant as centralized exchanges (CEXs), nor will they be able to compose with other programs and assets on a general-purpose chain. They do not benefit from ecosystem flywheels that exist on generalizable L1s.”

Well, Hyperliquid’s throughput and latency is not that far off of current CEX performance and over time we would expect Hyperliquid performance and latency to trend toward current the CEX performance. Further, the expansion to HyperEVM will fulfill this thesis & enable huge ecosystem flywheels as dApps are built upon this generalizable layer, whilst leveraging the highly performant order book infrastructure and oracles.

Current Ecosystem

Spot Markets

Hyperliquid spot assets have shown strong performance in recent months, notably in July when the main token PURR increased by 75%, contrasting with overall market decline. Subsequently, spot token returns have normalized, in line with market trends.

Spot tokens on the platform are categorized into two groups:

Strict: comprising five tokens - PURR, HFUN, RAGE, JEFF, and POINTS

All: encompassing all spot tokens launched on the platform

PURR, the first spot token on Hyperliquid, has lent its name to Hypurr Fun and Hypurr Scan, additional platform tools, and become the platform's mascot, depicted as a grey cat. Despite speculation about PURR's significance in Hyperliquid's token generation event, the team has clarified that it was initially launched to test spot markets.

Spot markets play a crucial role in Hyperliquid's function as both an L1 and an exchange. By supporting spot listings, the platform generates fees. Hyperliquid is able to attract asset listings on the platform, despite order books typically not being able to do this, both due to not being able to attract assets to list on them and because market makers usually don’t like taking on the inventory risk. Typically, we see assets initially launch on AMMs, on general-purpose L1s. Hyperliquid being able to attract assets to list on its order book is good, as it will allow them to generate fees. It also means that Hyperliquid has enough volume and liquidity on its platform that protocols believe their native assets can benefit from increased visibility and price discovery on Hyperliquid.

Hyperliquid functions as both an exchange and an L1, which allows it to offer full onchain composability and smart contract functionality. This architecture allows protocols to launch on top of it and deploy smart contracts, which distinguishes Hyperliquid from other order books that may not permit smart contract deployment or lack composability due to partially offchain order books. Hyperliquid has attracted a strong, active community of users and has garnered attention from both private and public market investors across the space. This obviously appeals to developers, who are drawn to the platform due to its engaged user and capital base.

Current Ecosystem

Telegram Bots

Hypurr Fun:

Hypurr Fun, one of the earlier applications on the protocol, is a Telegram-based trading bot for the Hyperliquid platform. The bot has an associated spot market, HFUN/USDC, currently trading at a 15M market cap.

PvP Trade:

PvP Trade, another Telegram-based trading bot, has recently launched on Hyperliquid. It allows users to copy trade or counter trade each other. Users can add the bot to a Telegram group with their friends and individually connect their existing Hyperliquid accounts.

Similar to HFUN, PvP Trade is likely to launch a spot token on Hyperliquid. The team has stated that they have acquired the PVP ticker on Hyperliquid and implemented a points program to reward users for using and promoting the bot.

You can use our code: asxn to trade on PVP Trade

Trading Tools & Aggregators

Insilico Terminal:

Insilico Terminal is a free-to-use order, position and execution management system. They’ve recently integrated Hyperliquid as an exchange.

Rage Trade:

Rage Trade is a multi-chain perpetual contract aggregator that combines trading from various platforms, including Hyperliquid. It utilizes aggregated liquidity across all perpetual contracts. The platform integrates GMX V2, Hyperliquid, Aevo, and dYdX, but offers markets only from GMX, Hyperliquid, and Aevo - not from dYdX.

The team recently launched their token, RAGE, on Hyperliquid. They conducted both a Public Sale on Fjord Foundry and subsequently held their TGE on Hyperliquid.

Bridging

HyBridge:

HyBridge is a bridge aggregator that facilitates asset transfers between EVM-compatible chains, Solana, and the Hyperliquid ecosystem. It tracks multiple bridging protocols to determine the most efficient transfer route based on speed and cost. HyBridge primarily focuses on bridging USDC, charging a base fee of 0.15% per transaction, with the goal of streamlining asset movement into the Hyperliquid platform.

Gasdotzip:

Gasdotzip is a bridge. It is primarily built to serve as a gas refuel bridge, which allows users to deposit assets from one chain and distribute them as gas tokens on multiple chains in a single transaction.

The platform recently integrated Hyperliquid, allowing users to not have to initialize a Hyperliquid account and deposit only through Arbitrum. Users can instead receive USDC in their Hyperliquid account from any gasdotzip supported inbound chain.

Lending Platforms

Hyperlend:

HyperLend is a money market built on top of the Hyperliquid L1. The platform uses a pool based model where users can deposit and borrow different assets. Interest rates are set based on supply and demand. The platform also allows flash loans.

There are more lending platforms (such as Keiko) but details surrounding them are limited.

Infrastructure and Analytics

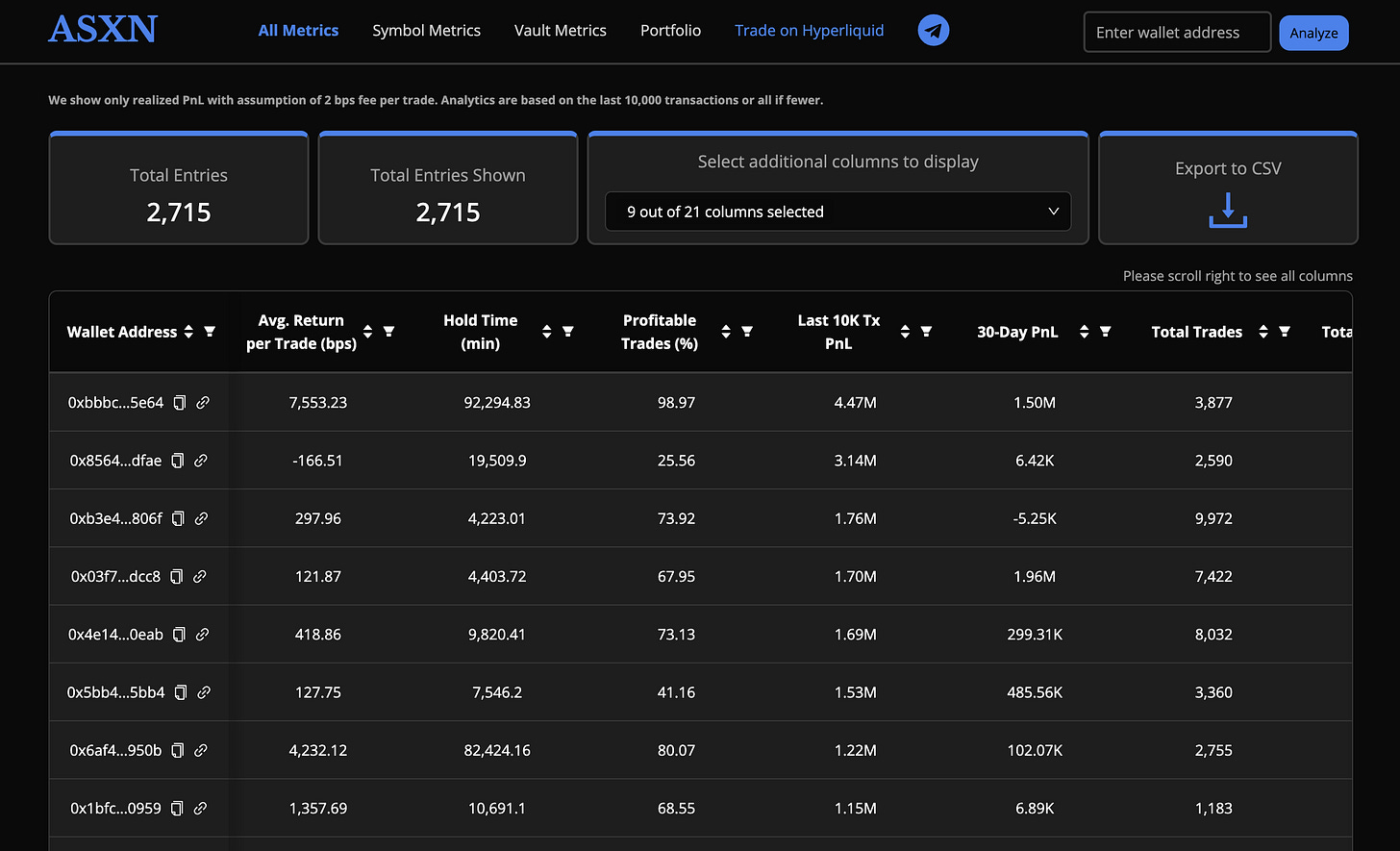

ASXN Hyperliquid Dashboard:

hyperliquid.asxn.xyz is a dashboard developed by ASXN Labs. It provides users with granular data surrounding trades settled on Hyperliquid, including returns, profitability, PnL and more. It can be used to track personal portfolio analytics, as well as track vault performance, and track and identify other traders on the platform.

HypurrScan:

HypurrScan.io is a community-made explorer for Hyperliquid. It’s developed by Syavel, to simplify onchain activity analysis. Syavel has also developed an HypurrScan API that goes with the explorer, which was used for data throughout this report. We highly recommend joining his Telegram group for HypurrScan if you’d like to learn more about Hyperliquid onchain data.

Purrburn:

Purrburn is a dashboard developed by Jan Klimo which tracks the PURR market, as well as other spot markets and the spot ecosystem on Hyperliquid.

Validao

ValiDAO is a DAO-owned validator which operates on Hyperliquid testnet. They have recently developed two tools to help with Hyperliquid infrastructure, decentralization and node running:

Hypermaps, a Hyperliquid testnet geo-map which shows where nodes are located and what ISPs they use.

Hyperliquid Testnet Monitor, a dashboard showing testnet metrics built using an open source prometheus exporter for Hyperliquid node runners.

Future Protocols and Ecosystem Development

Lending Protocols

Some lending primitives have already announced their launch on Hyperliquid. Lending markets are a natural fit as they allow traders to earn on their collateral. This is particularly beneficial for institutional investors or liquid funds who can now earn yield on idle capital on the same platform where they trade. Any primitive that enables collateral to generate yield is advantageous.

Lending markets are well-suited because they can utilize the native oracle to value collateral and execute liquidations in Hyperliquid's spot market. This eliminates the need for external oracles and liquidation systems, which have caused issues for other lending markets in the past.

Complex Trading Strategy-Based

Protocols enabling traders to execute and implement their entire strategy on a single platform can be advantageous. An example would be an Ethena-like protocol, such as a basis trading platform: which involves simultaneously purchasing (or selling) an asset and selling (or buying) the futures contract for that asset.

A robust ecosystem of strategy-based protocols launched on Arbitrum following GMX's popularity. A similar ecosystem developing around Hyperliquid would be logical and beneficial for the platform.

Options

Options have not gained significant traction onchain thus far, with most volume being done on Deribit. While order book-based options exchanges like Aevo exist, most are partially off-chain. Additionally, sizing options onchain is challenging due to low liquidity and volume. Transitioning these to a fully onchain order book could be beneficial, allowing traders to maintain their strategies on a single platform.

New Markets

A fully onchain, optimized order book with 0.2-second block times is currently the ideal venue for onchain trading. New markets can utilize the order book for price discovery and the L1 for settlement. Expanding the range of markets traded on this platform would be logical. For instance, Drift recently launched BET, enabling prediction markets on their platform, which would be a valuable addition to Hyperliquid.

USDC Rotation & Airdrop

The spot ecosystem on Hyperliquid is still in its early stages, with most projects currently centered around meme coins. However, we expect the launch of the HyperEVM to serve as a major catalyst for new projects, which should provide a compelling incentive for Hyperliquid's perpetual traders to redirect USDC capital into the spot market. At present, $575 million in USDC is held on Hyperliquid’s perpetual platform, while the spot ecosystem holds $123 million in capital, including the market cap of PURR and other HIP-1 assets.

We can see the breakdown of USDC and HIP-1 strict list market cap on Hyperliquid here:

Currently, 97.77% of USDC on Hyperliquid is held on the perpetual platform (excluding HIP-2 locked liquidity), while the strict list on Hyperliquid accounts for 93.52% of the total spot circulating market cap.

The following analysis shows how the USDC spot holdings from wallets that have interacted with the Hyperliquid spot ecosystem have evolved over time:

With this amount of stablecoin capital on the perpetual exchange, even a small proportion of this rotating to the spot ecosystem could result in sizable gains for the native HIP-1 tokens. For example, if 10% of spot perpetual USDC moved to the spot platform to bid HIP-1 assets, that would be an inflow of $57M into an ecosystem that has an average daily volume of ~$4M.

Points

A major catalyst for growth in the spot ecosystem could be the anticipated Hyperliquid token airdrop. Since November 2022, Hyperliquid has operated a points program where platform users earn points for activity and contribution. However, the weekly distribution criteria have been fluid and somewhat opaque, with early stages favoring perpetual traders and later stages shifting focus toward the spot ecosystem.

The points distribution has unfolded in four phases. During the closed alpha and Season 1, points were awarded primarily based on perpetual trading volume. In April 2024, Hyperliquid announced the conclusion of the points program, and by May, it was widely expected that platform usage would no longer earn points. However, in early June, Hyperliquid launched a new points program—Season 2—designed to incentivize broader usage of their Layer 1 blockchain, particularly the spot ecosystem. Additionally, users who traded organically during May were retroactively awarded points, now categorized under a newly created Season 1.5.

Season 2 of the points program concludes on September 31st. If this marks the final season before the TGE, the points distribution will be structured as follows:

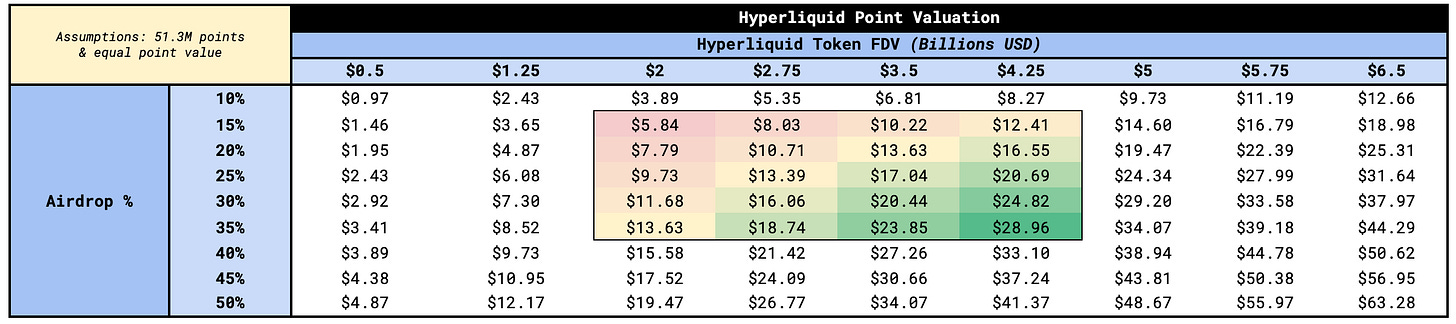

Using the total points accumulated after Season 2, the percentage of token supply allocated to points, and the fully diluted valuation of the Hyperliquid token, we can develop a rough model to estimate the value of each point:

For example, if the Hyperliquid token launches at $4B FDV and they airdrop 30% of the supply to point holders, each point would be worth ~$23.36 assuming every point has an equal value.

We can then sensitize this based on the various FDV that Hyperliquid may launch at and the varying airdrop percentages to point holders:

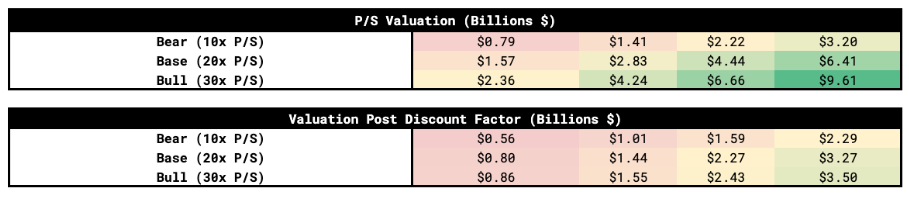

Crypto_adair provides an alternative valuation model for points:

Our in-house view, based on ongoing signals from the Hyperliquid team pointing to a "Bitcoin-like" immaculate conception—without VC allocations—and the need for sufficient decentralization for regulatory approval, is that Hyperliquid will likely airdrop a significantly larger percentage of their token supply to the community, far exceeding recent industry norms.

The airdrop will likely take the form of an HIP-1 asset, and the influx of capital into the ecosystem could drive up the value of native tokens as claimants rotate into them. On the flip side, there is uncertainty about the potential sell pressure from holders of these spot tokens who accumulated them solely for point generation and may exit the market following the airdrop.

Value Proposition

Hyperliquid offers users:

- a fully onchain orderbook

- a purpose-built Layer 1 blockchain

The onchain order book offers enhanced transparency compared to offchain systems, and efficiency compared to AMMs, vAMMs and peer-to-pool models, eliminating trust assumptions and mitigating market manipulation risks. The custom L1 is optimized for high-frequency trading, enabling atomic operations, complex order types, and consistent performance.

The combination of the fully onchain order book based system and the purpose-built, highly optimized L1 allows for strong user experience, gasless trading and native integration of trading primitives. Together, these features position Hyperliquid to potentially overcome limitations of existing DEX models, offering a more robust and efficient trading platform.

The Onchain Orderbook

The fully onchain order book has several key advantages that set it apart from alternative models discussed previously. In general, most of the industry likely recognizes that the fully onchain order book is the ideal solution for perpetual and spot trading, but it just hasn’t been possible due to limitations and bottlenecks at the network level. As mentioned before, AMMs, vAMMs, peer-to-pool model and offchain order books each come with various, different benefits and advantages. AMMs allow users to trade any asset without the need for market makers, allow permissionless asset listing and are computationally cheaper than orderbooks. Peer-to-pool models allow composability and consistent liquidity without relying on order matching between individual traders. Offchain order books have all of the benefits of order books over alternatives, but come with centralization trade-offs.