The Hyperliquid Issue #4

Bi-weekly Hyperliquid Ecosystem Report

Stake HYPE with ASXN:

https://app.hyperliquid.xyz/staking

Liquid stake HYPE with ASXN and StakedHYPE (Thunderhead Labs):

HyperEVM

The Hyperliquid HyperEVM went live on the 18th of February. The HyperEVM blocks built as part of L1 execution, and inherits all security from HyperBFT consensus.

With the launch of the HyperEVM, spot transfers between native spot HYPE and HyperEVM HYPE were enabled, and a canonical WHYPE contract was deployed.

We’ve compiled a non-exhaustive list of protocols live on the HyperEVM:

HyperSwapX (AMM)

Sunder Finance (AMM)

deBridge (Bridge)

ChainFlip (Bridge)

Hyperlane (Bridge)

Gas.zip (Bridge)

LoopedHYPE (LSD, Yield)

StakedHype (LSD)

HypurrFi (Money Market)

Keiko Finance (Money Market)

Pyth (Oracle)

Stork Oracle (Oracle)

Hyperliquid Names (Naming Service)

You can track the teams and protocols building on the HyperEVM on our Hyperliquid ecosystem dashboard:

https://data.asxn.xyz/dashboard/hyperliquid-ecosystem

Please reach out to us through Twitter if you’d like to be included in the ecosystem dashboard, or if you’ve already launched on the HyperEVM and would like to be included in the list above.

List of HyperEVM Tooling:

Ecosystem Dashboards:

https://data.asxn.xyz/dashboard/hyperliquid-ecosystem

https://www.hypurr.co/ecosystem-projects

Block Explorers:

Purrsec: https://purrsec.com/#hyperliquid-trending

Blockscout: https://hyperliquid.cloud.blockscout.com/

Volume

Hyperliquid continues to process impressive volume with $514B traded in the past 3 months. Since our last update, Hyperliquid has processed $35B in volume.

We saw a recent spike in daily volume following the Bybit on the 21st of February, with the recent Bybit exploit.

Over the past 3 months the average daily volume has been $5.6B, a 6% increase since our last update.

The 30d average HYPE/USDC spot volume has decreased by 14% from $178.2M USD to $153.3M USD since our latest update.

Hyperliquid continues to lead in market share of derivative DEX’s. As of the 21st of February, it represents nearly 72% of total derivatives DEX volumes.

Unique Traders

Daily unique traders has decreased by approximately 5% since our last update to just above 26.4K.

There has been an average of 26.3K unique traders per day over the past 3 months, an 8% increase since our last update.

Fees

Over the past month, the platform has averaged $1,511,106 in daily fees (a 18.5% decrease since our last update) and a total of $45,679,617 in fees (a 19.3% decrease since our last update). This translates to approximately $548.15M in annualized fees.

Staking

As of date, there are still 16 validators on the Hyperliquid L1 with over 426M HYPE staked (42.61% of supply).

In our previous update 426.8M HYPE was staked (42.68% of total supply), meaning that approximate 0.8M have unstaked since then.

You can stake with us here: https://app.hyperliquid.xyz/staking

Approximately 6.47M HYPE in total is currently pending unstaking over the next week.

The majority will unstake on the 23rd (1.3M HYPE) and 28th (1.12M HYPE).

You can track Hyperliquid staking data here:

Auctions

Hyperliquid auction costs have continued to decline. The latest auction cost $109K for the ticker WHYPI. Similarly to our last update, recent ticker auctions have been driven primarily by fundraising efforts for the Hypurrfun launch.

Most recent auctions:

HYPE Burn

The native spot and perpetual order books utilize the same volume-based fee schedule for each address. However, fees collected in non-USDC HIP-1 spot tokens are burned.

HYPE/USDC spot volume therefore directly results in the permanent burning of HYPE.

Since launch, over 161.8K HYPE (around $3.86M) has been burned.

Hyperliquid Ecosystem

We just launched our Hyperliquid Ecosystem dashboard, where we showcase projects building on Hyperliquid.

You can find it here:

https://data.asxn.xyz/dashboard/hyperliquid-ecosystem

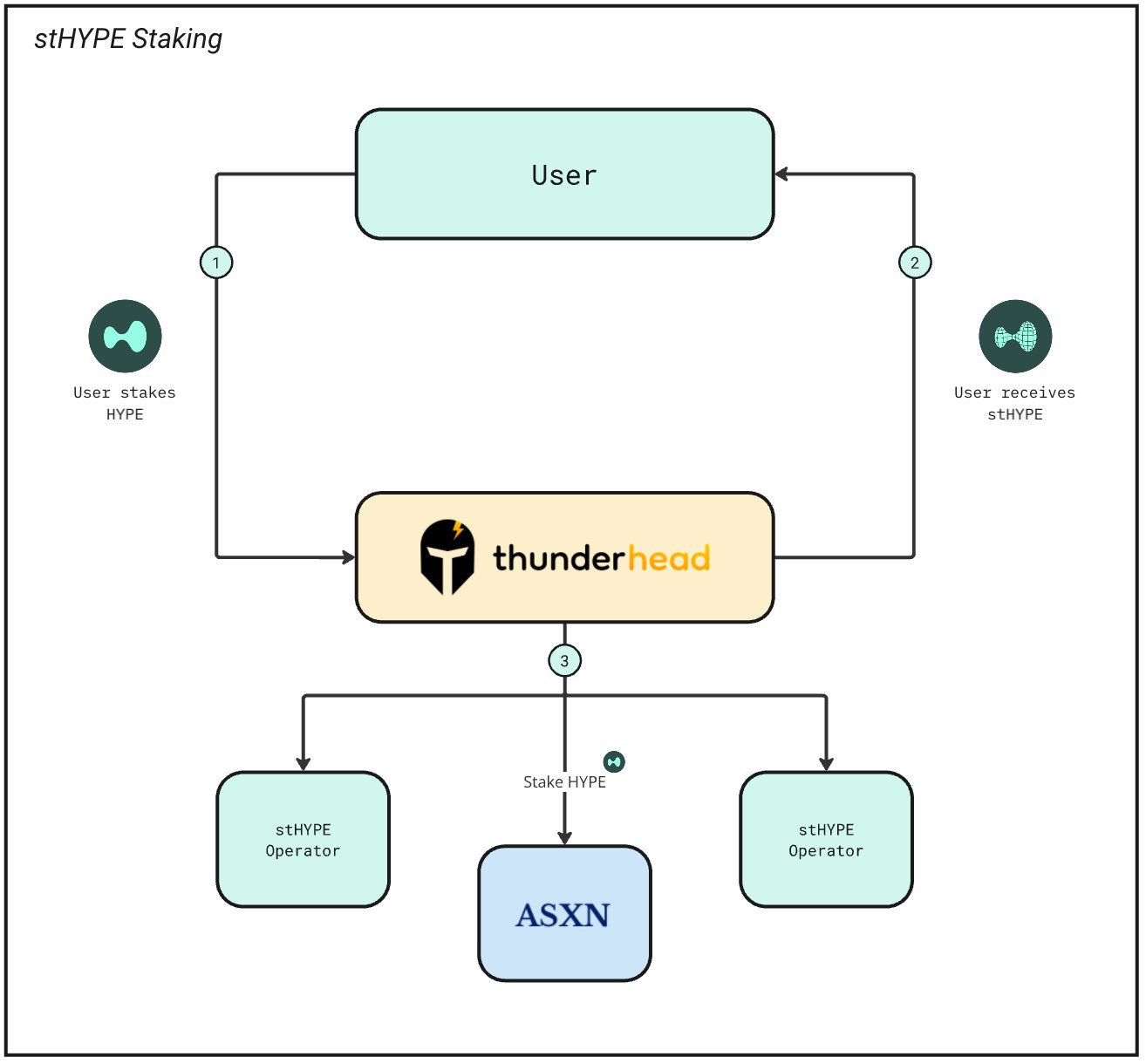

StakedHYPE

Twitter: @https://x.com/stakedhype

Website: https://www.stakedhype.fi

stakedHYPE launched on HyperEVM. stHYPE will integrate with money markets like Felix Protocol, Hyper Lend, and Euler Finance, DEXs including Valantis Labs, Hyper Swap, and Curve Finance, and yield protocols such as Looped Hype, Nucleus Earn, and Harmonix Fi.

They’re partnering with Valantis Labs to introduce the stHYPE AMM, a new type of AMM for liquid staking tokens (LSTs) that doesn’t depeg by leveraging native withdrawal mechanisms. This custom AMM removes depeg arbitrage for any LST with withdrawals enabled.

ASXN is an operator for stHYPE. You can liquid your HYPE with stakedHYPE through our frontend:

LoopedHype

Twitter: https://x.com/Looped_HYPE

Website: https://loopedhype.com/

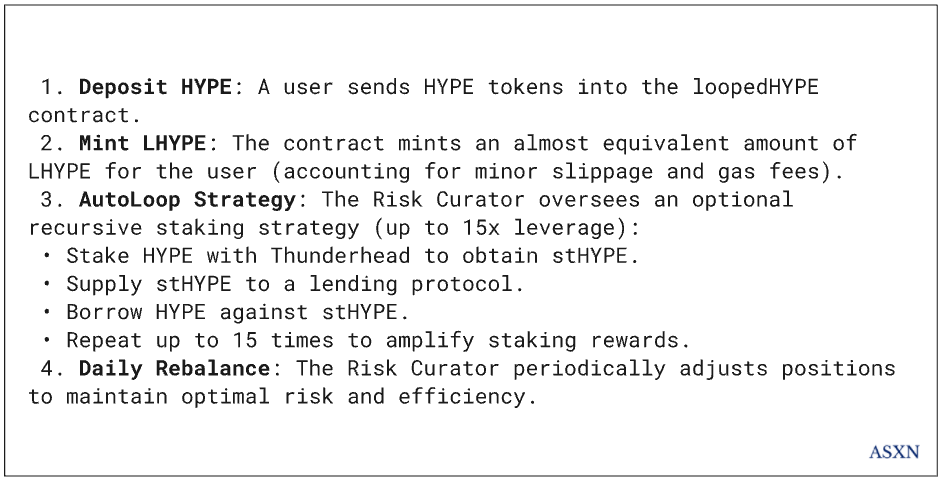

loopedHYPE is an automated yield vault that targets around 10% APY without the added risks of leveraged trading. Built by Staking Rewards, loopedHYPE employs an automated looping (or recursive staking) strategy to help stakers maximize yield.

Vault depositors can also ensure their stake is attributed to a validator of their choice through partnerships with Thunderhead and Kinetiq.

Users can deposit HYPE and receive a nearly equivalent amount of newly minted LHYPE, minus gas and execution fees. Slippage and fees are built into the mint and redeem process, and loopedHYPE does not take any profit from these transactions.

The Risk Curator manages AutoLoop—a recursive staking strategy up to 15x. It stakes HYPE with Thunderhead for stHYPE, supplies stHYPE to a lending protocol, borrows HYPE against it, and repeats the cycle. The position is rebalanced daily, adjusting the multiplier to optimize efficiency and safety.

Unit Protocol

Twitter: https://x.com/hyperunit

Unit Protocol launched on Hyperliquid since our last issue. Unit is a protocol that enables non-native asset issuance on the Hyperliquid chain through a lock-and-mint based bridging system. Its primary function is to allow users to deposit and withdraw assets like Bitcoin, Ethereum, and Solana directly to and from Hyperliquid.

As of February 24 2025, total deposits for Unit are at 544 BTC ($51.4M USD), with $200M volume traded since inception (February 13th) and 2852 unique users.

We wrote a research report on Unit Protocol which you can find here:

https://newsletter.asxn.xyz/p/unit-protocol

Pyth

Twitter: https://x.com/@PythNetwork

Website: https://www.pyth.network/

Pyth just went live on HyperEVM with over 1,000 price feeds. In addition projects like HyperLend, SharpeLabs, Kinetiq, HypurrFi, Keiko Finance, Felix Protocol, and Hyperdrive are integrating with Pyth’s oracle solutions into their products on the HyperEVM.

Felix

Twitter: https://x.com/felixprotocol

Website: https://usefelix.xyz/

Felix posted a teaser for Felix Edge, a mobile app designed to help onboard newcomers to HL and HyperEVM DeFi. It’s still in the early stages.

Charlie, founder of Felix, also released a short report titled Navigating HyperEVM DeFi, highlighting new lending and liquid staking protocols launching on the HyperEVM and exploring possible user flows within DeFi. Additionally, the Felix protocol published a brief piece discussing the potential unlocks that HyperUnit will bring.

You can read the full article here:

https://x.com/felixprotocol/status/1890438388915843405

HyperLend

Twitter: https://x.com/hyperlendx

Website: https://hyperlend.finance/

HyperLend announced a new partnership with LayerZero to enable crosschain deposits and expand its multi-ecosystem reach.

Aave and Marc Zeller also recognized HyperLend as a friendly fork, with the approval process currently underway. The Snapshot Temp Check to formally acknowledge HyperLend as a friendly fork was approved by Aave’s governance.

Hyperswap

Twitter:https://x.com/HyperSwapX

HyperSwap Beta is now live on the HyperEVM mainnet. They have already crossed $1M in TVL, with more than $500K in liquidity pools featuring stHYPE from Thunderhead.

If you’re building on Hyperliquid, please reach out to us to be included the next publication of the Hyperliquid Issue. You can reach us through our Twitter or through Telegram by messaging @fromm_asxn.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.