Monad Memo #1

Over a month has passed since Monad launched their testnet, and performance and metrics for the chain have significantly improved throughout that time. In anticipation of their continued growth and mainnet launch we are introducing a Monad state of the chain and ecosystem report to highlight metrics, important developments and ecosystem growth.

You can read our full report on Monad here:

https://newsletter.asxn.xyz/p/monad-bringing-back-the-evm

State of Testnet

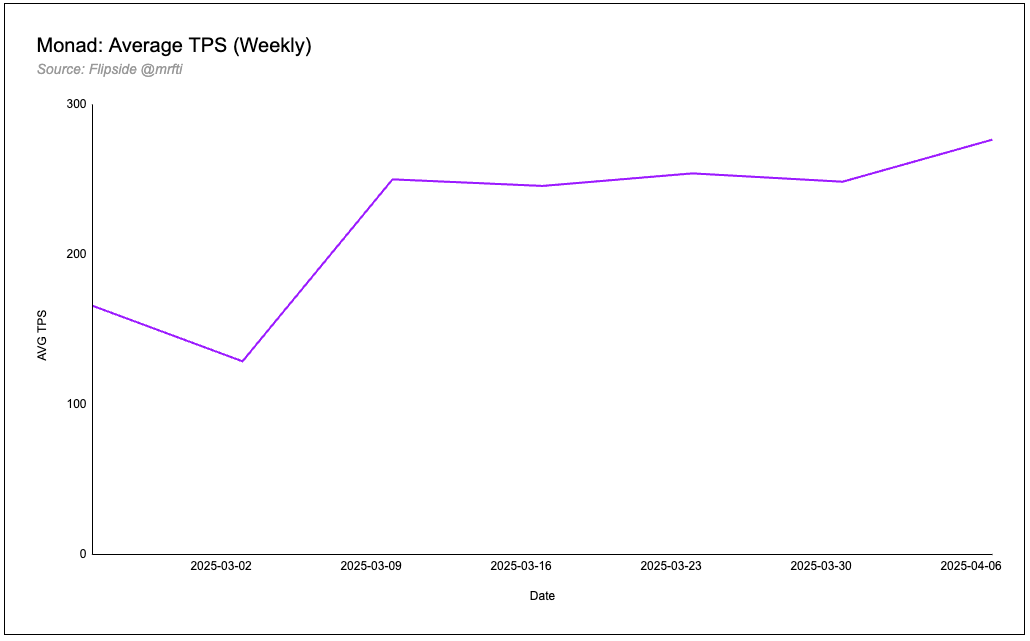

Average TPS on Monad has been 224 over the past month. At launch, 02/24, TPS hovered around 165 (weekly average), which has increased by around 67% to 276 (weekly average).

As of today, we see that the TPS has stabilized around 220, with spikes to 344 over the past day.

Block counts onchain have been approximately 1M per week. Average transaction count (per minute) today has been approximately 13.4K, with the daily high being 20.4K.

Blocks per second have averaged around 1.4 today. The chain has used around 2.2 gigagas per minute, with peaks reaching 2.5 Ggas. Comparatively, this places it higher than most EVM chains such as Polygon, Avalanche C-Chain, Arbitrum One and OP Mainnet, and just under BSC. We expect that the chain will continue to increase their gas target.

In terms of fees, Monad has averaged 112 MON in total fees today, split between base fees and priority tips. Around 87% of these have been from base fees (average of 98.5) while the remainder (approximately 13%) has been from priority tips.

We wanted to give a huge shoutout to Revick from gmonads.com who was extremely helpful and allowed us to use his data for our charts. Make sure to check out gmonads.com to stay up to date on Monad data.

Developments

evm/accathon

Monad announced the winners of their evm/accathon:

KiSignals:

Terminal which aggregates sentiment data, tickers and information from both Telegram chats and Twitter.

Twitter: https://x.com/tradeKiFi

Website: https://beta.kifi.app/en

StageFun:

Allows crowdfunding of events and repaying funders back through ticket sales and sponsorship dollars.

Twitter: https://x.com/stagedotfun

Website: https://stage.fun/

OwnPay:

RFID-based payments application.

Twitter: https://x.com/owndotfun

Website: https://own.fun/

Gorillionaire:

Trading terminal which analyzes onchain data such as holders, volume, listings and generates insights based on the data.

Website: https://www.gorillionai.re/

StitchAI:

Knowledge hub for AI agents, providing a platform-agnostic memory layer that enables cross-platform knowledge transfer.

MonadBFT Launch

Category Labs launched “MonadBFT: Fast, Responsive, Fork-Resistant Streamlined Consensus”. MonadBFT builds on pipelined HotStuff, while introducing tail-forking resistance, single-round speculative finality and linear complexity in the happy path.

Read more about MonadBFT here:

https://x.com/keoneHD/status/1908258919295967280

https://arxiv.org/abs/2502.20692

Kizzy

Kizzy, a social media betting platform focused on creator performance metrics, went live with Season 1! You can find a short introduction of Kizzy below:

The protocol allows users to bet on metrics like views and follower counts for content creators. The platform uses a peer-to-peer betting system where users bet against each other rather than against the house. On Twitter, betting is limited to the first post per day, with reposts, pins, and replies being ineligible for betting and display on creator stats. The betting pool stays open if a creator takes longer than a day to post, remaining active until a new action is detected.

Monad launched their soulbound NFT “1 Million Nads” and sent it to over 600K wallets.

You can view the NFT here.

Ecosystem Update

Liquid Staking Derivatives

Total MON LST supply on Monad has reached 3.2M.

Majority of the LST supply comes from aPriori (1.2M MON) and Magma (1M MON). Apart from aPriori and Magma, Kintsu’s sMON has 564.1K in supply and shMonad’s shMON has 392.2K in supply. Stonad have not yet launched their product on testnet.

You can find our full Monad LSD Dashboard here:

https://data.asxn.xyz/dashboard/monad-liquid-staking

In addition, below is a general overview of the LSD space in Monad:

Stonad - Thunderhead

Twitter: x.com/stonad_

Stonad is a liquid staking protocol on Monad built by Thunderhead. The protocol allows users to stake MON tokens while maintaining liquidity through stMON tokens. Users can stake MON and receive stMON tokens.

Community codes function like an onchain referral links. They allow stMON operators to use a community code which can be passed as a parameter in the transaction that stakes MON with Thunderhead. If a community code is included in this transaction, all the stake from that transaction will be managed by the operator who is assigned that community code.

Similar to StakedHype, Stonad will likely onboard operators based on their alignment with the Monad/Stonad ecosystem, performance metrics, and security practices.

AtlasEVM

Twitter: https://x.com/atlasevm

AtlasEVM is a modular execution abstraction framework for EVM-based chains which transforms how transactions are executed. It introduces a universal auction system where Solvers compete to provide optimal outcomes for user intents or MEV redistribution. Instead of users crafting transactions, they express high-level intents (e.g. “swap X for Y”), and Solvers bid to execute those intents in a single, efficient transaction.

Protocols can integrate Atlas by using its SDK to capture user intents and broadcast them to a network of Solvers. Solvers respond with Solver Operations – proposals that might include finding the best trade route or bundling a profitable arbitrage. An auction mechanism then selects the best proposal, and Atlas’s EntryPoint contract combines the user’s intent and the solver’s solution into one atomic transaction. Users don’t need a special smart wallet – AtlasEVM works with regular accounts, making it backwards-compatible with existing dApps.

AtlasEVM enables user-centric MEV capture, meaning value that would normally be taken by arbitrage bots can instead benefit users or protocols. By running decentralized auctions for transaction execution, it forces competition for solvers which can lead to better prices and outcomes for end-users.

Kintsu

Twitter: https://x.com/Kintsu_xyz

Kintsu is a liquid staking protocol built on Monad that allows users to stake MON tokens while maintaining liquidity for other onchain activities. The protocol works by pooling users' MON tokens and delegating them across network validators, issuing sMON tokens in return that represent a share of the total staked pool.

The core functionality revolves around a Vault contract that handles staking and unstaking operations. When users stake MON, they receive sMON tokens at a conversion rate determined by the current Redemption Ratio. The unstaking process involves a cooldown period enforced by the chain itself, after which users can redeem their MON tokens.

The protocol is designed to be MEV-client agnostic, with MEV rewards being redistributed to sMON holders through stake delegation eventually. In addition, Kintsu plans to implement cross-chain functionality through intent-based bridging.

aPriori

Twitter: https://x.com/apr_labs

aPriori is a liquid staking and MEV infrastructure protocol built natively on Monad. The protocol combines traditional liquid staking mechanics with MEV extraction capabilities, creating an integrated system to maximize validator returns while maintaining network efficiency. At its core, aPriori operates through a dual-layer architecture that manages both staking operations and MEV extraction through a unified validator set.

The protocol's liquid staking mechanism allows MON token holders to stake their assets while maintaining liquidity through derivative tokens. When users deposit MON tokens, they receive a liquid staking derivative in return while their original tokens are staked via aPriori's validator network. These validators participate in both network consensus and MEV opportunities, with extracted value distributed back to stakers as additional yield.

The MEV infrastructure layer implements a specialized auction system designed specifically for Monad's high-performance environment and MonadBFT consensus mechanism. This system organizes MEV extraction through structured auctions that reduce network spam while creating a marketplace for MEV opportunities.

Magma

Twitter: https://x.com/MagmaStaking

Magma is a DAO-owned liquid staking protocol built on Monad that enables token holders to stake and earn rewards while maintaining liquidity through its gMON token. The protocol allows users to stake Monad tokens and receive gMON tokens on a 1:1 basis.

The protocol's architecture consists of two main components: the liquid staking system and the Distributed Validator Technology ("DVT") network. The liquid staking component manages token deposits, delegation, and the issuance of gMON tokens, while the DVT network handles the operation of Monad full nodes. The DVT implementation utilizes Multi-Party Computation ("MPC") for key share distribution and Boneh-Lynn-Shacham ("BLS") threshold signatures for validator ownership splitting.

The system operates through a two-phase stake deployment process. Initially, user deposits are delegated to whitelisted node operators through governance. Following this, these assets transition to DVT-operated nodes. The DVT network functions through a high-throughput P2P network designed to support MonadBFT's subsecond validation requirements, with operators coordinating to achieve 2/3 consensus on signatures before network validation.

Kuru

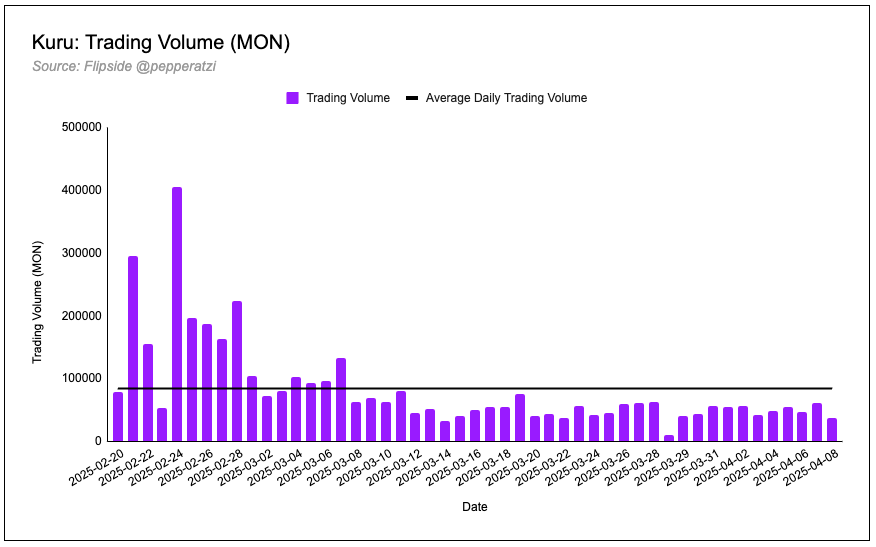

Kuru has had an average trading volume of 84.2K MON on testnet, with an all-time high of 404.8K MON on the 24th of February. Since their launch on testnet, they’ve launched 58.6K markets for trading. Users can launch markets by creating vaults.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.