Hyperliquid Issue #5

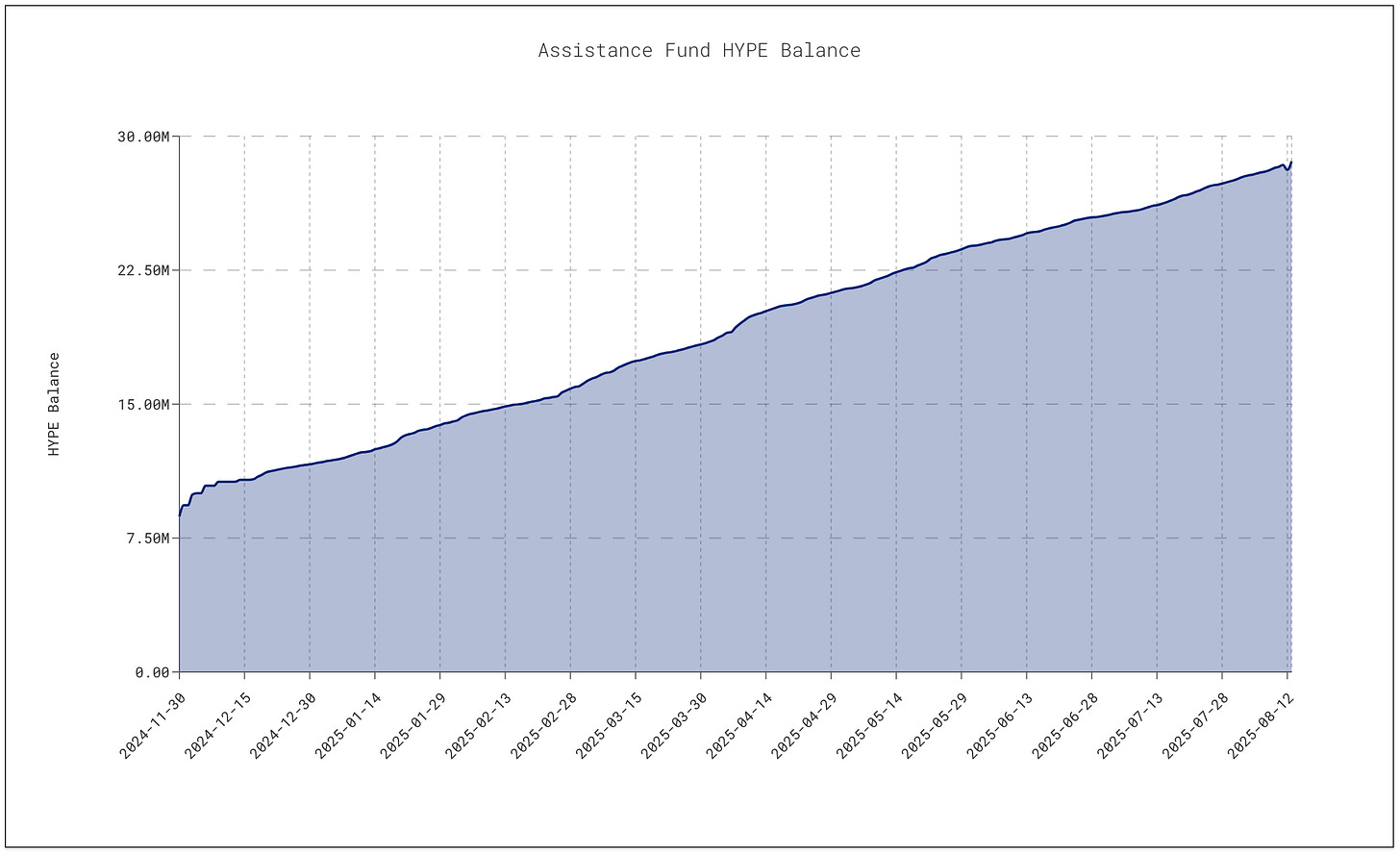

We published our last Hyperliquid update back in February 2025. Since then, Hyperliquid has continued to demonstrate exceptional execution across all fundamental drivers, with trading volumes increasing 88.75% since our February coverage to $10.57B daily average and open interest reaching $15.72B.

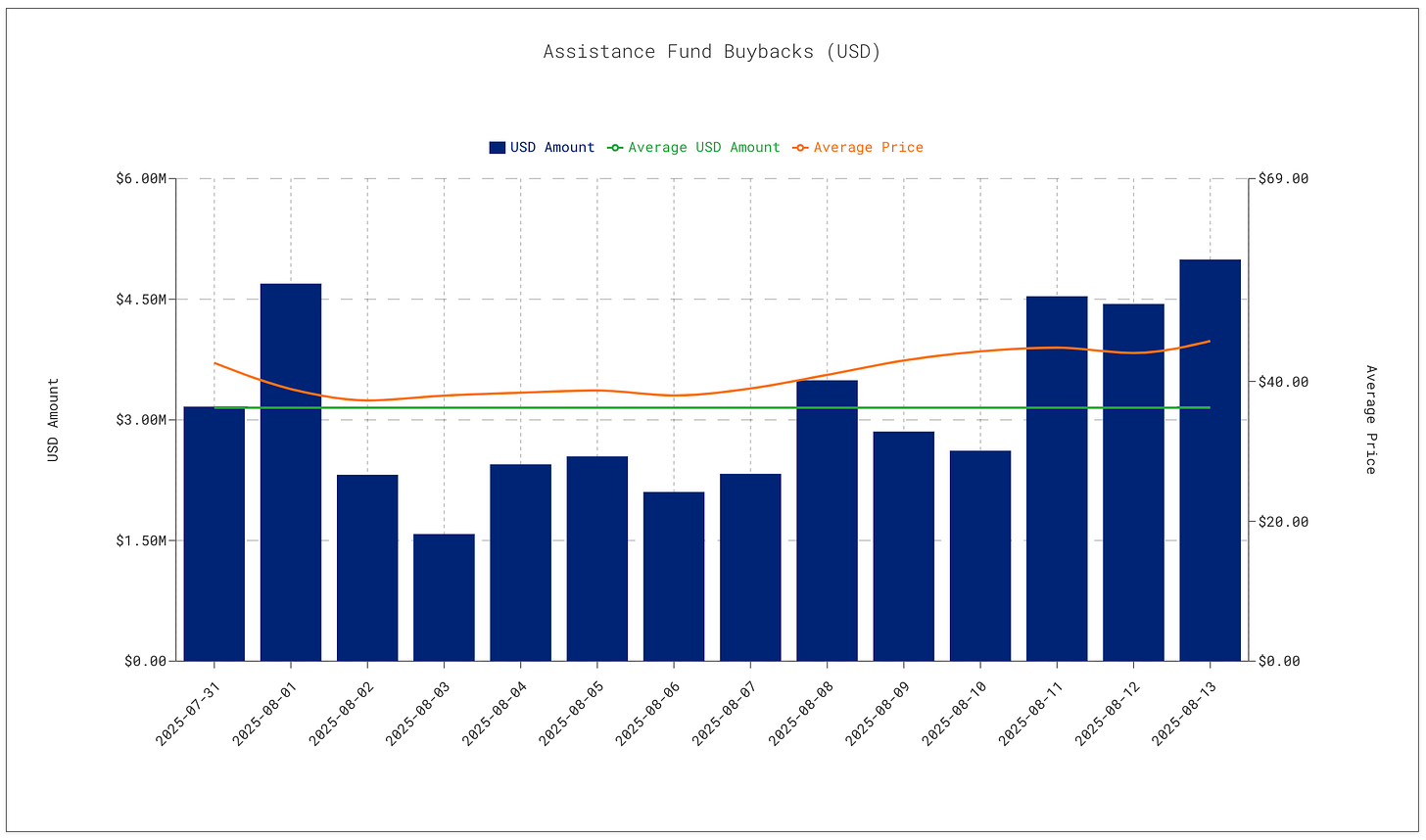

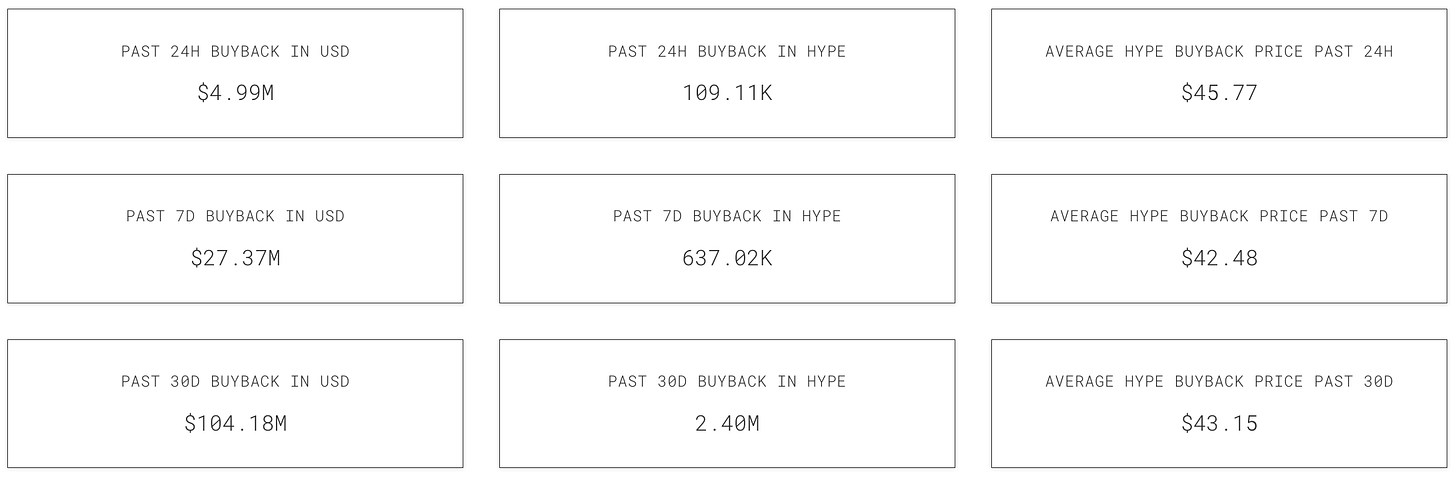

The protocol continues its aggressive revenue-based buyback strategy, with the Assistance Fund deploying $104M in HYPE buybacks over the past month, accumulating 8.58% of circulating supply worth $1.3B since inception.

Network security has strengthened with 43.10% of total supply now staked across permissionless validators, while the HyperEVM ecosystem is gaining significant traction with Kinetiq reaching $1.33B in total value locked.

Buybacks

The Hyperliquid AF bought back just above 310K HYPE over the past three days (worth approximately $14M USD).

Over the past week, the AF bought back 637K HYPE ($27.4M USD), which is nearly 0.2% of circulating supply.

Over the past month, the AF has bought back 2.4M HYPE ($104.18M USD), at an average price of $43.15 USD.

The HYPE assistance fund now holds 28.64M HYPE ($1.3B USD) or 8.58% of circulating supply.

Volumes and OI

Over the past month, Hyperliquid has averaged $10.57B USD in daily perpetual volumes. In our last update, back in February, Hyperliquid had averaged $5.6B in volume over the previous 3 months. Average volumes on Hyperliquid have since increased 88.75%.

Open interest on Hyperliquid sits at $15.72B as of today. Over the past month, the daily OI average has been $13.01B USD.

Spot Ecosystem and Stablecoins

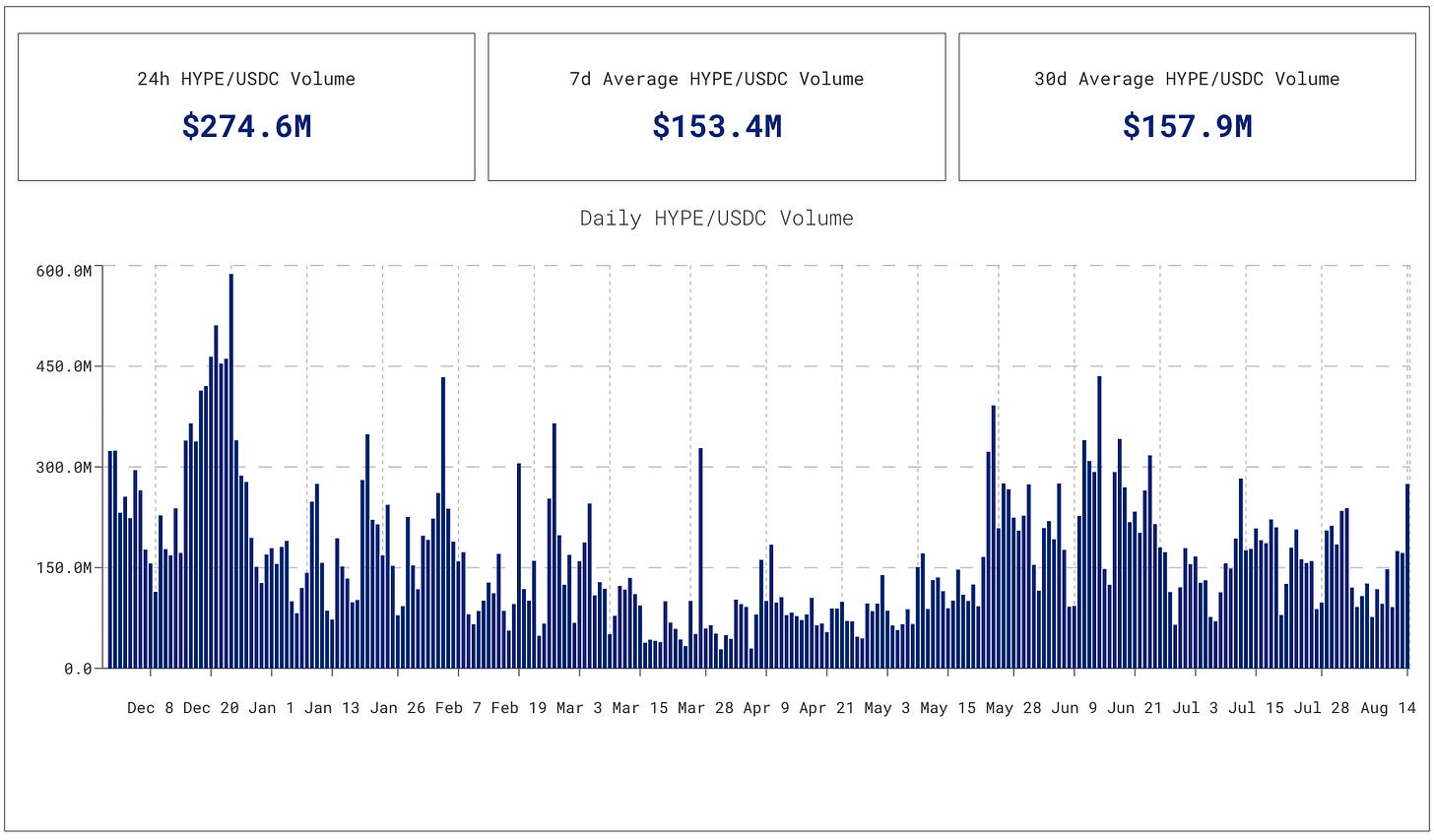

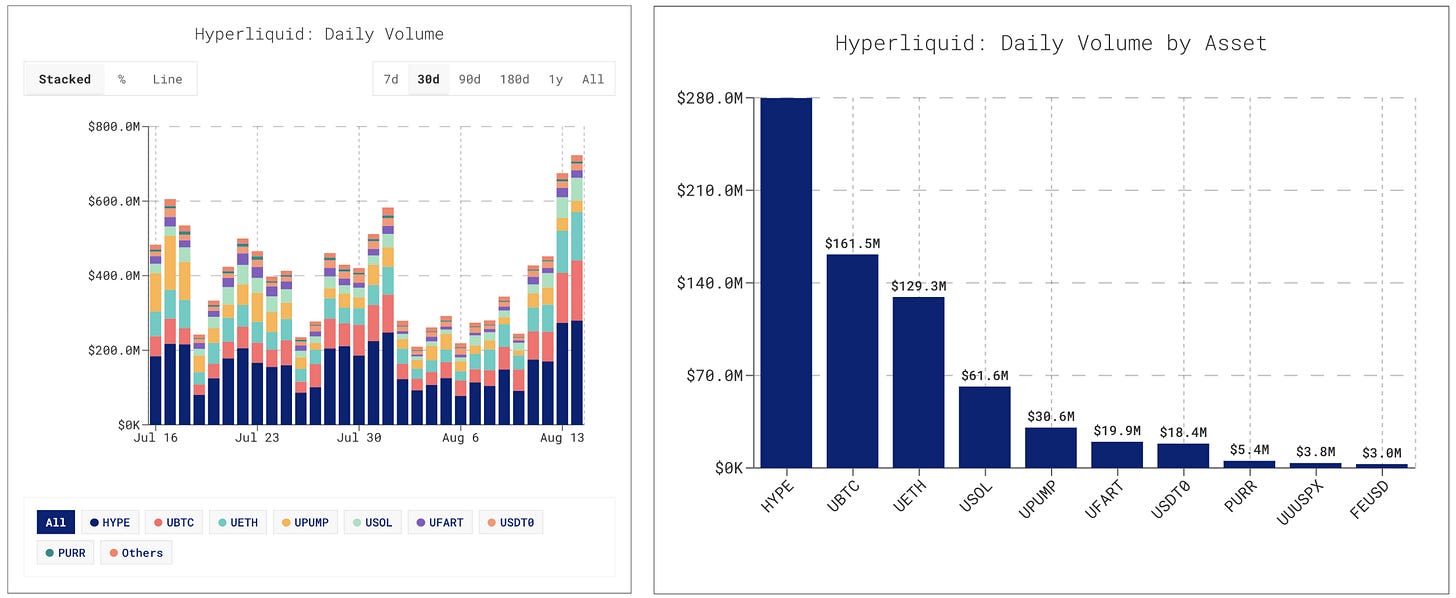

24H HYPE/USDC volumes are $274.6M USD, higher than the past 7D ($153.4M USD) and past 30D ($157.9M USD) averages.

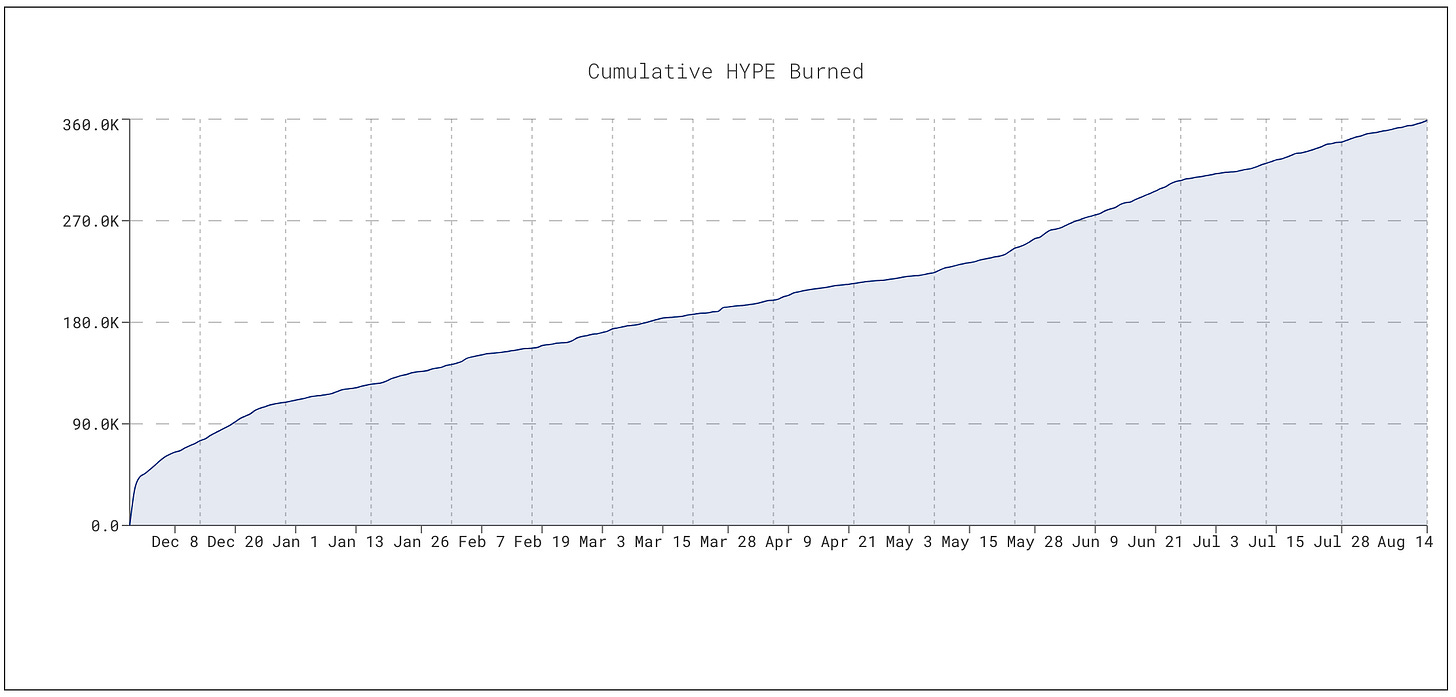

The native spot and perpetual order books utilize the same volume-based fee schedule for each address. However, fees collected in non-USDC HIP-1 spot tokens are burned. HYPE/USDC spot volume therefore directly results in the permanent burning of HYPE. Since inception, 360K HYPE has been burned

Spot volumes on HyperUnit are steadily increasing, with UBTC and UETH processing $161M and $129M in daily volume yesterday. HyperUnit assets made up 55.6% of daily spot volume over the past day.

The HyperEVM holds 18.7M HYPE ($898M) or 5.6% of circulating supply.

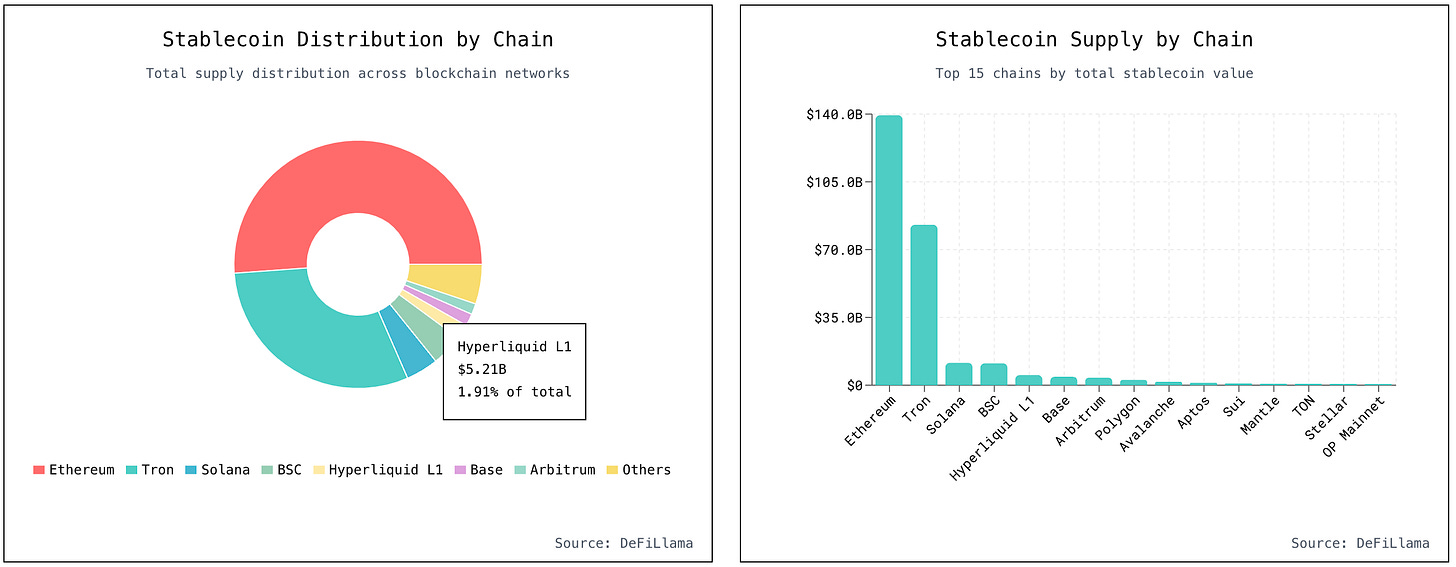

Currently 1.91% of all stables sit on the HyperCore (>$5B), with an account linked to Galaxy depositing $100M yesterday, August 13th 2025.

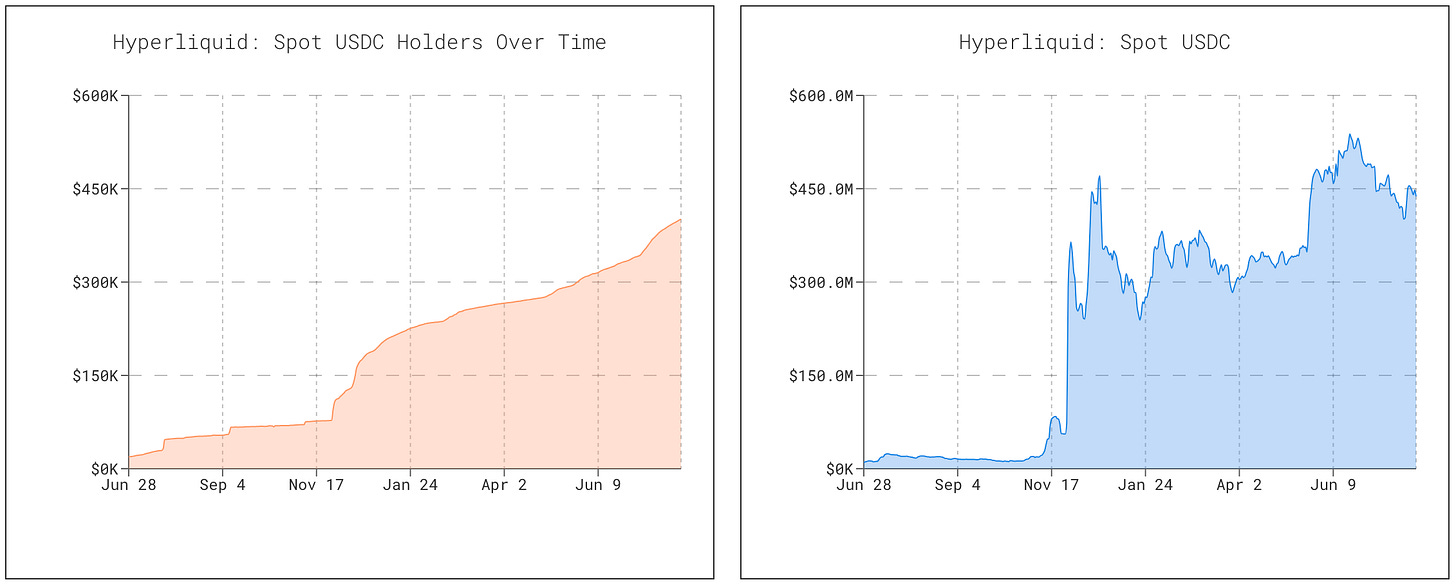

Spot USDC available on the HyperCore sits at just above $455M USD, while spot USDC holders are steadily increasing and have crossed 400K.

Circle committed to issuing native USDC on the HyperEVM, reducing the bridged USDC risk and enabling USDC to freely flow between core and EVM, which will greatly benefit HyperEVM apps that rely on stablecoins — such as HyperLend, Felix, etc.

Staking

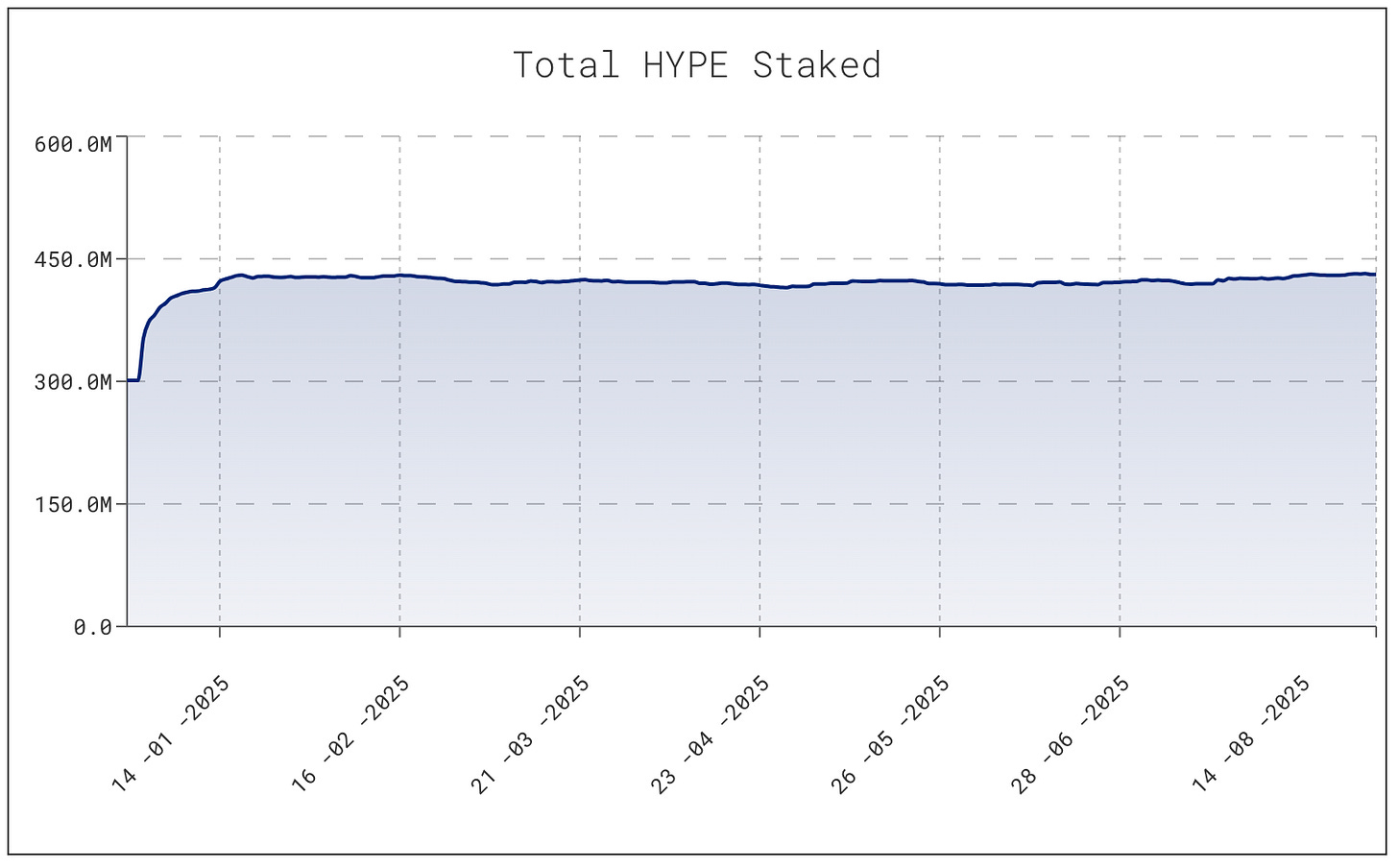

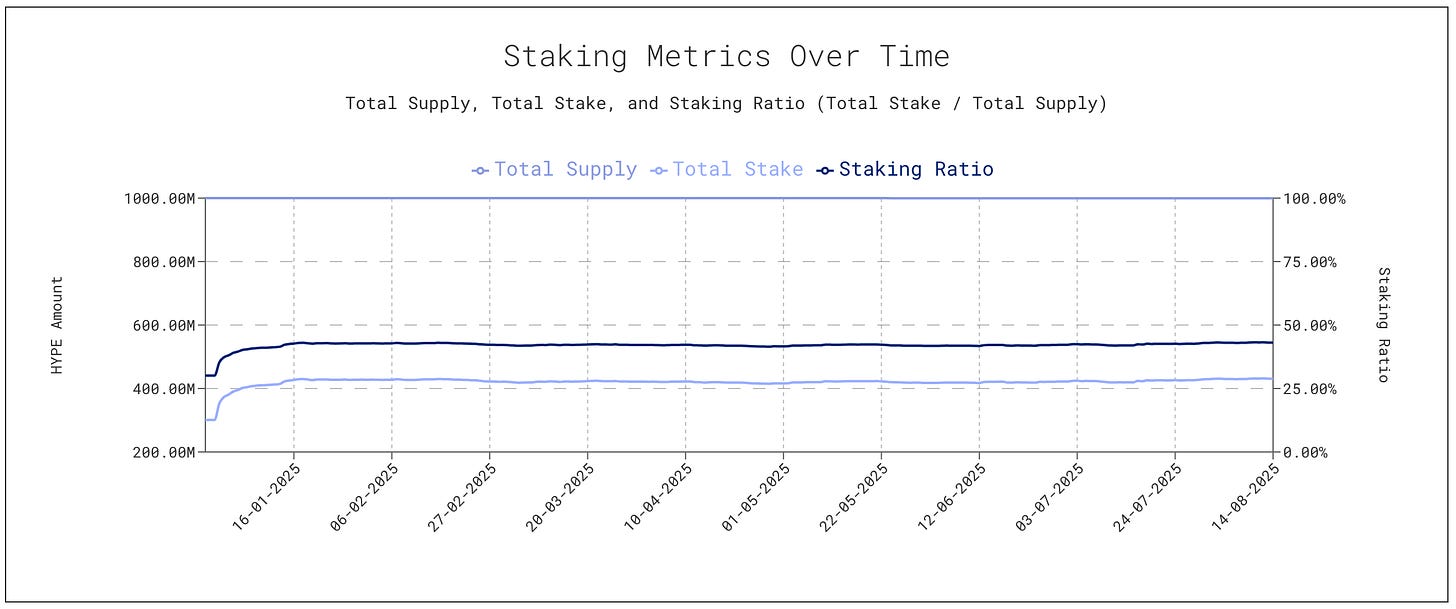

At launch, Hyper Foundation validators had a combined HYPE stake of 300.96M (60.192M HYPE each). Now, there is 430.9M HYPE staked across a permissionless validator set — meaning that 43.10% of the total supply is now staked.

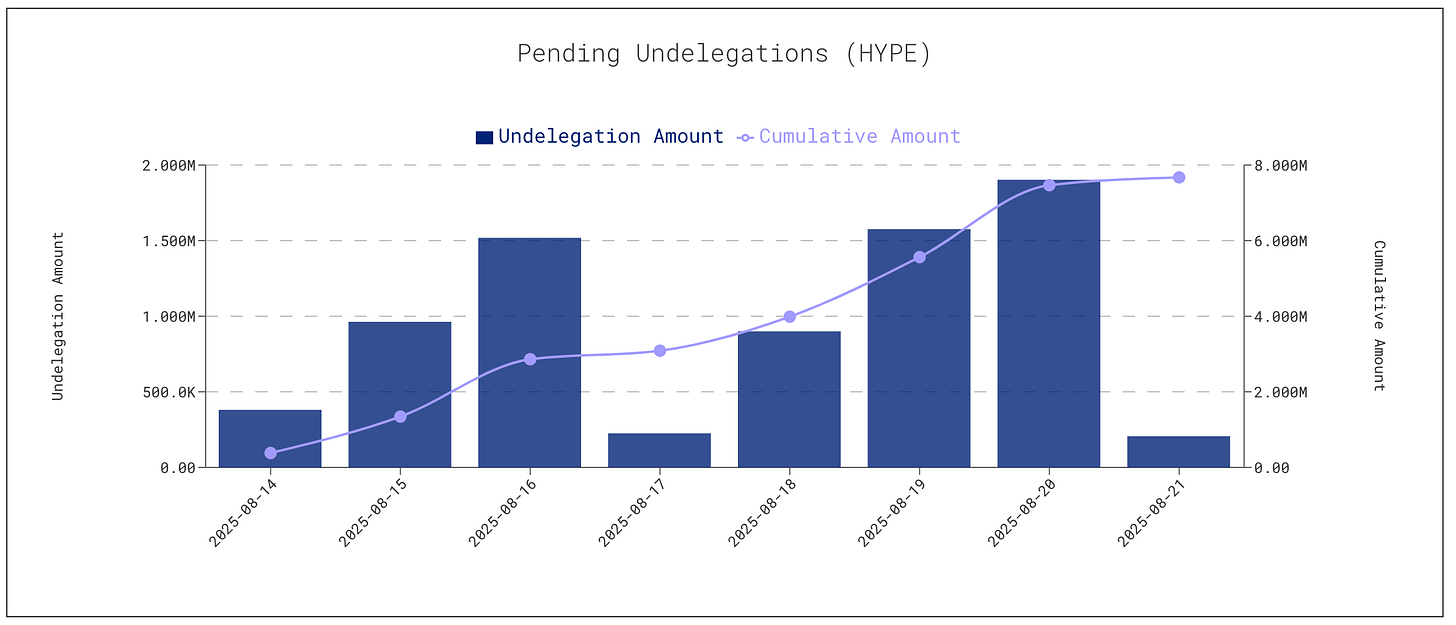

A cumulative 7.673M HYPE ($360.25M USD) will be unstaked over the next week. The largest daily unstaking will occur on August 20th, with 1.903M HYPE ($32.26M USD) being unstaked.

Recently Kinetiq’s kHYPE launched and has become the largest protocol on the HyperEVM with $1.33B in TVL.

ASXN joined Kinetiq's institutional LST, iHYPE, as a validator.

Auctions

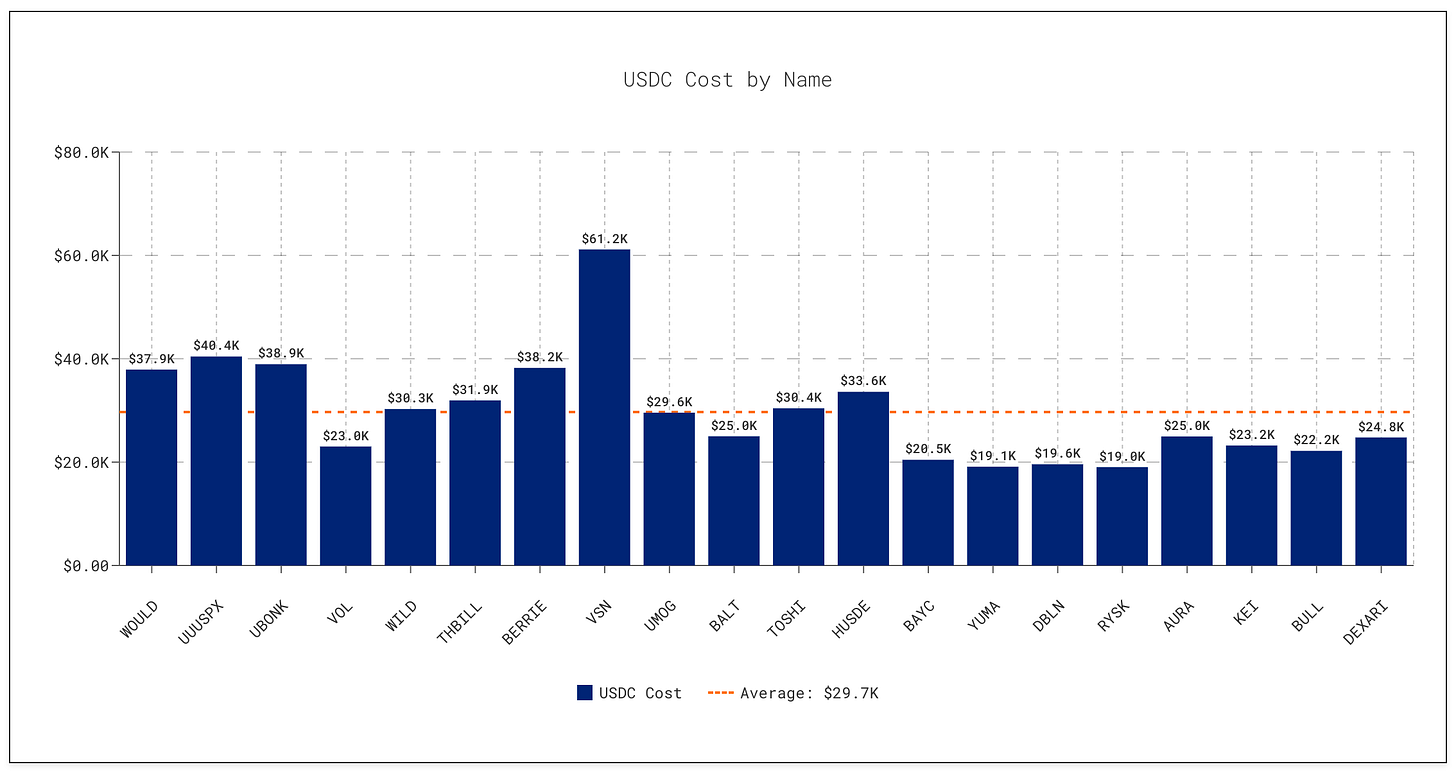

Auctions are averaging $29.7K in HYPE over the past 30 days, with the most recent auction being won by Dexari for $24.8K.

Notable HyperUnit tickers over the past 30 days include BONK, SPX, and MOG. In addition, the ticker RYSK was bought on the 7th of August — potentially by the team behind Rysk Finance, an options-focused protocol.

HLP

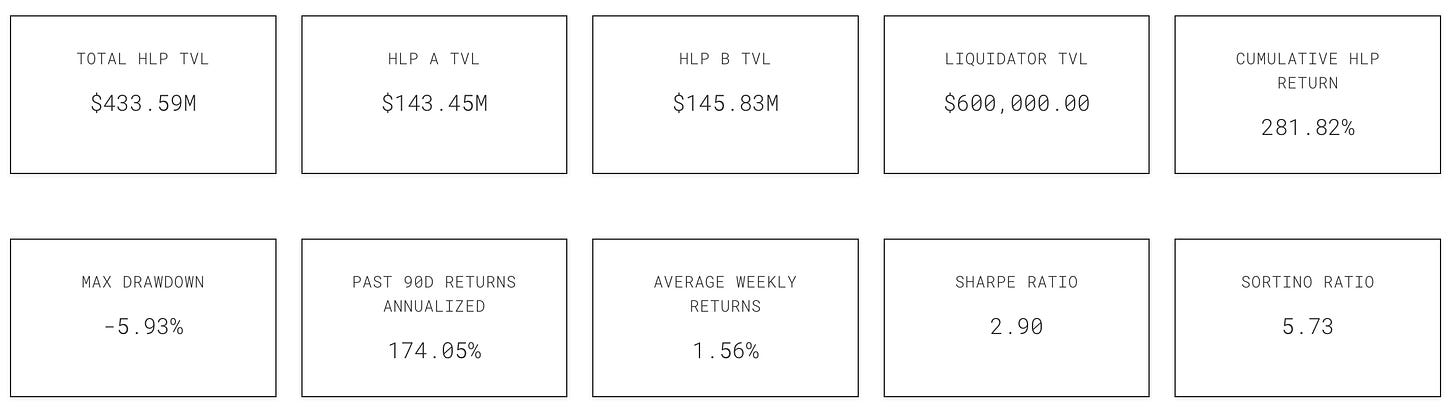

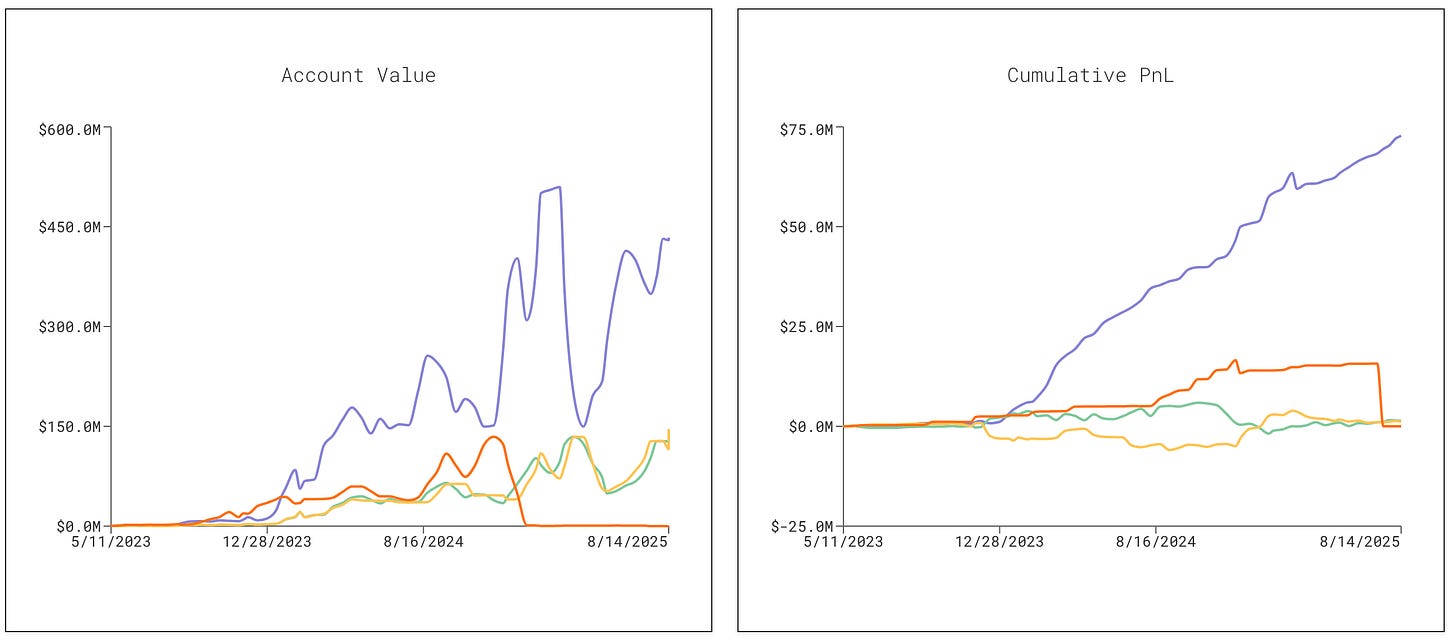

Total HLP TVL sits at $433.6M USD, split across HLP A ($143.45M USD), HLP B ($145.83M USD), and the Liquidator ($600K). The HLP's max drawdown has been 5.93%, and its average weekly return is 1.56%. Cumulative PnL is now $72.8M (281.82% return), putting the HLP's Sharpe ratio at 2.9.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.