Daily Notes 26-09-2023

Developments

Maker Governance Proposal To Double T-Bill Allocation

A poll has been posted to Maker’s governance board that seeks to reactivate the Debt ceiling instant access module which used to allow users to adjust the debt ceiling of their real world asset vaults within constraints.

The reactivation would set the:

Maximum Debt Ceiling to 3 billion DAI

Target Available Debt* to 50 million DAI

The Ceiling increase* cooldown to 24 hours

*The Target available debt parameter controls how much of a gap there is between the current debt usage and the debt ceiling.

*The ceiling increase cooldown controls how frequently user’s can increase the debt ceiling through the instant access module.

If successful the poll will move to an executive vote.

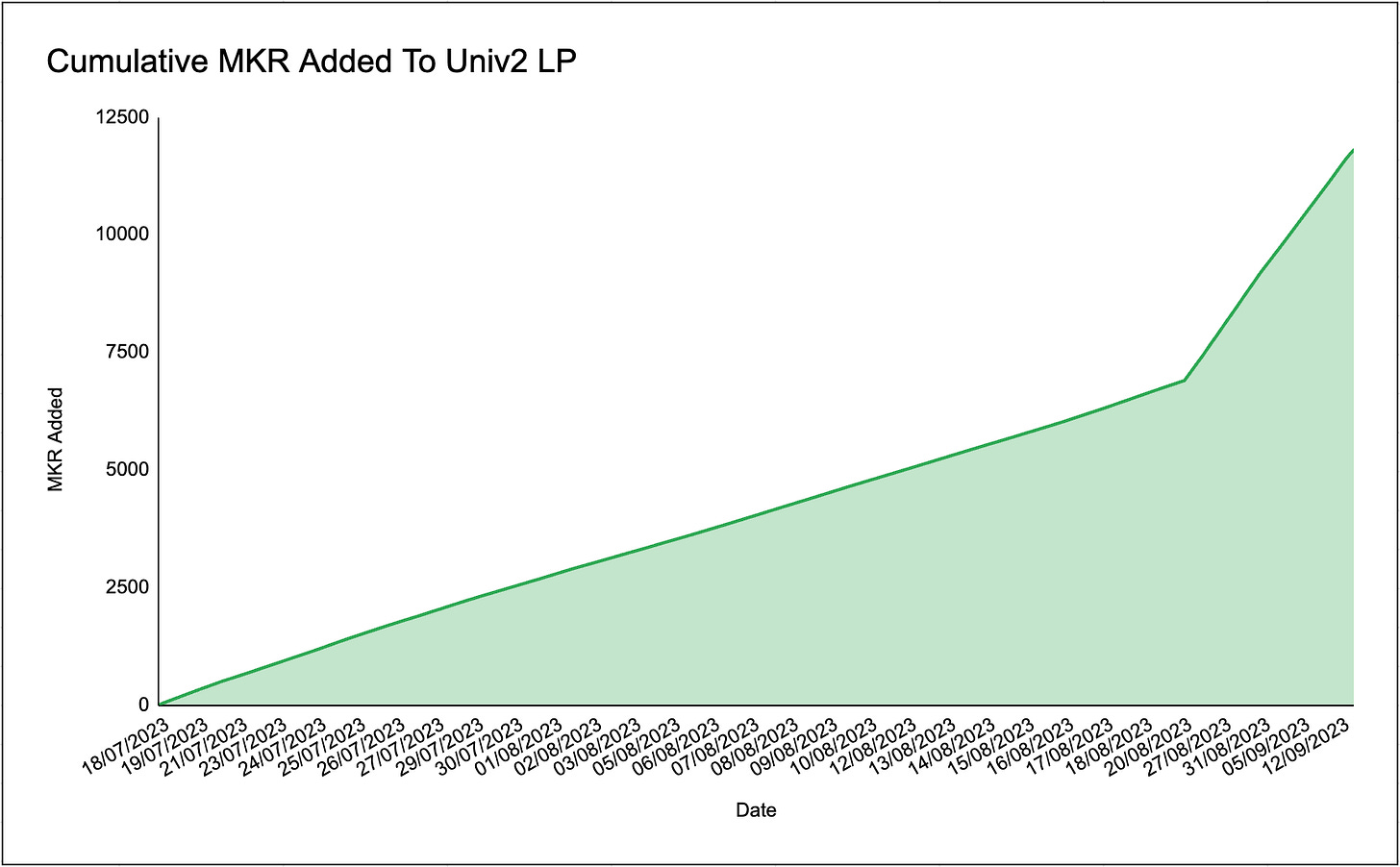

If the poll moves to and passes an executive vote, this would essentially double Maker’s allocation to T-bills, resulting in a huge jump in Maker revenue and thus a large MKR buyback and LP. So far, the Smart burn engine has bought back and LP’d 11,802 MKR.

HTX (formerly named Huobi) was hacked for $8 million worth of ETH today. The founder, Justin Sun,has stated that HTX has fully covered the losses incurred from the hack and that the exchange still operates as usual. HTX has also reached out to the hackers on-chain and stated that they have “confirmed their true identity” and offered a $400,000 white-hat bounty (5% of stolen funds) as well as a job as a security white hat advisor for HTX to incentivise the the

returning of the ETH within 7 days (Oct 2nd). If the hacker fails to return the funds, HTX will be involving law enforcement and will be seeking to prosecute the hacker.

Microstrategy Acquire 5,445 BTC

MicroStrategy has purchased an additional $149 million worth of Bitcoin at an average price of $27,053 per BTC. This brings their total Bitcoin holdings to 158,245 $BTC (equal to $4.68 billion), which have been acquired at a total average price of $29,582 per $BTC.

Celestia, a modular blockchain network that provides a scalable data availability layer for developers, has announced their upcoming Genesis drop which sees 7,579 developers and 576,653 eligible addresses able to claim their native token $TIA. The claim will distribute 60 million $TIA (6% of total supply) and users can check eligibility through Celestia’s site

$TIA will be used by developers to pay for blobspace on Celestia’s chain where users will also be able to stake $TIA to partake in governance of the network and over a community pool which receives 2% of block rewards.

Circle Will Soon Launch USDC On Polygon

Circle will be launching native $USDC on Polygon “soon”. It will replace bridged $USDC which has so far facilitated $475 billion in volume across 230 million transactions from July 2021 to July 2023, on the Polygon chain. In total 6.6 million addresses have interacted with bridged $USDC on Polygon with 1.6 million of those addresses added since January of 2023.

Mixin Network, a “decentralised peer to peer multi-wallet service”, was hacked for $200 million. The founder, Feng Xiaodong, communicated through a live stream that they can only guarantee 50% of user assets and are flirting with the idea of launching bond tokens for the rest that Mixin will buy back from users in the future.

Mixin have blamed the hack, which only took $BTC, $ETH, $USDT ($USDT was then swapped to $DAI), on the compromise of a third-party cloud database that presumably held user private keys. Mixin are currently in contact with Google and have also partnered with SlowMist to aid the investigation.

All withdrawals and deposits have been halted on the service which previously reported their top 100 tokens to be equivalent to ~$1.1 billion of assets.

MoneyGram will be launching a non-custodial wallet service set to release in the first quarter of 2024. The wallet will also be leveraging stablecoin technology MoneyGram is a service that allows customers to transfer money internationally to over 40 countries. Its stock was at a $1.09 billion market cap before it ceased trading in March of this year. The company also reported revenues of $303.4 million for the 4th financial quarter of 2022.

Binance has re-opened access to their exchange for Belgian users. The relaunch sees the reacceptance of new user registrations from Belgian citizens and continued access to Binance’s services for current users after Binance was told to cease operations in late last August by Belgian financial regulators. This returned access was made possible through the entity, Binance Poland.

Earlier this month Binance also banned the trading of privacy coins like Monero and MobileCoin among others in Belgium France, Italy, Poland and Spain.

Binance has now burned $500 million of $wBETH. This comes after yesterday’s minting of $500 million worth of $wBETH on-chain which was then deposited it to their exchange. $wBETH is a on-chain wrapped form of $BETH, a token pegged 1:1 to ETH, that users receive having staked their ETH on Binance. As a 1:1 pegged token, the $wBETH minted accounted for 27% of the total 1.157 million ETH staked through Binance.

Trending Assets

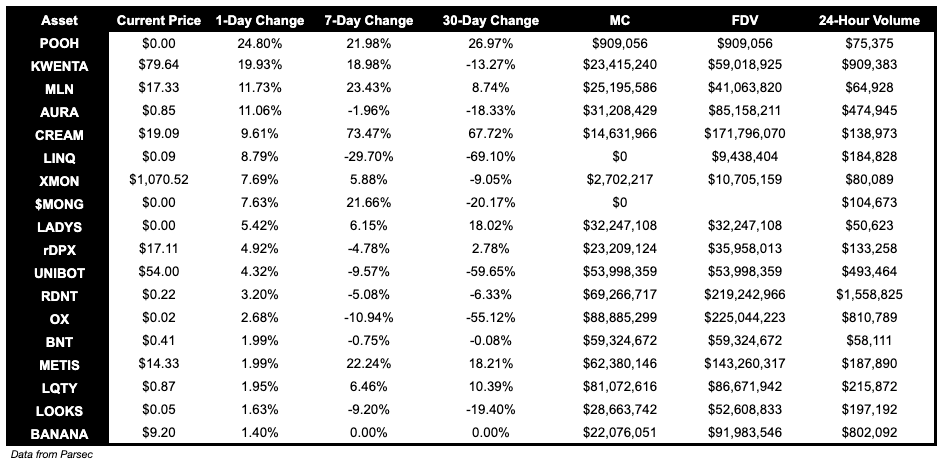

Top 300 Performers

Top 300 Losers

Below $100M MC by performance, on chain

KWENTA is up 19.93%, and AURA is up 11.06% over the past day.

Above $100M MC by performance, on chain

BONE did well today, up 10.51%. FXS is up 3.63%.

Above $1B MC by performance, on chain

SHIB, up 23.77%, and MKR, up 7.95%, performed well over the past day.

TVL

TVL Above $10M

Over the past day:

mySwap, DEX on Starknet, TVL is up 18.28%.

JediSwap, DEX on Starknet, TVL is up 8.64%.

Jito, LSD on Solana, TVL is up 6.86%.

Fees

Most fees earned down over the past day, apart from zkSync Era, whose fees earned are up 2.94%.

Articles / Threads

Raft outlines RAFT tokenomics: total supply of 2,500,000,000 $RAFT. Raft is used for staking and governance, and 10% (250,000,000 RAFT) of the total supply is allocated to veRAFT staking rewards.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.