Weekly Summary 7

16-07-2023 to 23-07-2023

Developments

Maker Smart Burn Engine Starts

Makers Smart Burn Engine has been activated. It will purchase MKR tokens using the excess DAI from the Surplus buffer. These acquired MKR tokens are then combined with DAI into a Uniswap v2 liquidity pool.

In the initial three months, the Smart Burn Engine will facilitate buybacks worth an estimated $16 million (485 MKR were bought from the market and added to the LP since Wed 19th July).

Maker had previously paused its buyback and burn program on February 1, 2022. Prior to the termination of the program, the protocol was generating an annual profit of $20 million in the month leading up to the end of the program. Currently, the profit rate has quadrupled to $85 million (thanks to interest rates and Makers RWA allocation), with half of it being allocated for the repurchase of MKR tokens following the proposal of the Smart Burn Engine.

Celsius Started To Sell Alts

Celsius have started sending altcoins to their FalconX deposit address and their OKX deposit address, presumably to convert to the majors, ETH & BTC.

Notably, 4.45 million 1inch tokens ($2.5mil) were sent to FalconX and the price fell 20% not longer after.

Mantle Network Launches

Mantle network launched their new L2 token, $MNT. Users are able to convert their BIT to MNT at a 1:1 ratio through Bybit or via a smart contract.

The contract: 0xfFb94c81D9A283aB4373ab4Ba3534DC4FB8d1295

By the 19th, a cumulative 49.7M BIT ($28.47M) has been converted to MNT via the contract.

Inscriptions

This weekend approximately 647,000 Ordinals were inscribed onto the Bitcoin blockchain with 386k inscriptions on Sunday alone. Sunday represents the third most active day since the inception inscriptions & there is a clear trend forming.

Ethena Finance, a stablecoin and RWA protocol on Ethereum, raised $6M for its seed round led by Dragon Fly Capital.

Uniswap has announced Uniswap X, a new permissionless, open source (GPL), auction-based protocol for trading across AMMs & other liquidity sources.

Uniswap X allows users to access better prices, gas-free swapping, MEV protection and no cost for failed transactions.

Vertex Protocol Overtakes GMX In Daily Volume

Vertex Protocol, a hybrid orderbook-AMM margin DEX on Arbitrum, has overtaken GMX, Synthetix and Kwenta in volume over the past 24 hours on the 20th of July.

Vertex had $116.03M volume over the day, followed by Synthetix ($97.14M), Kwenta ($95.94M) and GMX ($64.74M).

Vertex’s volume has increased by +569% and TVL has increased by 25.95% over the 30 days, likely due to airdrop farmers.

Chainlink announced that Chainlink CCIP is now in Mainnet Early Access for Avalanche, Ethereum, Optimism and Polygon. Additionally, CCIP has been adopted by Synthetix and Aave. Protocols will be needing LINK tokens to use CCIP.

Synthetix will be using CCIP to Synthetix to transfer tokens across chains through a burn-and-mint model. Aave protocol will use CCIP for their cross-chain governance system.

Now in Mainnet Early Access, CCIP has been adopted by DeFi leaders such as Synthetix and Aave to unlock the cross-chain economy.

CCIP allows:

Arbitrary messaging passing

Simplified token transfer

Programmable token transfers

Active Risk Management (ARM) Network

Token transfer rate limits

Smart Execution

Timelocked upgradability and more.

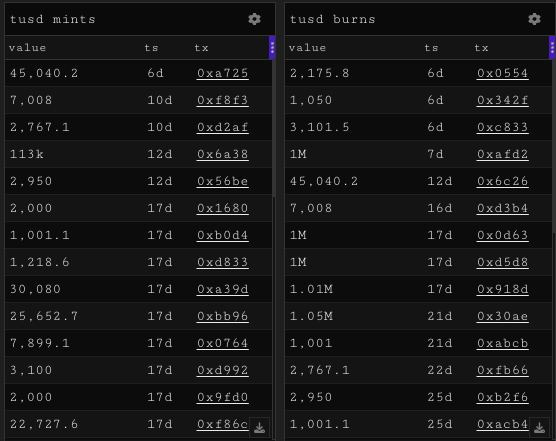

TUSD & Justin Sun Lawsuit

The founder of Archblock has initiated legal proceedings against Justin Sun, the founder of Tron amongst other things. The suit claims that Sun meticulously masked his involvement by using a series of entities and individuals to execute the acquisition of TUSD.

This comes after months of skepticism of the legitimacy of TUSD and it’s use on Binance and with the wind down of Prime trust. Taking a look at the burns and mints of TUSD we can see that none have been processed for 6 days and even before that only a few were being processed successfully. This raises questions as to the backing and financial health of the stablecoin.

Ethereum ICO Participants Moves Coins to Kraken

Ethereum ICO participant (0x8b5) deposited all 61.216K ETH (currently worth $116.74M), which they had received from the ICO to Kraken (Kraken Deposit: 0x828) on the 19th. The ETH ICO price was approximately $0.31.

BNB Burn

BNB Chain recently completed its quarterly "auto-burn," removing 1,991,854 BNB tokens, equivalent to $480 million, from circulation. This burn event reduced the circulating BNB supply by roughly 1.2%.

You can monitor burns at this site: https://www.bnbburn.info/

Tx here.

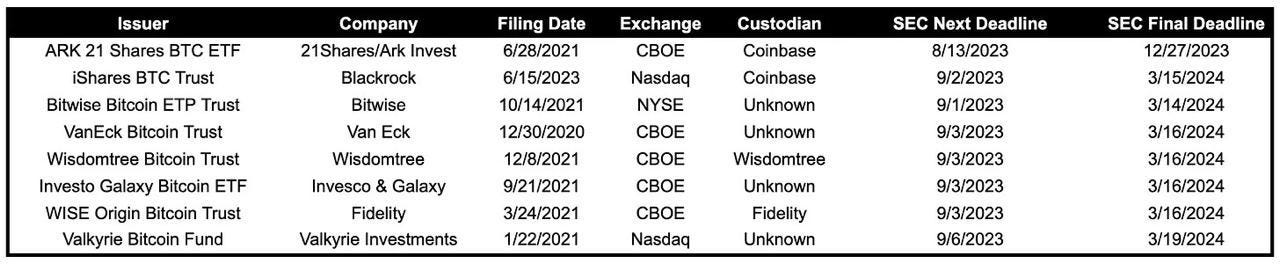

8 BTC ETFs Put on Register

The U.S. Securities and Exchange Commission (SEC) has accepted applications to create spot bitcoin exchange-traded funds from six firms today, putting them on their register.

Once applications are registered, they trigger a 240-day review period, broken down into four phases of 45, 45, 90, and 60 days respectively. At the end of each phase, the SEC decides whether to approve, reject, or postpone the application. Therefore, September 2, 2023, stands as the next crucial date to monitor.

A reminder of the current timeline:

Sui Passes Solana in Daily Transactions

Sui daily transactions have surpassed Solana's over the past few weeks.

Over the past 7 days, Sui has average 18.15M daily transactions per day, while Solana has averaged 16.99M Both Sui and Solana have much higher transactions per day compared to Aptos and Near, who combined average 726.6K transactions a day.

However, in every other metric, Solana continues to dominate other non-EVM chains: For daily active addresses, over the past week: Solana averaged 264.1K, Near averaged 81.2K, Sui averaged 32.4K, Aptos average 18.5K.

Solana also continues to hold the most TVL, at $312.7M, whereas: Aptos has a TVL of $42.32M, Near has a TVL of $36.93M, Sui has a TVL of $13.01M.

Solana holds more than 75% of the TVL market share amongst the four. Additionally, with the recent rise in Solana DeFi and TVL, Solana's TVL dominance has been growing.

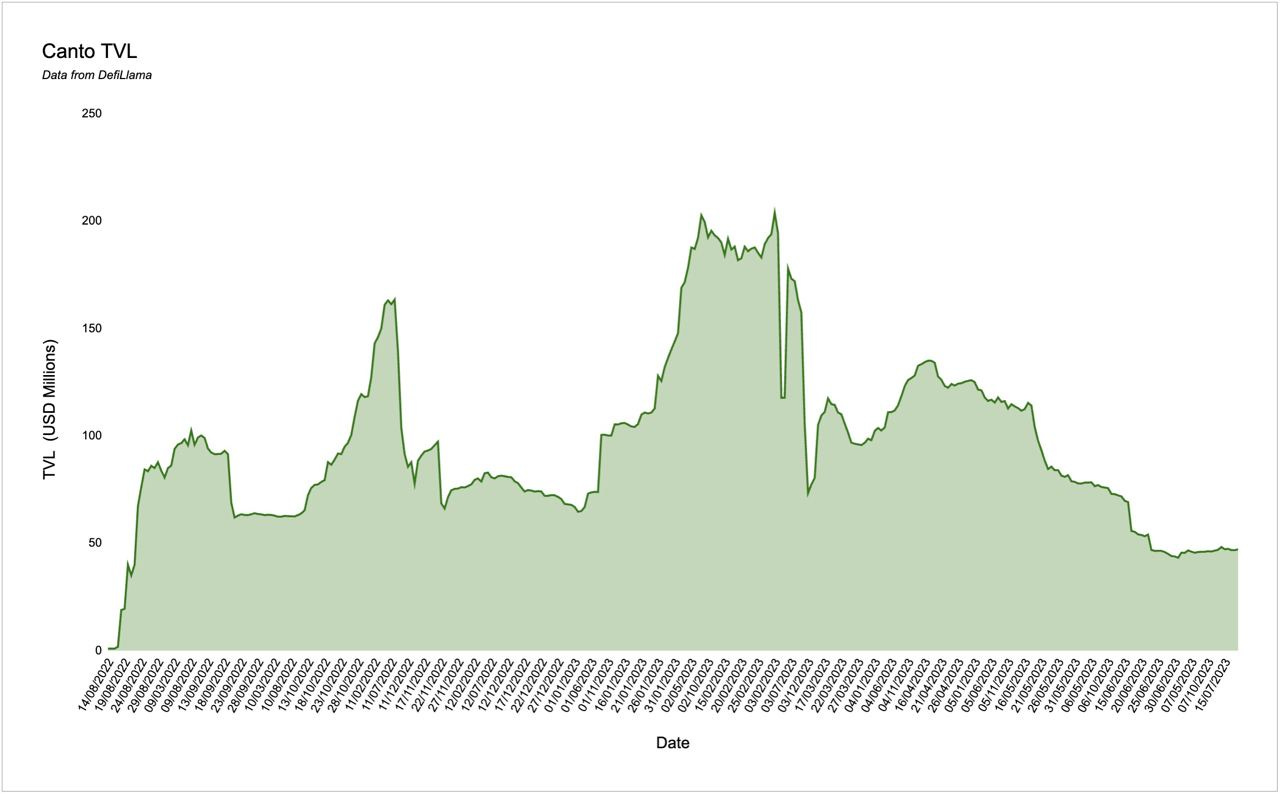

Fortunafi, a RWA protocol, will deploy native Treasury Bills on Canto.

1inch Token Balance on Centralized Exchanges Surges to $65M

The number of 1INCH tokens held in CEX wallets has reached a new ATH on Tuesday, surpassing 184.28M tokens (equivalent to $65M).

184.28M 1INCH represents 18.65% of the circulating supply and 12.2% of the total supply.

Thirteen hours ago, Dragonfly Capital transferred 12 million $1INCH tokens, worth about $4.12 million, to Coinbase and OKX.

They previously secured 50 million $1INCH tokens in two rounds, on January 3, 2022, and July 18, 2023.

Before these transactions, they had already moved 38 million $1INCH tokens, valued at $15.03 million, to Genesis Trading OTC, Coinbase, and OKEx.

Unibot announced Unibot X, a trading terminal with real-time data powered by Gecko Terminal. Early Access is available to: top 100 UNIBOT Holders, top 100 Users by Bot Txn Volume and 100 random users.

The cumulative number of new users also passed 4,200 today on the 22nd.

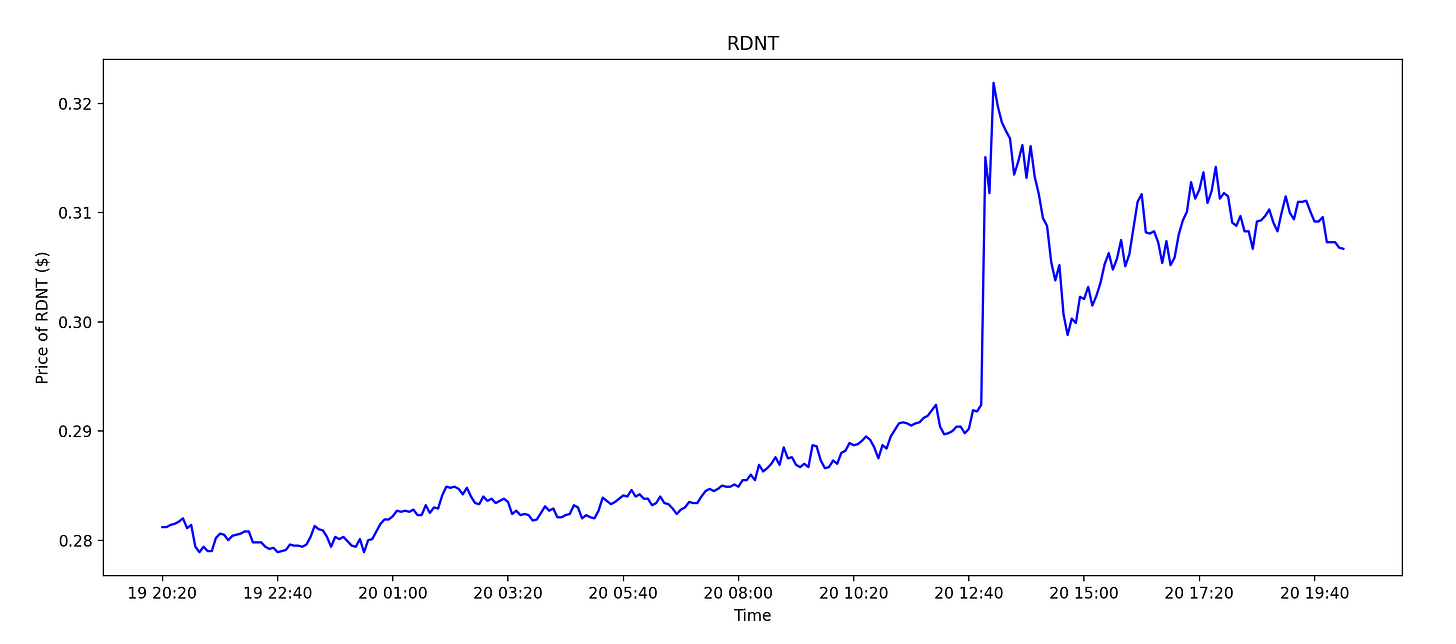

Radiant Capital, an omni-chain lending and borrowing protocol, received a $10 million investment from Binance Labs.

Worldcoin Launches on OP Mainnet

Worldcoins’s World ID and Worldcoin protocol have started their migration to OP Mainnet.

In support of World ID, the Worldcoin protocol has been migrated to Ethereum, with bridges in place for Optimism and Polygon PoS. Most of the Safe wallets have already been rolled out on OP Mainnet, while the remaining wallets will be deployed when users initiate the migration. The World App has started to offer support for Uniswap on OP Mainnet. Furthermore, the World App has been updated to prompt users to start the migration process, which typically takes around 90 seconds on average.

Gains Releases New Tokenomics Plan

Gains has released a new tokenomics plan, targeted to go live in September, where:

Development fund revenue will be redirected to $GNS staking

NFTs and features will be deprecated for $GNS compensation

NFT bot revenues will be redirected to GNS staking (80%) and oracles (20%)

Total supply will increase by 4.36M (up 14%)

$GNS revenue-capture share will increase from 33% to 60%

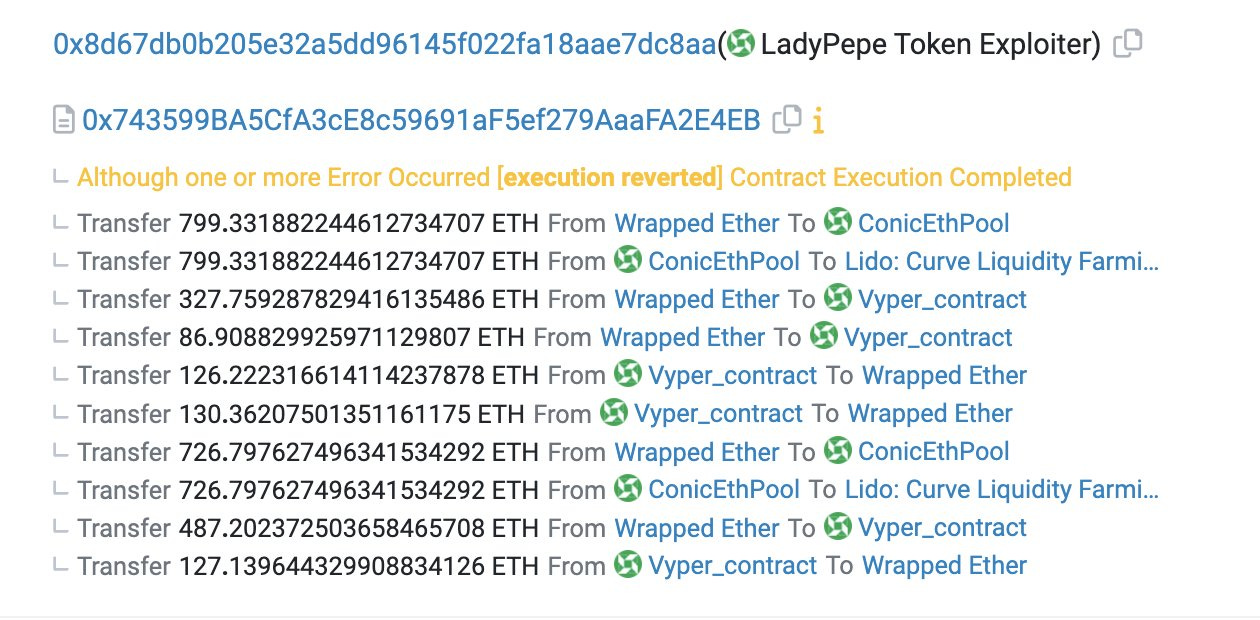

Conic Finance was exploited for $3M. The team announced that the attack was due to:

“The root cause was a re-entrancy attack that was able to be performed because of a wrong assumption as to what address is returned by the Curve Meta Registry for ETH in Curve V2 pools”

crvUSD, a collateralized-debt-position stablecoin pegged to the USD, surpassed $140M TVL and $100M in collateral backing it on the 21st.

Manifold Finance, mevETH and Cream ETH

Cream ETH multisig, where all the underlying ETH for crETH2 is held, moved 2848 ETH (worth approximately $5.4M) to a new multisig largely controlled by Manifold Finance.

This sent ETH is the remainder of the ETH to be deposited to be controlled by Manifold Finance. Manifold Finance recently announced that these deposits will be used for mevETH. mevETH is an MEV-optimized, natively multichain LST.

Optimism has decided to accept and work through two proposals by O(1) Labs and RISC Zero to add zk-proofs to OP chains.

Camelot’s ARB Grant Request Possibly Unsuccessful

The vote, scheduled to conclude on July 21, shows that only 21% are in favor of the grant, while 41% of the cast votes are against and 29% have abstained from granting Camelot $11 million worth of ARB native tokens.

Nexus Mutual, a DeFi coverage protocol, recently conducted one of its largest on-chain swaps, converting 14,390 ETH (equivalent to $27.3 million) from its "safety insurance module" into Rocket Pool's rETH liquid staking token.

The swap was facilitated using the CoW Swap DEX aggregator, as part of Nexus Mutual's strategy to diversify its holdings.

Trending Assets

Top Performers

Uni bot is the star performer of the week, reaching 4200 cumulative new users over since launch and gaining 130%.

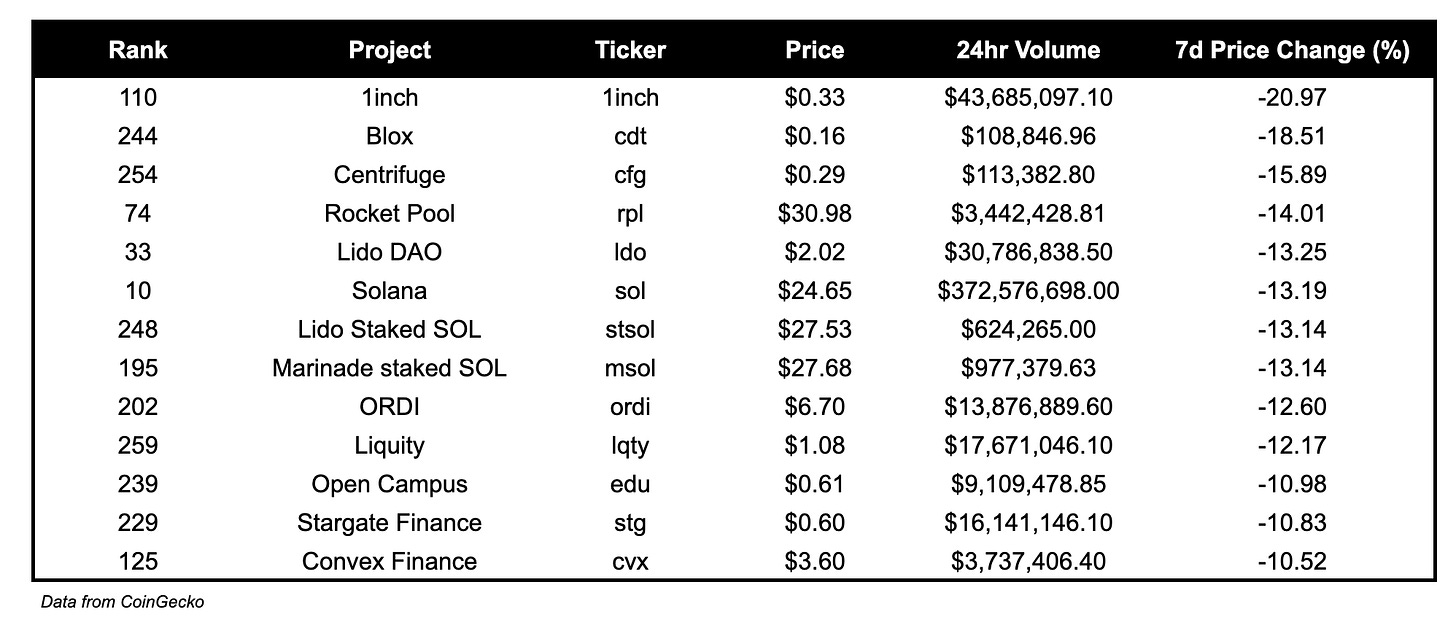

Top Losers

1inch was the worst performer in the top 300 largest coins this week, likely due to the large investor unlock and Dragonfly sending tokens to exchanges as we highlighted above.

Below $100M MC by performance, on chain

HAMS developer sold some tokens from the fee contract, which led to a HAMS pullback.

BITCOIN (HPOS10I) also underperformed over the past day, and is down 32.41%.

Above $100M MC by performance, on chain

Unibot +130% on the week with lots of attention online and huge fee days. OX, Su Zhu’s exchange token also had a strong week, gaining 21%.

Chainlink launched CCIP and the token moved 16% in the past 7 days on the positive development. OI on LINK grew tremendously throughout the week based off this.

Maker, in part due to the smart engine burn had a good week, gaining 11%.

Above $1B MC by performance, on chain

OP had a good week with multiple catalysts like the imminent launches of BASE, Coinbase’s new chain built using the OP stack. Coinbase have committed to sending 10% of sequencer fees to the Optimism treasury for using the stack. In addition, Worldcoin is launching on Optimism.

Stablecoin Netflows

Largest net inflows this week were into Arbitrum (+ $34.4M) and Polygon (+ $32.9M), followed by Avalanche who saw net inflows of $10.4M.

Largest net outflows were out of Ethereum (- $129.5M), followed by Optimism (- $6.5M)

TVL

All Protocols

Notable protocols with high TVL growth :

Revert’s (liquidity provision, multichain) TVL has grown 40197% over the past week.

KriyaDEX’s (DEX, Sui) TVL has grown 825.87% over the past week.

Oasis Swap’s (DEX, Arbitrum) TVL has grown 353.83% over the past week.

Protocols Above $10M MC

Notable protocols with high TVL growth :

Ajna’s (Permissionless Lending, Ethereum), TVL has grown 370% over the past week.

Margin Fi’s (Credit, Solana), TVL has grown 34.39% over the past week.

Extra Finance’s (Yield, Optimism), TVL has grown 79.56% over the past week.

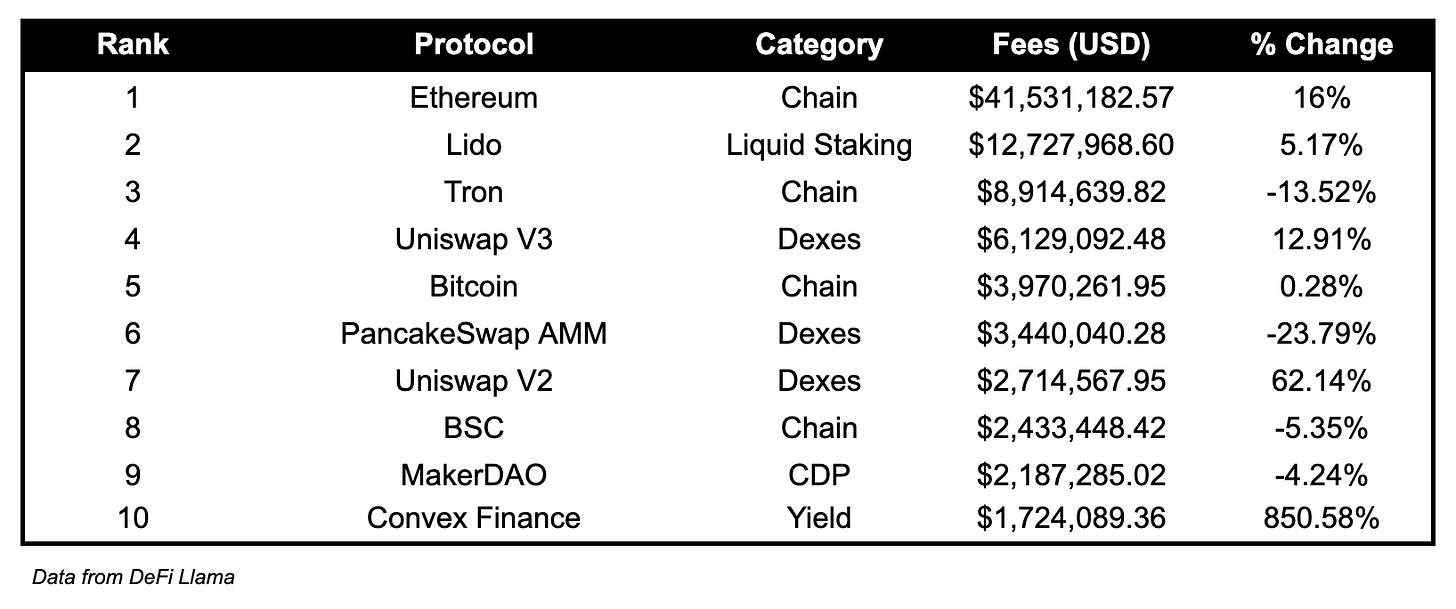

Fees

Ethereum earned the highest fees over the past week, at $41.53M, followed by Lido and Tron.

Most notably, Convex Finance fees earned is up 850.58% over the past week, at $1.72M earned.

Governance Proposals

RGP-33: Merge Ribbon Finance into Aevo

Ribbon team proposes that Aevo becomes the sole and unified brand and to wind down RBN and launch a new token: AEVO.

DRC - Shifting from LP rewards toward market maker rebates

Increase market maker rebate from 0.5bps to 0.85bps, and reduce the per-epoch LP rewards by 50% from 1,150,685 DYDX/epoch to 575,342.50 DYDX/epoch.

[SIP-26] Deploying Synapse Bridges onto Base Mainnet

Proposal to deploy a stablecoin bridge on day 1 launch of Base mainnet, comprised of nUSD and USDC, with funds sourced from Nima Capital.

Proposal to sell Bancor 3 token surpluses for ETH

Proposal for pools on Bancor 3 that have a surplus and are disabled to have the surplus converted to ETH

Articles / Threads

Injective Teams Up with Espresso Systems

Injective is collaborating with Espresso Systems, a protocol helping to create decentralized rollup sequencers.

This collaboration is to decentralize the rollups built within Injective’s ecosystem, most notably Cascade,a Solana SVM rollup for Injective and the broader IBC ecosystem.

Y2K’s ‘GTRADE’ Gains PnL Vault

Y2K is launching their ‘GTRADE’ Vaults, which will be used to protect gDAI holders from losses resulting from big profit wins on Gains.

Rysk Beyond, Rysk Finance’s options protocol, has launched on Arbitrum mainnet. Rysk’s main innovation is the DHV (Dynamic Hedging Vault), a hybrid AMM and RFQ options protocol.

The DHV uses a dynamic approach in hedging risk to generate market-neutral uncorrelated returns for liquidity providers.

Velodrome V2: Just Getting Started

Velodrome V2 is setting the groundwork for concentrated liquidity pools (clAMM) and automated voting management.

V2 has generated more weekly fees at nearly 6x the pace of V1

clAMM will improve trading execution and reduce slippage

veVELO votes control emissions