Weekly Summary 6

09-07-2023 to 16-07-2023

Developments

Ripple SEC Case

Ripple wins verdict that states XRP is not a security, but institutional sales of XRP constituted as investment contracts.

Off the back of this, XRP rallied 90% making it the 3rd largest crypto asset (ex-stablecoins). This move added >$35 billion in FDV to XRP’s market cap

NOT SECURITIES: Programmatic sales via digital asset exchanges were not classified as investment contracts as buyers did not know to whom or what it was paying its money to.

SECURITIES: Institutional buyers knowingly purchasing XRP directly from Ripple pursuant to a contract.

This should have wide implications across the industry when it comes to future token launches and sales

Less likely that protocols decide to launch via launchpads and investment rounds

More likely for tokens to have majority of offerings carried out on programmatic exchanges (DEX, CLOBs etc)

Celsius CEO, Alex Mashinsky, Arrested and Celsius Fined

The SEC has sued Celsius CEO, Alex Mashinsky. The FTC has banned Celsius network from trading, and fined them $4.7B.

Celsius also moved 2.867M LINK, 95.608K AAVE, 2.832M SNX to their OTC wallet today.

Polygon Rebrand Token to POL

Polygon launches whitepaper for the conversion of $MATIC into $POL, a token which will govern and validate all the Polygon chains.

Utility

Validator Staking

Validators can validate multiple Polygon ecosystem chains (zkEVM, supernets, Polygon PoS)

Validator Rewards

Governance

Tokenomics

Initial Supply: 10B POL

Entirety of initial supply dedicated to MATIC <> POL migration

MATIC will be exchanged for POL at a 1:1 ratio

Emissions

Yearly rate of 2% emission

1% to Community Treasury

1% to Validator Rewards

Emissions will be fixed and immutable for the first 10 years

After 10 years governance can vote to alter emissions

Silk Road DOJ BTC Sent To Coinbase

At approximately 13:25 UTC on the 12th of July, a wallet associated with James Zhong (Silk road hacker), moved 8,200 BTC to a Coinbase deposit address.

This wallet is now under the control of the Department of Justice (DOJ) and as per the mandate they set out earlier in the year, this BTC will likely be TWAP sold on Coinbase over the coming week / weeks.

This is their second tranche of sales of BTC for the year. After this is complete, they will sell another two tranches totalling around 30k BTC.

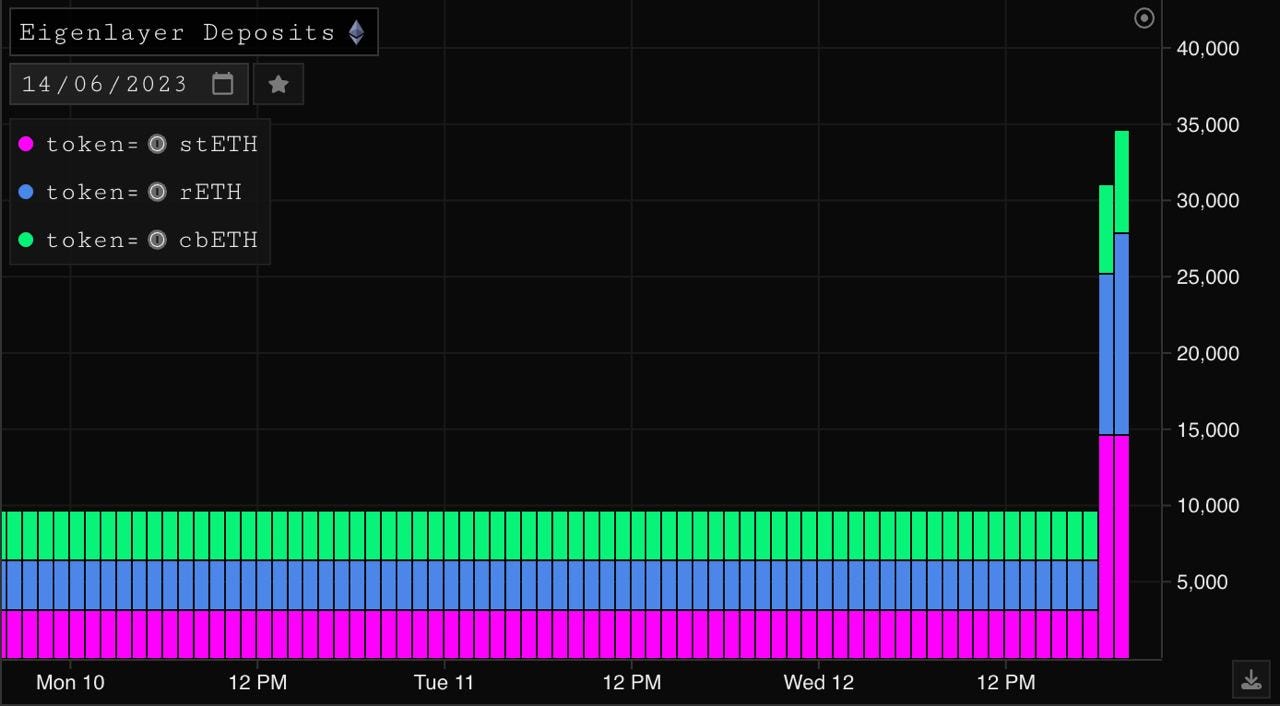

Eigenlayer opened up deposits on the 12th, increasing their cbETH, stETH and rETH limits from 3,200 ETH each to 15,000 ETH each. Within a few hours of opening their gates, Eigenlayer was flooded with ETH deposits, making it one of the largest gas consuming contracts on the day. Once 35k ETH was touched, decided to pause deposits to give people more time to enter the Eigenpod strategies.

Aave GHO

The vote to launch Aave’s stablecoin GHO has passed. The proposal is now queued and will be activated at around 2pm UTC.

100% of interest payments will accrue to the Aave DAO

DAO will be able to change GHO’s interest rate as necessary over time through governance

GHO will be available via Aave V3 only

stkAAVE accepted as a discount token for GHO borrow rate

Initial Parameters

GMX v2 voting

The vote to decide GMX v2’s Fee Split is live, with two options available for voting

Option One - Fund GMX Treasury

An allocation of 10% of protocol fees for which GMX stakers & GM liquidity providers participate be allocated to the GMX Treasury

This will assume the continuation of a 70:30 ratio between GMX stakers and liquidity providers to create an effective allocation for the protocolFee parameter of:

10% distributed to the GMX Treasury

63% distributed to liquidity providers in each specific liquidity pool

27% distributed to a pool that goes to GMX stakers across all chains

Chainlink oracles will be funded by a sub-allocation of the 10% GMX Treasury allocation

Option Two - Maintain Existing V1 Distribution

The protocolFee parameter continues in the 70:30 from GMX v1

70% distributed to liquidity providers in each specific liquidity pool

30% distributed to a pool that goes to GMX stakers across all chains

Distribution pool for GMX stakers would be reduced by 1.2% of protocolFee towards Chainlink oracles for effective distribution of 28.8%

Votes are currently heavily in favour of Option One, which is to allocate 10% to the GMX treasury (98.07% of votes in favour)

BIT token holder weighting post MIP-23 billion. 3 billion BIT tokens were sent to the burn address & will not be converted to MNT.

The Starknet Quantum Leap part 1: v0.12.0 has been deployed on the public Goerli Testnet.

It is now in its final testing phase before supercharging the Mainnet next week.

Ribbon team proposes that Aevo becomes the sole and unified brand and to wind down RBN and launch a new token: AEVO.

Terra wallet (0x15a5) started selling some of its CVX on the 12th of July. It has sold 50K CVX, worth approximately $200K. The wallet still owns 1.74M CVX ($6.95M).

A proposal is live for Mantle to stake 200k treasury ETH with Lido & under the MantleLSD program

200k will be split between the Lido staking proposal and MantleLSD, its own lsd implementation

No other LSD protocols are being considered other than Lido

Lido program

40k ETH from BitDAO treasury used to buy stETH/wstETH

stETH will be used to bootstrap DEX liquidity on Mantle

MantleLSD program:

LSD token will be called mntETH

Adopted as a version of ETH on Eigenlayer

mntETH may be adopted as the gas token on Mantle

Rodeo Finance was exploited for 472.1 ETH ($888K). Exploiter has since bridged the funds from Arbitrum to Ethereum. 285 of this ETH has been swapped to $unshETH , 150ETH has been transferred to Tornado Cash.

Rodeo Finance’s token (RDO) dropped 60% post hack, but has since recovered and is now trading at 40% below pre-hack levels.

CoWSwap announces the launch of CoW Hooks

CoW Hooks can be used to chain together actions such as trading, bridging, staking, depositing, and more.

Each CoW Hooks execution is a single transaction, and gas fees are only paid once execution is completed.

Cboe reaches surveillance agreement with Coinbase for spot bitcoin ETFs

Cboe has updated five filings on Tuesday, 11th of July. The amendments include adding information about how Cboe has “reached an agreement on terms” with Coinbase regarding surveillance-sharing agreements.

The filings that were modified are for the Wise Origin Bitcoin Trust, WisdomTree Bitcoin Trust, VanEck Bitcoin Trust, Invesco Galaxy Bitcoin ETF, and ARK 21Shares Bitcoin ETF.

COIN 0.64%↑ has been outperforming off of ETF narratives. Additionally, it benefits from:

Having the largest userbase in US for spot trading crypto

Having exposure to ETH + and OP via their Base L2

Coinbase Cloud infrastructure for staking

Building overseas exchange

Brian Armstrong being bald

Trending Assets

Trading Volume

ARB has been dominating trading volume over the past few weeks, followed by PEPE and crvUSD.

Amongst top traded coins, the highest volume in total was on Saturday, the 15th of July.

Above $100M MC by performance, on chain

Over the past week, COMP, up 38.82%, LQTY, up 37.35%, 1INCH, up 33.91%, and RLB, up 32.19%, outperformed.

Above $1B MC by performance, on chain

With coins above $1B MC, LDO, up 19.34%, MATIC, up 13.56%, and ARB, up 12.98% outperformed. Notably, ARB had the highest trading volume, excluding ETH and stables.

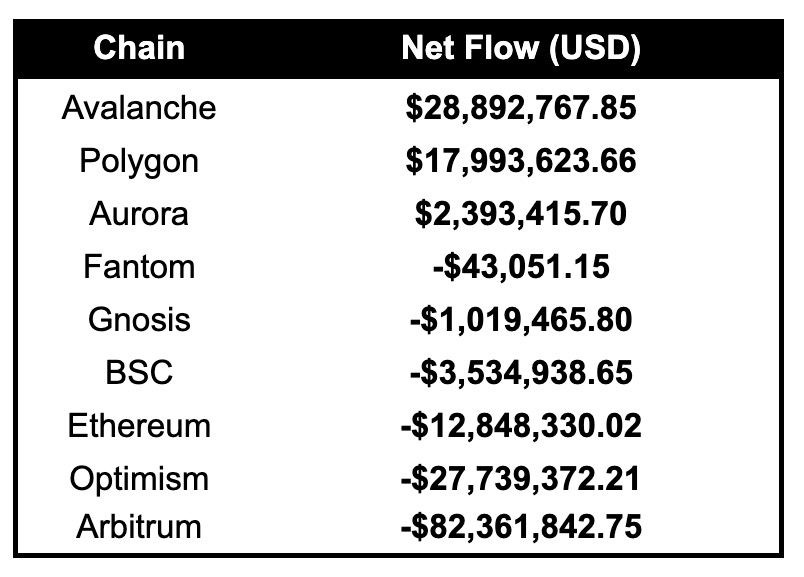

Stablecoin Netflows

Largest in flows: Avalanche (+ $28.9M), Polygon (+ $17.9M)

Largest out flows: Arbitrum (- $82.4M), Optimism (- $27.7M), Ethereum (- $12.8M)

TVL

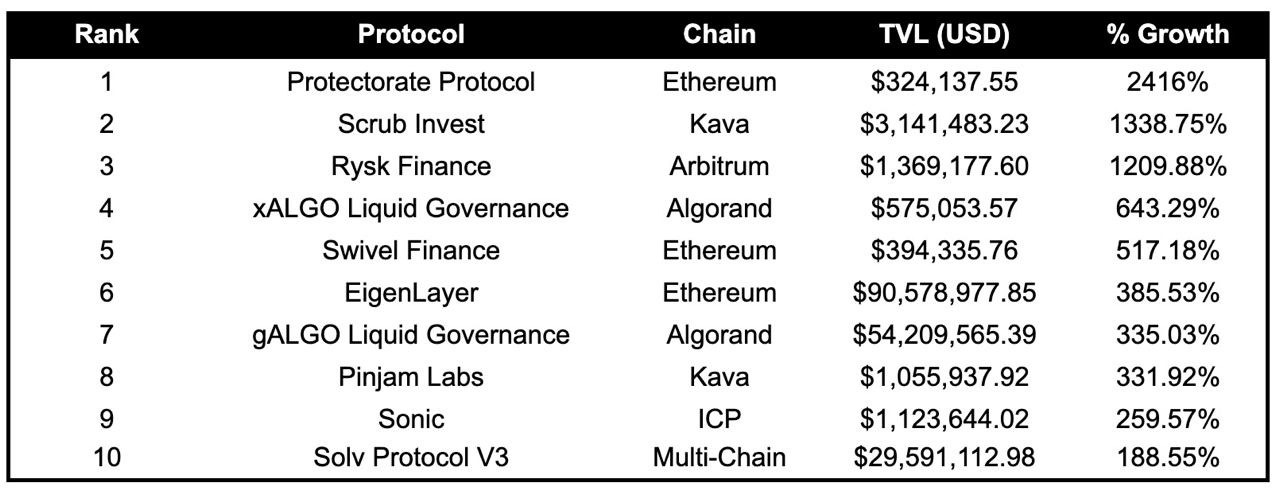

Notable Protocols with High TVL Growth, All Protocols

Protectorate Protocol (NFTFi, Ethereum), grew its TVL by 2416%.

Rysk Finance (Options, Arbitrum) grew its TVL by 1209.88%.

Swivel Finance (Fixed Income, Ethereum) grew its TVL by 517.18%.

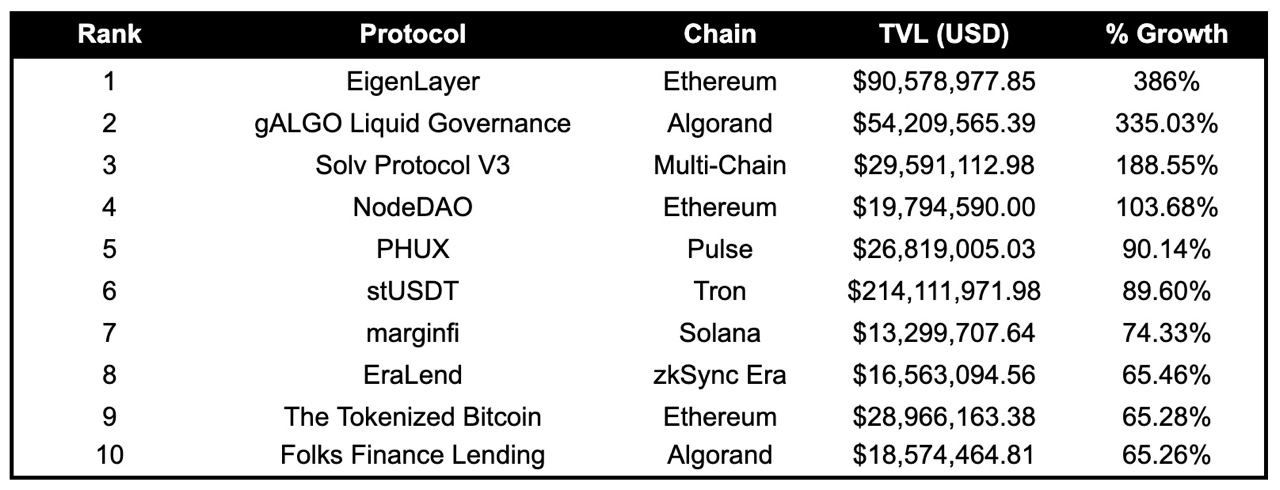

Notable Protocols with High TVL Growth, Protocols with TVL > $10M

EigenLayer (Restaking, Ethereum) grew its TVL by 386%.

NodeDAO (Staking, Ethereum) grew its TVL by 103.68%.

MarginFi (Lending, Solana) grew its TVL by 74.33%.

Fees

Over the past week, Ethereum earned the highest fees, followed by Lido and Tron. Overall, fees earned has decreased compared to the week before (except for Tron).

Governance Proposals

Accelerating Arbitrum - leveraging Camelot as an ecosystem hub to support native builders

Proposal to 1.5M ARB per month to Camelot DAO for the next 6 months to fund liquidity incentives for Arbitrum-focused projects on Camelot.

Articles / Threads

Staking V2 Come Get Some

Kwenta announces staking V2 with:

Escrow transferability

A 2 week unstaking cooldown period

In addition, Kwenta will be launching the following in the next few weeks:

Early Vest Fees

Automated Compounding

Upgradability

LandX announced their new tokenomics update. LNDX token will have:

Revenue sharing

Governance rights

Requirements for validators to stake