Weekly Summary 5

03-07-2023 to 09-07-2023

Developments

DeFi 1.0

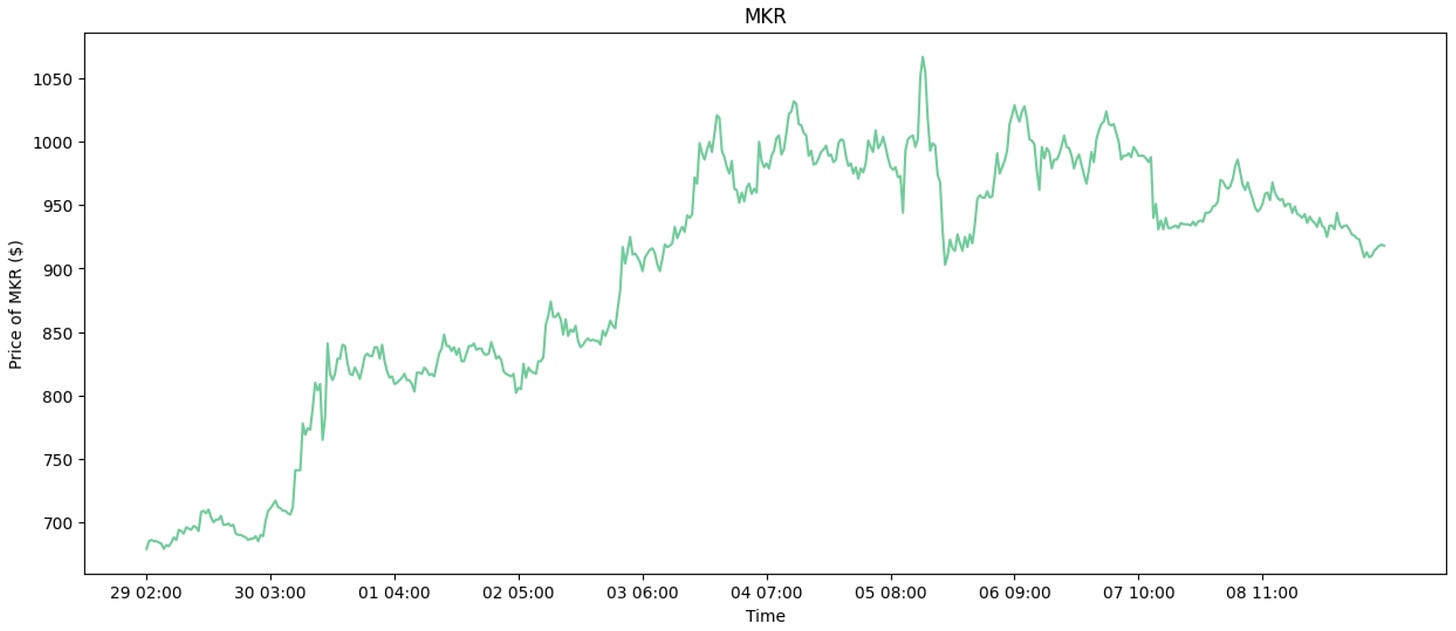

DeFi 1.0 coins have been top performers this past week, with names like COMP and MKR rallying 45%+ over the past week.

MakerDAO

Maker has demonstrated impressive performance over the past two weeks, capturing our attention.

This is attributed to their smart engine burn proposal, Spark protocol growth, augmented DSR (Dai Savings Rate), and the notable rise in protocol revenues. Upon analyzing the on-chain data regarding the types of holders, a recent trend has emerged within the last week.

Fresh wallets have been observed receiving MKR tokens from Coinbase or Coinbase Prime. This development suggests that the accumulation of MKR is being driven by sophisticated institutions or funds. In our analysis, we have successfully identified five wallets exhibiting these distinctive characteristics:

0x936a90cbD6f4E36DD56c1Cd03002ab07F09DbF2B

0xeC53c4042932e0f00fa95e540f091afafcB322F3

0xdA9C5F07db6a647647f46B9bfcd72E435dd7caD8

0x3FC9374492AAA1AE933993474efEA555659C674A

0xD56B25905F5572A96e84545467f53f7069d61C45

0xdD4f2b72CC50c7e7BB96f372AbEA14527b6d231E

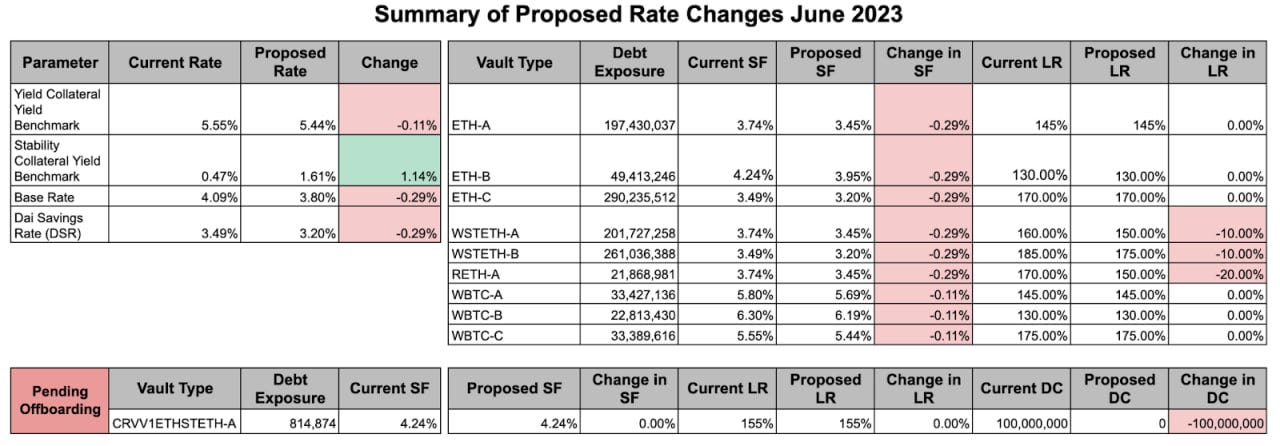

MakerDAO Proposal to Change Stability Scope Parameters

Maker is set to propose a reduction of the DSR from 3.49% to 3.19% in its upcoming executive vote.

Other changes include reducing Yield Collateral Yield benchmark from 5.55% to 5.44% and increasing the Stability Collateral Yield Benchmark from 0.47% to 1.60%

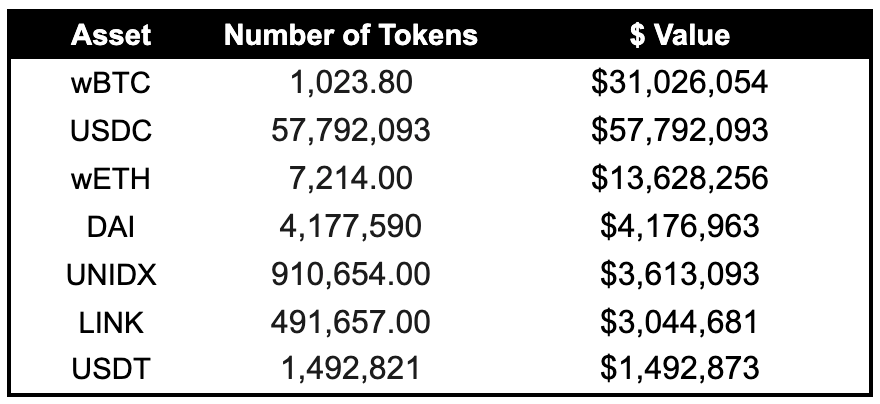

Multichain Fantom bridge is possibly drained. Assets affected are WBTC, USDC, DAI, ETH and LINK.

Whilst we don't know if this is a hack yet, these are the assets and quantities which were moved to freshly setup wallets.

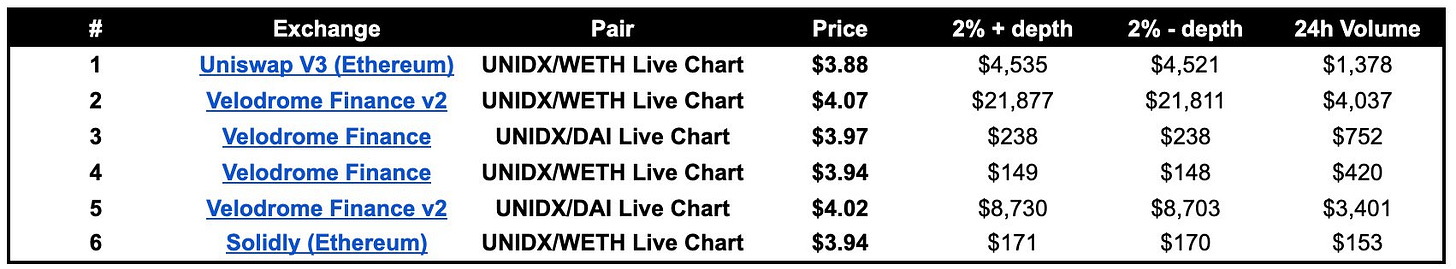

If Multichain is in fact hacked, UNIDX would essentially go to $0 if the exploiter market dumped these tokens into the existing liquidity pools. The -2% depth on UNIDX is around $20,000 & the potential exploiter has stolen $3.6M worth.

Celsius Moves Altcoins

Celsius has started moving some of the altcoins that they announced that they would be converting.

Notably, more than $17M LINK, $7M USD worth of AAVE, $5.68M RETH and $4M worth of SNX has been sent to Celsius' Fireblocks Custody wallets and to Wintermute.

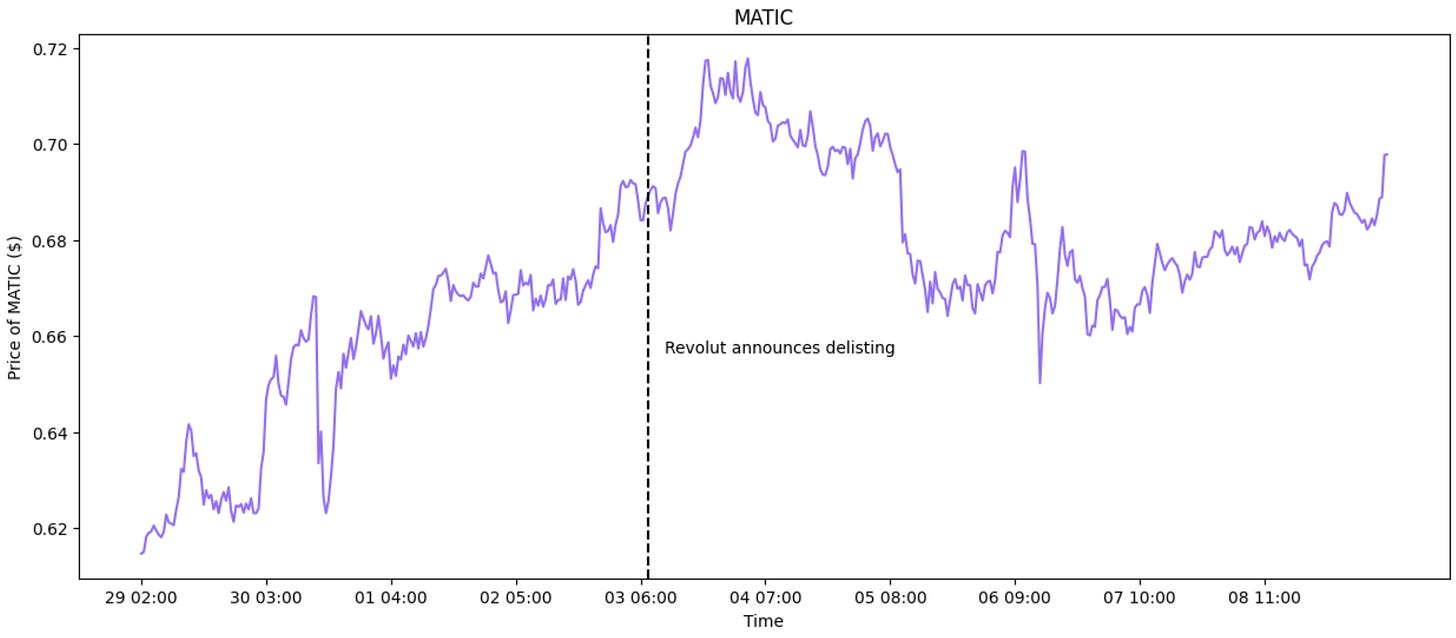

Revolut Delists SOL, ADA, MATIC

According to an email, if Revolut customers do not sell their current holdings in MATIC, SOL, and ADA before September 18, Revolut will sell the tokens on their behalf.

These tokens will be sold at the prevailing market price during the sale, and the resulting proceeds in USD will be deposited into the customers' Revolut accounts.

GMX Trader 0x61 Gets Liquidated

GMX Trader 0x61 had a 7x leveraged ETH short of $12 million on GMX that he kept adding collateral to in order to keep it open as you can see from the orange dots. Yesterday, he was liquidated at $1955 for $1.8 million.

Undeterred, 0x61 has now opened a new ETH short with 30x leverage (size $1.46 Mil) which will face liquidation at around $2000 ETH.

Umami Vaults

Umami’s Deconstructed GLP Vaults, which aim to generate delta-minimized returns on assets including USDC, BTC and ETH, are open to the public! Initial TVL caps will be:

USDC: 500K, ETH: 250K, BTC: 200K, UNI:25K, LINK:25K

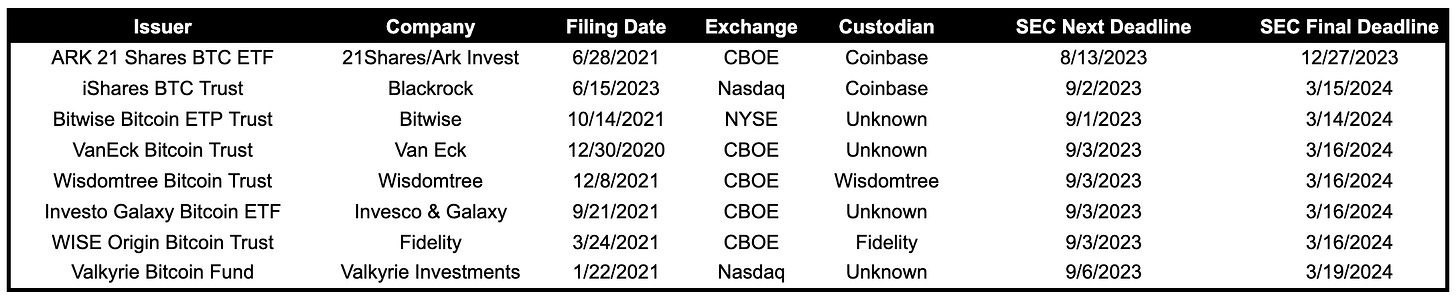

BTC ETF Updates

Valkyrie, a crypto asset manager, has recently re-submitted an application for a spot Bitcoin exchange-traded fund (ETF), with Coinbase listed as a Surveillance Sharing Agreement (SSA) counterpart. In an effort to align with the regulatory standards set by the US Securities and Exchange Commission (SEC), Valkyrie has included the SSA, following the footsteps of other similar filings like Blackrock and Fidelity.

Spot bitcoin ETF filers and SEC are also supposedly meeting next week, according to this guy who we have found to be a reliable expert on this stuff.

Another update in the BTC ETF world is that BlackRock CEO, Larry Fink, will be appearing on FoxBusiness with Liz Claman and C.Gasparino at 3:30PM EST to talk about the refiling of its BTC spot ETF, ESG and more.

ETF Timeline

ARK 21 Shares BTC ETF, filed on 28/6/2021, is set to receive a response from the SEC on 13/08/2023.

OUSG Closes in On $200 Mil

OUSG, which are on-chain T-bills developed by Ondo Finance are closing in on $200 Mil in total supply.

These are the top individual holders:

0x1a8c53147e7b61c015159723408762fc60a34d17 - Institution with links to Amber

0xa661484f4b298a2ba1061379342e15366edfeb58

0xc09bd180ba12b837d4a0ca163025fb5f8f86d711 - Linked to analytico.eth

0x5ed4ebaf21f83959f81b7e7545e25d313c84081f

0xc9442e6eecd5389d73322e965cd3fa488aaeee20 - Linked to 1kx

CME ETH Options Open Interest Reaches ATH

On the 3rd of June,ETH options OI on the CME has reached an all time high of $245 million. This comes after futures OI on BTC reached yearly highs last week. It broadly shows that institutions are becoming active and interested in the asset class again.

Gemini, a cryptocurrency exchange, has filed a lawsuit against Digital Currency Group (DCG) and its founder Barry Silbert. The Winklevoss twins, founders of Gemini, have alleged that over $1.2 billion worth of assets belonging to Gemini Earn users are currently held in limbo within Genesis Global, which is owned by DCG. Gemini's accusation states that Barry Silbert and Genesis provided false financial reports, despite knowing that Genesis was financially unstable, in order to sustain the Gemini Earn program.

1inch Team Sells ETH

The 1inch team sold 11,000 ETH ($20,975,572) AT 12pm UTC today. When asked if they will buy back, the Co-founder said “Sure, we need to test also in reverse direction”.

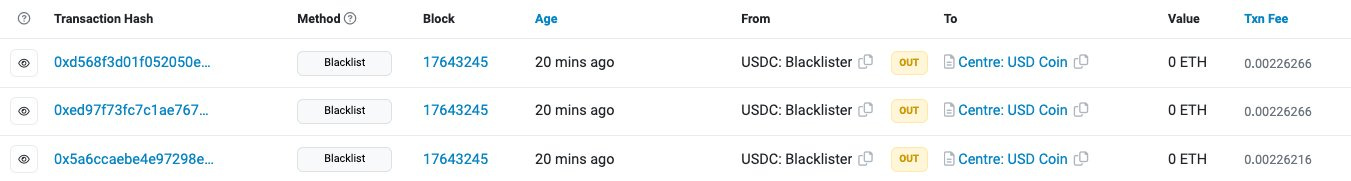

Circle Freezes Multichain Hackers Funds

Circle has blacklisted $63,290,029 USDC from the Multichain hacker.

The DAO of Arbitrum has given its approval to an improvement proposal, which entails locking 700 million ARB tokens, equivalent to $770 million, in a vesting contract. Over the course of four years, the contract will gradually release the funds to the Arbitrum Foundation.

The 700M ARB are part of the 750M that the Arbitrum Foundation had controversially transferred to the Administrative Budget Wallet and announced through AIP-1: Arbitrum Improvement Proposal Framework.

nftperp sunsetted their v1 vAMM after 280,000ETH ($518,000,000 USD) of trading volume in their private beta.

nftperp announced that due to liquidation logics and accounting error, the platform has accrued bad debt, which is why the team decided to sunset the v1 vAMM. Users that were in positive unrealized PnL, will receive their margin and a pro rata a share of VNFTP tokens.

Shibarium Set To Launch in August

According to a recent blog post by developer Shytoshi Kusama, Shibarium, the highly anticipated layer 2 blockchain, is set to launch following a conference in Toronto scheduled for August.

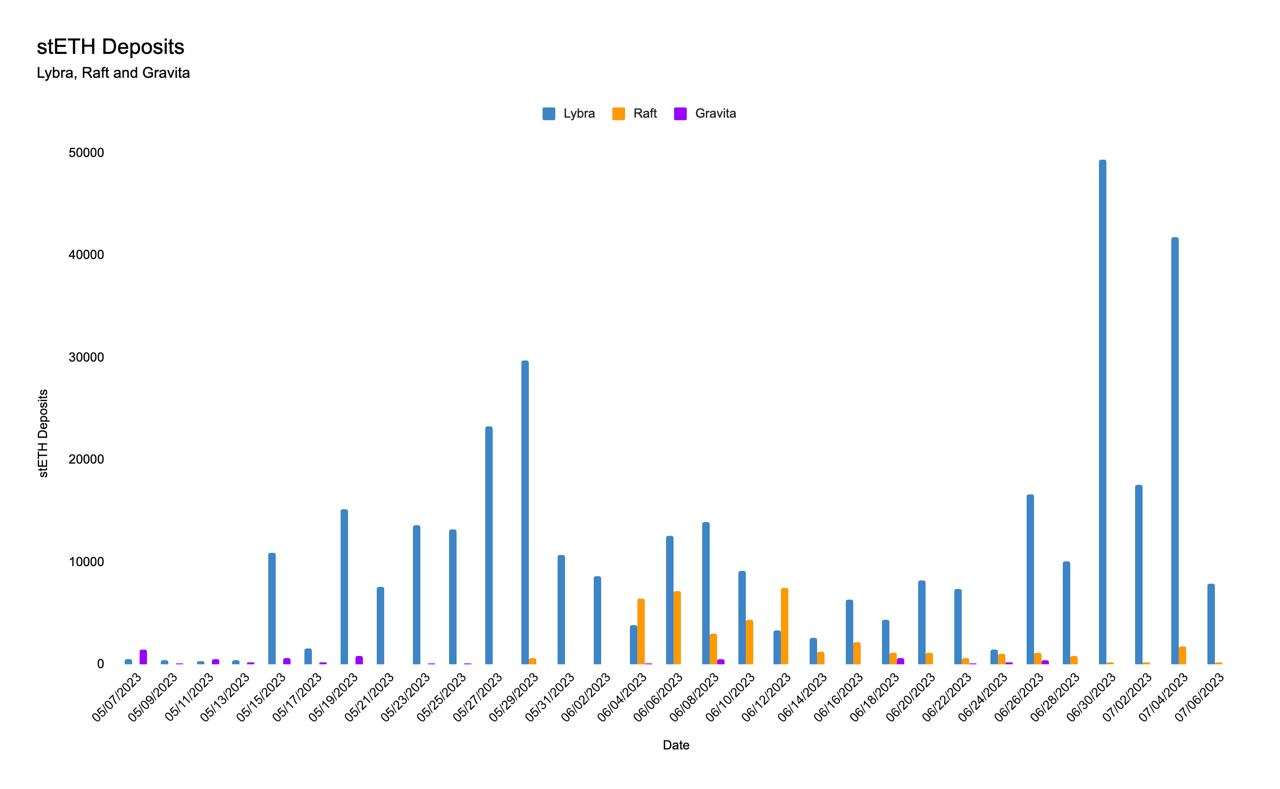

We have started to see Lybra Finance dominate the LST stablecoin space, by taking the lions share of stETH deposits.

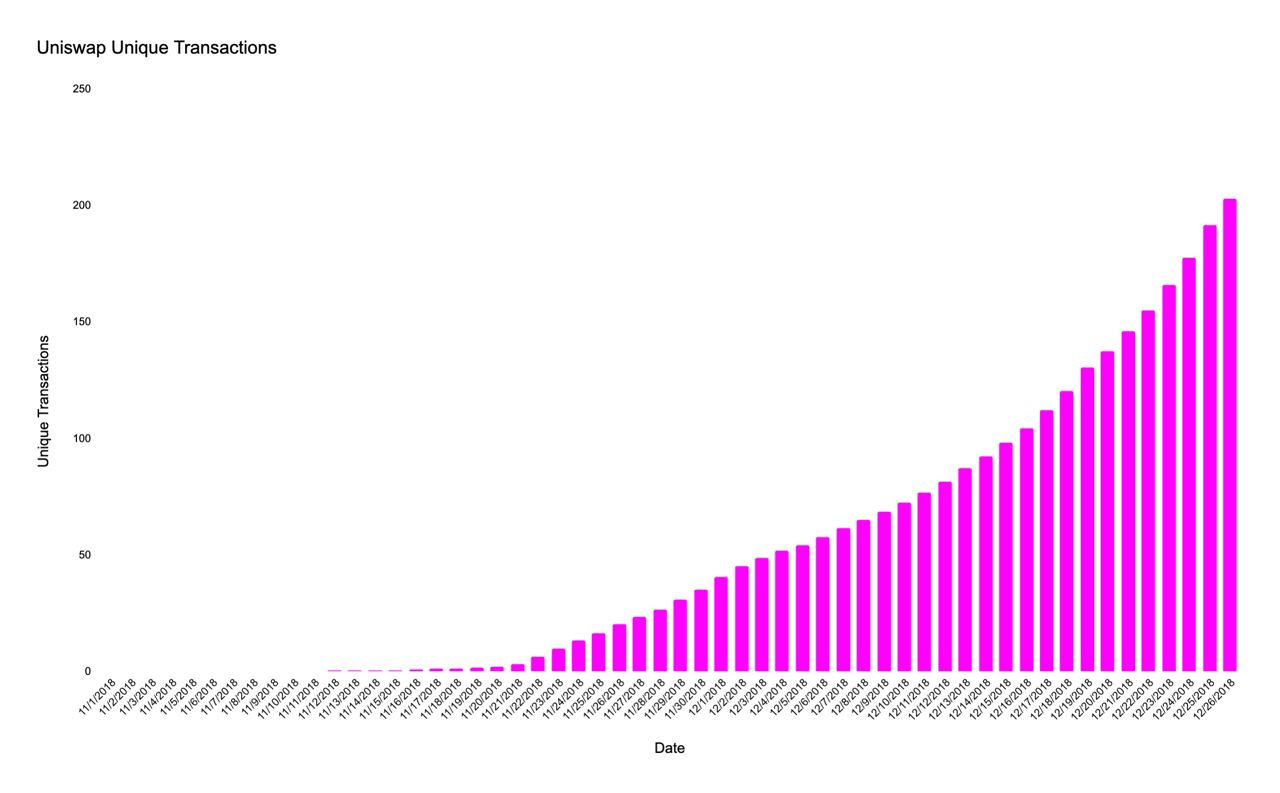

Uniswap Cumulative Transactions

Uniswap surpasses 200 million total transactions since it’s inception in 2018.

Ambient Finance (prev. CrocSwap) has reached $3.76M TVL in less than 1 month.

Binance Senior executives including General Counsel Han Ng, Chief Strategy Officer Patrick Hillmann, and SVP for Compliance Steven Christie have quit Binance.

Hidden Hand V2, which introduces features such as range bribes, limit bribes, a yield harvester, new markets, UX upgrades, and more, has gone live.

Sami teased that Hidden Hand V2 is the final launch before Dinero, Redacted’s stablecoin backed by blockspace.

Manifold Finance, mevETH and Cream ETH

Cream ETH multisig, where all the underlying ETH for crETH2 is held, moved 320ETH to a new multsig created 14 days ago.

Manifold Finance announced that this is the first official deposit for mevETH. mevETH is an MEV-optimized, natively multichain LST.

The new multisig is largely Manifold Finance controlled, with some Cream team members still as signers.

TVLs

Over the past week:

Camelot V3 TVL grew by 369% (+ $9.6M)

Lybra Finance TVL grew by 51.02% (+ $109.9M)

Velodrome TVL grew by 29.03% (+ $51.3M)

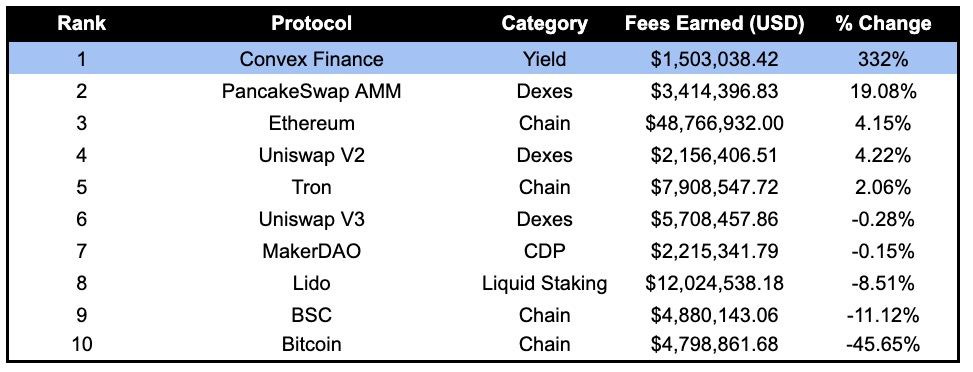

Fees

Over the past week:

Convex Finance fees earned grew by 332% ($1.5M)

PancakeSwap fees earned grew by 19.08% ($3.4M)

Articles

MAV staking page, where users can lock their MAV for veMAV has gone live.

Pika Protocol is launching Pika V4, where:

Pyth Oracle will be integrated

40 more trading pairs will be added

TradingView will be integrated

Trading fees will be reduced

Support for adding and withdrawing margin from active positions will be added

Low leverage will be offered

PIKA staking and esPIKA program will be offered

Aevo announces the launch of Aevo Referrals, which all users can access.

When new users sign up using a Referral link, the referrer gets 10% of the referee’s trading fees as rewards, and the referee gets a 10% discount on trading fees for 6 months.

On June 12th, the STFX DAO passed SIP-005: Liquidity Reduction to reduce 25% of liquidity from both Ethereum and Arbitrum STFX/ETH Uniswap pools.

After SIP-005, SIP-006: Proposed STFX Token Burn was proposed to either burn STFX or deliver it back to treasury. DAO passed to burn.

Yesterday, first STFX burn event took place. $10.3M was burned (1.03% of total STFX supply and 3.4$ of circulating STFX supply).

yETH: LSD Lobbying season is now open

Yearn announces that they are launching the the bootstrapping phase to launch yETH.

The bootstrapping phase will consist of three stages:

Whitelisting for LSD protocols

Deposit and Incentives

Voting

Governance Proposals

UIP 02: USH Liquidity Incentives Strategy Update

Proposal to:

Reduce effective USH emissions by 58%

Grow USH liquidity by shifting liquidity incentives from single-sided to LP lockers

Reserve emissions to grow unshETH beyond 2+ yrs

Proposal to:

Establish Mantle EcoFund with $100M from Mantle Treasury

Establish Mantle EcoFund Investment Committee

Authorize first capital call for 10M USDC from Treasury

[TEMP CHECK] Aave V3 Deployment on Linea Testnet

Temperature check to deploy Aave V3 on Linea Testnet and move to Mainnet right after all pre-conditions and dependencies are met on Linea Mainnet.

Aura Finance proposal to deploy on Optimism

Proposal to deploy Starknet Alpha v0.12.0 on Mainnet.