Weekly Summary 4

26-06-2023 to 02-07-2023

Developments

Frax Proposal [FIP -256] Optimizing FIP-77’s TWAMM Parameters, has passed it’s governance vote.

Proposal argues that currently the FXS buyback TWAMM is monotonic and doesn't take into account price levels

Instead, FIP-256 proposes that the TWAMM should become more aggressive and increase in magnitude at lower price levels, and stop buying FXS at a higher price levels.

On the 26th, a top holder of FXS, 0xb74, unlocked $14M of FXS. 0xb74 has received more than $80M FXS from distribution to the Frax Team/Investors.

0xb74 relocked 3 minutes later.

Celsius Receives Approval

On the 30th June, Celsius received approval from a judge to start converting altcoins from customers (with exception of custody and withhold accounts) to BTC and ETH from July 1st onwards.

Dinosaur Coins

9 out of the top 13 performers in the top 100 MC coins on June 29th fell under the dinosaur coin category with names like eCash and Bitcoin cash pulling >20% intraday moves. Much of the trading volume on these coins is coming from the Korean exchange, Upbit.

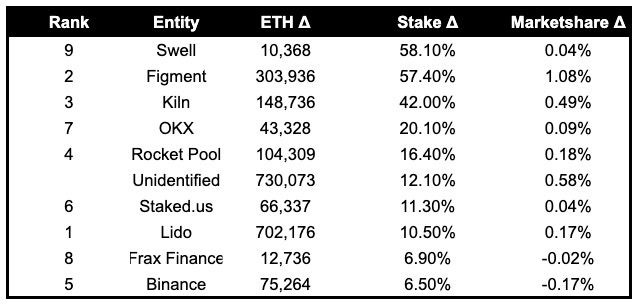

swETH Growth

swETH is the fastest growing ETH staker, adding 58% to it's stake in the past month.

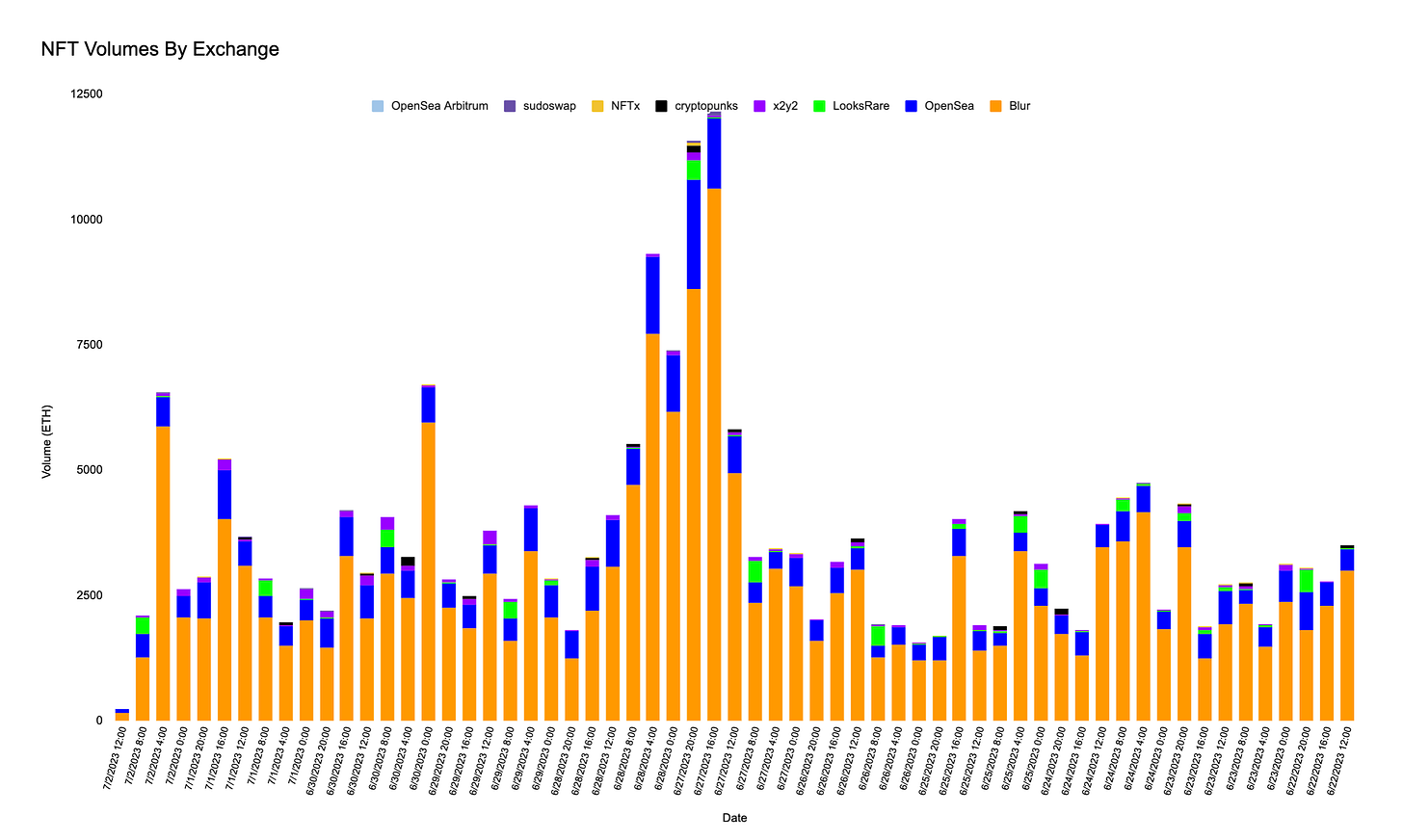

NFT Capitulation

NFT floor prices have plummeted over the past few days. Notably Azuki floor price is down 61.6% and BAYC floor price is down 33.9%, while CryptoPunks floor price has only decrease 6.5%.

NFT volumes peaked on the 28th of June, at close to approximately 12K ETH across exchanges. Since then, they have steadily dropped and currently hover around 3000 ETH volume.

Maker outperformance

Maker showed strong outperformance this week, gaining 17% on the 29th. A couple of things may have generated this performance:

Spark Protocol TVL grew approximately 45%, adding > $6mil in TVL

As per Makers ‘Smart Burn Engine Launch’ governance proposal, Maker is transitioning from a buy and burn model to a new approach called the protocol-owned liquidity (POL) model. Under this model, when the surplus buffer exceeds $50 million, the excess DAI will be utilized to purchase MKR tokens from the univ2 DAI/MKR pool. This will create demand for MKR and contribute to its value. The remaining surplus DAI will then be paired with the newly acquired MKR tokens and deposited back into the DAI/MKR pool as POL. This will enhance the liquidity of the MKR market, potentially generating LP fees for the protocol over time, as well as increasing buying pressure. This strategy represents a more effective utilization of funds compared to simply burning MKR tokens and has the potential to generate sustainable revenue.

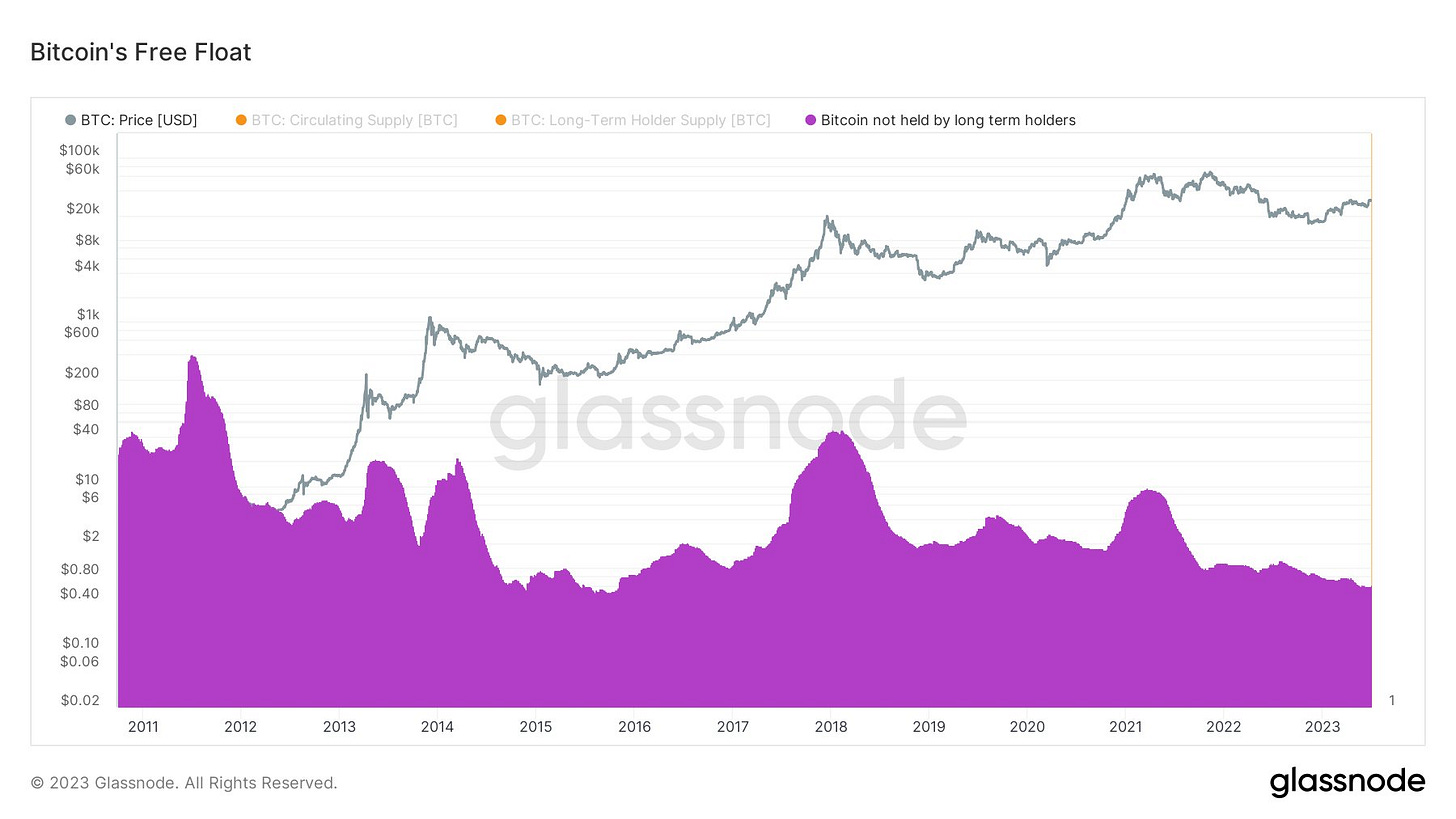

Bitcoin number of addresses with a balance equal to or above 1 (wholecoiners) reach 1 million.

Additionally, BITO, a Bitcoin Futures ETF, had its highest level of weekly net inflow of the year over the last week

The percentage of Bitcoin available for purchase (Bitcoin not held by long term holders) is nearing all time lows.

Level Finance announces proposal to:

1. Burn 180K LVL accumulated on TraderJoe LP

2. Implement continuous weekly burning of LVL tokens

Activate veYFI rewards with oYFI Gauges

Yearn proposal to introduce the oYFI token.

The oYFI token will be a reward token for vault gauges, with emission of oYFI rewards based on veYFI lock rate.

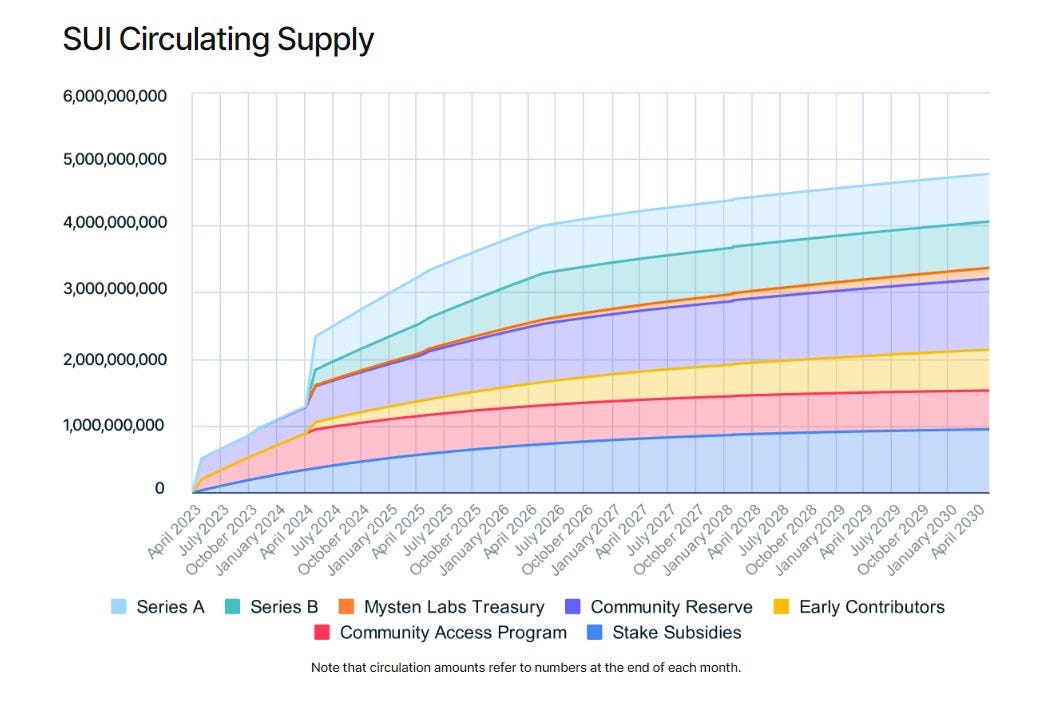

Sui Tokenomics

There are claims that the Sui team has misrepresented emissions and team has been selling rewards from staked SUI on Binance.

Additionally, the Sui team has stated that the SUI emissions chart on Binance is not real.

The SUI emission figures according to DefiSquared to amount to approximately 33M additional SUI per month. In addition, 37M non-foundation SUI are emitted each month from launch pads.

Following the recent claims that the team has misrepresented emissions and has been selling rewards, Sui Foundation has released their new tokenomics.

Notably, the investors’, early contributors and foundation cliffs have been postponed from November 2023 to April 2024

However, 61M SUI, approximately $41.9M USD, which represent 0.611% of total supply, will still be unlocked on the third of July 2023.

Maverick Incentive Program Pre-Season

Airdrop for Maverick Protocol is live.

The airdrop claiming went live on Ethereum and zkSync Era.

30,000,000 MAV was allocated to this airdrop, representing 1.5% of the total MAV supply and approximately 4.9% of the total Liquidity Mining and Airdrops allocation.

Maverick Protocol has reached $44.11M as of today, growing +15.41% over the past 7 days.

Compound Labs founders are developing regulated financial products for the blockchain

Superstate’s first product will be an on-chain government bond that you can hold in your crypto wallet

This could be a possible explanation for COMP’s outperformance yesterday.

dYdX is set to launch public testnet of Cosmos-based blockchain on July 5 at 1pm ET. Private testnet has been live since March.

At launch public testnet will only have BTC and ETH markets.

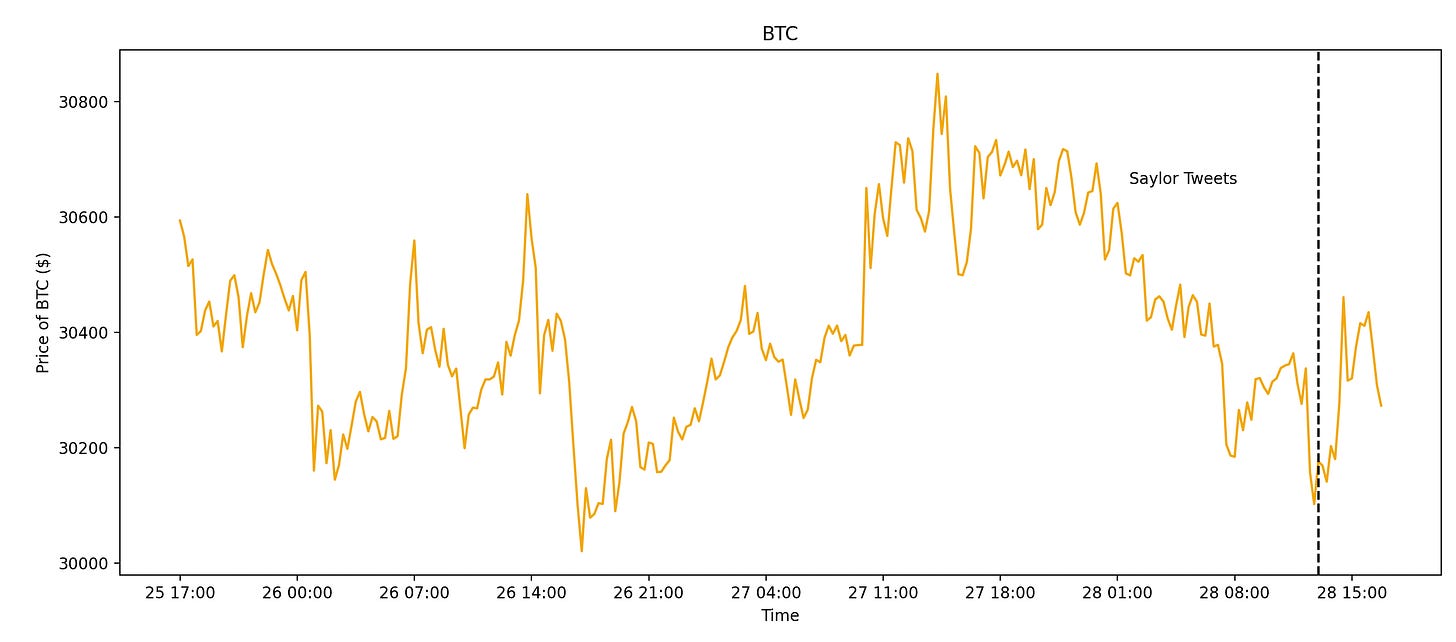

Microstrategy Buy BTC

Michael Saylor announced that MicroStrategy have acquired 12,333 BTC for ~$347.0 million at an average price of $28,136 per BTC.

MicroStrategy now holds 152,333 BTC, acquired at an average price of $29,668 per BTC.

Robinhood delisted ADA, MATIC and SOL.

Users were able to transfer ADA, MATIC and SOL until the 27th of June, 2023. Since the deadline has passed, untransferred coins will be sold for market value and credited to users.

A wallet reported as Jump’s Robinhood SOL Custody wallet has moved more than 1M SOL over the 26th and 27th of June (started at 1,273,857 SOL and ended at 162.97 SOL)

Based off of Jump's MATIC movements (another coin delisted on RH), it is likely that the SOL was transferred to MMs and sold on Binance or Coinbase.

Project Mariana, a collaboration between the Bank of International Settlement, Swiss National Bank, Bank of France and Monetary Authority of Singapore, is exploring the use of Curve v2 AMM for CBDC pools for simultaneous trading and settlement

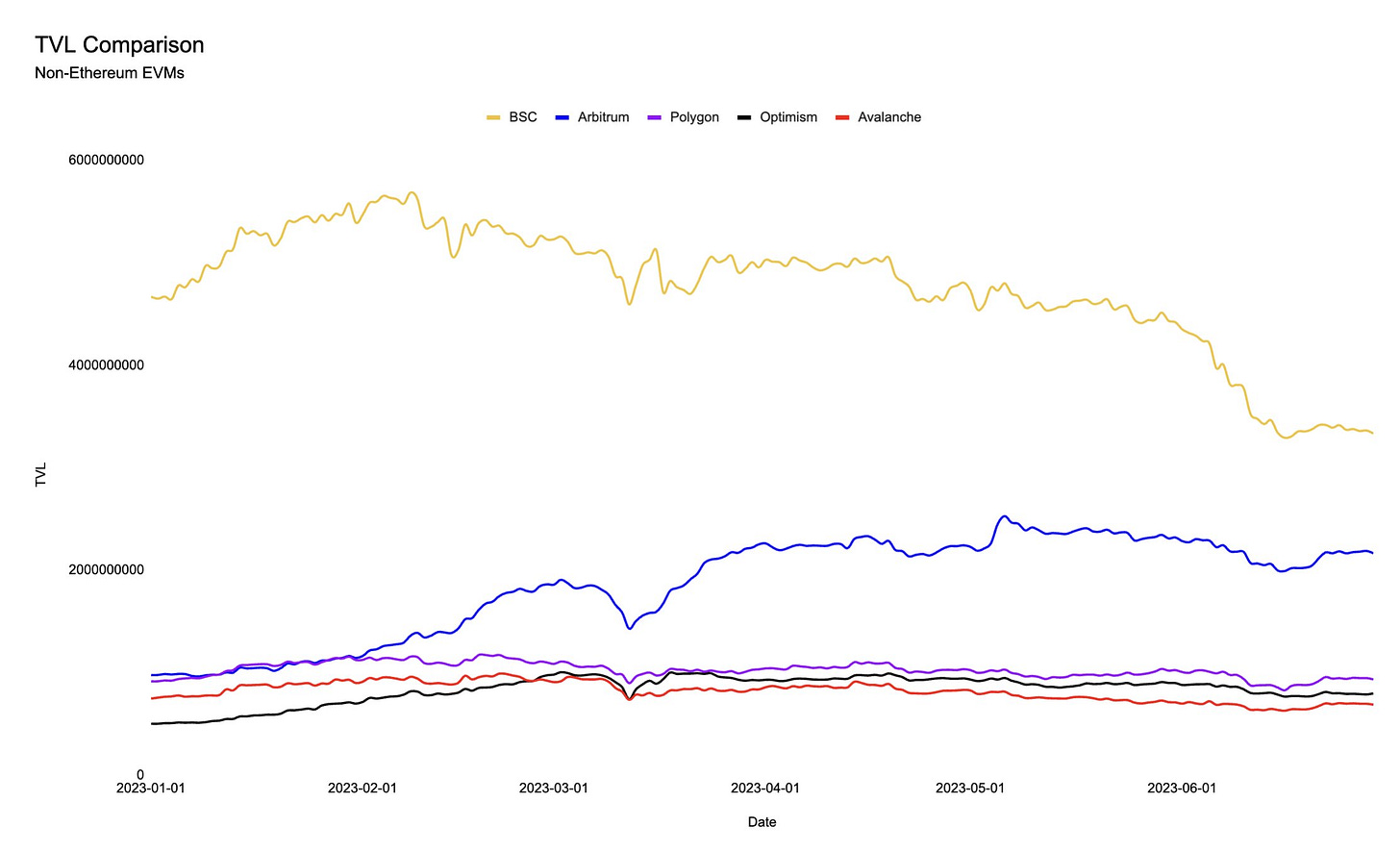

Non-Ethereum EVMs

There has been a steady decline in BSC TVL over the past few weeks, while Arbitrum TVL continues to climb.

Additionally, Avalanche, Optimism and Polygon TVL has been stagnant since the start of the year.

Notably, we are not seeing many new projects launch on Avalanche, while Optimism and Polygon seem to still attract some teams.

Camelot Proposal: Accelerating Arbitrum

Camelot DEX has proposed that Arbitrum Foundation grants 2M ARB per month to Camelot DAO for the next 6 months (totalling 12M ARB) to fund liquidity incentives for Arbitrum-focused projects on Camelot, including the onboarding of new and multi-chain protocols entering the ecosystem.

Liquidity incentives will be distributed across four different categories as follows:

Ecosystem Builders: 50%.

Integration Partners: 25%.

Core Pairs: 15%.

Liquid Staking Derivatives: 10%.

PancakeSwap Launches on Polygon zkEVM

PancakeSwap has launched on Polygon’s zkEVM. This is PancakeSwap’s fourth chain, after BSC, Ethereum and Aptos.

Synapse has integrated Circle’s CCTP natively.

Polygon Labs announces that they will unify the new Layer 2 zero-knowledge chains with new staking and interoperability layers.

Coinbase has done $900M USD in trading volumes over the period of June 21 to June 28. This comes after institutional interest in BTC rises and Binance loses access to European markets. Much of this volume could also be explained by Microstrategy’s acquisition of 12,333 BTC.

Weekly Stablecoin Flows

Stablecoin Exchange Flows

There was a large weekly stablecoin net flow out of exchanges, with a total of $1.5 billion moving.

Stablecoin Chain Flows

Optimism took the bulk of stablecoin net flows from exchanges this week with a total net flow of $56 million moving to the layer 2. Avalanche also saw relatively large inflows of stables this week.

Weekly TVLs

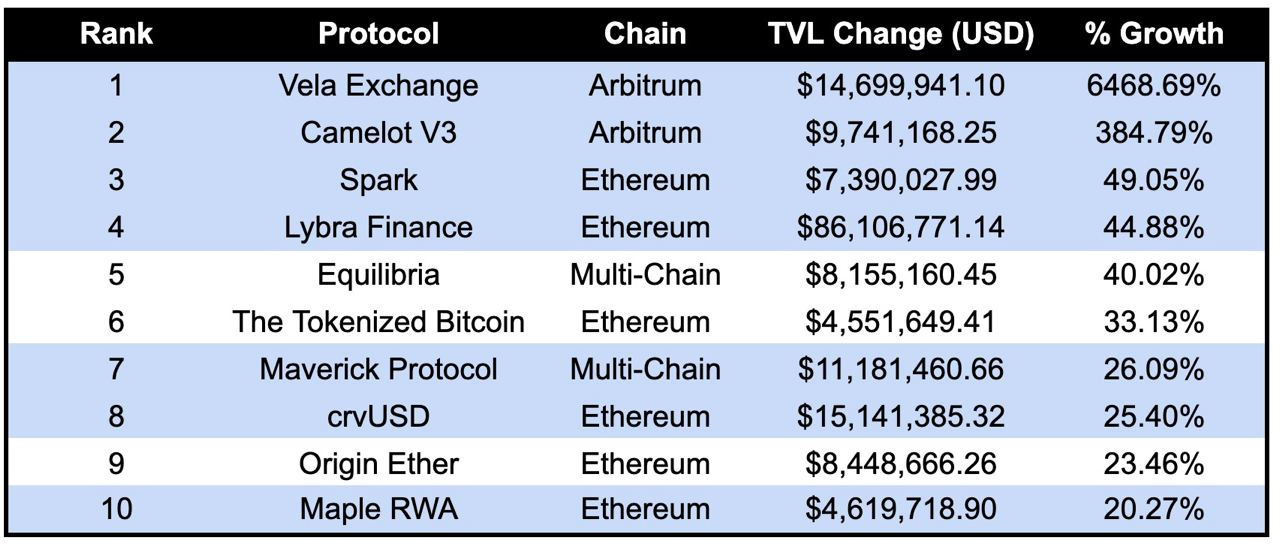

Top TVL Growth (Protocol - any TVL size)

Top TVL Growth (Protocol’s > $10m TVL)

Vela Exchange, an Arbitrum perp DEX, and Camelot V3, an Arbitrum DEX, are some relevant protocols that saw high TVL growth over the past 24 hours.

Notably, Vela grew 6468% over the past week, possibly due to their recent public access launch.

Additionally, stablecoin protocols crvUSD and Lybra Finance, Maverick Protocol, who recently had their airdrop and TGE, and Maple RWA have grown their TVL by double-digits over the past week.

Weekly Top Fee Growth

Blur had a huge week in terms of fees earned, this is due to the capitulation we have seen in NFTs led by the poor reaction to the Elementals drop by Azuki. As a result of this, NFT prices across the board collapsed and borrowers were liquidated, generating high fees for the protocol.

Governance Proposals

MIP-23: $MNT Supply Optimization in Preparation for Launch

Proposal to NOT convert 3B BIT (from Mantle Treasury) tokens to MNT, and to instead burn them.

[SIP - 27] SYN Emissions Reduction

Since the partnership with Nima Capital has allowed to reduce quotes on many crucial stableswap bridge routes, the DAO no longer needs to incentivize passive liquidity pools

In the short term, Synapse the proposal suggests that Synapse should:

Reduce all stableswap emissions by 50%

Reduce Metis and Fantom emissions to zero

Decrease emissions on high volume pools proportionately less (Arbitrum/BNB Chain).

[SIP-26] Deploying Synapse Bridges onto Base Mainnet

Proposal to deploy a stablecoin bridge on day 1 launch of Base mainnet, comprised of nUSD and USDC, with funds sourced from Nima Capital.

Articles

V2 Feature Highlight: Information Tax

y2k Finance discusses the "Information Tax": a new deposit fee for vaults that linearly increases as an epoch gets closer to starting.

i.e. those who deposit closer to the epoch’s start will pay a higher fee which gets passed down to $vlY2K holders.

Introducing rETH: A New Liquid Staking Token Joins Raft

Raft will be integrating of rETH, Rocket Pool ETH, into Raft.

Initially, rETH deposits will have conservative parameters, including higher borrowing and redemption fees, due to its currently lower liquidity compared to stETH.

zkSync announces the ZK Stack, a modular, open-source framework that is both free and designed to build custom ZK-powered L2s and L3s (referred to as Hyperchains), based on the code of zkSync Era.

zkSync announces hyperchains (L3’s using ZK Stack) and hyperbridges to connect them.

Maverick Ecosystem Incentive Program

Maverick Protocol introduces the Maverick Ecosystem Incentive Program. 30.85% of the total token supply is earmarked for airdrops and liquidity mining.

Incentive program will be used to:

Bootstrap liquidity during Maverick ve-model launch stage 1.

Incentivize early Maverick ve-model participants (token projects) and ecosystem builders (i.e. metaprotocol builders).

New Protocols

AlloyX

Description: AlloyX is a DeFi protocol aggregating tokenized credit, bringing liquidity, composability and efficiency to RWA.

Twitter: https://twitter.com/alloyx_xyz

Website: https://alloyx.xyz/

Superstate

Description: Building the future of compliant, blockchain-based financial products

Twitter: https://twitter.com/superstatefunds

Website: https://superstate.co/

Haptic Finance

Description: Permissionless option markets

Twitter: https://twitter.com/HapticFinance

Website: https://haptic.finance/

Sumero App

Description: Create and trade financial derivatives without a brokerage or clearing house.

Twitter: https://twitter.com/SumeroApp

Website: https://sumero.finance/