Weekly Summary 3

19-06-2023 to 25-06-2023

Developments

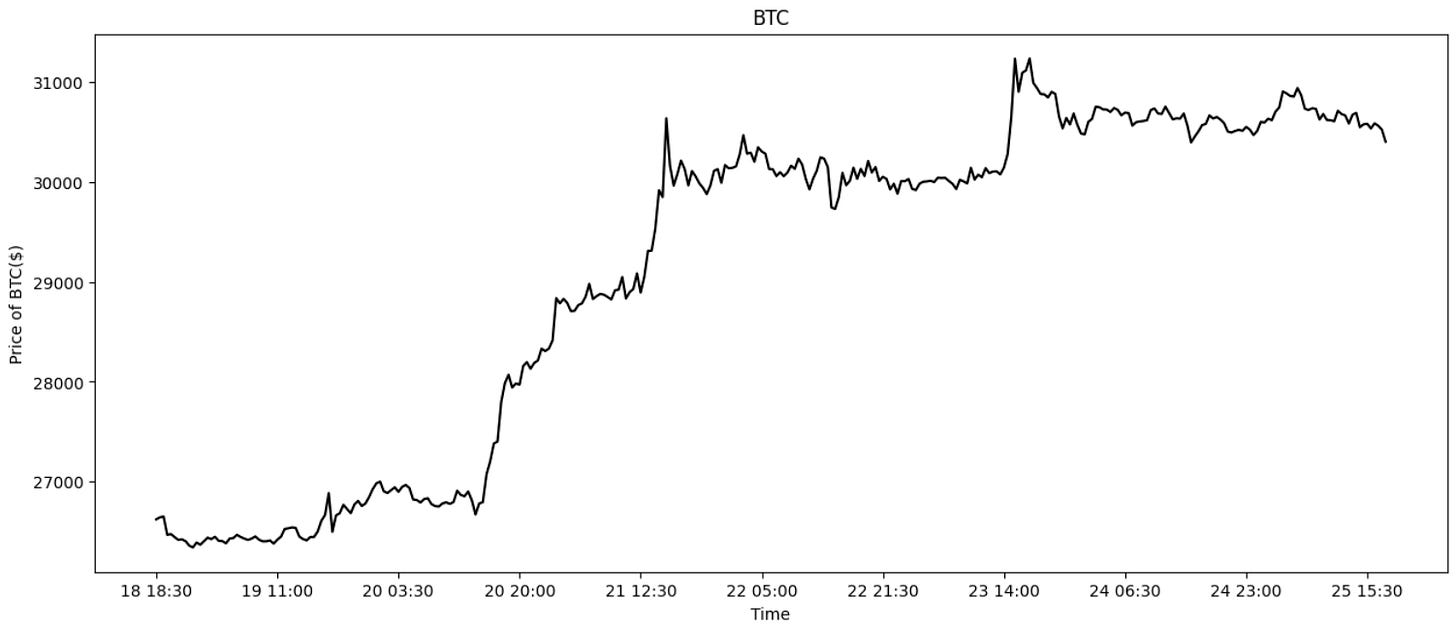

BTC Outperformance

BTC had a huge week, rallying 15%. Many are speculating this is a delayed reaction to the Blackrock BTC ETF news & there are some confirming data points of an institutional bid:

Large BTC spot volumes on Coinbase, the go-to exchange for US institutions. Coinbase premium.

GBTC discount closing greatly

CME futures basis trading up [h/t @thiccythot - post]

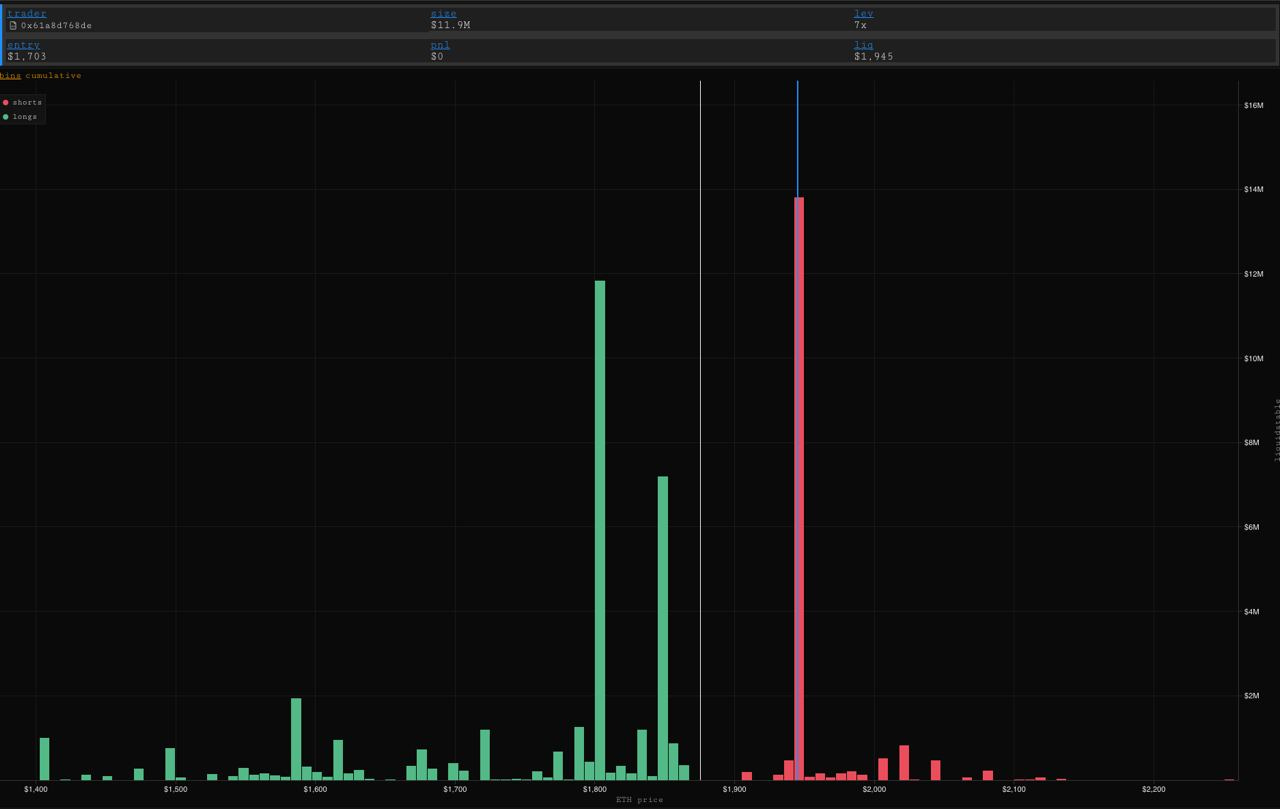

GMX Trader

GMX Trader 0x61 had a 7x leveraged ETH short of $11.6 million on GMX.

This position was set to start getting liquidated at $1945 (+3%) if he doesn’t add more collateral. 0x61 has limit orders set to add more collateral as price moves against his position, meaning his liquidation level is slightly higher than $1945.

Silk Road Related BTC Movements

A wallet associated with the US Government seized BTC from Silk road / James Zhong moved 1,500 BTC today. We are still trying to confirm whether this was actually the US Govt or a mislabel.

Some useful sources:

https://twitter.com/Dogetoshi/status/1671242496771334144

https://twitter.com/jconorgrogan/status/1671257631384543234

Later in the week, this wallet labelled by Arkham as a US Government wallet that has seized BTC from Silk Road moved 665 BTC ($20,113,630 USD) to Coinbase.

BitDAO Announces BIT to MNT Conversion Date

Bybit has announced that they will be supporting the BitDAO ($BIT) Token Conversion to Mantle ($MNT) starting on Jun 22, 2023.

To learn more about $MNT you can find ASXN’s notes on their Tokenomics AMA here.

stETH Maker Collateral

stETH has started closing in on overtaking ETH as collateral in MakerDAO, as it reaches 933K.

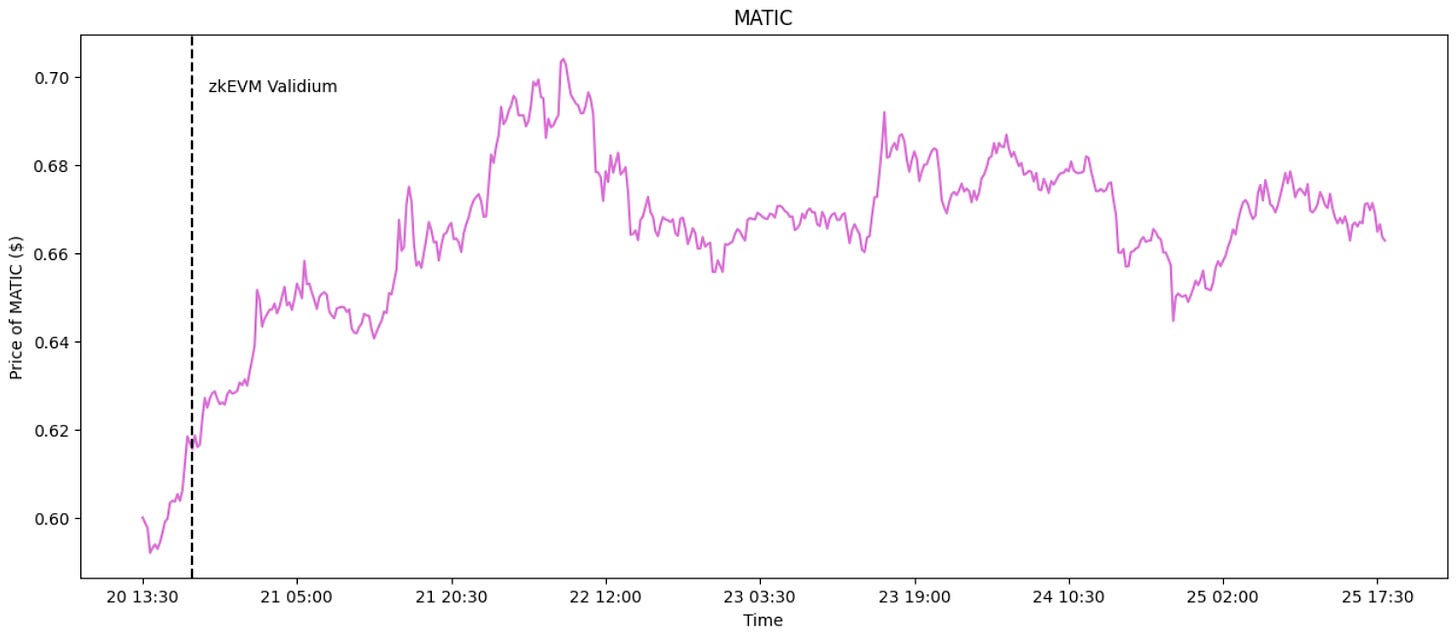

Polygon PoS Upgrade to ZK Validium

A proposal was published to upgrade Polygon PoS to a zkEVM validium.

Validiums are scaling solutions that use off-chain data availability and computation designed to improve throughput by processing transactions off the Ethereum Mainnet.

As a zkEVM validium, Polygon PoS would inherit Ethereum's security

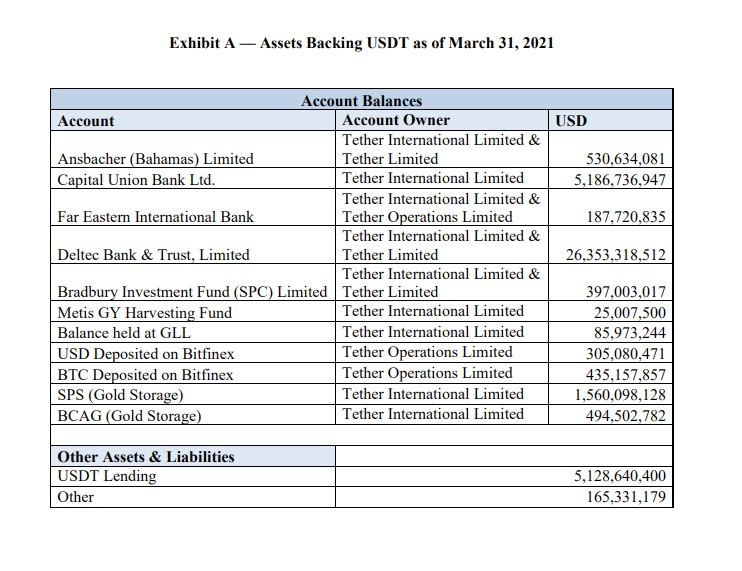

Coindesk’s Tether Report Published

On March 31, 2021, Tether claimed it had more than $35.5 billion in U.S. dollar equivalents at these institutions.

Additionally, $5.1 billion was detailed under "USDT lending" and other assets, totaling $40.6 billion in assets, almost matching the 40.8 billion USDT in circulation at the time.

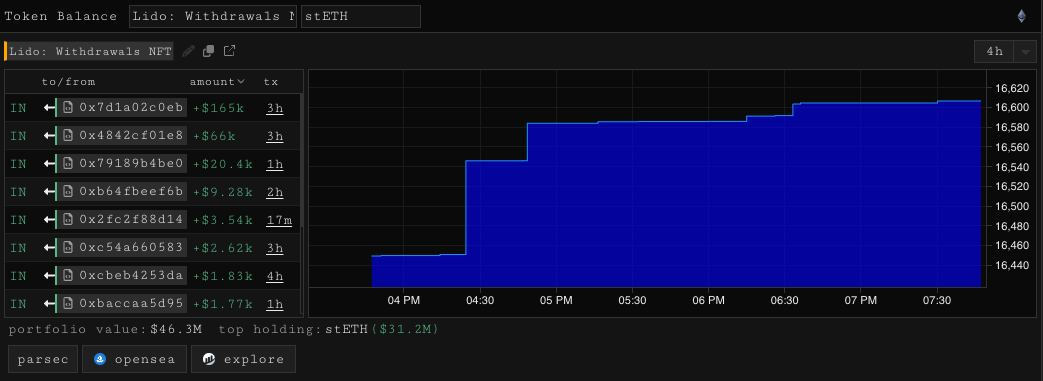

stETH withdrawals

Justin Sun submitted 15,805 stETH for withdrawal today, worth an approximate $30 million. He still holds 288,100 stETH that we know of, making him the largest individual holder.

We can see the jump in withdrawals around 04:30 UTC.

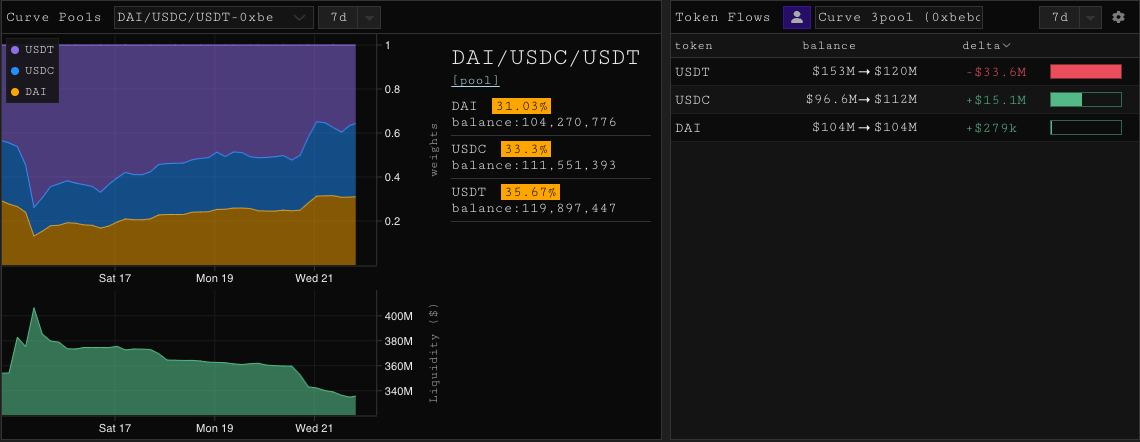

3Pool

The 3pool has returned to a more balanced state with a USDT weighting of 35%. Over the past 7 days we have seen inflows of USDC and DAI to an aggregate tune of $15.1 million.

Swell Hits $50M TVL and swETH to be Used to Mint Stablecoins soon

Lybra announced that swETH will be able to be used on Lybra’s platform to mint their native stablecoin, eUSD soon.

Swell continues to steadily grow in TVL, as it hits $50M TVL as of today, owing to its successful Voyage campaign.

Raft

Raft, a stablecoin issuer using staked ether (stETH), has seen its total value locked (TVL) skyrocket to $55 million within three weeks, marking a 4,595% growth. This contrasts with other stETH-backed stablecoin protocols like Lybra, whose TVL has remained steady at around $180 million.

Level Finance Incentives on Arbitrum Go Live

LVL incentives for Liquidity Providers of the Junior, Mezzanine and Senior Tranches went live on Arbitrum today at 16:00 UTC.

Senior Tranche earns 9.51% APR, Mezzanine Tranche earns 60.08% APR and Junior Tranche earns 84.47% APR (these figures fluctuate based on AUM).

Level Finance TVL continues to climb after their launch on Arbitrum. It has still not reached referral contract highs of $41.95M.

MakerDAO Purchases Treasury Bonds

MakerDAO has bought $700M in US Treasury bonds and has increased its holdings of treasury bonds to $1.2 billion.

MakerDAO had initially bought $500M in treasury bonds in October 2022.

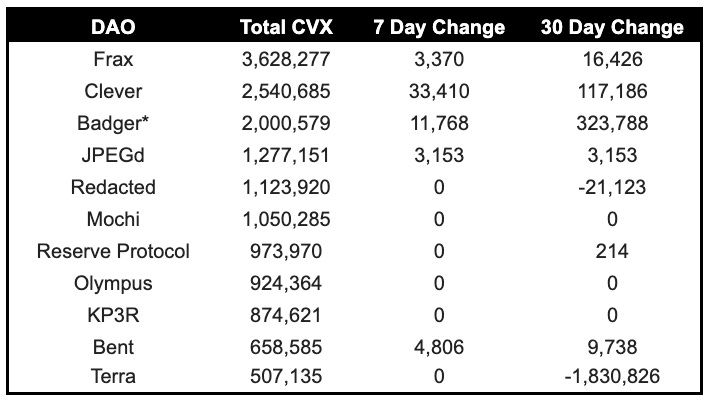

Sam Altman-backed Reserve makes $20m Curve Wars power play

Stablecoin issuer Reserve Protocol has been buying more voting power to increase liquidity for its stablecoins.

The $20M investment is the stablecoin platform’s largest so far.

Reserve is already the 7th largest holder of CVX

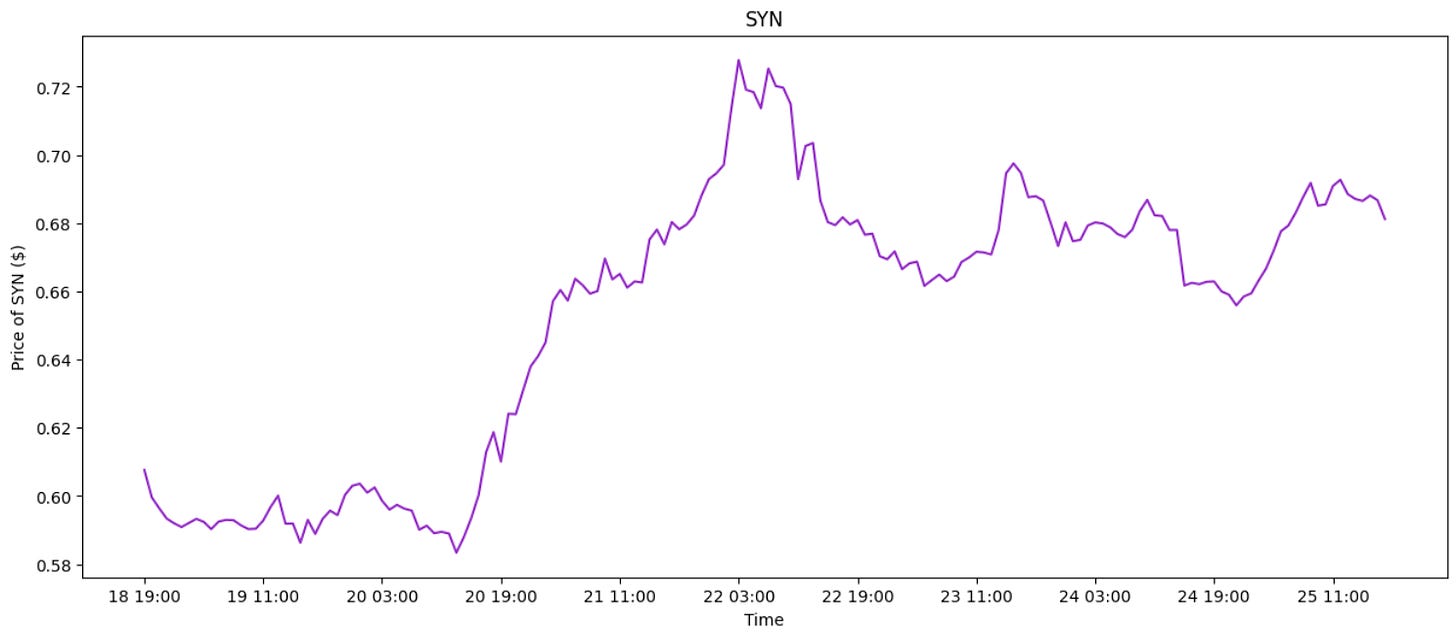

Synapse Chain Audits

Aurelius says Synapse chain audits started a few weeks ago and that he will share which firms are auditing the protocol closer to completion of the audits.

BNB Chain Releases Layer 2 Testnet Based on Optimism's OP Stack

BNB Chain, which is building their layer 2 on the OP stack, has released the opBNB testnet. opBNB testnet is supposed to reach 4K tps at a targeted cost of 0.005 U.S. cents per tx.

Prime Trust Faces Trouble

Prime Trust seems to be in trouble as they are accused of being unable to fulfill withdrawals and as BitGo terminates their acquisiton that they

Prime Trust Has 'Shortfall of Customer Funds,' Nevada Regulator Says

Nevada Department of Business and Industry claims that digital asset custody firm Prime Trust has "a shortfall in customer funds" and was unable to meet all withdrawal requests this month.

BitGo says it's terminating acquisition of Prime Trust

BitGo announced that it will be terminating the acquisition of crypto custodian Prime Trust, just two weeks after it announced plans for the deal.

Crypto Exchange Backed by Citadel Securities, Fidelity, Schwab Starts Operations

EDX Markets launched its digital assets market today.

EDX recently concluded a funding round attracting strategic investors such as Miami International Holdings, DV Crypto, Global Trading Strategies, GSR Markets and Hudson River Trading.

EDX currently only offers trading of BTC, ETH, LTC and BCH.

Deutsche Bank applies for digital asset custody license

Deutsche Bank has reportedly applied for a digital asset custody license to the German financial regulator BaFin.

Binance exiting the UK

Binance's subsidiary, Binance Markets Limited (BML), based in the United Kingdom, has formally terminated its registration with the Financial Conduct Authority (FCA).

Following the deregistration, the Financial Conduct Authority (FCA) has stated on its website that no Binance entity is authorized to offer any services in the United Kingdom. Therefore, after the termination of Binance Markets Limited's registration, no Binance entity holds authorization from the FCA to operate in the UK.

Weekly Stablecoin Flows

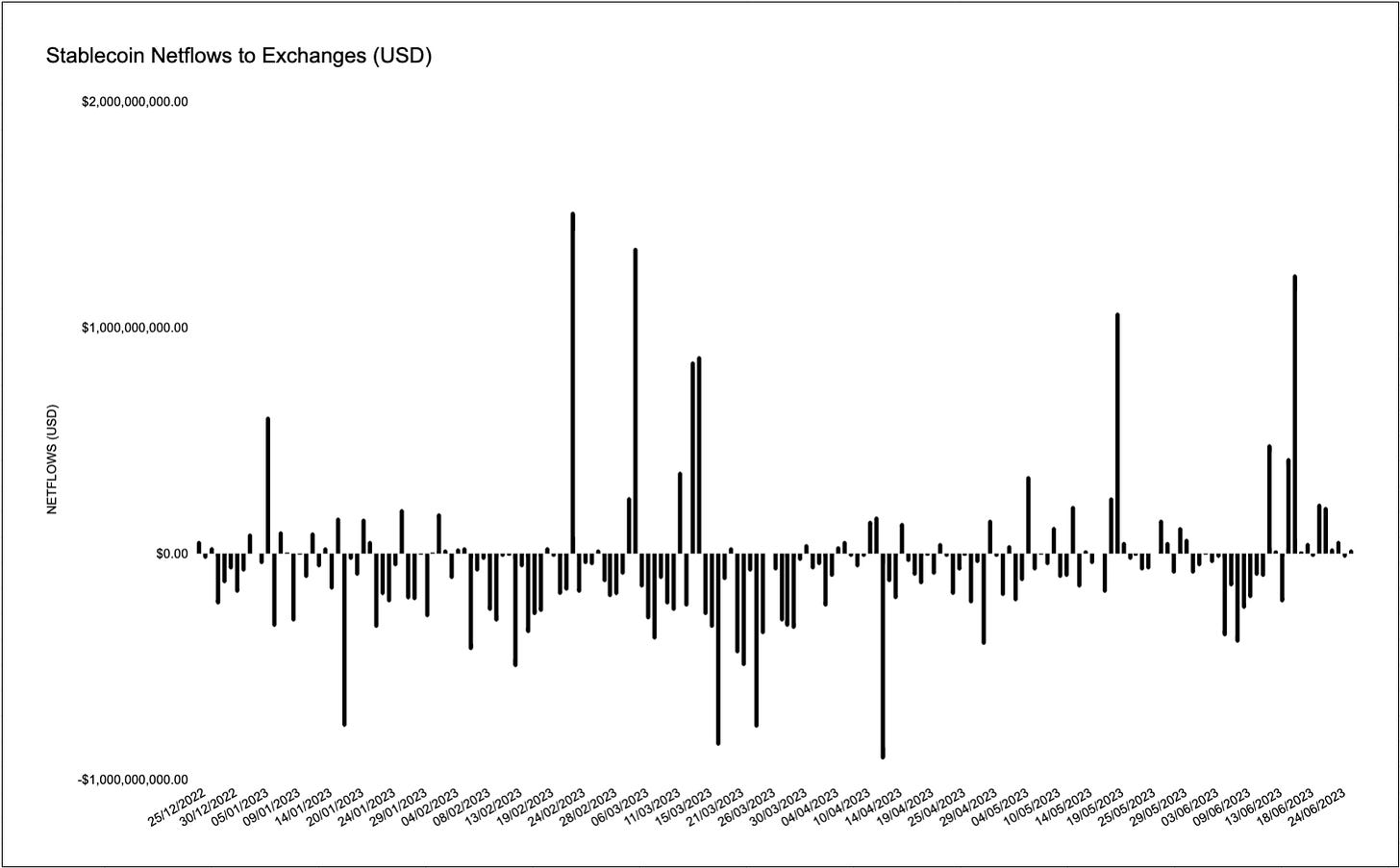

Stablecoin Exchange Flows

Moderate net inflows to exchanges in the past 7 days, with a net $517 mil stables moving to exchanges.

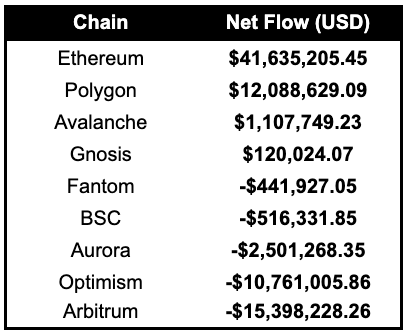

Stablecoin Chain Flows

Most notable stablecoin flows from chains this week is the large net outflows from the largest two optimistic rollups, Arbitrum and Optimism. Polygon saw a $12mil net inflow of stables which could be related to the upcoming zk Validium chain and the upcoming token utility changes (farming for a new token?).

Weekly TVLs

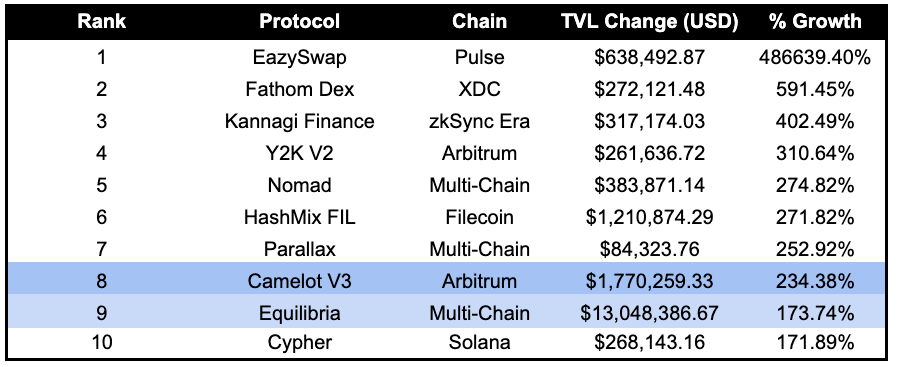

Top TVL Growth (Protocol - any TVL size)

Most notable TVL gainers this week is Camelot v3 on Arbitrum and Equilibria.

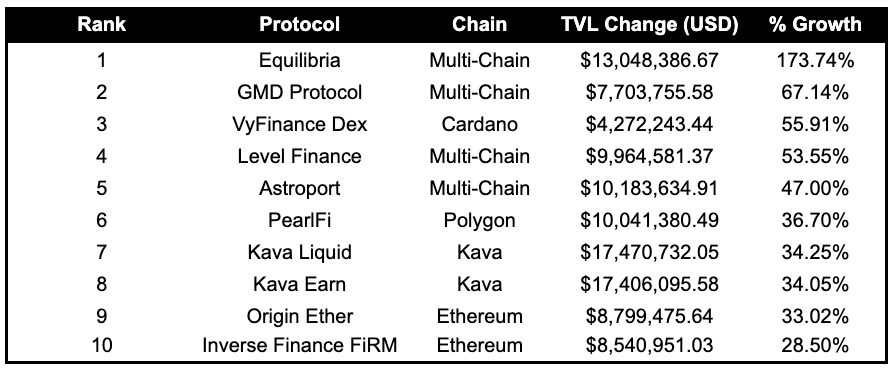

Top TVL Growth (Protocol’s > $10m TVL)

Equilibria, GMD Protocol and Level Finance are some relevant names who have seen large growth in TVL over the past 24 hours.

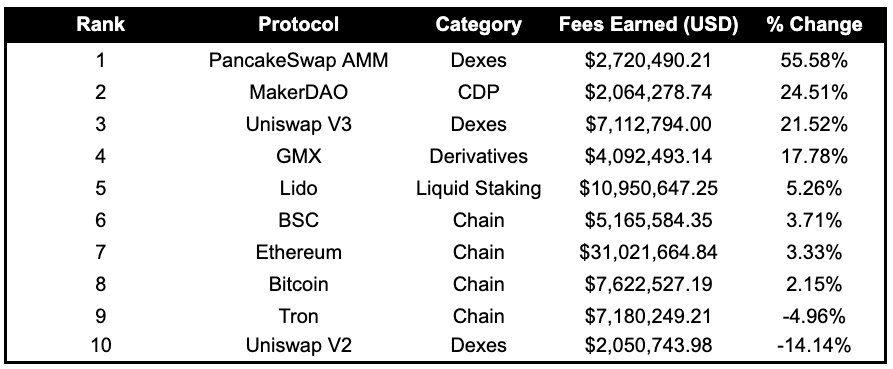

Weekly Top Fee Growth

PancakeSwap’s fees earned has increased by 55.58% over the past day, reaching $2.7M.

Governance Proposals

GMX: Updating Multiple Point System

Proposal is to adjust multiplier points (MPs), such that MPs accumulated in a wallet beyond a set % of staked esGMX/GMX tokens will accrue in the account but not be eligible for fees.

Level Finance: New Rounds of Strategic Investment

Level Finance has been approached by institutional investors looking to invest.

The first investment of such kind is a 9-figure asset management company looking to acquire a $20m stake in the project.

This investment would occur in tranches and would depend on the growth of the protocol along with the platforms underlying liquidity.

Each tranche will come with a one year lockup/vesting period.

All deals will be done at spot TWAP all of the proceeds will be added directly to the DAO treasury.

RFP-19: Radiant Expansion & Deployment to Ethereum Mainnet

Proposal is to deploy Radiant on Ethereum Mainnet. Timeline for the launch per the proposal would be Q3 2023.

Lido: Tiered Rewards Share Program: A Sustainable Approach to stETH Growth

Proposal outlines a rewards share program for Lido where a percentage of the Lido DAO’s 5% share of staking rewards would be offered to participants who stake ETH using Lido.

This program would have limited rewards pools, gradual payouts, a fixed duration that the DAO shares with participants, and filtering for program abuse.

Articles

Pika Retroactive Airdrop

Pika will be doing an airdrop, involving approximately 6.2 million esPIKA tokens (6.2% of supply. These tokens will vest for one year to unlock PIKA

To LPs and traders for all 3 Pika versions: ~4.09m esPIKA

To V2 LPs with loss: ~1.71m esPIKA (3.25 esPIKA is rewarded for each $1 loss)

To community contributors: 0.3–0.4m esPIKA(will reach out to each individual for confirmation)

Optimism announces the third round of RetroPGF.

30M OP tokens will be distributed to contributors to the Optimism Collective.

Introducing Maverick Protocol’s Voting-Escrow Model

The MAV token is a utility and governance token that can be used to stake, vote, and direct community and ecosystem incentives.

All of these utilities are based on a voting-escrow model, where MAV holders can stake their MAV to receive veMAV.

gETH: GND Protocol’s Approach to LSDFi

GND announces gETH.

gETH will be minted through using several LSDs and ETH derivatives as collaterals, which will allow it gain diversified yield from ETH and multiple LSDs

By employing a high-liquidity pool of LSDs, GND will also enable non-gETH holders to swap between LSD products.

gETH will support: wstETH, rETH, gmdETH, sfrxETH, WETH and ETH

gETH will earn fees and revenues from: minting/redeeming, Uni v3, bridge fees, LSD appreciation and partnerships.

New Protocols

Astria

Description: The Shared Sequencer Network

Twitter: https://twitter.com/AstriaOrg

Website: https://www.astria.org/

Parabol Fi

Description: A new stablecoin ecosystem that natively embeds risk-free return

Twitter: https://twitter.com/parabolfi

Website: parabol.fi

Galador Finance

Description: The hyper-efficient decentralized exchange and liquidity infrastructure on Mantle.

Twitter: https://twitter.com/galadorfi

Website: https://galador.io/swap