Weekly Summary 2

12-06-2023 to 18-06-2023

Developments

Blackrock Bitcoin ETF

BlackRock, the largest asset manager globally, has submitted an application for a Bitcoin Exchange Traded Fund (ETF). BlackRock plans to utilize Coinbase Custody for the ETF and will rely on the cryptocurrency exchange's spot market data for pricing.

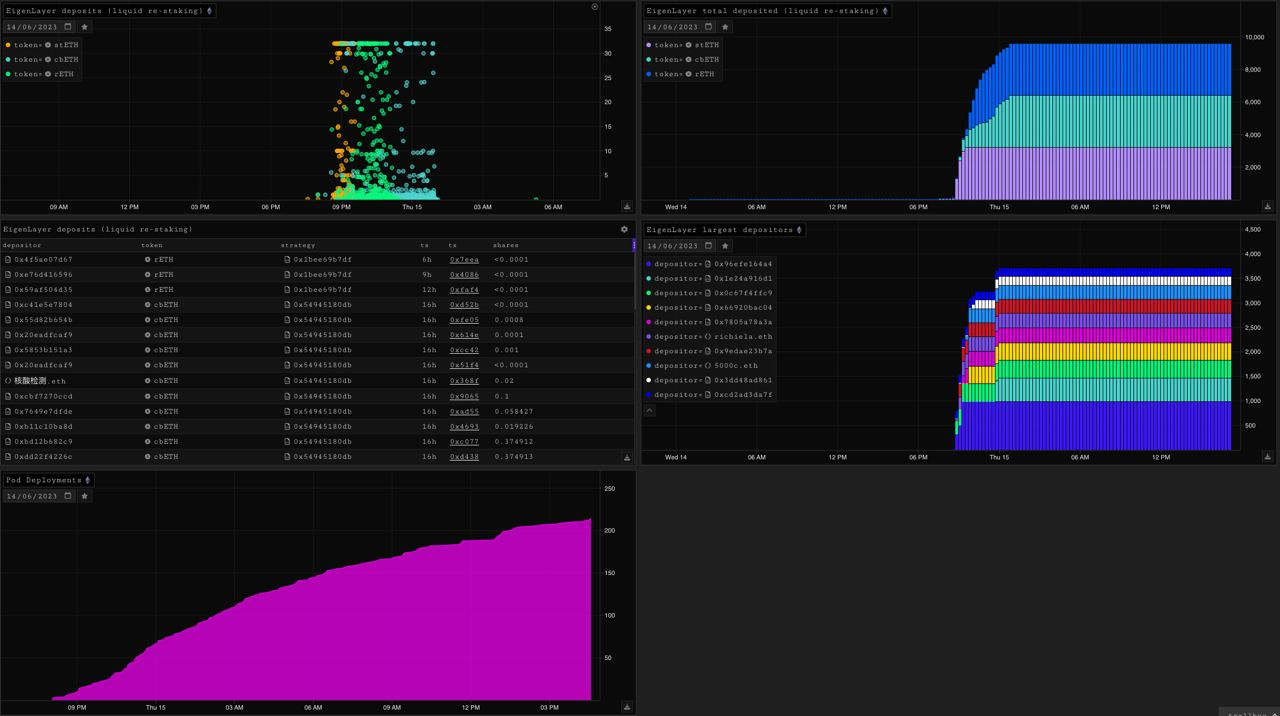

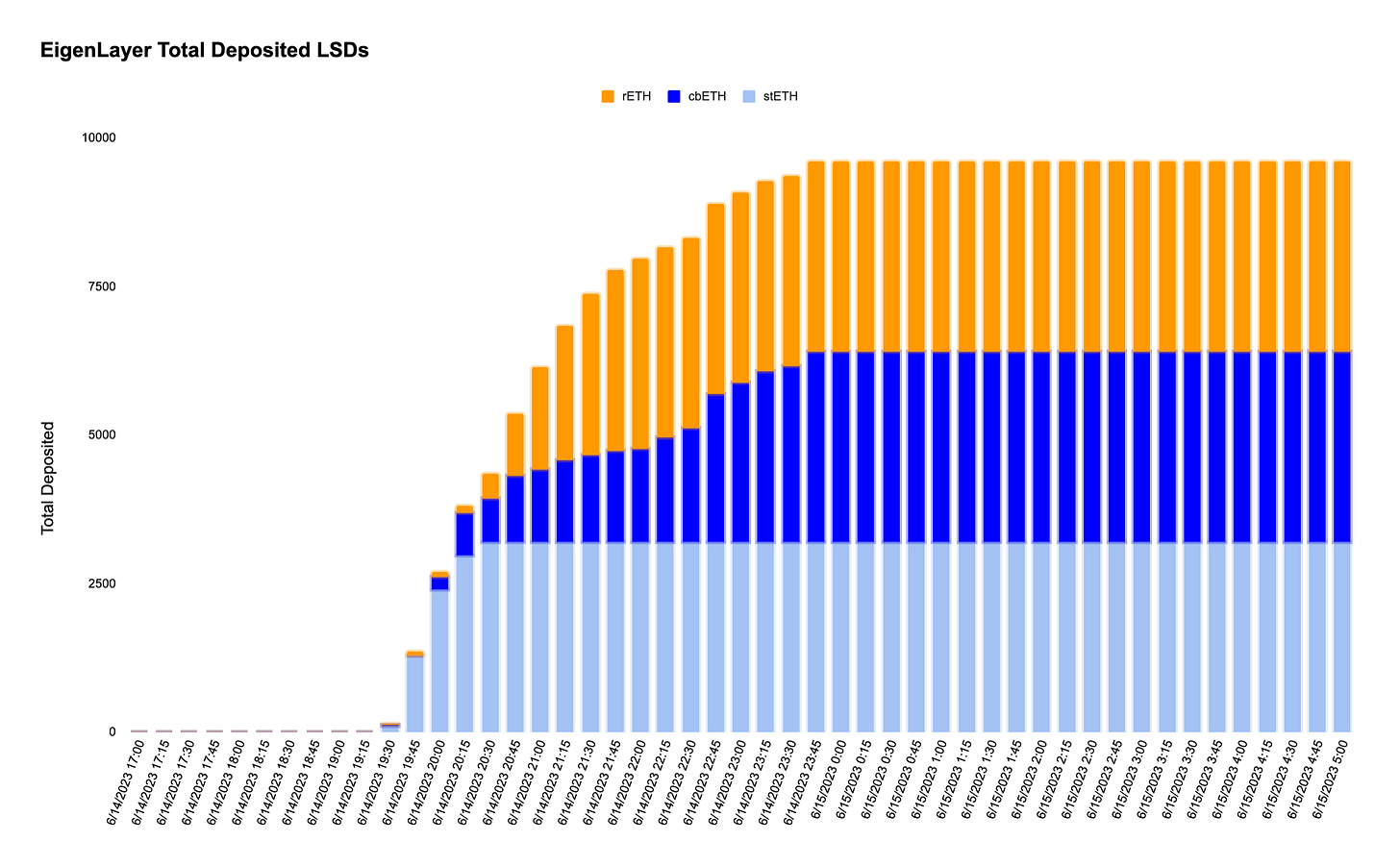

EigenLayer Stage-1 Deployment on Ethereum Mainnet

EigenLayer is a restaking protocol which enables the reuse of ETH on the consensus layer. Ethereum stakers can restake LSTs into EigenLayer.

The guarded launch filled in 4 hours - 3200 stETH, 3200 rETH, 3200 cbETH, 392.63 Beacon chain ETH now sit in the protocol.

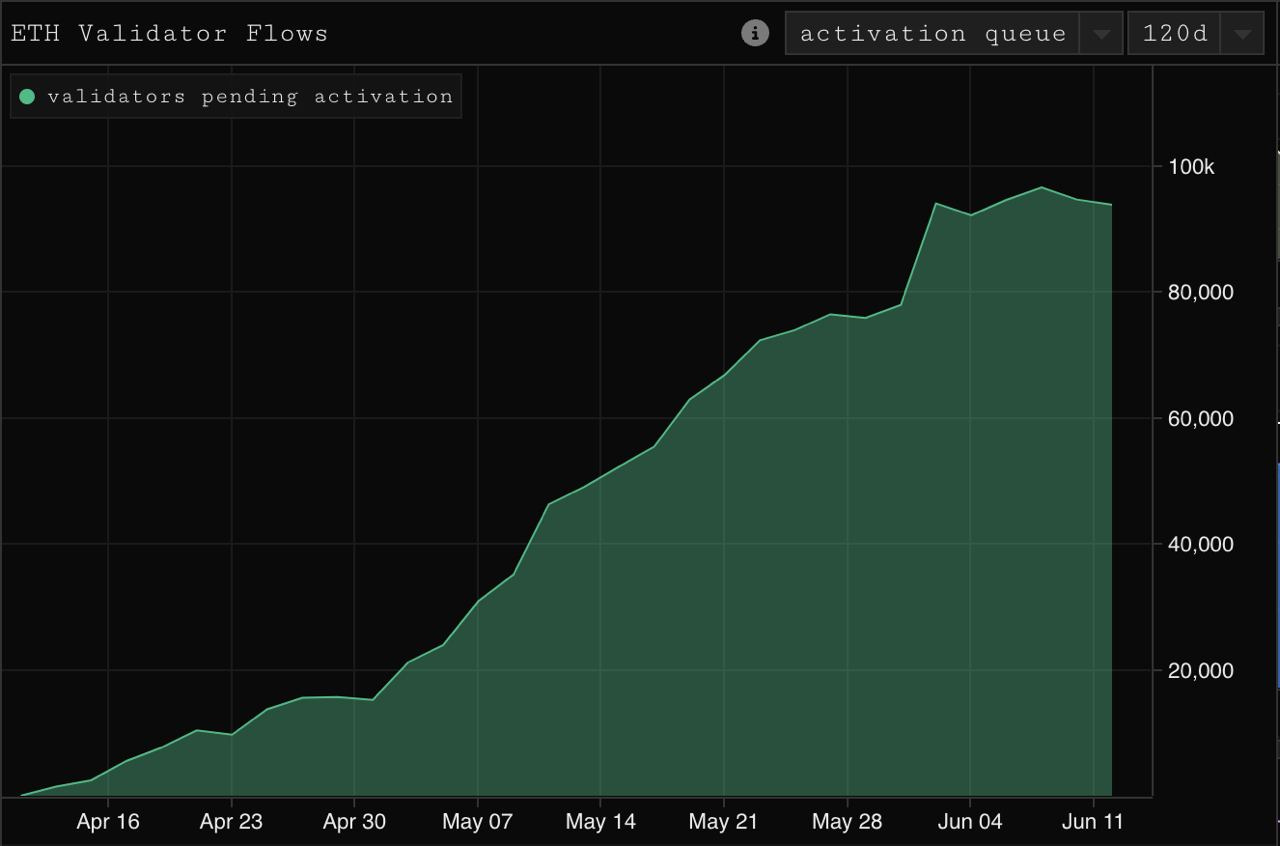

Ethereum Staking

The activation queue to stake Ethereum has reached 93,932 validators awaiting entry, representing 3,005,824 ETH. The queue to enter ETH staking is now at 47 days.

Liquid Staking

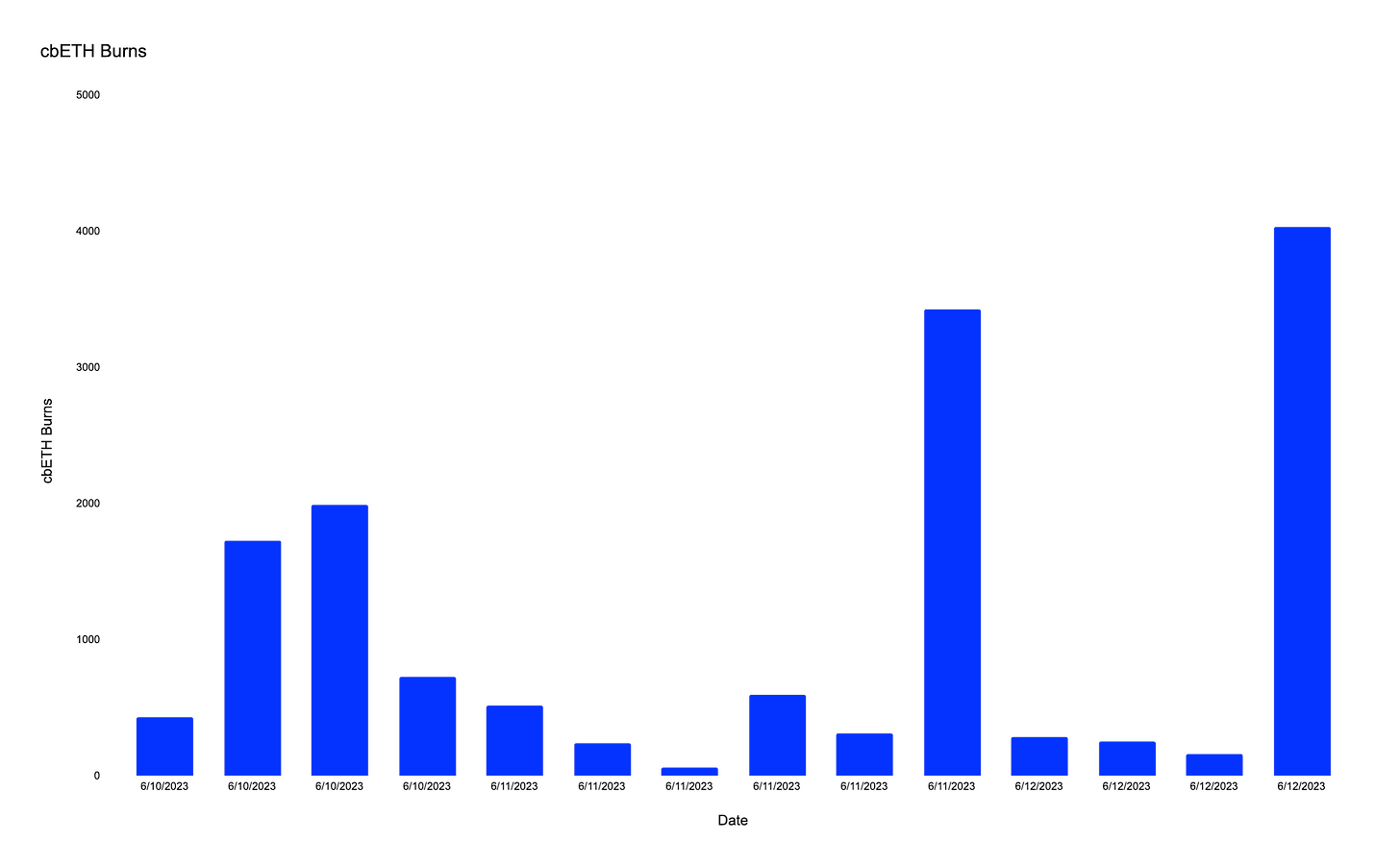

Taking a look at the centralised liquid staking landscape we can see that both cbETH and bETH (coinbase wrapped staked ETH & Binance ETH) have come under pressure this week.

cbETH saw some huge redemptions this week with all time high redemptions coming in at 24,750 cbETH on June 6th. The cbETH / ETH market exchange rate has stayed close to its ETH claim on the Beacon chain despite this pressure.

12,000 frxETH were burned in order to maintain the frxETH/ETH peg on the 11th of June.

Here’s what happened & how the frxETH AMO works:

The frxETH AMO mints frxETH tokens & pairs these tokens with ETH in the curve pool to deepen liquidity.

When frxETH/ETH strays away from 1:1, like during the market panic last week, the AMO will withdraw this LP position and collect the underlying tokens (frxETH & ETH).

The ETH recovered from the LP is then used to buy frxETH

The frxETH from the LP is burned

The AMO does this in the correct ratio to maintain peg, usually intervening at 0.998 frxETH/ETH

The mechanism worked as expected on the 11th, however, frxETH remains around 0.998 at the moment.

Abishek's Thought Experiment Regarding $SWELL and Pearls

Pearls are Swell’s pre-token rewards campaign to distribute governance to community. They will be convertible to $SWELL. Pearls grow at a rate of ~600K pearls / week on average.

Abishek states that:

Assuming that TGE is in Sept. 2023, there'd be 12M Pearl's by then based on pearl growth rate.

If you assume a value of $5M to $10M total Swelldrop to early adopters (5% to 10% of $100M FDV), the potential value of one Pearl should be between $0.40c and $0.80c per.

Raft Token

$RAFT will launch a token for governance and have launched their governance forum.

Governance will be minimized and limited to:

Appointment of the liquidity committee

Treasury management

Protocol fees

Managing additional collateral types

Chain deployments

Future partnerships and grants

21Shares intro ETP for Lido

21Shares Lido DAO ETP (LIDO) is a non-interest bearing, open-ended security. Each series of the product is linked to an index or specific underlying asset Lido DAO. The ETP offers access to LIDO, not stETH.

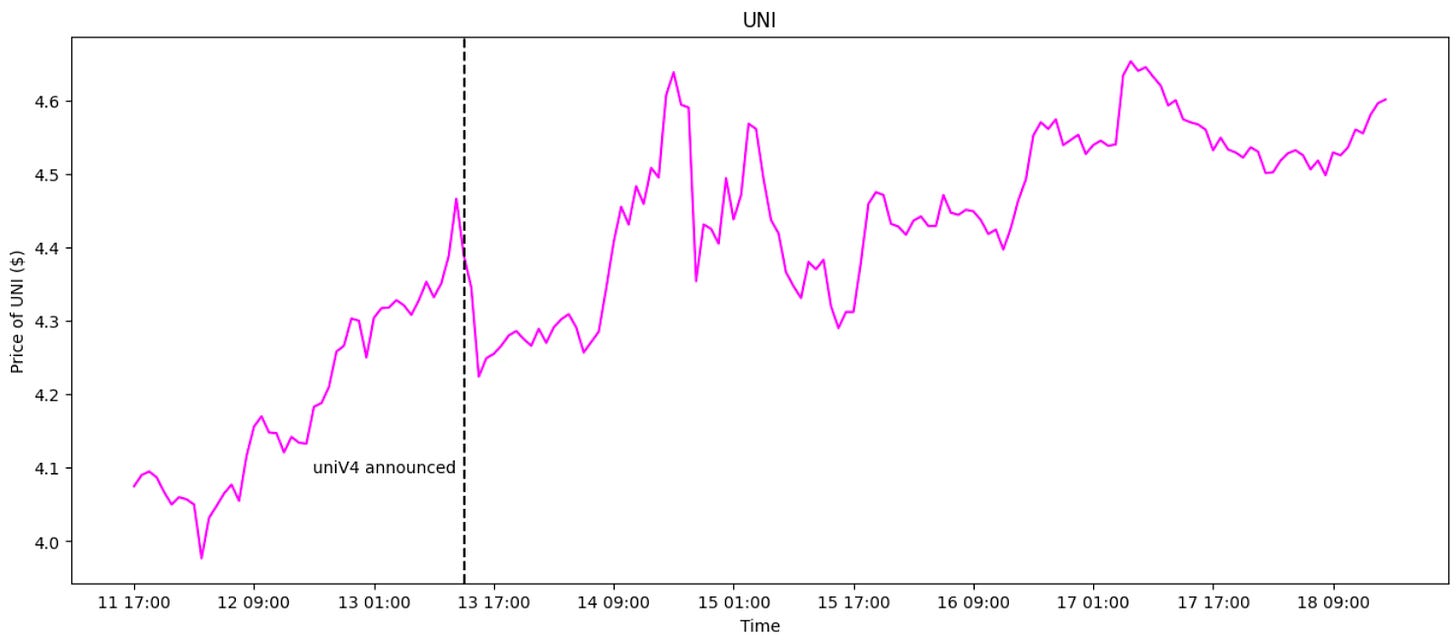

Uniswap v4

Uniswap announced v4, which include features such as:

Hooks, which modules or customizations that you can make when you deploy a pool.

Architectural changes to contracts, such as Singleton and Flash Accounting, to reduce gas costs, improve efficiency and flexibility

Support for native ETH.

Full summary of Uniswap v4 proposal can be found here.

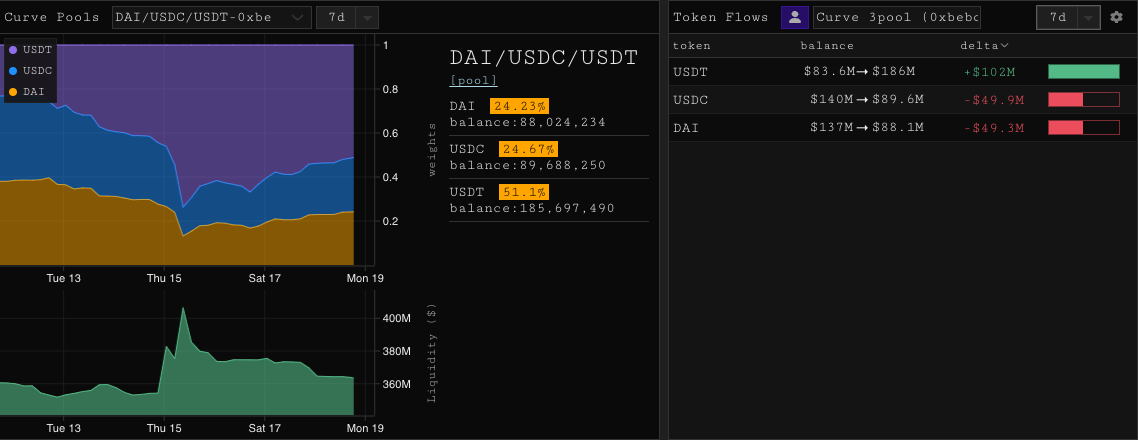

3Pool imbalance

There was an uptick in users selling USDT into the 3pool. USDT weighting in 3pool is currently sitting at a 51%, but reached a high of 73% in the early hours of June 15th. The imbalance was likely due to market participants derisking as the New York Attorney General (NYAG) audited Tether’s books back in 2021 and today Coindesk have just been allowed access to the results of these audits.

Post the Tether blog post (our summary here), it seems the balance is returning to the 3pool.

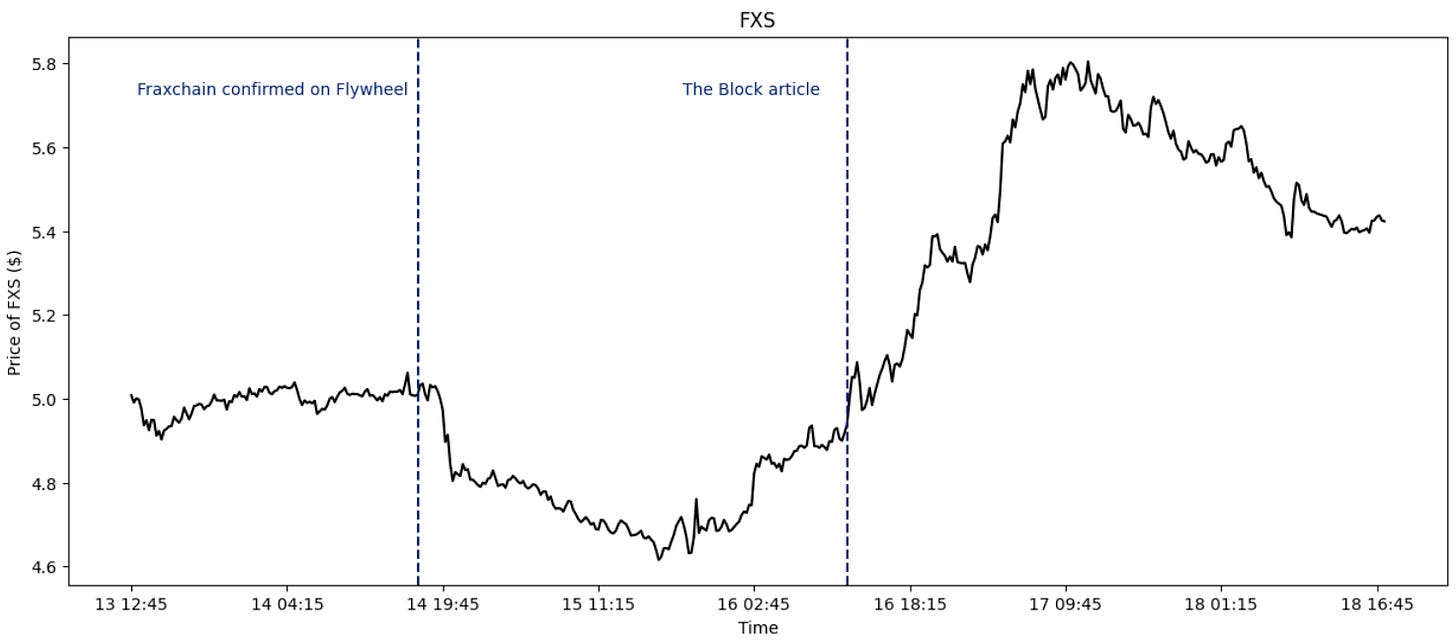

Fraxchain

Fraxchain, a DeFi focused Ethereum based optimistic rollup, will be ready before year end.

frxETH and FRAX will be used as gas tokens, and unlike other Layer 2’s, it will have decentralized sequencers.

Fees generated by the rollup could be partly burned or redirected back mainnet to be distributed among stakers of FXS.

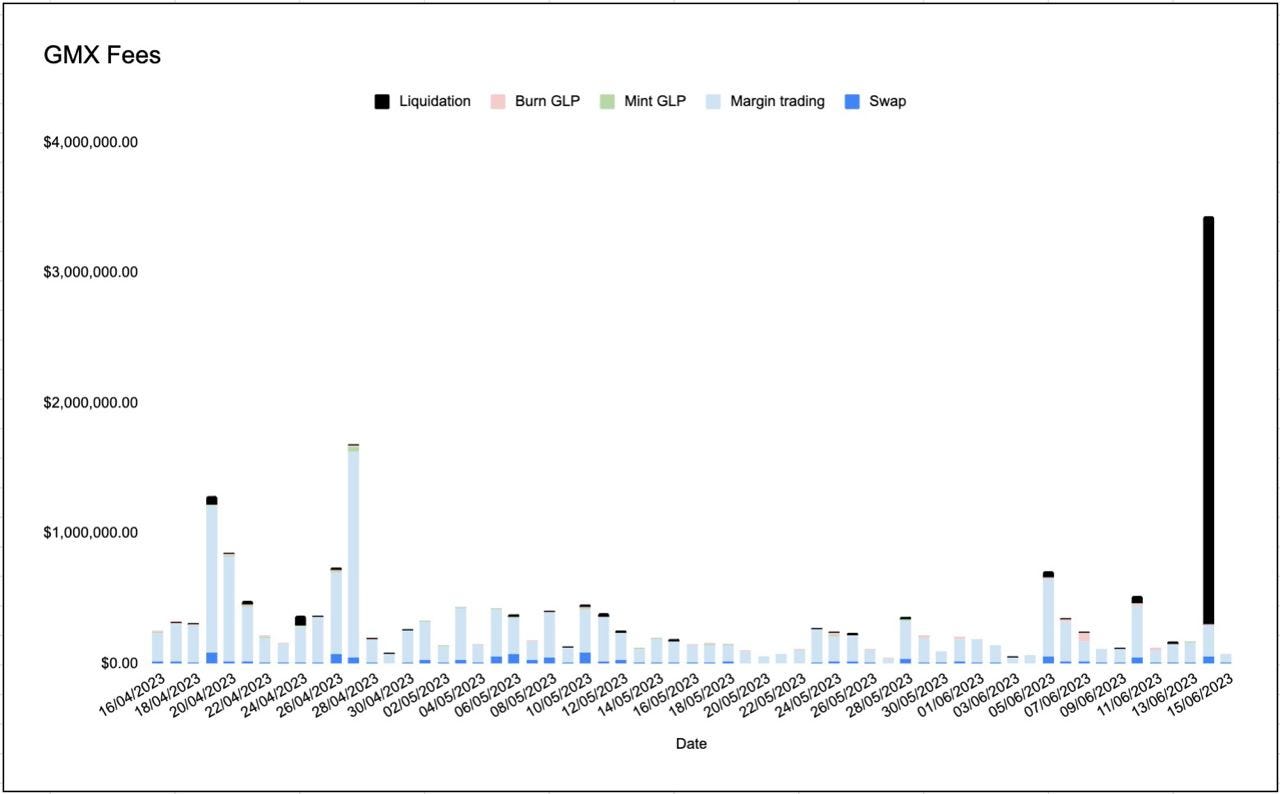

GMX liquidations

The past few months have been rough for GMX stakers and GLP holders as yield dried up with the low volatility markets. However, this week we had some of the largest liquidations to date & these LPs and stakers will be receiving a large amount of fees this week.

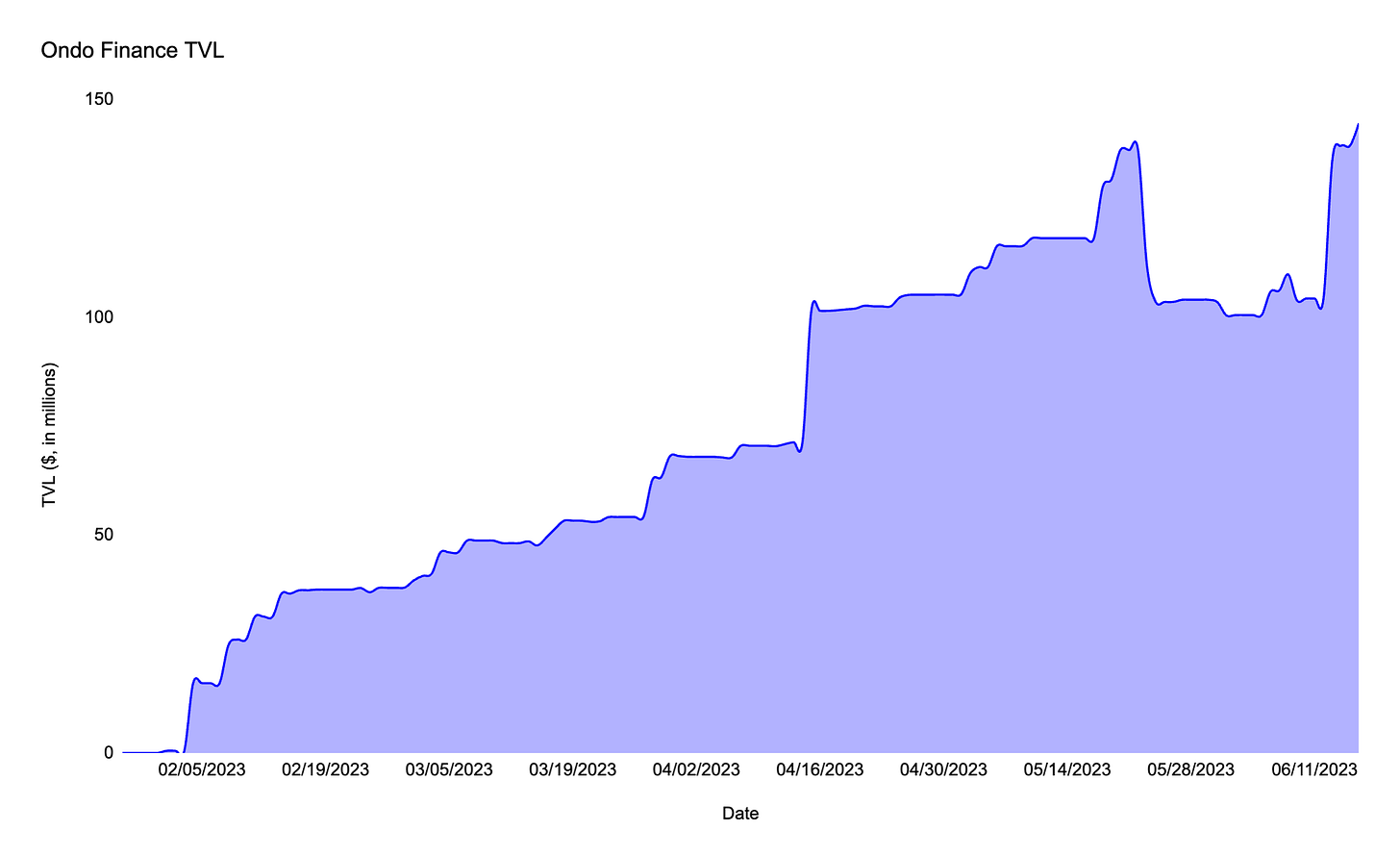

On-Chain T-Bills

Ondo Finance, a startup specializing in security tokens, is introducing a stablecoin alternative that offers interest payments to its holders through a tokenized money market fund. The company, in its blog post, states that the OMMF token will be pegged to the value of US$1 and supported by money market funds traded on established exchanges. Investors will have the ability to create and redeem OMMF tokens on weekdays, while earning daily interest in the form of additional OMMF tokens.

Coinbase have started offering a 4% yield on USDC held with the exchange.

Trouble with Delio Global and Haru

The largest Korean BTC lending service Delio Global and Korea's largest yield service Haru halts withdrawals. Delio offers lending services and typically offers lower yields for crypto. Haru on the other hand offers his yield across the board for lockups (>10% for majors and stables). There are some reports of mismanaged & co-mingled user funds.

Interestingly, Delio reports a total value utilized of (TVU):

41,740 BTC ($1.08B)

118,044 ETH ($205M)

Altcoins ($6M)

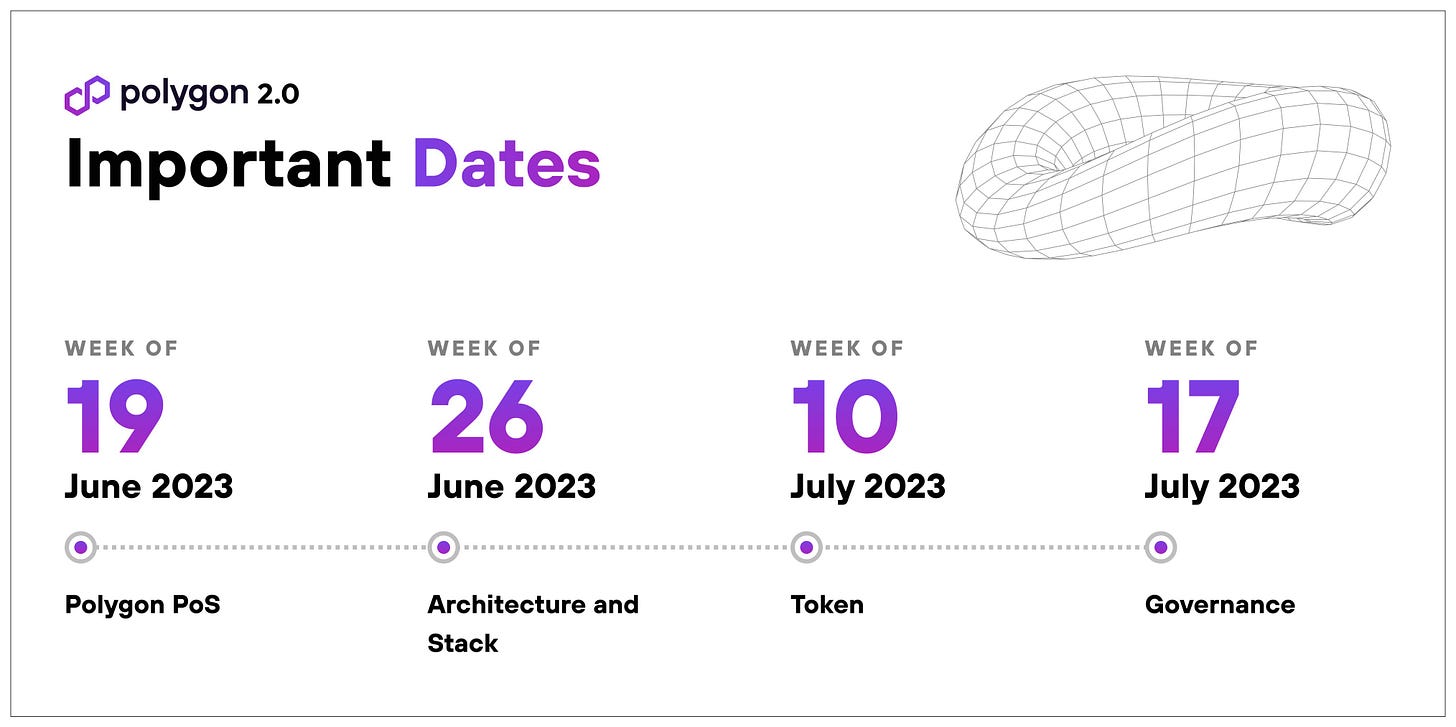

Polygon 2.0: Value Layer of the Internet

Polygon announces upcoming changes to protocol architecture, tokenomics, governance and more.

The announcement teases that Polygon will become the “Value Layer”, through enhanced scalability and liquidity using zero-knowledge tech.

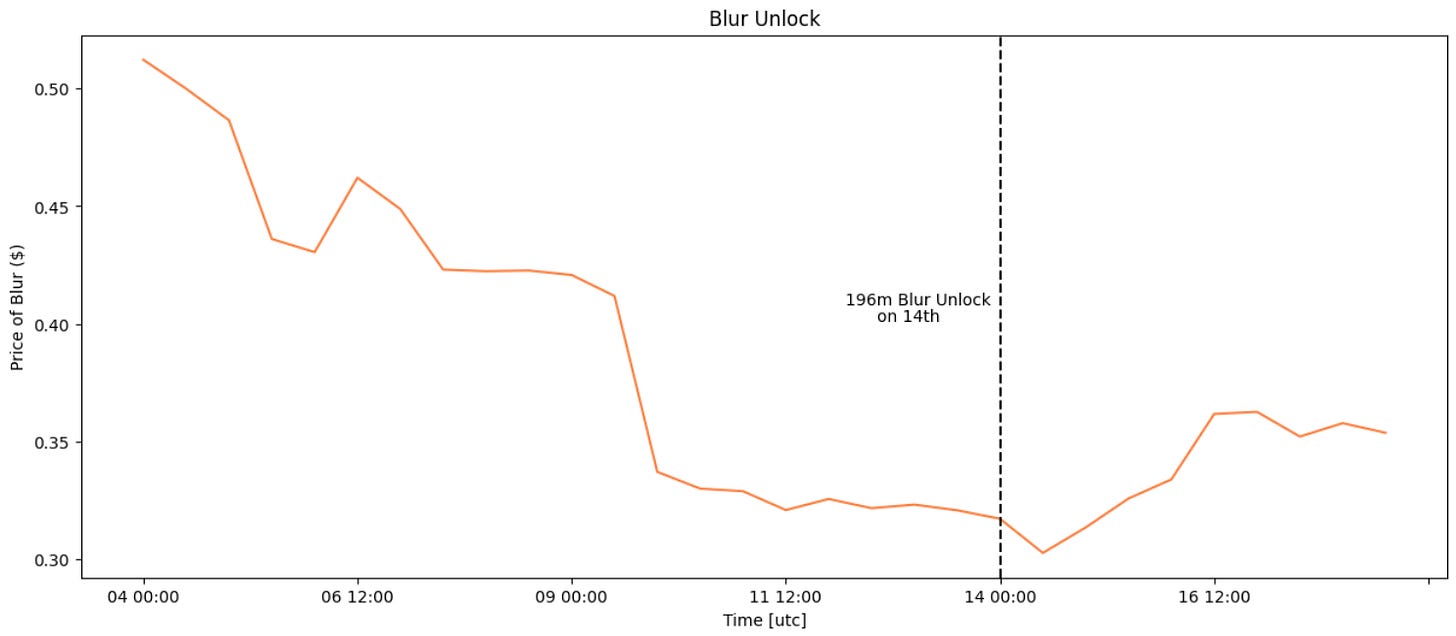

Blur unlocked

Blur unlocked 196 million Blur tokens (6.53% of total supply) on the 14th of June at 19:00 UTC.

The total circulating supply for Blur increased 40.66% from 508.7 million Blur to 715.6 million Blur.

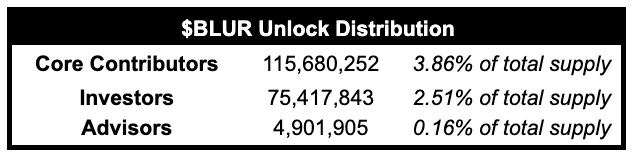

With this unlock, it is the first time contributors, investors and advisors are liquid. The breakdown of this unlock is as follows:

Regulation

Binance removed and ceased trading of the following spot pairs: BIFI/BUSD, DASH/BNB, FIO/BUSD, GAL/BNB, ILV/BNB, KLAY/BNB, LIT/ETH, MC/BNB, MINA/BNB, MLN/BUSD, ONE/ETH, OXT/BUSD, PEOPLE/BNB, PEOPLE/ETH, QNT/BNB, WAXP/BNB, XTZ/ETH, ZEC/BNB, ZRX/ETH

Binance and its CEO, Changpeng Zhao (CZ), have recently bolstered their legal team by bringing on board a highly experienced criminal defense lawyer, George Canellos. Background as the former Chief of the Major Crimes Unit in the U.S. Attorney's Office for the Southern District of New York, as well as holding prestigious roles such as the former head of the SEC's New York Office and former Co-Director of the SEC Enforcement Division. Market participants are speculating Binance have hired this lawyer to lead the rumoured DOJ criminal case against them.

Binance have closed up operations in the Netherlands after being unable to secure a virtual asset service provider (VASP) license from the Dutch regulator. Further, Binance's French division is currently being investigated by local authorities for allegedly engaging in the "unlawful" offering of digital asset services and committing "acts of aggravated money laundering".

On Tuesday, the Hinman documents from the SEC’s case against Ripple were made public. These documents have been in possession of Ripple’s attorney since last year but they will now be released to the public and admissible in court for a Judge and Jury to decide. See our summary here.

A16Z announced today they would be setting up an office in London, England because the regulatory environment in the U.K is much better for supporting innovation in the crypto space. U.K’s prime minister, Rishi Sunak, went to social media to congratulate and support this move.

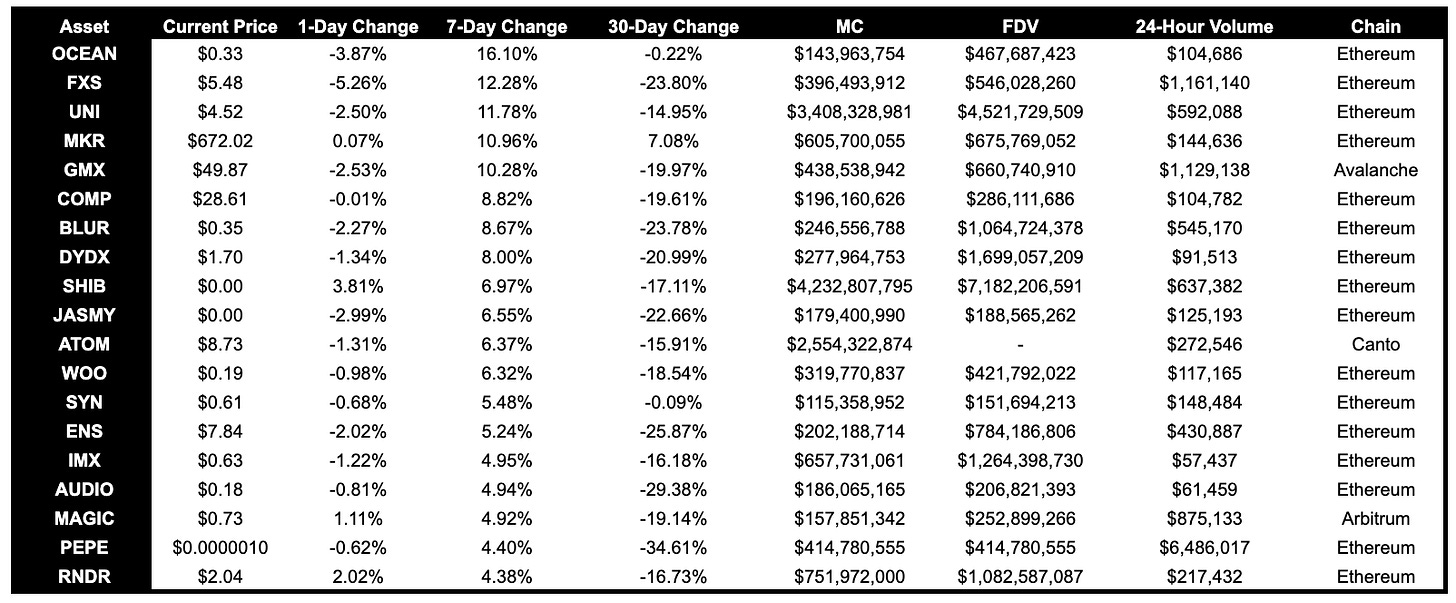

Trending Assets

Above $100M MC by performance

UNI and FXS have performed very strongly over the last week, possibly due to the Uniswap v4 and Fraxchain announcements.

Additionally, OCEAN, MKR, GMX and BLUR are strong performers.

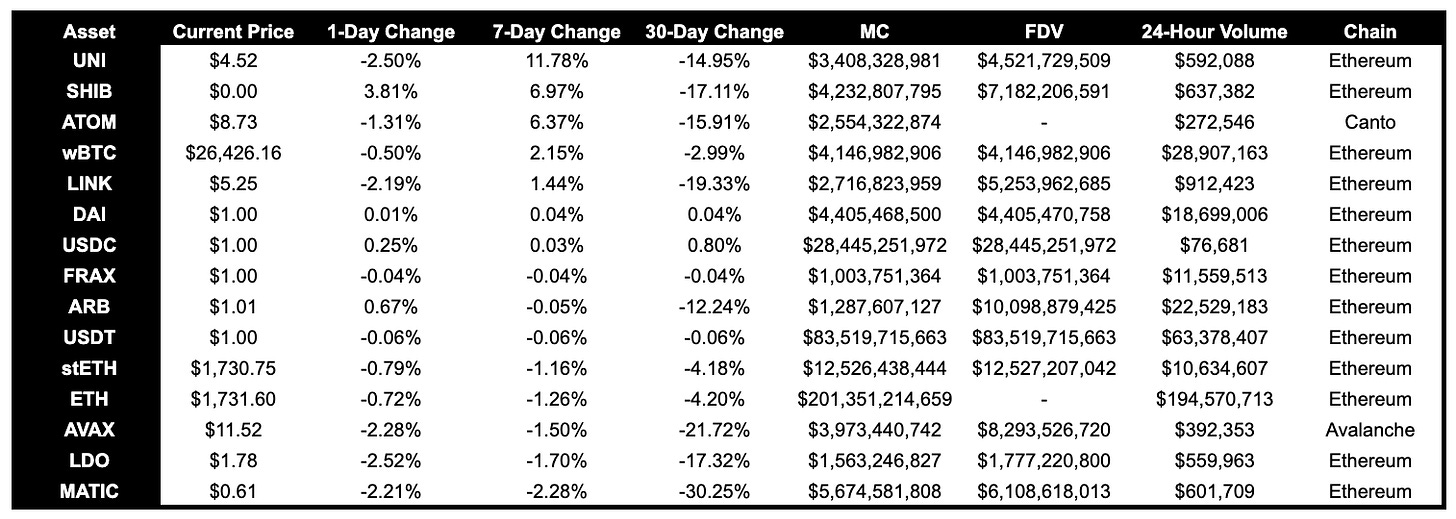

Above $1B MC by performance

At above $1B by performance, ATOM, SHIB, LINK and BTC have performed well.

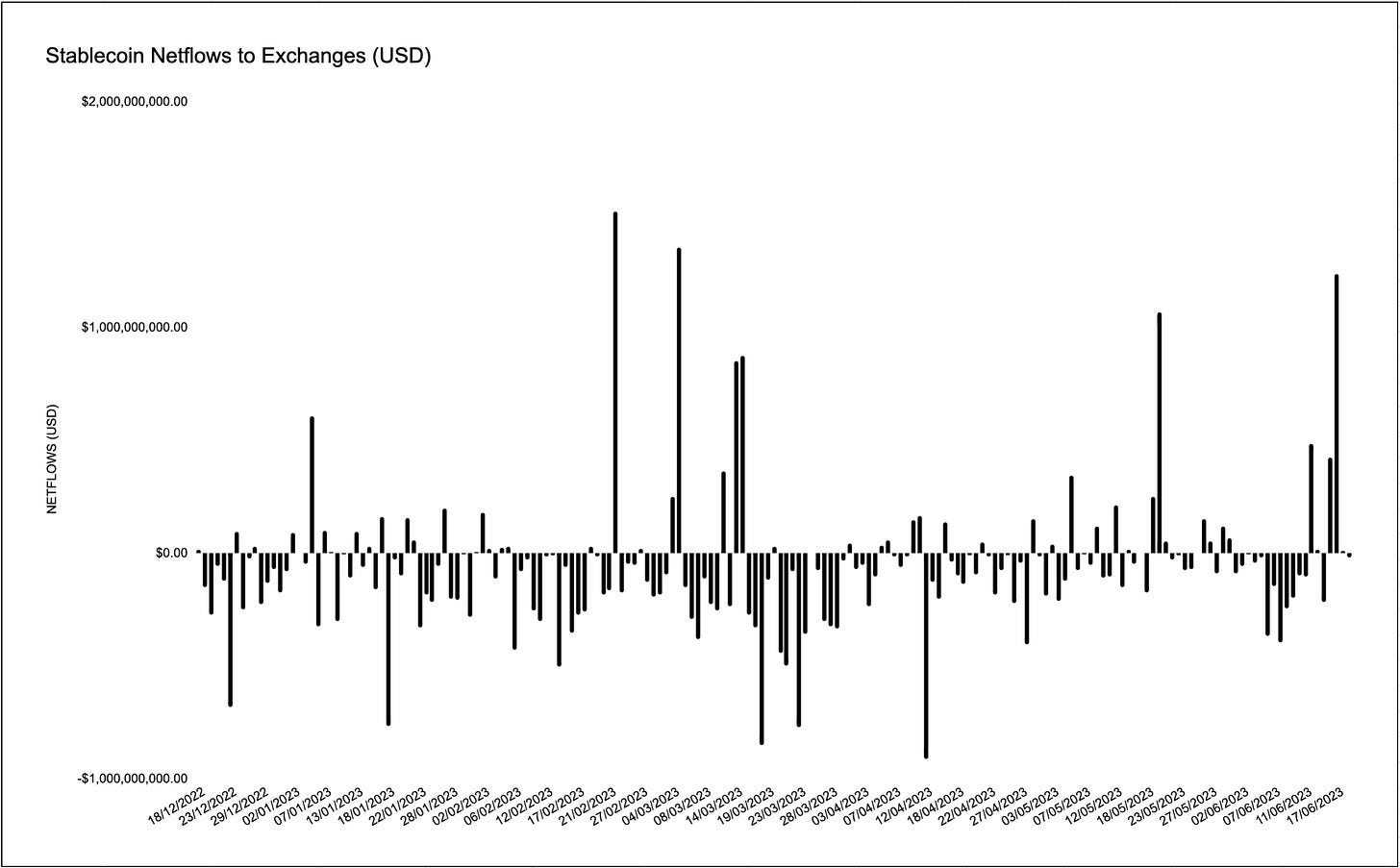

Stablecoin Netflows to Exchanges

Over the past 7-days, there have been $1.45B of net stablecoin inflows to exchanges, which is the third highest net inflow over the past 8 months.

Governance Proposals

unshETH: [RFC] Adjusting swETH Target and Maximum Weight in unshETH

swETH deposits in unshETH are above 1000 ETH and swETH is already above it’s target weight of 5%.

This proposal is to increase swETH target weight to 10% (and correspondingly, to 14% maximum weight).

Aura Finance: [AIP-31] Arbitrum Deployment

Proposal to deploy Aura Finance on Arbitrum.

To bridge AURA and auraBAL tokens across chains, Aura Finance will use Layer Zero.

Aura and auraBAL tokens on L2s and sidechains will be OFTs (Omnichain Fungible Tokens - LayerZero token standard).

Stargate: $ARB Token Allocation

Proposal regarding what to do with the $ARB allocation that was given to Stargate as part of the $ARB TGE.

Proposal offers to:

Allocated 70% for Liquidity Mining (1,171,083 $ARB), to boost liquidity on Arbitrum, which would additionally reduce emissions of STG.

Allocate remaining 30% (502,930 $ARB) for partner integrations and support of ecosystem.

Aave: Temperature Check - Aave v3 MVP deployment on Scroll mainnet

Temperature check for Aave v3 MVP deployment on Scroll mainnet

Proposal details that at deployment, three collaterals (WETH, USDC, wstETH) and one borrowable asset (USDC) will be available.

Scroll also commits 500,000 USD in $AAVE staked to the Aave Safety Module to provide additional security guarantees.

Articles / Threads

Premia Blue: Changes to Liquidity Pools

Premia Blue will be adding concentrated liquidity, range orders, and smart liquidity management (smart range orders automatically place orders around your set range as the price fluctuates within it)

Kwenta has launched stETH perps on their platform.

The $stETH price will be set by push-based Chainlink oracles, as well as pull-based Pyth Oracles.

Maverick Protocol Utility Token: MAV

Maverick Protocol is launch MAV, its native utility token. It is designed primarily to be used for staking, voting, and boosting.

Maverick has launched a ve contract, for vote escrowed MAV.

veMAV balance determines users' voting power.

Tokenomics are not fully released yet.

GMD Launchpad: Enhanced Model, GMD Incubator, & Allocation Marketplace

New adjustments will be made to the GMD launchpad model:

Instead of taking 4% of the total amount raised on the launchpad, GMD will take a reduced fee of 2.5%

Launch of GMD incubator

Introduce a Queue System where: esGMD stakers buy in first, then esGMD and xGND stakers and lastly all GMD stakers.

Allocation marketplace: will allow participants to trade their allocations in new projects before and after they go live

New Protocols

GNL Protocol

Description: Lending Protocol for concentrated liquidity LP positions. Built on top of GND Protocol.

Twitter: https://twitter.com/GNLProtocol

Website: n/a

Ambient Finance

Description: Zero-to-One Decentralized Trading Protocol

Twitter: https://twitter.com/ambient_finance

Website: https://ambient.finance/

Hoyu

Description: Permissionless money markets.

Twitter: https://twitter.com/hoyu_io

Website: https://hoyu.io/

Ekubo Protocol

Description: Next-generation AMM built for Starknet, coming soon!

Twitter: https://twitter.com/EkuboProtocol

Website: https://github.com/EkuboProtocol

Opsin Finance

Description: The omnichain modular DeFi trading terminal.

Twitter: https://twitter.com/opsinfinance

Website: https://opsin.finance/