Weekly Summary 1

05-06-2023 to 11-06-2023

Developments

Regulation

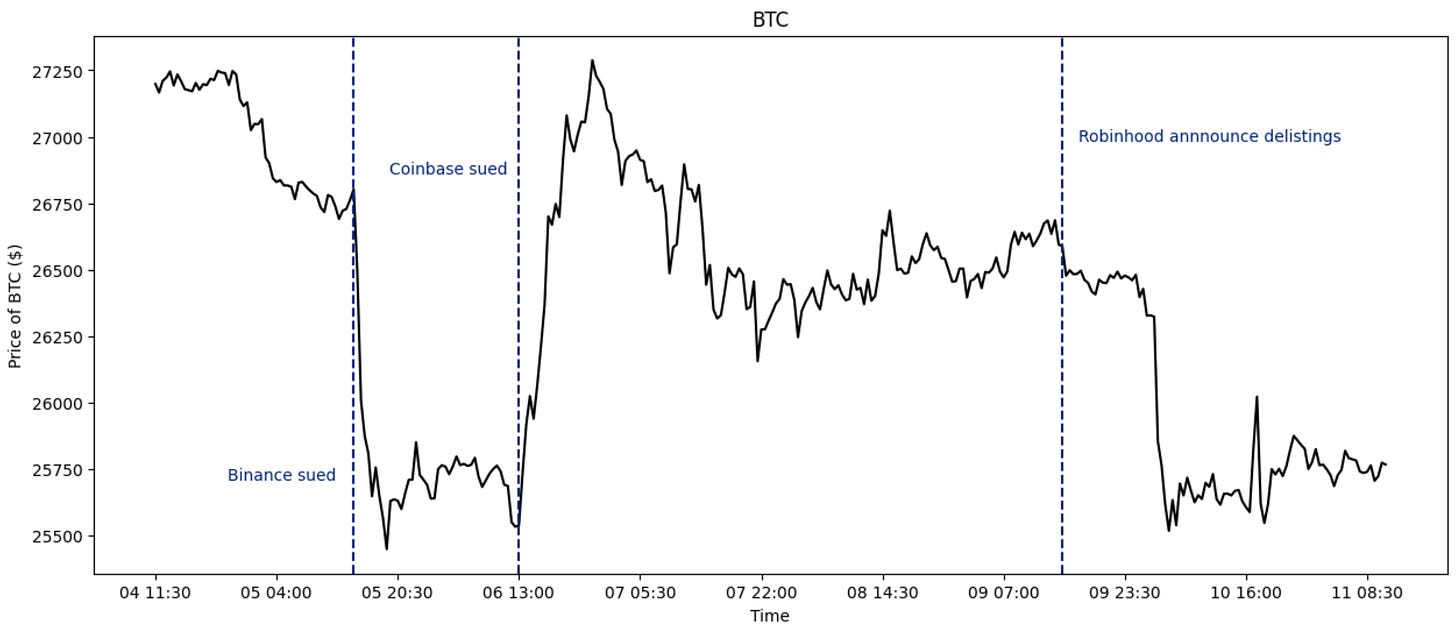

S.E.C. sues Binance for Mishandling Funds and Lying to Regulators. Binance US fiat rails are being shutdown. BTC & ETH traded as much as 7% premium and users fled the US exchange.

S.E.C. sues Coinbase for not registering with the Commission as a national securities exchange, a broker-dealer, or a clearing agency. Coinbase say they will not be delisting assets or removing their staking program.

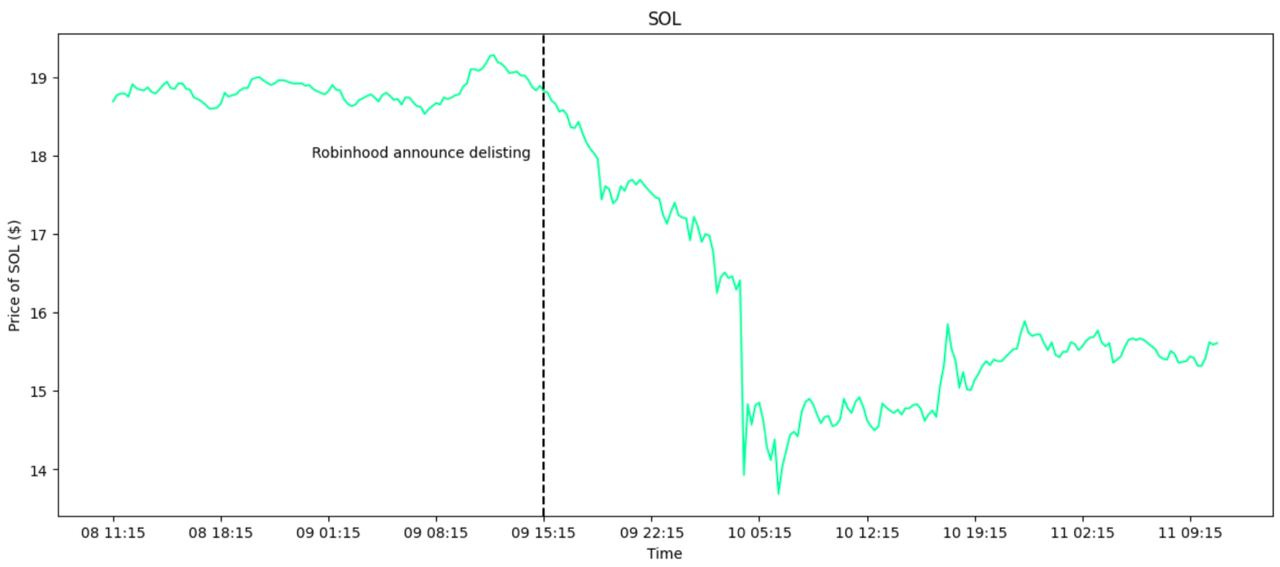

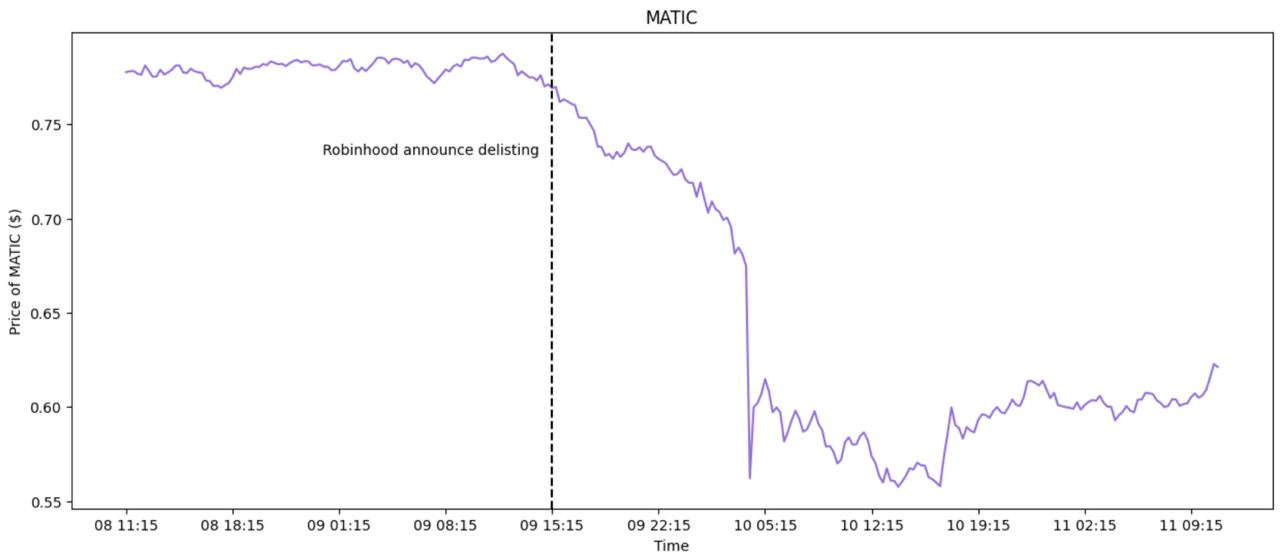

Robinhood is delisting ADA, MATIC and SOL. Users will be able to transfer ADA, MATIC and SOL until the 27th of June, 2023. After the deadlines, untransferred coins will be sold for market value and credited to users.

CFTC wins Ooki DAO case, setting precedent that DAOs can be held liable.

Binance US is suspending USD deposits.

Optimism Successfully Completes Bedrock Upgrade

Reduced L1 to L2 deposit times by over 4x

Slashes the cost of data submission to L1 by ~20%

Cuts difference with Geth down to a slim ~500 lines of code

Supports any number of alternative proof systems (including ZK)

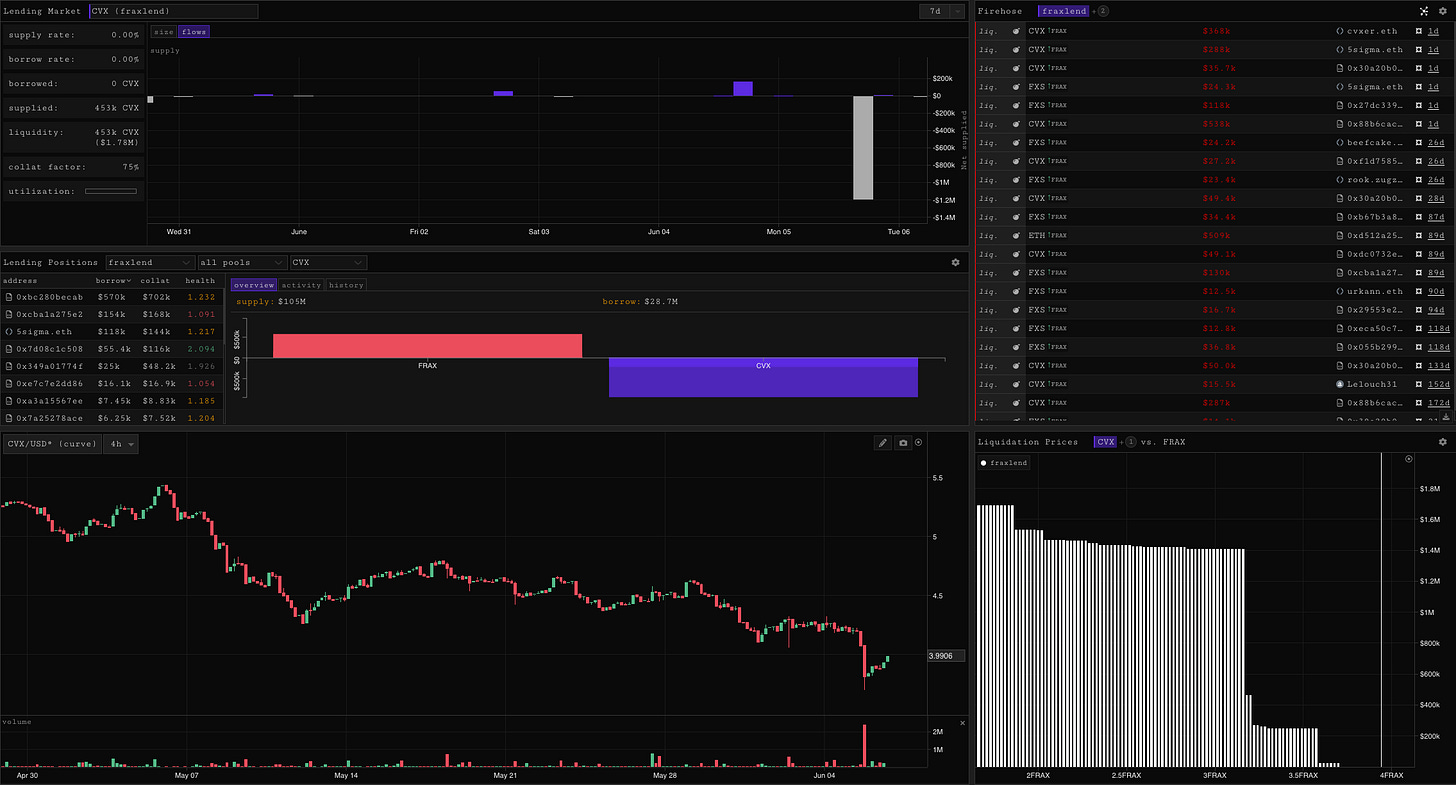

CVX liquidations

There were 4 large-ish CVX liquidations on Fraxlend on the 6th of June. cvxer.eth, 5sigma.eth and 0x88 got hit for a total liquidation of $1mil, leading to CVX in the pool dropping by 30%.

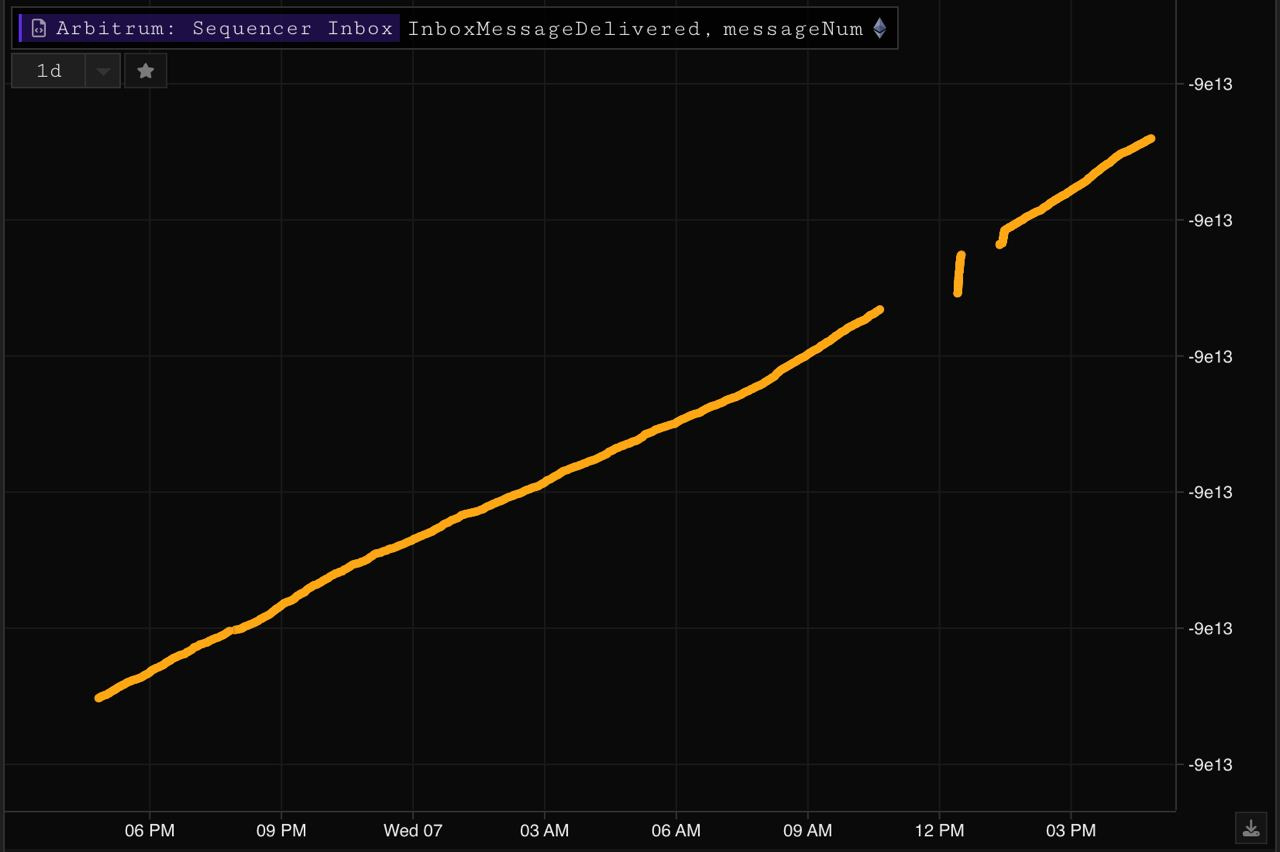

Arbitrum sequencer outage

On the 7th of June, the Arbitrum stopped processing transactions for an hour today after it’s sequencer ran out of gas to submit messages. The outage reminded us of the risks of centralised sequencers.

Ethereum co-founder sells ETH

Jeffrey, one of seven of the Ethereum cofounders moved a large number of ETH (22,000 ETH) to his Kraken account today (5th June), likely to sell. He still holds over 150,000.

BNB close to liquidations

Venus protocol has a $236 million BNB liquidation at at price of $218, from the BNB bridge hacker who deposited stolen BNB for stables before bridging off-chain. This has come to light again as the BNB token has fallen with the recent market downturn and the idiosyncratic Binance FUD, putting this liquidation only 15% away.

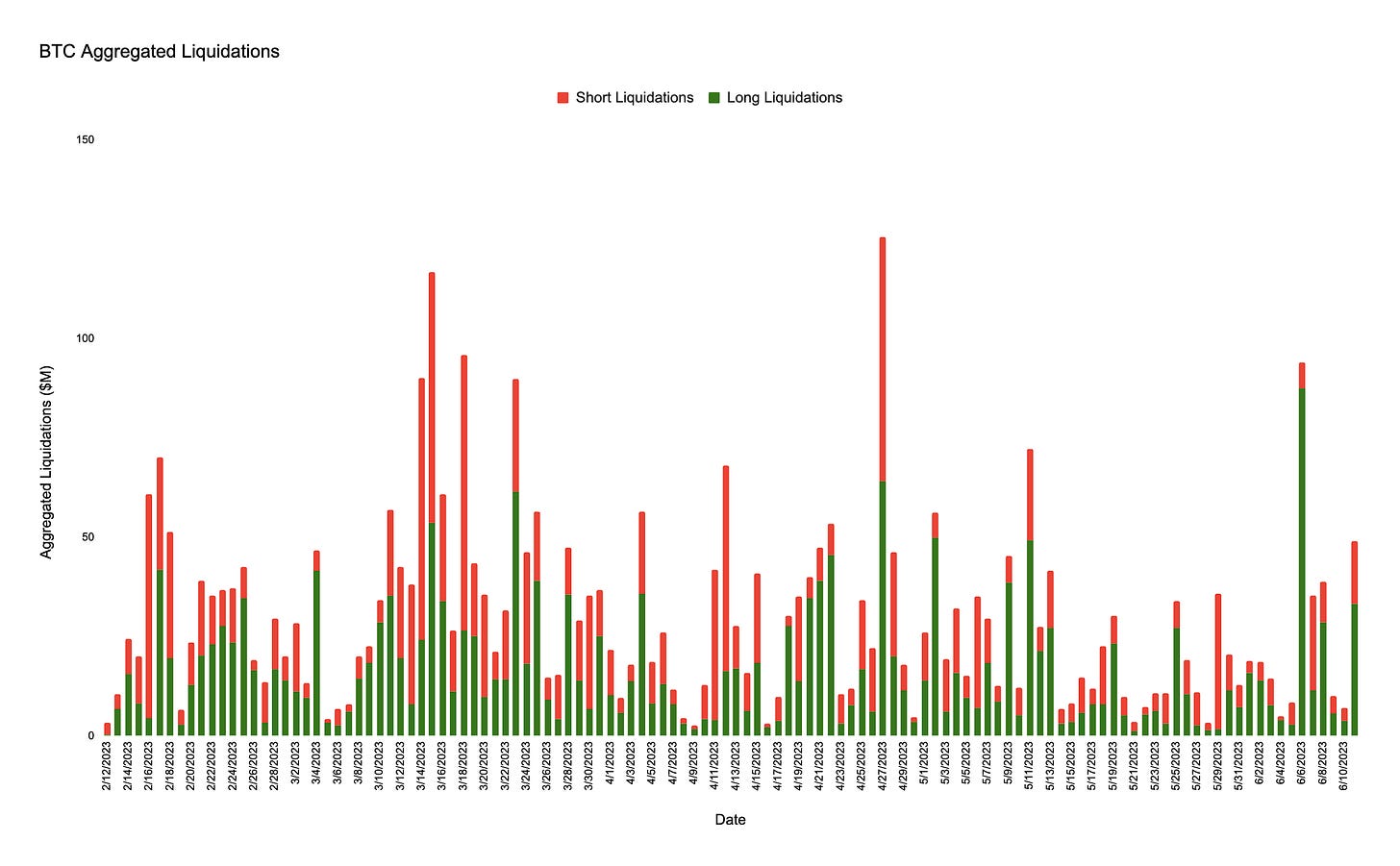

Long liquidations

Due to the negative news flow this week around regulation, we saw several large long liquidation candles, the most prominent one being on the 6th of June.

Aggregated BTC long liquidations on the 6th of June were $87.47M, the largest since the collapse of FTX.

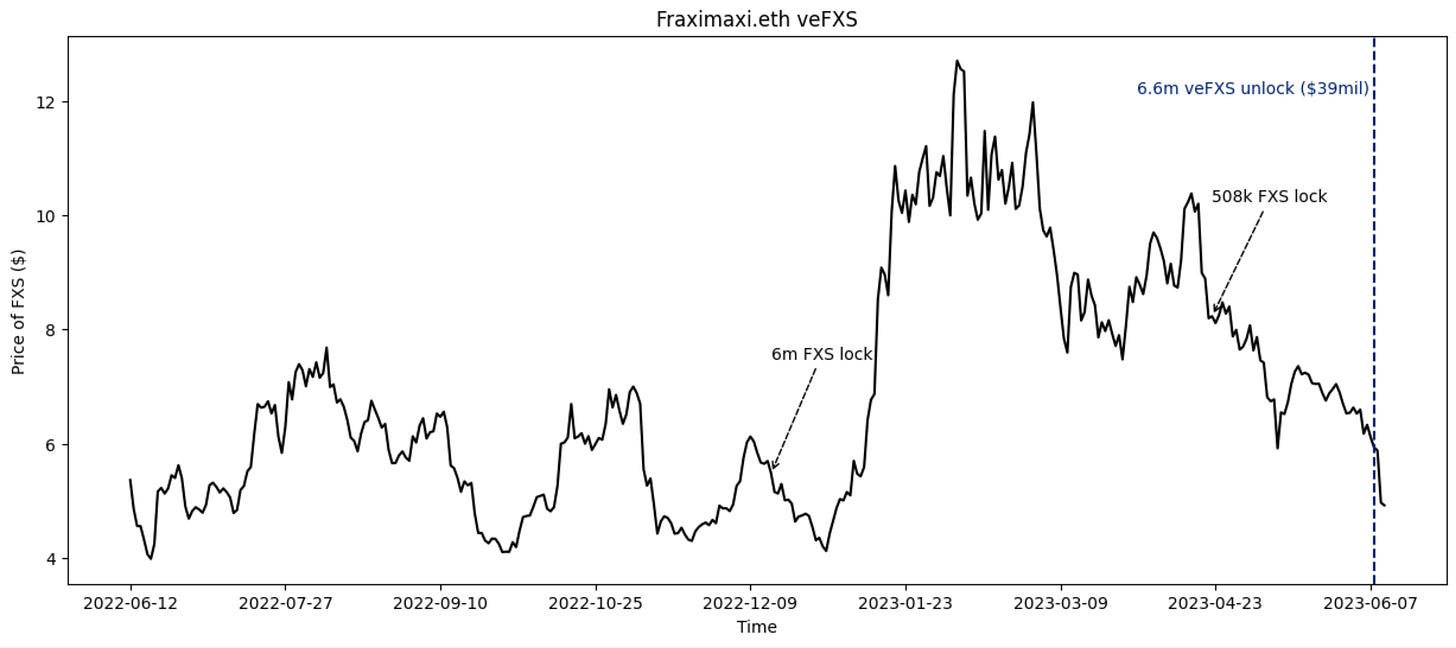

veFXS Unlock

As we reported in our daily notes on the 5th of June, Fraximaxi has now unlocked his large veFXS stake worth around $39 million at current FXS prices. We are Monitoring fraximaxi.eth address for movements.

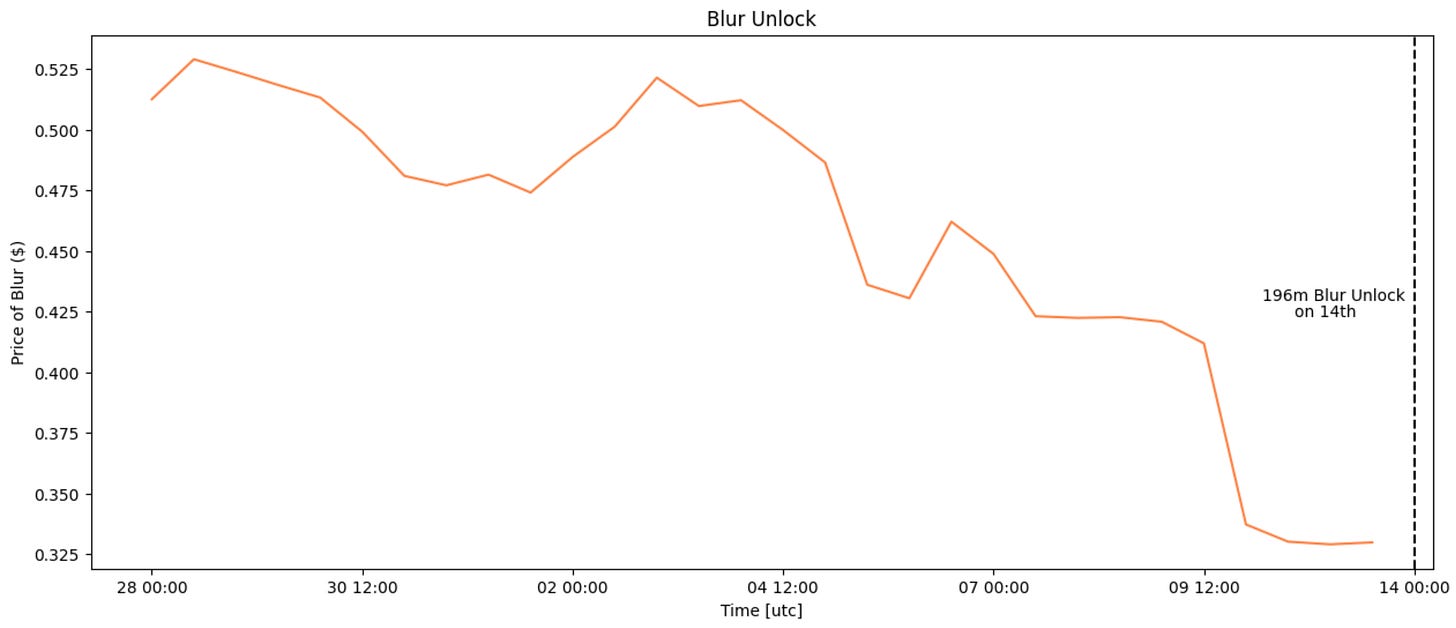

Blur unlock next week

Next week blur is set to unlock 196 million Blur tokens (6.53% of total supply) on the 14th of June at 19:00 UTC.

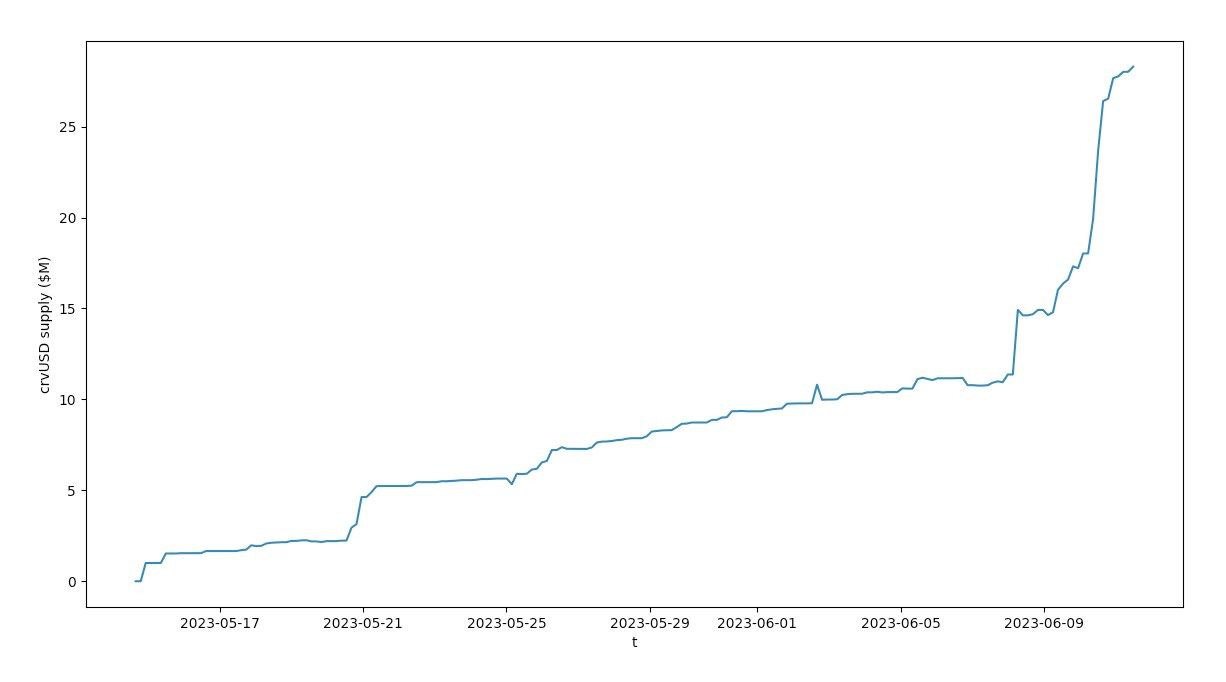

crvUSD

crvUSD supply has increased dramatically to over $25 mil.

Curve Finance recently passed a proposal to allow for crvUSD to be minted via wstETH, with a debt ceiling of $150M crvUSD and a borrowing rate of 6% APR.

crvUSD also had its first hard liquidation, where the users position is erased, yesterday, on June 10th.

Native USDC on Arbitrum

USDC is now natively available on Arbitrum One as USDC, (as opposed to bridged USDC.e), limiting the risks users face from bridge exploits.

Synthetix Spot Market V3 Alpha Release

Per proposals SIP-317 and SCCP-304, a synthetic ETH spot market and the snxETH token have been deployed to Optimism. The V3 spot markets allow users to exchange the V3 protocol’s stablecoin with a synthetic asset.

Russian nationals charged in Mt.Gox hack

The DOJ have unsealed charges for two men , Alexey Bilyuchenko and Aleksandr Verner for their involvement in the 2011 hack of Mt. Gox. They are charged with conspiracy to launder approximately 647,000 BTC from their hack of the now defunct exchange. Bilyuchenko has also been charged with operating BTC-e from 2011 to 2017. See the DOJ report here.

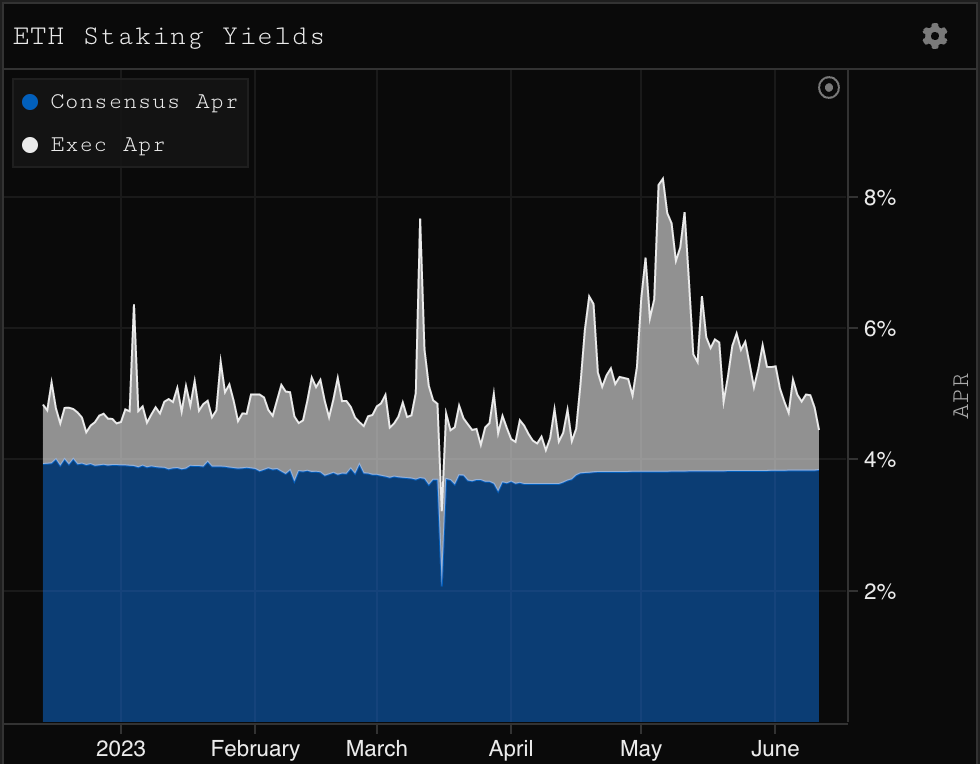

ETH Staking

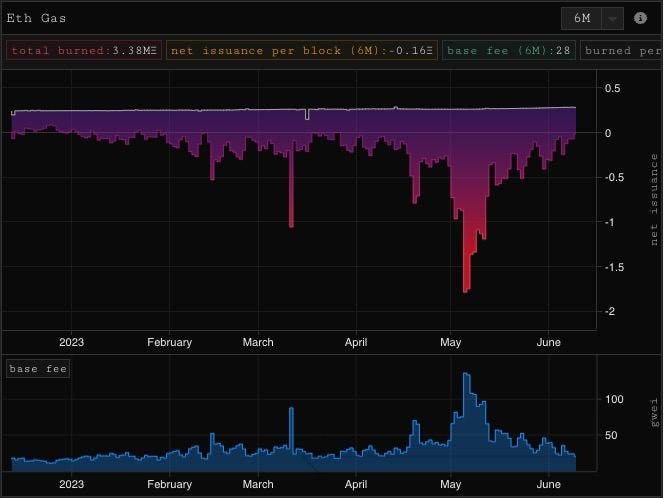

on-chain activity muted has reached its lowest level since pre-April with on-chain volumes and gas prices dropping.

Consequently, execution level APR (MEV related) and ETH burn have dropped significantly since their meme-coin induced highs in May.

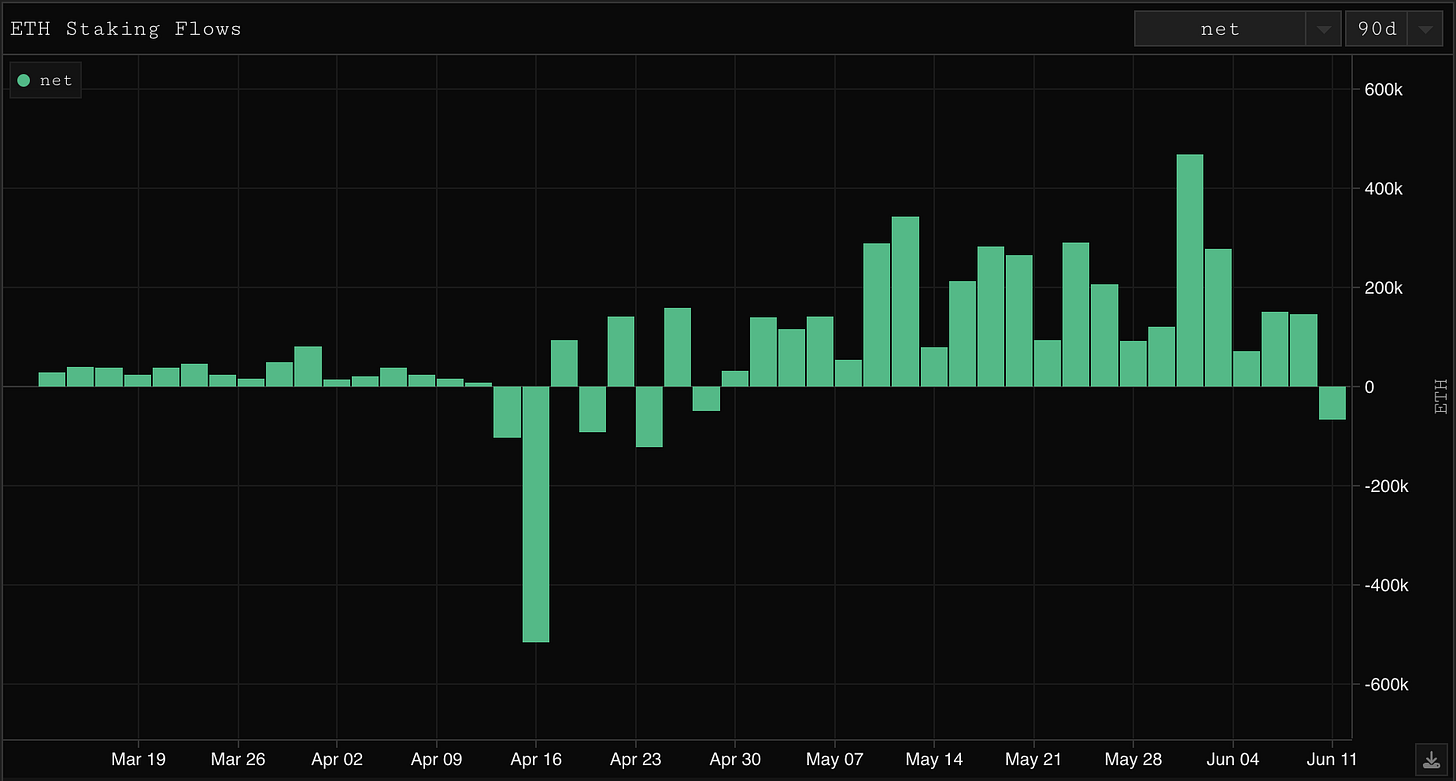

ETH staking Flows

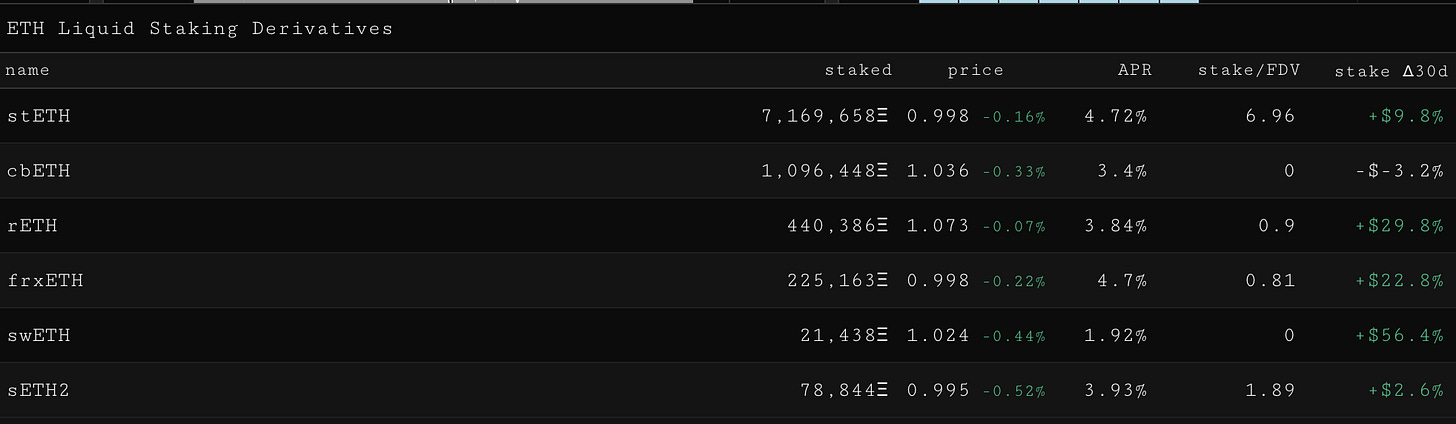

We saw another week of positive ETH staking inflows with a netflow of around 270,000 ETH being staked. Towards the end of the week (with regulatory headwinds for staking as laid out in Coinbase’s SEC case), we have started to see outflows. As you can see below cbETH is the only LSD that has lost stake in the past 30 days, losing 3.2% of it’s stake to more decentralised LSDs.

Liquid Staking Derivatives

APR’s from LSDs are down due to muted on-chain activity.

Swell’s swETH has grown the most in the past 30 days, adding 56.4% to it’s ETH staked. The total ETH staked with Swell is now 21,462 ETH.

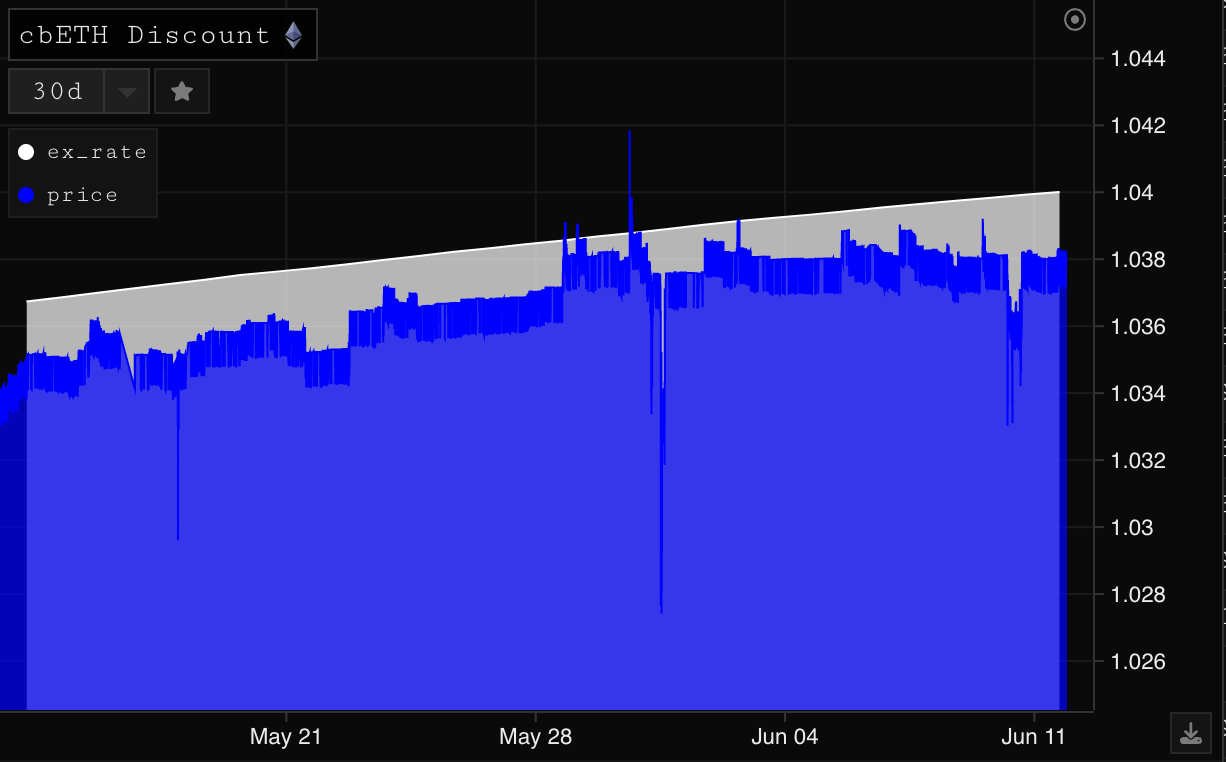

cbETH, despite the negative SEC news has maintained close to its underlying ETH claim, trading at a discount of 0.33%.

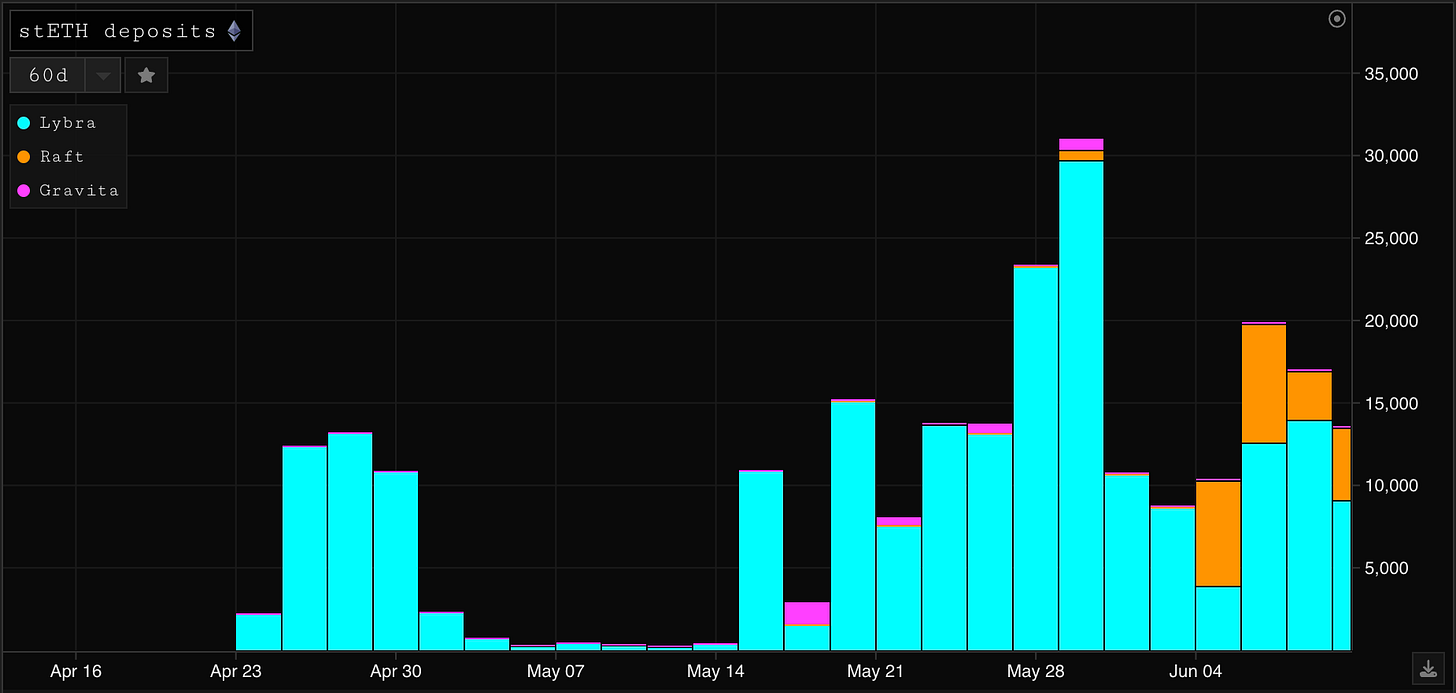

stETH gaining adoption through LSD-Fi protocols such as Lybra, Raft & Gravita

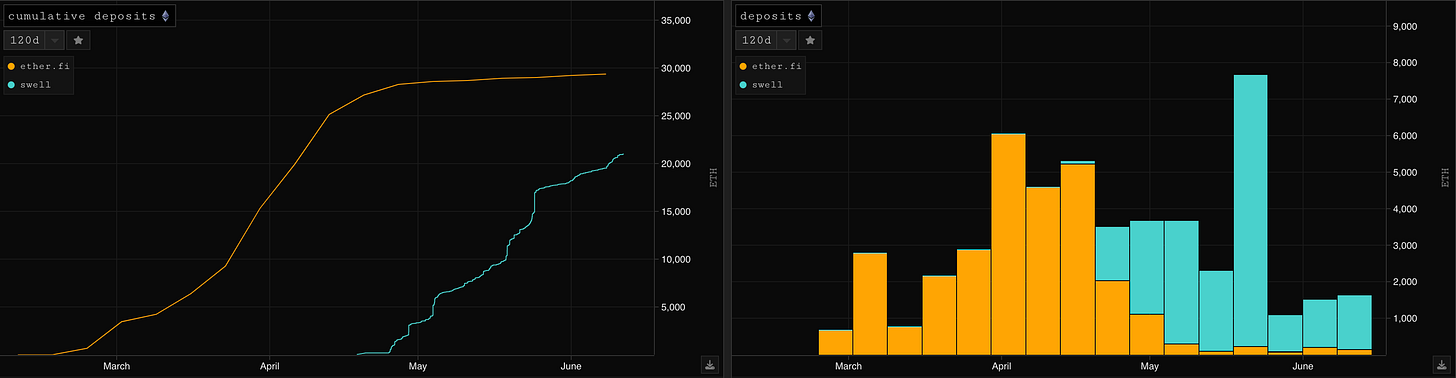

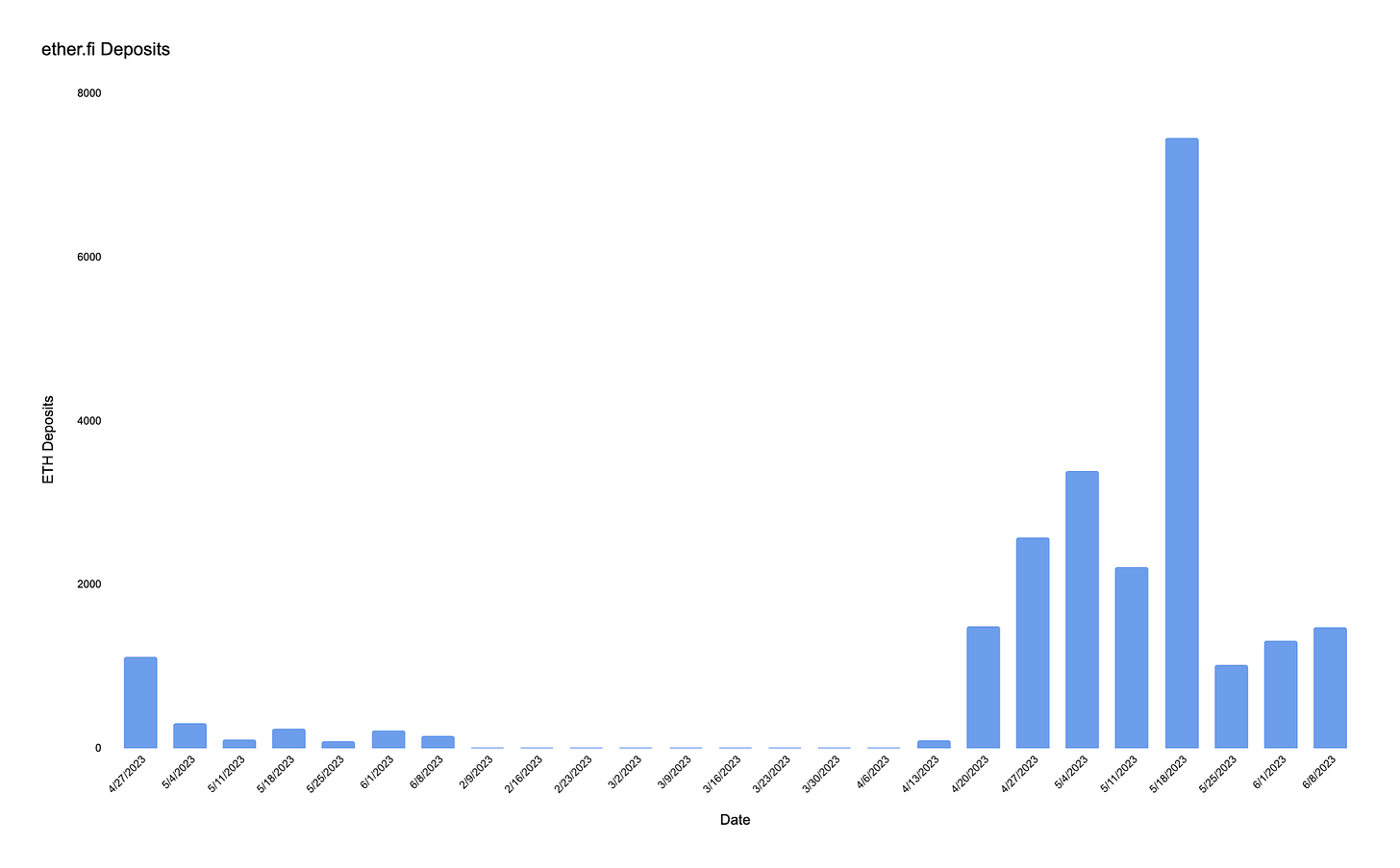

Another interesting development is the mass migration from Ether.Fi’s protocol to swETH, likely due to Ether.Fi’s announcement that they will not be issuing a token and will be implementing a loyalty based rewards system.

The clear drop in ether.fi deposits since they reiterated that they had no plans to launch a token can be seen clearly in the chart of the timeline of deposits below.

Prisma

Prisma offers an LST-backed stablecoin (similar to Raft and Lybra), and is backed by DeFi powerhouses, such as Curve, Convex and Frax.

Prisma recently released an article on what will set them apart from their competition:

Prisma will onboard five different LSDs from Rocket Pool, Coinbase, Binance and FRAX, and not just Lido.

Prisma will implement veTokenomics for governance. Governance will decide on protocol fees. vePRISMA holders will also be granted boosts.

Prisma will implement gauge systems similar to Curve to incentivize liquidity.

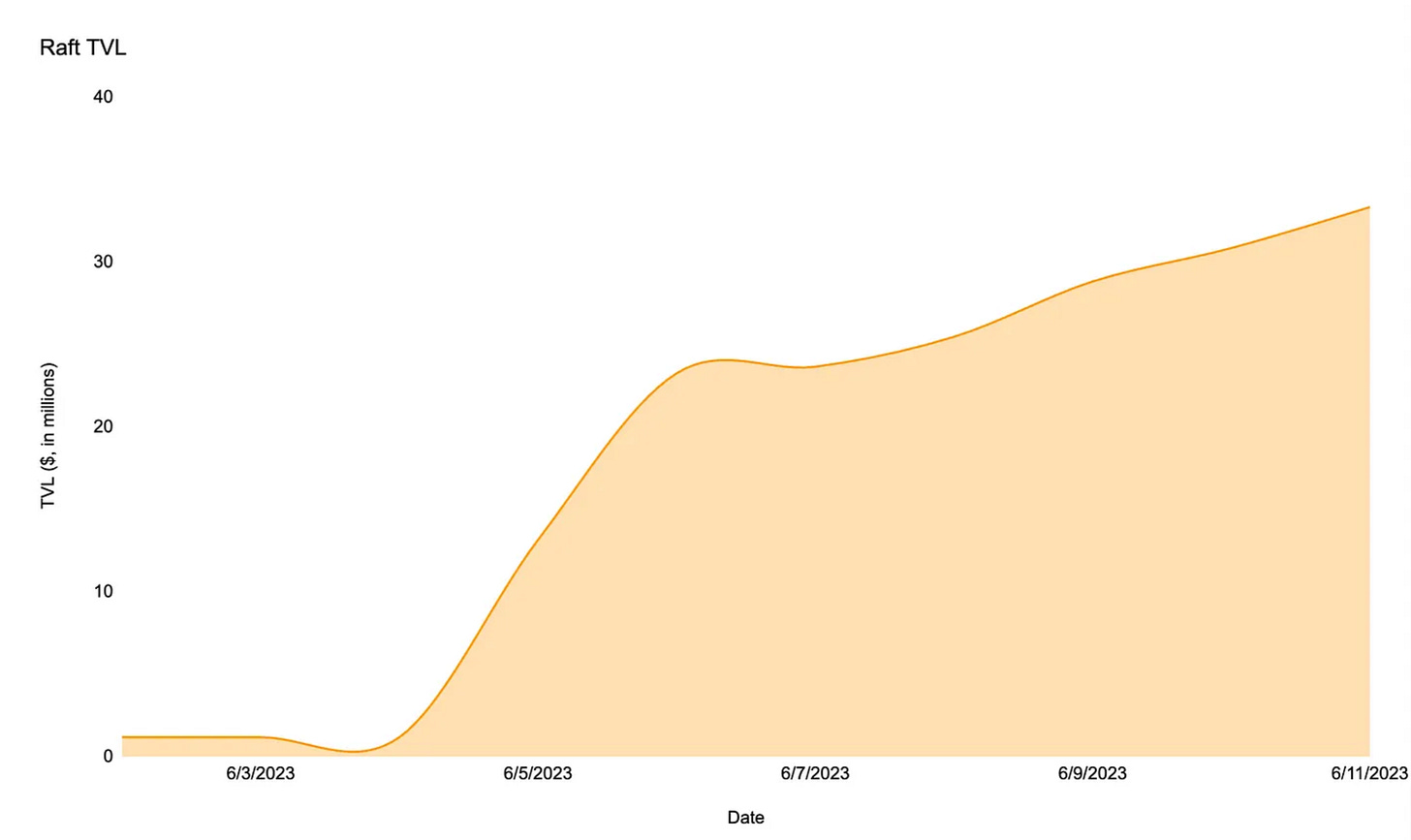

Raft

Raft offers decentralized borrowing and a stETH-backed stablecoin called R. Raft’s TVL continues to rise and is currently sitting at $33.36m.

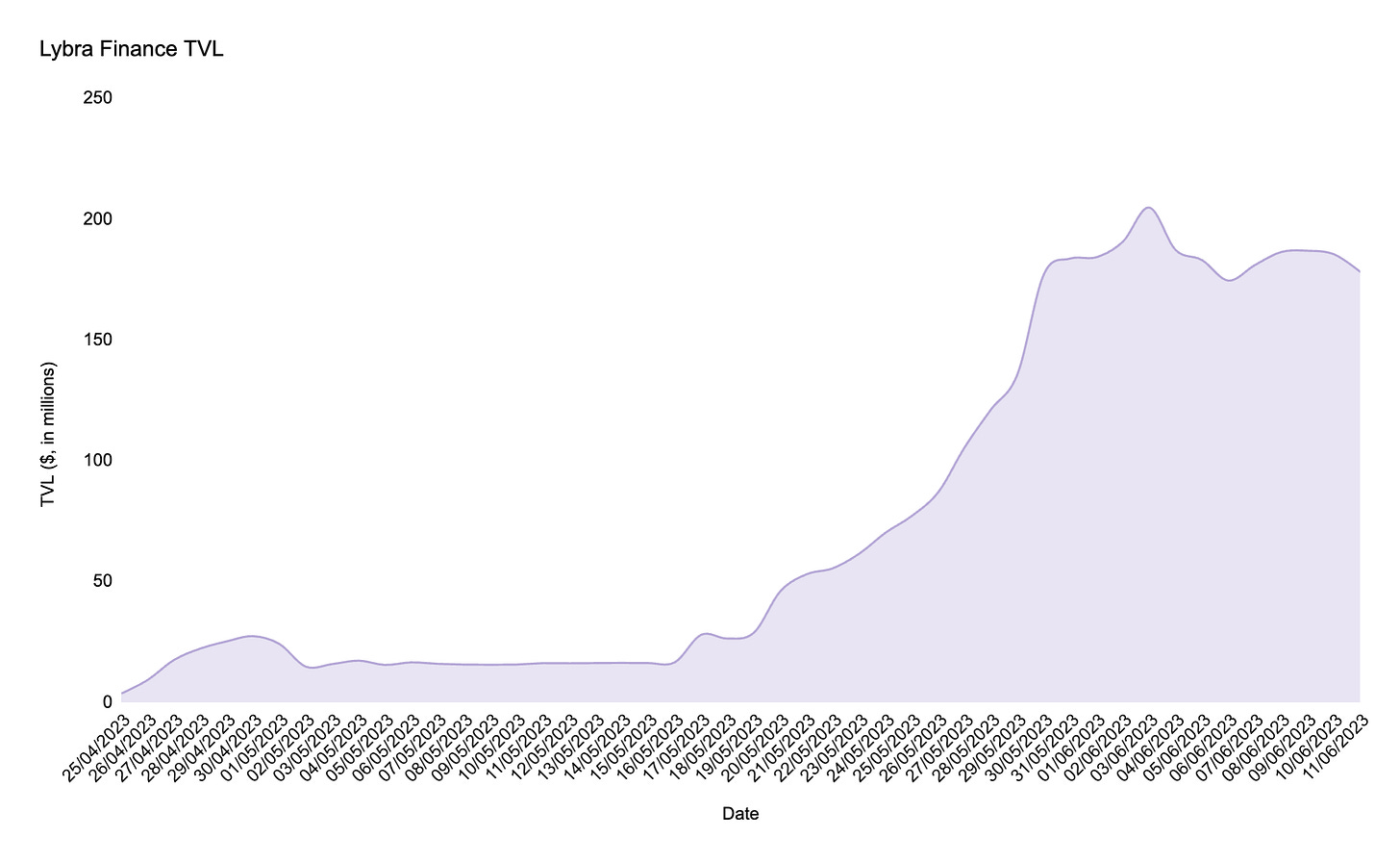

Lybra Finance

Lybra Finance has $178.44M TVL currently, which places it as the fifth highest CDP protocol based on TVL.

Lybra Finance offers the eUSD, an interest-bearing omnichain stablecoin backed by liquid staking derivatives (similar to Raft and Prisma)

Lybra Finance gained a lot of TVL through high emissions and farming incentives.

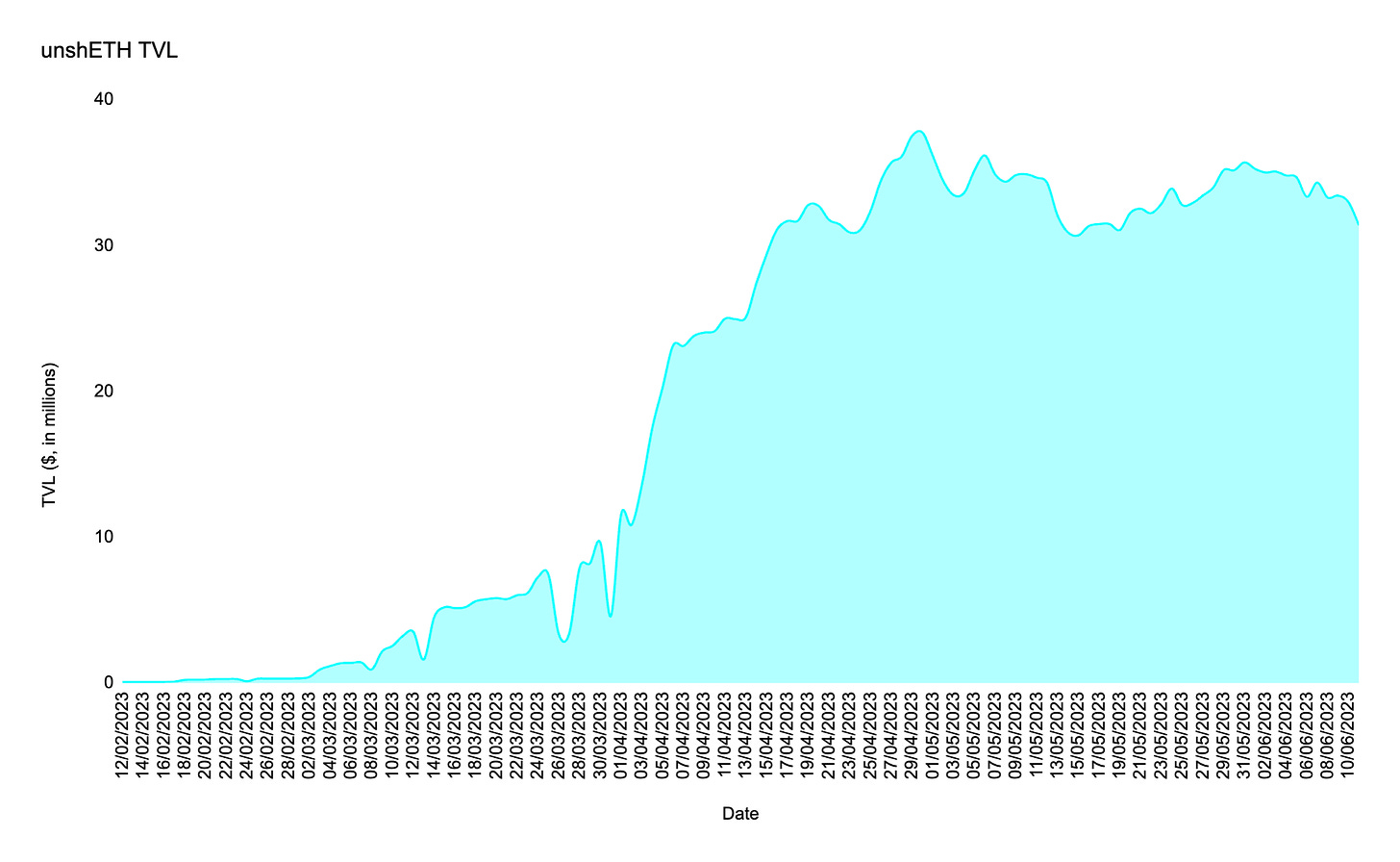

unshETH

unshETH have integrated Swell (swETH) and ankr (ankrETH) to the unshETH index and ecosystem. As a result, unshETH had the highest ever swap volume in the vdAMM, with more than $2M in arbitrage volumes.

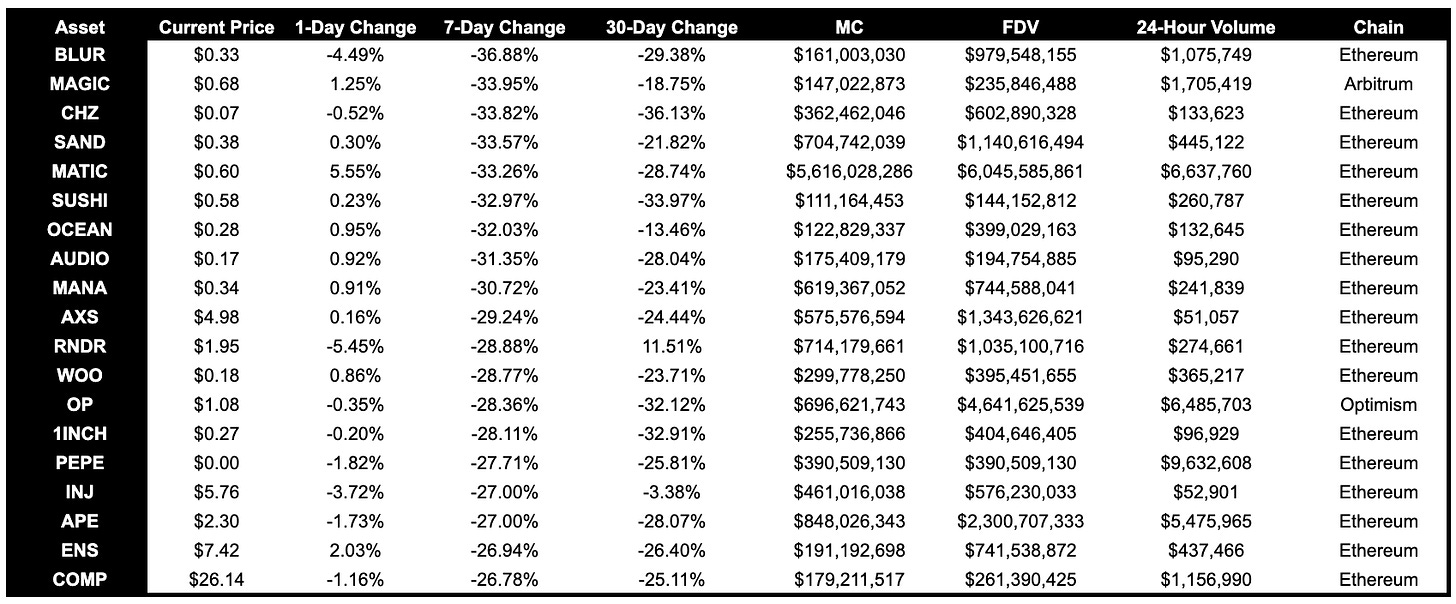

Asset Performance

Above $100M MC by performance

Most alts have decreased pretty significantly over the last few days, and have been in a larger downtrend over the last month. SUSHI, 1INCH and CHZ are the worst performers for the week.

BLUR has underperformed significantly, both over the past 30 days, as well as over the last day. Likely related to upcoming unlocks.

Additionally, Metaverse tokens (MANA and SAND) and GameFi tokens (MAGIC and AXS) have strongly underperformed.

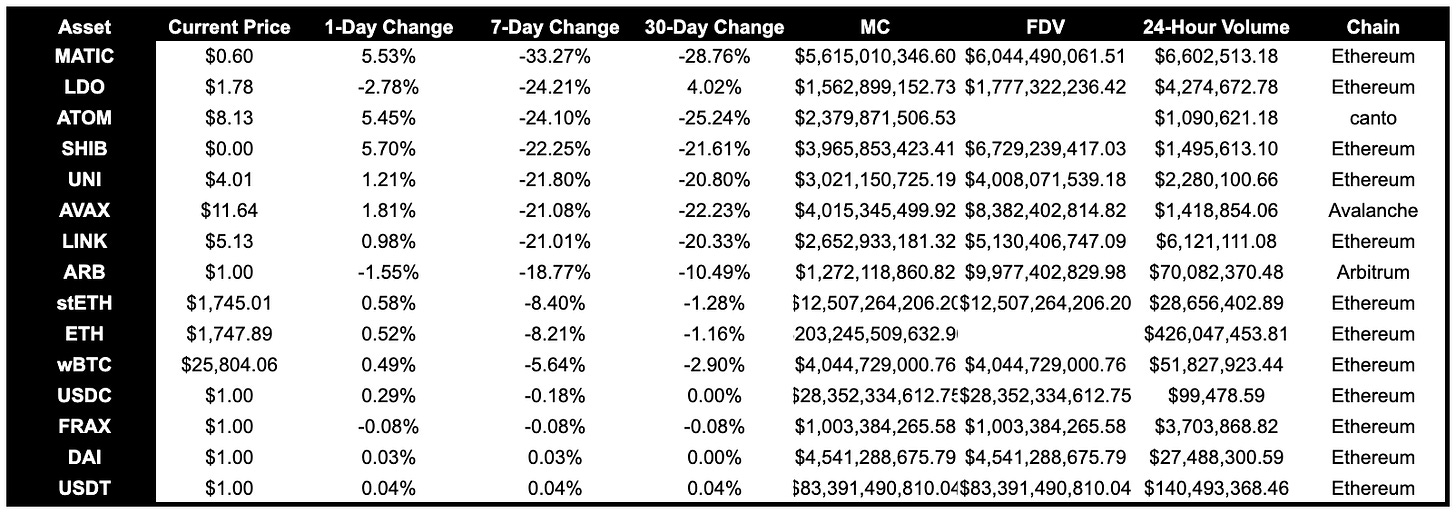

Above $1B MC by performance

In large caps, MATIC has underperformed, likely due to news that Robinhood will be delisting it on the 27th of June.

AVAX, LINK, SHIB and UNI have under performed significantly. Although LINK, AVAX and SHIB have failed to benefit off narratives over the past month, UNI underperforming even though fee switch discussions have been moving forward is surprising.

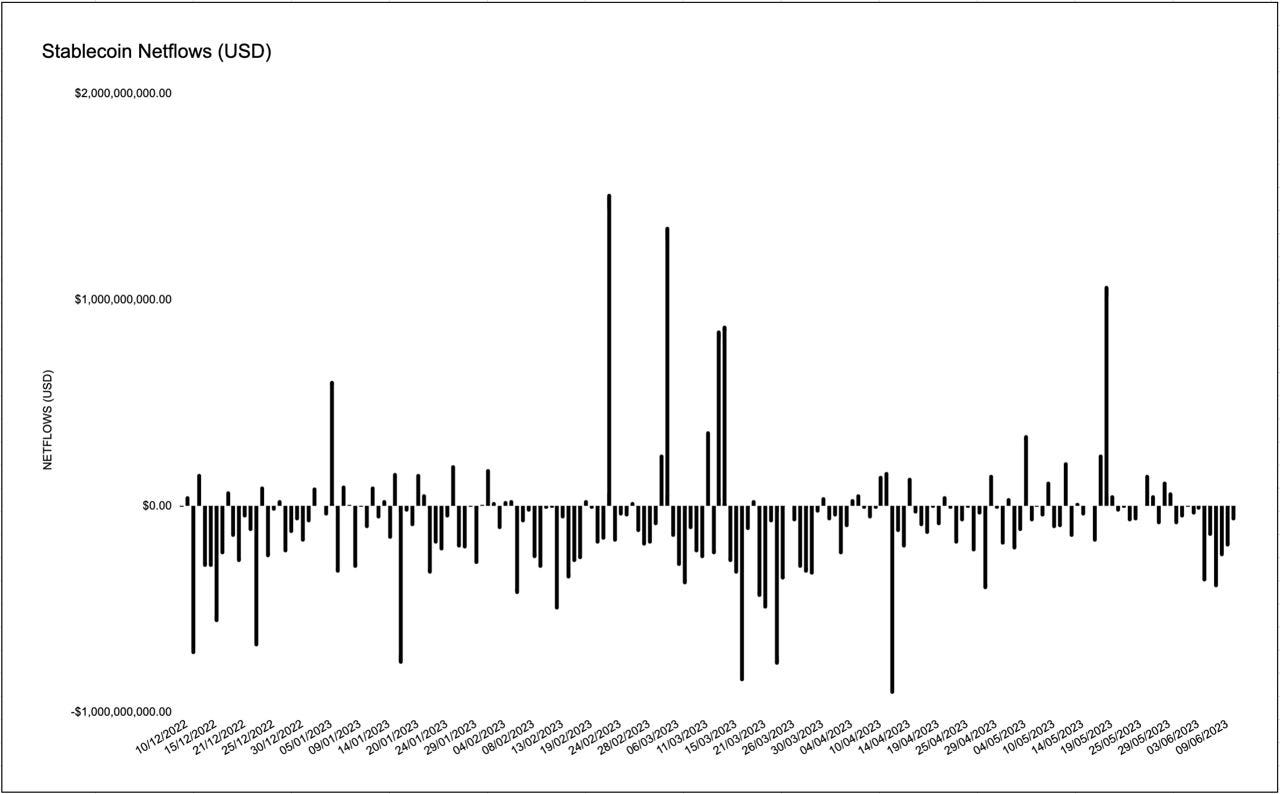

Stablecoin Netflows

This week we saw large stablecoin outflows, totalling a net outflow $1.4 billion.

Governance Proposals

AAVE: ARFC - GHO Mainnet Launch

Proposal to launch GHO, with two initial facilitators: the Aave V3 Ethereum Facilitator and the FlashMinter Facilitator.

A Facilitator can generate or burn GHO tokens.

Aave: TEMP CHECK - Aave V3 Deployment on Base

Temperature Check to see if the community is interested in deploying Aave v3 on Base mainnet.

JPEG’D: PIP-60 Add More CVX To The Treasury

The proposal is to allow the DAO to spend $5m USD of the treasury stablecoins to acquire more CVX.

The CVX will be used to vote on the pools with the synthetic assets of JPEG’d.

Balancer/Aura: BIP-322 - Allocate Balancer’s 3M ARB

Balancer received 3M ARB from the Arbitrum token launch.

Proposal recommends that 1M ARB is allocated towards direct LP incentives, while the remaining 2M is deployed as protocol owned liquidity in combination with Aura by pairing it 33/33/33 with BAL and AURA.

New Protocols

Diffuse Finance

Description: A concentrated liquidity platform built for DeFi-native assets. Make the most of your liquidity with single-token staking, long/short vaults and low slippage.

Twitter: https://twitter.com/diffusefinance

Website: n/a

Fstar Fi

Description: Fstar is a decentralized derivatives trading platform focused on omnichain. Construct on decentralized stable currency Frax Finance and Stargate Finance.

Twitter: https://twitter.com/Fstar_Fi

Website: https://fstar.fi/

Aerodrome Fi

Description: The central trading and liquidity marketplace on Base. Built in partnership with Velodrome.

Twitter: https://twitter.com/aerodromefi

Website: n/a

Prisma Fi

Description: The end game for liquid staking tokens. A non-custodial and decentralized Ethereum LST-backed stablecoin. Coming soon.

Twitter: https://twitter.com/PrismaFi

Website: https://www.prismafinance.com

Ethena Labs

Description: Enabling the Global Internet Bond. ETH staking derivative infrastructure with the initial product being a stablecoin, eUSD that is long stETH, short ETH perps and the stable earns the sum of funding rates + staking yield.

Twitter: https://twitter.com/ethena_labs

Website: https://www.ethena.fi/

Governance Articles

Kwenta releases their roadmap for Q3 and Q4 2023:

Q3 2023: TWAP perps testnet, v2 staking, SDK, referral program and smart margin upgrades

Q4 2023: DAO 2.0, SNX v3 migration and programmable delegated trading

Introducing The Sushi DEX Aggregator

Sushi launches their DEX aggregator

Level & Trader Joe: Teaming Up for Liquidity

Level Finance will use Trader Joe as the LVL Token's main DEX on Arbitrum.

To bootstrap liquidity on Trader Joe, Level has migrated the DAO-owned portion of the LVL/USDT LP from BNB Chain to Arbitrum.