Developments

Tether BTC Accumulation

Tether now ranks as the 11th largest holder of Bitcoin globally, with approximately $1.6 billion worth of the digital asset. In Q1 of this year, the stablecoin issuer disclosed its Bitcoin holdings, announcing plans to invest up to 15% of its profits regularly into Bitcoin. This move is part of its strategy to shift reserves from U.S. government debt to cryptocurrencies.

On-chain analysis shows this wallet matches up with Tether’s quarterly reported BTC holdings:

bc1qjasf9z3h7w3jspkhtgatgpyvvzgpa2wwd2lr0eh5tx44reyn2k7sfc27a4

The stablecoin issuer now holds 55,020 BTC.

$10 Billion Cumulative ETH Burned

Since EIP-1559, a cumulative $10billion in ETH has been burned.

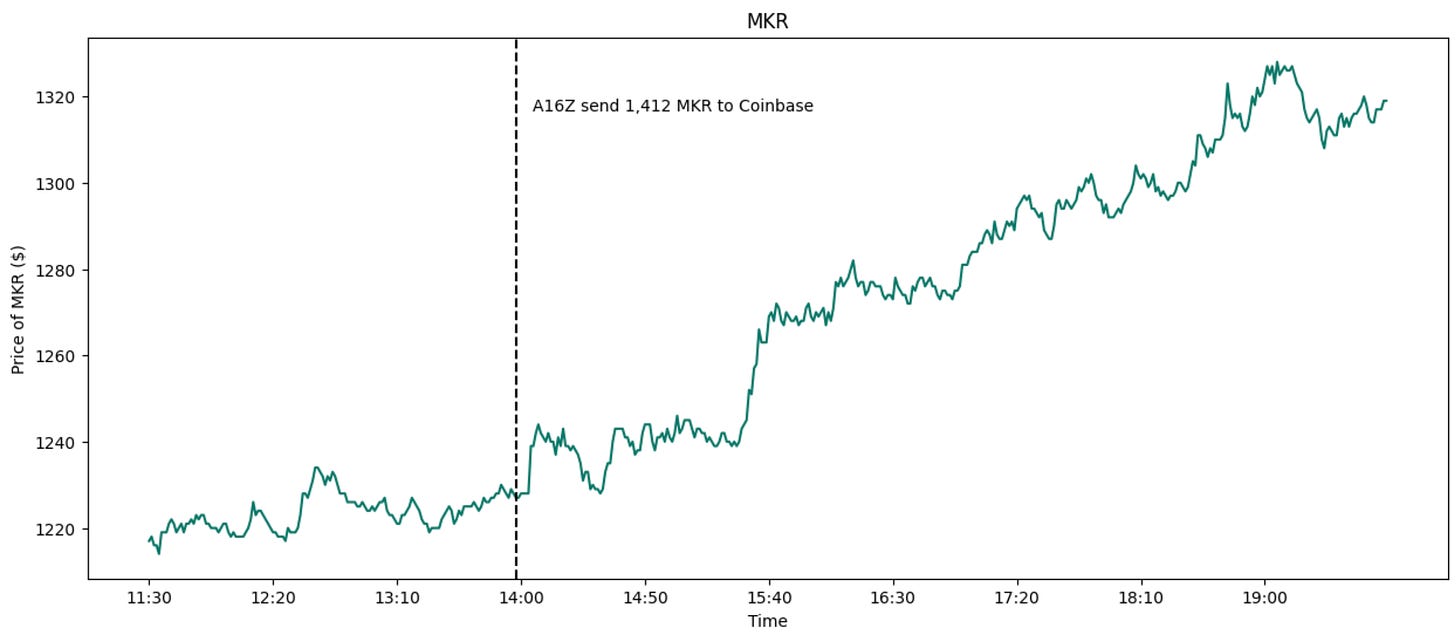

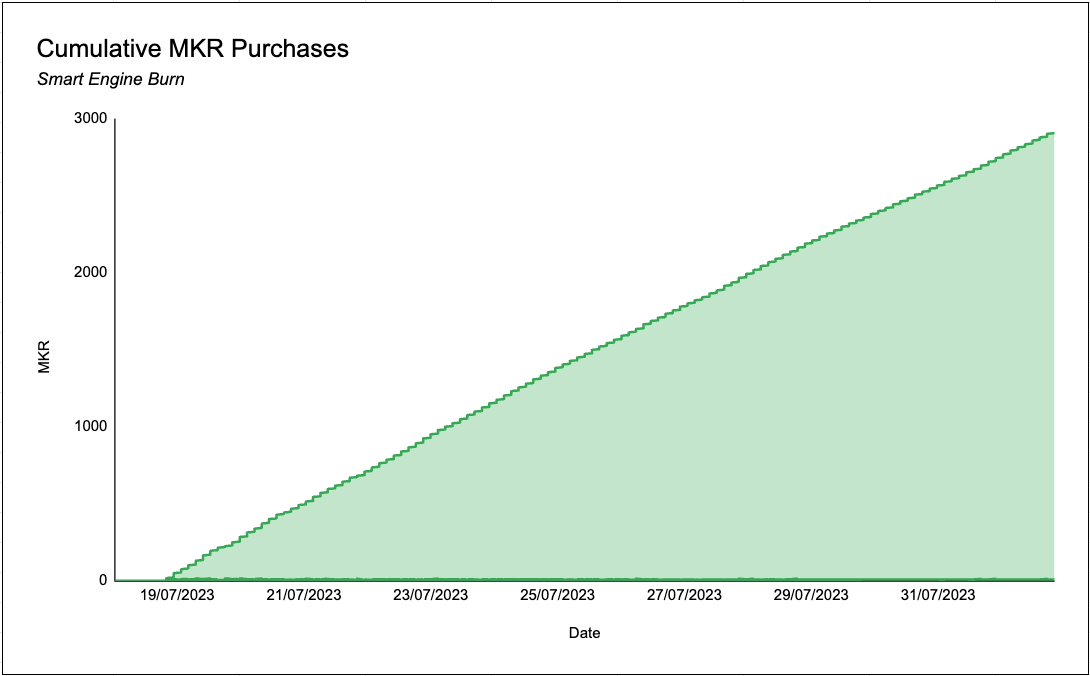

A16Z Maker Position

A16Z have finished exiting their MKR position. They sold a cumulative 14,000 + MKR over the past month. Despite the sales, MKR still rallied throughout > 100% in that time. Part of this sell pressure from Paradigm & A16Z is being absorbed by the smart engine burn which has now accumulated and LP’d ~4000 MKR.

Ondo Finance launched USDY, a tokenized note secured by US Treasuries and bank deposits. USDY pays holders a yield, initially 5% APY. This is an addition to their Short-Term US Government Bond Fund (OUSG) which now has a total TVL > $150 Mil.

GMX launch their highly anticipated v2 product. The product offers isolated GLP-like pools for assets to segregate risk. v2 allows users to trade more alts with half the maker and take trading fees as before in v1. However, a skew-based funding rate is included in v2 trades.

The current asset for trade are:

SOL, ARB, DOGE, XRP, LTC, UNI, LINK, BTC & ETH

3Pool Weightings

USDT at 60% weighting in the 3pool, notably on much lower token inflows as 3pool liquidity continues to dwindle.

Arbitrum Permissionless Validation

In their current state, Arbitrum One and Nova employ permissioned validation (fraud proof contestation) to counteract denial-of-service risks in their dispute protocols.

However, Offchain Labs announced BOLD (Bounded Liquidity Delay) today. BOLD makes validation of Arbitrum chains safely permissionless.

BOLD enables:

Fixed upper bounds on confirmation times for Optimistic Rollups’ settlement

Ensures a single honest party in the world can win against any number of malicious claims

Espresso Team’s Shared Sequencer Findings

Espresso team’s findings conclude that sequencers can enable complex features like flash loans, by ensuring transactions across different rollups are sequenced together, despite not guaranteeing atomic execution.

By utilizing a specialized "Bank" contract and crypto-economic incentives, this approach offers new opportunities for interoperability in the crypto space, but with limitations such as dependency on specific contracts and additional fees.

Frax Finance Move to Onboard T-Bills

To execute its FRAX v3 RWA asset strategy, Frax Protocol has posted a proposal with a potential mechanism to hold cash deposits and other low-risk cash-equivalent assets (including reverse repo contracts and treasury bills) using the FRAX stablecoin collateral. In order to onboard these assets Frax needs an offchain RWA manager. They have proposed to use FinresPBC.

FinresPBC facilitates the Frax Protocol's access to safe traditional financial assets on the blockchain without aiming for profits or charging fees, benefiting the public. Future plans include expanding traditional infrastructure and meeting Federal Reserve Master Account requirements.

Coinbase released their earnings for Q2, reporting a revenue of $707.9 million, surpassing the estimated $662.5 million. After hours, COIN jumped 10% higher on the news.

Michael Egorov Finds OTC For His CRV Position

Here is a summary of the counterparties to the Curve Founders CRV stake.

Base Network Public Access Launch

Coinbase announced that they will launch Base for public access on the 9th of August. An official Ethereum bridge is already live, allowing token movement between Ethereum mainnet and Base. The upcoming public release will include collaborative events and the introduction of NFT functionalities such as cb.id crypto usernames on the Coinbase Wallet.

Sei and CyberConnect join Binance Launchpool

Sei, an L1 built using Cosmos SDK, and CyberConnect, a social network protocol, have joined Binance’s Launchpool. Users can stake BNB, TUSD and FDUSD to farm SEI and CYBER.

According to a lawyer representing the bankrupt firm, Voyager Digital Holdings Inc. potentially faced a hack of user data as it reopened its crypto platform to allow customers to retrieve their funds during a court-supervised liquidation process.

FTX has confirmed plans to restart the exchange in a plan filing.

Microstrategy acquire 467 Bitcoin

In July, Microstrategy acquired an additional 467 BTC for $14.4M and now holds 152,800 BTC.

Leetswap Exploit / Sushi Launches on Base

LeetSwap, DEX on Base and Canto, was exploited for 340 ETH, worth approximately $628K.

Sushi has launched their DEX on Base with pools live for ETH/axlUSDC and BALD/ETH.

dYdX Shifting from LP Rewards to Market Maker Rebates Gains Early Support

dYdX proposal to increase market maker rebate from 0.5bps to 0.85bps, and reduce the per-epoch LP rewards by 50% from 1,150,685 DYDX/epoch to 575,342.50 DYDX/epoch has gained a lot of early support.

Curve Exploiter Returns Funds

In three transaction batches, the Curve Finance exploiter refunded a total of 4,820 alETH and 2,258 ETH to the protocol, which amounts to approximately $12.7 million in returned funds.

Trending Assets

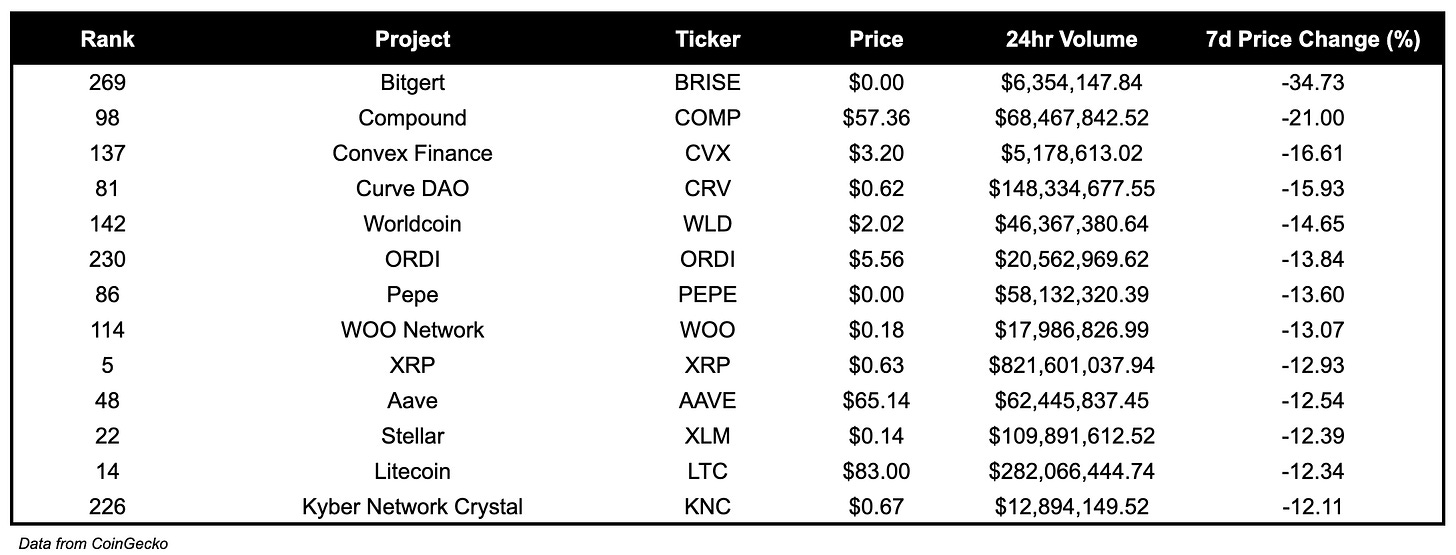

Top 300 Performers

Top 300 Losers

Below $100M MC by performance, on chain

DMT, up 383.48, is the top performer over the past week for coins below $100M MC.

Notably, SankoGameCorp recently announced that they will be releasing an L3 (on Arbitrum) in August with DMT as gas.

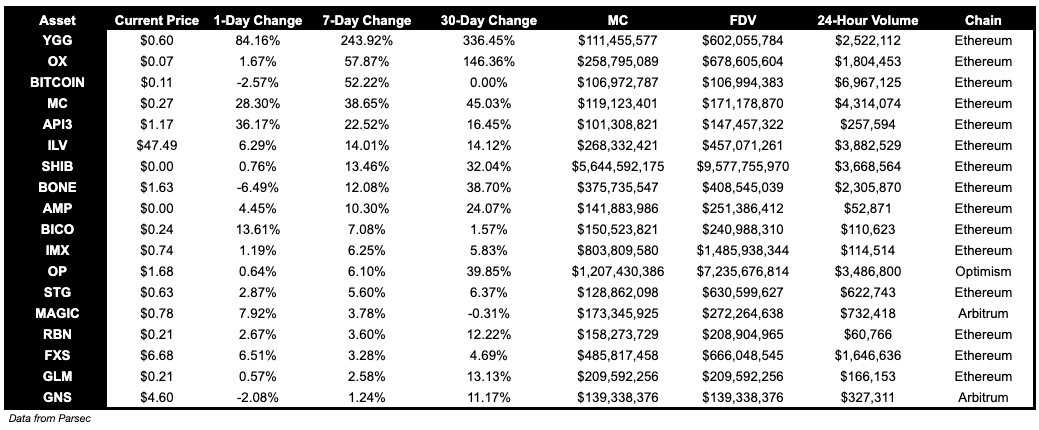

Above $100M MC by performance, on chain

YGG, up 243.92%, is the top performer for coins above $100M MC over the past week, followed by OX, up 57,87% over the past week, and BITCOIN, up 52.22% over the past week.

Above $1B MC by performance, on chain

SHIB, up 13.46%, is the top performer for coins above $1B MC over the past week, followed by OP, up 6.10%.

TVL

TVL Above $10M

Over the past week:

Morpho Compound TVL grew by 186.49%.

Agni Finance TVL grew by 110.88%.

Morpho Aave v3 TVL grew by 98.65%.

Fees

Ethereum earned the highest fees over the past week, at $37.7M, followed by Lido, at $12.9M, and Tron, $8.62M.

Notably, Aave v2 fees earned are up 59.06% week on week, at $4.97M.

Governance Proposals

#AIP: 13.6 - Adjustment in Interest

Proposal to apply collateral-based interest to both CRV cauldrons. Given the current outstanding principal is $12.5M, the base interest rate would be 150%.

Lido - April Slashing Incident: Key Limit Follow-up

In April 2023, a slashing occurred involving validators operated by the RockLogic GmbH. Proposal is to see if RockLogic GmbH can resume increasing their validator count.

MIP-25: Mantle Economics Committee, and ETH Staking Strategies

Proposal to authorize the Mantle LSD and Lido ETH staking strategies, with a combined allowance of up to 200L ETH, and Lido ETH staking strategies up to an individual allowance of 40k ETH.

[GIP-66] CA side incentives reduction

Proposal to reduce Credit Account users liquidity mining rewards. This will reduce 0.196% of the supply on an annual basis, equal to $100K yearly.

[FIP - 275] Add a new market into Fraxlend on Ethereum (FRAX/WBTC)

Proposal to add FRAX/WBTC market into Fraxlend on Ethereum.

[FIP - 276] Add a new market into Fraxlend on Ethereum (FRAX/WETH)

Proposal to add FRAX/WETH market into Fraxlend on Ethereum.

AIP #13.5: Interest rate adjustment for the CRV cauldrons

Proposal to apply collateral-based interest to both CRV cauldrons. Given the current outstanding principal is $18M, the base interest rate would be 200%.

At this interest rate, the loan would be fully covered within 6 months. As principal is repaid, the base rate would decrease.

Articles / Threads

Trader Joe is now live on Ethereum Mainnet

Trader Joe has launched their concentrated liquidity AMM ‘Liquidity Book’ on Ethereum Mainnet.

Through their integration with Socket, Kwenta will now offer users use their interface to bridge to Optimism from Ethereum Mainnet, Polygon, Arbitrum & BSC rewards as OP tokens.

Aerodrome: Launch & Tokenomics

Aerodrome has announced their official tokenomics ahead of their launch on Base.

Allocation:

veAERO

Airdrop for veVELO Lockers: 200M (40%)

Ecosystem Pairs and Public Goods: 105M (21%)

Aerodrome Team: 70M (14%)

Protocol Grants: 50M (10%)

AERO Pools Votepower: 25M (5%)

AERO

Voter Incentives: 40M (8%)

Genesis Liquidity Pool: 10M (2%)

Vertex Protocol now supports stop-market orders, and will soon support all stop orders.

On-chain Limit Orders

Trader Joe has launched on-chain limit orders. Users can set automated buy or sell orders that execute with no fees or price impact. The on-chain limit orders will allow:

No reliance on external oracles

Your trades have perfect execution

Swaps with no additional fees or price impact

Complete decentralization ‘on-chain’ execution

Vertex partners with Toa Capital Partners

Vertex has partnered with Toa Capital to provide deeper liquidity on the exchange. Toa will act as a market maker on Vertex.

Protectorate development team has been working on deploying PRTC vesting contracts (which should launch this week), development of V1 and launch of flagship product NFT Capsule and oPRTC (claiming & exercising).

Perennial has launched a dedicated interface for Maker’s and LPs. LPs can pick between simplified Earn page or advanced Make page.

$WLD is live on Synthetix Perps

Synthetix is launching $WLD perpetual futures for leverage trading.

Tokenomics and Transparency Update

unshETH team has burned 2M USH from team allocation in response to vdUSH farm exploit. Additionally, team members have extended vesting period to 2 year linear vest for remaining tokens.

Conic has raised $1m from Curve founder Michael Egorov. The $1M of additional funding is held in the Conic treasury and was raised at a valuation of $17M. The sold tokens are subject to an 8 month linear vesting schedule.

Clearpool Expands To Polygon zkEVM

Clearpool is expanding Polygon zkEVM.

End-of-V1 & Looking Ahead to nftperp V2

nftperp is sunsetting V1, where they generated 281.9K ETH in trading volume ($530M) across 2,576 of wallets. V1 was paused due accrued bad debt by the protocol.

V2 will move away from vAMM and use a hybrid Fusion AMM and decentralized limit order book system.

Love reading this weekly reports, keep it up guys!

By the way, are you looking for interns to join your team?