Weekly Notes 8

23-07-2023 to 30-07-2023

Developments

The CRV/ETH pool was drained of 7M CRV, 7.6K ETH.

Exploited address: 0x8301ae4fc9c624d1d396cbdaa1ed877821d7c511

CRV exploiter: 0xb1c33b391c2569b737ec387e731e88589e8ec148

At the time of the exploit, Curve founder (address), still had $195 mil in CRV supplied, borrowing $64M in stables. He's since started aggressively repaying loans. source

CRV exploiter hasn't sold any CRV tokens yet & likely cannot use a CEX for execution due to KYC limitations. source The money markets liquidating these positions (Aave, FraxLend & Abracadabra) could result in the protocols facing bad debt as they cannot sell the CRV collateral on-chain. Curve founders liquidation cascade starts at around $0.18. Chainlink oracles showing CRV at $0.637 still. source

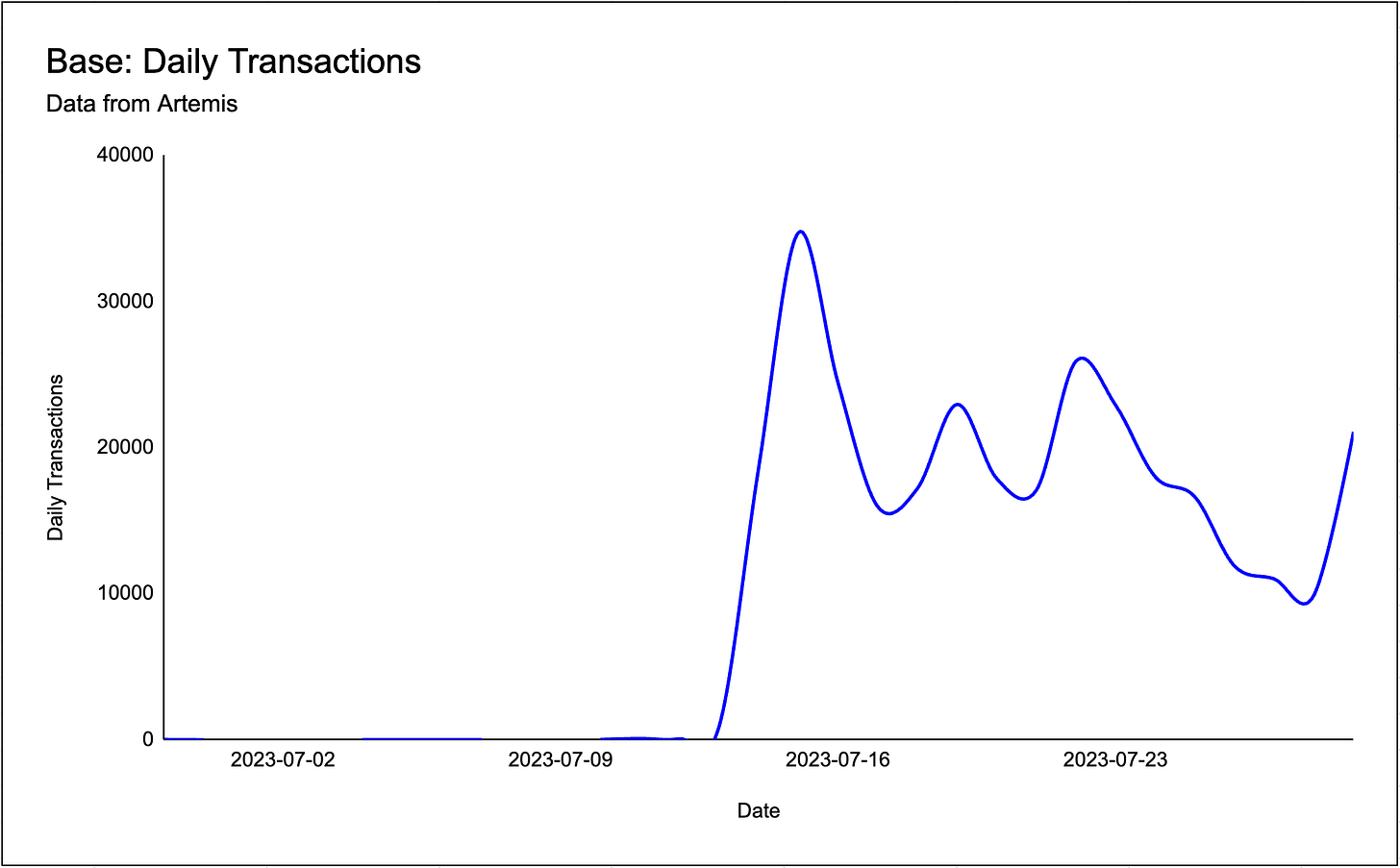

Base Activity Continues To Rise

Activity on Base continues to pick up:

As of Sunday, a total of 27.9K ETH, worth approximately $52.3M, has been bridged over to Base.

Daily active users up to 5.9K, 85% higher compared to the day before

Daily transactions are up to 21.1K, 113% higher compared to the day before

Shibarium’s Beta Bridge for Ethereum has gone live for public testing. Shibarium is an upcoming Layer 2 solution, which will require users to use $BONE to transact on it. $LEASH will be used as a liquidity token for users to stake them in liquidity pools to earn rewards.

BONE which will be the gas token of the L2 also performed well today, gaining 7.56%.

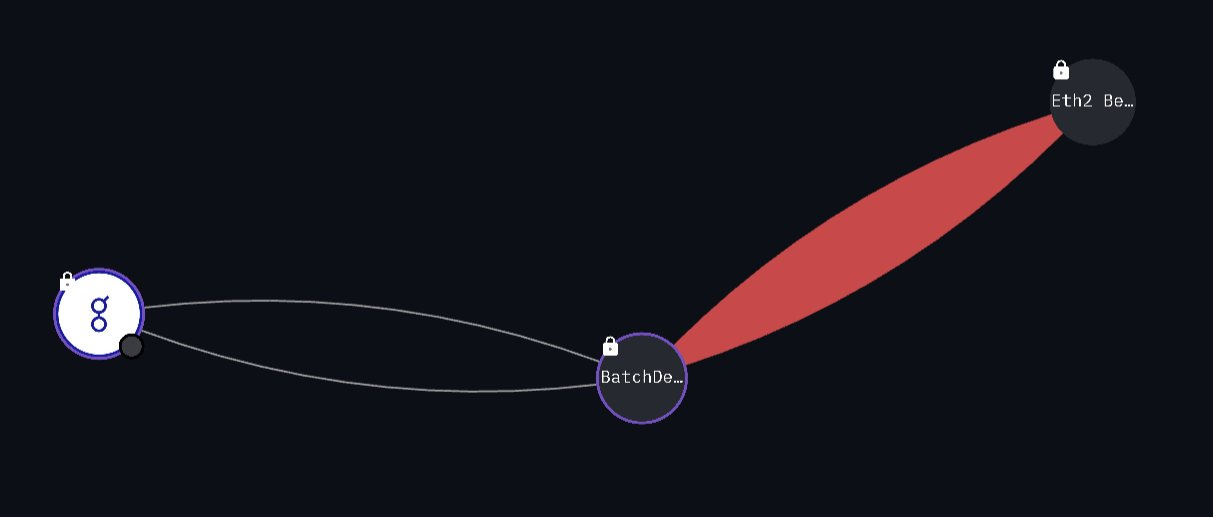

Golem, a project that raised 820k ETH ($8.6Mil at the time) in a 2016 ICO, deposited 98k ETH ($184Mil) into the Ethereum staking contract today.

Golem sent 7 transactions of 12,800 ETH each & 1 final transaction of 8.4k ETH to the ETH2 Beacon deposit address. You can track these movements at this address: 0xba1951dF0C0A52af23857c5ab48B4C43A57E7ed1

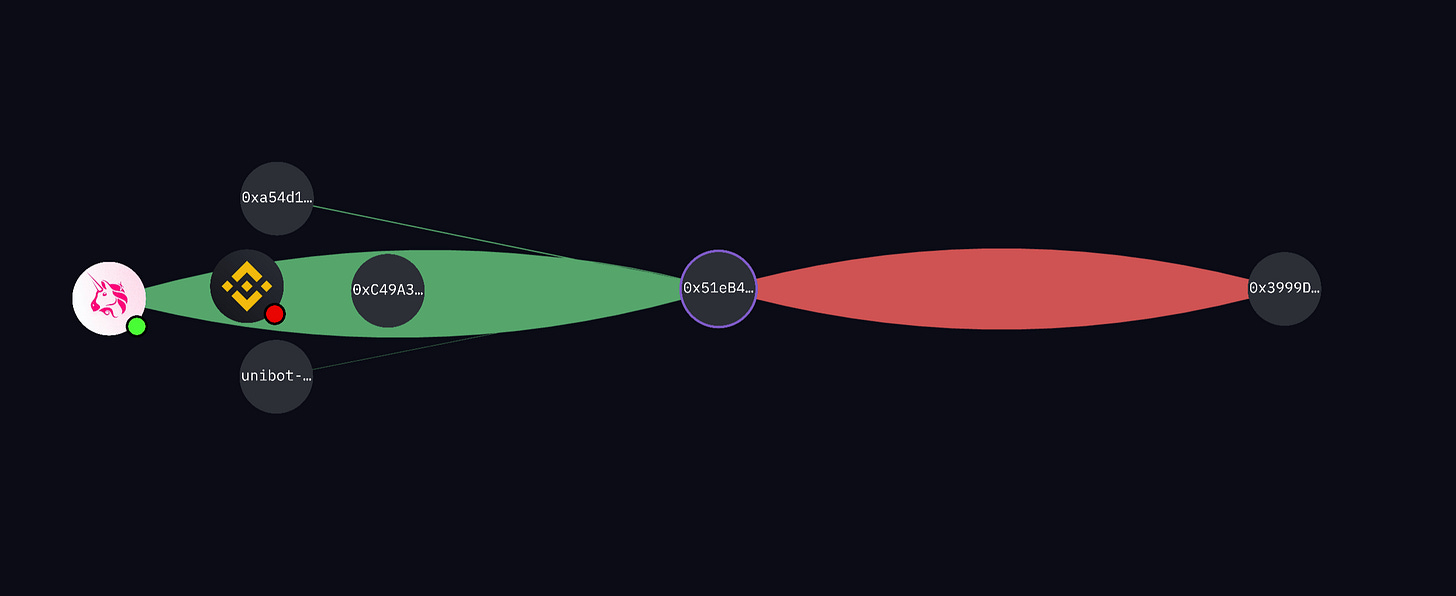

Fresh Address Accumulating UNIBOT

A wallet (0x51e), freshly funded a week ago using Binance, has been buying incrementally increasing clips of UNIBOT through using a UNIBOT Uniswap V2 Pool.

After receiving UNIBOT, 0x51e sends the tokens to 0xC49. 0xC49 currently holds 10.512K UNIBOT, worth approximately $1.61M. Both wallets have only interacted with Binance as a CEX. 0x51e stopped purchasing UNIBOT at approximately 7 AM UTC.

Earlier today, 18 blocks were reorganized on Ethereum Goerli Testnet.

As of today, 11.9M GHO has been minted. GHO is Aave’s multi-collateral stablecoin.

On the 28th, the launch of Pond0x, a token by Pauly0x, led to a sharp increase in gas costs, as it quickly became the highest gas using contract.

Base fee jumped to 300 GWEI as participants transferred other people’s tokens to themselves and sold into the liquidity pool.

Additionally, the contract allowed any user to directTransfer from and to any address. This resulted in people stealing each others tokens via transferring them to their own addresses and selling them into the LP.

Sequoia Reduce Crypto Fund

Sequoia Capital, has reduced the size of its crypto fund significantly, shrinking it from $585 million to $200 million. This move comes as a response to a liquidity crunch in the market and a strategic shift towards focusing on smaller players in the cryptocurrency space. In our opinion, Sequoia’s fund size in relation to the number of attractive VC deals to allocate encouraged the decision to downsize.

BTC Trading Volume Slump

The seven day moving average of BTC trading volume has fallen to levels not seen since January 2023, reducing almost 80% since the highs of the year.

Base New Contracts Deployed

Coinbase’s new chain built on top of the OP Stack, BASE, had a spike in contracts deployed as their devnet went live earlier this week.

New deployed contracts spiked the week of launch, and increased by 400% from the week of the 10th to the week of the 17th.

Rocket Pool experienced its largest daily redemption of rETH token this week. One user (0x390) redeemed 6,720 rETH and sent a total of 7.1k ETH ($13.1M) to Binance afterward.

Rocket Pool's TVL currently stands at $1.88B, making it the second largest liquid staking protocol, after Lido.

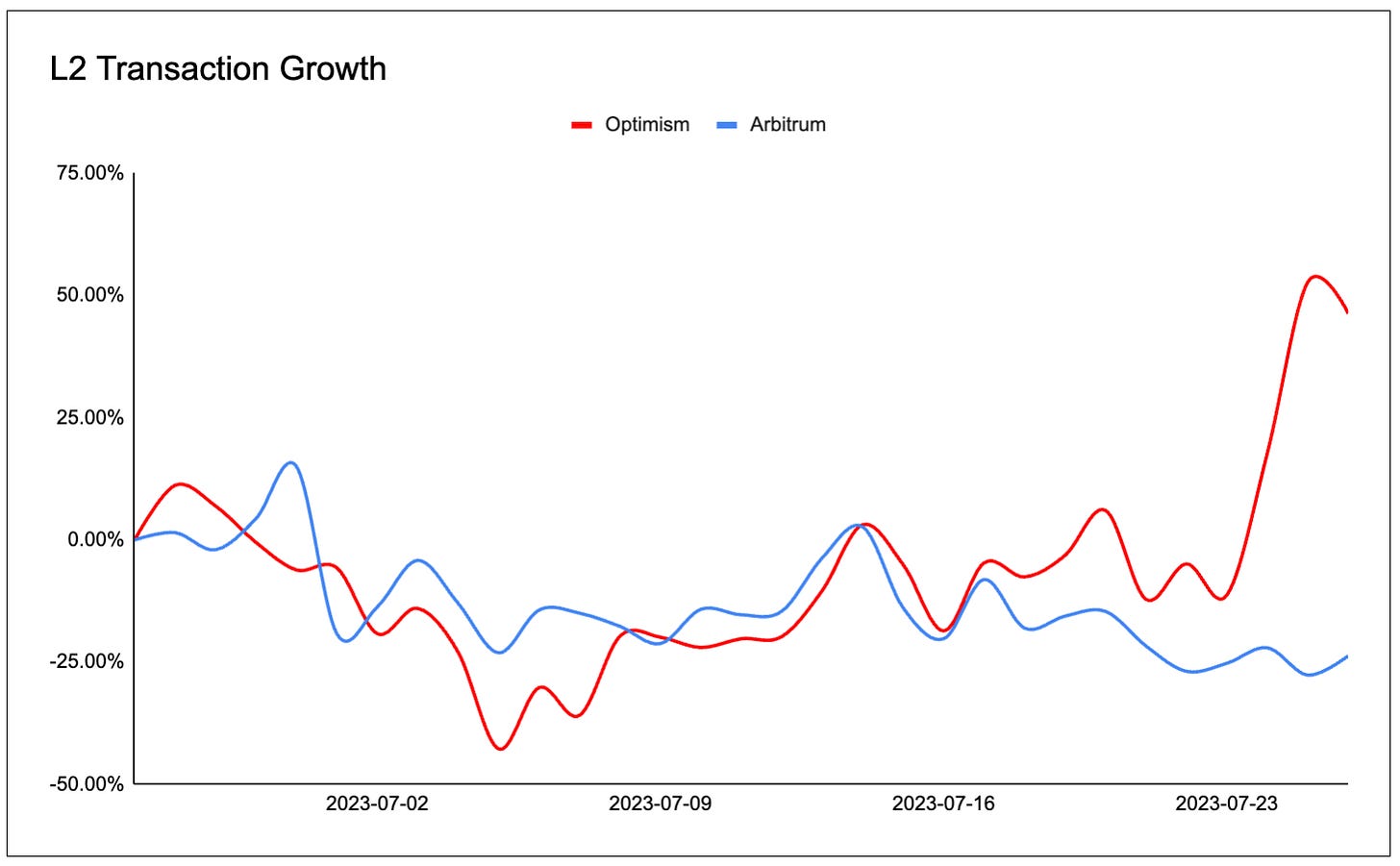

Optimism Daily Transaction Growth

Optimism daily transactions have surpassed Arbitrum daily transactions over the last week. Overall, Optimism daily transactions have grown 38% over the past week, and 46.35% over the past month.

Daily transaction growth for Optimism has averaged at 13.51% over the past week, while Arbitrum transactions have decreased at a rate of 23.12% over the same time period.

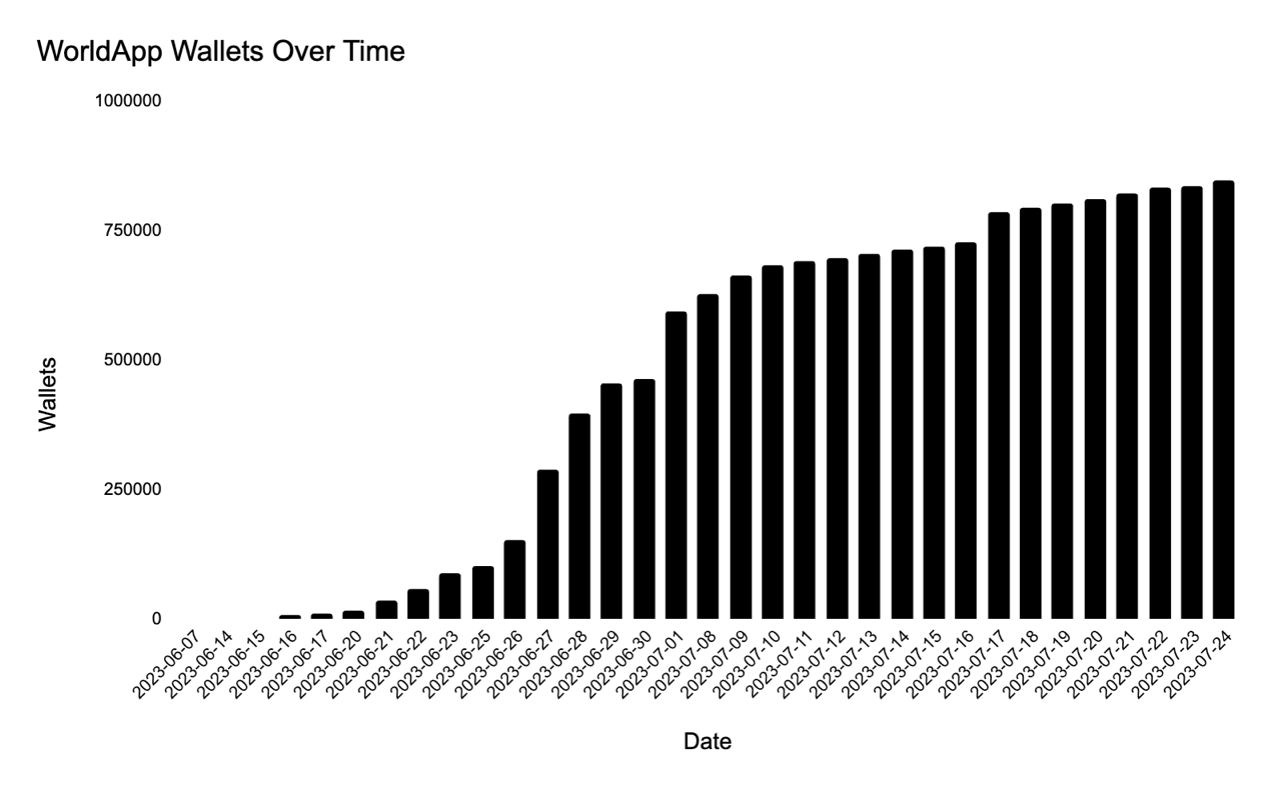

Optimism transaction growth is due to the growth of Worldcoin and WorldApp, since Worldcoin is built on Optimism directly (unlike the upcoming chains of Base and Zora, which are built using OP Stack). WorldApp wallets have grown to 943.4K over the past 2 months.

a16z (0x05e) sent 6.75K MKR to Coinbase(worth approximately $7.83M) at 12:45 PM UTC on the 27th. 0x05e has been selling clips of MKR around this size (ranging from 6.5K to 7K MKR), once a week since the 10th of July.

They currently have 5.65K MKR (worth approximately $6.53M) left in this wallet.

This come after Paradigm sent their remaining 3K MKR to Coinbase yesterday.

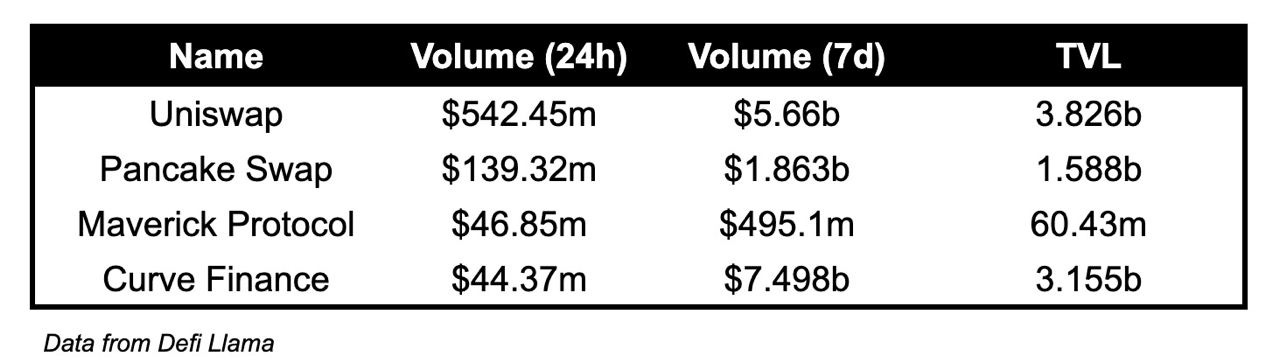

Maverick Surpassed Curve in Trading Volume

Maverick Protocol had the third highest volume traded on the 24th.

While Maverick Protocol had only $60.43M in TVL, it has had $46.85M in trading volume.

Comparatively, Curve had $3.16B in TVL, and saw only $44.37M in volume.

Spark Protocol’s DAI Borrows Hits New ATH

Spark Protocol's DAI borrows hit a new ATH and is currently sitting at 14.4M DAI. Spark Protocol is a lending protocol built on MakerDAO.

Worldcoin Launch and Optimistic World NFTs

WLD circulating supply is currently floating around 104.8M. The unlocked supply is 500M.

Community supply of WLD expected to increase to 1.65B by July of 2024. Beginning in July 2024, investor, team and reserve tokens will also start being released.

A total of 2.98M Optimistic World NFT's have been minted (as part of Worldcoin's launch). On average, 350K NFTs was minted per hour, from 8 AM UTC to 1 PM UTC on the 24th.

Additionally, the number of WorldApp wallets have surpassed 848K.

Vitalik Publishes Article on Worldcoin

Below is a summary of his article:

What is Worldcoin?

Worldcoin is a ground-breaking project with an ambitious aim to provide Universal Basic Income (UBI) to every human on earth via cryptocurrency. It operates using a unique device, the Orb, which scans people's irises to establish proof-of-personhood, a means of confirming individual identities. However, this innovative approach doesn't come without potential threats and challenges, encompassing issues of privacy, decentralization, and security.

Concepts and Challenges:

Worldcoin's system relies on Orbs, devices capable of scanning irises to generate unique identifiers. The ultimate goal is to decentralize Orb production and management. However, concerns arise about the potential failure to achieve decentralization, perhaps due to dominance by a single manufacturer or security issues stemming from distributed manufacturing mechanisms.

Significant risks include the system's fragility against malicious Orb manufacturers, who could produce unlimited fake iris scan hashes, and potential government interference. Governments could outright ban Orbs or force citizens to scan their irises under duress. There are also general challenges to proof-of-personhood designs such as 3D-printed fake people, selling IDs, phone hacking, and government coercion to steal IDs.

Solutions and Discussion:

Several solutions are proposed to address these challenges. Regular audits on Orbs could ensure they are built correctly, helping to counteract malicious Orb manufacturers. To limit the damage caused by any problematic Orb, World IDs registered with different Orbs should be distinguishable from each other.

Additional proposals include allowing re-registration (making ID selling less viable), running entire applications inside a Multi-Party Computation (MPC), and implementing decentralized registration ceremonies to ensure a trusted registration procedure.

The discussion also involves a comparison between biometric-based proof of personhood and social-graph-based verification, each with their own strengths and weaknesses.

Conclusion:

There's no perfect form of proof of personhood. Biometric-based and social-graph-based methods each come with unique strengths and weaknesses. The ideal solution might involve a combination of all these methods, with biometric solutions for short-term use and social-graph-based techniques for long-term robustness. Despite the inherent risks and challenges in developing a proof-of-personhood system, it's crucial to avoid a world dominated by centralized identity solutions. Vigilance, open-source approaches, and a commitment to privacy-friendly values are strongly advocated for achieving an effective proof-of-personhood system.

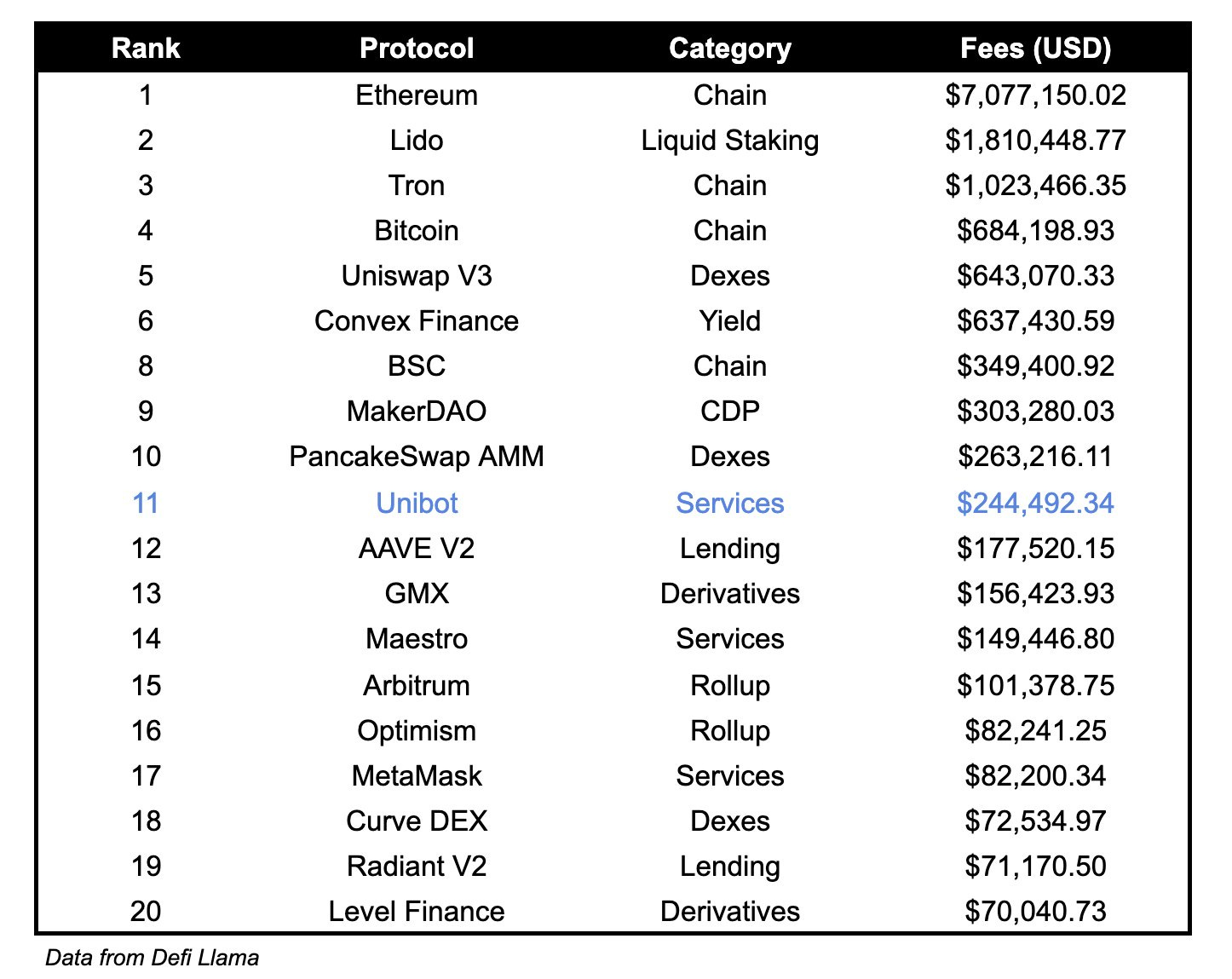

Unibot was earning more in fees than Arbitrum, Optimism, MetaMask and GMX on the 24th.

Trending Assets

Below $100M MC by performance, on chain

BITCOIN (HPOS10I), up 65.56% over the past week, is the top performer below $100M MC over the past week. BITCOIN is followed by VELO, which is up 29.35% over the past 7 days.

Above $100M MC by performance, on chain

OX, up 18.52%, MKR, up 14.51% and BONE, up 13.10%, are the top performers above $100M MC over the past week.

Above $1B MC by performance, on chain

SHIB, up 7.94%, and UNI, up 4.82%, are the top performers over the past 7 days for coins above $1B MC.

TVL

TVL Above $10M

LeetSwap, DEX on Canto and Base, TVL grew by 55,815% over the past week.

Exactly, a multichain interest rate protocol, TVL grew by 36.71% over the past week.

Spark, lending using MakerDAO on Ethereum, grew its TVL by 34.60% over the past week.

Jito, MEV-boosted staking on Solana, rew its TVL by 34.34% over the past week.

Fees

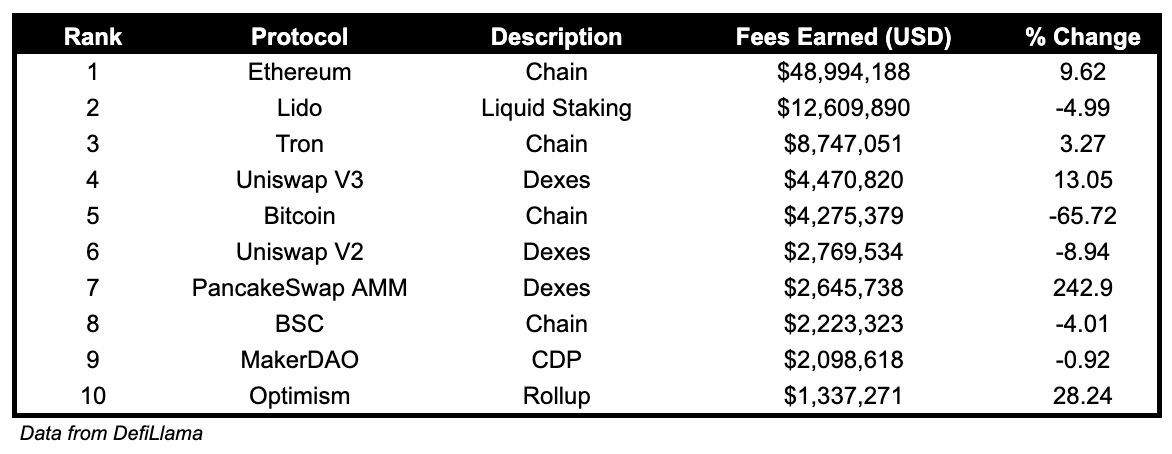

Ethereum earned the highest fees over the past week, at $48.9M, 9.62% higher than the week before. Ethereum is followed by Lido, earned $12.6M and Tron, earned $8.7M.

Notably, PancakeSwap fees earned are up 243% compared to the week before, and Optimism fees earned are up 28.24% compared to the week before.

Governance Proposals

[BIP-386] Allocate Base Incentives

Proposal to allocated 50,000 USDC for Balancer incentives on Base

[ARFC] GHO Liquidity Pools: Primary Pools Initial Strategy

The proposal aims to split the Aave DAO's veBAL voting weight to support upcoming GHO liquidity pools as follows:

40%: GHO/bb-a-USD V3 pool.

40%: GHO/LUSD pool.

20%: 80/20 wstETH/GHO pool.

Sushi: Strategic Cooperation with DWF Labs [Signal]

Proposal to enter into a market making partnership with DWF Labs to increase liquidity for pairs on Sushi, as well as for SUSHI on CEX’s (Binance and OKX)

RFP-21: Distribution Strategy for ARB Allocation

Radiant will distribute their allocation of 3.348M ARB tokens to wallets locked or relocked dLP for 6 or 12 months within the time specified on either Arbitrum & BNB Chain. Those who locked for 12 months might receive either 2.5 times or 3 times more.

GMX proposal for the approval of their V2 genesis parameters.

BIP-388: Wire up Base Chain in preparation for launch

Balancer proposal to take the final steps before their full launch on Base Chain, which includes configuring the Gauge Factory and Authorizer Wrapper and setting a 50% protocol fee.

[HIP-36] Launch Hop on Base Mainnet

Hop proposal to launch on Base Mainnet.

Sonne Improvement Proposal 6: Expansion to Base - Coinbase's Ethereum Layer-2 Blockchain

Sonne proposal to launch on Base Mainnet.

[CIP] Disable CNC emissions for Omnipools

Proposal to disable CNC rewards to Omnipools, and to reallocate these emissions to the Conic treasury. If this proposal is to pass, current Omnipool LPs would stop earning CNC rewards but still continue to earn base yield and CRV and CVX rewards.

4.P3 - Premia Meta-Economics Revamp

Proposal to revise token allocation re-categorizations, protocol fee structure, Insurance Fund, vxPremia, and voting influence, Hydraulic Solutions Framework & Options Liquidity Mining, and the AirDrip Initiative.

Articles / Threads

Vela Exchange Roadmap

Items which will be coming before end of August:

Kickoff for USDC rewards and $VELA buybacks

The start of remaining refunds for beta traders

Other items on the roadmap:

Building out API for integration with trading bots

Trading contest

Referral program

Items being considered:

New 1-click deposit features that go beyond multi-chain

Support for spot trading

Fee structure enhancements

VLP updates to support vault strategy builders

Bot trading marketplace for vendors

Unveiling Gravita x Arbitrum: A New Era begins

Gravita, a stablecoin LSDFi protocol, will be launching on Arbitrum. Initially wETH, rETH and wstETH will be supported. Each will have a 500K GRAI mint cap.

Kwenta has launched 8 new markets to trade: ETH/BTC (ratio), XMR, MAV, ETC , COMP, YFI, MKR, and RPL.

Since these are launched by Synthetix, they can be traded not only on Kwenta, but on other frontends such as Polynomial and dHEDGE as well.

Pika is announcing the Pika token rewards program. As base rewards, approximately 750K PIKA (0.75% of PIKA supply) will be given out as esPIKA every 30 days. 45% of this will go to LPs, 45% to traders, and remaining 10% to PIKA stakers.

In addition, boosting rewards, that Pika collects from early redeemers of esPIKA will be distributed, in the same manner.

In the future, trader rewards and staker rewards will be reduced to be used as rewards for an upcoming referral program