Weekly Notes 19

Developments

Binance has agreed to pay $4.3 billion in total to end the DOJ’s investigation of alleged money laundering, sanctions violations and more. CZ, the founder of Binance, has also agreed to resign and pleaded guilty to violating the Bank Secrecy Act. He will pay a fine of $50 million to the CFTC and is expected to enter his plea “on Tuesday, with sentencing at a later date”. Richard Teng will be replacing him as CEO of Binance.

Blast announced that they will be launching an EVM-compatible optimistic rollup L2. Blast is founded by previous Blur founder, Pacman, and will give users native yield for their ETH and stablecoins.

Over $544 million has been sent to the bridging contract so far.

The project raised $20 million from Paradigm, Standard Crypto, eGirl Capital and Primitive Venture as well as additional investments from angel investors.

Blur users have a little over a month to claim their Season 2 airdrop. So far hanwe.eth has claimed the largest amount of BLUR tokens valued at $8.45 million and the second highest user claimed $7.4 million of BLUR. So far 259 million tokens (84.29%) have been claimed across 31,000 addresses.

Tokenized Uranium has debuted on-chain via Uniswap. The token, Uranium3o8 (ticker U), is backed by Uranium from Madison Metals with each token representing one pound of physical uranium. Token holders must own 20,000 Uranium3o8 to take delivery of the physical Uranium and of course must meet strict regulatory requirements.

Ondo Finance’s yield-bearing, short-term treasury backed stablecoin USDY has launched on Injective’s L1.

The Avalanche chain has reached an all new daily transactions high of 5.75 million as Avalanche “inscriptions” (ASC-20s) have become popular.

Kinto, an L2 focused on providing safe access to financial services, has migrated from Ethereum to Arbitrum. Kinto aims to build a KYC-compliant layer 2 chain to support both DeFi and real world financial institutions.

BlackRock & Grayscale Meet With SEC

BlackRock and Grayscale have both met with the SEC to discuss details surrounding their spot BTC ETF applications.

Grayscale met with the SEC’s trading and markets division on Monday to discuss “NYSE Arca, Inc.’s proposed rule change to list and trade shares of the Grayscale Bitcoin Trust (BTC) under NYSE Arca Rule 8.201-E”

BlackRock’s meeting concerned “The NASDAQ Stock Market LLC’s proposed rule change to list and trade shares of the iShares Bitcoin Trust under NASDAQ Rule 5711(d)”.

Heco Bridge & HTX Hacked For Over $100M

Heco Bridge and HTX (previously Huobi), have both suffered a hack which stole $86.6 million and $23.4 million respectively. The attacks are suspected to have been carried out by the same entity. HTX, who has paused deposits and withdrawals, has stated that they will cover all $23.4 million lost from their hot wallets and will resume services once their investigation is complete.

unshETH has released their liquid staking token blETH to represent ETH deposits in the Blast bridging contract. Users who send ETH to the blETH contract will be able to mint blETH on a 1:1 basis. However, blETH will take a “small fee” from a user’s farmed points/airdrop.

Coinbase has accused the SEC of “hedging and delaying” its response to Coinbase’s ask for new clear rules for digital assets, and states that “only an order by this Court will make the commission [SEC] act”.

PancakeSwap Introduce veTokenomics

Cake introduces veCAKE and gauges voting. CAKE holders will be able to stake CAKE for veCAKE which will now power PancakeSwap’s governance. Additionally, veCAKE holders will be able to vote on which gauges CAKE emissions are allocated to.

Mt.Gox Will Commence Cash Repayments Before 2024

Mt.Gox has stated they will be commencing “cash repayments” to creditors before the end of 2023 and will continue going into 2024. Mt.Gox still holds a reported 69 billion Japanese Yen. It remains unclear how much cash will be redistributed. The letter, however, suggests that crypto will not be distributed as of yet.

Pyth Network’s native token, PYTH, opened for trading on Monday and saw a 50% price increase in the first 24 hours. It is currently up 56% from its all time low.

KyberSwap hacker was offered a $5 million (10%) white hat bounty on the $50 million they stole. The hacker had until 6 AM UTC on 25 November to return the funds.

South Korea will start a 100,000 person CBDC trial in late 2024. The trial will aim to explore if CBDC’s can fix the current issues with government voucher systems like high fees and fraudulent claims. Participants will be able to buy goods in stores with their CBDC.

As LooksRare launched their 0% marketplace and royalty fees NFT collection- INFILTRATION - and have launched a buyback and burn initiative in tandem.

25% of all LOOKS used for healing in INFILTRATION will be burned and 50% of the overall fee will be used to buy back LOOKS from the market. The LOOKS token is up 43% in the last 24 hours.

Aevo‘s BLAST token futures contract is trading at $4.50.

The company behind video game franchise Final Fantasy, SquareEnix, will be opening the NFT auction for their upcoming Ethereum blockchain based game - Symbiogenesis - on November 27. There will be three waves of NFT auctions: the first will see 10 NFTs auctioned from Nov 27-28, the second, 90 NFTs from Nov 30 to Dec 1, and the third, 400 NFTs from Dec 2-3.

TraderJoe Total Supply Reached

DEX platform Trader Joe’s native token JOE has reached its max token supply of 500 million. Additionally, 10 million JOE tokens from the treasury are permanently locked for a total supply of 490 million JOE.

With JOE daily emissions stopped, Trader Joe will use “treasury-held JOE tokens to support the ongoing growth of the Trader Joe ecosystem.

F2pool, a Bitcoin mining pool, will stop censoring transactions from addresses flagged by OFAC after Bitcoin developer 0xB10C discovered transactions being censored.

Co-founder of F2pool, Chun Wang, admitted to the transaction filter and has announced its removal until the community comes to a consensus.

Trending Assets

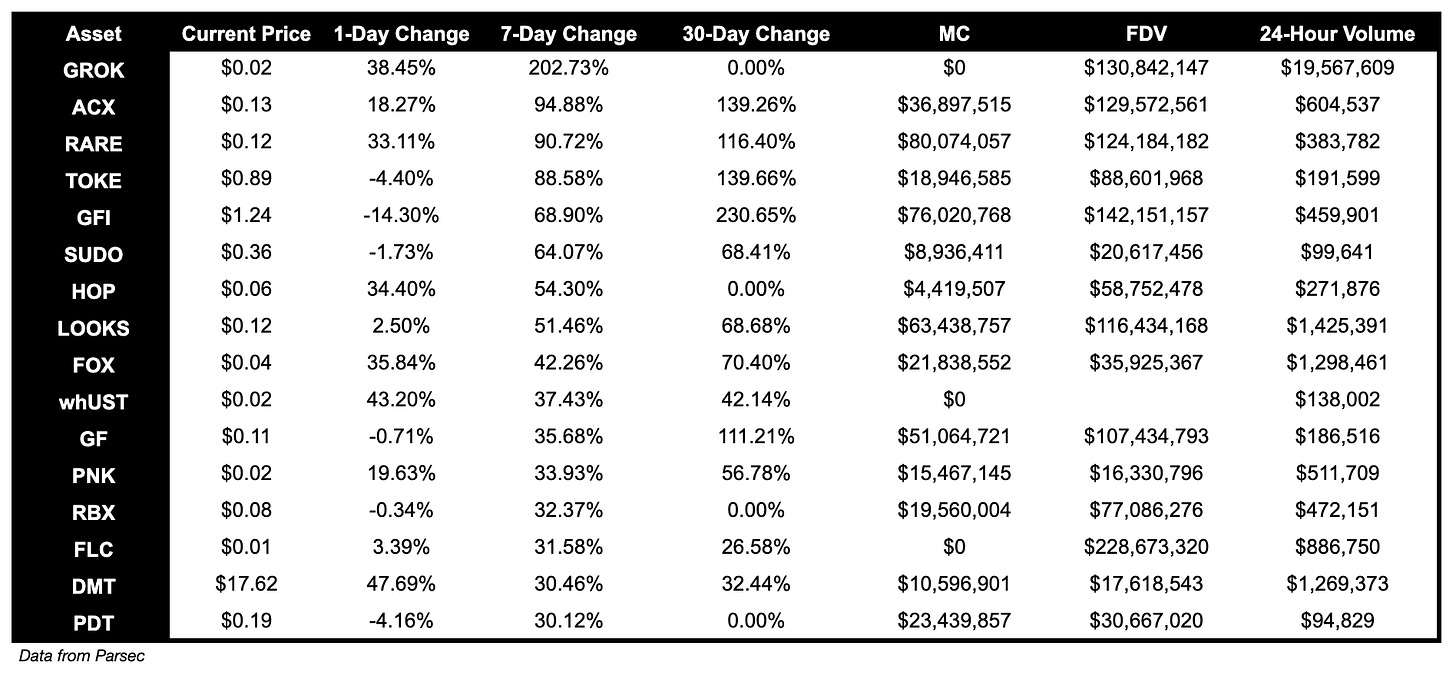

Below $100M MC by performance, on chain

GROK is up 202.73% this week.

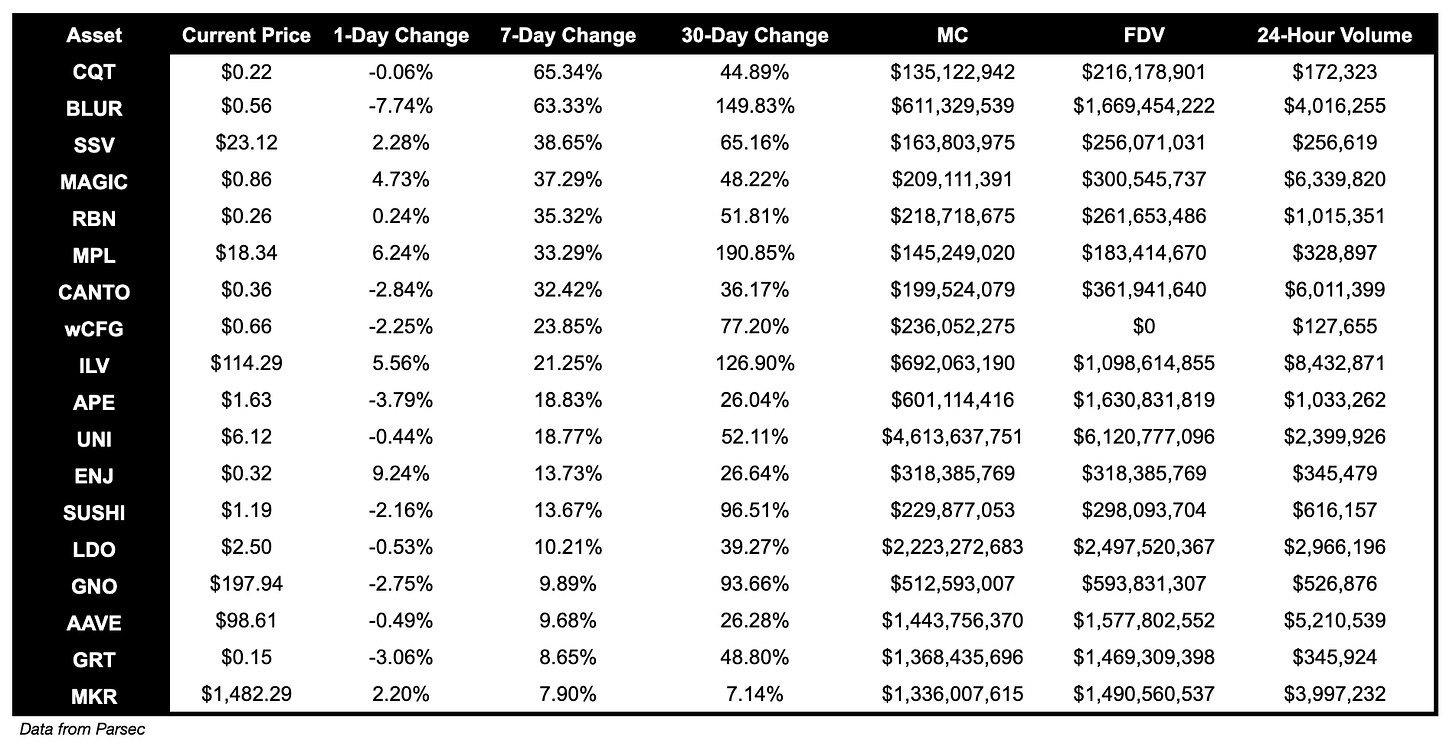

Above $100M MC by performance, on chain

BLUR, up 63.33%, SSV, up 38.65%, were top performers for tokens above $100M MC over the past week.

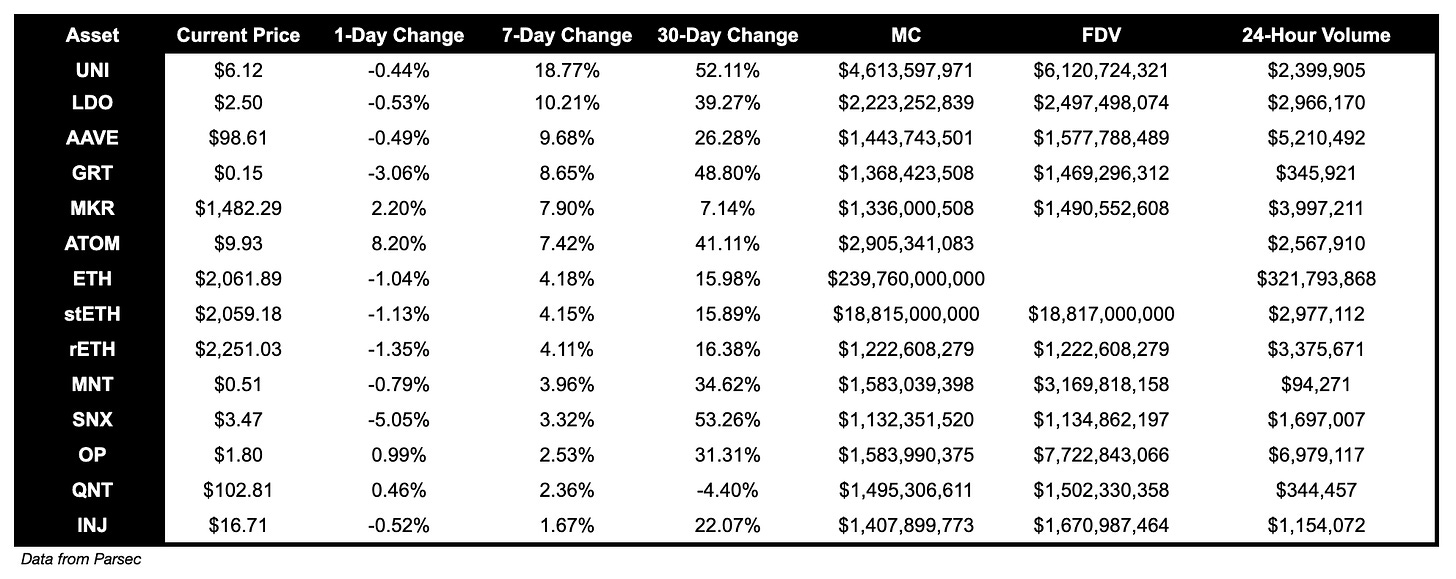

Above $1B MC by performance, on chain

UNI had a good week, and is up 18.77%. Similarly LDO performed well, and is up 10.21%.

Trading Volumes

TVL

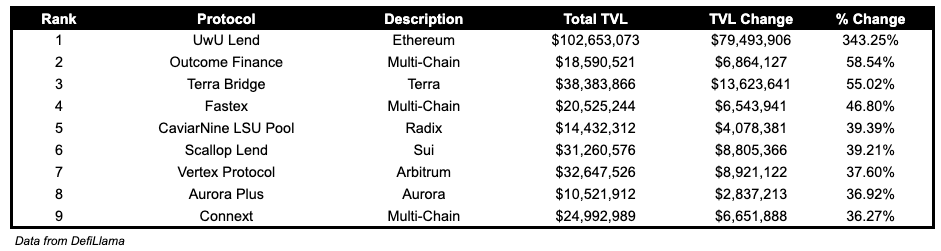

TVL Above $10M

Over the past day:

UwU Lend, lending on Ethereum, TVL grew by 343.25%.

Outcome Finance, multichain synthetics, TVL grew by 58.54%.

Terra Bridge TVL grew by 55.02%.

Fees

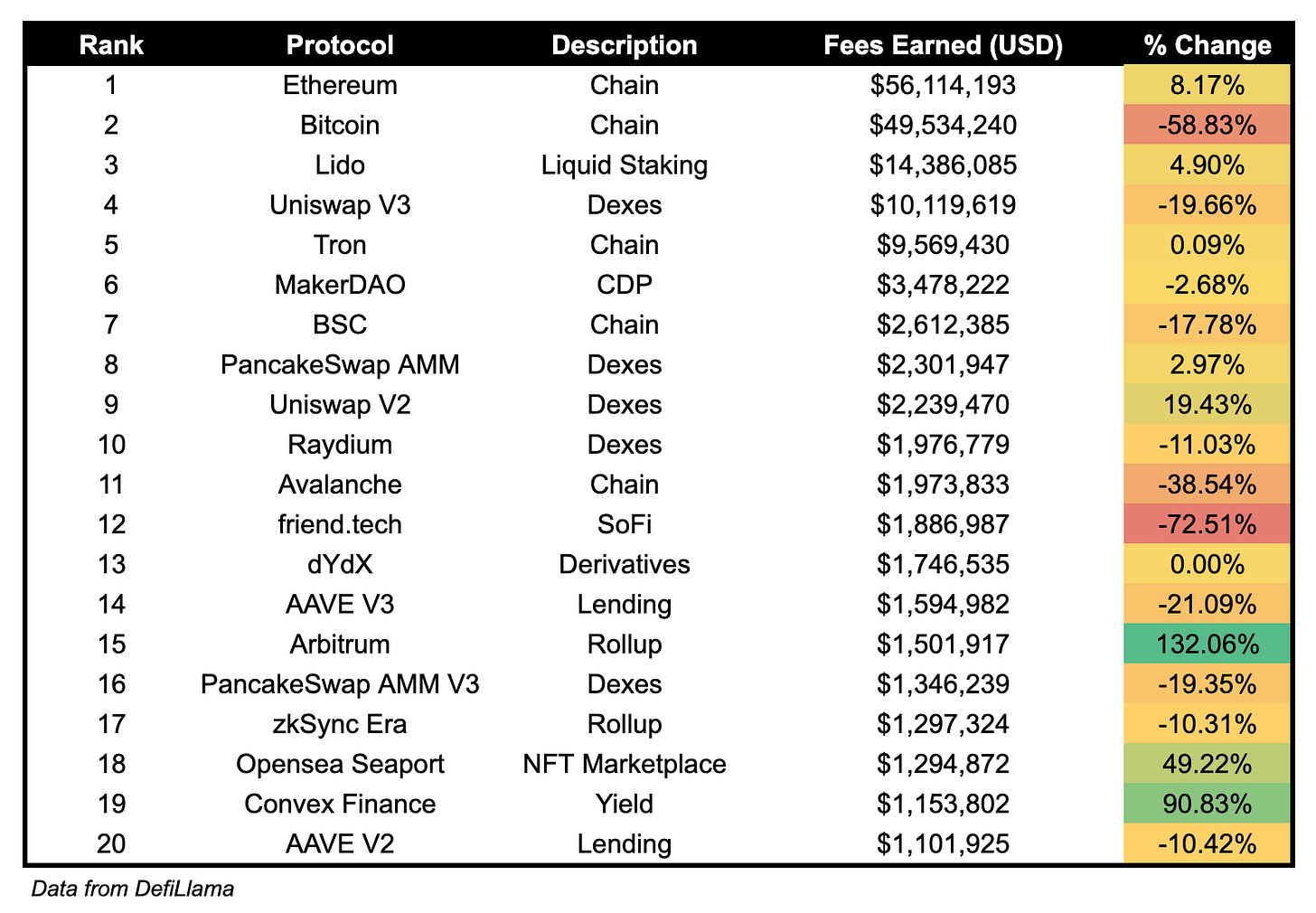

Arbitrum fees are up 132.06% this week. friend.tech fees earned are down 72.51%.

Governance Proposals

GIP-79: V3 Governance Framework

Gearbox proposal to separate different multisig roles and improve V3 governance in for future L2 deployments.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.