Weekly Notes 18

13-11-2023 to 19-11-2023

Developments

This week’s newsletter is sponsored by Pendle Finance.

Pendle Finance is a DeFi protocol that allows users to tokenize and trade future yields from staked assets and real-world assets.

Spartan Capital recently made an additional investment in Pendle through an OTC purchase to support Pendle's continued growth and expansion into new areas like real-world asset derivatives.

By enabling speculation on yields from both blockchain and traditional assets, Pendle presents an opportunity to bring more capital into DeFi and further its growth.

You can check out the different products and yield opportunities Pendle is offering:

South Korea’s National Pension Service (NPS) purchased $20 million worth of Coinbase shares (COIN). Relayed through their Q3 2023 report, this is the first investment the NPS has made in any digital asset related company.

It is of note that the NPS’ policy does state that it will never invest directly in crypto assets.

PancakeSwap Releases Gaming Marketplace

PancakeSwap has released a gaming marketplace which will allow developers to integrate CAKE, PancakeSwap’s native token, and publish their games for players to enjoy. Additionally, with PancakeSwap’s multi-chain presence and 1.9 million monthly user base, developers can “ensure the broadest reach for the games”

BlackRock has officially filed for a spot Ether ETF with the SEC.

Philippines Government Tokenizes Bonds

The Philippines will be offering $179 million of 1 year tokenized treasury bonds. Its interest rate is to be determined on the 20th November 2023 through book building.

The bonds will be due in November 2024 with a minimum denomination of $180,000.

Polygon’s gas fee skyrocketed to as high as 4000 gwei as the number of transactions on the network peaked to its highest since 2021 at 6.1 million transactions. This inflow is likely to be due to Polygon’s inscription event of PRC-20 POLs.

Bitcoin Ordinals NFT ‘Taproot Wizards’ announced that they have raised $7.5 million dollars in a round led by Standard Crypto. Co-founder of Standard Crypto, Alok Vasudev, has also said that “this investment has similar potential to the one Yuga Labs made in Bored Ape Yacht Club”.

Tether to Invest in Bitcoin Mining

Tether will be investing $500 million over the next six months to build out its own Bitcoin mining facilities in three countries.

Aave companies will be renamed to ‘Avara’ as it acquires a crypto wallet called “Family”.

The Aave protocol and Aave Labs names will remain unchanged but exist under Avara.

FRAX governance Proposal to make sFRAX bridgeable to multiple new chains

With the sFrax tokenized vaults only currently available on Ethereum, 5 proposals have been posted to make sFrax bridgeable via FraxFerry to 5 new chains: Arbitrum, Optimism, Polygon zkEVM, BSC (Binance smart chain) and Avalanche.

Posted earlier today, the proposals all have 91 thousand votes in favour but still need to each reach a 7 million vote quorum. The votes will conclude in 5 days on Nov 18th.

Another proposal is also in progress that would adopt “Axelar network’s representation of Frax Finance tokens” on chains where a dedicated Frax Ferry is unavailable allowing for bridging to Osmosis, Mantle, Linea, Kujira, Manta and Scroll.

Circle Ventures invests in Sei and announces upcoming integration of USDC

The venture arm of USDC stablecoin issuer Circle, has invested into the Layer 1 trading-focused chain, Sei.

This comes in tandem with Sei’s announcement stating the upcoming integration of native USDC which will bolster liquidity and unlock a more accessible means for cross-border transactions on the chain.

The TVL of Sei is $3.16 million and the MC of the SEI token is $284 million.

Circle Introduces USDC Minting For Entities In Singapore

Circle has announced the availability of ‘Circle Mint’ in Singapore after receiving a Major Payments Institution (MPI) licence. This means Singapore-registered entities can mint USDC with zero fees and instant availability.

Cosmos Governance Votes On If To Reduce Max Inflation Parameter From 20% to 10%

A proposal has been posted for voting on Cosmos governance to set Cosmos’ max_inflation parameter for ATOM (the staking token that secures the Cosmos Hub) from 20% to 10%. The current inflation of ATOM is 14%. If successful, this proposal would also bring the ATOM staking APR from 19% to 13.4%.

One of the main points is that lesser inflation of ATOM’s supply would position the token to be utilised as collateral and as a liquidity gateway onto the network thereby increasing its value proposition.

Four days in, 41.3% of voters have rejected the proposal, 36.0% have voted in favour, 1.5% have voted no with veto (a strong rejection of said proposal) and the rest have abstained. There are 10 days left until the vote concludes.

Ex-CEO of Compound Finance Raises $14 million For new on-chain RWA Tokenisation venture

The founder and ex-CEO of Compound Finance, Robert Leshner, has raised $14 million for his new venture - “Superstate” - an asset management firm that will offer tokenized real world asset investment products that benefit from the “speed, programmability, and compliance advantages of blockchain tokenization”.

The Series A round was co-led by Coinfund and Distributed Global.

Binance Labs Invests in Arkham’s token

Binance Labs announced its investment in the Arkham platform’s native token, ARKM,. The investment aims to support the at-scale on-chain insights Arkham offers as an AI-powered blockchain intelligence and data platform.

SEC DELAYS Hashdex BTC ETF and Grayscale Ether Futures ETF

The SEC has delayed its decision from November 17th to January 1st 2024 for both Hashdex’s application to convert its Bitcoin Futures ETF into a spot Bitcoin ETFas well as Grayscales application to launch a Ether Futures ETF.

OKX has launched their zero knowledge EVM compatible Layer 2 chain “X1” on testnet through Polygon’s Chain development kit. The chain will use OKX’s native token, OKB, which will be used by users to pay for gas fees on the network.

X1 will “serve as OKX’s new native network” utilising the security that zero knowledge proofs bring to “drive the future of Web3”. The chain aims to be live on mainnet in the first quarter of 2024

Aave Increases Borrow Rate for GHO

Aave has increased the borrow rate for their multi-collateral backed stablecoin, GHO, from 3% to 4.72% following governance approval.

The aim of this increase is to return GHO back to its $1 peg whilst remaining competitive to other stablecoin borrow rates (ie sDAI). The price of GHO has been under its peg for ~100% of its short lifetime and currently sits at $0.96 having dipped to as low as 0.91 late last month.

Noble and Circle USDC Cross Chain Transfer

Circle’s Cross Chain Transfer Protocol for USDC will be coming to Noble, an application-specific chain built for native asset issuance in Cosmos, on the 28th of November. This will allow users to send their USDC directly from other chains to all Cosmos chains that are connected to IBC like the dYdX chain.

Circle's CTO Marcus Boorstin said that “This will be the first time CCTP has integrated with a non-Ethereum Virtual Machine (EVM) chain.”

dYdX Chain‘s (dYdX v4) beta mainnet has gone live. Users can trade over 33 pairs. There will be no trading rewards at this stage but validators and stakers will accrue trading rewards.

Vitalik published an article on the Ethereum scaling technology, Plasma. Plasma chains settle on Ethereum but execute transactions off-chain with their own mechanism for block validation. The OMG network which utilises Plasma tech had its native token increase by as much as 33% before retracing to +10% on the daily.

Ankr partners with Optimism to launch a rollup as a service product to enable users to create an “an independent OP Stack-based L2 that exclusively serves traffic from their application or project”.

South Korean Crypto Legislation

South Korea's democratic party candidates will be required to disclose crypto holdings as it’s 2024 legislative election nears.

A proposal to swap $3 million of $ARB tokens, from the 1inch treasury, into USDC has been published for vote via 1inch’s Snapshot.

Having been live for 9 hours and with 7.5 million votes of the 10 million 1inch token quorum reached so far, 7.2 million votes are currently in favour of approving the swap.

The 2,575,405 $ARB tokens were received by 1inch as part of Arbitrum’s airdrop in March of 2023.

ether.fi 's liquid staking token, eETH, has gone live on mainnet. Currently, only whitelisted users can mint eETH. ether.fi will continue to whitelist more users to mint over the upcoming days.

Uniswap Labs has made over $1 million in the 27 days since turning on the 0.15% fee switch for the Uniswap Protocol last month.

Users may bypass the Labs fee through using aggregators, other frontends or through directly interacting with the smart contracts themselves.

Grayscale’s Solana Trust (GSOL) is trading at a 283% premium compared to the spot SOL price.

Today, GSOL ’s volume was $1.45 million. Its 30 day average volume is 2868 shares ($456,012 at $159 a share).

Ondo Finance has partnered with Axelar to make their short-term US treasury bill backed and yield-bearing stablecoin, USDY, bridgeable across chains. Initially, bridging for the token will only be available between Ethereum and Mantle.

Ryan Wyatt, former president at Polygon Labs and previously head of gaming for 7 years at Youtube, has joined Optimism as their Chief Growth Officer. He will lead business development, marketing and partnerships strategies among other initiatives.

Crypto Fund Inflows Reach $293M

Last week, weekly Crypto Fund inflows reached $293 million. Bitcoin inflows accounted for $240 million (81%) of that sum and Ethereum took second place with $49m million of total inflows.

Cumulatively, the last seven-weeks of inflows have reached over $1 billion. The year-to-date inflows have also totalled to $1.14 billion, the third highest yearly inflows on record.

Spot crypto trading volumes rose by 57.5% in October compared to September’s volumes.

Vertex Protocol, a DEX on Arbitrum, has released the tokenomics for their upcoming native token, VRTX. Users who stake VRTX will receive rewards directed from 50% of the protocol's revenue. Users will also receive voVRTX, a non-transferable token that represents a “token score” which acts as a multiplier effect on incentives for VRTX stakers.

Via Vertex’s rewards program, users can earn VRTX by trading on Vertex. Additionally, you can earn VRTX by participating in the VRTX Liquidity Bootstrapping Auction.

ZachXBT has revealed the GROK token’s twitter account to have previously “been reused for at least one other scam”. Upon publishing his findings on Twitter, the price of GROK went down by as much as 60% within 5 minutes. It currently trades at -40% from the price at posting and -48% from all times high which were achieved early today. The token has had $70.7 million in on-chain volume over the past 24 hours.

A proposal to backfund successful Arbitrum STIP proposals is ending tomorrow Nov 14 2:00 PM UTC. Of the 110,141,000 total votes so far, 69 million have voted in favour, 41 million have voted to reject and 141,000 have abstained to vote.

If successful, an additional 21.4 million ARB will be allocated to an additional 26 protocols for a total of 56 funded projects.

A fake BlackRock iShares XRP Trust Entity filing in Delaware was published. XRP spiked +20% upon the news being spread via notable crypto news stations but has since returned to -0.20% on the daily.

Note that anyone can place a file on Delaware's Website.

Trending Assets

Below $100M MC by performance, on chain

TAO, up 64.13%, and STFX, up 58.26%, were the top performers over the past week.

Above $100M MC by performance, on chain

OLAS had a great week, and is up 85.72%. PRIME is up 39.69% over the past week, and up 109.21% over the past month.

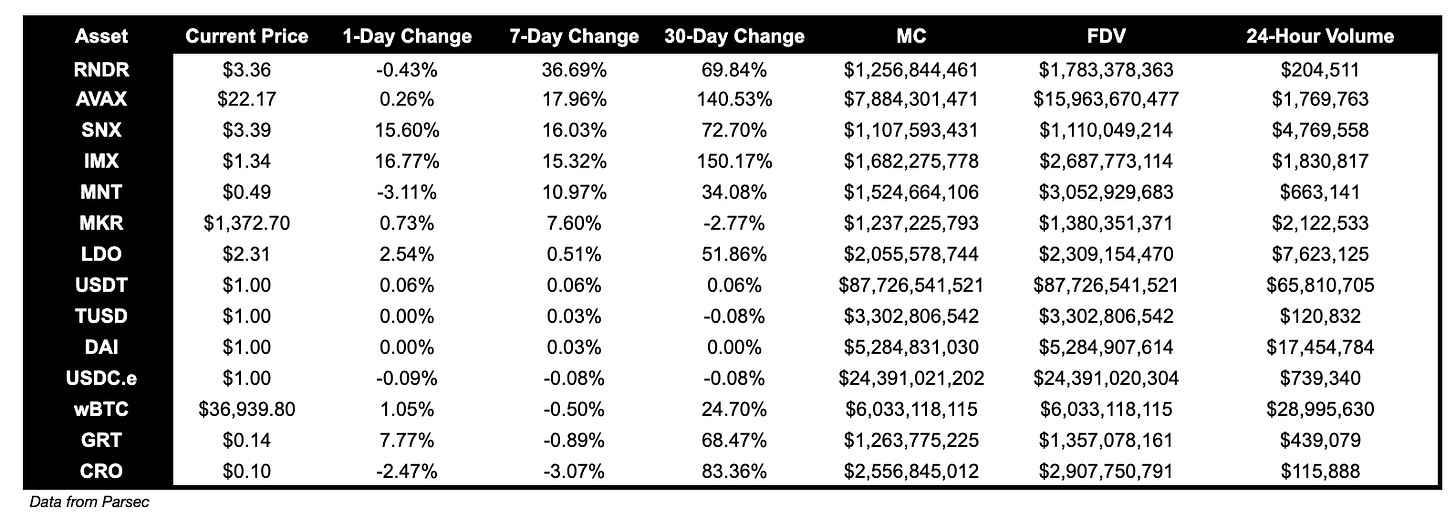

Above $1B MC by performance, on chain

RNDR did well, and is up 36.69% over the past week.

TVL

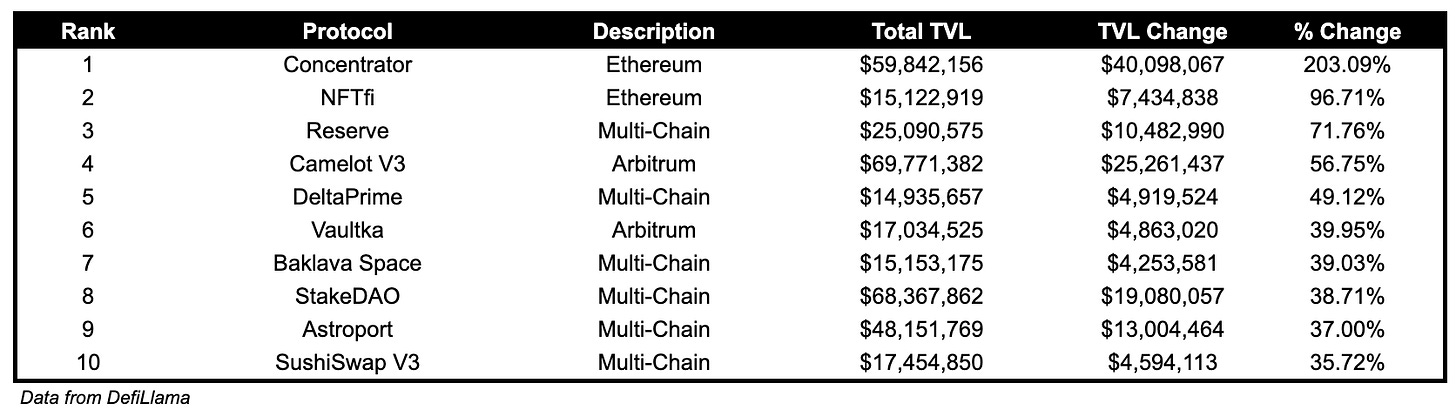

TVL Above $10M

Over the past week:

Concentrator, yield on Ethereum, TVL grew by 203.09%.

NFTFi, NFT finance on Ethereum, TVL grew by 96.71%.

Reserve, indexes on Ethereum, TVL grew by 71.76%.

Fees

friend.tech fees earned are up 358%, and Bitcoin fees earned are up 47.14% over the past week.

Governance Proposals

[ARFC] CRVUSD Onboarding on Aave V3 Ethereum Pool

Aave proposal to onboard CRVUSD onto Aave v3 on Ethereum.

Deploy New Tokenomics for Sushi [Signal]

Sushi proposal to update SUSHI tokenomics using trading, routing and staking fees as well as partnerships.

[FIP - 300] Frax Finance and Axelar Network

Axelar proposal for Frax to use Axelar Network to bridge FRAX and other Frax assets to chains where Frax Ferry doesn’t operate to.

Articles

ether.fi Ambassador Program

ether.fi has launched their ambassador program. Ambassadors,will receive exclusive access to project updates and news, early access to new products and features, and rewarding contribution opportunities.

New $STFX Staking Utility — Increased Performance Fees

STFX has introduced staking tiers that allow traders who stake the $STFX token to increase the performance fees they earn from 15% up to a maximum of 20% on each trade they manage. This represents a potential 33% increase in profits for staking traders.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.