Weekly Notes 17

Developments

BlackRock is working on launching a spot ETH ETF called the iShares Ethereum.

The SEC could approve spot BTC ETF’s as a minimum 8 day temporary window opens up starting on Friday Nov 9th.

ARB Staking Inital Proposal Passes

The Arbitrum staking proposal has passed Snapshot voting. If passing final vote, users will be able to stake their ARB to receive their share of 100 million ARB in rewards allocated from the Arbitrum treasury.

To get a ballpark figure for staking yield, we can use a simple model that looks at the # of ARB tokens in circulation and the number of ARB allocated for staking rewards. We can see that with 1.275B ARB tokens circulating, if 30% of these are staked, that would be 382.5M ARB.

See out full post here -

https://twitter.com/asxn_r/status/1721589480120103158

Illuvium

Illuvium, a game built on Immutable X, was listed on the Epic Games Store on Thursday. In response, the project's token, ILV, has surged by 22%. On Friday then ILV token reached a high of $95.

Previously, Illuvium raised $15 million in seed funding and another 4,018 ETH and 239,388 sILV2 (valued at $72 million in June 2022 and $26 million today if unconverted) in an NFT land sale in June of 2022. The game is set to be available to the public for download on November 28th as "Early Access."

The Illuvium universe will initially contain three different games: "Illuvium: Overworld," "Illuvium: Arena," and "Illuvium: Zero."

"Illuvium: Overworld" is a third-person open-world adventure where players explore an alien planet and capture powerful creatures known as Illuvials. These range in rarity and strength from Tier 0 to Tier 5 and are received in NFT form.

Note that the free-to-play experience of Illuvium will restrict players to only collecting Tier 0 creatures, which will always be obtainable. Players can then use ETH, the primary currency for playing Illuvium, to unlock the upper tiers and rarer creatures.

"Illuvium: Arena" is an auto-battler strategy game that lets players use their collected Illuvials to compete.

"Illuvium: Zero" is a game for mobile and desktop where players can develop and manage their own digital industrial complex.

The project's token, ILV, is a governance token that also rewards players for in-game achievements. It will be bought back by the team with all in-game purchases and fees revenue generated through the Illuvium universe.

The ILV bought back will then be directed to the Illuvium "Vault," where staked ILV holders and holders of Sushiswap’s ILV/ETH pool can claim ILV. The pools will receive ILV bought back in a 20:80 ratio, respectively. Users will claim ILV proportional to their personal "token weight."

Additionally, users who stake ILV can opt to receive sILV2 (synthetic ILV, 1:1), which can be used as in-game currency for travel and shard curing (activities that don't involve another player).

Chainlink staking v0.2 will launch to the public on December 11th 2023. The pool will have 45 million LINK in rewards. Early access will open on December 7th.

USDC’s Circle is considering going public via an initial public offering (IPO) in early 2024 as reported by Bloomberg.

In response, a representative of Circle stated that “Becoming a U.S.-listed public company has long been part of Circle’s strategic aspirations. We don’t comment on rumors.”

Previously, Circle was valued at $9 billion when it attempted to go public via a blank check merger deal with Concord Acquisition Corp in 2021, which was ultimately terminated in December 2022 due to the transaction timing out. After the failed merger in 2022, Jeremy Allaire, co-founder of Circle, expressed disappointment and said that “becoming a public company remains part of Circle's core strategy to enhance trust and transparency,” which reinforces the news.

The EigenLayer voting contest to add new LSTs to the protocol is complete. The current standings as of Wednesday 7th are as follows:

All projects that receive over 15k ETH in votes will be added to EigenLayer in order of the votes received, in ‘the next few months’.

swETH, sETH2 & oETH will be added to EigenLayer as a result.

EU Parliament Approves Data Act With Smart-Contract Kill Switch Provision

The European Parliament approved an act that would require smart contracts to have a kill switch. The next steps towards the act being implemented would be approval from the European Council.

Circle Releases v2.2 For USDC and EURC

Circle has released v2.2 for their stablecoins - USDC and EURC. The update decreases gas costs, increases the security of transactions involving them on EVM chains, and provides improved support for account abstraction which enables developers to build products where users can pay gas in USDC or EURC.

Ark Invest and 21Shares are getting ready to launch 5 new ETF‘s that will give investors exposure to digital assets, including Bitcoin and Ethereum futures contracts.

Riot Platforms, a Bitcoin mining firm, has released their 2023 Q3 report which shows increased revenues by 11.2% from $46.3 million to $51.9 million compared to their Q3 2022 reports. Additionally, they mined 1,106 BTC compared to 1,042 BTC in Q3 2022.

Immutable Partners with Ubisoft

Immutable has partnered with Ubisoft’s Strategic Innovation Lab to “a new gaming experience to further unlock benefits for players through the power of web3”.

A New York judge approved Celsius’ plan to restart under the name “NewCo” which would see the distribution of $2 billion BTC and ETH to Celsius customers as well as NewCo Stock.

NewCo would also be seeded with up to $450 million of liquid cryptocurrencies and have its stock listed on the NASDAQ. Fahrenheit LLC, who will manage NewCo, will inject up to $50 million in exchange for an equity stake in the company. NewCo would expand on Celsius’ mining and staking operations.

Polygon has relaunched their grant program “Polygon Village” which will use 110 million MATIC ($90 million) to fund both projects both existing and being developed on the chain.

Former Flashbot’s co-founder, Stephane Gosselin, has released a Telegram bot named ‘Alfred’ which allows users to trade tokens on Ethereum while protecting against MEV.

HTX and Tron founder, His Excellency Justin Sun, has asked via his Twitter if the public would like to see Inscriptions come to Tron.

HSBC Partner With Ripple Owned Company

HSBC has partnered with Metaco, which is a Ripple owned company. Metaco provides infrastructure for financial and non-financial institutions to securely build their digital asset operations including tokenized securities custody service for institutional clients. The service aims to go live in 2024.

Robinhood Expands Crypto Services To EU

Robinhood to expand its Crypto services into the EU. It will also be establishing a UK brokerage in the next few weeks.

Near Partner With Polygon On zkWASM

The Near Foundation and Polygon Labs have partnered to develop a zero knowledge prover for WebAssembly (WASM) blockchains available via Polygon CDK. Success will mean a more interoperable Web3 ecosystem that will allow WASM chains to tap into Ethereum liquidity.

Grayscale’s Chainlink Trust is trading at $44 which is a 297% premium on spot LINK prices. Note that Fridays volume was $880,000 and the 30 day daily volume of the Trust is $132,000.

Ondo Finance has partnered with Mantle to launch USDY on the Mantle network. USDY is a yield bearing stablecoin overcollateralized by short-term US Treasuries and “high-quality bank demand deposits' that currently yields 5.1% APY. The TVL of USDY is currently $35 million. It is unknown how much of the current TVL is contributed by the Mantle DAO Treasury.

Sushi’s founder, Jared Gray, has published a proposal to redefine the tokenomics for the protocol’s token, SUSHI. The revamps would scale fees from Sushi pools, routing fees via Sushi’s aggregation router, and more. Additionally, it would attempt to align SUSHI tokenomics to ensure longer term incentives for LPs, provide a stable token supply for xSushi holders.

Kraken Considering Building an L2

Kraken is considering blockchain-technology firms to help them launch their own Layer 2 chain. These firms include Polygon, Matter Labs, and Nil foundation and others that are not publicly disclosed.

GMX To Deploy ARB LP Incentives

GMX started to deploy the 12 million ARB (~$13 million) received via the Arbitrum STIP program on the 8th of November. A portion of the ARB will be used to incentivise liquidity providers and trading weekly over a 12 week period. Week 1 will see 200,000 ARB allocated to GM liquidity incentives. Additionally, 2 million ARB will be used to support Arbitrum protocols building on and integrating with GMX.

On Tuesday 7th NovAn Enjin token multisig withdrew 169.3 million ENJ (~$52 million) from Binance. The wallet now holds 201.7 million ENJ which is equal to 20% of the tokens supply and valued at $64 million.

Co-founder of BitMEX, Samuel Reed, has pleaded guilty to Bank Secrecy Act Violations and has agreed to pay a $10 million fine. His co-founders, Arthur Hayes and Benjamin Delo pleaded guilty to the same crime earlier in February of 2022.

USDC will be natively available on Moonbeam. Users will be able to pay for gas and transact with USDC without needing to hold DOT via establishing a Polkadot Asset Hub account. This has been done in order to attract mainstream users to Polkadot and grow the ecosystem.

Aave V3 has gone live on Gnosis chain.

Shrapnel, a first person Avalanche blockchain based shooter that recently raised $20 million and another $10.5 million in 2021, has launched their token SHRAP on the Avalanche chain. It will be available for trading on HTX and Kucoin tomorrow when deposit volum meets the demand of market trading on HTX and "10:00 UTC" on Kucoin.

Shrapnel's early access beta is scheduled for December on the Epic games store for players who own an Extraction pack.

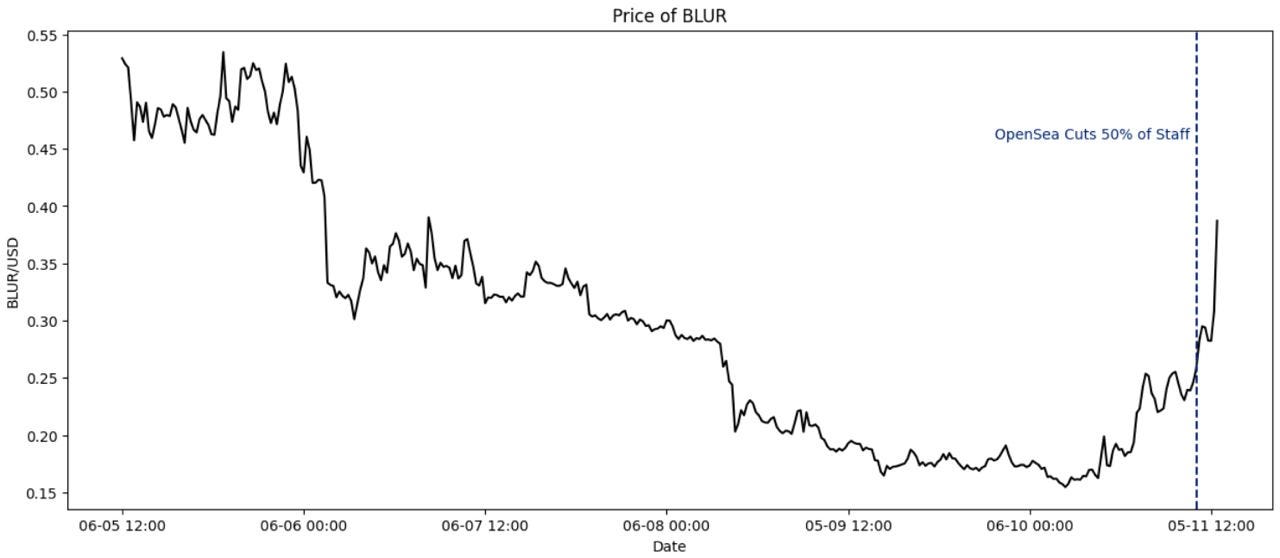

Blur Shows Strength Amidst NFT Bear Market

As OpenSea cuts 50% of its employees, the BLUR token has soared by 31% on the 6th. Since bottoming on October 12th, BLUR has gone up by 140% to its current price of 0.36 cents.

$44 million of Hashflow's token, HFT, will be unlocking on November the 7th at 00:00 UTC. $17 million worth will go to early investors, $13.52 million to Ecosystem Development, $13.28 million to the Core Team and $115,000 for community rewards.

Germany 3rd Largest Bank Launch Crypto Custody

Germany’s third largest bank, DZ BANK, has launched its own digital asset custody platform for the processing and custody of digital financial instruments. Dr. Holger Meffert, the head of Securities Services & Digital Custody at DZ BANK, stated that “within the next ten years a significant proportion of capital market business will be processed via distributed ledger technology (DLT)-based infrastructures”.

Last week, weekly crypto fund inflows reached $261 million. Cumulatively, the last six-weeks of inflows have totalled $767 million, the largest since December 2021.

Bank of England Stablecoin Bill

The Bank of England and Financial Conduct Authority (FCA) is asking for feedback on their proposals for stablecoin regulation which would, if successful, seek to regulate fiat-backed stablecoins in early 2024 and algorithmic stablecoins which would come shortly after.

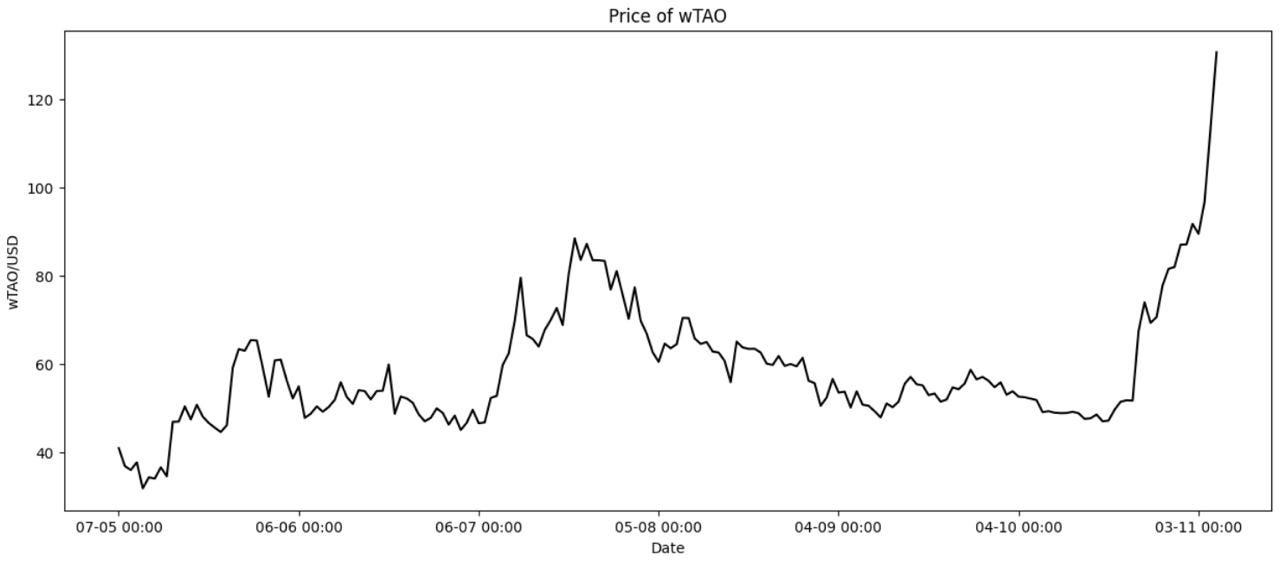

TAO

Bittensor, a decentralised AI project broke out to near all time highs with large social media engagement.

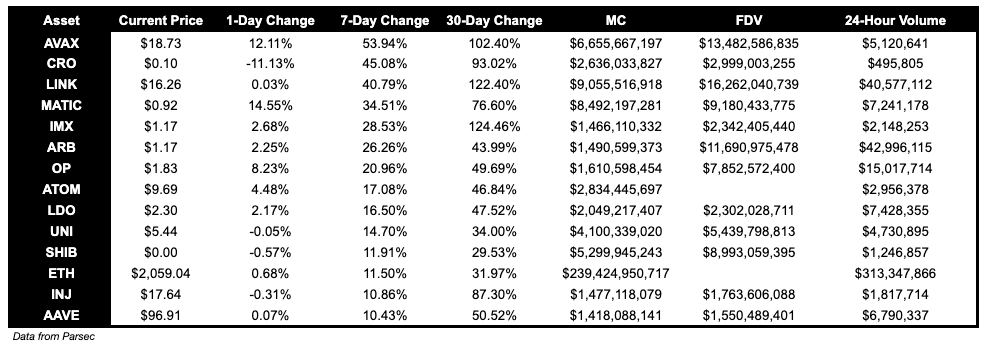

Trending Assets

Below $100M MC by performance, on chain

FTT is up 214.30% this week.

Above $100M MC by performance, on chain

PRIME, a P2E game, had a great week, and is up 77.31%. BNT was the top performer of the week, and is up 167.84%.

Above $1B MC by performance, on chain

AVAX performed well this week, and is up 53.94%. CRO continues to show strength, and is up 45.08%.

TVL

TVL Above $10M

Over the past day:

Equation, derivatives on Arbitrum, TVL grew by 117.59%.

Ghost, lending on Kujira, TVL grew by 85.72%.

Cetus, DEX on Aptos and Sui, TVL grew by 85.19%.

Fees

Bitcoin fees earned are up 406.68% - following the rise in inscription and BRC-20 volume. Raydium’s, a DEX on Solana, fees earned are up 341.96%.

Governance Proposals

[ARFC] GHO - Increase Borrow Rate

Proposal to increase the GHO Borrow Rate from 3.00% to 4.72%, the proposed sDAI rate.

Stargate proposal shutto down BNB BUSD pool and associated pathways and swap all BUSD multisig holdings into another highly liquid, USD-pegged stablecoin.

Aave proposal to upgrade the Aave Swap Contract to include Limit Orders and TWAP swap functionality.

Proposal to Backfund Successful STIP Proposals

Arbitrum proposal to backfund 26 STIP Round 1 proposals that were approved but not funded due to budget issues, allocating 21.4M additional ARB. Projects which would potentially receive the highest portion of the backfund allocation are: Gains (4.5M ARB), Synapse (2M ARB), Wormhole (1.8M ARB) and Stargate (2M ARB).

Should the Lido DAO accept ownership of wstETH Bridge Components on zkSync Era?

Lido proposal for Lido DAO to accept the ownership of the wstETH bridging on zkSync Era.

[ARFC] Treasury Management - vlAURA

Aave proposal to lock the AURA holding in vlAURA via the Strategic Asset Manager and delegate managing the position to the GHO Liquidity Committee.

[ARFC] Arbitrum USDC Migration

Aave proposal regarding the parameters to migrate USDC.e to native USDC on Arbitrum.

[BIP-481] Claim and Lock Balancer DAO Aura allocation into vlAura

Balancer proposal to lock the vested 1.4m Aura and 600k unvested Aura into vlAura to begin earning rewards and eventually start allocating vote weight towards revenue generating pools.

Articles / Threads

Introducing $ARB Trading Incentives on Vertex

Users can earn VRTX and ARB by trading on Vertex or LPing Elixir Fusion pools.

STFX has launched spot vaults, and users can now trade every ERC-20 coin directly through the platform.

Lido has launched wstETH on Base. The initiative was led by KyberSwap, Beefy, and Superbridge.

Arbitrum STIP Rewards for Rysk

Rysk Finance's proposal to the Arbitrum STIP was voted to receive $500k ARB to distribute as rewards to Rysk liquidity providers and options traders on the Rysk platform. The rewards will be distributed weekly from November 3rd, 2023 to February 9th, 2024. Liquidity providers in the Rysk DHV vault will receive a share of ~17.8k ARB weekly, proportional to their share of the total vault. Options traders will receive a share of ~17.8k ARB weekly, with 80% going to contract sellers and 20% to buyers who hold positions for over 24 hours.

Introducing ARB Rewards on Perennial

Perennial has been granted 750,000 ARB tokens from Arbitrum to distribute as incentives over the next 3 months to grow activity on Arbitrum. The incentives program will run for 12 weeks with rewards distributed each week totalling around 62,500 ARB per week. Rewards will be split between traders and liquidity providers.

Take Profit & Stop Loss Orders – Live on Vertex

Vertex has launched Take Profit and Stop Loss orders on their trading platform.

Introducing the Canyon Hardfork

Canyon will activate on Optimism, Base, and other Superchain testnets on November 14th at 17:00 UTC.

The hardfork includes support for the Shanghai and Capella Ethereum hardforks and some minor bug fixes.

The EIP-1559 basefee denominator will increase from 50 to 250, reducing how quickly the basefee rises when blocks are over the gas target.

Unclosed channels will now be handled differently, allowing the op-node to read the first channel ready instead of requiring channels to time out.

A new field will be added to deposit transaction receipts to fix a bug in consensus encoding.

The create2Deployer bytecode will be set on all OP networks, enabling access to a commonly used contract.

Node operators will need to upgrade their nodes, and governance updates will announce when mainnets can upgrade.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.