Weekly Notes 16

23-10-2023 to 29-10-2023

Developments

Blackrock Receive BTC ETF CUSIP

The Blackrock iShares spot Bitcoin ETF was listed on the DTCC (Depository Trust & Clearing Corporation), and is the first spot ETF to do so. It received a CUSIP number (all North American / Canadian securities have this 9-digit alphanumeric code identifying it) and had the ticker $IBTC if approved.

In the most recent iShares s-1 amendment, the application was also altered to suggest that the cash to seed the ETF would be started in October. The listing lead to positive price action.

The following day, on the 24th, Blackrock’s iShares spot BTC ETF was removed from the DTCC (Depository Trust and Clearing Corporation). It was listed back later.

The Grayscale spot BTC ETF conversion ruling has been confirmed by US courts after the SEC announced it would not be appealing last week. A refreshed, new application has been filed by Grayscale to convert the Trust into a ETF which also has to be reviewed by the SEC along with the several other BTC spot ETF applications.

Prisma Finance will be raising the debt cap for their four depositable collaterals tomorrow on Tuesday 24th at 7pm UTC. This is the final debt cap increase before the launch of PRISMA, the protocol's native token that when locked into vePRISMA will allow users to determine how PRISMA emissions are distributed within the protocol much like veCRV.

Celestia, a modular blockchain network that provides a scalable data availability layer for developers, is “ready to launch'' the mainnet beta for their network as stated by an official blog post written by the team. Additionally, according to a milestone date on their github repository, “Mainnet” is due by the 31st of October

Yearn Finance, a yield aggregator, has revamped the tokenomics of their native token YFI. Token holders can now lock their $YFI for up to 10 years for veYFI which will allow users to vote on where to allocate previously bought back YFI to pools for an increased reward boost. veYFI will also serve as the protocols governance token. Furthermore, the revamp sees the introduction of dYFI, which will allow holders to redeem 1:1 for YFI in exchange for ETH but at a discounted rate compared to the market.

The Astar Network's zkEVM testnet, zKatana, is now live. The network will aim to empower builders and enterprises to tap into web3 securely.

Worldcoin Change Payment Currency

Worldcoin will be paying their eye-scanning Orb operators in the project's native token WLD instead of USDC. The transition is estimated to be completed by next month.

FTX Exchange Has 3 Bids For Relaunch

FTX is considering three bids proposing to restart trading on the bankrupt exchange. The FTX estate has said they will make a decision on how to proceed by mid December in a court hearing held on the 24th as they engage with multiple parties interested in acquiring, partnering and possibly investing in the future of FTX.

Perella Weinberg Partners - who were hired as the investment bankers after FTX collapsed - represented by Kevin M. Cofsky in the hearing, outlined the potential options to Judge John Dorsey. They include the selling of the entire FTX exchange and the 9 million accompanying customers, or bringing in a partner to help restart the exchange

Additionally, FTX is also considering restarting the exchange by itself.

Galaxy Estimate $14B In ETF Inflows In The First Year

Galaxy has estimated possible inflows of up to $14 BILLION in the first year following the listing of a spot BTC ETF in a research article published 24th. They also predict inflows of $25B in the second year and $38.6B in the third year after a spot BTC ETF

dYdX chain (v4) is now completed and fully open source to the public after undergoing an audit from Informal Systems which found 1 critical issue that is now resolved. The chain, currently in public testnet, will run on Cosmos and will offer "greater decentralisation, scalability, customizability, and speed than any other version of dYdX to date".

On the 24th, Scroll had seen 7479 ETH ($13.64 million) bridged to its mainnet, over 26,000 unique users and 657,842 transactions on the network since the 11th of October.

1inch Investment Fund Sell stETH

The 1inch Team investment fund sold 4685 stETH for 8.54M USDC at an average price of $1823 per stETH. The estimated profit is $1.28 million.

Gnosis’ actively managed treasury sold 3000 wstETH for $6.2 million $DAI at an average of $2,066 per wstETH.

The TON Believers fund has stopped accepting new deposits after 1.317 billion TON tokens (~25% of TON supply and worth approximately $2.832 billion) were deposited by $TON holders. 1.034 billion TON was deposited by users that opted to lock their tokens for 5 years. For the first two years, the tokens are completely locked and then vested over the remaining 3 years with additional TON rewards. These additional rewards amount to 284 million TON which came from community members that opted to donate TON into the fund to benefit those who locked their tokens.

LSD Whale Sends 30k ETH To Binance

A large staked ETH & money market farmer just withdrew 28,939 stETH from the Lido staking contract, before sending 30,710 ETH to Binance.

Address: 0x4353e2df4E3444e97e20b2bdA165BDd9A23913Ab

On the 24th, the FTX estate sent 100,000 $SOL (approximately $3 million) to Kraken, 51,335 $SOL ($1.54 million) to Binance, 25,000 $SOL ($750,000) to Coinbase and 15,335 $SOL ($460,050) to an unlabelled address.

This amounts to a total of $5,750,000 worth of $SOL moved.

On the 25th, Alameda has also sent $2.2 million of $LINK, $2 million of $MKR and $1 million of $AAVE, to Wintermute.

Polygon’s POL token contracts are now live. The POL token will replace $MATIC and will act power Polygon L2’s, including Polygon zkEVM, “via a native re-staking protocol that allows POL holders to validate multiple chains and perform multiple roles on each of those chains [as validators]”.

Users can choose to migrate by sending MATIC to the contract address. Regardless, all MATIC tokens on Polygon POS will automatically become $POL with a 1:1 ratio throughout.

Maestro, a Telegram trading bot, had their router hacked for 280 ETH ($510,000) of user funds. In response, Maestro spent 276 ETH “to secure our users tokens” and within 10 hours of the exploit, Maestro spent an additional 340 ETH to fully refunded users affected.

Ark Invest, sold $3.6 million worth of Coinbase stock ($COIN) and Grayscale Bitcoin Trust $GBTC this week.

Two days before this sale, on Tuesday, Ark Invest also sold $5.8 million worth of $COIN and $GBTC.

Shrapnel, a blockchain based first person shooter game being built on Avalanche, has raised $20 million in a funding round led by Polychain Capital.

Previously, Shrapnel also raised $10.5 million in 2021. The game is currently still in development but will incorporate NFTs and smart contracts to allow a tournament host to automatically distribute rewards.

Shrapnel will also have its own token, $SHRAP. $SHRAP will be used to pay validators, to reward players, to buy in-game items in the Shrapnel marketplace and also to mint player created content. It will also be used for Governance.

SBF took the stand. This comes after his defence team said it would seek to introduce evidence that highlights "inconsistent statements" testified by former FTX executives Gary Wang and Nishad Singh.

Arbitrum will be integrating Celestia for its scalable data availability into ‘Arbitrum Orbit’ - a service that allows users to create chains that settle on Arbitrum L2.

The Fantom Foundation has launched the testnet for Fantom Sonic, a new virtual machine that will enable Fantom to achieve “2000+ TPS at an average finality of one second while consuming a fraction of the storage used by its predecessor, Opera”.

LayerZero Integrating EON and wstETH

LayerZero integrates Horizen’s “EON”, a EVM compatible side chain and smart contract platform powered by Horizon. Additionally, LayerZero will be integrating Lido’s wstETH, allowing it to be moved across Ethereum, Avalanche, BNB Chain, and Scroll.

On the 24th, the ProShares Bitcoin strategy ETF ($BITO) traded 36.92 million shares which is 4 times the average daily volume.

Vodafone Partners with Chainlink

Vodafone’s Digital Asset Broker partnered with Chainlink to successfully test the transfer of trade documents via public and private blockchains to support trade processes.

Circle has partnered with crypto exchange, BitoPro, and FamilyMart, a convenience store franchise chain with shops throughout Asia, to work on a service that will allow customers in Taiwan to redeem their FamilyMart loyalty points - “FamiPoints” - for cryptocurrencies, like USDC, via their BitoPro account.

J.P.Morgan’s “Coin Systems”, which uses a permissioned distributed ledger (a private blockchain) to facilitate 24/7 cross border payments, now facilitates $1 billion in daily transactions.

DYDX Chain Launches

On the 25th, the dYdX chain (v4) went live to mainnet and produced its genesis block. The frontend for bridging to the chain is set to go live on the 30th of October.

During the alpha stage after the bridge is deployed, dYdX will limit trading functionality to prioritise stability and security.

Prisma Finance will be launching their governance token, PRISMA, on the 2nd of November.

3% (9 million PRISMA) of the total supply will be distributed towards veCRV voters, who voted to whitelist mkUSD and Prisma pools on Curve finance, and Prisma point holders, who received points for engaging with the protocol.

EtherFi Partner With Polygon zkEVM

ether.fi has partnered with Polgyon zkVM to bring native ETH staking to the chain. Soon users will be able to stake their native ETH directly on Polygon zkEVM by acquiring weETH, ether.fi’s wrapped version of their LST, eETH.

Arbitrum Orbit, a service that allows users to create chains that settle on a Arbitrum L2, is “mainnet ready”. Users are still advised to first deploy on testnet to mitigate the risks of a new chain.

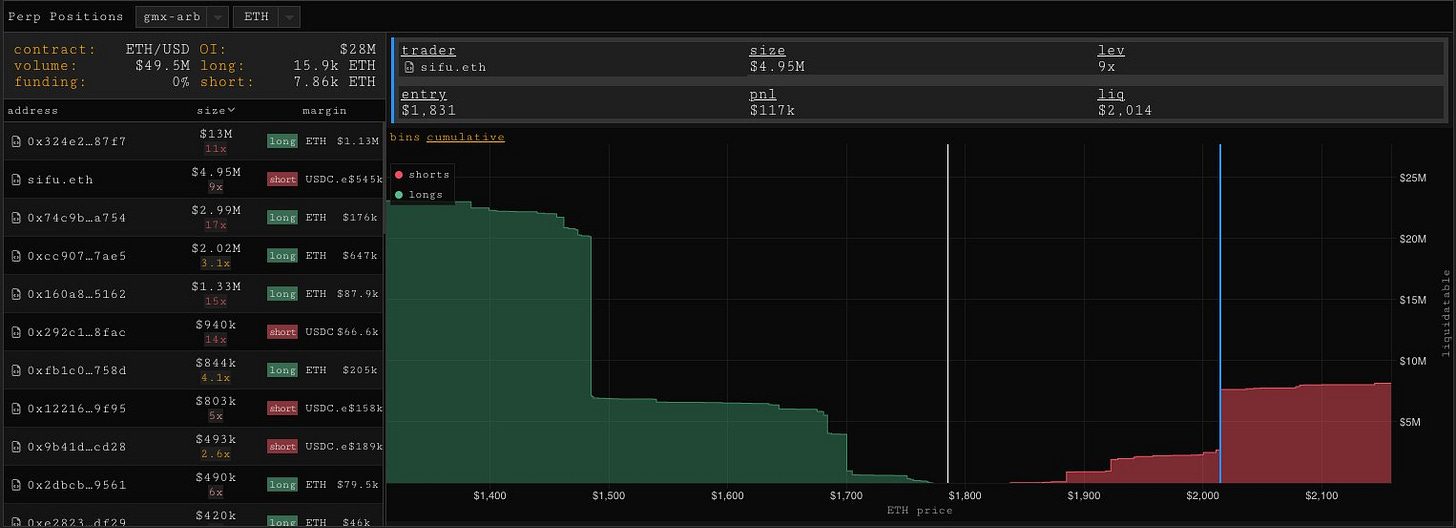

Sifu Shorts $5M On-Chain

0xSifu has migrated his $4.95M ETH short from Synthetix to GMX.

His liquidation level is $2,014 (+13%).

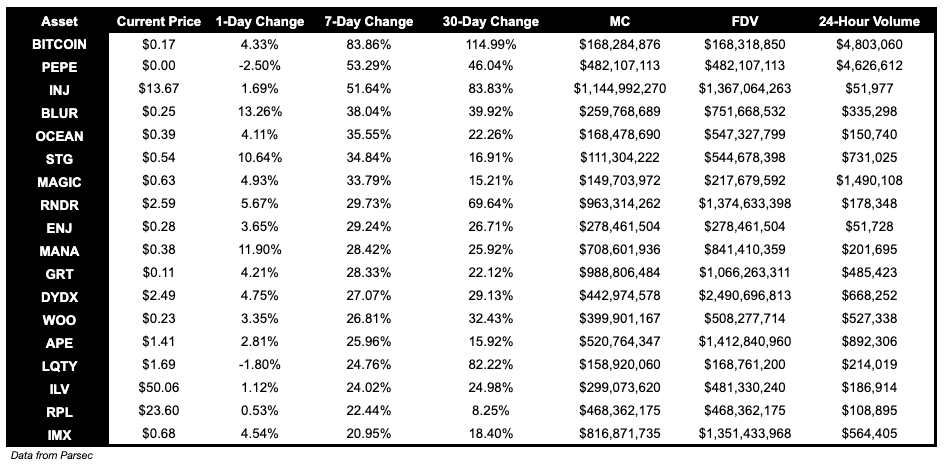

Trending Assets

Below $100M MC by Performance, on chain

Botto, an AI related coin gained 138% this week. AI sector has been performing well with the likes of TAO, WRLD, IMGNAI having outsized weeks also.

Above $100M MC by performance, on chain

BITCOIN & PEPE were two meme coins that performed well this week, both up more than 50%. Injective put in a big week also, with optimism about their buyback and burn mechanism taking shape.

Above $1B MC by performance, on chain

LINK broke out of its 524 day range and gained 16.8% this week.

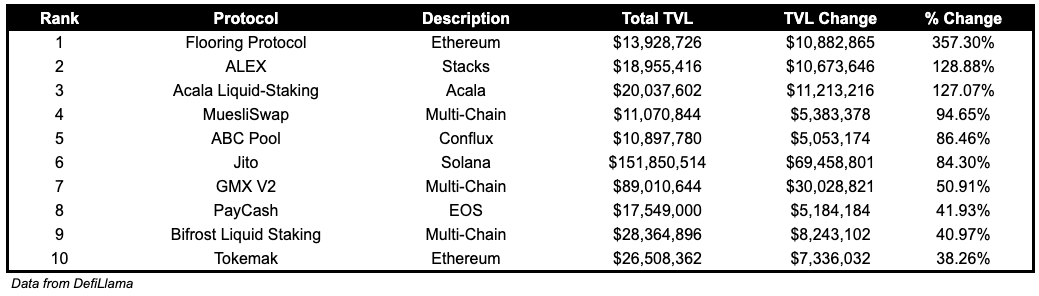

TVL

TVL Above $10M

Over the past week:

Flooring Protocol, NFTFi on Ethereum, TVL grew by 357.30%.

ALEX, DEX on Stacks, TVL grew by 128.88%.

Acala Liquid Staking, liquid staking on Acala, TVL grew by 127.07%.

Fees

Opensea Seaport fees earned are up 323.47% over the past week. GMX, Synthetix and Gains fees earned are all down more than 50%.

Governance Proposals

SIP-57: Introduce Protocol Owned Liquidity

Proposal to introduce protocol-owned liquidity via sales of SPA bonds using the bond protocol and treasury tokens.

[FIP - 294] Add pETH-frxETH to FXS Gauge Controller

Proposal to add pETH-frxETH to the FXS Gauge Controller. pETH is JPEG’d’s ETH-pegged derivative product.

SIP-56: Proposal to Reduce Emissions

Proposal to decrease SPA emissions from Demeter farms by 50%, curb SPA bribes dispensed by SPA Gauge by 20% and to shift Demeter emissions to xSPA.

Articles / Threads

Synthetix V3 Loans: No interest. No fees.

Synthetix V3 will have zero interest or fees charged to borrowers. Users can deposit collateral to generate sUSD without interest or other fees

Injective Integrates Web3 Finance Data into Google Cloud BigQuery

Injective has launched Injective Nexus, their official data integration and availability on Google Cloud, one of the leading providers of cloud computing services.

Introducing Buyback and Make: Kicking Off The PRTC Flywheel

The protocol will use a portion of their revenue, to buy back PRTC from the open market. Instead of burning the bought back tokens, they’d live in a custom Balancer Weighted Pool, with an initial weight of 80/20 - PRTC/ETH.

[BIP463] Enable D2D/rETH 80/20 Gauge [Arbitrum]

Balancer proposal to activate a 2% capped gauge for an 80% D2D / 20% rETH pool on Arbitrum.

[BIP-462] Enable axlETH/WETH Gauge [Base]

Balancer proposal to activate an uncapped gauge for a stable axlETH/WETH pool on Base network.

[BIP-461] Enable swETH/wstETH gauge [Ethereum]

Balancer proposal to enable a Balancer gauge for a swETH/wstETH pool on Balancer Ethereum.

Staking Router Module Proposal: Simple DVT

Lido proposal for DAO approval for the addition of a new module that will utilize Distributed Validator Technology (DVT) on mainnet through Obol Network and SSV Network implementations.