Weekly Notes 14

18-09-2023 to 24-09-2023

Developments

Bitcoin Hash Rate Reaches All Time Highs

Bitcoin hash rate has reached a new all-time high at 423.1M Hash Rate TH/S.

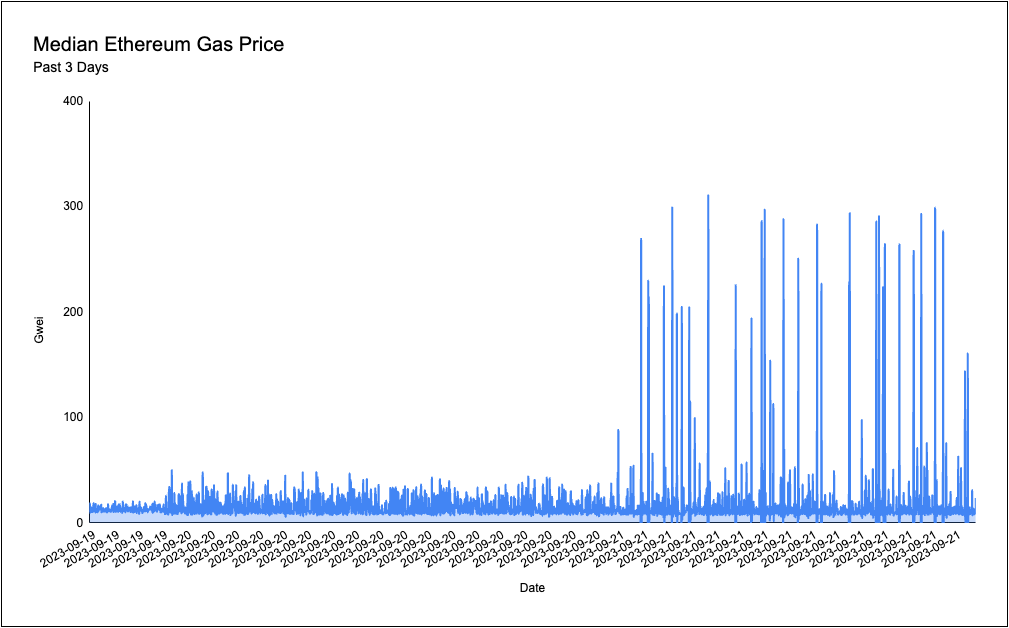

Binance Hot Wallet Address Spikes Ethereum Gas

A Binance address spent 530 ETH, equivalent to $845,000, on Ethereum gas fees in order to consolidate user funds across 140,000 transactions. The spree saw the address use 300 gwei consistently, bringing the Ethereum network’s gas fees from $0.17 to $11.20 a transaction.

The address is a Binance hot wallet address that accumulates user’s crypto that has been deposited onto the exchange and transfers crypto to users when they withdraw from the exchange.

Optimism Sell OP Tokens To VC’s

Optimism has sold a total 116 million $OP tokens, valued at $151,960,000 at today's price, to 7 entities in a private token sale for “treasury management purposes' “. These tokens will be locked for 2 years but the owners will be able to delegate their tokens to third parties that can then participate in Governance.

The 116 million tokens is equivalent to 14.5% of Optimism’s current circulating supply and comes from the 8.8% of unallocated tokens (8.8% of total supply = 377,957,122.048 $OP) from the total supply.

over the last 24 hours.

Ripple (XRP) has revealed that they spent a cumulative $200 million on legal fees after winning the lawsuit against them in July of this year, by the SEC (who accused XRP of being a security). Ripple’s troubles may not be over however as the SEC is seeking approval to appeal the result of the lawsuit.

Lido has proposed a new governance module called GOOSE (Guided Open Objective Setting Exercise) which sees short (1 year) to long term (3 year) goals be set in a decentralized and adaptable manner.

It is not uncommon for protocols to suffer from low governance participation. Therefore Lido’s GOOSE - and other future modules – will seek to provide an adequate replacement for the traditional managerial systems and procedures that, although efficient, do not align with Crypto’s main attribute of decentralisation and thus are unavailable.

GOOSE is the first module in a possible wider framework that allows anyone from Lido as well as the wider Ethereum community to contribute and submit goals tied to the DAO’s “mission, vision and purpose (aka vibes)”. These goals will be open to reevaluation on a yearly basis in order to allow protocol contributors to have an easily accessible and up-to-date reference point, whilst keeping sovereignty over the creation, building and contribution process.

Incentivisation of users creating proposals (and builders building projects of course!) was also touched upon in the proposal and does see a possible compensation for contributors/builders who’s proposals align with the reference maxtrix “Vibes”.

The possible benefits are that the framework would allow for faster and easier governance decisions as well the proper alignment of goals with funding to reduce the unnecessary waste of resources. In addition incentivisation also attracts better builders and contributors alike.

Spark Protocol Debt Ceiling Increase

Spark Protocol, a DAI-centric Maker SubDAO focused on lending and borrowing, has increased their debt ceiling from $200 million to $400 million. This means another additional $200 million directly injection from Maker, can be borrowed by users.

Citigroup (Citi), whose assets total $2.4 trillion, has debuted their “Citi Token Services” pilot which uses a private blockchain owned by Citi to facilitate the exchange of customer’s deposits for digital tokens that can be sent anywhere instantly.

Reportedly, Citi’s customers will also not need to set up their own digital wallets and will be able to access the service through existing systems.

Notably, Citi has also explored the use of smart contracts in trade and shipping with one of the largest ocean-cargo companies, Maersk (a.k.a A.P. Moller-Maersk A/S), to demonstrate the automatic transfer of tokenized tokens upon prerequisites and conditions being met via smart contracts. This would reduce the transaction speed from days to minutes.

Canto L2 Migration

Canto will be migrating to a zero-knowledge powered Layer 2, utilizing Polygon’s Chain Development kit to do so.

Canto’s current TVL is $42.82 million,. It’s all time high TVL was $204 million back in March of 2023.

Standard Chartered, Northern Trust and SBI partner with Zodia

Standard Chartered, Northern Trust and SBI Holding’s (combined AUM of $2.29 trillion) together with Crypto custody focused venture, Zodia Custody, have partnered with OpenEden to work on providing institutional clients yield on their tokens via real world asset opportunities. Additionally, Zodia will also be offering staking services.

As of now, Zodia offers clients secure custody of their crypto, an Ethereum Staking solution, a service called “Zodia interchange” that allows clients to “trade assets directly from a fully segregated institution-grade trading wallet” in a isolated manner as well as other services.

Eclipse has introduced the architecture of their future Ethereum SVM L2 which will be “Ethereum’s fastest Layer 2”.

The chain will execute on the Solana Virtual Machine to take advantage of the environments parallel transaction capability, settle on Ethereum (and use ETH as it’s gas token) and post its data to Celestia for scalable data availability to meet Eclipse’s large blockspace demands.

The chain will also use RISC Zero for zero knowledge proofs of fraud without Intermediate State Serialization.

Eclipse has also said that there are no plans for Eclipse Mainnet to have its own token as of now.

Optimism has airdropped a total 19 million Optimism ($OP) tokens to over 31,000 addresses to reward positive-sum governance participation. A maximum of 10,000 $OP was set per address.

Details on criteria and allocations can be found here

Phoenix Labs has proposed the activation of Spark Lend (a Spark protocol service) on the Gnosis chain. The initial collaterals to be onboarded are GNO, WETH, wstETH, and wxDAI.

These assets will have a supply cap of 200,000 GNO, 5000 wstETH, 5000 WETH and 10 million wxDAI. wxDAI will also be able to partake in the Daily Savings Rate (DSR contract).

The borrow cap will be 100 wstETH, 3000 WETH, 8 million wxDAI and not applicable for GNO

Metis launches a $5 million DeFi incentive program to support new and existing dapps on the Metis chain. The first provision has been a 100,000 $METIS token (~ $1.19 million) allocation to all Aave liquidity pools on Metis to draw in liquidity providers. The program will also look to “extend funds to regular users who contribute liquidity, engage in trading, and actively participate in our thriving ecosystem”.

Injective unveils their new Ethereum L2 coined inEVM in partnership with Caldera. It will be the first ever EVM to achieve true composability across Cosmos and Solana and will give developers access to “ultra-fast speeds due to a parallelized structure, instant transaction finality, a modular toolkit, shared liquidity, and composability across the Cosmos IBC universe and Solana”.

This announcement comes after there recent release of inSVM, a Solana Virtual Machine.

Optimism has entered into a private token sale of approximately 116M OP tokens, split among seven purchasers, for treasury management purposes. The tokens are subject to a two-year lockup.

The tokens come from the Unallocated portion of the OP Token treasury, and are part of the Foundation’s original working budget of 30% of the initial OP token supply.

CoinEx will be resuming deposits and withdrawals on their exchange after suffering a $70 million hack supposedly executed by the North Korean Lazarus group. CoinEx also maintains that no user funds were compromised and that the financial losses will be fully covered by the CoinEx User Asset Security Foundation.

Deposits and withdrawals will be restored for BTC, ETH, USDT (ERC20 and TRC20, USDC (ERC20), TRX, LTC, BCH, DODGE, SHIB and BNB tomorrow on September 21st at “8:00 UTC” and will gradually resume the deposit and withdrawal services for other assets.

The Gro DAO has voted to unwind the Gro protocol and DAO. The $5.37 million treasury will be distributed to all who deposit their $GRO to a redemption contract within 4 weeks.

A $180,000 budget will be allocated to Groda while they focus on unwinding the protocol from October 3rd to January 3rd 2024.

Note that Gro users will be able to withdraw from GVT, PWRD and Pools indefinitely and “All pods support users in exiting the protocol until January and then dissolve together with the Groda Pod.”

Base has open-sourced their security monitoring system, Pessimism, which is designed to quickly detect potential threats and also assess the health of a chain. Pessimism is now available for EVM) compatible chains as well as chains built using the OP stack.

Pessimism allows for the identification and mitigation of security threats and vulnerabilities by detecting unauthorised access attempts, unusual behaviour, and potential breaches.through monitoring smart contract events, withdrawal events (bridging), and enforcing balance boundaries for privileged addresses.

The system can also monitor the performance of a chain through metrics like response time, throughput and error rates to alert developers of malfunctions.

Balancer has regained control of their sites after EuroDNS, their DNS registrar, was socially engineered and compromised. This update comes through Balancer’s Twitter page. So far, $238,000 of Crypto was stolen.

dYdX’s founder, Antonio Juliano, has announced that its mainnet is expected to launch next month. The founder also states the dYdX chain is “pretty much completely built and in its final stages of testing”.

After deciding to migrate from building a Layer 2 on Ethereum to a Layer 1 blockchain built using Cosmos technology, dYdX chain aims to be a decentralised,but off-chain order book and matching engine that will provide unmatchable throughput scalability and TPS to the order of 1000+ transactions per second.

Grayscale Files for ETH Futures ETF

Grayscale has filed for an Ethereum futures ETF with the SEC. The nature of the future contracts will not require a custodian for the Ethereum and will be managed by Grayscale Advisors LLC.

Grayscale has also previously applied for a spot BTC ETF which is still awaiting approval after the SEC’s previous decision to reject it was overturned.

Wintermute deposited 7.3 million $BLUR, valued at $1.3 million, to Kraken and Coinbaseon Thursday.

They have deposited 46.6 million $BLUR (worth $8.5 million) to various exchanges over the last 30 days.

Over the last 7 months, this address has received 105,250,219 $BLUR tokens and distributed 105,250,219 tokens.

94,441,149 of the distributed $BLUR went to other exchanges, 10 million tokens went to a Blur owned multisig (which holds $56 million worth of $BLUR) and 800,000 went to an unknown entity.

Note that these tokens may have been deposited to other exchanges and then withdrawn back to the Wintermute address.

Trending Assets

Top 300 Performers

WLD is up 24% this week.

Top 300 Losers

OX had continued to pull back from its highs of the year, recently breaking support and leaving a lot of DeFi participants underwater.

Rollbit also had a bad week down 17% after winding down their DegenX exchange, citing regulatory reasons and lack of adoption.

Below $100M MC by Performance, on chain

CREAM was relisted on Binance and gained 62%. Daniel Sesta’s ICE also had a big week gaining 47%.

Above $100M MC by performance, on chain

CRV showed strength this week as a wallet has accumulated a large position from Binance.

Above $1B MC by performance, on chain

Of the large caps, LINK had a good week going into their SmartCon conference throughout Oct 2nd - Oct 3rd.

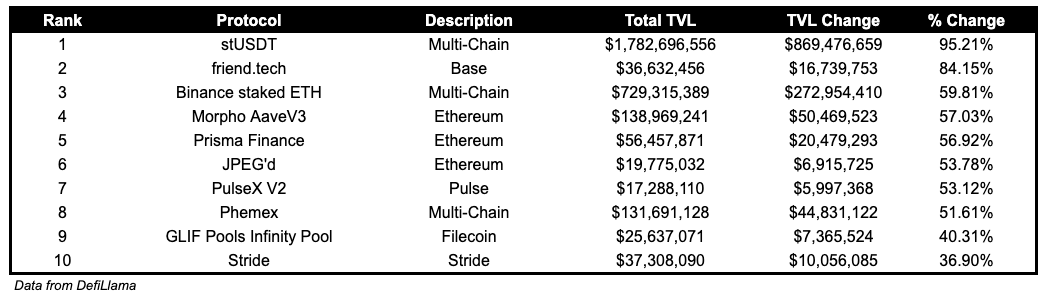

TVL

TVL Above $10M

Over the past week:

stUSDT, multichain RWA, TVL increased by 95.21%.

friend.tech, social platform on Base, TVL grew by 84.15%.

Binance staked ETH, multichain LSD, TVL increased by 59.81%.

Fees

Governance Proposals

Stargate New Oracle Configuration: Google Cloud Oracle

Proposal for Stargate to adopt The Google Cloud Oracle for all of its products (Stargate and TheAptosBridge).

Articles / Threads

GammaSwap is officially live on Arbitrum Mainnet!

GammaSwap which allows users to borrow liquidity from any AMM pool and potentially reduce IL for LPs launched on Arbitrum Mainnet today.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.