Weekly Notes 11

21-08-2023 to 27-08-2023

friendtech

Bots setup on Base chain have been sniping friend key listings by monitoring addresses bridging to Base and through using an RPC which is rumoured to be leaking a ‘mempool’ of sorts (ORU’s don’t have mempools). These snipers are profiting from the aggressive bonding curve by buying multiple keys first and selling when the keys trade higher as buyers come in after.

0xcc..cc85 has profited the most, making 346 ETH according to Tom from 21Shares.

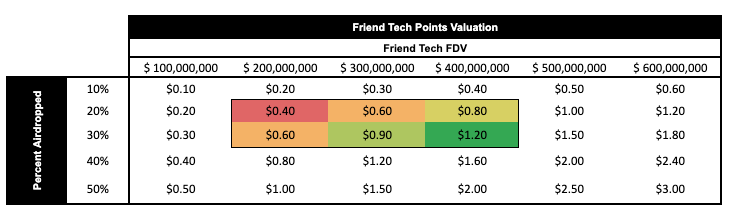

Airdrop Valuation

friendtech recently announced that they will be distributing 100M points over the 6 month beta period. The points will have a special purpose after the end of the beta period.

Based off a simple sensitivity table, we can seen that, if 30% of total supply is airdropped at an FDV of $200M, each point would be worth $0.60. Details regarding the special purpose of the points have not yet been announced.

BNB Venus Partial Liquidation

The $200mil BNB position on Venus protocol from the BNB bridge hack was partially liquidated ($32M in BNB) by BNB chain on the 21st. This comes after $30mil of the $200mil was liquidated on the 18th.

You can track:

the BNB liquidator here: 0x56306851238d7aee9fac8cdd6877e92f83d5924c

the BNB position on Venus here: 0x489a8756c18c0b8b24ec2a2b9ff3d4d447f79bec

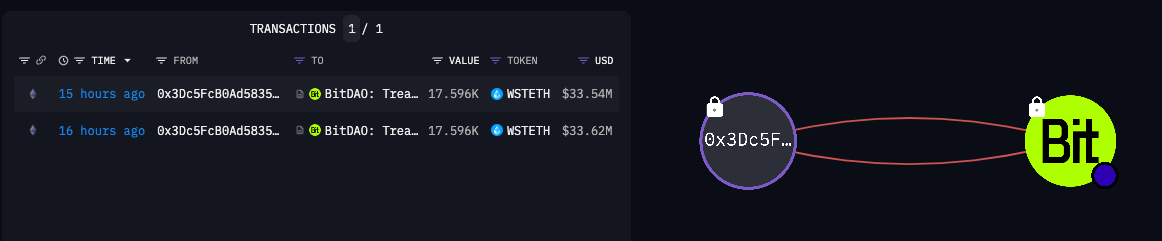

Mantle Invest 40,000 ETH into Lido’s Staked ETH

Mantle has deposited 40,000 ETH into Lido. Through this agreement, Mantle aims to bootstrap a vibrant and sustainable Liquid staking token ecosystem and attract DeFi integrations to the Mantle network.

In addition, Mantle will also receive a percentage of revenue earned by Lido’s 5% share of staking rewards through Lido’s Tiered Rewards Share Program.

With Mantle staking 40,000 ETH, the program dictates that they will receive 30% of the 5% share that Lido would otherwise take from an individuals staking rewards. It is of note that the 30% was stated to have been negotiable in the original proposal and so may have increased.

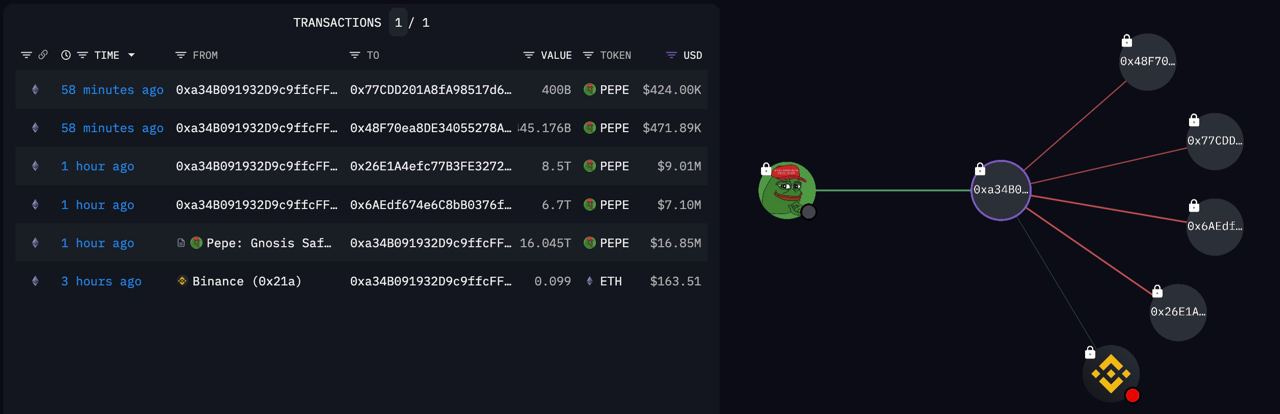

On Thursday, the Pepe multisig wallet, changed the amount of signatures required on their multisig from a 5/8 to 2/8. This comes after sending $15.7 million worth of PEPE to exchanges.

The multisig first received funds from Binance & proceeded to send Pepe to the following places:

$8.36 million to OKX

$6.6 million to Binance

$438,000 to Bybit

$400,000 to an unknown exchange/wallet.

$10.42 million worth of $PEPE remains in the multisig.

Prisma Finance Whitelisted to Perma-lock CRV

Prisma Finance has been whitelisted to permanently lock $CRV for veCRV tokens, Curve Finance's governance token, which will be used by Prisma in a bid to draw Curve’s reward boost for their PRISMA/WETH and mkUSD/FRAXBP pools.

Prisma incentivised users to approve the proposal by guaranteeing a share proportional to their votes of a PRISMA airdrop as a locked position on the Prisma protocol for 52 weeks with early exits subject to penalties. The airdropped PRISMA that can be used in Prisma DAO voting.

There has been a $27.2M (77.8%) increase in DYDX OI across OKX, Bybit and Binance, since the 21st of August.

Notably, dYdX v4 is set to launch later this year, with the platform moving from StarkWare to it's own L1 built on Cosmos.

With v4 dYdX will have:

Improved finality to settlements

Minimized MEV

Increased throughput

Validators earning fees

Additionally, 6.52M DYDX, worth $14.21M, is set to unlock on the 29th of August. The unlock represents 3.77% of circulating supply.

Base will receive an initial token grant of 10,737,418 $OP tokens ($15.8 million) which is to be locked for 1 year as well as an additional 107,374,177 $OP ($160 million) that is to be vested over 6 years with an initial 1 year cliff. Note that only 9% of the total grant will be allowed to be used in governance votes.

This grant is contingent upon Base’s continued participation in the Optimism Superchain.

In exchange, Optimism will receive a fee contribution of either the greater of 2.5% of Base's total sequencer revenue, or 15% of Base’s net on-chain sequencer revenue (L2 transaction revenue minus L1 data submission costs) which will go towards the Optimism collective.

Coinbase Acquire Minority Stake In Circle

Coinbase is purchasing a minority ownership in Circle Internet Financial, leading to the dissolution of their joint Centre Consortium that managed the USDC stablecoin. Circle will now solely oversee USDC, which will also expand its integration to 15 blockchains by adding six new ones.

Worldcoin Investigated In Kenya

The Kenyan parliament has formed a committee to investigate Worldcoin after it’s suspension earlier this month due to security and privacy concerns.

The committee is being chaired by MP Gabriel Tongoyo who noted that “the government is concerned by Worldcoin’s activities involved in the registration of citizens through the collection of eyeball/iris data”.

The committee has 42 days to investigate before reporting there findings back to the House.

Grass Network Growth

Grass, an application that allows you to sell your unused bandwidth to AI labs and data scientists has seen over 65K downloads, 60K referrals and 458K unique IPs connected in just over 2 months into their beta program.

Scroll Join Chainlink Scale Program

Scroll, an EVM compatible zero knowledge proof scaling solution has joined the Chainlink Scale Program. The program accelerates the growth of L1 and L2 ecosystems by covering the operating costs of Chainlink’s oracle networks until dapps on that network can support the full backend costs through user fees.

Centrifuge Pool Potential Default

A governance forum post has indicated that MakerDAO's $1.84 million investment is in jeopardy due to potential default issues with tokenized loans on the blockchain credit platform Centrifuge. ControlFreight, the entity responsible for overseeing the troubled credit pool, announced last Friday that the pool's biggest borrower is at risk of liquidation because of a legal conflict. The credit pool in question is valued at $2.7 million.

Grayscale Decision

No opinions were released by the U.S. Court of Appeals for the District of Columbia Circuit this week. We are still waiting for an opinion to be released as it relates to the Grayscale ETF case and we typically get these opinions on Tuesdays and Fridays.

Tether has updated there reserves to show that they are overcollateralized and have a +$3.29 billion liquidity buffer. As of 24/08/2023, Tether's total assets were US$86.1B, its total liabilities were US$82.8B, and its reserve ratio is above 100%.

1inch has launched its DEX aggregator on Base. This announcement coincides with PancakeSwap’s launch on Linea as we see DEXs rushing to stake their bets into new L2s and 1inch's aims to capitalise on the incoming floods as an aggregator

Performance

CEX Overview

DYDX, up 14.56%, BCH, up 3.98%, ETC, up 2.39%, SUI, up 6.91% and TRU, up 3.07%, were top gainers on CEXs over the past week.

Notable changes in OI over the past week:

DYDX OI up 73.86%

SUI OI up 34.14%

OCEAN OI up 15.39%

FET OI down 13.51%

TRU OI down 36.45%

Top 300 Gainers

RLB, up 28.66%, dYdX, up 13.64% and SUI, up 6.88%, performed well over the past week.

Top 300 Losers

$BITCOIN, down 48.57%, was the top under performer of the week. PEPE is down 21.12% following team wallet selling, and RBN is down 19.96%.

Below $100M MC by performance, on chain

SONNE, up 28.96%, rDPX, up 26.79% and LOOKS, up 24.27%, were some notable top performers for coins below $100M MC.

Above $100M MC by performance, on chain

BONE, up 7.46%, and YFI, up 3.68%, were notable coins with above $100M MC which held up well over the past week.

Above $1B MC by performance, on chain

Large caps underperformed: ETH is down 1.76%, OP is down 2.23% and ARB is down 7.65% over the past week.

TVL

TVL Above $10M

Over the past week:

Eigenlayer, restaking on Ethereum, TVL is up 200.97%.

Silo Finance, multichain lending and borrowing, TVL is up 85.28%.

Alien Base, DEX on Base, TVL is up 62.02%.

EigenLayer raised their restaking caps on the 22nd of August and Silo Finance announced isolated crvUSD lending/borrowing on the 18th of August.

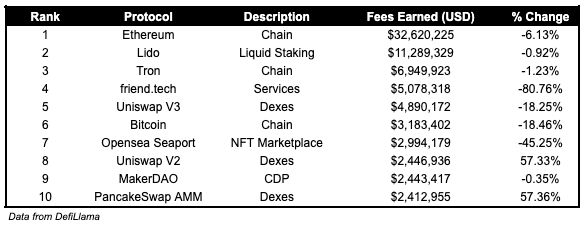

Fees

friendtech fees earned are down 80.76% over the past week. Opensea Seaport fees earned are down 45.25%. Notably both PancakeSwap AMM and Uniswap V2 fees earned are up approximately 57% over the past week,

Governance Proposals`

TIP-29: MAGIC Reconciliation Mint and TIP-25 Token Schedule Assignment

Proposal for TreasuraDAO to mint 8,068,497 MAGIC, and allocate it to their ecosystem fund with a vesting schedule. These tokens are accounted for in the original tokenomics plan, but were unminted.

Articles / Threads

unshETH Labs raises $3.3mm Seed Round

unshETH raised $3.3M in their seed round, for 5% of their total supply (21.525M USH). These tokens are allocated from the teams allocation, meaning that the teams 20% allocation has now become 15%.

Unveiling Frax x Gravita: A New Era of DeFi Collaboration

Gravita has announced that sfrxETH can now be used as collateral to mint GRAI.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.