Developments

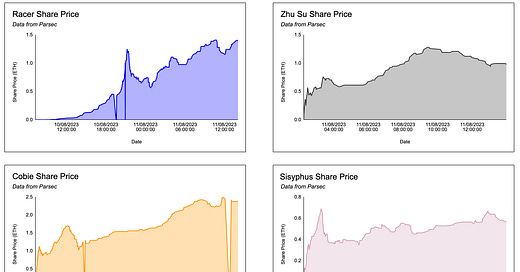

Friend Tech

friend.tech is an on-chain social networking platform built on Base. It allows users to create shares of themselves. These shares can be bought and sold by other users.

Each friend share is priced using a quadratic bonding curve with the only real variable impacting price being the number of shares outstanding.

Each share is priced purely on the number of shares in supply and as the number of shares goes up, the price of each share in ETH goes up.

Price in ETH = supply ^ 2 / 16000

We made a sheet to model the pricing of shares which you can access here:

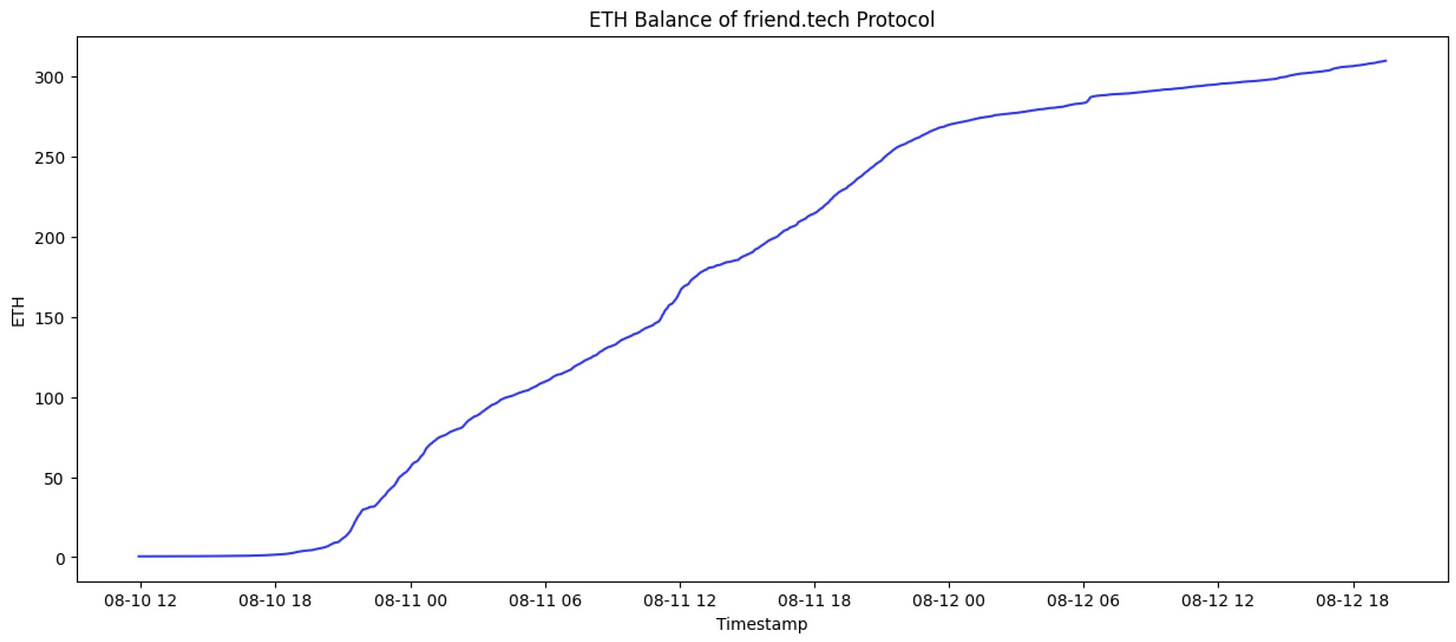

A total of 6,195.4 ETH in total volume has been traded, with the friend tech protocol taking home 309 ETH in fees [5%].

If you’d like to read more on friendtech, you can read our research report here:

EDSR Yield Cap

DAI in the DSR module has reached $1.25 Bil as yields have reached 8% APY with the introduction of the Enhanced DAI Savings Rate. Rune posted a proposal to cap the ESDR at 5% APY.

The move comes after a few whales have been depositing crypto collateral in Spark and borrowing DAI (& looping) to earn the EDSR, crowding out average users.

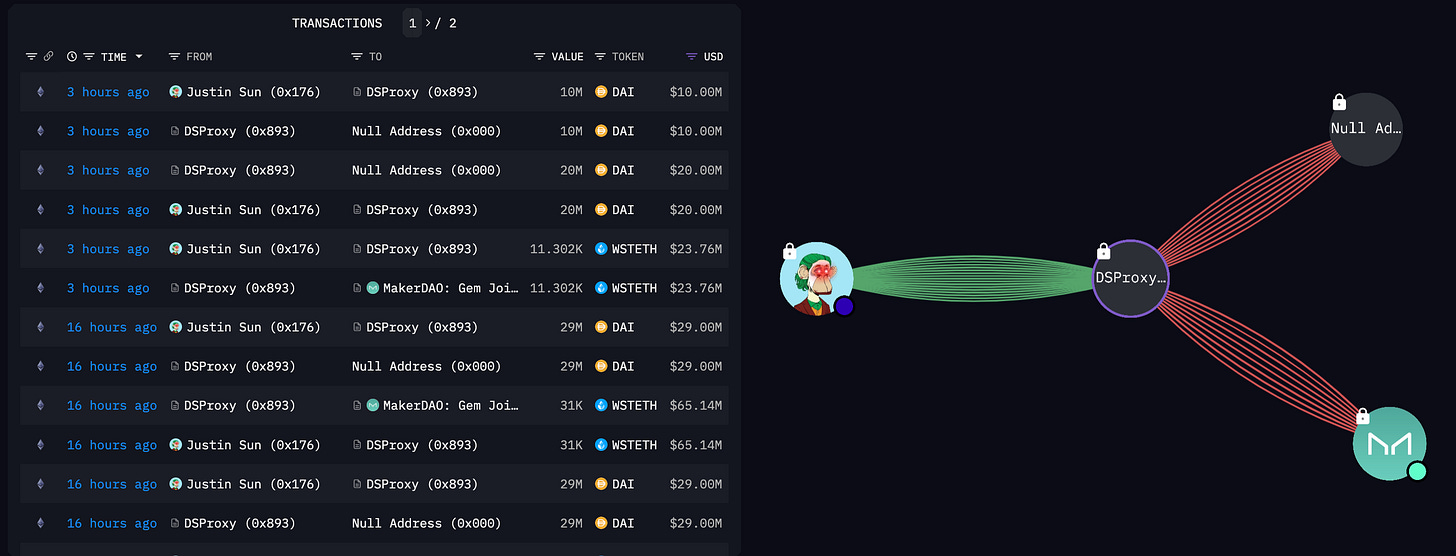

Justin Sun Utilises EDSR

Justin Sun has deposited 178,545.18 stETH ($332.5m) over the last 24 hours into Maker, to mint $135.8m of DAI which he then deposited into Makers DAI Savings Rate (DSR) to earn the current 8% yield.

As of now 1.25B DAI has been deposited into the DSR contract which is a 2.8x increase from August the 6th’s 396m.

SparkDAO SPK Airdrop

The SparkDAO SPK pre-farming airdrop aims to incentivize continued usage of Spark Protocol, particularly if the proposed stability fee increase to 5% is implemented. The objectives are dual-fold:

Trust and Liquidity Boost: The initiative seeks to attract substantial assets to Spark Protocol by encouraging users and borrowers, even those engaged in arbitrage, to persist in their usage. This endeavor aims to establish a robust market presence and enhance overall market trust.

Community Alignment: Through the airdrop, a community aligned with SparkDAO's mission and potential will be fostered. Users and participants who share a common vision will be incentivized to actively contribute to the platform's growth.

In terms of execution, the Support Facilitators will retrospectively identify users who have borrowed from Spark Protocol since the stability fee increase to 5% during the Phase 2 Launch. A predetermined quantity of SPK tokens, as specified in the Support Scope of the next amendment proposal, will be distributed proportionally to users who utilized volatile assets as collateral for borrowing. This distribution, which functions as a bulk airdrop, will reward users based on their borrowing amount and duration.

Notably, users will automatically qualify for the airdrop without needing to take any specific actions. Simply engaging in regular borrowing activities from Spark Protocol will make them eligible for this token distribution.

Mantle Ecosystem Partner With Lido

MIP-25 has passed, which means that the Mantle (previously BitDAO) treasury are able to allocate a combined 200,000 ETH into Lido’s LST and Mantle’s upcoming LST. There is a 40,000 ETH allocation limit to stETH & wstETH in this proposal.

Rollbit Announces Buy and Burn

Rollbit has announced their buy & burn program. They will be using 10% of revenue from their Casino, 20% of their revenue from their Sportsbook, and 30% of their revenue from their 1000x futures to buy and burn RLB on a daily basis.

As per Rollbit’s new tokenomics upgrade, they burned 11,074,278.65 RLB (0.33% of supply) today. This represents a ~$1.9 Mil token buyback and burn. Since the burn RLB gained 25%, making it the top performer in the top 300 today.

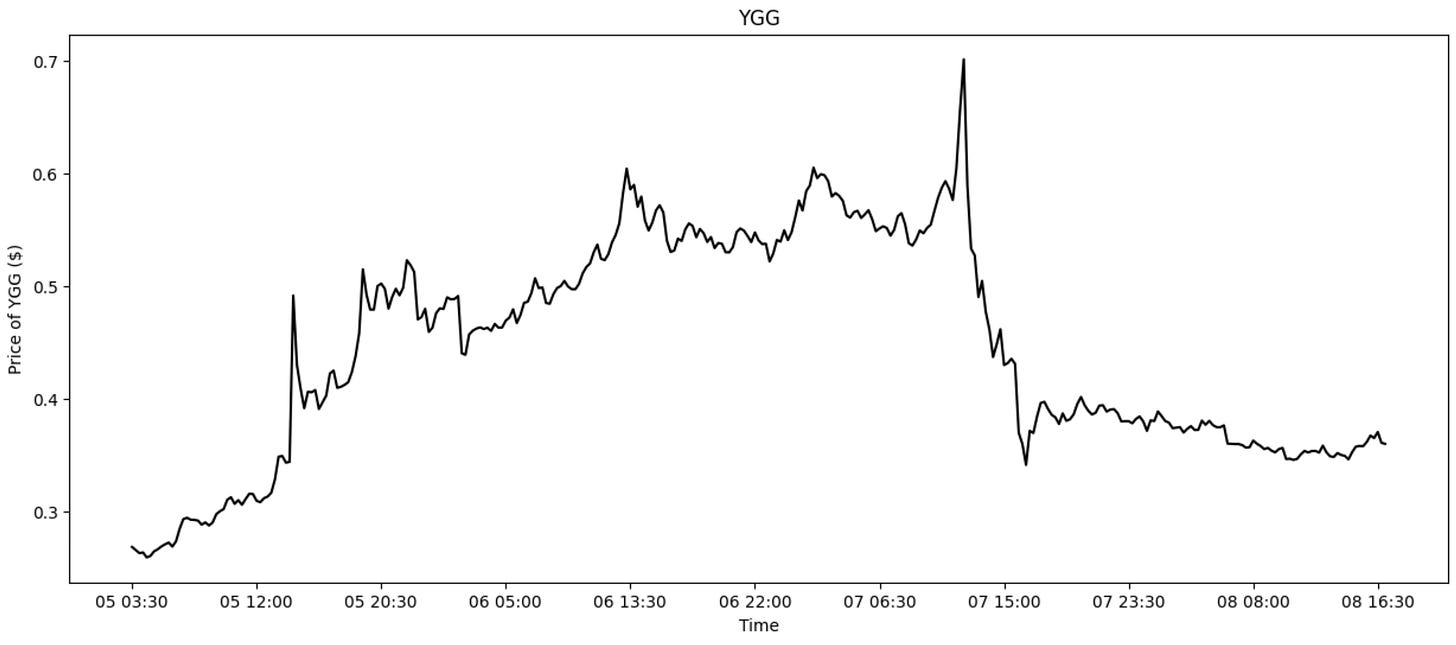

YGG

Yield Guild Games (YGG) has fallen back to $0.36 after briefly touching $1 on Binance futures. DWF labs were market making this project and have been openly talking about this coordinated pump of the token.

YGG showed such a huge dispersion in the spot and perpetual futures markets, with the perp trading 30% higher than spot at one point.

Base Mainnet Official Launch

Coinbase’s L2 built on top of the OP stack has officially opened for launch on the 9th of Auguest. So far a cumulative $207 million tokens have been bridged to BASE.

Mantle Whale Sells MNT

On the 8th of August, the address 0x137AfecE9991a5625Ab1510cf98Eadc937f0B55f sold $4 million of the Mantle token ($MNT) over the span of 30 minutes plummeting the price by 20% to $0.38.

The price has since bounced to $0.47 at the time of writing which is -20% of it’s all time high of $0.60.

Recent reports show that this wallet was a hackers wallet that stole MNT tokens from a BitDAO / MNT early contributor / investor.

Curve Founder Opens a New Position

Michael Egorov, the founder of Curve Finance, has opened a new borrow on Cream Finance. He has deposited 13 million CRV and borrowed a combined $2.5 million USDC and USDT. This is on top of his already large Aave, Fraxlend and Inverse Finance positions.

nd4.eth Burns A Cumulative $8.5Mil

nd4.eth, an anonymous market participant has sent a cumulative $8,440,765.52 of crypto asset to the burn address.

This sum is compromised of:

$4,680,320.96 of $ETH

$1,782,112.76 of $GMX

$1,568,640.52 of $GNS

1 Crypto Punk, 3 BAYC, 2 MAYC, 1 BAKC, $18,500 worth of ApeCoin, $2365 of $ARB, $400 of W$Cas well as 6 ens domains of indeterminable value.

All NFTs above that have been sent to the dead address have been purchased by nd4.eth within the last 2 months (65 days) for a cash value of $388,318.78.

Milady

Milady’s (back) in control

SAND Unlock

Sandbox will unlock 332.55M $SAND tokens on the 14th of August, which is valued at $135 million and represents 16.6% of the Sandbox’s Market Cap.

The 332.55M $SAND token unlock is divided as shown below:

Paypal has launched their own stablecoin PayPal USD (PYUSD) on Ethereum Mainnet.

Chainlink price feeds have been integrated into Coinbase’s Base L2. Base is scheduled to launch for the public on the 9th of August.

SecondLane July 2023 Secondary Market Report

SecondLane released their July 2023 secondary market report, where they reported taht there was a 47% increase in volume since June. Top projects were Worldcoin, Scroll, EigenLayer, Celestia, zkSync, Fuel, Starkware, Animoca and Aelo. 60% of offers were for (Pre-)Seed and 40% Rounds A-D. 21% of offers were on L1, L2 projects and 14% on DeFi.

GoldFinch Default

Goldfinch is a decentralized credit protocol that enables cryptocurrency borrowing without the need for crypto collateral. Instead, loans are fully collateralized off-chain.

Goldfinch extended a $5 million loan to The Tugende Kenya Facility, which breached the agreement by lending $1.9 million to its sister company, Tugende Uganda. This discrepancy was discovered in December 2022, and Goldfinch attempted to address it through an equity raise to cover the shortfall.

The $1.9 million loan constituted the majority of Tugende Kenya’s available liquid funds at the time. This led to a reduction in portfolio size and a decline in portfolio quality over the last nine months. As the remaining $3.1 million in Goldfinch's available assets within the business decreased in value due to repaid receivables and Tugende's lack of profitability, Goldfinch's team communicated potential losses of "up to 100% of the loan." They also acknowledged the possibility of recovering nothing if a prolonged legal process ensues.

While this setback represents around 4% of the protocol's Total Value Locked (TVL), users are concerned about the slow withdrawal pace, estimated to take approximately "7.6 years."

Blake West, Goldfinch's Co-founder and CTO, countered claims that the withdrawal process would indeed take 7.6 years. He clarified that "34% of the principal is due in 2024, 42% in 2025, and the remaining 20% in 2026."

Yoots Migration To Ethereum

y00ts will be migrating to Ethereum from Polygon stating that “It's just time to unite the DeGods & y00ts communities”. The team has also stated that they intend to return 100% of the $3m that was provided by polygon to incentivise the migration back in late December of last year.

This announcement comes with DeGods Season III refresh which sees the upcoming integration of 20,000 new non-dilutive art pieces this sunday; “1 DeGod, 4 pieces of generative art.” .

Additionally, the new seasons will allow for the possibility to swap your DeGod 1 for 1 for a female version, as well the introduction of the points parlor where Season III DeGods can use points to play & win prizes.

Trending Assets

Top 300 Performers

Livepeer up 118% this week, led by a perp rally similar to YGG pump and dump last week.

Rollbit up 64% after announcing their new tokenomics and burning 11.07 mil RLB on the 10th of August.

Top 300 Losers

GMX had a poor week, losing 14%. This could be a ‘sell the news’ event with v2 officially going live.

Worldcoin was down 13% this week, having been banned in Kenya and investigated in Argentina.

Mantle, as noted above, had a poor week due to a victim with $3.5 mil MNT getting hacked. This MNT was then sold into the MNT/ETH LP in a 30 minute period.

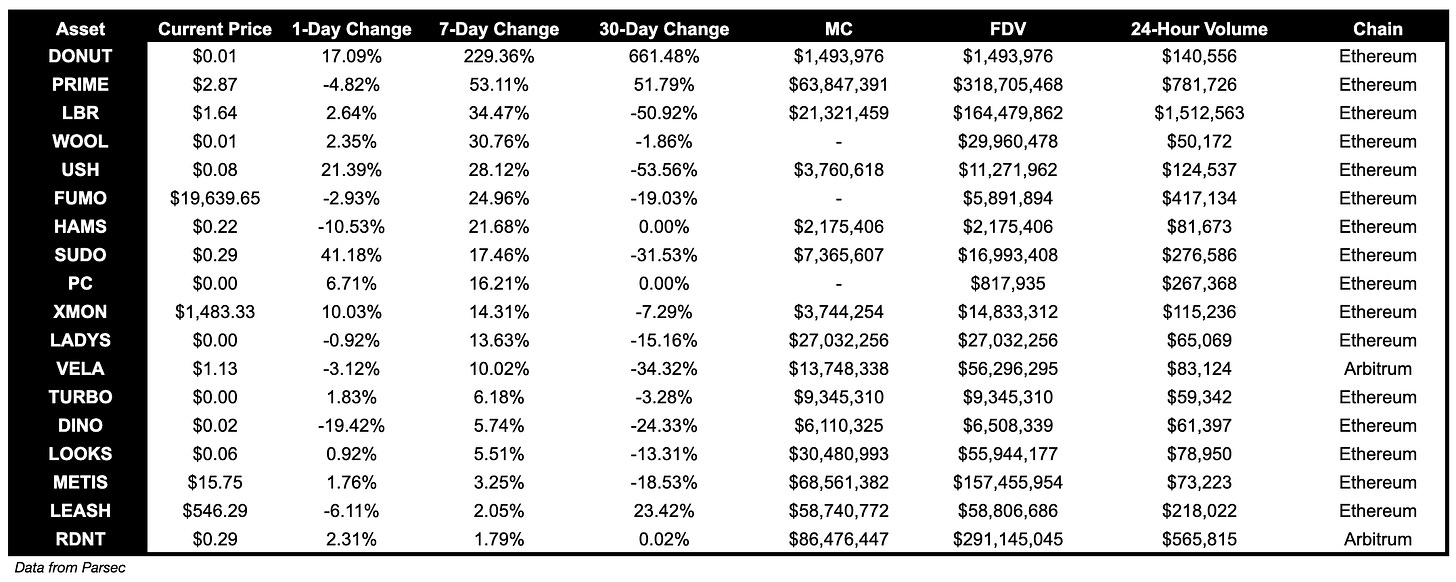

Below $100M MC by Performance, on chain

PRIME, up 53.11%, LBR, up 34.47%, and USH, up 28.12%, performed well over the past week.

Above $100M MC by performance, on chain

LPT, up 123.73%, was the top performer for coins above $100M MC on chain over the past week, followed by RLB, up 57.80%, and UNIBOT, up 42.00%.

Above $1B MC by performance, on chain

SHIB performed well over the past week, and is up 8.19%.

TVL

TVL Above $10M

Over the past week:

PearlFi, ve(3, 3) DEX on Polygon, TVL grew by 3859.88%, to $50.8M.

Spark, lending using MakerDAO on Ethereum, TVL grew by 663.52% to $441.9M.

BaseSwap, DEX on Base, TVL grew by 50.21% to $52.1M

Fees

Ethereum earned the highest fees over the past week, at $34.7M, followed by Lido, at $12.1M and Tron, at $7.9M. Notably, Aave V2 fees earned are up 1008.33% over the past week.

Governance Proposals

Activate LUSD as Collateral on Aave V3 ETH Pool

Aave proposal to allow LUSD to be used as a collateral asset on the Aave V3 ETH pool. The risk parameters will be the same as those used for USDC.

[SIP-28] Using the Arbitrum Grant - Swap ARB for ETH

Synapse proposal to convert their 1.03M ARB airdrop to ETH and use it as liquidity on Synapse’s ETH pool on Arbitrum.

[TEMP CHECK] Aave Treasury Proposal for RWA Allocation

Proposal for Aave to allocate a portion (initially 1M) of Aave Treasury’s stablecoin holdings to a low-risk RWA investment through Centrifuge Prime.

Make Aura and Balancer the STG Liquidity Hub on Arbitrum

Proposal to move $1.5M of POL from the current 50/50 pool to the already available Balancer 50/50 STG/Boosted Aave V3 USD pool on Arbitrum, staked in Aura.

Proposal for Balancer to build a ve8020 Launchpad to incentivize protocols to adopt the ve8020 model created by Balancer.

[GIP-68] Remove FRAX LM rewards

Proposal to remove FRAX liquidity mining rewards from Gearbox.

[FIP - 277] Onboard FinresPBC as FRAX v3's Offchain RWA Partner

Proposal to establish a partnership with FinresPBC to hold USD deposits, mint stablecoins like Paxos USDP and Circle USDC, and oversee United States Treasury Bills for yields.

[FIP-278] Acquire CRV with DAO treasury funds

Frax proposal to buy 1M FRAX worth of CRV using FRAX DAO treasury funds to increase liquidity across all FRAX/FrxETH/FPI.

Articles / Threads

The Balancer Report: Base or Avalanche? How about both!

Balancer has launched on both Base and Avalanche.

Kwenta and Synthetix Launch USDT Perps

Synthetix and Kwenta have listed USDT perps on their platforms.

Aevo is launching Pre-Launch Token Futures, which are perpetual futures which have no index price nor funding rate. The first market that Aevo will list is Sei Network, ahead of it’s listing on Binance next week.

Binance Labs backs Helio Protocol with $10M investment

Binance Labs has pledged a $10 million investment in Helio Protocol. Helio will use this to focus on the LSDFi landscape by diversifying collateral options for liquid staking, and bolstering their plans for multichain expansion.

Aevo has added USDT as a collateral option.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.