The State of Staking

The State of Staking

Proof-of-Stake (PoS) is a consensus mechanism used by some networks to validate transactions and secure the network. Unlike Proof-of-Work (PoW), which relies on computational power and energy consumption, PoS requires participants ‘stake’ or lock assets into the network to provide cryptoeconomic security, as the stake can be forfeited/slashed if they engage in dishonest behavior.

There are a number of variations and technical differences between validators on different networks, but in general the mechanics of validation are very similar. We can take a look at Ethereum’s PoS mechanism to get a sense of how validation works:

To participate as a validator, a user must deposit 32 ETH into the deposit contract and operate three distinct software components: an execution client, a consensus client, and a validator client.

Upon depositing their ETH, the user enters an activation queue that regulates the influx of new validators joining the network.

Once activated, validators receive new blocks from peers. They re-execute the transactions to verify the proposed changes to Ethereum's state and check the block signature. The validator then broadcasts an attestation vote in favor of the block across the network.

In Ethereum, time is divided into slots (12 seconds) and epochs (32 slots). In each slot, one validator is randomly chosen to propose a block. This validator is responsible for creating a new block and broadcasting it to other nodes on the network.

Additionally, in every slot, a committee of validators is randomly selected to vote (attestations) on the validity of the proposed block.

PoS rewards

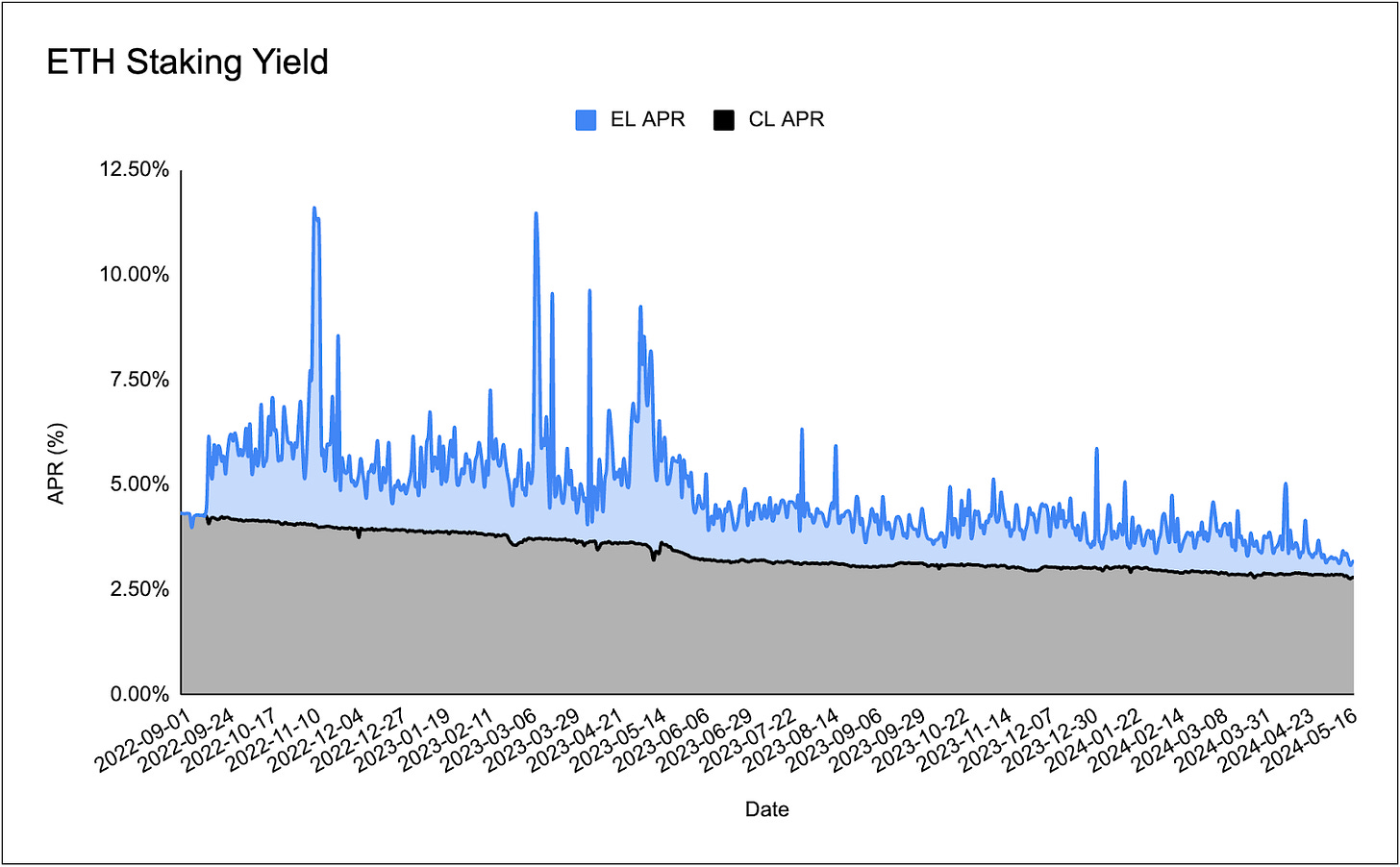

A validator on Ethereum therefore has two main roles: verifying and attesting to new blocks if they are valid and proposing new blocks when randomly selected. If they complete either of these tasks, they are rewarded with Ether. Rewards accrue from two primary categories: Execution layer rewards and Consensus layer rewards.

Execution layer rewards include block rewards, transaction fees, priority fees, and Miner MEV. These rewards constitute approximately 20-30% of the total reward package historically.

Notably, execution layer rewards are not predefined and can vary significantly. They are only awarded when a validator is selected to propose a block. Given that there are currently over 1 million validators and only 1 block is proposed every 12 seconds, the probability of a single validator being chosen to propose a block is 0.71% per day. Consequently, it takes an average of about 140 days for a validator to be selected for a block proposal. Source.

Consensus layer rewards consist of rewards for attestations, validations, and committee participation when selected. These rewards account for approximately 80% of the total reward package historically. Consensus rewards are distributed every epoch, which occurs approximately every 6.4 minutes. The annual protocol issuance on the beacon chain depends on the number of active validators and follows a scaled square root curve. Conversely, the yield earned from the CL rewards follows an inverse square root curve, meaning that as the number of validators on the network increases, the yield decreases.

The total yield a validator earns is then equal to the sum of the execution yield and the consensus yield:

Ethereum Issuance Debate

The current ETH issuance rate is quite low compared to other PoS or PoW networks. Since the Merge, staking dynamics have not changed significantly, with the staked ETH percentage slowly growing over time, currently at slightly less than 30%. The main driver of staking growth is currently the demand from restaking protocols, where users can farm points and participate in airdrops for future and current restaking protocols. In addition, we might see increased staking as yield-bearing L2s, such as Blas, become more popular. tInstitutional staking is also slowly increasing, with institutions likely to prefer safer ways to stake.

Ethereum's staking dynamics differ from other PoS networks like Solana (85% staked) and Cosmos (60% staked). Ethereum's unique path to becoming a PoS network sets it apart, as most ETH was distributed before staking was introduced, unlike newer PoS networks where tokens are primarily used for staking from the start. Additionally, Ethereum's ETH is highly financialized, serving as collateral, a unit of account, and a store of value, with a diverse economy built around it.

There are two potential endgames for Ethereum's staking ecosystem. One is to have a high percentage of ETH staked (e.g., 60% or more), creating a stable equilibrium where stakers and token holders are mostly aligned, promoting network security. The other proposed endgame is to have a minority of ETH staked (e.g., 25%), with stakers acting as service providers to the larger community of ETH holders who hold more power. In the minority staking scenario, stakers may be more motivated to extract maximum extractable value (MEV) and less motivated to work towards the network's goals. The relationship between stakers and holders can become more adversarial in low-stake scenarios, while high-stake environments promote greater alignment.

The principal-agent problem arises differently in high-stake and low-stake scenarios. With low staking percentages, the principal (ETH holders) and agents (stakers) have less overlap, leading to a more pronounced principal-agent problem. In high-stake environments, the principal-agent problem may exist between large staking providers and the broader network, but this can be managed through decentralization efforts. Low-stake scenarios may lead to increased competition among validators, potentially encouraging harmful MEV extraction or centralization around the cheapest staking providers.

Several proposals have been made to modify the ETH issuance curve, such as the Minimum Viable Issuance (MVI) proposal by Ansgar and the 25% staking cap proposal by Casper and Ansgar. These proposals aim to address concerns around high staking percentages, such as increased network overhead, overspending on security, and the potential for liquid staking tokens to overtake ETH as the primary trustless base token. Proponents argue that capping the staking percentage could help maintain a more decentralized validator set and reduce issuance costs for the network.

However, some argue that the benefits of high staking rates, such as stronger alignment between stakers and token holders, are underexplored and may outweigh the potential drawbacks. Capping the staking percentage through issuance reductions could lead to centralization, as larger players with additional revenue streams (e.g., exchanges, ETFs) can afford to stake at lower rates and outcompete solo stakers. Efforts to improve solo staking accessibility and affordability, such as Lido's "Community Staking Module," could be undermined by issuance curve changes that significantly reduce staking rewards.

Solo stakers are seen as crucial for maintaining Ethereum's censorship resistance and decentralization. They are often more ideology-driven and less profit-oriented, making them more likely to prioritize network health and resist censorship pressures. As institutional capital enters the staking ecosystem, a strong core of solo stakers can help counterbalance centralization tendencies and ensure the protocol remains secure and censorship-resistant.

To support solo stakers and improve staking accessibility, Lido is developing a permissionless staking module called CSM. This module will allow solo stakers to participate in Lido's staking pool with lower minimum deposits and benefit from the platform's staking rewards. CSM will be introduced gradually, starting with a test mode and slowly increasing its share of Lido's staked ETH over time. Lido is collaborating with various solo staking tools and communities to onboard more solo stakers into the CSM ecosystem.

The current issuance policy has some issues, as it makes it economically viable for all ETH to be staked, with rewards not dropping off conclusively enough to ensure an upper bound on staking levels. Most ETH will likely be staked via LSTs in the long run due to their increasing moneyness and the economies of scale of Staking Service Providers. High staking ratios are undesirable due to negative externalities that outweigh the benefits of increased security, such as added trust assumptions, the potential for a dominant LST to replace ETH as the de facto money of Ethereum, reduced competitiveness of solo stakers, dilution of ETH holders beyond what is necessary for security, and increased peer-to-peer networking load.

The endgame vision for staking economics is a stake targeting policy that economically guarantees an upper bound on stake participation. However, remaining questions and technical dependencies prevent the implementation of a targeting policy in the near term. Leaving the issuance curve unchanged until transitioning to a targeting policy entails numerous disadvantages.

To address these concerns, Caspar and Ansgard suggest adopting a new issuance curve, as proposed by Anders, in the Electra upgrade. The new curve is trivial to implement and significantly reduces the incentive for new stake inflow, helping mitigate the issues outlined above. It caps dilution at ~0.4%, compared to ~1.5% under the current curve, keeps reward variability concerns for solo stakers in check, and maintains correct incentives for consensus duties. While the new curve does not economically guarantee an upper bound for staking participation, it significantly reduces the net incentive to stake. Lower nominal yields under the new curve may not imply lower real yields in the long-run equilibrium, as demonstrated by a hypothetical example.

It is important to note that current staking levels are arguably sufficiently secure, and there is no objectively optimal level of staking. The proposed issuance change can help keep solo staking viable by mitigating the negative impacts of increased stake participation on solo stakers. The endgame issuance policy should target a range of staking ratios (e.g., around 1/4 of all ETH) to be secure enough while avoiding overpaying for security. The easiest mechanism for achieving targeting is an issuance curve designed to go towards negative infinity beyond some staking level. However, the targeting policy cannot be implemented immediately due to the lack of an in-protocol MEV capture mechanism and the undesirability of added staking fee complexity. Removing the slashability of delegated stake to make LSTs more trustless does not mitigate all concerns and is not in competition with the proposed issuance curve change.

Operational Expenditures

Operating multiple validators on multiple chains requires both technical expertise and a small amount of Opex. The main costs in running a validator are:

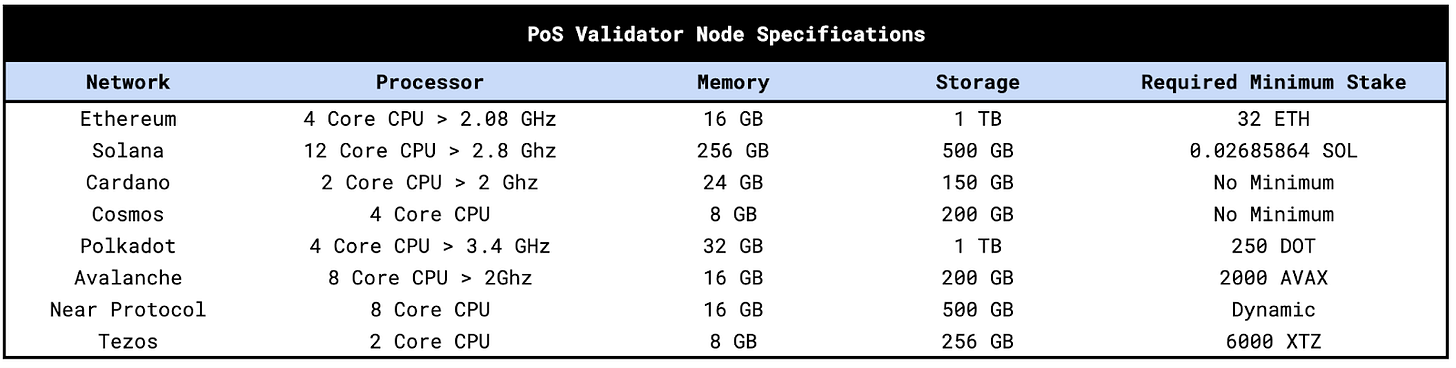

Hardware: Investing in a reliable computer or server with sufficient processing power, memory, and storage, along with redundant systems and backups to prevent downtime or data loss. The hardware requirements for validation differs per chain, with the high throughput chains requiring a higher number of cores and storage. Via state growth and advancements in tech, these requirements can increase over time:

Internet: Maintaining a stable, high-speed internet connection with low latency to ensure constant network connectivity.

Electricity: Covering the power consumption of running the hardware 24/7.

Maintenance: Regularly updating and maintaining software, including execution, consensus, and validator clients.

Security: Implementing robust security measures to protect against hacks and ensure the validator’s integrity.

Whilst the Opex costs are non-trivial, they are orders of magnitudes less than PoW Opex and to the business opportunity for validation services is essentially:

Profit = Staking rewards - (Opex + Capex)

The name of the game therefore is to Scale the amount of stake you are running as a validator through attracting delegations from users.

The State of Validation

Ethereum, whilst the largest PoS network, it just one of many networks that validators can provide their services to. The top 15 PoS chains have a circulating market cap greater than $769B and generate an estimated $13.5 billion in annual rewards for validators.

Source: Stakingrewards

With costs remaining relatively constant, the price of PoS assets is linearly correlated to the revenue and thus the profit earned by validators. With crypto prices increasing over the past year, the revenue opportunity has increased linearly. Solana being a standout performer (+682%), now produces annualised rewards of $4.5B, greater than Ethereum’s $4.3B in rewards.

Similarly, the cumulative circulating market cap of these top 15 PoS projects have ballooned, now sitting at 24.3% of the total crypto market capitalization.

Over the past year, Ethereum's market share has gradually declined, dropping from 69% of the cumulative market cap in May 2023 to 57.4% today. This again reveals the outperformance of Solana, but also highlights the launch of new large PoS networks such as Celestia and Sei.

Liquid Staking

Ethereum

Originating as a solution to the lockup imposed by the Beacon chain pre-merge and as a way to combat the large centralised exchanges capturing the majority of staked ETH, liquid staking has emerged as a dominant form of staking within the Ethereum ecosystem. Liquid staking provides users with a receipt token representing their claim on the underlying ETH on the Beacon chain, enabling them to utilise this ETH within DeFi.

Source: Dune, Defillama

Currently, liquid staking makes up 32.7% of all stake on Ethereum, making it the largest category of staking. Lido is the dominant force here, with an 87.5% market share of the liquid stake market.

Lido

Lido's focus over the past year, prior to reGOOSE, was to decentralize the node operator set and governance, and increase the utilization rate of stETH. Since then, Lido has launched their first staking router modules for Simple DVT and has added more than 70 new node operators. They have also improved client diversity, with geth dominance reducing from 80% to 45%. Regarding governance decentralization, the Lido DAO ratified the dual governance model, which will allow stETH holders to govern the protocol. The new model will be audited over the summer.

However, as outlined by Hasu in his recent proposal, reGOOSE, the Lido DAO has not been successful in increasing the utilization rate of stETH, as stETH market share has declined due to the increased popularity of restaking and liquid restaking tokens (LRTs). In reGOOSE, Hasu outlined that Lido should continue being a simple and safe LST, support Ethereum-aligned validator services like preconfirmations without exposing stakers to additional risk, and make stETH the top collateral in the restaking market, allowing stakers to opt into risk, but keeping the stETH product safe.

In addition to reGOOSE, Lido DAO has recently embarked on building a "Lido Alliance", to grow an ecosystem around stETH. To achieve this, they are encouraging and looking to work with trustless LRTs which use stETH and preconfirmation services and other AVSs amongst other things. One such project is Mellow, a novel restaking primitive that allows for permissionless LRT creation, based on their own risk profiles and curation models. The Lido alliance may be setting up for a similar trajectory to Maker’s subDAOs with each joining project allocating some proportion of token supply to the alliance.

Recently, Coindesk reported that Lido co-founders Konstantin Lomashuk and Vasiliy Shapovalov, through their venture firm Cyber Fund, along with Paradigm, are funding a new player in the restaking space called Symbiotic. Users will be able to restake using Lido's stETH token, as well as other popular ERC20 assets that are not natively compatible with EigenLayer. Internal documents describe Symbiotic as "a permissionless restaking protocol that provides flexible mechanisms for decentralized networks to coordinate node operators and providers of economic security."

Source: Coindesk / Symbiotic Internal documentation

Ethena

Ethena is quickly becoming a player in the staking space with the launch of USDe. Athena essentially tokenizes a 'delta neutral' carry trade on ETH by issuing a stablecoin that is long stETH and short ETH perpetual futures in an equivalent amount.

USDe works as follows:

Users deposit stETH into the protocol and mint an equivalent amount of USDe against it.

The stETH is transferred to a custodian (e.g., Fireblocks or Copper), and its value is communicated to various CEXs.

The protocol shorts ETH perpetual futures contracts on various CEXs against the collateral, effectively neutralizing the delta of the deposited stETH.

The net result is a portfolio that is long stETH and short ETH perpetual futures, creating a delta neutral position that serves as the backing behind USDe.

The 'internet-native yield' is generated by combining the staking yield from stETH with the basis yield from the short ETH perpetual futures position. This yield is then passed back to the holder of USDe. Specifically:

Ethena currently stake ETH via Lido, Coinbase, ether.fi, Kiln, Binance, Renzo, Figment and some unidentified providers.

Swell

Another noteworthy trend is the development of full ecosystems by staking protocols. Swell exemplifies this evolution, having started with just swETH, their LST, in April 2024. Within a year, Swell has integrated swETH throughout the DeFi ecosystem, launched an LRT (rswETH), and built a restaked L2.

The Swell team have made a conscious effort to deeply integrate swETH into DeFi via their ‘Earn’ platform and as such we see a wide distribution of swETH on DEXs and yield platforms. We can see how this DeFi utilization has evolved over time:

The majority of swETH is now within Eigenlayer, having been voted into the staking composition in November of 2023.

Heroglyphs

Heroglyphs aims to incentivize complete validators, home stakers who are not using LSTs, by using graffiti data. Graffiti data, refers to a small piece of arbitrary data that validators can include in the blocks they propose when participating in PoS consensus mechanism. Currently it's used by validators for simple messages or identifiers. The Heroglyphs protocol proposes to use Graffiti data to incentivize solo validators.

The protocol uses an encoder and a translator to create these incentives. An encoder allows validators to embed information in the graffiti data, which is included in proposed blocks. This information can include details about a created token, properties and recipient addresses. The translator interprets the encoded graffiti data and executes corresponding on-chain transactions, extracting the encoded information and minting and distributing tokens based on the information.

The goal is to incentivize independent, complete validators to continue to stake and operate nodes to improve validator decentralization and network resilience, by reducing reliability on liquid staking protocols. As of now, the Heroglyphs protocol has not been adopted to a large extent, and has captured limited attention. However, it is an interesting experiment on monetizing/financializing "arbitrary" space for incentivization.

Solana

In contrast to Ethereum, Solana has in protocol delegation for stake and we only see a 6.24% LST penetration on the chain, led by Jito’s MEV-enhanced jitoSOL.

Jito

Jito Network currently offers a suite of three products, Jito-Solana client, an MEV client, jitoSOL, a MEV-boosted LST, and StakeNet, a Solana stake pool manager.

As of today, 9.93M SOL ($1.856B USD) has been staked into JitoSOL, making it the dominant LST on Solana, followed by Marinade Finance, at 9.24M SOL ($1.622B USD). Compared to Marinade, Jito offers MEV rewards to stakers, based on MEV tips.

Jito's MEV boosted LST relies heavily on the Jito-Solana validator client. The validator client auctions off blockspace for each Solana block, where Jito ensures that transaction sets (bundles) will be included. Searchers who need to include their transactions in a block (potentially for arbitraging or liquidations) can submit their bundles and tip validators for inclusion.

A portion of these tips are distributed to JitoSOL holders, on top of the Solana emissions rewards. In addition, Jito has been exploring incentive programs to ensure that user retention for products is improved. Although currently token emissions to JitoSOL directly are not considered, it may become an additional source of staking rewards in the future.

Aside from JitoSOL, Jito also expanded it's involvement in the Solana staking space through StakeNet, a Solana stake pool manager. StakeNet is made up of two components: Validator History Program, which stores three years of verified on-chain and off-chain history of every validator on the Solana network, and Steward Program, which computes scores and stake delegation amounts for each validator. At its core, StakeNet scores validators (using the VHP and SP), to ensure that liquid staking providers can manage their stake delegation: to ensure that there is a sufficiently decentralised validator set.

Marinade Finance

Marinade Finance is the second most popular LST provided on Solana, at 9.24M SOL ($1.622B USD). Unlike Jito, Marinade does not offer MEV boosted rewards, but has it’s own unique product suite, spearheaded by Marinade Native, which allows SOL holders to access an automated validator management strategy, to optimise yield and reduce risks that come with staking with a single validator. It has no smart contract interactions, charges a 0% performance fee and 0% deposit fee, and aims at becoming a public good to decentralise stake.

Apart from Marinade Native, Marinade also announced their Protected Staking Rewards (PSR) in December 2023, with the goal of reducing validator degradation impact on SOL stakers. Historically SOL stakers would have to bear the cost of validator downtime, or commission changes. PSR necessitates validators to put up a protection bond to be eligible for Marinade stake. This bond will be used to cover for staking reward losses incurred, if the node operator's performance degrades.

Sanctum

Sanctum is a liquid staking token product that offers two products, Infinity, a multi-LST liquidity pool and Validator LSTs.

Infinity is a LST LP that supports different Solana LSTs natively, by computing the prices of different LSTs based on the SOL contained in the stake account. Instead of using a CPMM or stableswap style curve, Infinity calculates the prices of LSTs by calculating the ratio of total lamports (smallest unit of currency within Solana, akin to wei for Ethereum)and the total supply of SOL inside of the stake account. As rewards accrue to the LST over an epoch, the total lamports increase, leading to an increase/change in the price of the LST.

Sanctum also offers INF, it's own LST. The goal of INF is to create a Solana LST liquidity hub. Users can trade any Solana LST into INF-SOL or INF-USDC liquidity, theoretically benefiting from increased access to liquidity.

In addition to the Infinity product, Sanctum offers Validator LSTs. Validator LSTs represent liquid version of a stake account, which can be thought of as inaccessible "vaults" for locked and delegated SOL. However, since there is underlying SOL, an LST can be issued, with backing, to be used in DeFi. The unlock with Sanctum's Validator LST product is that it enables validators to spin up their own LST products with adequate liquidity. This liquidity mainly comes through the Sanctum Reserve Pool. The Reserve is a pool of idle SOL, which can accept staked SOL and return liquid, unstaked SOL. The Reserve can then unstake the staked SOL at the end of an epoch and replenish the pool. Additionally, Validator LSTs can use the Infinity pool, and benefit off the liquidity offered through it.

Restaking

A more recent development with the validation space is the advent and proliferation of restaking services. Restaking is a new primitive in crypto economic security that allows staked assets to be reused to secure not only the underlying blockchain but also additional protocols and applications. This mechanism enables new protocols to utilize a modular technology stack, inheriting security from the underlying blockchain without the need to establish their own validator sets.

By restaking their assets, stakers can earn incremental rewards for securing additional protocols and applications. However, this also introduces additional slashing risks. Both rewards and slashing penalties are determined at the individual protocol or application level, which means that each protocol can set its own parameters for these incentives and penalties. It is the job of the operator to opt-in to additional validation services such as:

Data Availability Layers: Similar in functionality to Celestia, these layers ensure that data needed by the blockchain is available and accessible.

Source: @hahahash Dune

Shared Sequencers: Entities like Espresso Systems that help order and validate transactions across different blockchains.

Proof Aggregators: Services that aggregate and verify multiple proofs from various protocols to enhance efficiency and security.

Oracles: Systems that provide reliable external data to smart contracts.

Liquid Restaking

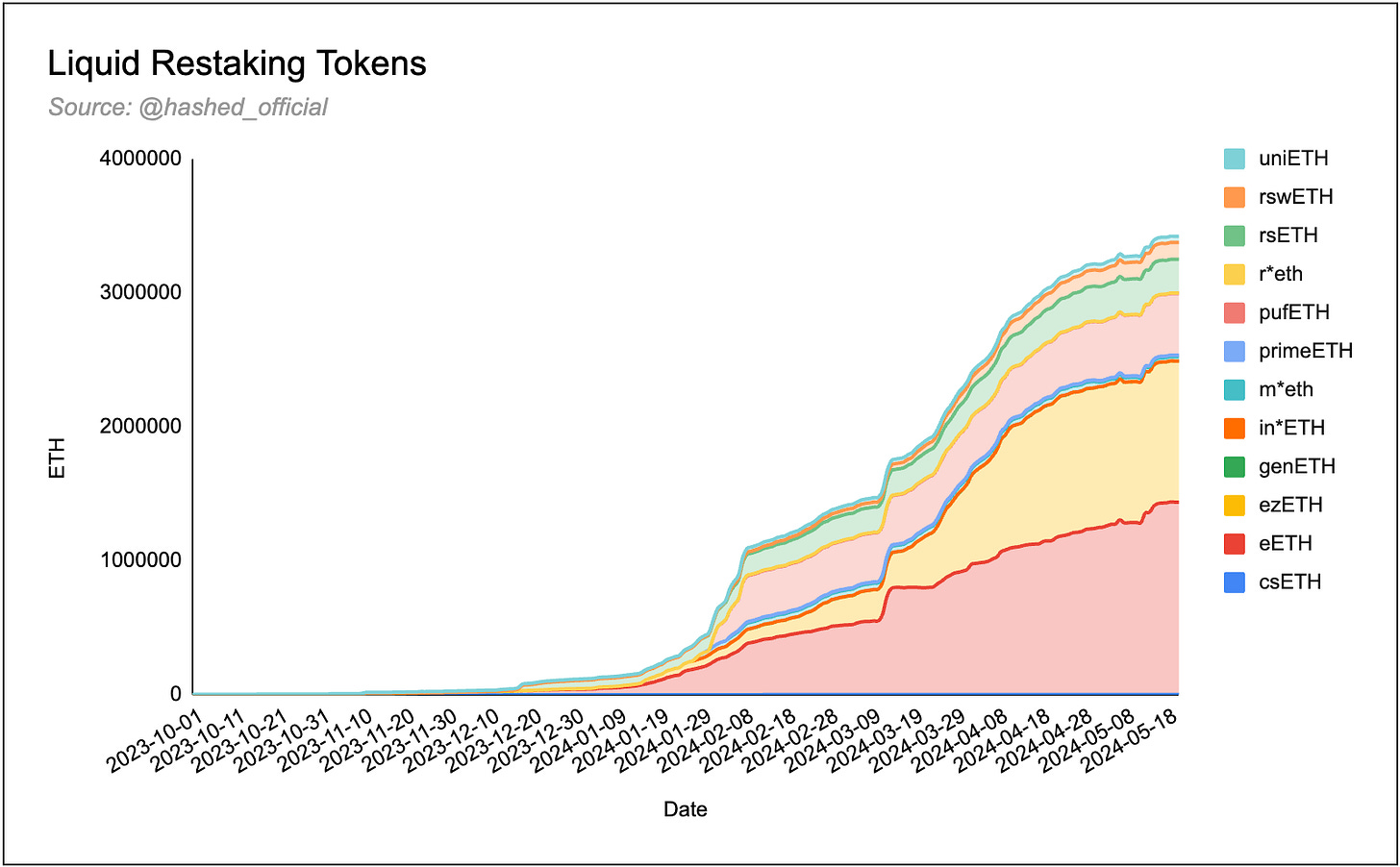

Another development within the staking space is the emergence of liquid re-staking tokens (LRTs), which enable users to have a liquid receipt token representing their claim on the underlying restaked ETH. Since their introduction in late 2023, LRTs have accumulated over 3.4 million ETH ($10.5B).

One of the first LRTs to market was Bedrock’s uniETH, which had a 94% market share of the LRT market in late October, but has since squandered it’s lead to new LRT protocols and incumbent LST protocols launching their own LRT. EtherFi is one such LST protocol, which now has the lions share of the LRT market (42.1%) with their eETH product.

Karak

Karak is another novel protocol within the restaking sector, with their development of a universal restaking layer designed to provide cryptoeconomic security using any asset.

Currently Karak supports four networks: Ethereum, Arbitrum, Mantle and Karak’s L2 network (K2). Across these networks Users can engage in restaking via several approaches, including:

Interestingly, Karak enables users to restake a number of more exotic assets such as Eigenlayer LRT’s and Pendle’s PT tokens, meaning users can earn the underlying yield of these assets as well as the yield from Karak.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.