The Hyperliquid Issue #3

Bi-weekly Hyperliquid Ecosystem Report

Stake HYPE with ASXN:

https://app.hyperliquid.xyz/staking

Volume

Hyperliquid continues to process impressive volume with $479B traded in the past 3 months. Since our last update, Hyperliquid has processed $145B in volume.

On Jan 18th to 20th we saw a spike in daily volume (above $15B) with the launch of TRUMP and MELANIA.

Over the past 3 months the average daily volume has been $5.3B $3.5B, a 51% increase since our last update.

The 30d average HYPE/USDC spot volume has decreased over the past month, while weekly volume average has increased 50% since our last update.

Hyperliquid continues to lead in market share of derivative DEX’s. As of the 1st of February, it represents nearly 71% of total derivatives DEX volumes.

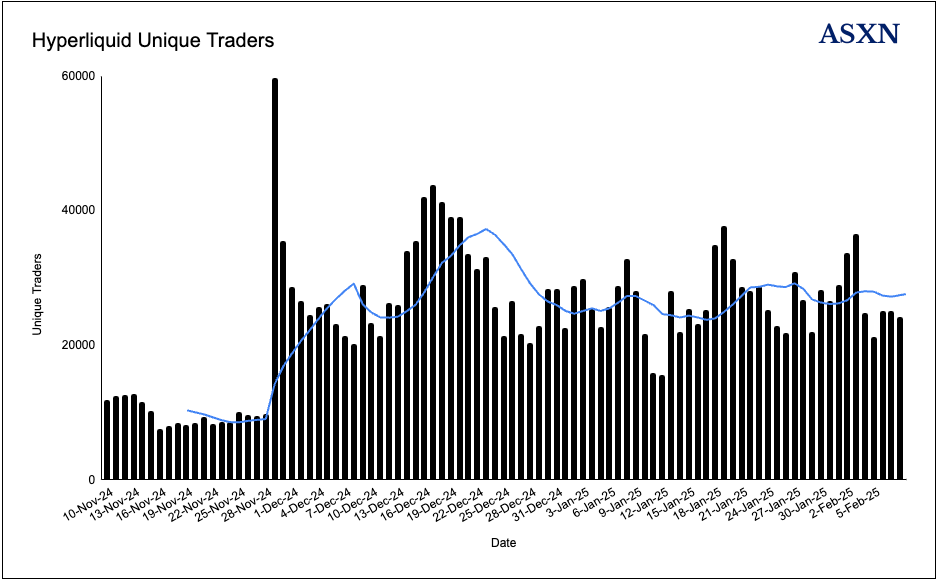

Unique Traders

Daily unique traders has decreased by 5% over the past week to just above 25K.

There has been an average of 24.2K unique traders per day over the past 3 months, a 33.5% increase since our last update.

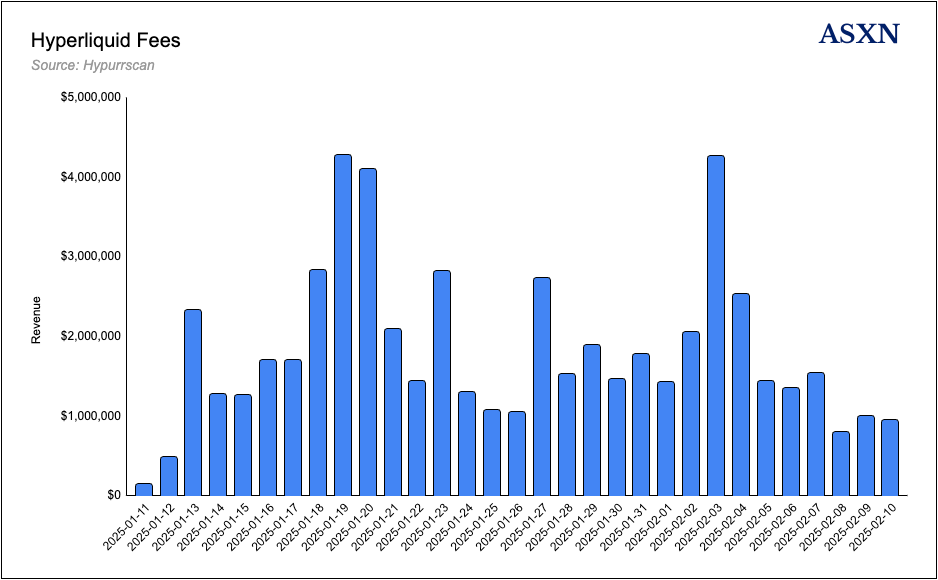

Fees

Over the past month, the platform has averaged $1,854,702 in daily revenue, and a total of $56,589,226 in revenue. This translates to approximately $$679.07M in annualized revenue.

Staking

As of date, there are still 16 validators on the Hyperliquid L1 & with over 426.8M HYPE staked (42.69% of supply).

In our previous update 430.3M HYPE was staked (43.3% of total supply), meaning that approximate 3.5M have unstaked since then.

ASXN was selected as a genesis mainnet validator & has since accumulated more than 4.7M in HYPE staked (approximately $115M).

You can stake with us here: https://app.hyperliquid.xyz/staking

Approximately 7M HYPE in total is currently pending unstaking over the next week.

The majority will unstake on the 14th (1.7M HYPE) and 15th (1.65M HYPE).

You can track Hyperliquid staking data here:

Auctions

Hyperliquid auction costs have continued to decline. The latest auction cost $146,766 for the ticker APU. Similarly to our last update, recent ticker auctions have been driven primarily by fundraising efforts for the Hypurrfun launch.

Most recent auctions:

HYPE Burn

The native spot and perpetual order books utilize the same volume-based fee schedule for each address. However, fees collected in non-USDC HIP-1 spot tokens are burned.

HYPE/USDC spot volume therefore directly results in the permanent burning of HYPE.

Since launch, over 152.9K HYPE (around $3.64) has been burned.

HyperEVM Testnet

To maximize customizability in balancing block speed and size, the HyperEVM introduces a dual-block architecture. Users prioritizing speed and submitting low-overhead transactions can utilize fast blocks, which have a 2-second duration and a 1M gas limit per block. Meanwhile, builders requiring larger blocks for more complex transactions can opt for slow blocks, which run on a 1-minute duration with a 30M gas limit. This approach effectively distributes total EVM throughput between small and large blocks, offering a flexible solution to the long-standing Bitcoin block size debate.

Additionally, the Hyperliquid team has upgraded the testnet, allowing native EVM <> L1 transfers to be initiated not only from EOAs (user wallets) but also directly from smart contracts. This enhancement expands interoperability and simplifies asset transfers across layers.

Hyperliquid Ecosystem

We just launched our Hyperliquid Ecosystem dashboard, where we showcase projects building on Hyperliquid.

You can find it here:

https://data.asxn.xyz/dashboard/hyperliquid-ecosystem

Felix

Twitter: https://x.com/felixprotocol

Website: https://usefelix.xyz/

Felix released a short article announcing their partnership with Anthias Labs for risk management.

Anthias will collaborate with Felix to expand their in-house risk monitoring and parameterization capabilities for better mint caps, LTVs, liquidation incentives, and more.

You can read the full article here:

https://x.com/felixprotocol/status/1879875287460250005

HyperLend

Twitter: https://x.com/hyperlendx

Website: https://hyperlend.finance/

HyperLend announced that they have started being audited and running security/bounty programs as well as monitoring with @AckeeBlockchain, @cantinaxyz, @PashovAuditGrp and Hypernative Labs.

Additionally, they announced that they will be onboarding Block Analitica (who work with DAI and USDS) as their new risk management team.

LoopedHype

Twitter: https://x.com/Looped_HYPE

Website: https://loopedhype.com/

loopedHYPE is an automated yield vault that gives users the opportunity to earn ~10% APY, without taking on the additional risks associated with leveraged trading.

Built by Staking Rewards, the team behind the leading staking platform, loopedHYPE allows stakers to maximize yield through an automated looping strategy, also known as recursive staking.

loopedHYPE is designed not just to benefit individual investors but also to enhance the Hyperliquid ecosystem as a whole. The vault is community-owned, with its own governance and utility token. 90% of the token supply will be distributed directly to vault depositors and ecosystem players, ensuring that the majority of the economic benefits are shared with the active participants of the ecosystem.

Vault depositors also have the option to ensure their stake is attributed to their chosen validator, through loopedHYPE’s partnerships with Thunderhead and Kinetiq. Additional yield from the vault strategy will also be attributed to the chosen validator, helping to grow the Hyperliquid staking ecosystem.

Phase 1 of loopedHYPE deposits will go live with the launch of HyperEVM.

Hyperswap

Twitter:https://x.com/HyperSwapX

HyperSwap is a liquidity hub designed to provide seamless liquidity solutions for users and projects within the ecosystem. HyperSwap offers advanced liquidity management through both concentrated liquidity pools (V3) and traditional AMM pools (V2). By driving liquidity and adoption, HyperSwap plays a key role in the growth of the HyperEVM ecosystem

The team is Hyperliquid native, involved in the ecosystem for more than a year, and is prioritizing liquidity, sustainable yield opportunities, and an intuitive user experience.

Early in January, HyperSwap released a new testnet version featuring Concentrated Liquidity Pools (v3) and an updated design:

https://x.com/HyperSwapX/status/1875216013425533030

With this week’s dual-blocks upgrade on the HyperEVM testnet, the HyperSwap dApp has been updated accordingly. You can still try it out at: https://hyperswap.exchange

The next features added on HyperSwap will be:

Incentivized Pools – A permissionless feature allowing anyone to incentivize liquidity providers joining in.

One-Sided LP – Providing liquidity with a single asset.

Their first educational thread covering the basics of the HyperEVM has been published this week. Read it at this link: https://x.com/HyperSwapX/status/1886411955461628276

A complete user guide of the HyperSwap dApp has been published on the Hypurr Collective website, you can find it at this link: https://www.hypurr.co/ecosystem-projects/hyperswap

Silhouette

Twitter: https://x.com/silhouette_ex

Silhouette came out of stealth and announced that they are launching a decentralized trading platform built on Hyperliquid, with a focus on private trading capabilities through a hidden matching engine.

The protocol’s main goal is to keep market views private, protect leveraged positions, mitigate front-running on swaps (MEV) and conceal hedging strategies.

You can find the full announcement here:

https://x.com/silhouette_ex/status/1882083723669385342

If you’re building on Hyperliquid, please reach out to us to be included the next publication of the Hyperliquid Issue. You can reach us through our Twitter or through Telegram by messaging @fromm_asxn.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.