The Hyperliquid Issue #2

Bi-weekly Hyperliquid Ecosystem Report

Volume

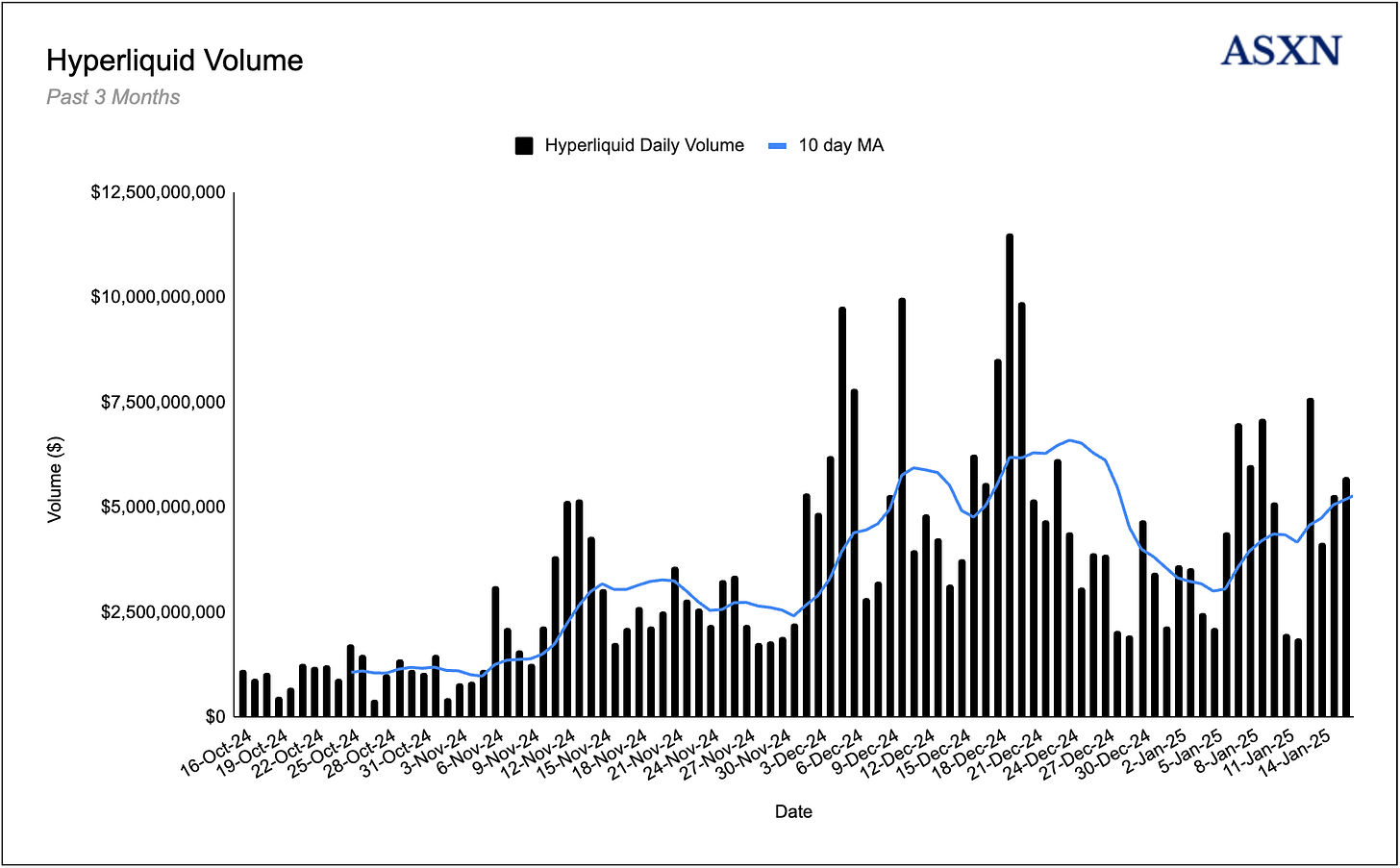

Post TGE, Hyperliquid still continues to process impressive volume with $324B traded in the past 3 months.

The 10 day moving average was decreasing since the 23rd of December - likely due to the slow holiday period. On Jan 1st the protocol spiked back above $5B in daily volume and this MA has been trending up ever since.

Over the past 3months the average daily volume has been $3.5B

HYPE/USDC spot volume has slowed down in the past month, with weekly volume average about 60% of the past months volume. We can see this drop off since late December.

This is likely tied to a reduction in airdrop sellers / tax exits.

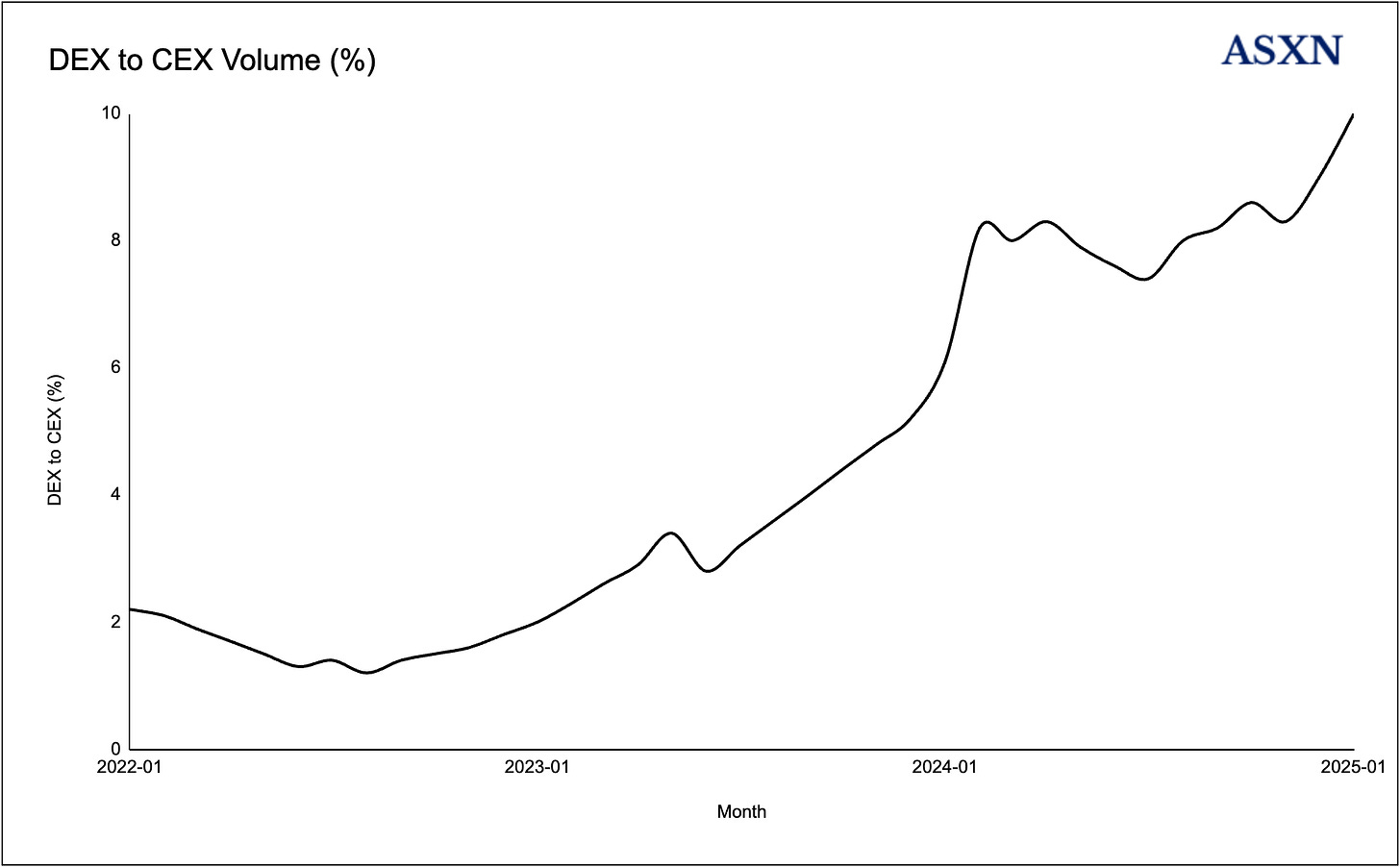

Hyperliquid continues to make ATHs in market share of derivative DEX’s, currently facilitating >70% of total volume.

DEX to CEX perpetual futures volume, fuelled by Hyperliquid, is ay all time highs with 10% of all future volume now coming from DEXs.

Unique Traders

Daily unique traders continue to average above 20,000, briefly peaking at 60,000 unique traders the day of HYPE TGE.

There has been an average of 19k Unique traders per day over the past 3 months & Hyperliquid has take >50% of all unique traders on derivative DEX’s.

Fees

Since DeFiLlama began tracking Hyperliquid's revenue, the platform has averaged $1,257,079 in daily revenue, even including the typically slower holiday season. This performance translates to an impressive $458,833,820 million in annualized revenue.

Staking

HYPE staking went live on mainnet on the 30th of December, with Hyperliquid adding 11 non-Hyper foundation validators to set.

There are now 16 validators on the Hyperliquid L1 & over 430.3M HYPE staked (43% of total supply).

In our last update 2 weeks ago, there was 380.1M staked, meaning >50M of HYPE stake was added.

ASXN was selected as a genesis mainnet validator & has since accumulated more than 4.7M in HYPE staked (approximately $115M).

You can stake with us here: https://app.hyperliquid.xyz/staking

We recently added a pending undelegations chart to the HYPE staking dashboard. Currently, a cumulative 17M HYPE tokens are undergoing unstaking over the next 7 days.

You can track Hyperliquid staking data here:

Auctions

After peaking at just under $975,746.79 for the GOD ticker, Hyperliquid auction costs have declined to the low-to-mid six-figure range. Recent ticker auctions have been driven primarily by fundraising efforts for the Hypurrfun launch.

Most recent auctions:

HYPE Burn

The native spot and perpetual order books utilize the same volume-based fee schedule for each address. However, fees collected in non-USDC HIP-1 spot tokens are burned.

HYPE/USDC spot volume therefore directly results in the permanent burning of HYPE.

Since launch, over 125k HYPE (more than $3M) has been burned.

Spot Token Holder Trends

Two weeks ago, spot holders of HYPE had begun to decline over the preceding 7- and 3-day periods, likely driven by recent sell-offs and tax-related trading activity. During that time, a corresponding increase in USDC holders was observed. However, the trend has since reversed, with HYPE spot holdings now trending upward, signaling renewed interest and accumulation among investors.

Hyperliquid Ecosystem

Felix

Twitter: https://x.com/felixprotocol

Website: https://usefelix.xyz/

Felix released a short article announcing their partnership with Anthias Labs for risk management.

Anthias will collaborate with Felix to expand their in-house risk monitoring and parameterization capabilities for better mint caps, LTVs, liquidation incentives, and more.

You can read the full article here:

https://x.com/felixprotocol/status/1879875287460250005

Pyth

Twitter: https://x.com/PythNetwork

Website: https://www.pyth.network/

Pyth announced their new product, Pyth Lazer which enables 1ms price feeds (which is 400 times faster than Pyth Core) at 15K compute units and 100-byte proofs with 20 price feeds per transaction.

You can read more about Pyth Lazer here:

https://x.com/PythNetwork/status/1879545169781166397

HyperLend

Twitter: https://x.com/hyperlendx

Website: https://hyperlend.finance/

HyperLend announced the release of their new landing page. You can find out more about their new landing page here:

https://x.com/hyperlendx/status/1877792529975783682

Solv

Twitter: https://x.com/SolvProtocol

Website: https://solv.finance/

Solv, a yield aggregation and liquidity management protocol focused built around SolvBTC, announced that their native token, SOLV, will be the first token with Day 1 CEX and Hyperliquid spot listings.

You can find the full announcement here:

https://x.com/HyperliquidX/status/1879496761997394102

HypioHL

Twitter: https://x.com/HypioHL

HypioHL, a new NFT project coming to Hyperliquid, but currently on Base launched earlier this month.

The project has seen 1,134 ETH (approximately $4M USD) in volume since launch, and is currently sitting at a floor price of 0.52 ETH.

Timeswap

Twitter: https://x.com/TimeswapLabs

Timeswap, an oracleless lending/borrowing protocol, had their public sale on Fjord earlier today.

You can find more information about the public sale here:

https://x.com/TimeswapLabs/status/1879953538870374842

If you’re building on Hyperliquid, please reach out to us to be included the next publication of the Hyperliquid Issue. You can reach us through our Twitter or through Telegram by messaging @fromm_asxn.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.

amazing work, thanks for all the time you guys put into everything you do!