The Hyperliquid Issue #1

Bi-weekly Hyperliquid Ecosystem Report

Over a month has passed since Hyperliquid's TGE, and the network has continued to gain momentum, consistently expanding its user base, trading volume, and market offerings. Significant progress has been made toward decentralization, with the addition of 11 non-Hyper Foundation validators and the introduction of mainnet staking, all while maintaining a best-in-class user experience.

Hyperliquid’s EVM is expected to launch in 2025. In anticipation of this, we are introducing a bi-weekly Hyperliquid ecosystem report to highlight emerging trends across the network and key protocols building on its foundation.

Volume

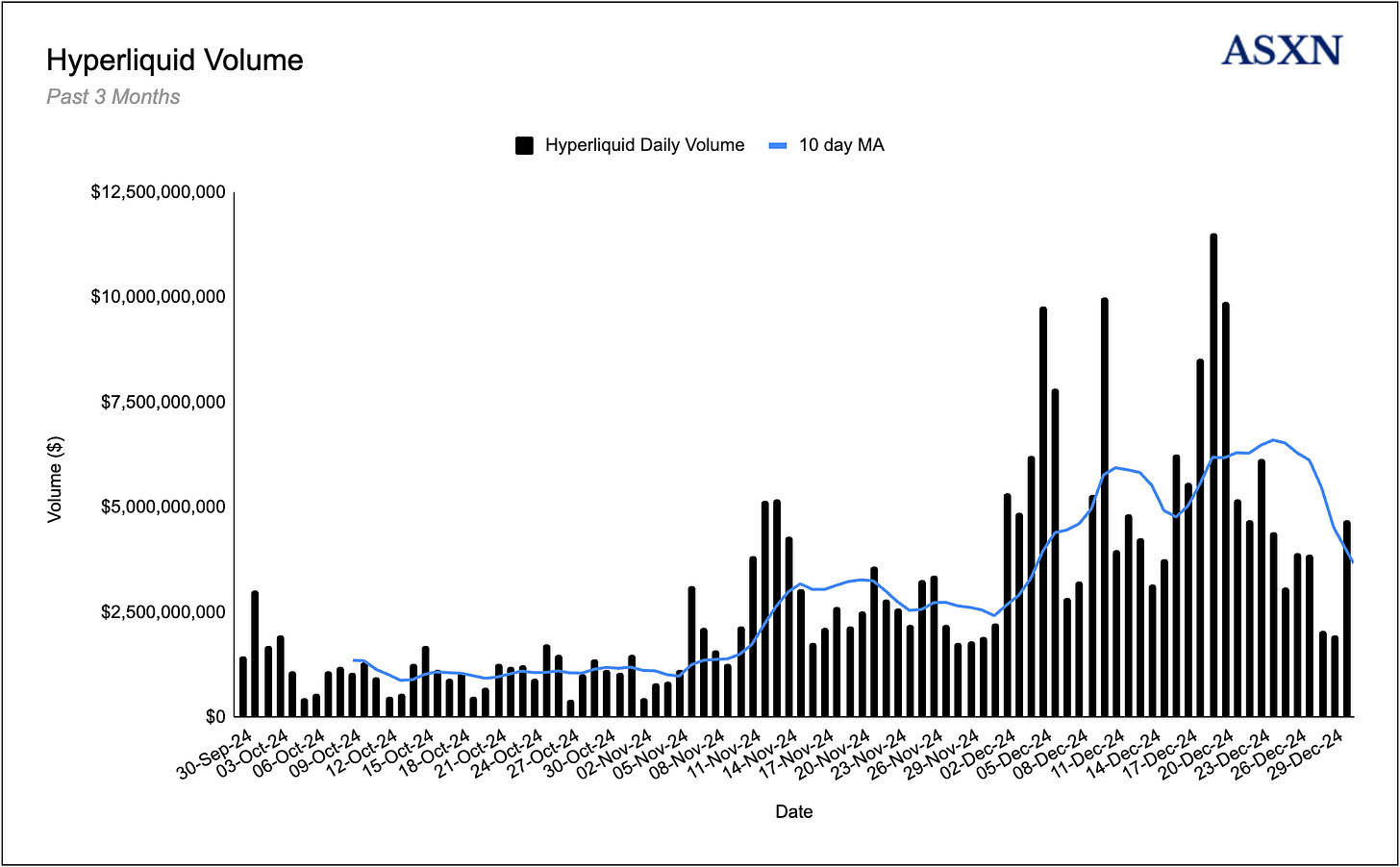

Post TGE, Hyperliquid still continues to process impressive volume with $268.9B traded in the past 3 months.

The 10 day moving average has been decreasing since the 23rd of December - likely due to the slow holiday period. On Jan 1st the protocol spiked back above $5B in daily volume.

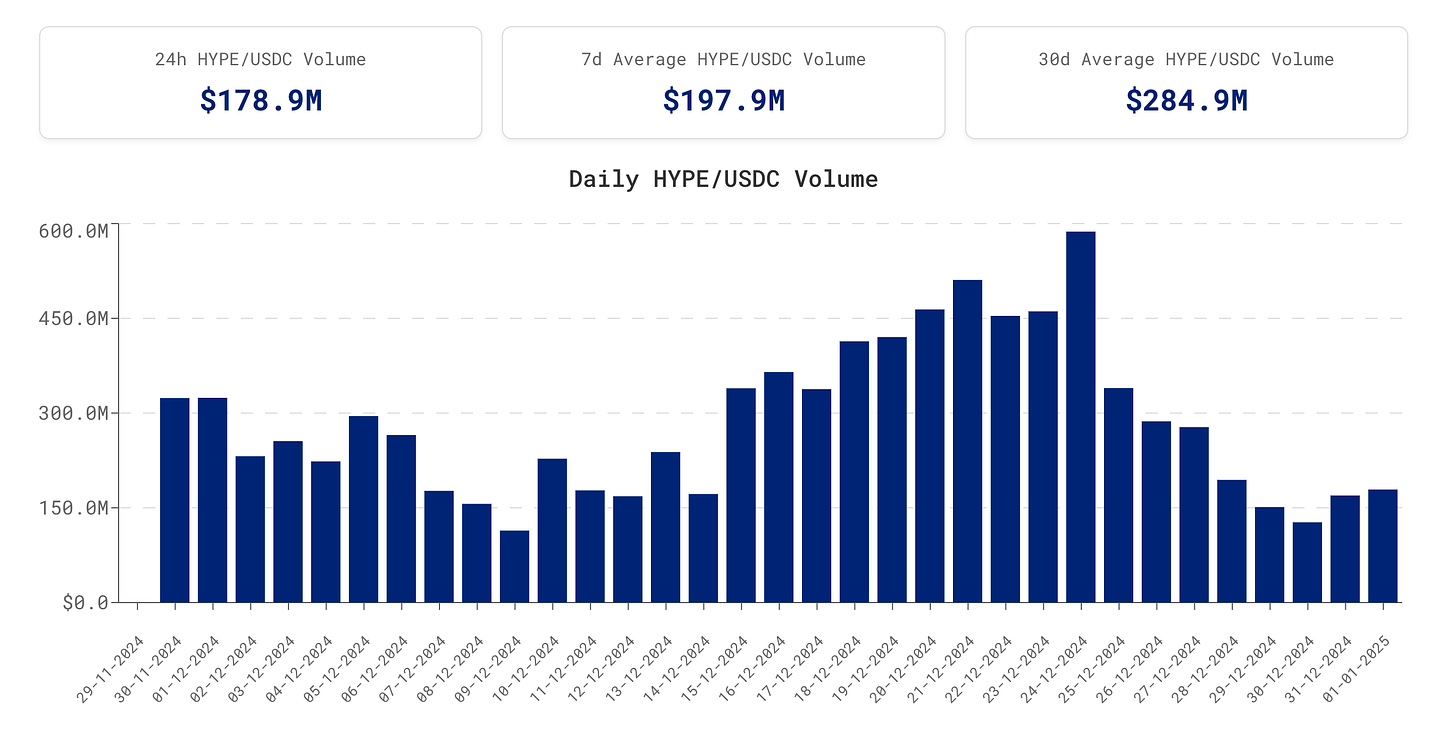

More than $10B of this volume came from the HYPE/USDC spot pair.

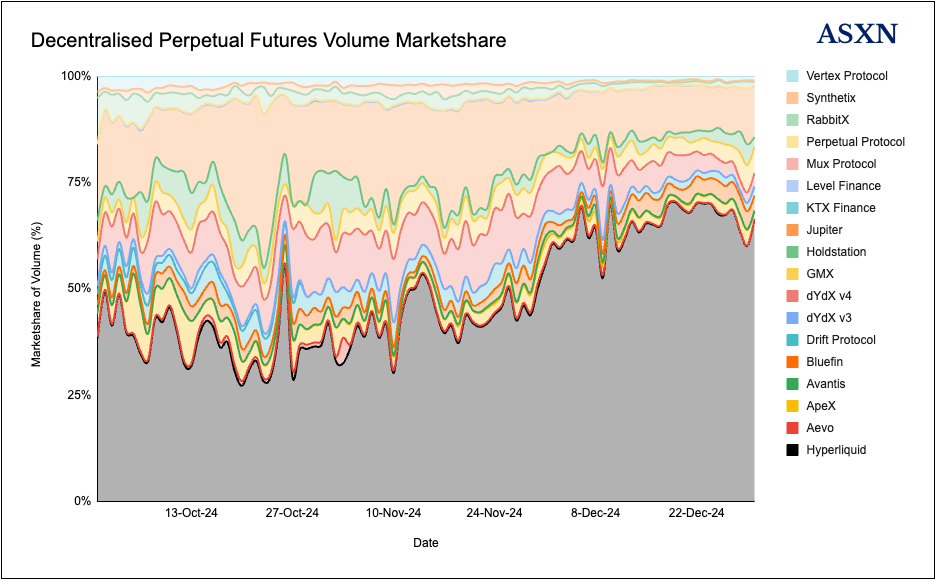

Unlike other decentralised perpetual exchanges post TGE, Hyperliquid has maintained and even expanded it’s volume market share.

Unique Traders

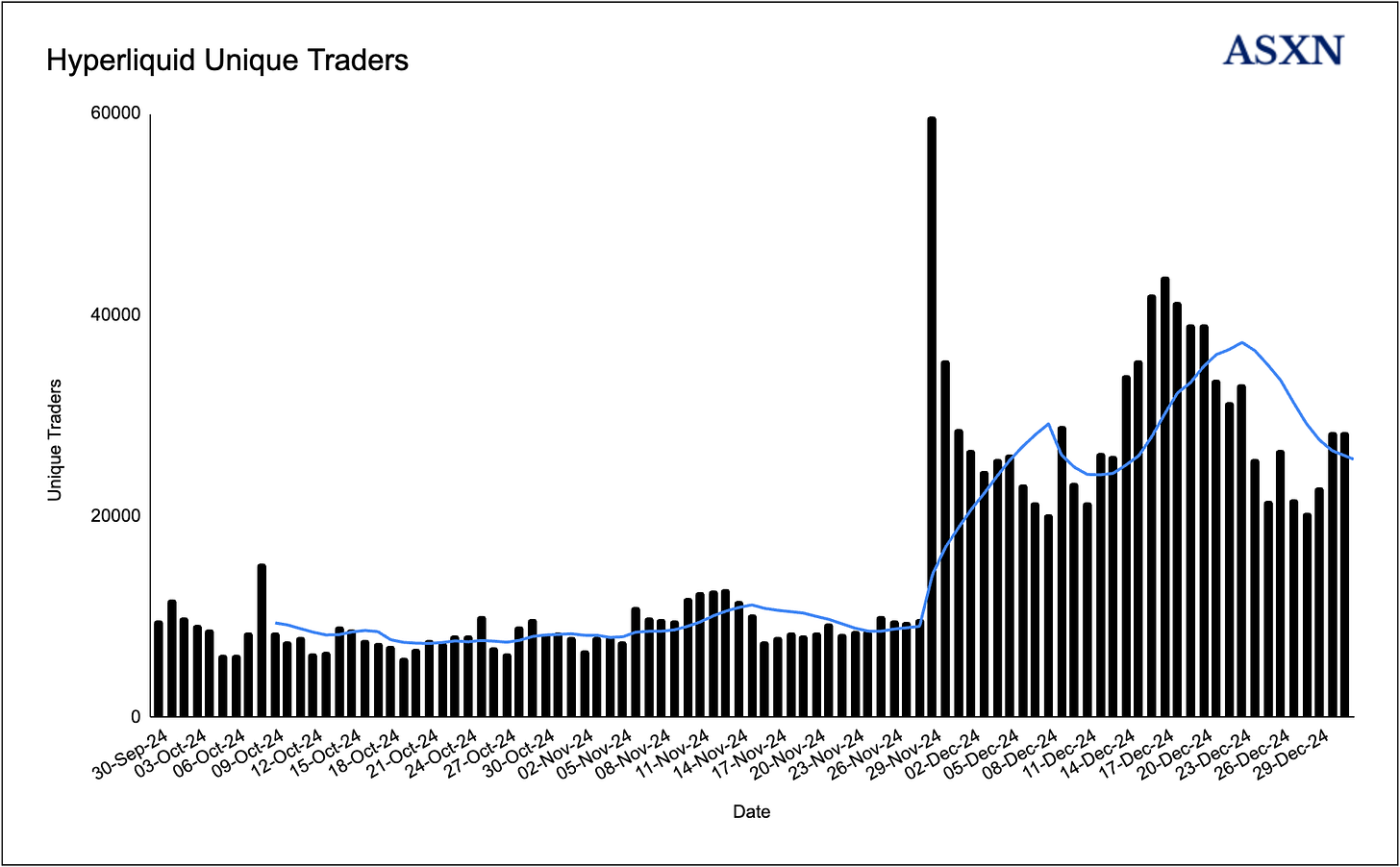

Daily unique traders continue to average above 20,000, briefly peaking at 60,000 unique traders the day of HYPE TGE.

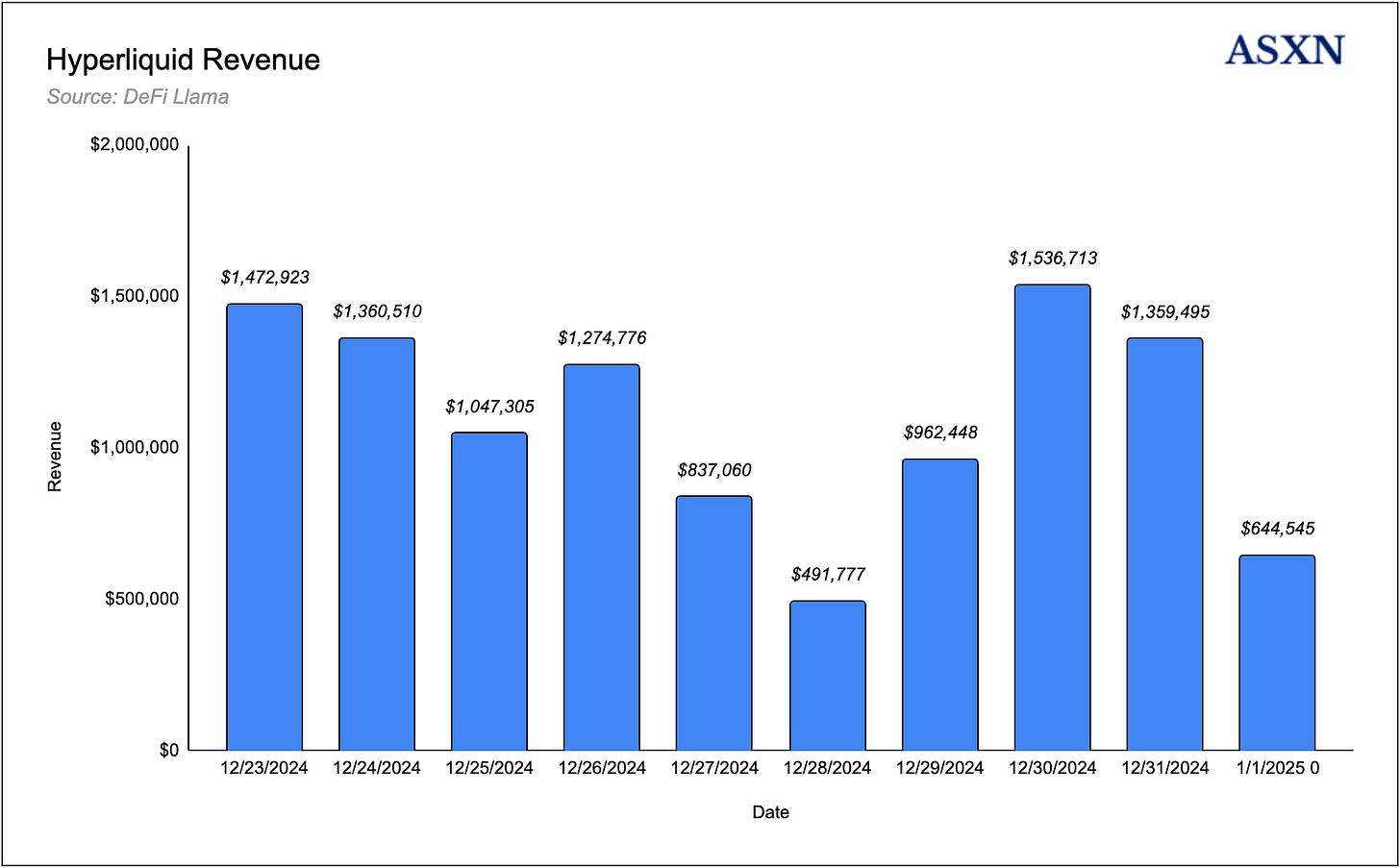

Fees

Since DeFiLlama began tracking Hyperliquid's revenue, the platform has averaged $1,149,223 in daily revenue, even during the typically slower holiday season. This performance translates to an impressive $419.7 million in annualized revenue.

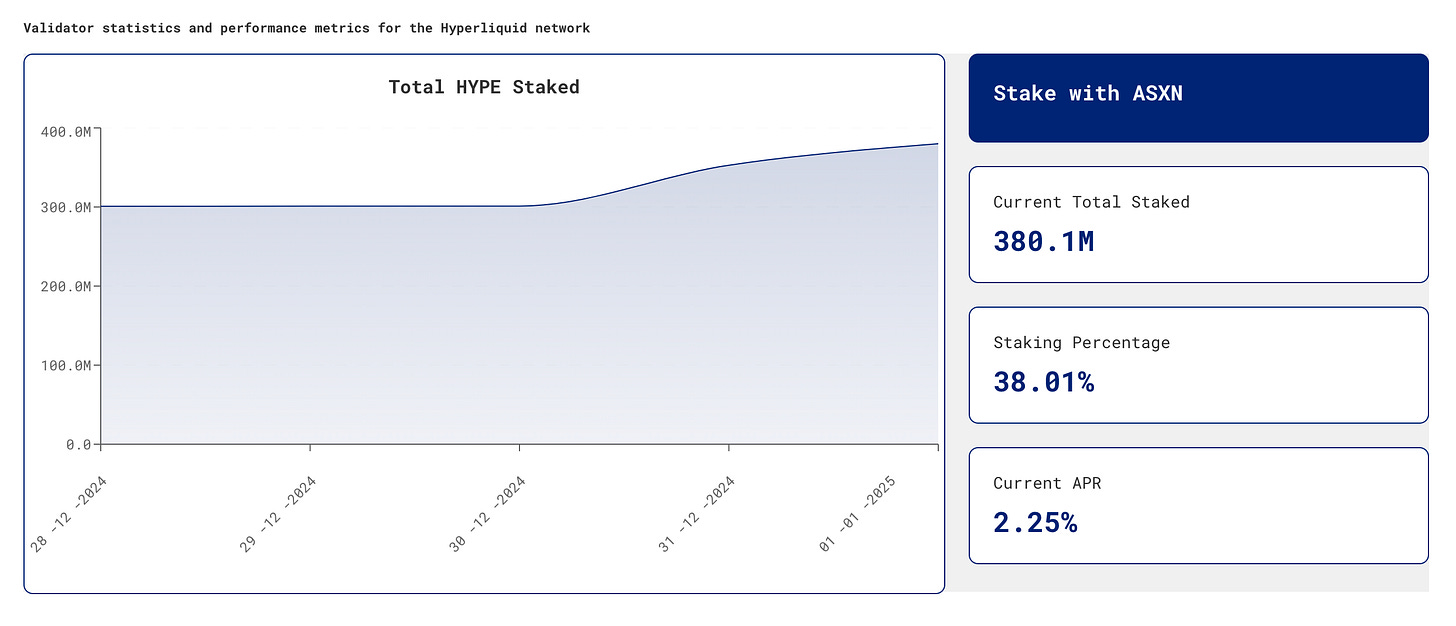

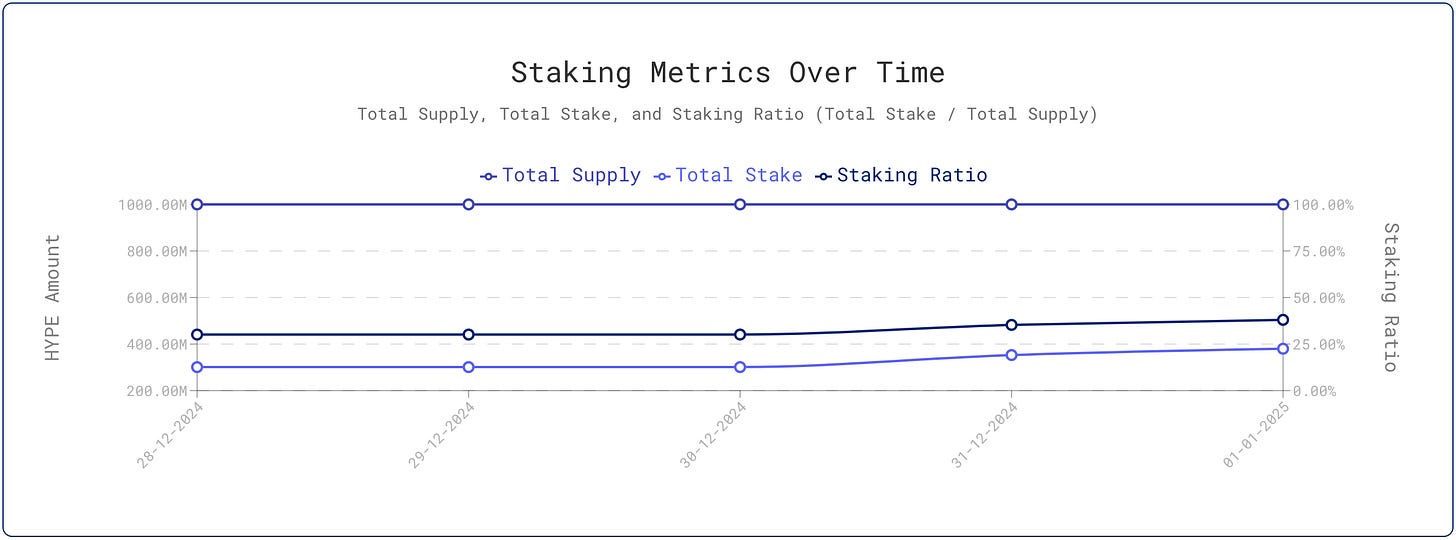

Staking

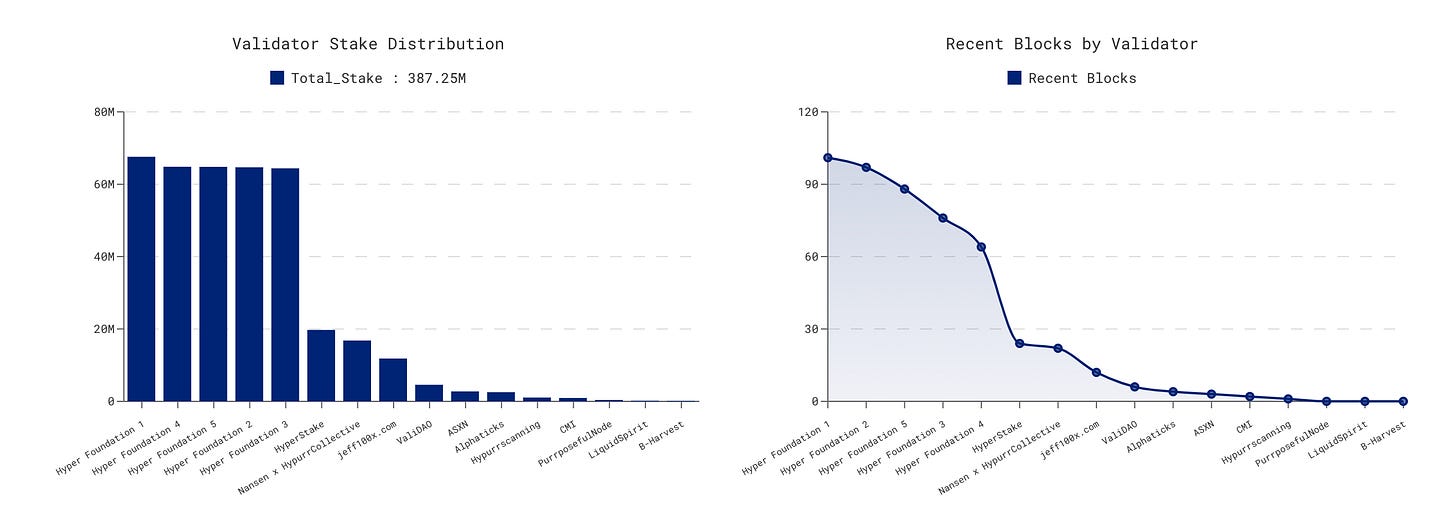

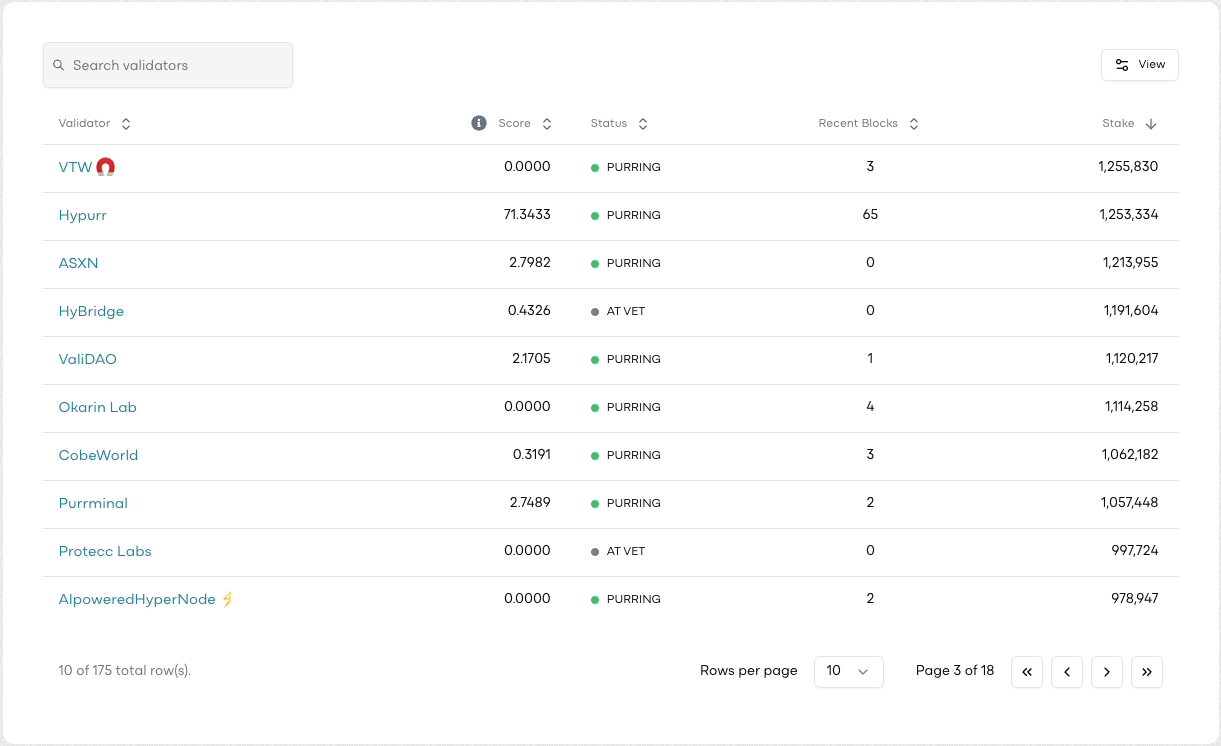

HYPE staking went live on mainnet on the 30th of December, with Hyperliquid adding 11 non-Hyper foundation validators to set.

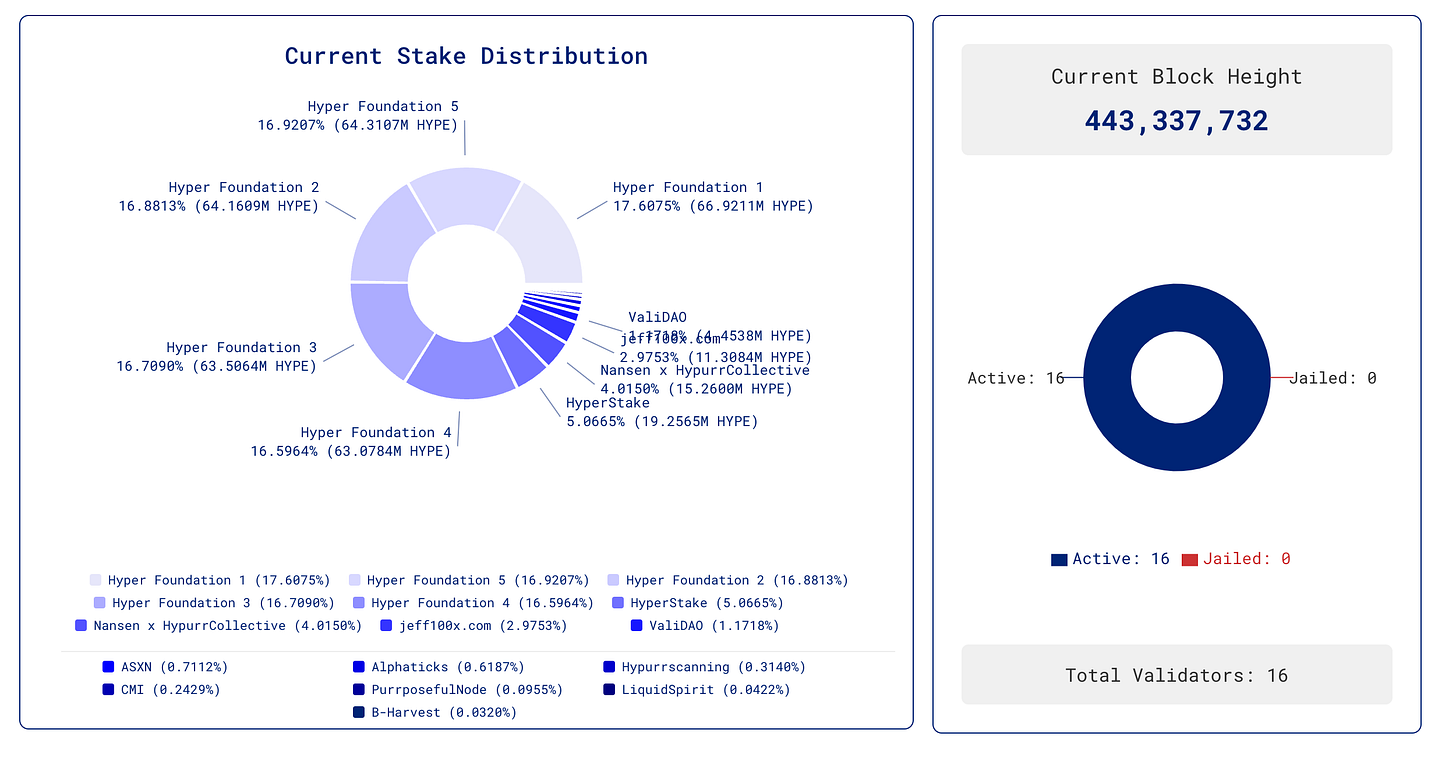

There are now 16 validators on the Hyperliquid L1 & over 380.1M HYPE staked (38.01% of total supply).

ASXN was selected as a genesis mainnet validator & has since accumulated more than 4.1M in HYPE staked (approximately $98M).

You can stake with us here: https://app.hyperliquid.xyz/staking

Whilst 38.01% of total supply is staked, 30.9% of this is from the team allocation + foundation allocation + the unclaimed airdrop. Any tokens that are undergoing vesting period and are locked will also have their rewards locked.

A significant portion of the current stake remains concentrated with the Hyper Foundation validators. However, since the mainnet launch, this concentration has improved, with the Foundation validators now holding 83.98% of the total stake.

You can track Hyperliquid staking data here:

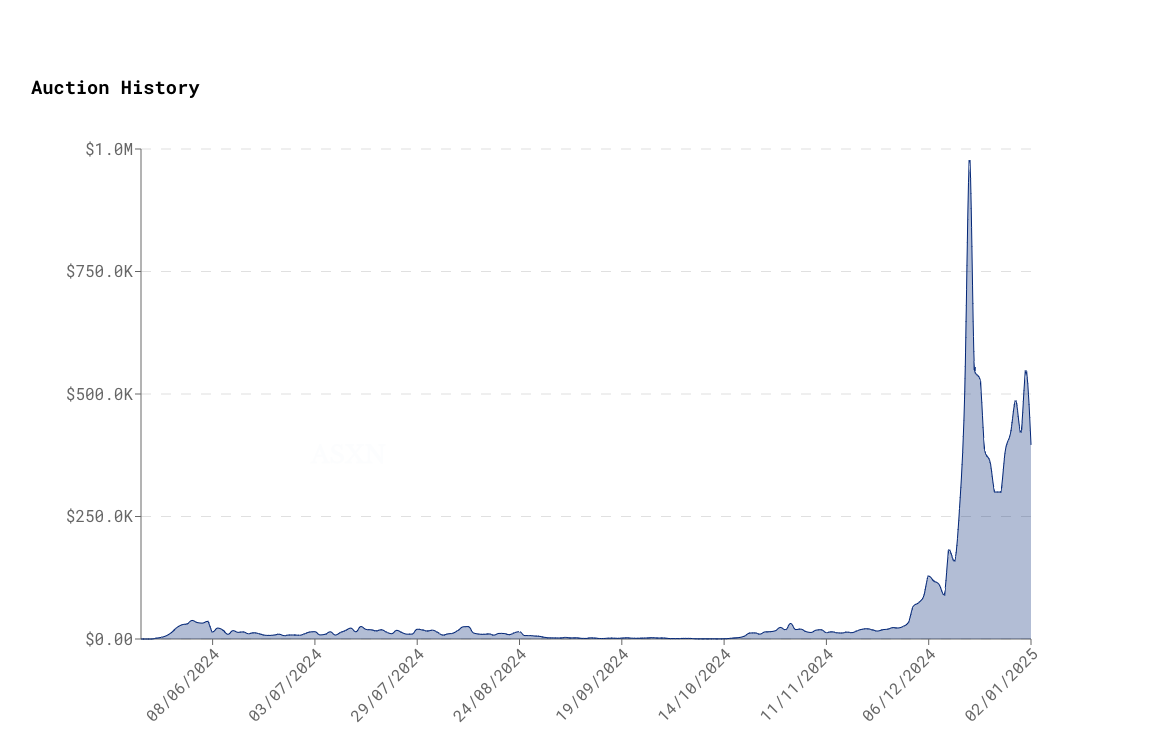

Auctions

After peaking at just under $975,746.79 for the GOD ticker, Hyperliquid auction costs have retreated to the low-to-mid six-figure range. Recent ticker auctions have primarily stemmed from Hypurrfun launch fundraising efforts.

HYPE Burn

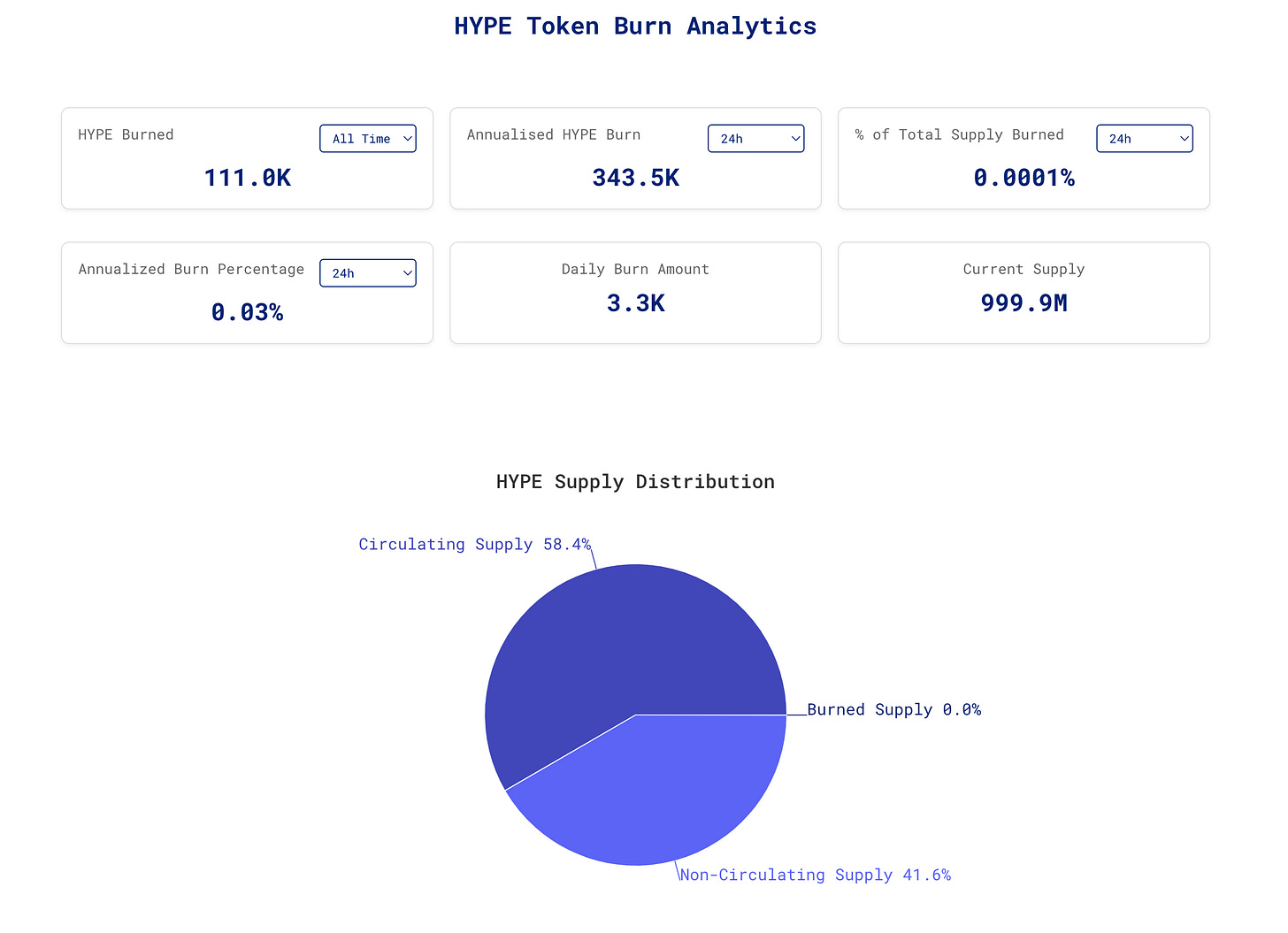

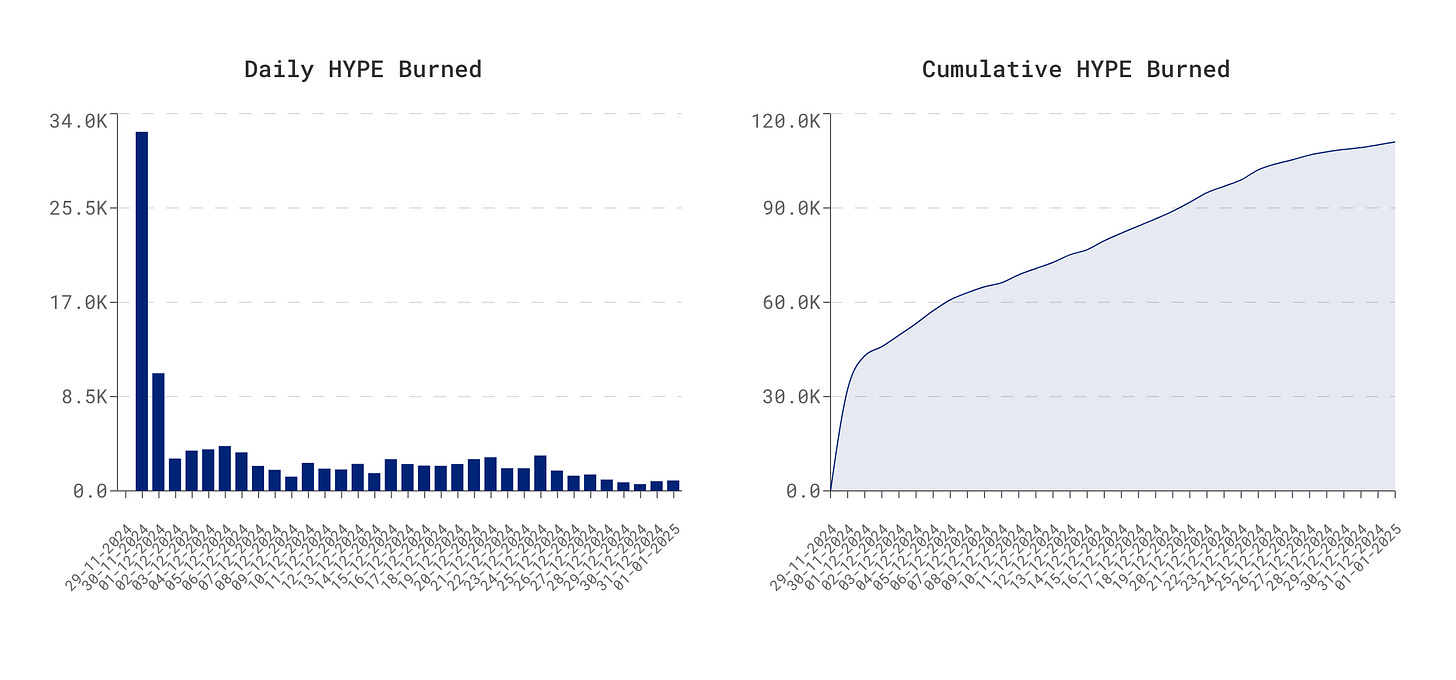

The native spot and perpetual order books utilize the same volume-based fee schedule for each address. However, fees collected in non-USDC HIP-1 spot tokens are burned.

HYPE/USDC spot volume therefore directly results in the permanent burning of HYPE.

Since launch, over 111k HYPE (more than $2.5M) has been burned. Based upon all-time data this would result in 1.2M HYPE burned per year or 0.12% of the total supply.

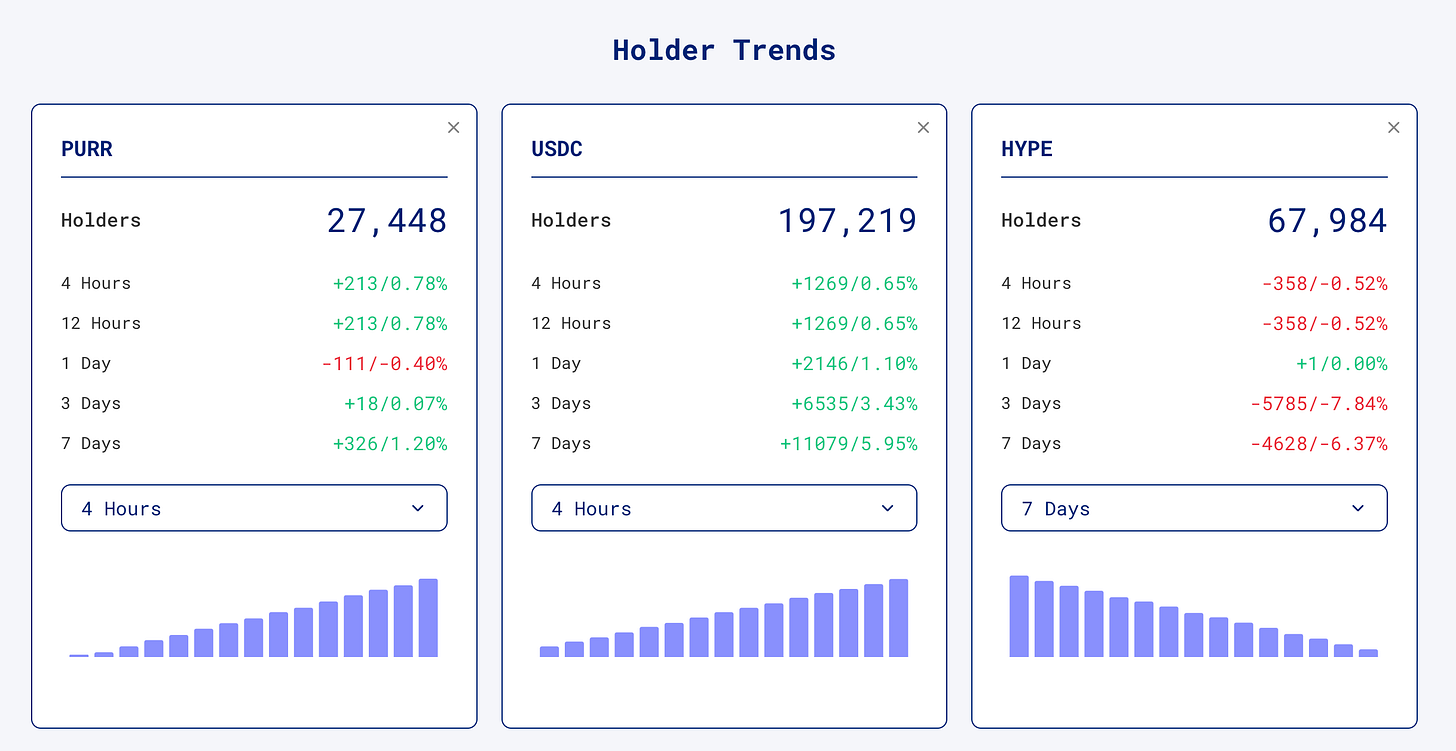

Spot Token Holder Trends

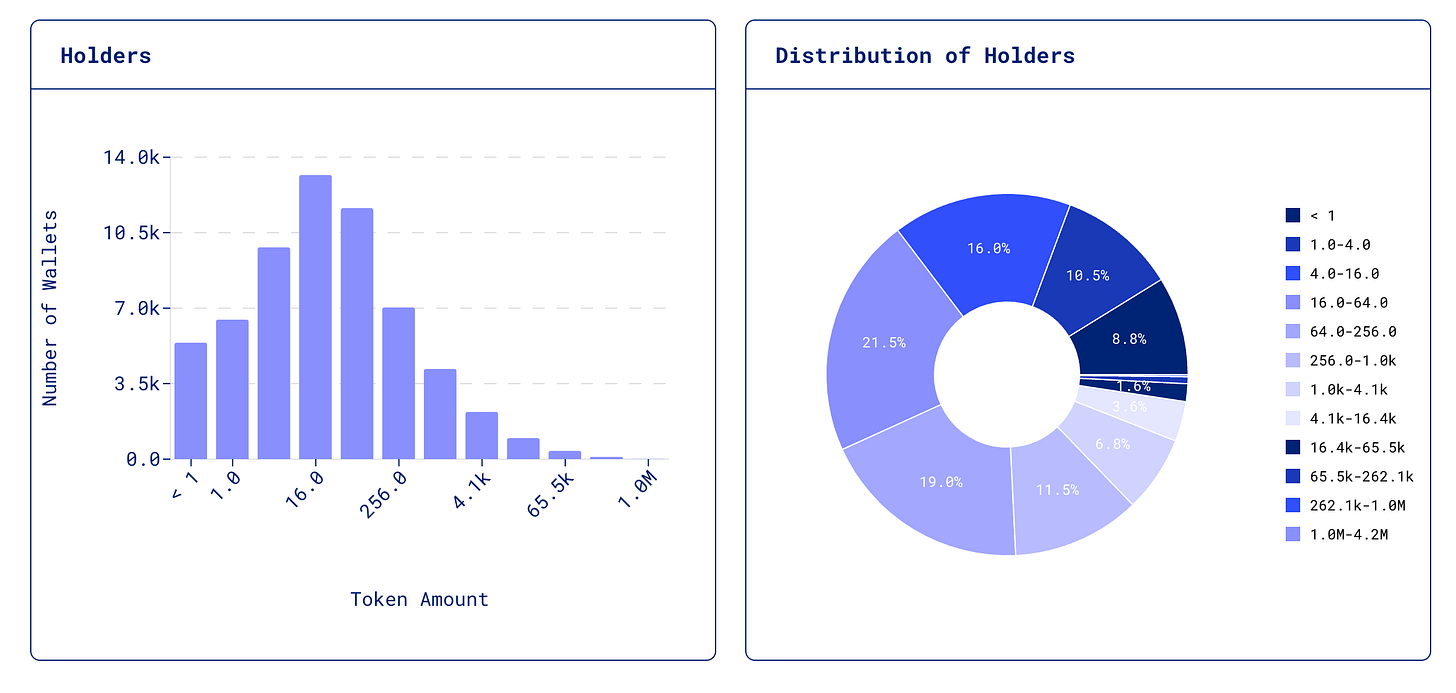

Spot holders of HYPE are for the first time starting to decrease over the past 7 days and 3 days. This is likely related to the recent sell off / tax trading. We see a commensurate increase in USDC holders.

The majority of addresses still hold less than 4,000 tokens. In fact, if you hold >10k HYPE you are in the top 2000 holders.

Hyperliquid Ecosystem

StakedHYPE

Twitter: https://x.com/stakedhype

Website: https://www.stakedhype.fi/institutional

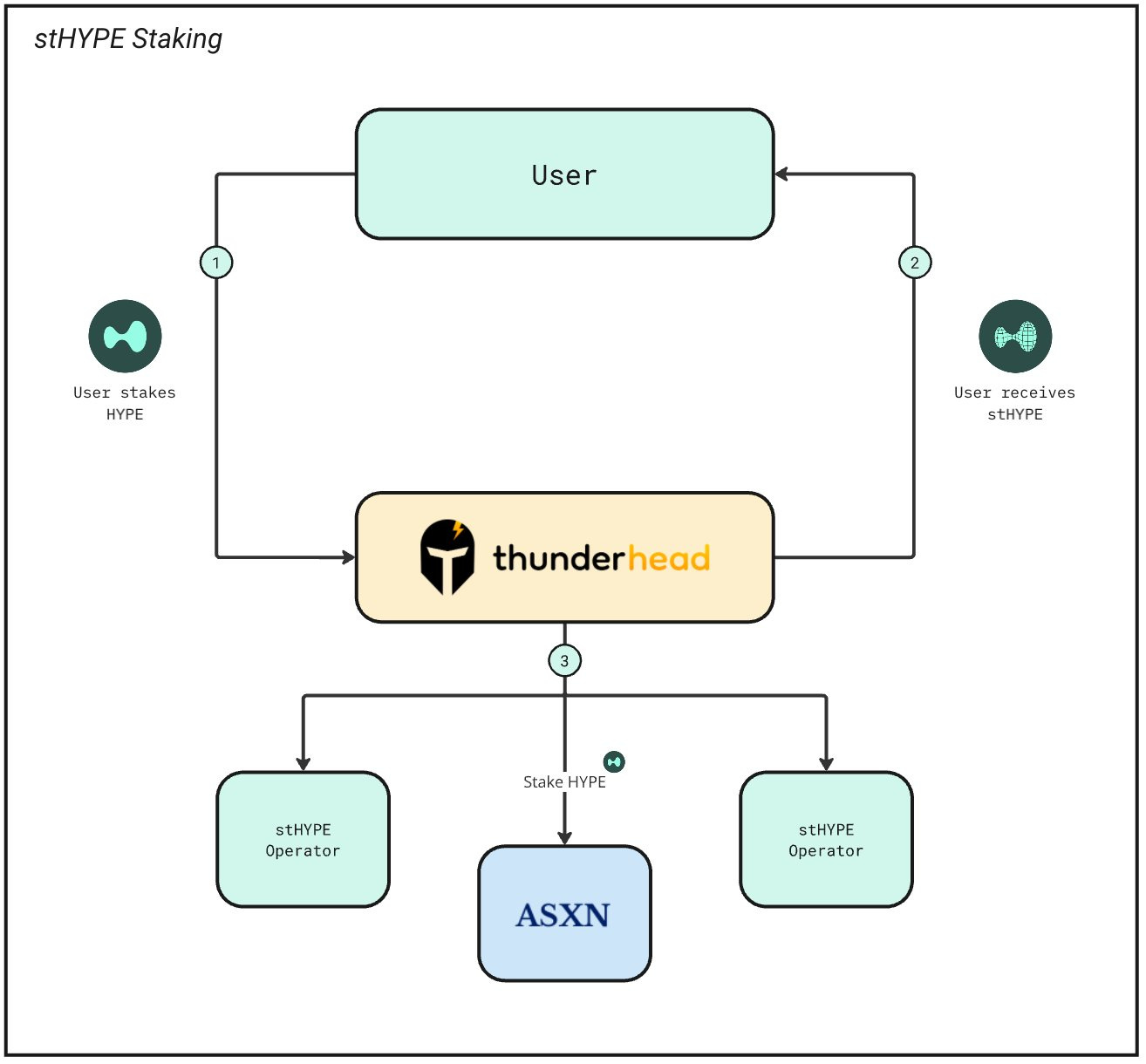

StakedHYPE is a liquid staking solution for the Hyperliquid built by Thunderhead. The protocol allows users to stake HYPE tokens while maintaining liquidity through stHYPE tokens. Users can stake HYPE and receive stHYPE tokens.

On top of offering secure, instant HYPE staking to maintain liquidity, the stHYPE team have also developed a novel staking mechanism called 'Community Codes’.

Community codes function like an onchain referral links. They allow stHYPE operator to use a community code which can be passed as a parameter in the transaction that stakes HYPE with Thunderhead. If a community code is included in this tx, all the stake from that tx will be managed by the operator who is assigned that community code.

StakedHYPE has already onboarded 8 operators based on their alignment with the Hyperliquid / stHYPE ecosystem, performance metrics, and security practices. ASXN is part of the operator set, and you can use the community code ‘asxn’ to stake with us.

The team recently released their institutional primer, which you can find here:

https://www.stakedhype.fi/institutional

Kinetiq

Twitter: https://x.com/kinetiq_xyz

Website: https://stakehub.kinetiq.xyz/

Kinetiq is a liquid staking provider built on Hyperliquid, with an upcoming LST, called kHYPE. They recently launched StakeHub v0.1, which scores testnet validators based on their performance and uptime metrics.

StakeHub is an autonomous validator scoring and stake distribution protocol, which is crucial in ensuring Kinetiq’s LST kHYPE.

kHYPE liquid stakers can openly and publicly verify that their stake is delegated to only the most performant and aligned validators on the backend, via our StakeHub dashboard.

StakeHub is developed in collaboration with their risk partners, Anthias Labs.

pvp.trade

Twitter: https://x.com/pvp_dot_trade

Website: https://pvp.trade/

PVP Trade is a Telegram-based trading bot that allows users to buy or sell spot and/or long and short perpetuals on Hyperliquid.

They are currently running a points program, which began in July 2024, where they are distributing 1M points. Points are distributed based on user activity and referrals, with users earning 1 point for every 5 points their referred users earn. Bonus points are awarded to the top 3 clans every week.

You can trade on pvp.trade through our referral link if you wish:

Felix

Twitter: https://x.com/felixprotocol

Website: https://usefelix.xyz/

Felix is a money market built on Hyperliquid. Their first product will be a CDP stablecoin called feUSD.

Through Felix, users will be able to borrow money for coin margin, run carry trades, and leverage loop on yield-bearing assets. Users can also deposit stables in Felix and earn money market yield. In addition, Felix enables users to set their own interest rates.

They are planning to be live on Day 1 of HyperEVM launch, and they have recently crossed the 1,000 user mark on their testnet.

Silhouette

Twitter: https://x.com/silhouette_ex

Silhouette is a protocol focused on privacy mechanisms for traders within Hyperliquid, both on the CLOB L1 and the upcoming HyperEVM. The protocol allows users to get trade execution guarantees and tap into the liquidity on Hyperliquid (e.g. protect TWAPs from being frontrun).

The protocol is still in stealth and will share more details soon.

Pyth

Twitter: https://x.com/PythNetwork

Website: https://www.pyth.network/

Pyth Network is a decentralized oracle network designed to bring real-time financial market data - with a "pull oracle" architecture.

Pyth enabled $1T of transaction volume in 2024. They have over 600 feeds available across crypto, stocks, FX, commodities and energy (such as Brent and Oil).

They also have Pyth Express Relay, which is live on Solana with Kamino Swap (with $25M in volumes since launch) - which offers zero slippage, zero MEV and free transactions.

They are live on testnet and are set to go live on HyperEVM on launch, with HyperLend, Felix and Keiko Finance (and others) integrating their price feeds.

HyperLend

Twitter: https://x.com/hyperlendx

Website: https://hyperlend.finance/

HyperLend is a money market built on Hyperliquid. The protocol offers lending and borrowing through a pool-based architecture (including multi-token pools, isolated markets and peer-to-peer lending). In addition, they offer a liquid perpetuals product and a liquid HLP product.

The Liquid Perpetual Vault takes users' USDC deposits, automatically opens and manages perpetual futures positions on Hyperliquid exchange, and gives them vault shares in return. These vault shares change in value based on the performance of the underlying positions (including profits/losses and funding fees). The vault shares, which are ERC-20 tokens, can be used as collateral in other parts of the protocol or redeemed back for USDC.

The Liquid HLP vault takes users' USDC deposits and uses them to provide liquidity on Hyperliquid exchange, giving them vault shares in return. These vault shares track their portion of liquidity provider fees and can be used as collateral or redeemed back for USDC.

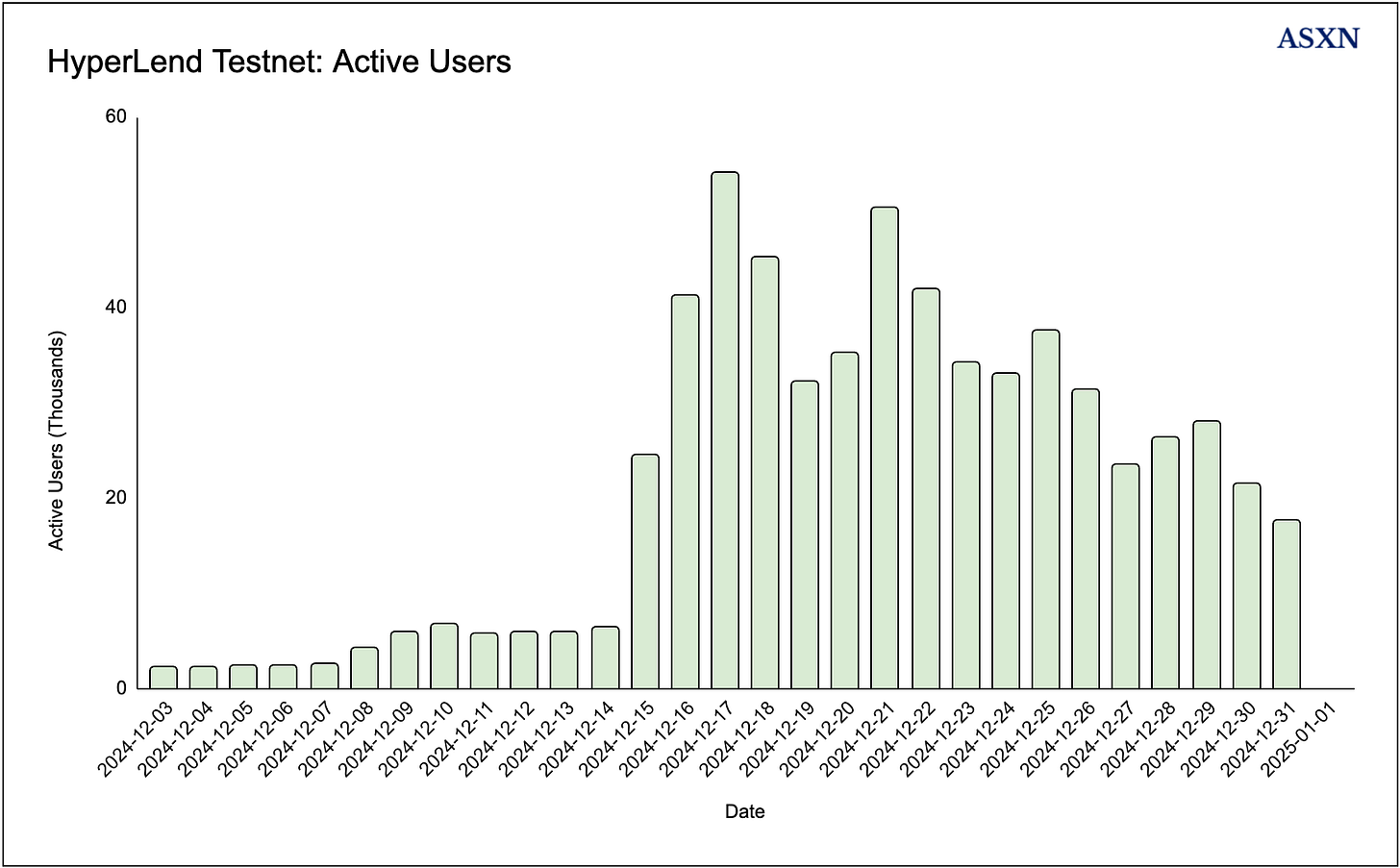

As of date, they've had 326K active users on testnet over the past month, with 50K active users in the past week.

If you’re building on Hyperliquid, please reach out to us to be included the next publication of the Hyperliquid Issue. You can reach us through our Twitter or through Telegram by messaging @fromm_asxn.