Polymarket: An Election-Driven Success Story

The Rise of Betting Culture: A Prelude to Polymarket

The last decade has witnessed a significant surge in betting culture, driven by a confluence of societal, technological, and economic factors. By understanding the rise of betting culture as a macro trend, we are better able to contextualize the rise of Polymarket.

Societal and Cultural Factors

One of the most notable aspects of this shift is the normalization of betting, particularly among young adults and sports enthusiasts. The normalization can be partially attributed to the utility gain of being a part of the culture, bettors are more involved in the event if there is capital at stake and it creates a sense of community amongst others who are betting on outcomes. Put simply, there is a definitive ‘buzz’ present when groups gather to watch a sports game that has been bet on.

Technological Advancements

The advent of mobile technology has revolutionized the accessibility of betting. Smartphones provide a platform for quick, convenient, and private betting, which has led to a surge in mobile betting activities. This ease of access facilitates impulsive betting behaviors, as users can place bets on virtually anything, anywhere, at any time.

Increasing Wealth Inequality and the Rise of 1000x Culture

In recent years, wealth inequality has become a defining issue of our time. The disparity between the rich and the poor continues to widen, with significant economic and social repercussions. It’s estimated that the top 1% of the global population now own more than 50% of the world's wealth. This has far reaching consequences, affecting everything from political stability to social mobility. This blend of increased wealth inequality and limited social mobility has led to the rise of 1000x culture – the idea that one needs to win the lotto in order to achieve financial freedom. The quintessential example of 1000x culture is the rise of multibets (accumulator bets) where bettors optimize for worse odds by stacking conditional bets in the vague hope that their 527:1 bet pays off.

Quantifying the online gambling market – Source: Statista

Revenue in the Online Gambling market is projected to reach US$97.70bn in 2024.

Revenue is expected to show an annual growth rate (CAGR 2024-2029) of 6.46%, resulting in a projected market volume of US$133.60bn by 2029.

In the Online Gambling market, the number of users is expected to amount to 281.8m users by 2029.

User penetration will be 5.9% in 2024 and is expected to hit 7.4% by 2029.

The average revenue per user (ARPU) is expected to amount to US$0.45k.

In global comparison, most revenue will be generated in the United States ($25bn in 2024).

As a macro point, it’s worth zooming out and contextualizing the rise of betting culture within the rise of online culture. The average Gen Z user spends 9h/day+ online, an astonishing figure when adequately considered. Moreover, the majority of Gen Z is below working age, thus the 9h/day+ spend online can largely be attributed to leisure. With 56% of Gen Z and 48% of Millennials stating they ‘feel addicted’ to their phone, it’s hard to underscore how pervasive these devices have become in our everyday life. The Covid-19 pandemic, and its effects on social relations and mental health, only served to accentuate the amount of time spent online.

The rise of online culture has provided a fertile ground for the growth of online betting, integrating it seamlessly into the fabric of daily digital life. The continuous evolution of technology, coupled with strategic marketing and changing societal norms, suggests that online betting will remain a significant aspect of online culture.

Polymarket

For those unaware, Polymarket is a crypto-based prediction market platform where users can speculate on the outcome of real-world events by trading in information markets. Built on Polygon, Polymarket allows participants to buy and sell shares in event outcomes, leveraging the wisdom of the crowd to predict future occurrences. The platform covers a wide range of topics, from politics and economics to sports and entertainment, providing a transparent and accessible way for individuals to express their views and potentially profit based on their knowledge and insights.

How as it become successful vs other betting sites

Thanks to well thought out marketing, the growth of 1000x culture, and its unique features, the rise of Polymarket has been nothing short of astronomical. Polymarkets marketing efforts have allowed it to tap into internet native culture, specifically, the Polymarket X account has spearheaded the growth of the platform through an onslaught of shitposting which has resonated with the crypto-native community known as CT. Polymarket offers its users unique features, the two most interesting of which being the ability to trade binary outcomes as continuous variables and markets for absurd outcomes – these are two unlocks that have helped foster an engaged user base. Finally, the rise of 1000x betting culture and the most volatile election in recent memory have served as perfect tailwinds for Polymarkets growth. However, questions remain as to whether Polymarket has achieved true PMF (Product Market Fit) or will struggle to maintain its user base once the election cycle has passed – this will be analyzed in detail later.

Protocol Mechanics

Polymarket operates similarly to any normal exchange, it serves as a marketplace where buyers and sellers meet to express opinions on price – in Polymarkets case, it’s the price (probability) of an outcome. The trading range of an outcome is constrained between 0% (an outcome occurs with 0% probability) and 100% (an outcome occurs with 100% certainty). As is the case with all markets, the price of an asset (probability of an event) is determined by the marginal dollar relative to the available liquidity.

Polymarket offers two types of markets, a binary outcome market (Yes/No) as well as a multi-outcome market (many options, one winner), let’s dive in.

Binary Outcome Markets

A perfect example of a Yes/No binary outcome market is the market for Ethereum making a new all time high in 2024. There is one Central Limit Order Book (CLOB) for this prediction market and users can set either market buy/sell or set limit buy/sell orders, this market functions almost exactly the same as the ETHUSDT pair on any CEX does. The payoffs at resolution can be calculated by taking the fill price and inverting it – i.e., $100 of Yes at 47c yields a payoff of $212 (100/47 * 100), should Ethereum make a new ATH in 2024. As alluded to earlier, the novel aspect of this type of market is that a binary Yes/No outcome can be traded as a continuous variable, this allows market participants to adjust positioning based on new information which also allows others to get a feel for the evolution of how other market participants are thinking about this outcome.

Multi-Outcome Markets

The second type of Yes/No market is called a multi-outcome market, pictured below. These are prediction markets where the user is offered more than one option. Interestingly, multi-outcome markets are priced in the same way that a binary outcome market is – each outcome (i.e., each candidate) is priced individually, there is no mechanical link between each outcome which keeps the total outcome = 100%. As one can see, the cumulative probability of the ‘Yes’ outcomes listed below is < 100%, it’s in the region of 98% and this offers market markers an arbitrage opportunity. Considering all the ‘No’ outcomes are priced richly, a market maker can buy up all the ‘Yes’ options at a total price of 98c and guarantee a 2% profit upon the markets resolution, this will push the price of ‘Yes’ up across the board. Obviously, this is an oversimplification of how an arbitrage trade would work in this context – there are transaction fees, slippage and the probability that neither Trump nor Harris wins the presidential election that have not been accounted for. This simply serves as an example to illustrate how arbitrage serves as a ‘soft’ link between these markets.

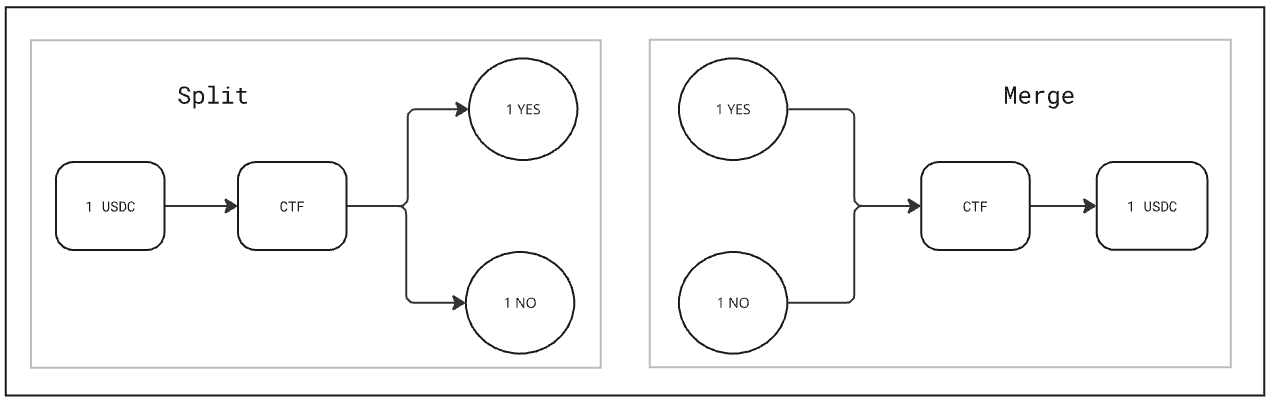

Conditional Token Framework

All outcomes on Polymarket are tokenized and exchanged both non-custodially and atomically on the Polygon Network. Specifically, Polymarket outcome shares are binary outcomes, Yes/No, and are represented using Gnosis’ Conditional Token Framework. The Gnosis CTF contract allows for “splitting” and “merging” full outcome sets. This means, for prepared conditions (markets), any user can split one unit of collateral (USDC) for 1 of each binary outcome token or can merge one of each outcome token into one unit of collateral. Therefore, in a correctly structured marketplace, the market price of these tokens should always be somewhere between (0, 1) and should sum to 1.

In order to better understand splitting and merging, let’s look at examples of how market making and order matching works. When placing a limit order for an outcome (i.e., Yes), a limit order also appears on the complementary outcome’s book (i.e., No). The reason for this is that the underlying binary market is a single, “unified” orderbook.

Example 1 – Bid/Ask Non-Complement:

Jack places a limit order to buy 10 Yes @ 35c

Jill places a limit order to sell 10 Yes @ 35c

The matching calculation for this example is simple, $3.50 will be transferred from Jack to Jill in exchange for her 10 shares.

Example 2 – Bid Complement:

Jack places a limit order to buy 10 Yes @ 35c

Jill places a limit order to buy 10 No @ 65c

At first glance it might seem that these orders are distinct, but recall that $1 can be split to 1 Yes and 1 No at any time, thus these two limit orders can be matched. An amount of $3.50 from Jack and $6.50 from Jill ($10 in total) is used to mint 10 full conditional token sets (10 YES and 10 No), then distribute 10 Yes to Jack and 10 No to Jill. This match is achieved using the Split operation.

Example 3 – Ask Complement:

Jack places a limit order to sell 20 Yes @ 75c

Jill places a limit order to sell 20 No @ 25c

A match is again possible in this scenario. It works as follows, transfer 20 Yes from Jack and 20 No from Jill and merge them via the CTF into $20 and distribute $15 to Jack and $5 to Jill. This match is achieved using the Merge operation.

CLOB

Polymarket orderbook is structured as a CLOB which resembles that of all centralized exchanges as well as some decentralized exchanges. Polymarkets CLOB is hybrid-decentralized in so far as there is an operator that provides off-chain matching/ordering services while settlement and execution happens on-chain, non-custodially, and according to instructions provided by users in the form of signed order messages. Underlying the exchange system is a custom exchange contract that facilitates atomic swaps (settlement) between binary outcome tokens and collateral assets according to signed limit orders. The exchange contract is purpose built for binary markets, this allows the unification of orderbooks such that orders for a position and its complement can be matched.

Resolvers

When the event in question takes place, the market resolves and payouts are made. All market resolution is completely decentralized, a majority of markets are resolved via UMA's optimistic oracle (OO), the rest (some price markets) are resolved via Pyth. In order to allow CTF markets to be resolved via the OO, Polymarket has developed a custom adapter contract called UmaCtfAdapter which allows the two contract systems to interface.

Market Making Rewards Program

In order for any market place to function smoothly, deep liquidity is needed. Deep liquidity promotes efficient price discovery, reduced volatility, and lower transaction costs – the absence of deep liquidity impacts UX and hurts platform adoption. To promote liquidity, Polymarket has taken after dYdX’s successful incentive program and tailored it to suit their platform and idiosyncrasies. The difference between the two platforms is Polymarkets binary market liquidity (a bid on A counts as an ask on A’), the lack of any staking mechanism, a slightly modified order utility relative to depth function and reward amounts isolated per market. By posting resting limit orders, a market maker is eligible for Polymarkets incentive program. Rewards are a function of uptime as well as quote tightness (vs midpoint), order books are sampled randomly every minute.

General ideas

How accurate is the prediction market?

One will routinely find national news outlets quoting Polymarket odds as an oracle of truth – this begs the question, how accurately does Polymarket price outcomes? The accuracy of an outcome market can be understood through a ‘wisdom of the crowds’ lens:

“Wisdom of crowds is the idea that large groups of people are collectively smarter than individual experts when it comes to problem-solving, decision-making, innovating, and predicting. The idea is that the viewpoint of an individual can inherently be biased, whereas taking the average knowledge of a crowd can result in eliminating the bias or noise to produce a clearer and more coherent result” – Investopedia.

The ‘wisdom of the crowds’ framework indicates that the accuracy of a predicted outcome scales with the notional volume of bets placed. According to Jordi Alexander, once a prediction market has passed 9 figures in volume, the quoted probabilities will be priced reasonably efficiently. However he also points out there are inefficiencies when pricing a lower percentage outcome which results in excessively bulky tails – i.e., an outcome occurs with probability 1% is priced at 4%. This is a function of capital costs associated with taking the ‘No’ side of the bet – risk 99c and wait x amount of time to make 1c . Given how unattractive the ‘No' side of the bet is at 99c, the market will end up pricing inefficiently. The implicit hurdle rate when pricing a low percentage outcome with reasonable time horizon is the risk free rate (5.5%), thus a low probability outcome may be priced richly due to the high opportunity cost of capital to pricing it efficiently.

Does Polymarket lean right?

There have been concerns raised that the outcomes on Polymarket are skewed right by way of participation bias – crypto natives use Polymarket and crypto natives lean right. While these concerns are valid and the reasoning stands, there will always be people who are willing to come in and take the other side of the bet if an outcome is mispriced. Participants will always optimize for profit over expressing a political opinion, therefore a political outcome market may skew right, but there are limits to the mispricing.

Product Market Fit (PMF) Found?

Another question that has taken shape in popular discourse is whether Polymarket has achieved PMF or its success is largely a function of the election cycle. If we look at historical election cycles, there tends to be one or two dominant prediction markets – this is a function of network effects and liquidity.

Intrade (2000s – Early 2010s) gained significant attention during the 2008 and 2012 U.S. presidential elections. However, it faced regulatory scrutiny from the U.S. Commodity Futures Trading Commission (CFTC) and eventually ceased operations in 2013 due to legal and financial issues.

Predictit (2014 – Present) is a popular prediction market platform launched in 2014, allowing users to buy and sell shares in the outcomes of political events, including elections. PredictIt has been widely used during recent election cycles, including the 2016 and 2020 U.S. presidential elections.

Betfair (2000s – Present) is a large online betting exchange that offers a wide range of markets, including political events. It has been a significant platform for election predictions, especially in Europe. Betfair has consistently been used for election forecasting, including the Brexit referendum and various UK and U.S. elections. It remains one of the largest and most active prediction markets globally.

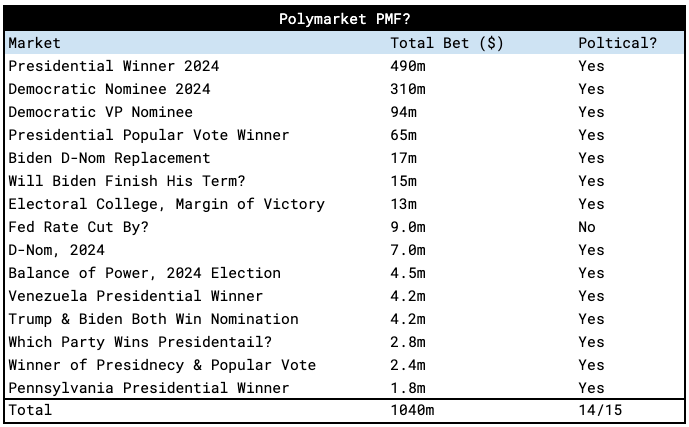

This brings us to Polymarket and an assessment of their PMF. If we look at the top 15 prediction markets by volume, there 3 stand out metrics are:

14 of the 15 highest volume markets are Political

99.2% ($1031m of $1040m) of the volume occurs in Political markets

Cumulative volume since inception (2020) is $1.1bn, 2/3rds of that occurred in the last 6 months.

Upon inspection of the data, the question whether Polymarket has achieved PMF or is the latest ‘new shiny toy’ becomes increasingly pertinent. The data indicates that a vast majority of Polymaket usage is centered around political markets and the US election – this lends itself to the notion that Polymarket is the ‘new shiny toy’.

An interesting point was raised by Kyle Salami of Multicoin Capital in this tweet, he points out that what really matters for prediction markets and their success is regularity. The sporadic nature of political events means that, while these markets can draw substantial engagement and media attention, they occur too infrequently to sustain continuous user activity and revenue. This irregularity limits the ability to generate consistent lifetime value (LTV) from users, which is crucial for justifying high customer acquisition costs (CAC). Looking at the data, the logical conclusion is that, absent an election cycle, the platform may struggle to maintain the ongoing engagement necessary for a thriving prediction market platform.

Based on the available evidence, there is no denying that Polymarkets recent success is almost entirely a function of the election cycle, however there are arguments to be made that Polymarket has the tools to translate its adoption into a sticky user base. As highlighted in the opening section, the rise of 1000x culture and socialization of betting culture is only going to become more pervasive, and Polymarket has positioned itself to capture the capital flows downstream of that trend. The ability to trade binary outcomes as continuous variables is a new primitive that hasn’t received enough attention, we view this as a material upgrade to the status quo of static probabilities. The Polymarket onboarding process is sufficiently abstracted that a non crypto-native will face little barriers to onboarding, this at least puts it on par with the likes of Betfair. Moreover, they are a Web3 protocol at heart, this positions them as favorites in a marketplace dominated by participants with a proclivity for gambling. Finally, they have raised a total of $70 million in funding so far. Most recently, the company announced a $45 million Series B round in May from investors including Peter Thiel’s Founders Fund and Vitalik Buterin. This runway should keep them afloat while adjusting their business model.

A Market Makers Perspective

We have had an in-depth look at the protocol mechanics of Polymarket, but a betting market is a two-sided ordeal. It serves us to understand those who provide the liquidity we use to bet. In pursuit of this, we’ve interviewed an anon who does just that.

Q: Can you tell me a bit about how you think about fair value when pricing an outcome? As well as toxic flow/adverse selection.

A: I'll preface by saying that I make markets manually and do it in a way to extract value from Polymarket vs. building a sustainable algo that profits from providing liquidity. I generally make markets that have reference markets with good liquidity. So fair value is usually the volume-weighted average of the venues.

Q: What are your input variables? Or can you tell me something about the mechanics of the market making you do?

A: I'm mostly looking at daily rewards vs. volume and historical top of book liquidity to back out the yield on the incentives. From there, I'm making an educated guess on how much I'm going to lose by providing liquidity.

Q: How do you think about market selection? And how do you think about the differences between single markets and multi-outcome markets?

A: Mostly selecting sports markets or markets that are able to be arbitraged, like "will Biden drop out" vs. "will Biden and Trump both win the nomination." Multi-outcome markets just provide more inputs into fair value and are therefore more difficult to make. Price discovery can occur on any one of the outcome markets and this needs to be factored into the other markets.

Q: How do you take in external information (Bayesian inference) and how do you change your strategies/liquidity provided based on this?

A: It’s usually an all-or-nothing strategy. If there’s an obvious enough edge, I take it. If the edge dissipates due to new market info that I can’t easily factor in, I’ll just stop providing liquidity.

Q: What are some of the ways market making on Polymarket differs from market making on a centralized exchange (CEX)?

A: CEX market making is real market making, Polymarket has 10%+ spreads and way more toxic flow. The only way to feel good about being a market maker is to play for the incentives. The only participants doing traditional market making do so in high volume markets such as the Presidential election market – these firms, such as SIG or other similar large market makers are profitable by way of structural advantage. Specifically, they are connected enough to be able to hedge their book over-the-counter. Additional context: I used to make markets for CS:GO skins. Polymarket is pretty similar to that experience vs. a true market maker's experience.

Q: What are the biggest challenges you face?

A: Lack of P&L opportunity to justify building out actual quant models. Same issue as sports betting early in its market structure. Pro-firms haven't come in to make the markets, so they're inefficient to the point of allowing manual market makers and relatively unsophisticated market makers to make reasonable P&L on small books.

Q: Is there anything else you think is relevant or any info you’d like to share that I haven’t asked about?

A: The only thing I haven't mentioned which I probably should, although I haven’t looked into it because I don’t really care much, is that it's likely that "market makers" are employing similar strategies to exploit dYdX v3’s liquidity incentives. All top of book liquidity is treated equally, so algorithmic traders participating in the more liquid markets like Trump vs. Harris Presidency are able to spoof orders to get rewards without taking meaningful P&L risk. The general strategy is to quote the tightest spread, typically 1 penny (1-3% depending on odds), and refresh your order whenever it’s the next price to execute in the queue. This way, you're always providing top of book liquidity, but within the top of book quotes, you’re always staying at the end of the queue, so your orders never get hit. I’m too lazy to do it, but there’s probably a couple hundred thousand in annual P&L to be made on that strategy alone.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services