Karak Network: Universal Restaking Layer

Overview

Karak is developing a universal restaking layer designed to provide cryptoeconomic security using any asset, which enables developers to build products, including data availability protocols, oracles, rollups, and bridges, without worrying about bootstrapping security. This ensures that these applications and their participants behave appropriately by introducing slashing risks as a deterrent against malicious behavior.

Karak Mechanics

Karak has a few key shareholders in their ecosystem, which enable for the proliferation of decentralised trust:

Restakers - The core building block of Karak is the restakers themselves. A distributed set of participants deposit their crypto assets to the platform in exchange for additional rewards. Restakers can opt in to which services they would like to validate through delegations.

Distributed Secure Services (DSS) - DSS’s utilize the cryptoeconomic collateral that restakers deposit to Karak and use this value to secure applications and protocols that launch on Karak.

Operators - Operators, whether individuals or organizations—play a crucial role in validation of DSS’s. By registering with Karak, they allow restakers to delegate their assets. These Operators then voluntarily choose to offer various services to DSS’s, thereby boosting the security and efficiency of the networks they support.

We can walk through the user flow and protocol mechanics of Karak’s security layer:

Users come to the Karak site and deposit their assets. There are several assets which can be restaked on multiple chains. Currently Karak is in private beta and users can only sign up if they receive a invite code.

Once restakers deposit collateral, they can then allocate their assets to various Distributed Secure Services on the Karak networks and in doing so grant the protocol additional enforcement rights on their staked assets. Restakers can opt-in to providing economic security to various protocols and in doing so earn higher returns.

Upon opting into a Distributed Secure Service, additional slashing risks are applied to the collateral, in addition to the slashing risks / protocol risks of the underlying asset. For instance, a user who opts into a data availability protocol by supplying stETH would earn yield from both Lido staking the ETH and the protocol itself. However, they also assume the slashing risks associated with staking ETH through Lido, as well as those inherent in validation of the data availability protocol.

DSS Operators are entities which manage the technical effort required when validators these services. Restakers will delegate their assets to specific Operators.

For security reasons, there is a 14 day “unstake” period.

Protocol Metrics

Currently Karak supports three networks: Ethereum, Arbitrum and Karak’s L2 network (K2). Across these networks Users can engage in restaking via several approaches, including:

Liquid Staking Tokens

Users have the option to deposit standard liquid staking tokens (LSTs) into Karak. Validators can take these LSTs which have been deposited into Karak’s staking pools and restake these assets on Karak. On Ethereum mainnet the following LSTs can be restaked:

Swell’s swETH

Frax’s sfrxETH

Mantle’s mETH

Lido’s stETH

Rocketpool’s rETH

Coinbase’s cbETH

Binance’s wbETH

Stader’s ETHx

Currently, LSTs account for the smallest share of restaking deposits, comprising only 5.7% of the total deposited value.

Liquid Restaking Tokens

The bulk of Karak's deposits stem from Liquid Restaking Tokens (LRTs) that have previously been restaked within Eigenlayer. These LRTs contribute $82,411,145 to the TVL, representing 40.1% of all deposits. So far the following LRTs are accepted on Karak:

Swell’s rswETH

EtherFi’s eETH

KelpDAO’s rsETH

Renzo’s ezETH

Magpie’s mswETH

Magpie’s mstETH

Magpie’s MwbETH

Puffer’s pufETH

Stablecoins

Stablecoins can be restaked on Karak, making up $37.4M in deposits of 18.2% of TVL. So far the following stablecoins can be restaked:

Circle’s USDC

Tether’s USDT

Frax’s sFRAX

Maker’s sDAI

For sDAI and sFRAX, the standard FRAX and DAI stablecoins are initially deposited into an ERC-4626 staking vault before being restaked. This process mirrors how an PoS asset is first staked, allowing other crypto assets to be utilized productively prior to restaking.

Pendle

One of the primary differentiators of Karak is their addition of Pendle’s PT assets as eligible assets.

As a quick summary:

Pendle wraps yield and point-bearing tokens into SY (standardized yield tokens), which is a wrapped version of the underlying yield-bearing token that is compatible with the Pendle AMM (e.g. stETH → SY-stETH).

SY is then split into its principal and yield components, PT (principal token) and YT (yield token) respectively, this process is termed as yield-tokenization, where the yield is tokenized into a separate token. The principal token is the principal portion of the underlying yield-bearing asset, for example in the case of stETH, it represents ETH, while YT represents the yield component of stETH.

Karak allows users to deposit PT tokens to earn extra Karak XP rewards on top of them.

As of now the following Pendle related assets are eligible:

Pendle’s Kelp rsETH

Pendle’s Etherfi eETH

Pendle’s Swell rswETH

General Metrics

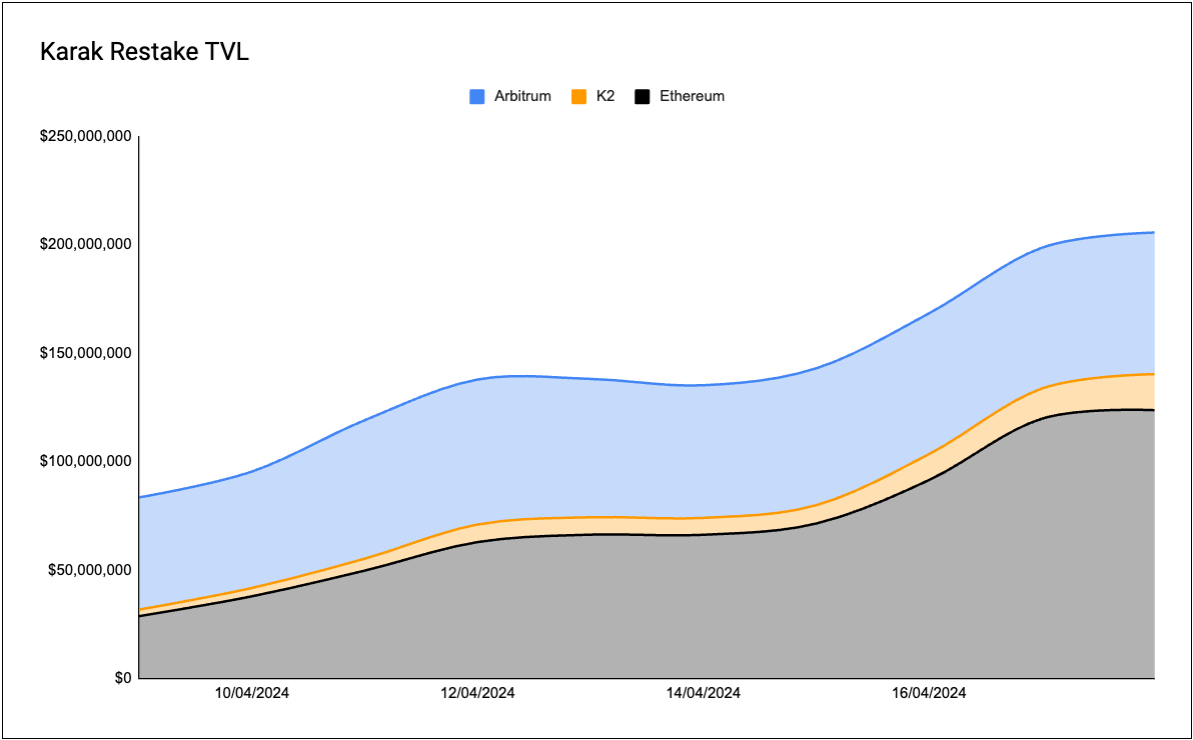

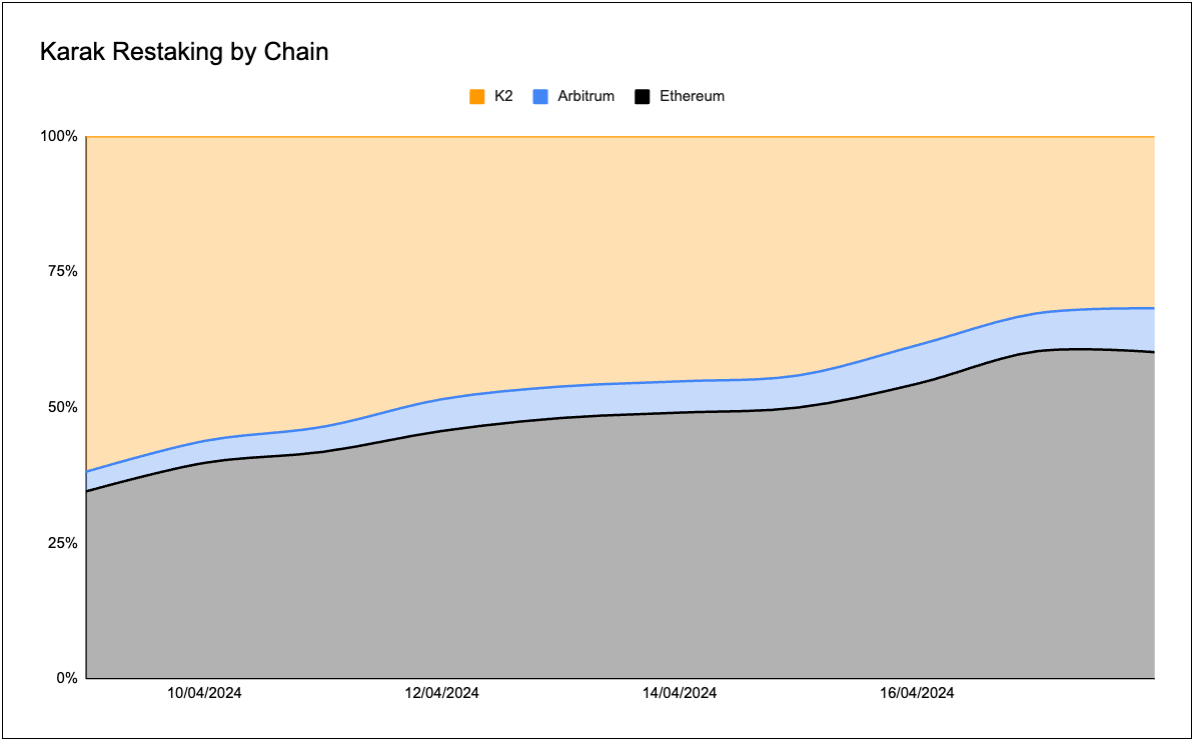

Karak currently has $257M in TVL, with the majority deposited on Ethereum (60.2%). From April 9 to April 18, 2024, the TVL in the protocol showed a steady increase from $83,580,571 to $205,619,599.

Examining the composition of restaked assets reveals that LRTs are a favored deposit choice, allowing users to concurrently earn Ethereum PoS rewards, Eigenlayer points, and Karak XP. The recent introduction of Pendle PTs has also seen significant uptake, amassing over $45 million in TVL within just four days of their addition.

Rewards

The Karak XP Program offers users the opportunity to earn Karak XP by restaking assets and referring others to do the same. Users can increase their XP earnings by restaking assets and maintaining them in restaked status for extended periods.

Additionally, referrals generate more XP; users can use invite codes from the homepage to invite others and earn 10% of the XP their referrals accumulate. Apart from these methods, participating in Discord activities, creating content, and more can also earn XP, with potential new bonus programs anticipated soon. The XP rate may vary weekly.

Restaking wETH or USDC on Karak’s K2 chain earns a 2x Karak XP multiplier.

Karak is currently in private beta, with new users requiring an access code to join and restake their assets. You can join using ASXN’s infinite referral codes here:

e8O6F

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.