Ethena: USDe, Converge and The New Frontier

Ethena

Ethena's strategy has centered on the two primary use cases of cryptocurrencies, as outlined by the team in various interviews, which are:

"Settlement for speculation" - meme coins, derivatives, yield farming and casino-type activity. The team has pursued this market historically, through USDe and sUSDe.

"Settlement for stablecoins, digital dollars and tokenization" - bringing traditional financial assets onchain. The team has increasingly shifted focus here, with iUSDe, USDtb and Converge.

In relation to speculation, the protocol has focused extensively on integrating USDe throughout both decentralized and centralized venues to ensure proximity to trading-related activities.

In DeFi, this integration manifests in multiple ways: users can borrow against their USDe holdings (to engage in speculation, or earn yield), trade sUSDe yield on platforms like Pendle, or utilize USDe as collateral on perpetual and trading platforms across both decentralized and centralized venues. Through this approach, Ethena attempts to build its competitive moat by positioning itself adjacent to speculation and trading activities, serving as the asset users can borrow against and use as collateral. In certain cases, USDe becomes the traded asset itself, as seen with Pendle.

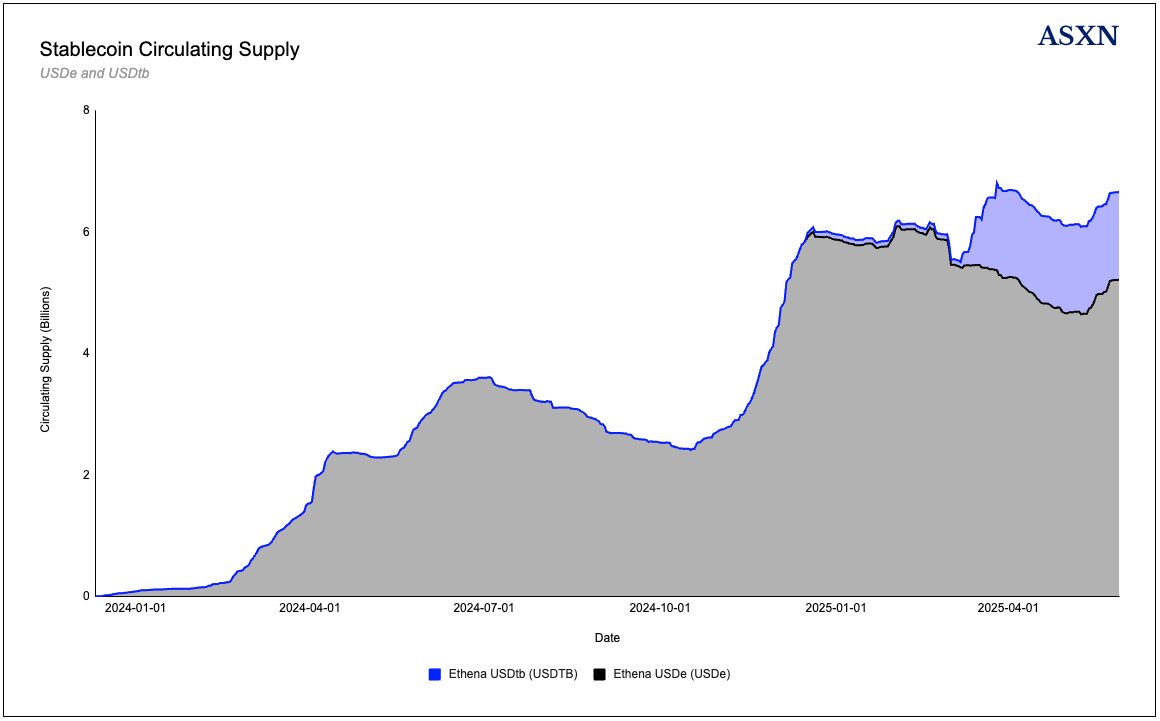

Regarding settlement and tokenization, Ethena has begun expanding its product suite more extensively. The initial years of Ethena's existence focused clearly on growing the core USDe product, an effort in which the team demonstrated strong execution.The protocol experienced rapid growth: with USDe supply growing to $6B in circulation within its first year, making USDe one of the fastest growing dollar products and DeFi protocols in crypto. Since then, it has become the third most popular dollar product within crypto and DeFi, behind Tether (USDT) and Circle (USDC).

However, over the past year their focus has increasingly been on bringing traditional financial assets onchain, and focusing on settlement for stablecoins, digital dollars and tokenization. Ethena's founder, Guy, has stated that the “inflows of institutional capital into the space is the single most important narrative of this entire cycle and like going forward”. To position itself to successfully capture institutional capital flow, the team has developed a variety of products (iUSDe, USDtb and most importantly Converge) to launch alongside USDe, which work to not only attract institutional capital and onboard tokenized assets, but are also complementary to one another.

Recently, the case for cryptocurrencies has changed significantly. While decentralization, trustless systems, permissionless access, and transparent markets and finance remain important, the settlement and efficiency improvements that cryptocurrencies can bring to traditional financial infrastructure have become increasingly prominent. Ethena's product expansion directly targets these institutional efficiency trends through stablecoins and tokenization.

Ethena

USDe

USDe is Ethena's cornerstone product, a tokenized basis trade represented as a synthetic dollar product. USDe’s growth was catalyzed by high embedded yield which users could access by staking for sUSDe, and integrations across both DeFi protocols and centralized exchanges. The team followed an aggressive path towards making sure that USDe was integrated across venues, where it often became the highest yielding dollar product. As Guy (the cofounder) has mentioned throughout the past few years, USDe’s offering was fundamentally different from that of USDT and USDC, which often internalize their yield (they keep the Treasury interest rate, or return it only on specific venues, i.e. USDC and Coinbase). Instead of competing with USDT and USDC on velocity or liquidity, Ethena competed on returns - passing on the basis trade yield completely to stakers and USDe holders.

As of May 2025, circulating USDe sits at $5.3B, around 2% of total stablecoin market cap. In particular, Ethena has permeated money markets, yield products, and other CDP based stablecoins, often becoming the source of yield, the instrument to be traded, or the collateral which is used.

We refer to USDe as a dollar product, or synthetic dollar product throughout this report, but it is important to note that it has a different risk profile to what many consider to be a traditional stablecoin (i.e. one that is based on treasury bills or short term government debt instruments).

It's important to note here that Ethena has in particular focused on offering a store of value or savings product for users in the form of their synthetic dollar, USDe. As discussed later, the team has not attempted to compete outright with USDT, and to a lesser extent USDC, to become a major player in payments and settlement. USDT has strong network effects and wide distribution, especially dominant amongst MENA, Africa and Asia regions. Instead, Ethena has provided a semi-complementary product, USDe, which shares yield with users and can act as a savings account (albeit with higher risk due to the higher yield), allowing Ethena to grow market share amongst users who are seeking yield on dollarized products. The team has only recently started offering a treasuries-backed stablecoin product, USDtb, which is positioned to complement USDe, instead of outright competing with USDT and USDC.

Unlike fiat-backed coins, USDe is backed by volatile crypto assets hedged with short positions in derivatives markets. For each USDe minted, the protocol holds an equivalent dollar-value of crypto (e.g. ETH, BTC, or liquid staking tokens) and simultaneously shorts an equal notional amount via perpetual swaps or futures. This creates a self-hedged “long + short” position (known as a basis trade) where the crypto’s price moves cancel out: if the underlying asset’s price rises, the short position loses value, and vice versa, keeping the net portfolio value approximately constant at $1. Because price risk is neutralized, USDe can be fully collateralized at 100% (1:1 backing) without needing the large buffers that traditional over-collateralized stablecoins require.

To earn the yield generated by Ethena mechanism, users must stake USDe for sUSDe, the yield-bearing version. sUSDe can be understood as a savings token: it accrues protocol revenue (funding rates, etc.) over time, whereas base USDe itself remains a non-interest-bearing stablecoin if held idle. Users can stake USDe to receive sUSDe, which accrues the yield generated by the system. In 2024, sUSDe delivered an average ~19% APY to holders by capturing crypto market yields.

Minting Mechanics

Minting USDe involves converting assets into a hedged structure. For example, a whitelisted market maker might deposit $100 of USDC or USDT to Ethena and receive 100 USDe. On the backend Ethena uses those funds to buy spot assets and open a short perpetuals position of equal value. This process is atomic and automated, the backing assets are immediately hedged at creation. Ethena does not charge a spread or profit on minting/redemption beyond execution costs.

All backing assets remain custodied off-chain in secure accounts (with providers like Copper and Ceffu) rather than sitting on exchanges, which minimizes counterparty risk. Due to this, Ethena was able to withdraw positions and not lose user collateral during the Bybit hack. Exchanges are only delegated temporary control of assets as needed for margin, due to the existence of said “off-exchange settlement” custody solutions.

USDe Mechanics and Yield

Ethena’s design starts with the basis trade as the core yield, then layers in additional yield sources.

Basis Trade

At the core of USDe is the basis trade. Historically, perpetual futures often trade at a premium to spot, meaning longs pay a funding rate to shorts to maintain parity. Ethena’s USDe essentially tokenizes the basis trade described by Arthur Hayes as the “Nakadollar” concept: long the underlying crypto, short a perpetual swap, resulting in a synthetic USD position. Because the long and short offset each other’s price movements, the position’s value stays approximately constant, but the short accrues the periodic funding payments from perpetual swaps. In addition, if the underlying asset is yield-bearing (e.g. staked ETH that earns protocol rewards), those rewards also accumulate. The net effect is that USDe’s collateral generates yield from two sources:

Perpetual Funding Rates

When there is net demand to be long crypto, shorts receive funding. Crypto markets tend to have persistent long bias; for example, ETH perpetuals often trade at an annualized premium (funding) due to ETH’s deflationary and staking yield properties. By being perennially short, Ethena captures this yield.

One topic often brought up with regard to Ethena’s yield strategy (specifically the basis trade) is around its sustainability. Based on funding rate data for ETH and BTC, we can see that negative funding persistence is quite low: negative funding rates rarely sustain for extended periods - BTC experienced a maximum of only 8 consecutive negative days, while ETH saw up to 13 consecutive negative days. On average, negative funding periods last just 1.6 days for BTC and 2.2 days for ETH, suggesting that the market's structural long bias quickly reasserts itself.

Notably, the above chart includes an outlier following Ethereum’s switch from PoW to PoS, driven by arbitrage across perpetual markets. Below is the data without the outlier.

The histogram analysis reinforces this positive skew: BTC funding rates were negative only 10.5% of the time, while ETH showed negativity 12.5% of the time. The distribution is heavily right-skewed, with both assets showing mean funding rates (BTC: 7.27%, ETH: 7.62%) well above their medians, indicating occasional very high positive funding rates that boost average yields. Most notably, the funding rate distributions show that the most common ranges are solidly positive, with both BTC and ETH spending the majority of time in the 5-10% annualized funding rate range.

Funding rates for BTC and ETH markets have changed throughout the past few years. From the relatively low averages in 2022 (BTC: 1.69%, ETH: -1.92% due to the Merge-related anomaly where funding briefly hit -276%), funding rates increased considerably in 2023 (BTC: 7.59%, ETH: 9.09%) before reaching their peak in 2024 (BTC: 11.12%, ETH: 12.68%).

With Ethena now commanding nearly $6 billion in TVL and representing a significant portion of the perpetual futures short interest, there's a theoretical risk that the protocol's own hedging activities could compress funding rates over time. However, the data still shows funding rates remain comfortably positive, well above the threshold needed to generate attractive yields when combined with other rewards. The fact that funding rates have stabilized at these levels even with Ethena's massive scale suggests the market can accommodate the protocol's hedging demand without completely eroding the basis trade opportunity.

Underlying Yield (Staking and Lending)

Ethena holds various forms of collateral. A portion (increasingly minimal) is staked ETH (and liquid staking tokens like stETH) that earn ETH staking rewards. This adds a baseline yield to the collateral pool. Ethena also can hold stablecoins as part of collateral (e.g. idle USDC/USDT in reserve) and deploy them in safe yield opportunities (e.g. lending markets). The inclusion of liquid stables both provides a buffer in volatile markets and earns extra yield for the protocol when placed in yield venues. By dynamically allocating between crypto collateral and stablecoins, Ethena can optimize yield while managing risk (holding more stablecoins in downturns when funding is low or negative).

Ethena's exposure to ETH staking yields has reduced since the launch of the protocol, as staking rates have changed. Guy discussed recently that when Ethena first launched, staking rates were around 5-6%, but over time yields have drifted below 3%. He argues that current returns no longer appropriately compensate for the duration and liquidity risks inherent in staking. This perspective has driven a dramatic reallocation in collateral for the protocol - Ethena has moved from being 80% backed by LSTs initially to now sub 6%.

ETH staking yields peaked above 13% in early 2023 but have compressed significantly since then. Starting from around 4.3% at proof-of-stake launch in September 2022, yields averaged 3.9% in early 2024 before declining further to current levels around 3.1%.

Ethena's collateral composition reflects this pivot. Staked ETH allocation declined from 6.4% in December 2024 to 5.4% by June 2025, while liquid cash expanded to nearly 50% of total collateral. The shift represents a clear prioritization of robust collateral and capital preservation.

The risk-return profile makes this reallocation logical. At 3% yields, stakers face multiple risk layers: unstaking periods create duration risk, liquid staking protocols introduce smart contract risk, and validator operations carry slashing risk. These risks accumulate for returns that do not exceed traditional risk-free rates. In addition, Ethena's core perpetual futures strategy already generates substantial yield without requiring additional staking exposure, which introduces complexity and additional effort due to necessity of monitoring and further risk analysis, despite low returns.

In addition to perpetual funding rates and staking rewards, Ethena pursues supplemental yield strategies to enhance USDe’s return or ensure resilience:

Protocol Revenue Sharing

Ethena charges 10bps on mint, and zero fees redeem. The mainly protocol earns revenue by capturing any yield not paid out to users. Only staked USDe (sUSDe) earns yield. This reserve can be used to bolster collateral or fund initiatives. It effectively means Ethena can have a sustainable yield source to fund operations or insure the peg. For users, it creates an incentive to stake. As of May 2024, Ethena’s reserve fund had grown substantially, with monthly protocol earnings in the millions of dollars after distributing sUSDe yields.

Liquidation and Trading Fees

The protocol may occasionally realize gains from rebalancing collateral. If a backing asset price moves and the position is re-hedged, there could be small arbitrage profits or losses (Ethena likely minimizes this, but any structural gain goes to the system).

External Yield Integration

Ethena has explored integrating with DeFi platforms that generate yield on top of USDe. For instance, depositing USDe in lending markets (when not needed for hedging) or in liquidity pools can earn fees. Ethena mentions that even the “liquid stablecoin” portion of backing might earn rewards depending on where they are held. This hints that Ethena actively manages idle collateral , e.g., holding some USDT in a yield-generating account when funding rates are low, or using protocols like Aave to earn on reserves without compromising peg stability. Each protocol has to be approved by governance - the risk committee.

Market Volatility

Although not constant, Ethena can also benefit from market volatility. For example, earlier in the year, when there were cascading liquidations on Ethereum, which sent price below 2.2K USD, since Ethena was short the instrument that's dislocating to the downside, which led to the protocol profiting around 5 to 7% in PnL, even though the position should be delta neutral. This is because the short perpetuals position dislocated to the downside, due to cascading liquidations, and was dislocated from the spot price.

Ethena’s Growth

Ethena’s growth has been characterized by rapid integration into both DeFi protocols and CeFi (centralized finance) platforms, driving demand for USDe and expanding its use cases. Below we outline key growth vectors:

CEX and Trading Integrations

A core focus for Ethena has been integrating USDe across perpetual futures exchanges. This taps into a large existing use case for stablecoins (collateral on trading platforms). In 2024, Ethena announced their integration with Bybit, to support USDe. Bybit both listed USDe trading pairs, and additionally allowed traders to post USDe as margin for perpetual contracts and earn yield on it. Traditionally, traders use USDT or USDC as margin, which, as mentioned before, keeps yield. By allowing users to use USDe, Bybit’s users could offset some of their funding fees by the yield USDe generates. More than 700M USDe was held on the exchange before the hack incident, demonstrating significant uptake.

In early 2025, Ethena signaled plans to integrate USDe on Deribit, the leading crypto options exchange, and more recently, announced their integration with Hyperliquid. In addition, USDe is integrated into Ethereal, a Converge native perpetuals DEX. The protocol is working towards making USDe a standard margin asset alongside USDT/USDC across trading venues. Each exchange integration can lead to large inflows: if traders migrate their collateral to USDe due to its yield-bearing nature. Given the tens of billions of USD are used as collateral on exchanges industry-wide, Ethena is tapping into a substantial market. For exchanges, supporting USDe can attract liquidity, as traders can earn yield on their collateral. In addition, exchanges typically have an existing relationship with the protocol, given that the short-leg for Ethena’s basis trade is done on exchanges. For Ethena, it creates a virtuous cycle: more USDe on exchanges means more funding yield captured, which increases sUSDe APY, attracting more users to mint USDe.

Lending and Borrowing Integrations

Money markets and lending and borrowing platforms are a natural fit for a yield-bearing dollar product. Protocols like Aave, Morpho, Euler and others allow users to borrow and lend stablecoins and dollar products. USDe integration into these protocols allows users to lend USDe and earn both the lending interest as well as the inherent sUSDe rewards.It also lets users borrow USDe against collateral, which could be attractive since a borrower of USDe could stake it to partly offset interest, and potentially capture the spread.

Spark Protocol, the lending sub-DAO under Sky (formerly MakerDAO), began integrating with Ethena early in 2024. On 29 March 2024 Spark used Maker’s Direct-Deposit-Module (DDM) to move USD 100 million in newly-minted DAI into two Morpho Blue markets (DAI/USDe and DAI/sUSDe). The DAI is lent against over-collateralised USDe positions, creating a credit line for traders while producing stability-fee income for Maker. Governance disclosures published in February 2025 state that Spark may expand direct holdings of USDe and sUSDe, or related credit exposures, up to USD 1.1 billion if market conditions remain acceptable. sUSDS (formerly sDAI) makes up a considerable portion of Ethena’s TVL, at 1.4B.

In addition, Ethena is heavily integrated into Pendle (discussed further below). Pendle principal tokens, particularly PT-SUSDE and PT-EUSDE, are heavily integrated across Morpho, Euler and Aave.

Pendle and Yield Derivatives

One of the most important integrations for Ethena has been with Pendle Finance, a protocol for tokenizing yield. Pendle allows users to split yield-bearing assets into Principal Tokens (“PT”) and Yield Tokens (“YT”) and trade them. USDe/sUSDe ideal for tokenizing yield: sUSDe is a yield-bearing asset (earning basis yield). Ethena and Pendle’s integration led to the creation of SY (Standardized Yield) USDe markets, where users could deposit USDe and receive an SY token that accrues the yield, or trade future yield via YT and PT.

The outcome has been mutually beneficial growth. Pendle’s platform attracted USDe holders by offering them fixed yields or leveraged yield opportunities. For example, in mid-2024 users could deposit USDe into a Pendle pool maturing July 2025 for a fixed ~32% APY, essentially locking in the high funding rates of the time. Others bought YT to speculate on or amplify the yield (with YT-sUSDe giving much higher effective APY, albeit with higher risk). This flexibility drove a significant portion of USDe supply into Pendle (over 17% by July 2024). Pendle’s volumes and TVL increased drastically due to the popularity of sUSDe yields, boosting Pendle’s growth as well.

Ethena, for its part, actively incentivized this via campaigns such as the “Sats Campaign”, a rewards program where users earned Bitcoin sats points for holding or using USDe in certain ways. Pendle deposits were given among the highest reward multipliers (e.g. 20x for depositing USDe into Pendle YT/LP). This drove even more USDe into Pendle, creating a positive feedback loop: high yield, which led to more USDe demand, which led to increased Pendle usage, which led to yields staying competitive, etc. By rewarding usage in external protocols, Ethena effectively bootstrapped liquidity and utility without having to build those services itself.

Risk Profiles: USDe, USDC and USDT

Ethena’s USDe differs fundamentally from fiat-backed stablecoins like USDC and USDT in its construction and risk.

Collateral and Transparency

USDe is crypto-collateralized and hedged, whereas USDC/Tether are fiat-collateralized. For USDe, the collateral assets (BTC, ETH, etc.) reside onchain or in crypto custody, and a matching liability (short position) exists on centralized, derivative exchanges. For USDC/USDT, collateral is cash or bonds (i.e. treasury bills or short term government debt instruments) held in bank/trust accounts offchain. This means USDe’s backing is transparent onchain (with some offchain exchange elements), and can include crypto assets, while USDC/USDT rely on offchain audits (e.g. USDT)

USDe is arguably more transparent, one can monitor the value of backing assets on-chain (e.g., see how much collateral Ethena holds in custody addresses if published, and the size of short positions via exchange APIs). Ethena also publishes monthly custodian attestations for USDe backing, proving assets are in off-exchange custody. USDC has monthly attestations by auditors too; USDT does quarterly attestations. Decentralization-wise, USDe has more moving parts but also more distributed trust (multiple exchanges, multiple custodians, smart contracts). USDC/USDT are fully centralized (single point of issuance control). That means USDe cannot be censored or frozen unilaterally , an advantage for censorship-resistance.

Counterparty and Exchange Risk

USDC and USDT are exposed to the traditional financial system , bank failures (as seen with Silicon Valley Bank causing USDC to depeg to $0.88 in 2023), regulatory freezes (e.g., OFAC blacklists addresses, Circle or Tether can freeze tokens), and lack of transparency (especially USDT, though Tether has improved disclosures). USDe’s risks are more crypto-native: it depends on exchange counterparties (if a major exchange holding Ethena’s short positions goes insolvent, Ethena could face losses or difficulty re-hedging). This happened partially with Bybit’s hack (an effective stress test): Bybit lost assets, but Ethena’s off-exchange custody meant only the derivatives PnL (unrealized) was at risk, which Ethena’s reserve could cover. Ethena had ~$30M exposure on Bybit at time of hack, which was more than offset by its reserve fund , and they promptly reduced exposure to zero after. This demonstrates that Ethena’s model, while exposed to exchange risk, has mitigations like distributed custody and a reserve buffer. Nonetheless, if a larger exchange (or multiple) failed suddenly, USDe could be under-collateralized until collateral is recovered or reserves fill the gap.

Stability Mechanism

USDC/USDT rely on the simple promise of redeemability: if price dips, arbitrageurs can buy the token cheap and redeem 1:1 for USD from the issuer (assuming the issuer honors redemptions). USDe’s stability relies on market mechanisms and the arbitrage of its hedge. If USDe < $1, arbitrageurs can buy USDe and redeem via Ethena’s process: burning USDe returns the underlying collateral (which is worth $1 if the hedge is in place). The catch is, only authorized parties can directly redeem; however, in practice, those parties (market makers) will do so if profitable, thereby keeping the peg tight. Additionally, Ethena’s system may use its reserve fund to stabilize if needed (though no explicit peg defense via reserves has been publicized, the reserve mainly covers shortfalls). So far, USDe has held its peg closely, aided by deep liquidity pools.

Scale and Backing Limits

USDC and USDT can, in theory, grow as large as fiat inflows allow (hundreds of billions, limited by banking capacity and market trust). USDe’s growth is linked to derivatives market capacity and crypto collateral availability. There are practical limits: e.g., to mint huge amounts of USDe, Ethena needs to execute equally large short perps. Open interest limits on exchanges could constrain growth. Ethena already accounts for significant portions of OI on some platforms (e.g. ~4.3% of BTC perp OI and ~4.9% of ETH perp OI across major exchanges by July 2025). If USDe doubled, it might strain these markets or force spreads. Ethena mitigates this by using multiple exchanges (Binance, Bybit, OKX, Bitget, etc.) and will likely push for USDT-margined perp markets to expand. In contrast, USDT’s growth might be limited by how much US debt Tether can buy or banking relationships, but those limits are high (Tether has grown to $80B+ without issue).

Volatility, Funding and Market Risk

USDe is exposed to derivatives market conditions. A prolonged period of negative funding (where shorts pay longs) would mean Ethena’s positions lose value steadily. Ethena would have to pay these funding costs out of pocket or via collateral , effectively a bleed. The protocol can handle short bouts (using reserve fund), but if the market regime changed fundamentally (e.g., massive demand to short crypto for months), USDe could face a yield deficit or even risk collateral if not managed. Ethena’s introduction of USDtb is partly to address this scenario by shifting to a positive-yield asset in such times. Traditional stablecoins don’t have this risk , their value doesn’t depend on market rates, just on solvency of the issuer.

USDe’s peg could, in theory, be more fragile during extreme crypto moves. If crypto prices double overnight, Ethena’s short positions would incur losses that might slightly lag the collateral gains or vice versa, causing minor imbalance (though the design is 1:1, slippage in execution could matter). If exchanges’ liquidity is thin, rebalancing large positions might incur costs. These could translate to a small fraction off the $1 backing until arbitraged. However, Ethena’s daily PnL is typically settled and collateral adjusted, so this risk is minimal in normal conditions. USDT and USDC can also depeg if people panic-sell (USDC’s $0.88 event was due to fear its banks failed), but arbitrage usually restores it if reserves are intact. A key difference: trust vs algorithm , USDC/USDT rely purely on trust in issuers; USDe relies on an algorithmic hedge plus trust in Ethena’s operations. In any scenario where Tether’s reserves are doubted, USDT could depeg significantly (like if a major audit failure happened). USDe’s depeg would likely come from a technical failure (smart contract bug, cascade of exchange defaults) or extreme funding inversion.

Regulatory and Institutional Adoption

From a risk perspective for institutions: USDC and USDT are well-understood and have clear legal frameworks (USDC is regulated as a stored value, etc.). USDe might be seen as riskier or more complex, possibly falling through cracks of regulation. Institutions might worry about the operational risk of USDe , e.g. how to explain a short position backing a stablecoin to risk committees. USDtb will likely be the product pitched to institutions to alleviate those concerns, while USDe finds more use among crypto-native funds, prop desks, and DeFi users. Over time, if USDe proves its mettle, even institutions (like hedge funds) might utilize it for the yield (indeed, those who allocated to it early reaped near 20% APY in a low-rate environment , attractive by any measure).

USDC and USDT face regulatory scrutiny (e.g., New York AG vs Tether, potential stablecoin legislation). USDe introduces derivatives, so it could attract scrutiny as a sort of “synthetic prime money market fund”. If regulators view it as a systemic risk or unregistered product, Ethena might face pressure, especially as it reaches scale. Ethena’s global and decentralized nature may give some buffer (the foundation is likely offshore). On the flip side, regulators concerned about stablecoin reserves might find comfort in USDe’s full transparency and non-reliance on banks , it’s crypto market risk, not banking risk. This is uncharted territory.

For institutions and protocols, these differences mean USDe is a complement, not necessarily a replacement, to USDC/USDT at present. Protocols like Maker found a role for USDe (earning yield on DAI reserves), but they wouldn’t abandon USDC entirely for stable backing yet. However, if USDe and USDtb continue to grow in track record and liquidity, one can envision protocols like Maker or Frax using USDtb as reserves (instead of USDC), or exchanges preferring USDe for collateral. Institutions might hold USDtb as a cash equivalent on their balance sheet and USDe in yield-generating strategies.

To capture institutional flows and interest, and capture market share in settlement for stablecoins, digital dollars and tokenization, Ethena has decided to develop a variety of new products. Two of these are iUSDe and USDtb, two additional stablecoin products, which are aimed at institutional flows and capital.

USDtb and iUSDe

iUSDe

iUSDe is the core sUSDe product wrapped in a compliant format with basic permissioning and KYC restrictions. This structure enables traditional financial institutions and entities to interact with the product, as it incorporates KYC restrictions and other AML/KYC specifications required for institutional adoption. While this product will likely not reach the scale of USDe, it serves as an important tool specifically tailored toward institutional participants.

USDtb

USDtb is Ethena’s second stablecoin product, a “digital dollar” fully backed by tokenized U.S. Treasury assets. In contrast to USDe’s basis trade structure, USDtb is built on the model of fiat-backed stablecoins. Each USDtb token represents a claim on a dollar invested in institutional-grade U.S. Treasury funds - similarly to USDC and USDT. At launch, Ethena partnered with BlackRock’s USD Institutional Liquidity Fund (“BUIDL”) as the primary backing asset. In essence, USDtb holders have exposure to U.S. Treasury bills and other short-term instruments via BUIDL, similar to how USDC holders rely on Circle’s T-bill and cash reserves.

USDtb functions like a traditional stablecoin from a user perspective: it maintains a 1:1 peg with USD, is transferable on blockchain networks (initially Ethereum and likely Ethena’s Converge chain), and can be used for payments, trading, or lending, similarly to USDC/USDT.

USDtb's design capitalizes on growing institutional recognition of stablecoins' infrastructure advantages.

Visa stated this perspective in a report dated April 30, 2025, stating:

Modernizing settlement infrastructure: From our lens at Visa , we see stablecoins improving the efficiency and utility of back-end financial and money movement infrastructure. While there has been significant progress digitizing and modernizing the 'front end' of money movement over the past decade, the back end of the world's settlement and money movement infrastructure needs to catch up.

Currently, cross-border payments and settlement on traditional rails follow a complex multi-step process, with many intermediaries that need to coordinate:

Banks debit customer accounts and send SWIFT messages containing payment details and compliance checks.

Messages travel through one or more correspondent banks, as most banks do not maintain accounts in every currency. Each correspondent moves money between reciprocal "nostro/vostro" accounts, updates its ledger, and charges fees. The reliance on these correspondent relationships has decreased as banks have reduced such partnerships.

Within each currency area, banks settle accumulated daily balances through the central bank's real-time gross settlement (RTGS) or deferred-net systems. These systems operate only during set hours, meaning payments that arrive outside operating windows must wait until reopening, extending end-to-end settlement from minutes to potentially two days.

While funds are in transit, intermediaries must maintain parked funds or secure intraday liquidity, adding both cost and risk to the process.

The recipient's bank finally records the credit and releases funds to the payee, completing the transfer.

Stablecoins can reduce the number of intermediaries required for payments and settlement. Cross-border transactions typically involve lengthy transaction chains where each additional link increases costs and complexity while introducing settlement risk. Stablecoin-based systems can simplify cross-border transactions by reducing the need to maintain numerous correspondent relationships.

The reduction in intermediary links that stablecoin systems provide decreased settlement risk, reduces pre-funding and intraday credit requirements, and limits opportunities for rent-seeking behavior, resulting in lower fees. In addition, widespread adoption can further reduce costs through network effects and economies of scale, while standardized data formats make integration with other systems more cost-effective and straightforward.

Lastly, blockchains operate continuously and settle payments end-to-end in near real-time. Current correspondent-bank routes can take anywhere from under five minutes to more than two days (depending on the banking system of the country/countries involved), which are delays that stablecoins could eliminate when used for complete payment legs.

Beyond settlement and efficiency improvements, stablecoins serve a critical function for individuals in countries with mismanaged monetary systems, such as Argentina, Lebanon, and Nigeria, where preserving purchasing power is a primary concern. Converting from domestic currency to USD-pegged stablecoins enables instant dollarization. Stablecoins inherit the relative stability and credibility of the US dollar, providing an appealing alternative in countries where trust in local currency has deteriorated.

In these jurisdictions, converting to physical dollars is often difficult and costly, while withdrawing dollars from the domestic banking system presents additional challenges. Those holding USD in banks frequently face arbitrary withdrawal limitations. Stablecoins allow users to store dollar-denominated assets on secure hardware wallets with self-custody capabilities, providing constant access to their funds.

Furthermore, traditional dollar-based services such as banks or remittance providers are subject to surveillance, censorship, and political interference. Stablecoins, particularly when transacted through peer-to-peer or decentralized platforms, can offer greater privacy and censorship resistance.

Finally, stablecoins provide access to yield opportunities. While safety remains the primary motivation, users can gain exposure to various yield options with different risk profiles based on their individual risk tolerance. Stablecoins can generate yield through integration with the broader cryptocurrency ecosystem, through their underlying backing mechanisms, or both. For example, a user in an inflationary environment might deposit, USDe into a decentralized lending protocol to earn 10-15% APY, converting their stablecoin holdings into interest-bearing assets. This capability is particularly valuable when local banks offer near-zero or negative real interest rates.

Note: Additional use cases for stablecoins exist beyond the above-mentioned, which focuses on what we consider the two primary use cases currently. We will examine additional applications and use cases in greater detail in our forthcoming report on stablecoins.

It’s important to note here that Ethena has in particular focused on offering a store of value or savings product for users in the form of their synthetic dollar, USDe. The team has not attempted to compete outright with USDT, and to a lesser extent USDC, to become a major player in payments and settlement. USDT has strong network effects and wide distribution, especially dominant amongst MENA, Africa and Asia regions. Instead, Ethena has provided a semi-complementary product, sUSDe, which shares yield with users and can act as a savings account (albeit with higher risk due to the higher yield), allowing Ethena to grow market share amongst users who are seeking yield on dollarized products. The team has only recently started offering a treasuries-backed stablecoin product, USDtb, which is positioned to complement USDe, instead of outright competing with USDT and USDC.

USDtb is 100% backed by liquid, low-risk assets, primarily shares of BlackRock’s money market fund (which holds short-duration U.S. government debt). This mitigates bank credit risk and concentrates on sovereign credit risk (considered relatively risk-free). It also means USDtb’s reserves inherently earn yield (money market yields), currently around 4.5% APR, given the interest on T-bills. Attestations for USDTb reserves are done monthly. Reserves are custodied by Zodia, Komainu and Copper.

Ethena also maintains a portion of USDtb’s backing in stablecoin reserves (like USDC) to facilitate rapid redemption and on-chain swaps. This allows USDtb to handle large withdrawals or transfers without needing to instantly redeem BUIDL shares.

Complementary Stablecoins

USDtb and USDe are fundamentally different products. Unlike sUSDe, which focuses on returns and yield to build a moat, USDtb’s main purpose is to to attract institutional capital. Institutions, treasuries, and investors might not be familiar with USDe style products, or may not be completely comfortable with USDe’s reliance on crypto derivatives. USDtb offers them a crypto-dollar with familiar backing (U.S. government debt) and strong regulatory footing ( Securitize is a regulated digital securities platform). By offering a product that meets institutional standards (KYC’d, fully collateralized, yield from liquid, low-risk Treasuries), Ethena can onboard significant new capital into its ecosystem.

In this way, USDtb also acts as a complementary product to USDe. With both USDe and USDtb, Ethena covers the entire spectrum, USDe with higher risk and higher yield, USDtb with minimal risk and base yield. This allows Ethena to capture users across different preferences and market conditions. For example, an investor might hold USDtb as a stable reserve (earning around 4.5%) and deploy USDe for more aggressive yield farming. This helps Ethena effectively become a one-stop issuer for stablecoins, reducing reliance on third-party stablecoins. It also allows Ethena to offer a product for all market conditions, where funding is low, but rates are high, USDtb can grow, and vice versa.

iUSDe represents the other end of the spectrum. Although some institutions may be interested in a tokenized basis product, they may not be able to gain exposure, primarily due to KYC/AML risks.

Institutional flow and capital cannot use permissionless finance for a variety of reasons:

Institutions cannot transact with unknown parties due to regulatory and compliance risks.

Institutions need to know who they're borrowing from or lending to (especially in the case of sanctioned entities).

Institutions are legally required to comply with anti-money laundering (“AML”) and know-your-customer (“KYC”) regulations

Large financial institutions have internal policies requiring counterparty identification. Risk management departments require full transparency of transaction counterparties

iUSDe represents Ethena's solution to the aforementioned regulatory challenges. While USDtb offers a stablecoin with a completely different risk and yield profile, iUSDe ensures that funds and investors can access the same yield and risk characteristics as USDe without the potential regulatory and compliance risks.

Converge

Ethena Labs, in partnership with Securitize, is developing Converge, a new chain focused on onboarding tokenized RWAs, traditional financial markets and instruments.

Similarly to stablecoins, over the past year, tokenization has increasingly been adopted by traditional financial institutions, for the benefits that it can bring to real world financial instruments and markets, by providing improved transparency, reducing transaction and information costs, increasing processing speed, and improving risk management capabilities.

Programmability and Composability

Traditional financial transactions involve multiple intermediaries, each maintaining separate records across the various stages of a trade, including issuance, trading, matching, settlement, custody, and corporate-action processing. Tokenization fundamentally changes this structure by enabling all these steps to be automated through smart contracts rather than handled by disparate intermediaries.

The use of a shared ledger for recording all assets creates opportunities to combine functions that typically operate in isolated systems. For instance, foreign-exchange payment rails, securities depositories, and collateral management platforms can be integrated into a unified framework. This consolidation reduces the cost of moving value and makes previously expensive or difficult swaps easier to clear.

Tokenization also introduces enhanced composability through conditional transactions. These arrangements allow transactions to be combined and their execution to be automated based on complex criteria, creating more sophisticated financial instruments and workflows.

Furthermore, the automation capabilities inherent in token arrangements can improve asset servicing by streamlining corporate actions such as dividend and interest payments, as well as facilitating shareholder voting processes.

Transparency and Auditing

The current cross-border payment system relies on chains of correspondent banks, where each institution maintains its own ledger and sends only periodic confirmation messages. This structure necessitates extensive reconciliation processes as institutions must align their separate records.

In contrast, a shared tokenization platform maintains a single, continuously synchronized ledger that remains visible to all relevant participants. This shared "source of truth" provides real-time visibility, which eliminates the need for banks to coordinate across separate systems or conduct end-of-day reconciliations. Additionally, duplicate manual processes,such as repeating AML/KYC screening at multiple points in the transaction chain,can be eliminated or handled once through smart-contract logic. These improvements result in lower operational costs and faster straight-through processing.

Standardization and Streamlining

Asset issuance processes are typically costly and time-consuming due to the involvement of numerous parties and reliance on manual procedures. Tokenization addresses these inefficiencies through standardization of asset issuance processes and reduction of required intermediaries, potentially lowering costs and reducing barriers to entry in capital markets.

These improvements could facilitate new issuances and enable shared or fractional ownership of existing assets, including those that are currently less liquid in traditional market environments. This expanded accessibility may help reach new sources of investor demand. Where legally permitted, tokenization could also enable participants to directly issue assets or negotiate contract terms for specific tokens without traditional intermediaries.

Tokenization further enables atomic settlement for multi-leg transactions. For example, when purchasing a Treasury bond token with stablecoins on a blockchain, a dealer commits cash tokens while the seller commits bond tokens, and a single smart contract releases both simultaneously. If either party lacks sufficient assets, no transfer occurs, eliminating principal risk entirely. In contrast, traditional off-chain transactions handle the two legs through separate systems, often at different times, and require clearing brokers, central counterparties, custodians, and banks, with settlement typically taking up to T+2.

Asset Class Differentiation

The benefits of tokenization vary significantly across different asset classes. Illiquid, non-standardized assets have the highest potential for efficiency improvements through tokenization. These include syndicated loans and mid-market private credit, which involve manual onboarding processes, bespoke covenants, and lack centralized market infrastructure. Commercial real estate equity slices also fall into this category, as they are typically illiquid and traded bilaterally.

Conversely, liquid and standardized assets such as US Treasury bills, large-cap equities, and ETFs are likely to experience less material improvements, given their existing well-developed infrastructure. However, even these assets benefit from tokenization through enhanced capabilities including trading and settlement outside local market hours, atomic settlement mechanisms, increased composability, programmable lifecycle events, unified record keeping, and fractional ownership opportunities.

Ethena is building out Converge, a new chain focused on onboarding tokenized RWAs, and connecting them with DeFi and cryptocurrencies (hence the name, Converge). Tokenization is still a nascent sector, but is likely to exponentially expand. As of today, many chains, both permissioned and permissionless have made bids to attract tokenization onto their network, with some providing KYC, AML and complete control of the stack (Avalanche Subnets, L2s, and other institutional chains) while others offer composability, burgeoning DeFi, and adjacency to cryptocurrency issuance and activity (Solana, Ethereum etc.). As discussed later in the report, Converge attempts to offer both control and composability to institutions looking to onboard assets.

Technical Design and Performance Specs

Converge is envisioned as a high-throughput, low-latency chain that is EVM-compatible. The chain will launch with a 100 ms block time, targeting a reduction to 50 ms by Q4 2025. The chain aims for at least 1 gigagas per second of throughput, i.e., the ability to process on the order of 1 billion gas units per second. For context, Ethereum processes ~15 million gas per block (~100 million gas per minute).

Architecture

Converge is built on the Arbitrum Orbit stack with Celestia as a data availability layer. It uses an optimized Arbitrum-based sequencer (Conduit G2) for execution and ordering of transactions. Converge runs the Arbitrum Nitro stack (which provides fraud-proof based security and EVM compatibility), but with a custom sequencer and configuration tailored for high throughput.

For data availability, Converge initially publishes data to Celestia, to publish data blobs at high volume, cheaply. Celestia’s architecture supports very large blobs (its recent testnet demonstrated 128 MB blobs and ~21 MB/s throughput, with a roadmap toward 1 GB blocks).Through Celestia, Converge can post large amounts of data for transactions in parallel, without being constrained by Ethereum’s current data throughput limits.

Transaction ordering on Converge is handled by a Conduit G2 sequencer, which is a high-performance sequencer implementation from Arbitrum. This sequencer is responsible for collecting transactions, executing them, and proposing blocks at a rapid cadence. The target block interval is approximately 100 ms, meaning new blocks (sometimes called mini-blocks or flash blocks) are produced 10 times per second on average. Converge plans to push block times even lower – targeting sub-50 ms block times by Q4 2025 by introducing optimizations such as continuous mini-block streaming and improved RPC handling.

Converge Validator Network (CVN) and Security

A key component of Converge is the Converge Validator Network (“CVN”), a specialized validator layer. The CVN is a permissioned set of validators, which act as a “security council” with discretionary authority. The validator set can intervene in emergencies (pause the chain, rollback in case of major hacks or bugs, etc.). Unlike a typical validator set that only handles block production or ordering, the CVN’s role is to provide secure guardrails for the network’s economic integrity and user funds.

For example, the CVN can throttle or block malicious cross-chain messages that come through bridges to prevent bridge-based exploits. It can also trigger protocol-level circuit breakers (halting or pausing certain contracts or the entire chain) if there are signs of oracle manipulation, critical smart contract bugs, or other economic anomalies that could lead to loss of funds. In extreme cases, the CVN even has the authority to dispute the chain’s finality or coordinate a network halt/fork if required to protect users. These powers are designed to be used as a last resort, providing a safety net for institutional users (who often require risk mitigation) without fundamentally compromising the chain’s decentralization or liveness.

Execution

Converge implements a multi-threaded execution pipeline that can process transactions in parallel where possible, leveraging multi-core CPUs. Unlike the traditional single-threaded EVM, this design executes independent transactions concurrently while maintaining strict determinism in results.

Instead of producing monolithic blocks at longer intervals, the sequencer emits a continuous stream of small “flash blocks” (micro-blocks) as transactions come in. Validator nodes can begin executing and verifying these mini-blocks incrementally, rather than waiting for a full block. This reduces propagation latency across the network and keeps the system highly responsive even under heavy load. Essentially, block production is more continuous, smoothing out bursts of transactions and cutting down the time for new transactions to reach validators.

To handle the rapid state growth that comes with high TPS, Converge uses a flat, path-based state storage model backed by a high-performance database. This improves the efficiency of reading and writing contract state. The storage engine supports concurrent reads and writes, meaning multiple parts of the state trie can be accessed/updated in parallel without conflicts. It also includes online state pruning capabilities to discard old state as needed. These features are crucial for a chain pushing 10× the throughput of current networks, preventing the state database from becoming a performance bottleneck or growing impractically large.

Converge itself is a permissionless chain at the base layer: anyone can bridge assets to it and any developer can deploy smart contracts freely. However, it supports an ecosystem where some applications may enforce their own permissioning at the application level (especially those dealing with regulated assets). Converge expects to host two parallel categories of apps: (1) fully permissionless protocols and (2) regulated or permissioned apps for traditional finance use cases. Crucially, both types can interact. A permissioned RWA platform can benefit from onchain liquidity and composability with DeFi primitives (e.g., a bond token could be used as collateral in a DeFi lending pool) as long as those interactions respect whatever compliance rules are needed. Converge’s design does not impose any global permissioning; decisions about access control are made at the smart contract level by the app developers or asset issuers.

Initial Ecosystem

Horizon - Aave

Horizon is a new institutional lending market built by Aave Labs as a licensed instance of the Aave protocol, purpose-designed for real world assets (“RWAs”). In essence, Horizon extends Aave’s money market architecture to let institutions borrow stablecoins against tokenized traditional assets. The first product focuses on tokenized money market funds (e.g. tokenized shares of U.S. Treasury funds) as collateral, allowing qualified investors to unlock liquidity from low-risk yield-bearing assets.

Under the hood, Horizon will initially use Aave V3 smart contracts (upgrading to Aave V4 when available) deployed in a standalone environment with institutional customizations. The protocol retains the core design of over-collateralized loans and automated risk parameters, but adds a compliance layer for restricted assets. Notably, Horizon’s design builds on lessons from Aave Arc (Aave’s earlier permissioned pool framework). Instead of gating the entire market, it enforces permissions at the token level. In practice, only whitelisted institutional players can hold the RWA collateral tokens, while the protocol’s stablecoin liquidity pool remains open and decentralized.

Horizon was introduced in March 2025 via an Aave governance proposal and Temp Check vote. Horizon will share revenues with Aave DAO (50% of profits in year one) while using Aave’s governance for oversight. Remaining revenue will go to the Labs team - which has been controversial (which is outside the scope of this report).

Unlike Aave, which focuses on crypto-native collateral, Horizon onboards traditional financial instruments (starting with tokenized money market funds) into Aave’s borrowing model. The protocol allows users and institutions with portfolios of T-bills and high-quality debt assets to tokenize these assets and borrow stablecoins against them onchain, analogous to a repo or secured line of credit in traditional markets. This unlocks capital efficiency without requiring the institution to sell the asset or engage in complex repo agreements.

For example, a money market fund manager could use Horizon to borrow iUSDe against their fund tokens. On the lender side, Horizon’s target users include stablecoin holders and cash managers who are comfortable with lower-risk yields from lending against high-quality collateral. This could be institutions looking for yield on iUSDe or USDtb who want to earn additional interest. The relationship is symbiotic: Ethena provides Horizon with a compliant stablecoin (iUSDe and USDtb) and a settlement layer (Converge), and Horizon provides a major use-case for Ethena’s USDe/iUSDe in onchain lending markets.

Morpho

Morpho is a money market protocol that provides permissionless infrastructure for onchain loans. At its core, Morpho allows anyone to create lending/borrowing markets with custom parameters; each market is defined by a collateral asset, a loan asset, and a set of risk parameters, with no restrictions on what combinations can be offered.

This design lets Morpho aggregate liquidity across many markets and act as a primitive for onchain loan origination. In practice, Morpho’s architecture comprises two main components: the Morpho Protocol, which handles market creation and continuous interest accounting, and Morpho Vaults, which sit above the base protocol to manage risk and yield for lenders. The protocol tracks lenders’ earnings and borrowers’ debts across all markets in real-time, while Vault smart contracts can automatically allocate lenders’ liquidity across a curated set of markets, offering a passive, managed yield experience. These Vaults are typically run by professional risk managers who adjust allocations based on market conditions to optimize risk/return profiles.

Similarly to Horizon, Morpho is going to provide a major use-case for Ethena’s USDe/iUSDe by allowing funds, institutions and users to tokenize real world financial instruments, and borrow against them, improving capital efficiency. Since Morpho’s design is flexible, it allows for creating permissioned markets, where a KYC-wrapped token can be used as collateral - which enables diverse credit arrangements from crypto-backed loans to real-asset-backed lending.

Maple

Maple Finance operates as a decentralized institutional credit marketplace specializing in under-collateralized and cash-flow-based lending. The platform connects borrowers and lenders through onchain lending pools managed by credit underwriters called Pool Delegates.

Each lending pool on Maple operates with specific mandates, such as lending to crypto trading firms or financing real-world assets like invoices, with defined terms including interest rates, tenors, and collateral requirements. Lenders contribute stablecoins to pools while Pool Delegates screen and approve loans, with all loans represented onchain and accruing interest transparently.

The platform's hybrid model combines onchain fund management with offchain legal contracts, enabling unsecured or lightly secured loans that pure code-based protocols cannot offer. Loan servicing, interest distribution, and default handling are automated, while Pool Delegates perform due diligence including KYC and credit analysis on borrowers.

Maple operates through two distinct products serving different user bases. Maple Institutional offers permissioned pools for large capital allocators and accredited investors, featuring curated borrowers, rigorous risk management, and often collateral requirements like Bitcoin held in custody. These pools operate under legal agreements and typically require lender KYC. Syrup.fi provides permissionless pools that tokenize or tranche portions of loans from Maple Institutional.

Pendle Finance

Pendle Finance is a decentralized protocol that enables yield trading and interest rate markets on tokenized yield-bearing assets. In simpler terms, Pendle lets users split a yield-generating asset (like a yield-bearing stablecoin or staked token) into two components: a principal token (PT) and a yield token (YT). The principal token represents the underlying asset’s principal (redeemable at a set maturity for the original asset), and the yield token represents the right to the asset’s yield (interest) generated until that maturity. By separating these, Pendle creates a marketplace where participants can either lock in a fixed yield or speculate on future interest rates. Users can sell their future yield (by selling YT) in exchange for upfront principal, effectively fixing their yield in advance, or conversely buy YT to gain leveraged exposure to yield (speculating that the underlying will pay more yield than the market expects). Pendle supports assets ranging from stablecoin yield tokens (like sUSDe, cDAI) to staking derivatives (like stETH) to other DeFi yield-bearing tokens.

Pendle creates a primitive for interest rate discovery in DeFi, similar to how bond markets set interest rate expectations in TradFi. The architecture involves locking the original asset into Pendle’s smart contract, which then issues PT and YT. These tokens are tied to a specific maturity date (e.g., a PT that matures in Dec 2025). Pendle AMMs allow trading of PT for base asset (which implies a certain discount and thus an implied fixed rate) and trading of YT for base asset (implying yield pricing). As time progresses, PT prices converge to the underlying asset value (1 PT will be redeemable for 1 underlying at maturity), and YT accumulates actual yield. Pendle is non-custodial and automated; however, it has introduced new mechanisms like Synergy (to automatically reinvest yield) and yield staking to improve capital efficiency.

Ethereal

Ethereal is a non-custodial DEX offering both spot and perpetual trading, built natively on Converge. It uses Ethena’s USDe stablecoin as the primary asset for margin and settlement. Ethereal is designed to achieve sub-20ms latency and process over a million orders per second.

As of 2025, Ethereal is in a pre-launch phase called Season Zero, which allows USDe pre-deposits to bootstrap liquidity. Participating early users earn Ethereal Points (loyalty rewards) and boosted Ethena (USDe) yield incentives, gaining priority access to the platform’s upcoming releases.

Ethereal is an offchain orderbook DEX. User orders are collected and matched offchain by Ethereal’s high-performance trading engine. The core mechanics involve an offchain order matching process to enable near-instant execution, followed by onchain settlement to finalize the trades.

Offchain Orderbook Engine: Ethereal runs a high-performance order book and matching engine off chain to handle trades in real time. Both perpetual and spot markets are supported using this offchain order book system , enabling the platform to execute a very large number of orders with minimal latency.

Sequencer for Batch Settlement: A specialized sequencer node is responsible for processing the offchain transactions and committing the results onchain in batches. This sequencer aggregates user orders and trade executions, then periodically posts a compressed batch of transactions on Converge. By batching updates, Ethereal minimizes onchain transaction load while still ensuring that settlement is onchain.

The exchange operates as an L3 that settles onto Converge. Ethereal has its own reserved block space and control over transaction ordering, ensuring consistent performance even during periods of heavy trading activity. By not competing with general network traffic, Ethereal can avoid congestion or delays that often affect DEXs on shared chains.

Notably, because USDe is yield-generating (via Ethena’s sUSDe rewards mechanism), traders on Ethereal benefit from continuous interest on their collateral even while it is deployed for trading. This integration of a yield-bearing stablecoin allows users to pursue various onchain trading strategies (e.g. basis trades, lending, liquidity provision) with greater capital efficiency.

All user funds on Ethereal are held by smart contracts on the Ethena network rather than by the exchange itself. This means the exchange never takes custody of deposits – users’ assets remain under their control (managed by their private keys) throughout the trading process. The smart contracts govern deposit balances, match results, and withdrawals, providing transparency and security. This non-custodial design, combined with onchain settlement, ensures that Ethereal delivers the performance of a centralized exchange without sacrificing the trustlessness and asset sovereignty of decentralized finance.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services