Daily Notes 31-08-2023

Developments

Arbitrum has launched the Arbitrum Stylus Testnet, which allows developers to build on Arbitrum using programming languages other than Solidity, such as Rust, C, C++ and more.

The team was able to achieve this due to Arbitrum Nitro’s fraud-proving technology which can replay the execution of the chain in WASM (WebAssembly) when there is a dispute. This means that the any program that compiles down to WASM can be deterministically proven hence allowing developers to program in a host of languages.

Arbitrum quotes that there are only 20,000 Solidity developers which means that the advent of Arbitrum Stylus will provide tens of millions of programmers who otherwise wouldn't have have accessibility to the blockchain build the next generation of dApps.

SWIFT and Chainlink Tokenisation

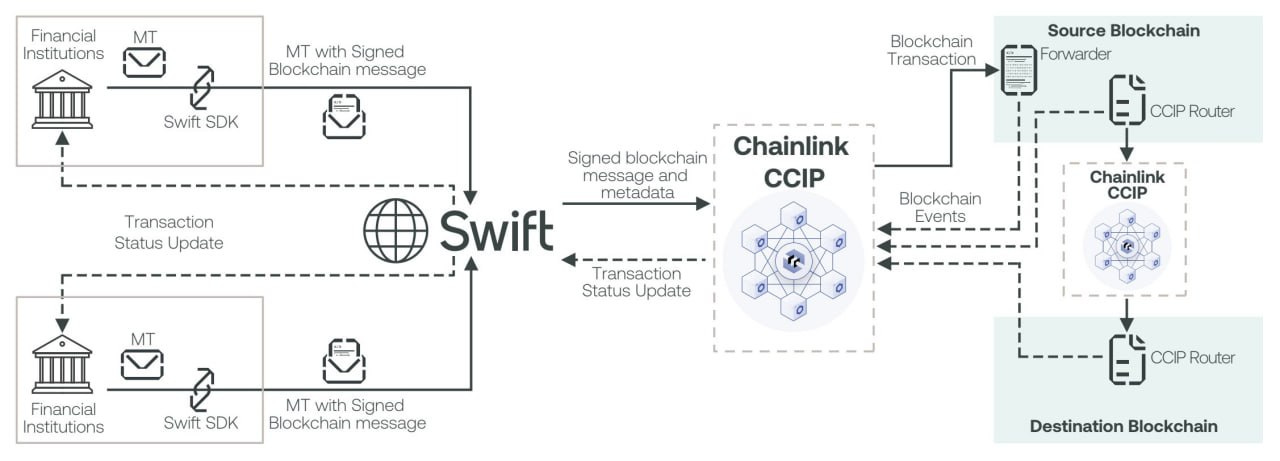

SWIFT has announced the successful testing of tokenised transfers across multiple public and private blockchains. SWIFT partnered with more than a dozen financial institutions and market infrastructures including Chainlink’s CCIP (Cross-Chain Interoperability Protocol) for the testing.

The project aims to ensure “secure, global interoperability as new technologies and platforms emerge” and demonstrate how Swift’s’ infrastructure could support the financial sector in “interconnecting Central Bank Digital Currencies (CBDCs) and other digital assets with new and existing payments systems” like blockchain technology.

The tests saw the successful transfer of tokenised assets between:

Ethereums’s Sepolia and Avalanche’s Fuji

Ethereums’s Sepolia and the private Quorum blockchain (a private Ethereum fork)

As well as the transfer of assess between two Ethereum wallets

The project enabled Swift to show that it’s existing infrastructure could serve as a single point of entry for financial institutions saw the utilization of Chainlinks CCIP as a layer to enable interoperability between the source and destination blockchains.

September will see a large amount of tokens being unlocked with the total value equalling $225 million.

The largest unlock will be $HBAR valued at $61.27 million which unlocks tomorrow on the 1st of September. The $APE token closely follows at $60 million worth of tokens to be unlocked on the 17th of September.

Prisma Finance has announced that they will launching on the 1st of September.

Primsa Finance is an Ethereum based liquid staking token backed stablecoin project that has made a number of notable partnerships in the run-up to their launch including a partnership with Convex (to launch cvxPRISMA).

They have also recently acquired and locked up $2 million of CRV. Today, they proposed the launch of their mkUSD/FRAXBP via Curve’s governance. The proposal is currently active and is set to conclude on the 6th of September.

The SEC has delayed the decision on 6 Bitcoin ETF applications with the next set of deadlines in October. The applications come from Fidelity, VanEck, Valkyrie, Invesco Galaxy, WisdomTree and Blackrock.

Trending Assets

CEX Overview

MKR, up 10.27%, DYDX, up 5.23%, and YGG, up 4.97%, were the top performing CEX coins over the past day.

MKR OI is up 54.20%, DYDX OI is up 19.76% and FET OI is up 16.19% over the past day.

Below $100M MC by performance, on chain

SHARES, up 26.42%, FUMO, up 7.47%, and DONUT, up 6.91%, were outperformers for coins below $100M MC.

Above $100M MC by performance, on chain

JOE, up 28.40%, outperformed over the past day. IMX, up 15.09% also performed well.

Above $1B MC by performance, on chain

MKR and MNT performed relatively well today. MNT is up 1.43%.

TVL

TVL Above $10M

Over the past day:

Aerodrome, ve(3,3) DEX on Base, TVL grew by 2629.04% over the past day.

Overnight DAI, multichain delta-neutral yield, TVL grew by 157.76%.

Binance Staked ETH, multichain LST, TVL grew by 100.82%.

Fees

Not much to say about fees earned today. Ethereum is the highest fee earner, followed by Lido and Uniswap V3. MakerDAO fees earned grew by 15.27% and have reached the 9th spot.

Governance Proposals

[ARFC] Enabling USDT as collateral on Aave v3 AVAX Market

Proposal to enable USDT as collateral on the V3 AVAX market outside of isolation mode as well as update the risk parameters to be on par with USDC.

[Temperature Check] Deploy Friendly Fork of Uniswap V3; ZERO Protocol on Polygon zkEVM

Proposal to deploy Zero Protocol as a friendly fork of Uniswap V3 on Polygon zkEVM propose a partnership between the Uniswap DAO and Zero Protocol. This comes after a vote to deploy Uniswap V3 on Polygon zkEVM failed.

[BIP-417] Enable ELFI/WETH Gauge [Ethereum]

Proposal to enable a Balancer gauge for ELFI/WETH pool on Ethereum. ELFI is the governance token for the Element Finance protocol.

[BIP-416] Enable STAR/USDC Gauge [Arbitrum]

Proposal is to add a veBAL gauge for the STAR/USDC.e Stable Pool on Arbitrum.

[BIP-415] Enable wstETH/cbETH Gyro Gauge w/ 10% cap [Ethereum]

Proposal to enable a 10% capped Balancer gauge for a wstETH/cbETH pool on Balancer Ethereum.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.