Daily Notes 30-11-2023

Developments

Michael Saylor’s MicroStrategy has bought another 16,130 Bitcoin at an average price of $36,785 for $593.3 million total.

This brings the firm's total Bitcoin holdings to 174,530 Bitcoin at an average price of $30,252 per coin.

MicroStrategy may also be looking to raise $750 million through the sale of class A common stock.

Illuvium Partnering with Team Liquid

Illuvium is partnering with eSports organisation Team Liquid to release themed NFTs as well as advise on the development of games in the Illuvium ecosystem and their eSports scene.

ParaX has rebranded under Parallel Finance as they announce a $30 million raise from Sequoia, Polychain, Blockchain Capital, Coinbase Ventures among others. Parallel Finance aims to be a “DeFi super app” through unifying lending, staking,Trading and more.

Sony Moving Into Digital Assets

Sony has filed a patent that would enable players on their Playstation console to transfer digital assets to each other through blockchain technology.

Similarly, leaked Microsoft documents from September 2023 showed that Microsoft is looking to integrate crypto wallets to Xbox.

The KyberSwap Exploiter who stole over $46 million has demanded “Complete executive control over Kyber (the company)” through an on-chain message sent to the KyberSwap team that states their terms.

Additional terms also include the "surrendering of all Kyber (the company) assets. This is both On-chain and Off-chain assets”and temporary full authority over the KyberDAO.

Furthermore, they state that once their demands are met, executives will be bought out, the salaries of employees that stay doubled (with those that leave given 12 months full severance), and LPs “gifted a rebate based on your recent market-making activity”.

They end with “This is my best offer. This is my only offer.” and require the demands to be “met by December 10th” without police contact or the treaty falls through .

A Blast “bridge contract” parameter led to a 10% loss in slippage off a users deposit. When a user deposits USDT or USDC, the contract automatically swaps these tokens into DAI in order to then stake in the DSR contract which provides the 5% APY.

Blast states through their twitter “A misconfigured parameter on the Blast UI led to1 user receiving 100k less DAI than they should have across 2 txs”. The user was refunded the 100k lost in slippage plus a 10% bonus for a total of $110k and the issue is now resolved.

StakeWise V3 launched yesterday. V3 brings a myriad of upgrades and use cases to the StakeWise protocol such as allowing any node operator and staker on Ethereum to mint their staked ETH LST, osETH. Moreover, the upgrade features a marketplace of staking offers, where users can choose a “vault” to stake their ETH based on the vault's performance, infrastructure setup, MEV setup and commission. After staking their ETH through a vault, the user can then also mint osETH.

Binance Pilots Banking Triparty Agreement

Binance is piloting the first ever Crypto triparty agreement which “enables institutional investors to keep collateral off-exchange in the custody of a third party banking partner”. Additionally, the collateral can be in fiat or even US t-bills.

Polygon, DraftKings and 60M MATIC

According to Coindesk, Polygon delegated sports-betting firm ‘DraftKings’ over 60 million in MATIC, who took a 100% staking commission, in exchange for publicly running a validator on the Polygon network.

Polygon publicised the partnership as “the first time a major publicly-traded firm has taken an active role in blockchain governance” without disclosing said delegations.

Despite being delegated 60 million MATIC (2% of total staked MATIC on Polygon) which delivered millions of dollars in returns for DraftKings due to a highly unusual 100% commission, their validator failed to keep up with the network and was kicked off the network in September 2024.

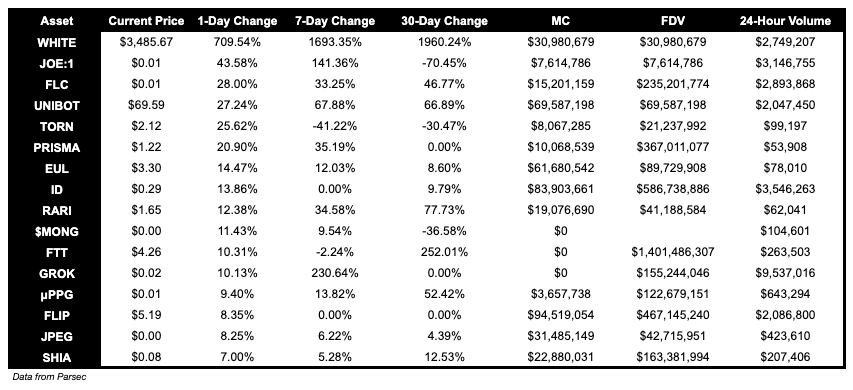

Trending Assets

Below $100M MC by performance, on chain

UNIBOT had a good day, and is up 27.24%. PRISMA is up 20.90%.

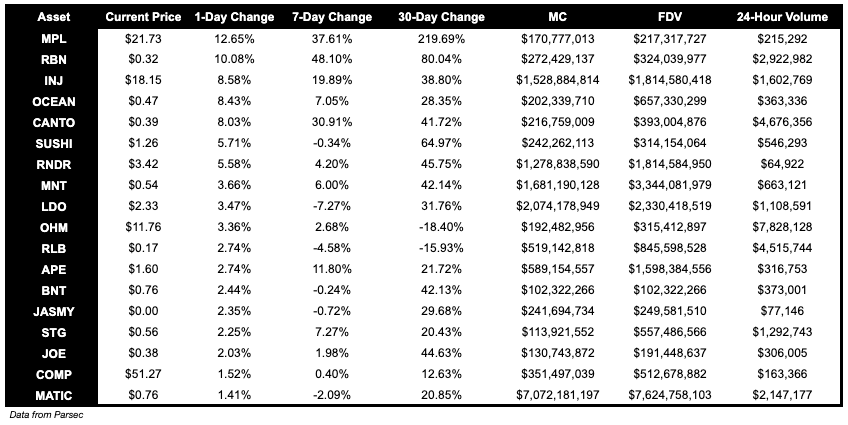

Above $100M MC by performance, on chain

MPL, up 12.65%, RBN, up 10.08%, and INJ, up 8.58%, are the top performers over the past day.

Above $1B MC by performance, on chain

RNDR, up 5.58%, and MNT, up 3.66%, were top performing tokens above $1B MC.

Trading Volumes

OHM, crvUSD and SYN dominated trading volumes onchain today.

TVL

TVL Above $10M

Over the past day:

rhino.fi, multichain DEX, TVL grew by 87.75%.

Arrakis V2, multichain liquidity manager, TVL grew by 33.31%.

Equation, derivatives on Arbitrum, TVL grew by 17.35%.

Fees

MetaMask earned more than $7.7M USD in fees today, making it the second highest fee earner.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.