Daily Notes 30-10-2023

Developments

Whale Accumulates $2M RLB

Over the past day a large wallet, 0x8..34, accumulated 10.9M RLB tokens on-chain, spending a total of $2.136M, in just a short 2 hour period.

We can see how 0x83d6474e18215bfe7a101e37e9e2a746570b6834 pushed the price of RLB up ~10% from these buys, briefly taking RLB a few percent below all time highs.

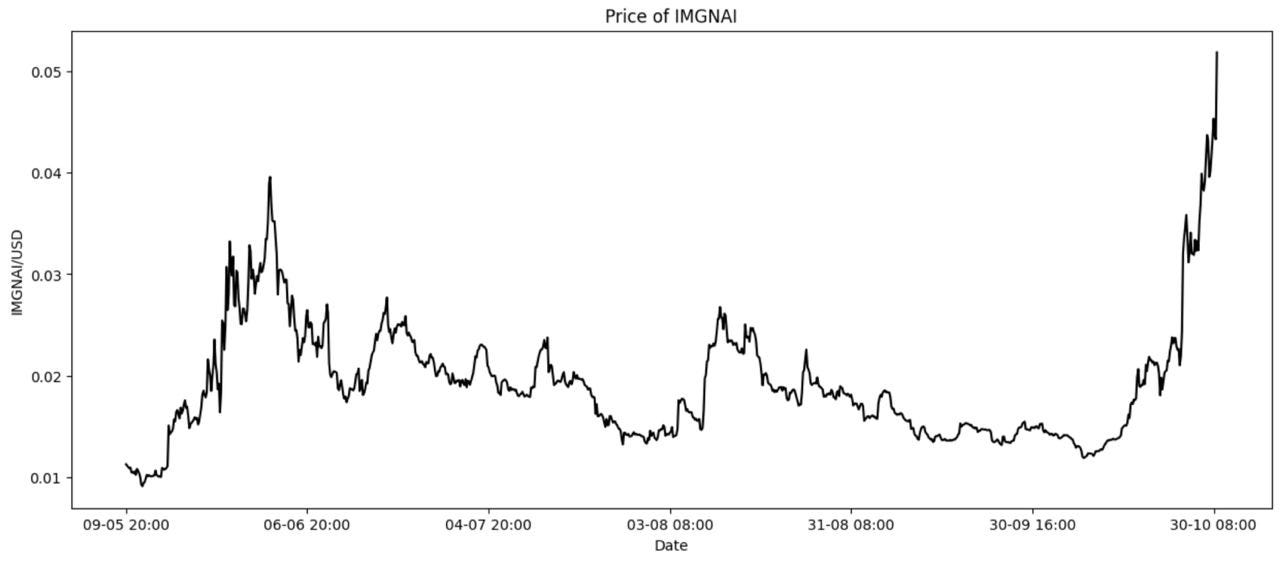

ImgnAI Announce Nvidia Program Acceptance

ImgnAI, a crypto native project that allows users to generate AI art, has been accepted into Nvidia’s Inception Program. The program is designed to help startups build their products and grow faster. It focuses on AI, deep learning, data science, HPC, networking, graphics, AR/VR, and gaming.

The program has a global network of over 15,000 technology startups.

The project’s token, $IMGNAI, has responded positively to the news, increasing by up to 34%. It currently sits at +21%.

First MEV Block Produced With DVT

On the 28th, the first MEV block using distributed validator technology was proposed on the Ethereum mainnet.

Distributed validator technology (DVT) is where multiple machines are used to secure a validator through the splitting of the private key among them.

Thus a maximum extractable value (MEV) block using DVT means that multiple machines contributed to not only validate a block, but manipulate the transactions included in it to extract the most value for themselves compared with the standard block rewards they would otherwise receive.

Yesterday, Scroll saw 200,000 transactions and over 86,000 new addresses created in 24 hours. This may be due to the Scroll Origins NFT which commemorate Scroll’s recent mainnet launch. The current TVL of Scroll is $14 million according to Defillama.

Scroll has consistently made new all time highs for transactions on the network and accounts created, every single day for the last 3 days. Cumulatively, transactions in the last 3 days alone account for 39% of all transactions on the network since the 10th of October.

Celestia Launch TIA Token Tomorrow

Celestia’s token, $TIA, will “tentatively” go live for trading on Binance tomorrow at 16:00 UTC. User’s will be able to deposit TIA on Binance from 14:00 UTC.

This comes as Celestia’s mainnet is set to go live tomorrow.

Additionally, Bybit and KuCoin will also be allowing deposits of TIA at 10:00 UTC and 14:00 UTC respectively. However, trading will only go live on Bybit and KuCoin after TIA 's liquidity meets their listing requirements.

Digital Asset Investment Products

Last week Digital asset investment products saw $326 million of inflows, the largest weekly inflow since July 2022.

Bitcoin inflows accounted for $296 million (90%) of that sum and Ethereum took second place with $75 million of total inflows

Countries Partner To Test Tokenization

Regulators in Singapore, Japan, Switzerland and the UK are partnering in a plan to test the tokenization of assets for “fixed income, foreign exchange and asset management products”. The tests will aim to advance cross-border transactions by utilising the features of blockchain technology, identify potential risks and “facilitate industry pilots for digital assets through regulatory sandboxes”.

Trending Assets

Below $100M MC by performance, on chain

VELA, up 103.61%, was the top performer today for tokens below $100M MC.

Above $100M MC by performance, on chain

RLB had a great day, and is up 13.07%, following 0x8..34’s 10.9M RLB buys on-chain. wCFG is up 9.95%, LQTY is up 4.69%.

Above $1B MC by performance, on chain

ATOM is up 3.35% today.

TVL

TVL Above $10M

Over the past day:

StakeDAO, multichain metagovernance, TVL grew by 599.19%.

Hashnote, multichain RWA, TVL grew by 373.68%.

B.Protocol, multichain lending, TVL grew 111.35%.

Fees

No particularly drastic changes. MetaMask fees earned increased 66.93% over the past day.

Articles / Threads

Introducing the RAFT Bond Program Powered by Bond Protocol

RAFT will be introducing a RAFT bond program using Bond Protocol. The tokens will be sold using a sequential Dutch auction (SDA).

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.