Daily Notes: 30-06-2023

Developments

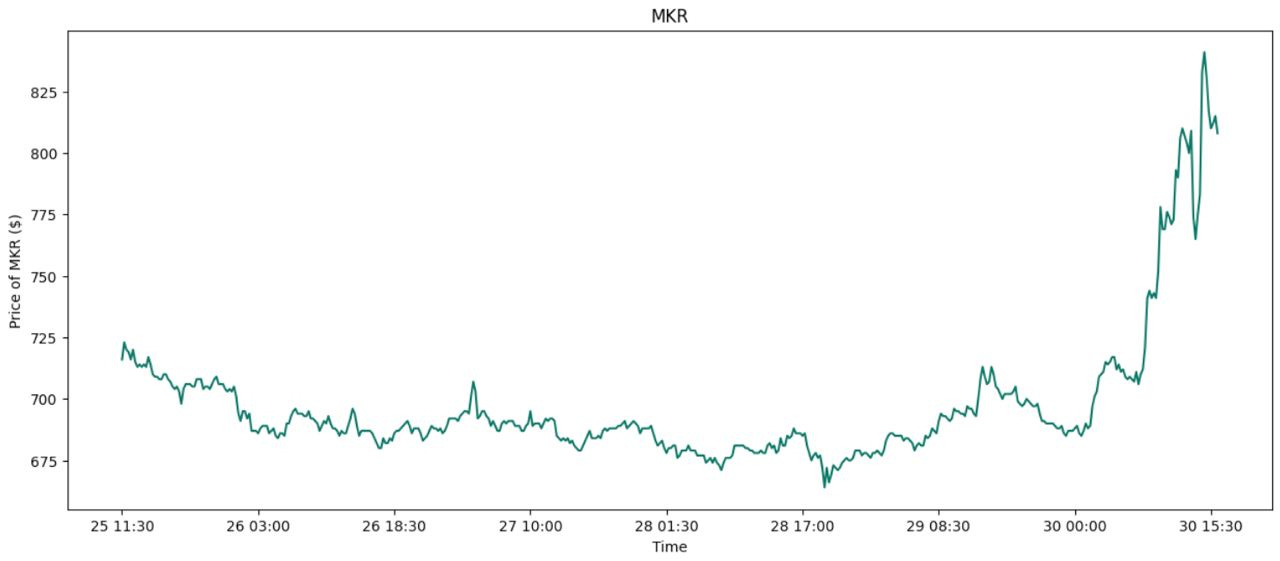

Maker outperformance

Maker showed strong outperformance today, gaining 17% in the past 24 hours. A couple of things may have generated this performance:

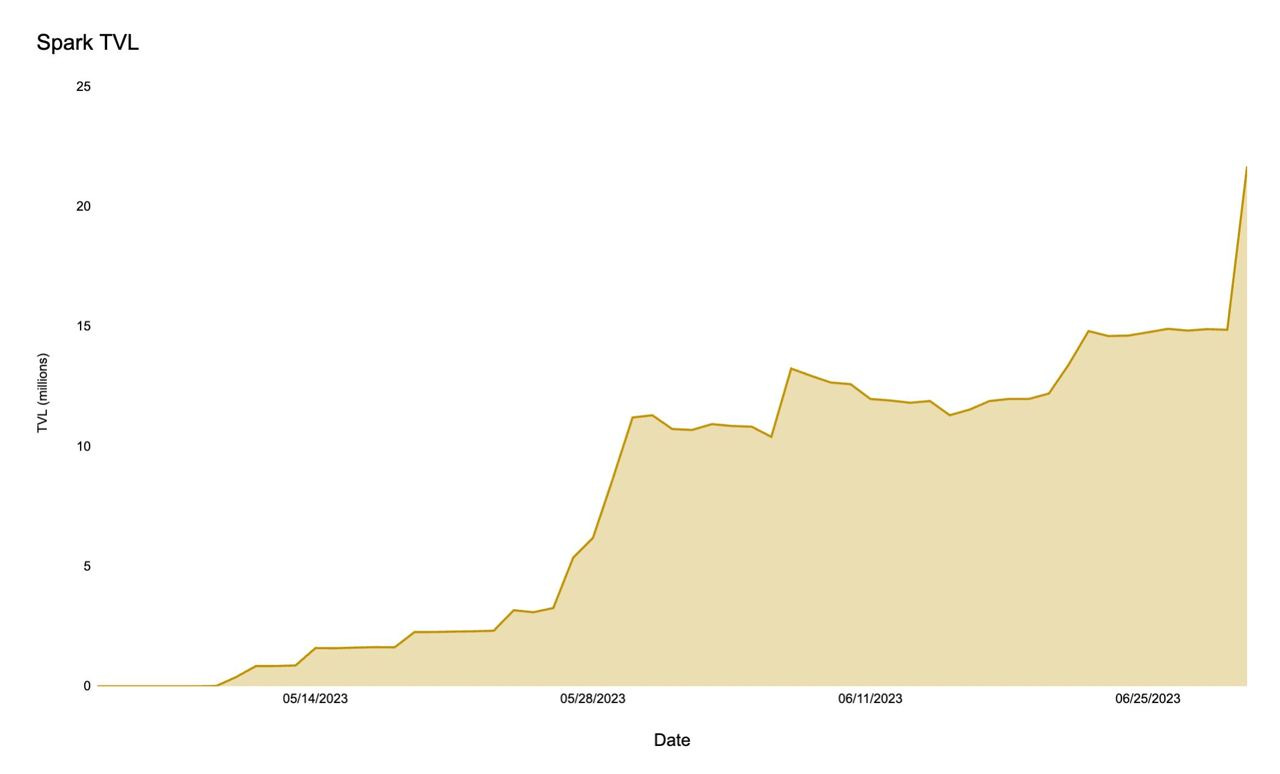

Spark Protocol TVL grew 44.8%, adding > $6mil in TVL

As per Makers ‘Smart Burn Engine Launch’ governance proposal, Maker is transitioning from a buy and burn model to a new approach called the protocol-owned liquidity (POL) model. Under this model, when the surplus buffer exceeds $50 million, the excess DAI will be utilized to purchase MKR tokens from the univ2 DAI/MKR pool. This will create demand for MKR and contribute to its value. The remaining surplus DAI will then be paired with the newly acquired MKR tokens and deposited back into the DAI/MKR pool as POL. This will enhance the liquidity of the MKR market, potentially generating LP fees for the protocol over time, as well as increasing buying pressure. This strategy represents a more effective utilization of funds compared to simply burning MKR tokens and has the potential to generate sustainable revenue.

Dinosaur Coins

9 out of the top 13 performers in the top 100 Mcap coins fall under the dinosaur coin category with names like eCash and Bitcoin cash pulling >20% intraday moves. Much of the trading volume on these coins is coming from the Korean exchange, Upbit.

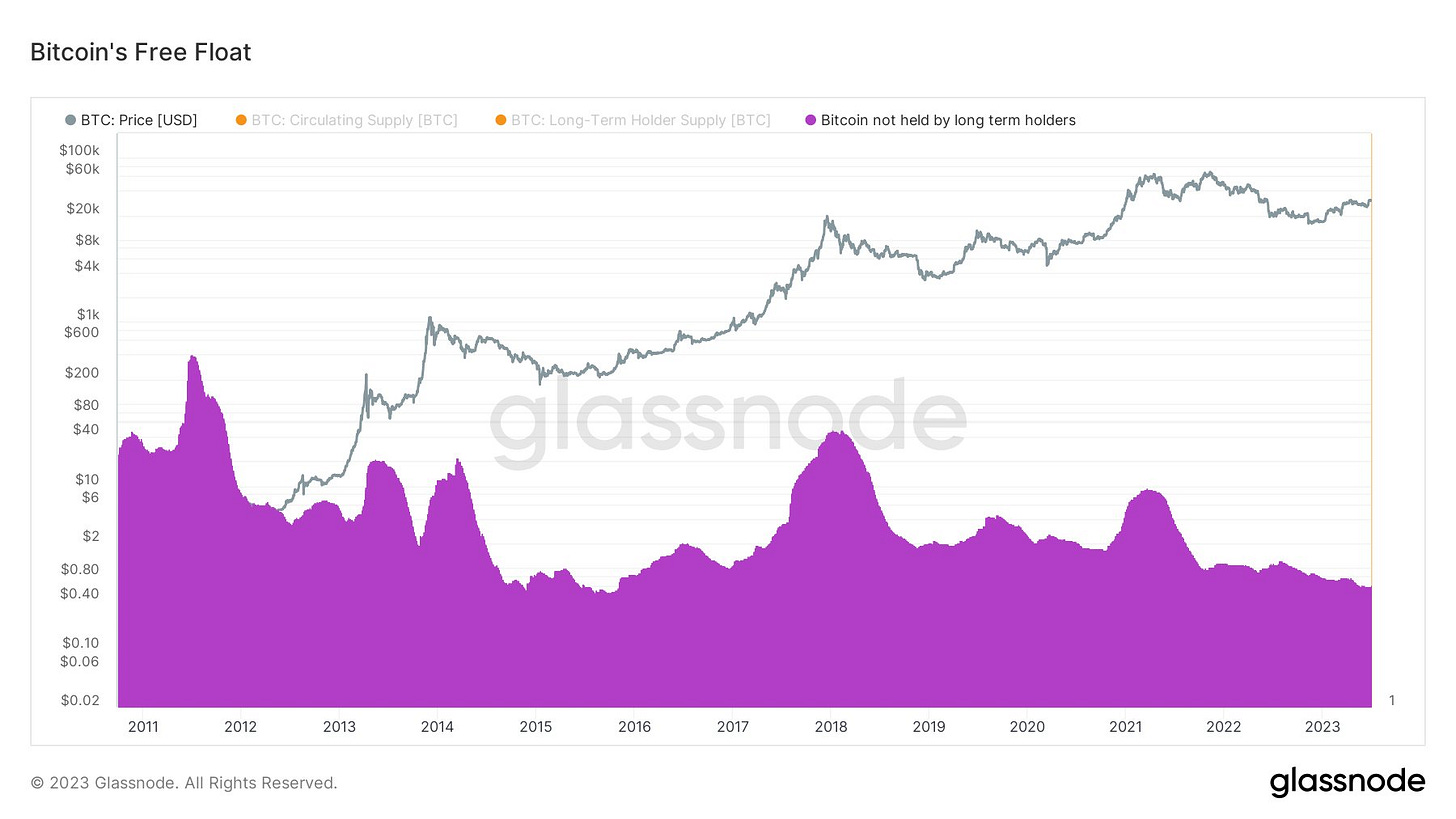

Bitcoin Free Float

The percentage of Bitcoin available for purchase (Bitcoin not held by long term holders) is nearing all time lows.

Celsius Receives Approval

Celsius has today received approval from a judge to start converting altcoins from customers (with exception of custody and withhold accounts) to BTC and ETH from July 1st onwards.

Trending Assets

Above $100M MC by performance

AXS, MKR, OX and COMP up on the day. Notably, OX is up 31.64% over the past week.

Above $1B MC by performance

LDO and LINK are the only coins up more than a percentage above $1B MC.

Trending Contracts

Coingecko Trending Assets

Matic

Apecoin

Curve

Maverick

Point pay

Pepe

Bitcoin cash

Stablecoin Netflows

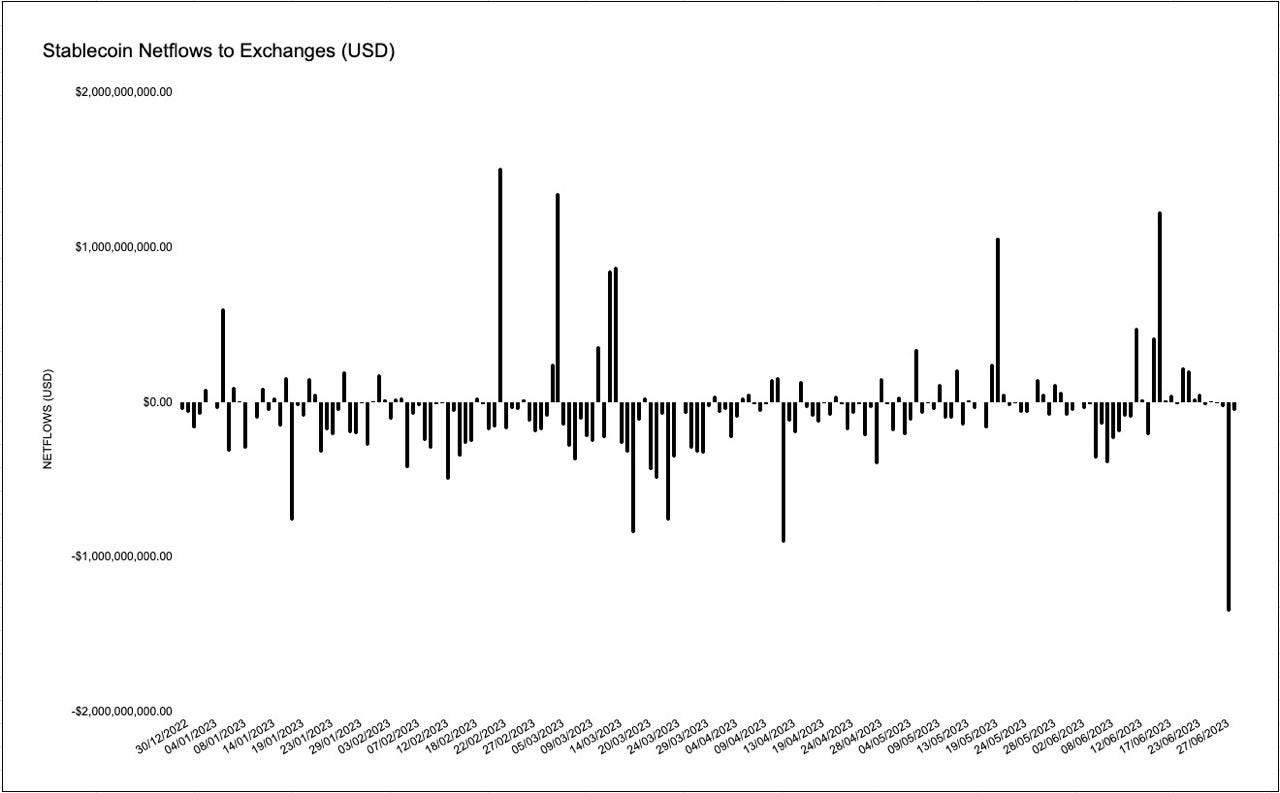

Stablecoin Netflows to Exchanges

Moderate stablecoin net outflows from exchanges today showing a $55 million outflow. This comes off of a huge $1.35 billion outflow on the 27th of June.

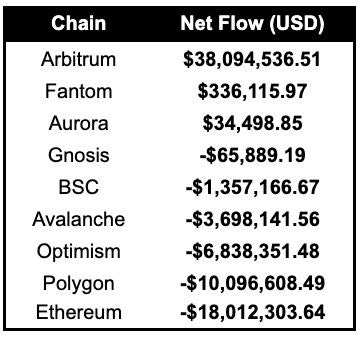

Arbitrum has seen large net inflows of stablecoins today, essentially taking all flows from other EVM chains.

Governance Proposals

MIP-23: $MNT Supply Optimization in Preparation for Launch

Proposal to NOT convert 3B BIT (from Mantle Treasury) tokens to MNT, and to instead burn them.

Proposal for GRAI be added as a bribe token on Hidden Hand for all markets.

GRAI is Gravita's LSD-backed stablecoin.

[FIP-259] Add msETH/frxETH to FXS gauge controller

Proposal to add the msETH/frxETH to the FXS gauge controller.

msETH is Metronome's synthetic ETH.

[CAP] USDC Omnipool - Whitelist USDC+crvUSD

Proposal is to whitelist the USDC+crvUSD Curve pool to receive liquidity allocations from the USDC Omnipool.

Articles / Threads

V2 Feature Highlight: Information Tax

y2k Finance discusses the "Information Tax": a new deposit fee for vaults that linearly increases as an epoch gets closer to starting.

i.e. those who deposit closer to the epoch’s start will pay a higher fee which gets passed down to $vlY2K holders.

GMD Ecosystem Near-Term Roadmap

GMD Ecosystem announces their near-term roadmap:

GMD will be introducing a MUX protocol vault, a 2nd airdrop round and launch confirmed projects through their launchpad

GND will be launching gETH and zGND.

Introducing: Cega’s Puppy Vault & L2 Vault

Cega (decentralized structured investments protocol) will be launching Puppy Vault and L2 Vault.

The Puppy Vault and the L2 Vault are part of the Pure Options Vaults (POV) family.