Daily Notes 29-08-2023

Developments

The United States Court of Appeals has rejected the SEC’s decision to deny the conversion of Grayscale’s Bitcoin Trust to an ETF.

The court sided with Grayscale agreeing that ‘The denial of Grayscale’s proposal was “arbitrary and capricious”’. Although this is a massive win for Grayscale, it does not guarantee that the ETF is approved.

The SEC denied the Grayscale ETF on the basis that the products did not have the necessary safeguards to prevent “fraudulent and manipulative acts and practices”. This is the same reasoning the SEC has used to deny numerous proposals from the likes of Fidelity and VanEck to list BTC investment products on national exchanges over the last few years.

In the case, Grayscale was able to argue that the SEC lacked consistency with its ruling due to their approval of “materially similar” Bitcoin futures ETF proposals like those from Valkyrie and Teucrium’s in the past.

It remains unclear as to what the next steps shall be but this ruling most definitely sets a new precedent and points towards the successful coming of a Bitcoin ETF in the near future.

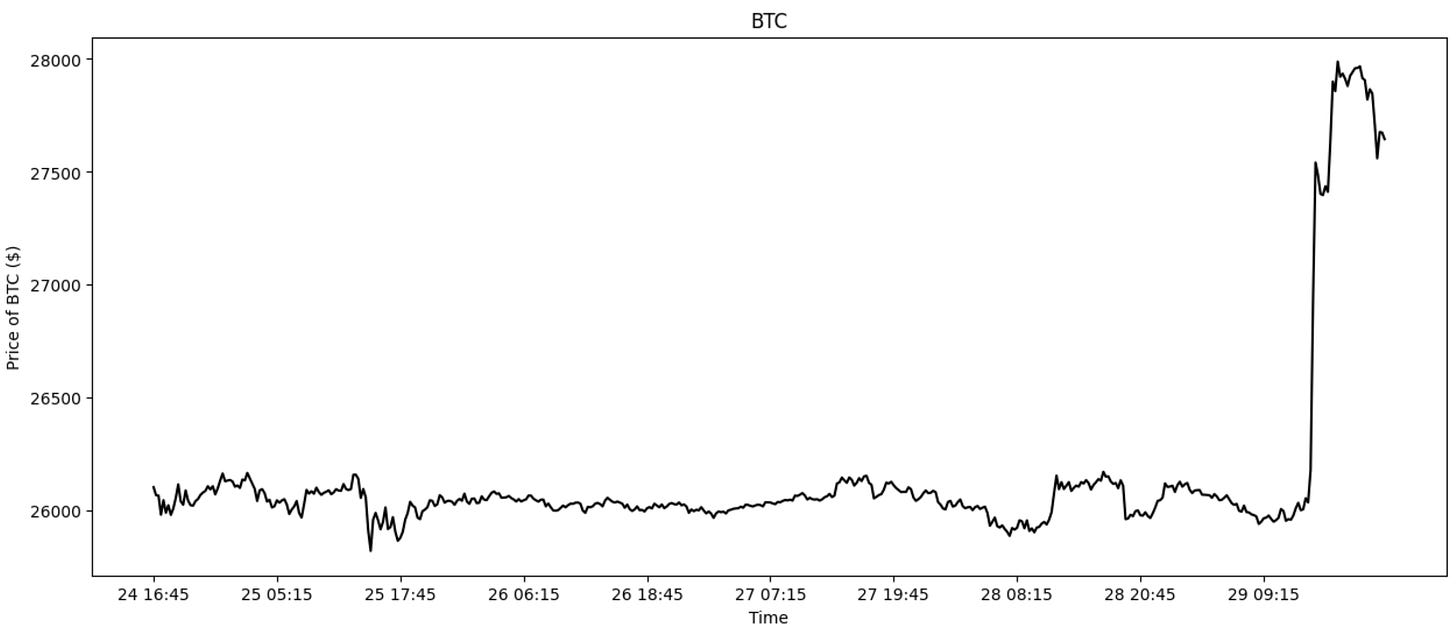

The crypto community has responded with ecstasy with prices reflecting as we see Bitcoin’s price increase by 7.3% to $28,000 along with the general market as a whole.

Additional Sources:

https://grayscale.com/wp-content/uploads/2023/08/GBTC-Decision-829.pdf

X (Twitter) Acquire Payments License

X (Twitter) has acquired the necessary license needed to integrate crypto payments into their platform. The Rhode Island license will allow X to store, transfer and exchange digital assets adding to Twitter’s previous Crypto related implementations like NFTS as profile pictures and Bitcoin tips.

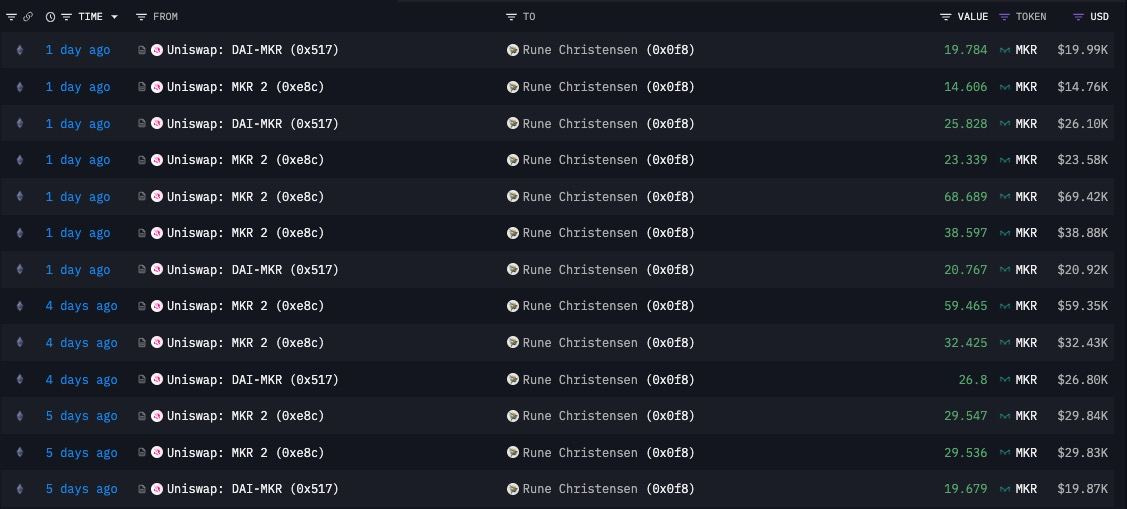

Rune Christensen, the founder of MakerDao, has added $215,000 worth of Maker ($MKR) to his wallet in the last 24 hours. This brings the total value of their $MKR holdings to $4.837 million.

In the last 45 days, Christensen has accumulated ~2454 $MKR which is equal to $2.57 million at today's prices.

Last week, saw Digital asset investment products outflows reaching $168 million with Bitcoin making up $149 million of that sum.

This was the largest weekly outflow seen since March bringing August’s total to a cumulative $278 million as of August the 25th.

It shall be of interest to see how the flow is affected by the success of Grayscale’s lawsuit against the SEC.

BlueMove, a NFT marketplace on Aptos and Sui, has announced the ceasing of operations on Sei on August 31st due to “the current trading volume on Sei falling short of our expectations.”

This comes only 14 days after Sei launched their mainnet with BlueMove previously retweeting a post expressing disdain towards Sei’s handling of their $SEI airdrop campaign.

Additionally, BlueMove have requested that users delist their NFT’s on their Sei platform to prevent loss of assets.

Echooo, a zkSync crypto wallet, has exceeded 10,000 smart contract wallets and has 276,219 users according to coincu.

In July of this year, Echooo reportedly raised $15 million at a $100 million valuation backed by Skyview capital and A&T Capital among other Crypto funds.

Noticeable Changes in Smaller Chains

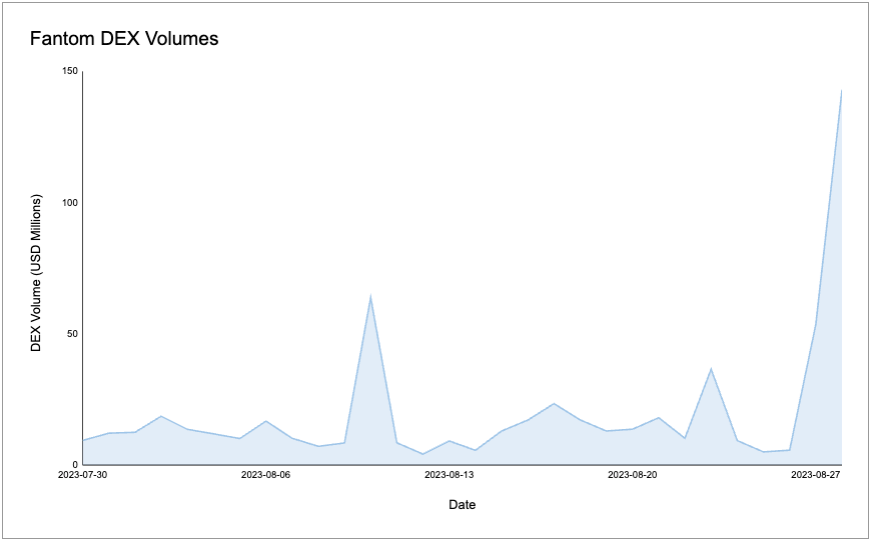

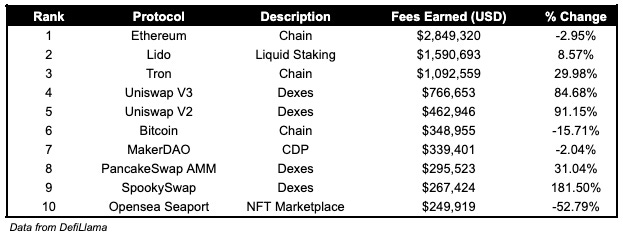

Fantom DEX volumes have increased by 1302.7% over the past 7 days, and reached 143.1M from 10.2M. Additionally, SpookySwap's fees earned have increased 181.50% over the past day. It is currently the 9th highest fee earner.

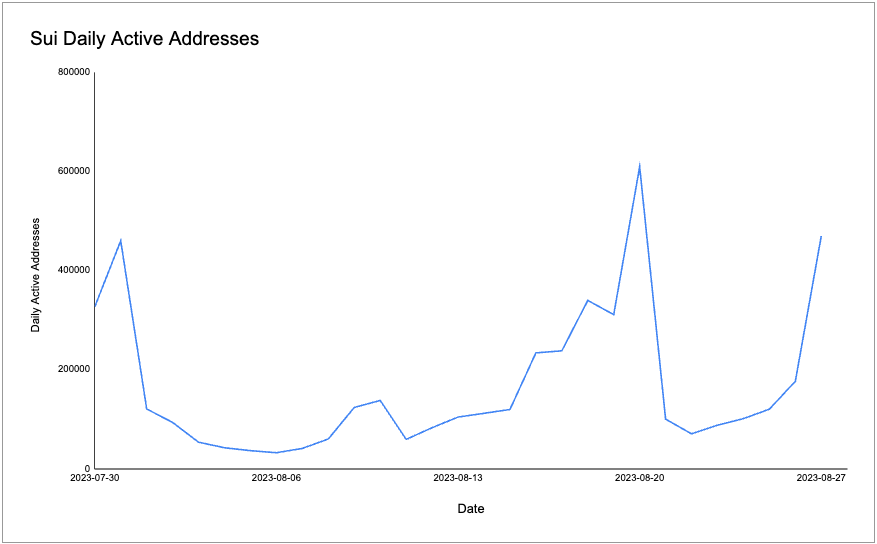

Sui daily active addresses are up 565.6% over the past 7 days and reached to 469.4K.

Trending Assets

CEX Overview

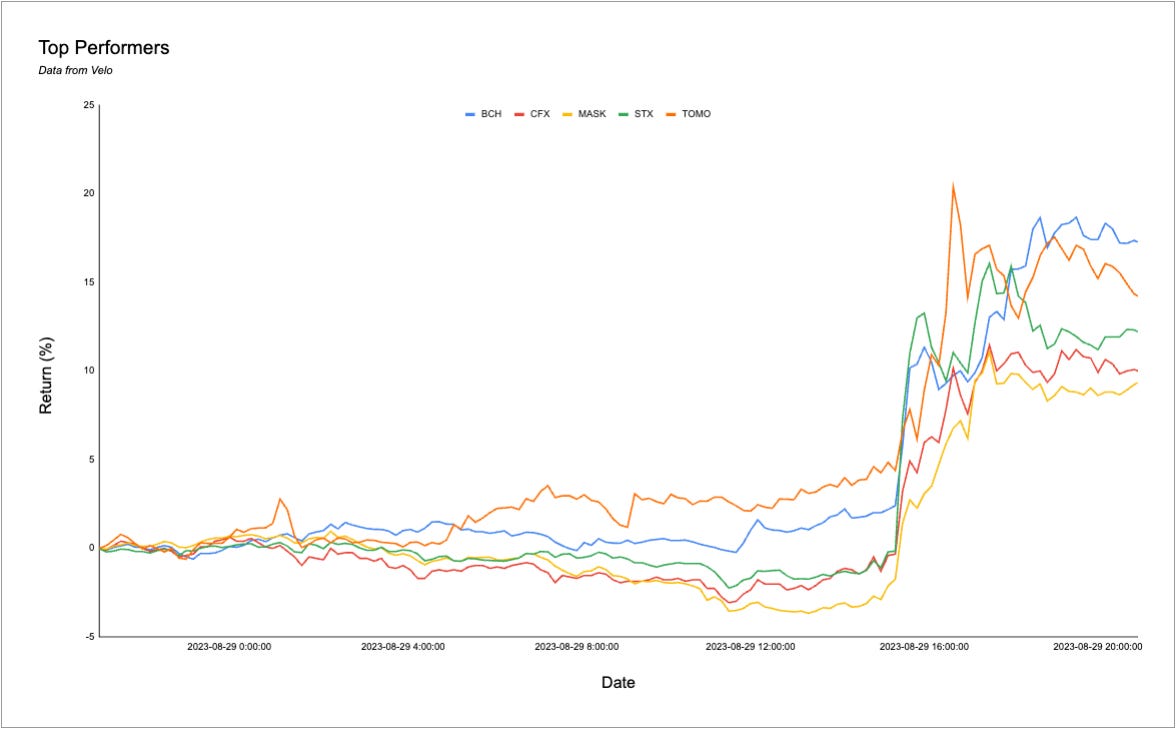

BCH, up 17.26%, and TOMO, up 14.22%, were the top performing CEX coins over the past day.

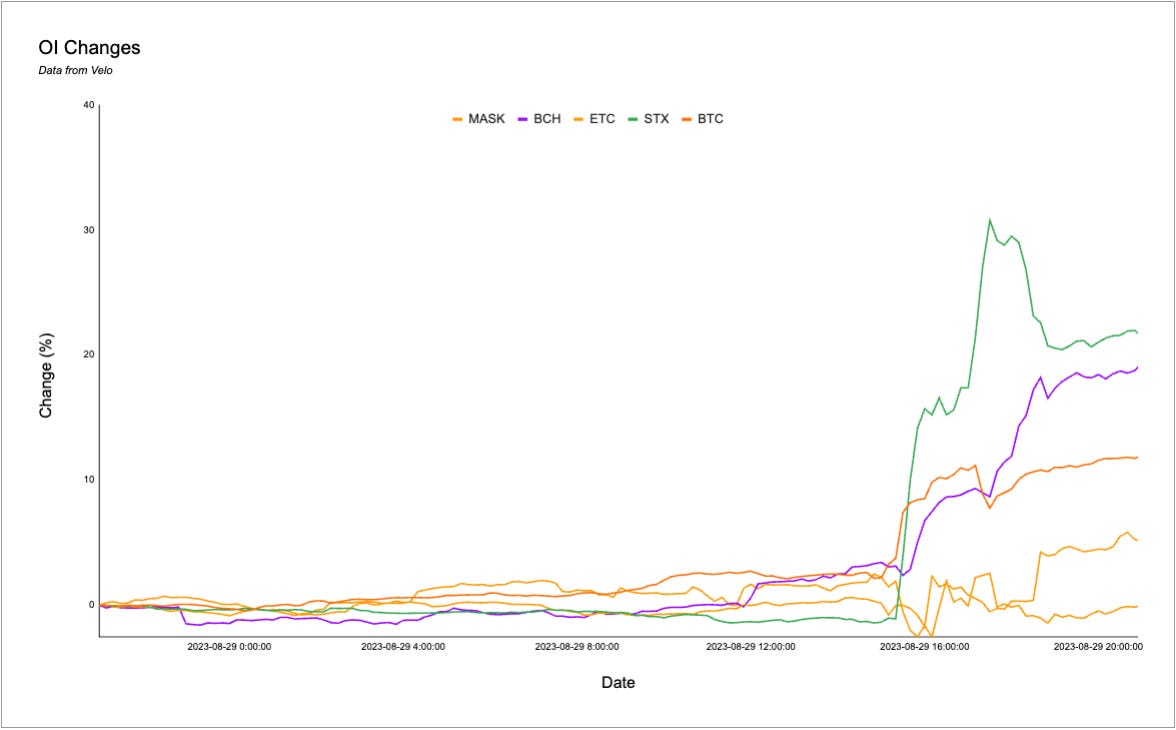

STX OI has increased 21.74%, and BCH OI has increased 19.04%, over the past day.

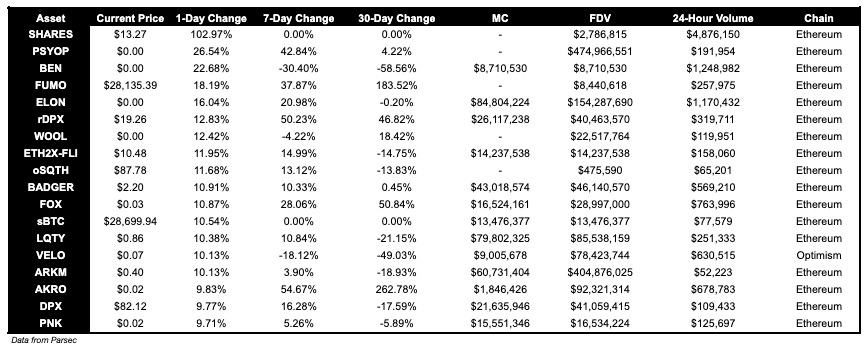

Below $100M MC by performance, on chain

SHARES, up 102.97% was the top performer for coins below $100M MC. Notably, SHARES is associated with a friendtech fork, and has increased in price drastically following Racer (founder of friendtech) announcing that users who use friendtech and friendtech forks will potentially forfeit their friendtech airdrops.

Above $100M MC by performance, on chain

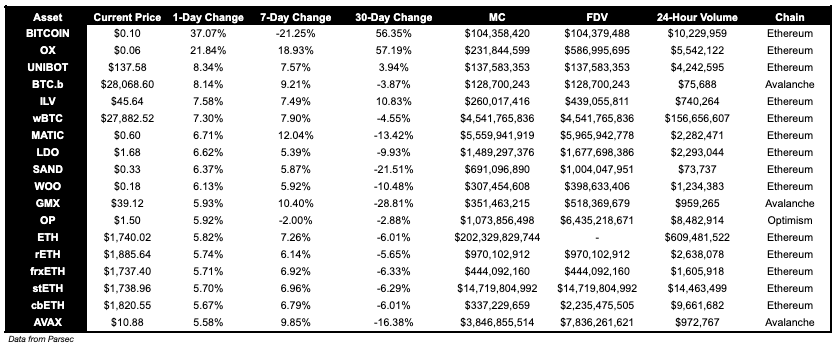

On chain index, BITCOIN, OX and UNIBOT, outperformed today. BITCOIN is up 37.07%, OX is up 21.84% and UNIBOT is up 8.34%.

Above $1B MC by performance, on chain

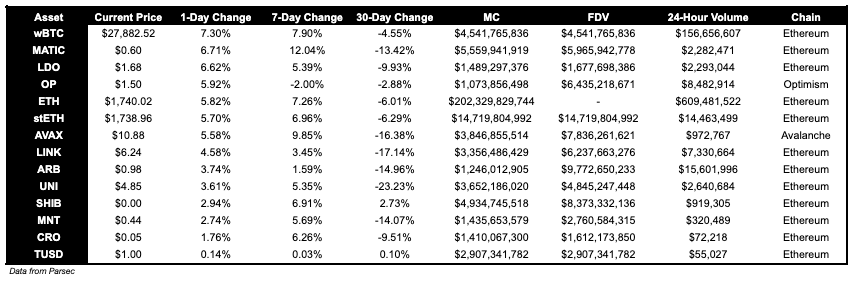

MATIC, up 6.71%, LDO, up 6.62% and OP, up 5.92%, performed well today.

TVL

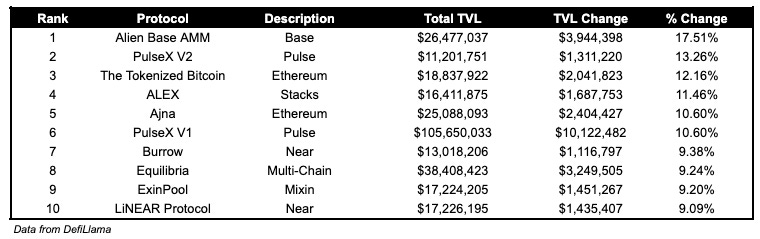

TVL Above $10M

Over the past day:

Alien Base, DEX on Base, TVL grew by 17.51%.

ALEX, DEX on Stacks, TVL grew by 11.46%.

Ajna, permissionless lending on Ethereum, TVL has grown by 10.60%

Fees

Notably, SpookySwap fees earned are up 181.50%. Additionally, Uniswap V3 fees are up 84.68% and Uniswap V2 fees are up 91.15%.

Governance Proposals

[ARFC] Treasury Management - Avalanche v2 to v3 Migration

Proposal to redeem all Aave DAO funds on Aave v2 Avalanche and deposit the underlying assets into Aave v3 Avalanche.

V4 Adoption & DYDX Token Migration to dYdX Chain

Proposal for the dYdX community to:

Adopt DYDX as the L1 token of the dYdX Chain

Adopt the Ethereum smart contract commissioned by the dYdX Foundation which would provide a one-way bridge for the DYDX token to be migrated from Ethereum to the dYdX Chain

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.

Jai besoin dun depot dans mon compte toute suite