Daily Notes 28-11-2023

Developments

Kronos Offers White Hat Bounty

Kronos Research, a crypto trading and investing firm associated with WOO, has offered a 10% white hat bounty to a hacker who stole $25 million from the firm's treasury via authorised access to their API keys.

Ark Invest, whose CEO is Cathie Wood, sold $5.3 million of $COIN (Coinbase’ stock) on monday and bought $1.2 million of Robinhood stock

Animoca Brands has become the largest validator of the TON blockchain as it recently invested in the TON ecosystem. Animoca announced that they have and will continue to assist third party GameFi projects on TON as they seek to scale.

Notable previous investments by Animoca Brands and its subsidiaries include Yuga Labs, Axie Infinity, Polygon,, Consensys, and Yield Guild Games among others.

dYdX Distributing Token Rewards

dYdX has initiated the distribution of DYDX token rewards from the chains trading fees to validators and stakers.

Additionally dYdX chain has also launched its trading incentive program which offers $20 million of DYDX tokens over the next 6 months.

So far the chain, which is in public beta, has done $1.86 million in volume across 14,000 transactions.

Some Coinbase users have received a subpoena that involves Bybit from US Commodity Futures Trading Commission regulators (CFTC). Coinbase announced that if needed, Coinbase will send information concerning the user accounts to the CFTC.

According to Glassnode data, ETH has turned deflationary again as ETH entering the validator queue has slowed down and the number exiting increases, alongside increased network activity which burns ETH.

Over the last 4 months NFT and DeFi transactions have both decreased by 3% and 57% respectively whereas gas usage for token and stablecoin transfers has increased by 8.9% and 19% respectively.

Chainlinks priority migration period for existing users staking LINK, the project's native token, has gone live as Chainlink’s new staking pool (v0.2) goes live. The new pool has 45 million LINK (8% of total LINK supply) in rewards. The next stage will allow early access whitelisted wallets to stake in the new pool on December 7th and the pool will open to the public on December the 11th.

Circle’s Cross Chain Transfer Protocol for USDC is now live on Noble, an application-specific chain built for native asset issuance in Cosmos. This will allow users to send their USDC directly from other chains to all Cosmos chains that are connected to IBC like the dYdX chain.

Circle's CTO Marcus Boorstin said that “This will be the first time CCTP has integrated with a non-Ethereum Virtual Machine (EVM) chain.”

SEC Delays Hashdex and Franklin Templeton Spot BTC ETFs

The SEC has delayed both the Hashdex and Franklin Templeton spot BTC ETFs. Their next deadlines both lie on the 31st of March 2024.

Notably, Franklin’s BTC ETF is the only issuer who hasn't submitted a S-1a filing.

James Seyffart (of BBG) also suspects that this could potentially be the SEC lining up the BTC ETFs for simultaneous approval in 2024.

Trending Assets

Below $100M MC by performance, on chain

RBX, a perpetuals DEX on Starknet, is up 54.15% over the past day.

Above $100M MC by performance, on chain

$BITCOIN is up 21.87% today. RBN is up 19.26%.

Above $1B MC by performance, on chain

MNT had a good day, and is up 7.77%. RNDR is up 5.43% and SNX is up 5.28%.

Trading Volumes

No notable changes in tokens with highest trading volume onchain compared to yesterday.

TVL

TVL Above $10M

Over the past day:

Reaper Farm, multichain yield, TVL grew by 90.81%.

Tranchess Ether, LSD on Ethereum, TVL grew by 34.83%.

ether.fi, LSD on Ethereum, TVL grew by 16.80%.

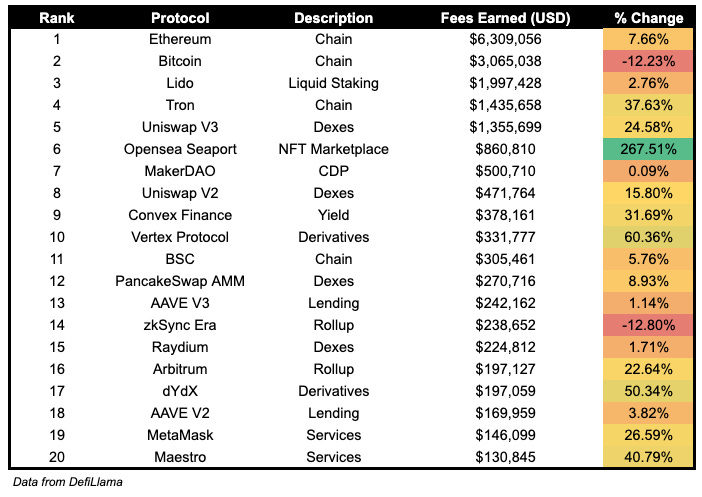

Fees

OpenSea Seaport fees earned are up 267.51%. Vertex fees earned continues to climb up, now the 10th highest fee earner.

Governance Proposals

Hidden Hand: Deployment for Marionette for Thena

Redacted proposal to deploy Marionette, a voting optimizer for bribe markets, on BNB Chain and support Thena’s veTHE.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.