Daily Notes 28-08-2023

Developments

Ethena Labs Partner With Copper & ByBit

Ethena Labs, a project with the goal to provide global access to a truly decentralized financial system through its stablecoin USDe, has announced it’s first end-to-end integration with Bybit, Lido and Copper. USDe is a stablecoin created via a delta neutral position; long stETH, short ETH perpetual future on a CEX. A user gives USD/ETH/stETH to Ethena and receives USDe, a stablecoin that earns the sum of stETH yield and the funding for the short leg.

The risk here is holding the collateral on a centralised exchange. The copper integration allows Ethena to hold the collateral for the short leg of the stablecoin position to be held in a permissioned / self-custodied off-exchange wallet, reducing counterparty risk somewhat.

SEC Charge Impact Theory

The SEC has charged Impact Theory for the unregistered Offering of NFTs, fining them $6.1 million.

The SEC states that Impact Theory encouraged potential investors purchase the NFT as an investment into the business saying that investors would profit from their purchases if Impact Theory was successful. Thus the SEC found that the NFTs offered and sold to investors were investment contracts and therefore securities.

Magic Eden partners with Polygon to launch their $1 million Polygon NFT creator fund.

The fund aims to spark the next wave of NFT adoption through providing grants aswell as mentoring by a selected group of successful NFT creators on Polygon.

The head of gaming at Magic Eden, Chris Akhavan, has also emphasised a focus on Utility stating ”[what] we don’t necessarily need a lot more of, is your traditional 10,000 [profile picture] collection with no utility”.

1inch Purchase ETH

The team at 1inch deployed $10M of USDT and $70K in USDC (USDC) to acquire an estimated 6087 Ethereum (ETH) at an average rate of $1,655 each. They had previously sold 11K ETH, at an average price of $1906 (worth $20.98M at the time) on the the 5th of July.

Mantle Proposal

A proposal to deploy a portion of Mantle’s Treasury, which is currently valued at $3.3 billion ($2.6 billion consisting of MNT tokens), to support liquidity on applications deployed to the Mantle Network has been posted on the chains governance forum.

The cap for liquidity is set at a combined allowance of 60M USDx, 30k ETH, and 120M MNT for applications.

Seed Liquidity for RWA-yield Backed Stablecoins shall see a combined allowance of 60M USDx.

Liquidity Support for third party bridges will also see up to a combined allowance of 10M USDx, and 5k ETH

It is of note that the above allocations may overlap.

The effort will aim to provide a better experience for Mantle users by supplying a foundational layer of liquidity for the dapps to function and hopefully increase the appeal of the Mantle ecosystem as a whole.

More here.

Shibarium Bridge Re-opens

The Shibarium bridge is now up and running giving users access back to their funds after 11 days.

There have been no notable fluctuations in the price of either the Shiba inu or Bone token since the announcement was made.

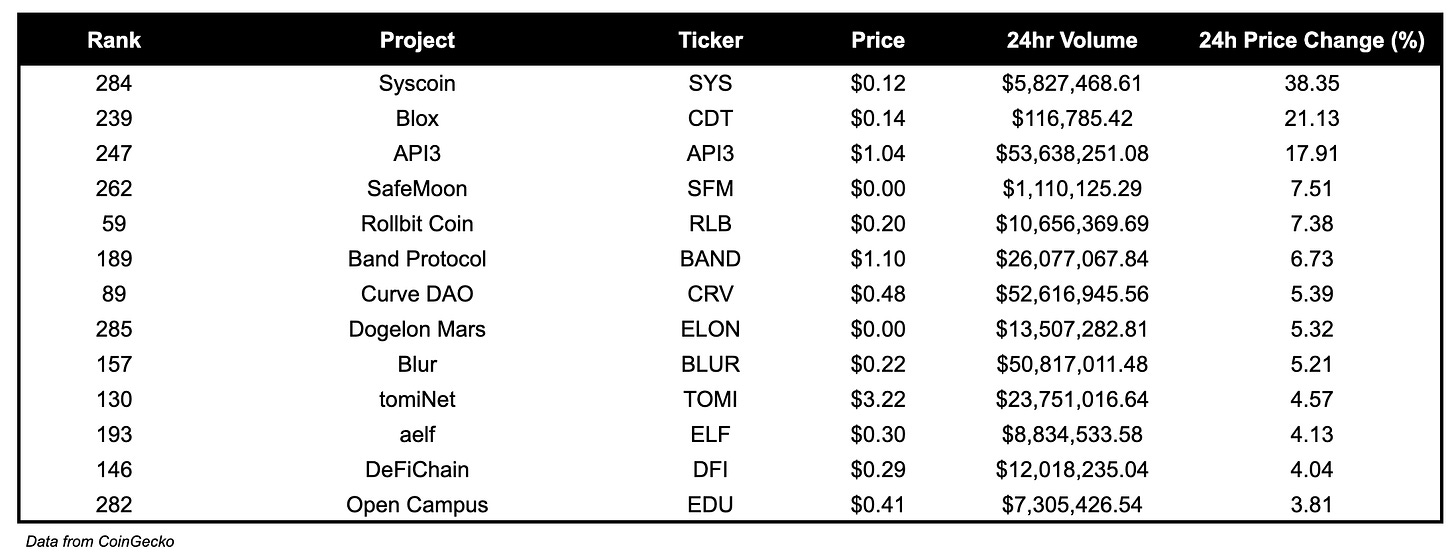

Trending Assets

CEX Overview

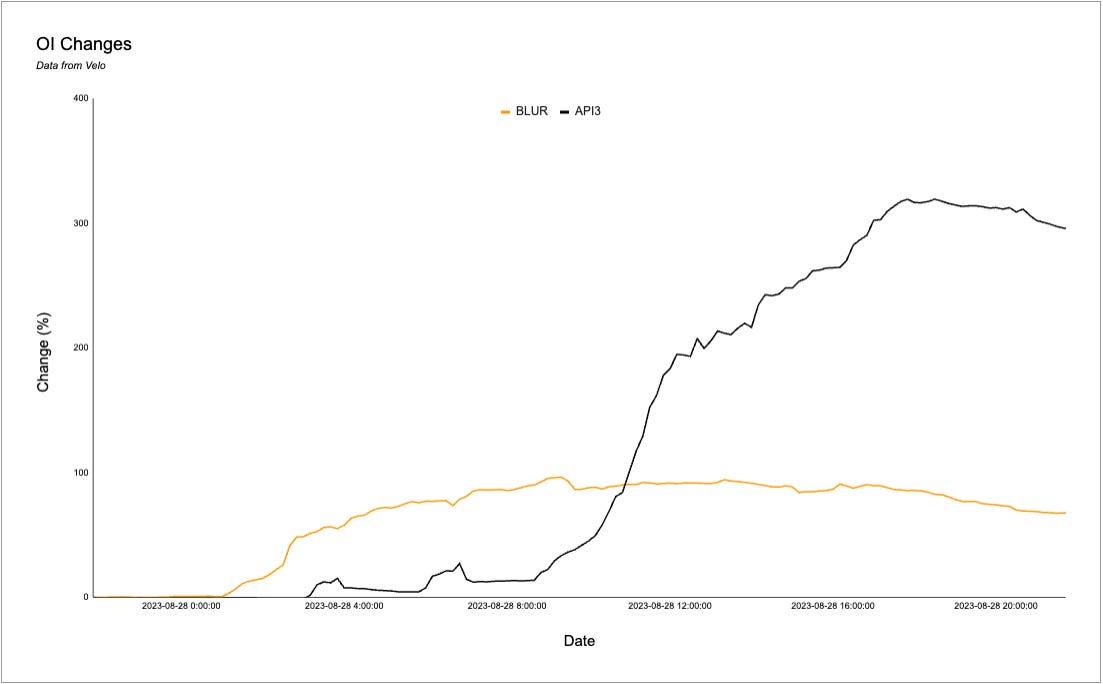

API3, up 15.99%, CRV, up 5.69%, and BLUR, up 4.59%, were some notable CEX coins that outperformed over the past day.

API3 OI is up 295.83% and BLUR OI is up 67.68% over the past day.

Top 300 Performers

Top 300 Losers

BITCOIN is the top loser of the day, and is down 25.77%. OX, down 5.89% and SUI, down 6.93%, were some other notable under performers over the past day.

Below $100M MC by performance, on chain

LBR, up 13.98%, VELA, up 9.29%, and LINQ, up 8.20%, are some relevant coins below $100M MC that performed well over the past day.

Above $100M MC by performance, on chain

RLB, up 5.25%, is the top performer for coins above $100M MC, followed by CRV, up 4.60%.

Above $1B MC by performance, on chain

CRO is up 3.83% over the past day.

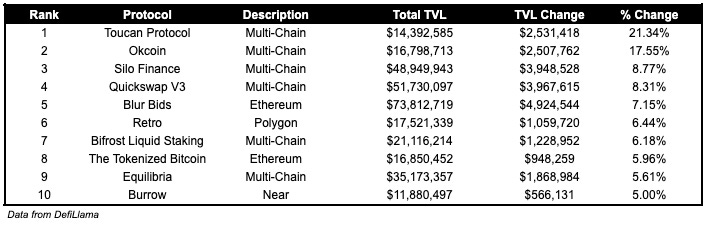

TVL Above $10M

Over the past day:

Toucan Protocol, multichain RWA (carbon credits) protocol, TVL is up 21.34%.

Silo Finance, multichain lending and borrowing, TVL is up 8.77%.

Blur Bids, NFT marketplace on Ethereum, TVL is up 7.15%.

Fees

Notably, Opensea Seaport fees are up 99.24% over the past day, zkSync Era has become the 10th highest fee earner, and Ethereum fees earned are down 42.39% over the past day.

Governance Proposals

[FIP - 283] Sunset Fraxferry for FRAX ( EVMOS )

Fraxferry is a bridging solution built by Frax for safer bridging of Frax native assets. Proposal to sunset Fraxferry for FRAX for Evmos.

[FIP - 282] Sunset Fraxferry for FRAX ( Aurora )

Proposal to sunset Fraxferry for FRAX for Aurora.

[FIP - 281] Sunset Fraxferry for FRAX ( Boba )

Proposal is to sunset Fraxferry for FRAX for Boba.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.