Daily Notes: 28-07-2023

Developments

Shibarium’s Beta Bridge for Ethereum has gone live for public testing. Shibarium is an upcoming Layer 2 solution, which will require users to use $BONE to transact on it. $LEASH will be used as a liquidity token for users to stake them in liquidity pools to earn rewards.

BONE which will be the gas token of the L2 also performed well today, gaining 7.56%.

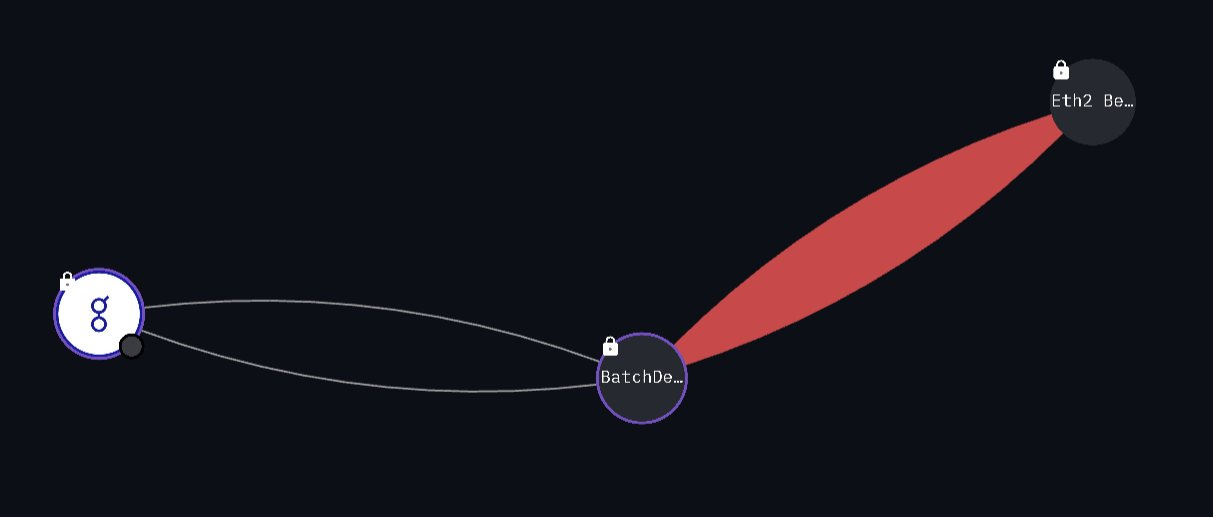

Golem, a project that raised 820k ETH ($8.6Mil at the time) in a 2016 ICO, deposited 98k ETH ($184Mil) into the Ethereum staking contract today.

Golem sent 7 transactions of 12,800 ETH each & 1 final transaction of 8.4k ETH to the ETH2 Beacon deposit address. You can track these movements at this address: 0xba1951dF0C0A52af23857c5ab48B4C43A57E7ed1

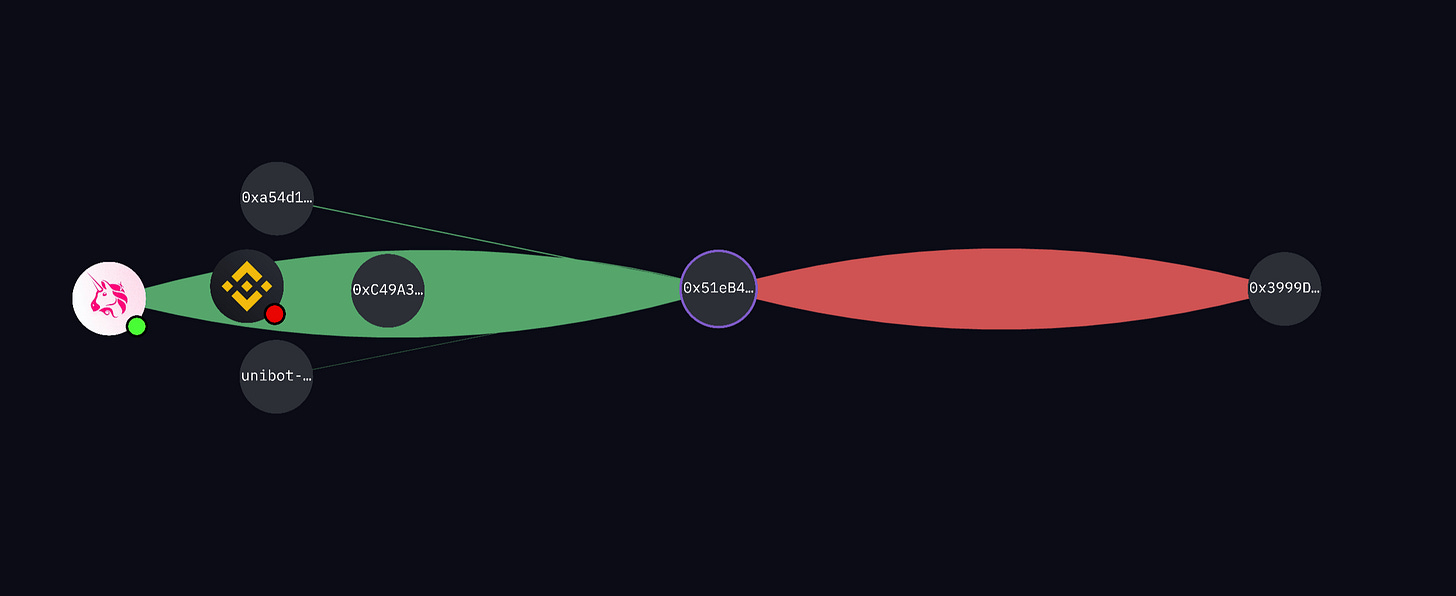

Fresh Address Accumulating UNIBOT

A wallet (0x51e), freshly funded a week ago using Binance, has been buying incrementally increasing clips of UNIBOT through using a UNIBOT Uniswap V2 Pool.

After receiving UNIBOT, 0x51e sends the tokens to 0xC49. 0xC49 currently holds 10.512K UNIBOT, worth approximately $1.61M. Both wallets have only interacted with Binance as a CEX. 0x51e stopped purchasing UNIBOT at approximately 7 AM UTC.

Earlier today, 18 blocks were reorganized on Ethereum Goerli Testnet.

As of today, 11.9M GHO has been minted. GHO is Aave’s multi-collateral stablecoin.

The launch of Pond0x, a token by Pauly0x, led to a sharp increase in gas costs, as it quickly became the highest gas using contract.

Base fee jumped to 300 GWEI as participants transferred other people’s tokens to themselves and sold into the liquidity pool.

Additionally, the contract allowed any user to directTransfer from and to any address. This resulted in people stealing each others tokens via transferring them to their own addresses and selling them into the LP.

Sequoia Reduce Crypto Fund

Sequoia Capital, has reduced the size of its crypto fund significantly, shrinking it from $585 million to $200 million. This move comes as a response to a liquidity crunch in the market and a strategic shift towards focusing on smaller players in the cryptocurrency space. In our opinion, Sequoia’s fund size in relation to the number of attractive VC deals to allocate encouraged the decision to downsize.

BTC Trading Volume Slump

The seven day moving average of BTC trading volume has fallen to levels not seen since January 2023, reducing almost 80% since the highs of the year.

Base New Contracts Deployed

Coinbase’s new chain built on top of the OP Stack, BASE, had a spike in contracts deployed as their devnet went live earlier this week.

New deployed contracts spiked the week of launch, and increased by 400% from the week of the 10th to the week of the 17th.

Trending Assets

Top 300 performers

BONE had a good day on the news that the Shibarium bridge went live, up 7.56%. Likewise, SHIB gained 6.47% on the day.

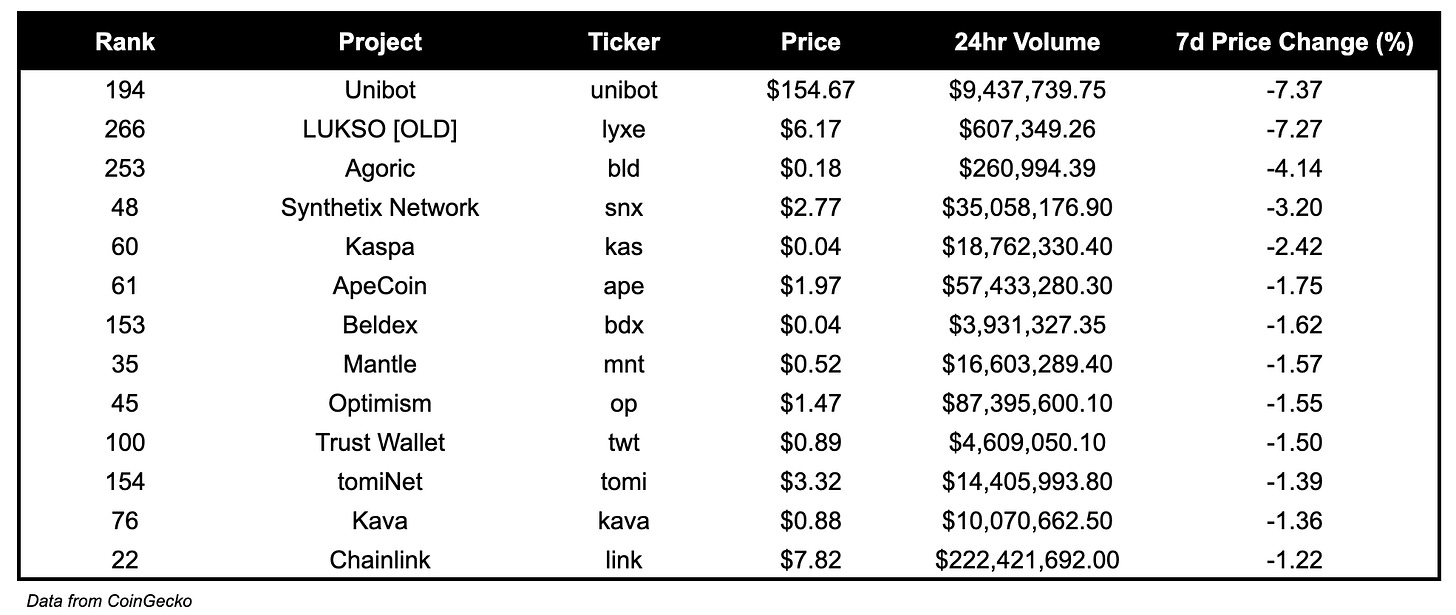

Top 300 Losers

Below $100M MC by performance, on chain

The top performing coin below $100M MC is PIKA, which is up 20.96% over the past day. Notably, PIKA announced their esPIKA rewards program today.

LEASH also performed well over the past day, and is up 8.37%. Notably, LEASH is the liquidity token for Shibarium, which recently launched its beta bridge for public testing.

Another relevant coin that outperformed was VELO, up 6.81% over the past day and 48.07% over the past month.

Above $100M MC by performance, on chain

BONE (gas token for Shibarium), up 8.85%, is the top performer of the day for coins above $100M MC.

Following BONE, JASMY, is up 7.18%, LQTY, is up 6.49%%, and IMX, is up 6.46% have outperformed over the past day.

Above $1B MC by performance, on chain

SHIB, up 4.52%, has outperformed over the past day. SHIB is followed by UNI, which is up 2.26%.

Stablecoin Changes

Largest changes:

Total circulating USD on Ethereum decreased by $124.4M (-0.18%)

Total circulating USD on Optimism decreased by $69.5M (-10.14%)

Total circulating USD on zkSync decreased by $2.8M (-2.03%)

TVL

All Protocols

Over the past day:

Fluidity Money, multichain yield protocol, TVL grew by 1645%.

Agni Finance, DEX on Mantle, TVL grew by 267.55%.

Thala, CDP on Aptos, TVL grew by 39.71%.

Protocols Above $10M TVL

Over the past day:

Helio Protocol, CDP on BNB Chain, TVL grew by 231.95%.

Flux Finance, money market on Ethereum, TVL grew by 15.59%.

Ondo Finance, RWA, TVL grew by 5.49%.

Fees

Ethereum earned the highest fees over the past day, at $6.6M, followed by Lido, at $1.8M, and Tron, at $1.3M.

Notably, Convex is the 6th highest fee earner of the day, with $371.5K earned.

Governance Proposals

[CIP] Disable CNC emissions for Omnipools

Proposal to disable CNC rewards to Omnipools, and to reallocate these emissions to the Conic treasury. If this proposal is to pass, current Omnipool LPs would stop earning CNC rewards but still continue to earn base yield and CRV and CVX rewards.

Articles / Threads

Kwenta has launched 8 new markets to trade: ETH/BTC (ratio), XMR, MAV, ETC , COMP, YFI, MKR, and RPL.

Since these are launched by Synthetix, they can be traded not only on Kwenta, but on other frontends such as Polynomial and dHEDGE as well.

Pika is announcing the Pika token rewards program. As base rewards, approximately 750K PIKA (0.75% of PIKA supply) will be given out as esPIKA every 30 days. 45% of this will go to LPs, 45% to traders, and remaining 10% to PIKA stakers.

In addition, boosting rewards, that Pika collects from early redeemers of esPIKA will be distributed, in the same manner.

In the future, trader rewards and staker rewards will be reduced to be used as rewards for an upcoming referral program.