Daily Notes 26-01-2023

Developments

Aleo Zero-Knowledge L1 Network Set for Imminent Launch

Aleo, a zero-knowledge L1 network, “set to launch imminently”.

Celo Integrates Centrifuge for Real World Asset Focus, Transitions to Ethereum L2

Celo, a Real World Asset focused chain that is in the process of transitioning to an Ethereum L2, integrates Centrifuge via Axeler.

Allnodes Transitions All Ethereum Validators from Geth to Besu

Allnodes transitioned all 23,895 of their Ethereum validators from Geth to Besu. Broadly, the percentage of Ethereum validators using Geth still remains high at 78%.

Peaq Integrates Wormhole, Aims for Mainnet Launch This Year

Peaq, a Real World Asset protocol, integrated Wormhole for cross chain liquidity access. Peaq also revealed their aims to launch their mainnet this year.

Curve Finance Announces Upcoming Launch of Llamalend

Curve Finance tweeted that “Llamalend is some days away from launch”. Llamalend is lending/borrowing markets with crvUSD.

Venus Protocol to Deploy on Multiple Chains Including Ethereum and Arbitrum

Venus protocol is supposed to deploy soon on Ethereum, Arbitrum, zkEVM, and opBNB.

Lido Adds ParaSwap to Its Withdrawal Aggregator

Lido integrated ParaSwap into their withdrawal aggregator.

Trending Assets

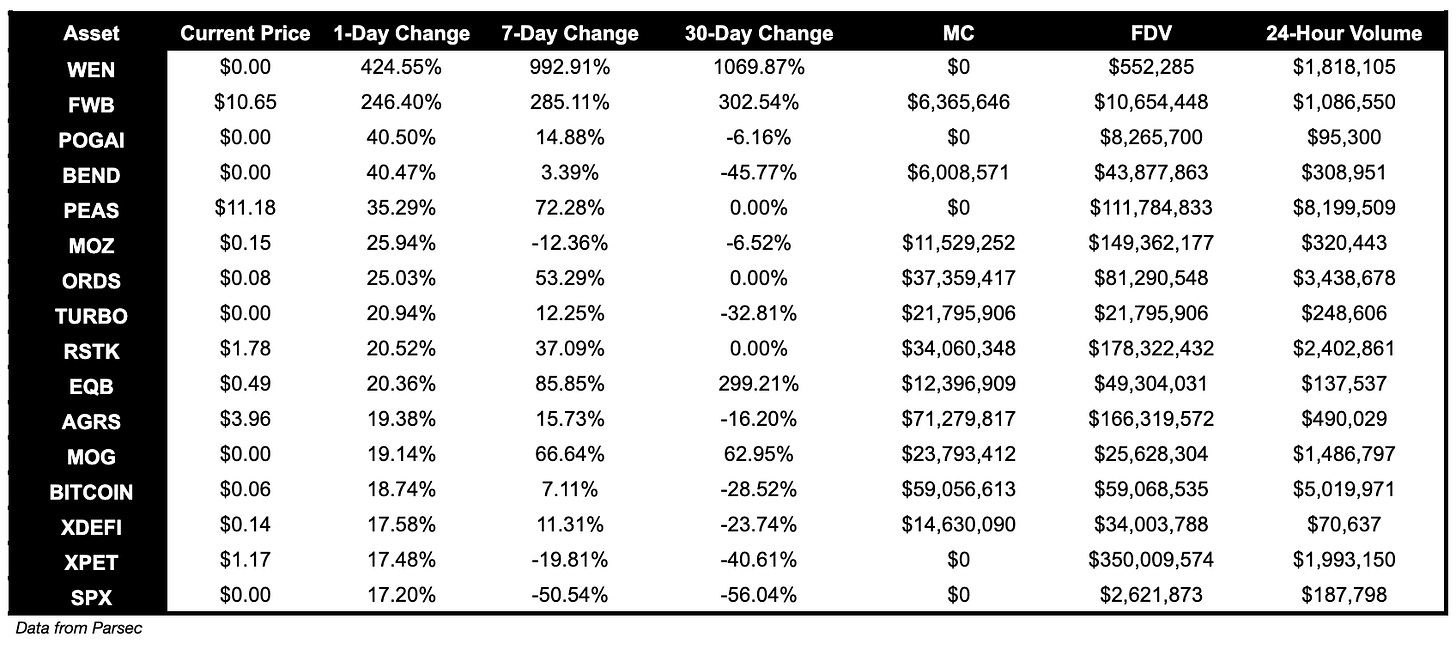

Below $100M MC by performance, on chain

WEN (on Ethereum) is up 424%, FWB is up 246%, and POGAI is up 40.5%. PEAS is up 35.29%, ORDS is up 25.03% and RSTK is up 20.52%.

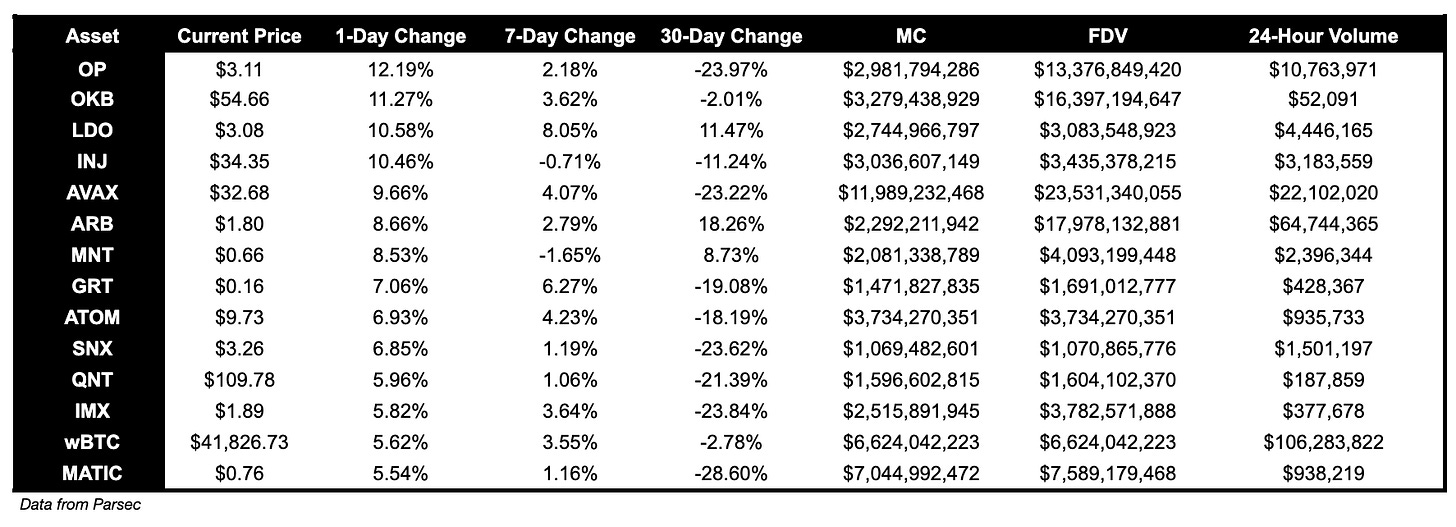

Above $100M MC by performance, on chain

ZRX is up 24.61%, ENS is up 21%, and MUBI is up 20%.

Above $1B MC by performance, on chain

OP had a good day, and is up 12.19%. OKB is up 11.27%, and LDO is up 10.58%.

Trading Volumes

SAVM, FLC, crvUSD, PEAS and OHM dominated on-chain volumes OHM and PEAS announced a partnership today.

TVL

TVL Above $10M

Over the past day:

GooseFX, a perpetuals DEX on Solana, TVL grew by 210%.

RosSwap, a DEX on FSC, TVL grew by 76%.

MuesliSwap, a multichain DEX, TVL grew by 37.5%.

Fees

Convex Finance fees earned are up 417%, Uniswap V3 fees are up 54.67%, Ethereum fees earned are down -17.68%, and Bitcoin fees earned are down -32.33%.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.