Daily Notes 25-10-2023

Developments

Yesterday, the FTX estate sent 100,000 $SOL (approximately $3 million) to Kraken, 51,335 $SOL ($1.54 million) to Binance, 25,000 $SOL ($750,000) to Coinbase and 15,335 $SOL ($460,050) to an unlabelled address.

This amounts to a total of $5,750,000 worth of $SOL moved.

Today, Alameda has also sent $2.2 million of $LINK, $2 million of $MKR and $1 million of $AAVE, to Wintermute.

Polygon’s POL token contracts are now live. The POL token will replace $MATIC and will act power Polygon L2’s, including Polygon zkEVM, “via a native re-staking protocol that allows POL holders to validate multiple chains and perform multiple roles on each of those chains [as validators]”.

Users can choose to migrate today by sending MATIC to the contract address. Regardless, all MATIC tokens on Polygon POS will automatically become $POL with a 1:1 ratio throughout.

Maestro, a Telegram trading bot, had their router hacked for 280 ETH ($510,000) of user funds. In response, Maestro spent 276 ETH “to secure our users tokens” and within 10 hours of the exploit, Maestro spent an additional 340 ETH to fully refunded users affected.

Ark Invest, has sold $3.6 million worth of Coinbase stock ($COIN) and Grayscale Bitcoin Trust $GBTC.

Two days ago, on Tuesday, Ark Invest also sold $5.8 million worth of $COIN and $GBTC.

Shrapnel, a blockchain based first person shooter game being built on Avalanche, has raised $20 million in a funding round led by Polychain Capital.

Previously, Shrapnel also raised $10.5 million in 2021. The game is currently still in development but will incorporate NFTs and smart contracts to allow a tournament host to automatically distribute rewards.

Shrapnel will also have its own token, $SHRAP. $SHRAP will be used to pay validators, to reward players, to buy in-game items in the Shrapnel marketplace and also to mint player created content. It will also be used for Governance.

SBF will be taking the stand. This comes after his defence team said it would seek to introduce evidence that highlights "inconsistent statements" testified by former FTX executives Gary Wang and Nishad Singh.

Arbitrum will be integrating Celestia for its scalable data availability into ‘Arbitrum Orbit’ - a service that allows users to create chains that settle on Arbitrum L2.

The Fantom Foundation has launched the testnet for Fantom Sonic, a new virtual machine that will enable Fantom to achieve “2000+ TPS at an average finality of one second while consuming a fraction of the storage used by its predecessor, Opera”.

LayerZero Integrating EON and wstETH

LayerZero integrates Horizen’s “EON”, a EVM compatible side chain and smart contract platform powered by Horizon. Additionally, LayerZero will be integrating Lido’s wstETH, allowing it to be moved across Ethereum, Avalanche, BNB Chain, and Scroll.

Yesterday, the ProShares Bitcoin strategy ETF ($BITO) traded 36.92 million shares which is 4 times the average daily volume. As of today, one share costs $17.66.

Vodafone Partners with Chainlink

Vodafone’s Digital Asset Broker partnered with Chainlink to successfully test the transfer of trade documents via public and private blockchains to support trade processes.

Trending Assets

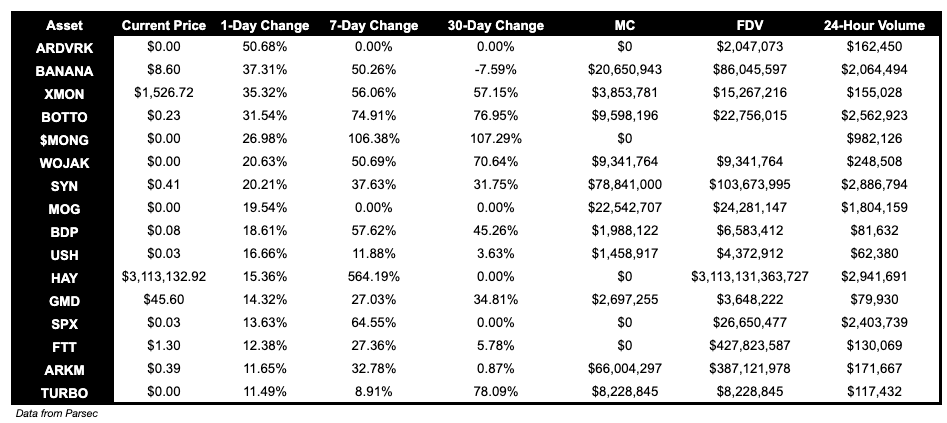

Below $100M MC by performance, on chain

BANANA, up 37.31%, XMON, up 35.32%, and MONG, up 26.98%, performed well today.

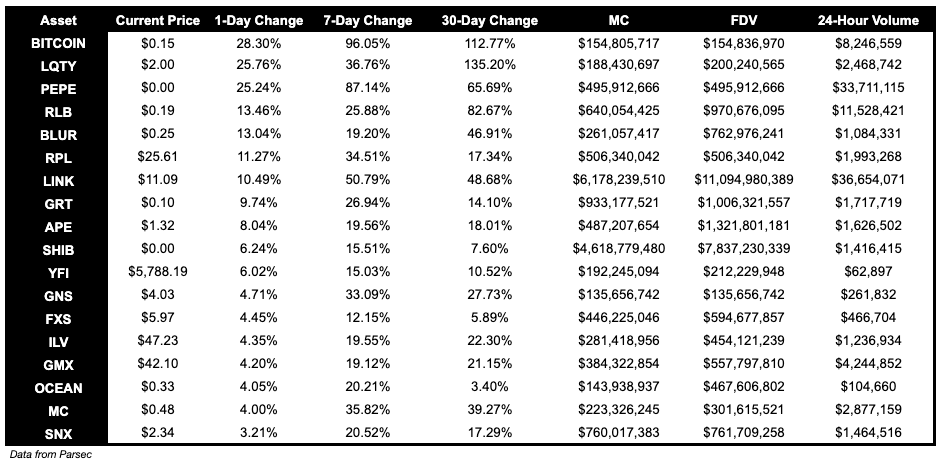

Above $100M MC by performance, on chain

For tokens above $100M MC, Ticker BITCOIN, up 28.30%, LQTY, up 25.76%, and PEPE, up 25.24%, performed well today.

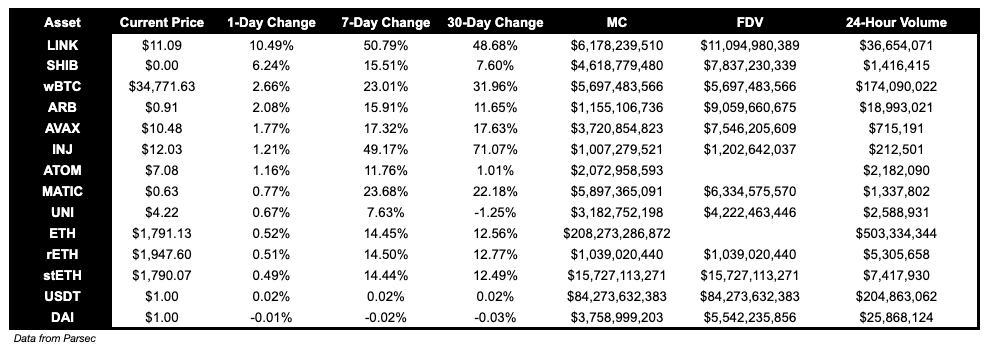

Above $1B MC by performance, on chain

LINK is up 10.49%. SHIB up 6.24%.

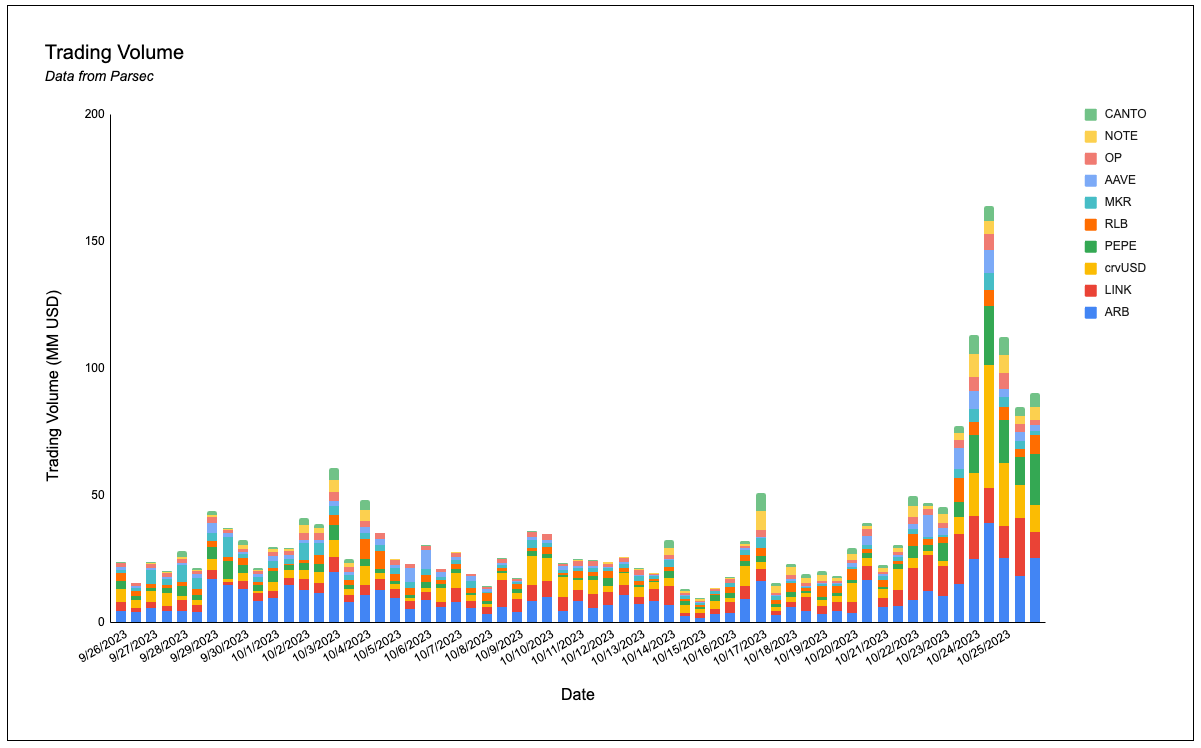

Trading Volumes

Trading volumes on-chain are still up. ARB, PEPE, RLB and LINK have the highest trading volumes on-chain.

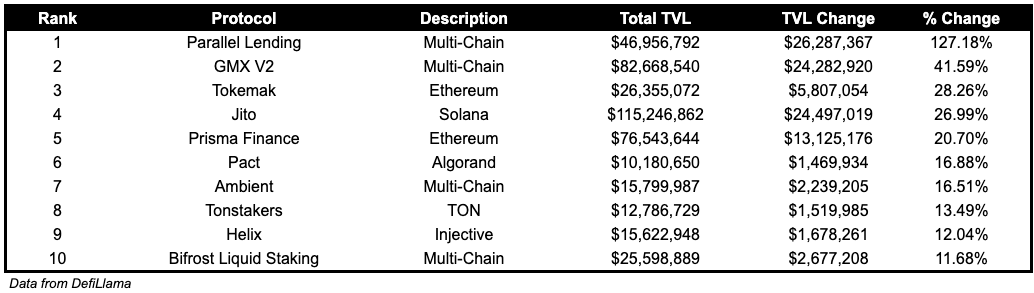

TVL

TVL Above $10M

Over the past day:

Parallel Lending, multichain lending, TVL grew by 127.18%.

GMX V2, multichain perps, TVL grew by 41.59%.

Tokemak, yield on Ethereum, TVL grew by 28.26%.

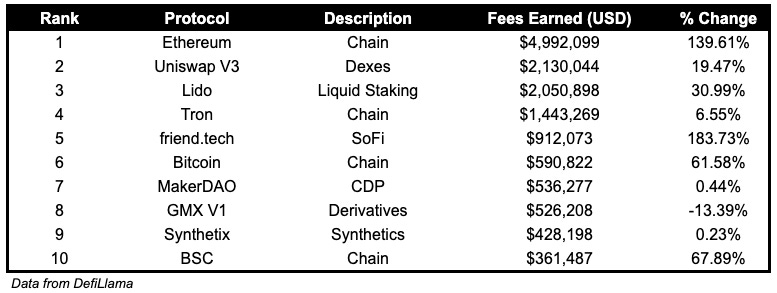

Fees

friend.tech fees earned are up 183.73% over the past day. Ethereum fees earned are up 139.61%.

Governance Proposals

SIP-57: Introduce Protocol Owned Liquidity

Proposal to introduce protocol-owned liquidity via sales of SPA bonds using the bond protocol and treasury tokens.

[FIP - 294] Add pETH-frxETH to FXS Gauge Controller

Proposal to add pETH-frxETH to the FXS Gauge Controller. pETH is JPEG’d’s ETH-pegged derivative product.

SIP-56: Proposal to Reduce Emissions

Proposal to decrease SPA emissions from Demeter farms by 50%, curb SPA bribes dispensed by SPA Gauge by 20% and to shift Demeter emissions to xSPA.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.

Great read ser! SBFs legacy - FTX - is on the move. They've started selling their assets slowly on pumps. They recently sold some $LINK, $MKR and $AAVE. Check it out in this tweet - https://x.com/loch_chain/status/1717125914801365368?s=20

And analyse the FTX wallet over here - https://app.loch.one/intelligence/transaction-history?p=0