Daily Notes 24-10-2023

Developments

FTX Exchange Has 3 Bids For Relaunch

FTX is considering three bids proposing to restart trading on the bankrupt exchange. The FTX estate has said they will make a decision on how to proceed by mid December in a court hearing held today as they engage with multiple parties interested in acquiring, partnering and possibly investing in the future of FTX.

Perella Weinberg Partners - who were hired as the investment bankers after FTX collapsed - represented by Kevin M. Cofsky in today's hearing, outlined the potential options to Judge John Dorsey. They include the selling of the entire FTX exchange and the 9 million accompanying customers, or bringing in a partner to help restart the exchange

Additionally, FTX is also considering restarting the exchange by itself.

DTCC Delist Blackrock CUSIP Information

Blackrock’s iShares spot BTC ETF has been removed from the DTCC (Depository Trust and Clearing Corporation). This comes after appearing on DTCC’s site only yesterday along with the CUSIP identifier 46438f101 and the ticker $IBTC. It was also the first spot ETF to be listed on DTCC before today’s delisting.

Galaxy Estimate $14B In ETF Inflows In The First Year

Galaxy has estimated possible inflows of up to $14 BILLION in the first year following the listing of a spot BTC ETF in a research article published today. They also predict inflows of $25B in the second year and $38.6B in the third year after a spot BTC ETF

dYdX chain (v4) is now completed and fully open source to the public after undergoing an audit from Informal Systems which found 1 critical issue that is now resolved. The chain, currently in public testnet, will run on Cosmos and will offer "greater decentralisation, scalability, customizability, and speed than any other version of dYdX to date".

So far, Scroll has seen 7479 ETH ($13.64 million) bridged to it’s mainnet, over 26,000 unique users and 657,842 transactions on the network since the 11th of October.

1inch Investment Fund Sell stETH

The 1inch Team investment fund sold 4685 stETH for 8.54M USDC at an average price of $1823 per stETH. The estimated profit is $1.28 million.

Gnosis’ actively managed treasury sold 3000 wstETH for $6.2 million $DAI at an average of $2,066 per wstETH.

The TON Believers fund has stopped accepting new deposits after 1.317 billion TON tokens (~25% of TON supply and worth approximately $2.832 billion) were deposited by $TON holders. 1.034 billion TON was deposited by users that opted to lock their tokens for 5 years. For the first two years, the tokens are completely locked and then vested over the remaining 3 years with additional TON rewards. These additional rewards amount to 284 million TON which came from community members that opted to donate TON into the fund to benefit those who locked their tokens.

LSD Whale Sends 30k ETH To Binance

A large staked ETH & money market farmer just withdrew 28,939 stETH from the Lido staking contract, before sending 30,710 ETH to Binance.

Address: 0x4353e2df4E3444e97e20b2bdA165BDd9A23913Ab

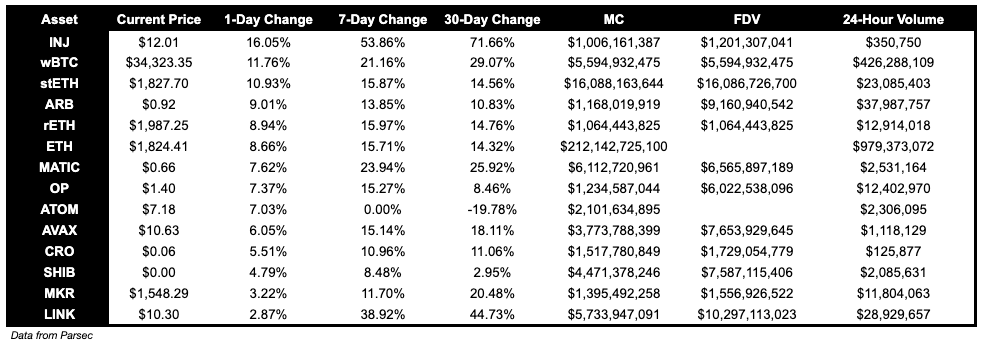

Trending Assets

Below $100M MC by performance, on chain

AERO is up 35.42% over the past day. KWENTA is up 41.43%.

Above $100M MC by performance, on chain

BITCOIN, up 34.81%, PEPE, up 31.84%, and RPL, up 16.79%, performed well today.

Above $1B MC by performance, on chain

INJ had a great day and is up 16.05%.

TVL

TVL Above $10M

Over the past day:

Acala Liquid-Staking, liquid staking on Acala, TVL grew by 92.65%.

Helix, DEX on Injective, TVL grew by 77.87%.

ABC Pool, staking on Conflux, TVL grew by 64.64%.

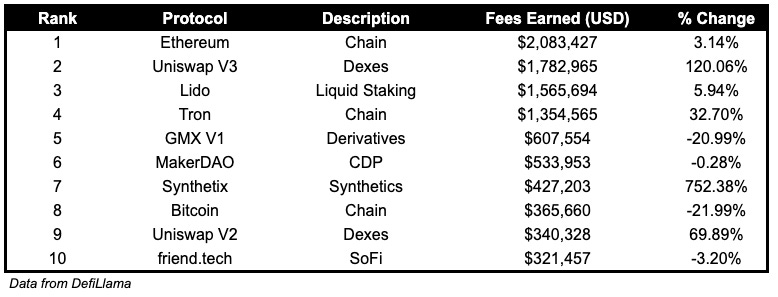

Fees

Uniswap V3 fees earned are up 120.06% as on-chain activity picks back up. Synthetix fees earned are up 752.38%.

Articles / Threads

Synthetix V3 Loans: No interest. No fees.

Synthetix V3 will have zero interest or fees charged to borrowers. Users can deposit collateral to generate sUSD without interest or other fees

Injective Integrates Web3 Finance Data into Google Cloud BigQuery

Injective has launched Injective Nexus, their official data integration and availability on Google Cloud, one of the leading providers of cloud computing services.

Introducing Buyback and Make: Kicking Off The PRTC Flywheel

The protocol will use a portion of their revenue, to buy back PRTC from the open market. Instead of burning the bought back tokens, they’d live in a custom Balancer Weighted Pool, with an initial weight of 80/20 - PRTC/ETH.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.