Daily Notes 24-08-2023

Developments

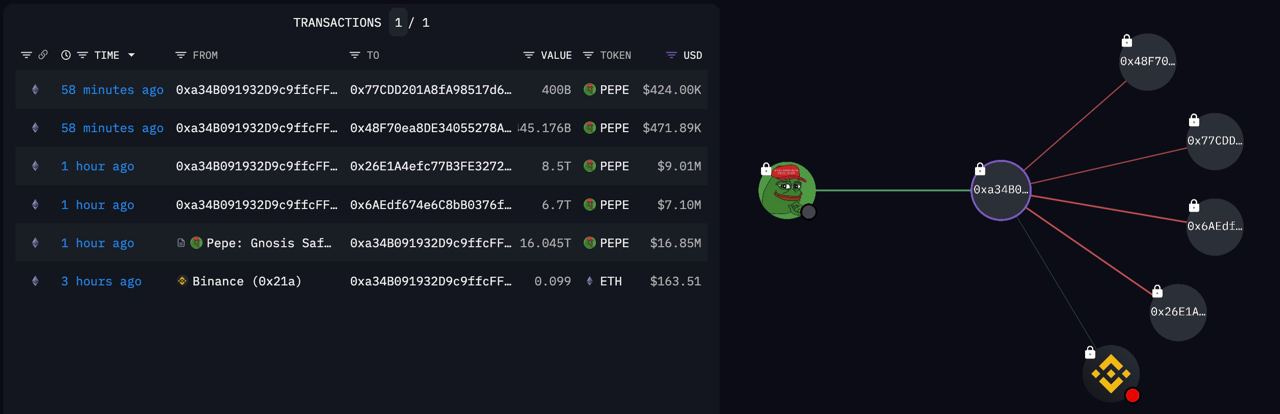

Today, the Pepe multisig wallet, changed the amount of signatures required on their multisig from a 5/8 to 2/8. This comes after sending $15.7 million worth of PEPE to exchanges.

The multisig first received funds from Binance 3 hours ago & proceeded to send Pepe to the following places:

$8.36 million to OKX

$6.6 million to Binance

$438,000 to Bybit

$400,000 to an unknown exchange/wallet.

$10.42 million worth of $PEPE remains in the multisig.

Optimism and Base will collaborate through shared upgrades as well as a fee contribution of either the greater of 2.5% of Base's total sequencer revenue, or 15% of Base’s net on-chain sequencer revenue (L2 transaction revenue minus L1 data submission costs) which will go towards the Optimism collective.

In addition, Optimism will provide Base the opportunity to earn up to approximately 118 million OP tokens over the next six years with a 9% cap on the votable supply given.

Prisma Finance Whitelisted to Perma-lock CRV

Prisma Finance has been whitelisted to permanently lock $CRV for veCRV tokens, Curve Finance's governance token, which will be used by Prisma in a bid to draw Curve’s reward boost for their PRISMA/WETH and mkUSD/FRAXBP pools.

Prisma incentivised users to approve the proposal by guaranteeing a share proportional to their votes of a PRISMA airdrop as a locked position on the Prisma protocol for 52 weeks with early exits subject to penalties. The airdropped PRISMA that can be used in Prisma DAO voting.

There has been a $27.2M (77.8%) increase in DYDX OI across OKX, Bybit and Binance, since the 21st of August.

Notably, dYdX v4 is set to launch later this year, with the platform moving from StarkWare to it's own L1 built on Cosmos.

With v4 dYdX will have:

Improved finality to settlements

Minimized MEV

Increased throughput

Validators earning fees

Additionally, 6.52M DYDX, worth $14.21M, is set to unlock on the 29th of August. The unlock represents 3.77% of circulating supply.

Friendtech Snipers

Bots setup on Base chain have been sniping friend key listings by monitoring addresses bridging to Base and through using an RPC which is rumoured to be leaking a ‘mempool’ of sorts (ORU’s don’t have mempools). These snipers are profiting from the aggressive bonding curve by buying multiple keys first and selling when the keys trade higher as buyers come in after.

0xcc..cc85 has profited the most, making 346 ETH according to Tom from 21Shares.

Grass Network Growth

Grass, an application that allows you to sell your unused bandwidth to AI labs and data scientists has seen over 65K downloads, 60K referrals and 458K unique IPs connected in just over 2 months into their beta program.

Scroll Join Chainlink Scale Program

Scroll, an EVM compatible zero knowledge proof scaling solution has joined the Chainlink Scale Program. The program accelerates the growth of L1 and L2 ecosystems by covering the operating costs of Chainlink’s oracle networks until dapps on that network can support the full backend costs through user fees.

1inch has launched its DEX aggregator on Base. This announcement coincides with PancakeSwap’s launch on Linea as we see DEXs rushing to stake their bets into new L2s and 1inch's aims to capitalise on the incoming floods as an aggregator

Trending Assets

Top 300 Performers

BONE, up 11.74% is the top performed over the past day, for coins in the top 300 by MC. Notably, Shibarium started processing blocks again yesterday.

Top 300 Losers

Ticker $BITCOIN, down 10.13%, UNIBOT, down 10.08%, and Rune, down 8.29%, are some notable under performers over the past day.

Below $100M MC by performance, on chain

SHARES, up 91.92%, USH, up 35.55% and rDPX, up 11.69%, are some notable top performers for tokens below $100M MC.

Above $100M MC by performance, on chain

RNDR, up 4.35%, OCEAN, up 3.62%, and DYDX, up 2.23%, were notable top performers for tokens above $100M MC.

Above $1B MC by performance, on chain

Large caps underperformed over the past day.

TVL

TVL Above $10M

Over the past day:

Spark, a lending protocol on top of MakerDAO, TVL has grown 35.61%.

Maple RWA, RWAs on Ethereum, TVL has grown 19.77%.

Fees

Notably, friendtech fees earned are down 56.31%. Ethereum fees earned are up 28.59%, and PancakeSwap fees earned are up 48.30%.

Articles / Threads

unshETH Labs raises $3.3mm Seed Round

unshETH raised $3.3M in their seed round, for 5% of their total supply (21.525M USH). These tokens are allocated from the teams allocation, meaning that the teams 20% allocation has now become 15%.

Hashflow Integrates with MetaMask Swaps

Hashflow has integrated with MetaMask Swaps. Hashflow price quotes are now live on MetaMask swaps.

Unveiling Frax x Gravita: A New Era of DeFi Collaboration

Gravita has announced that sfrxETH can now be used as collateral to mint GRAI.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.