Daily Notes: 24-07-2023

Developments

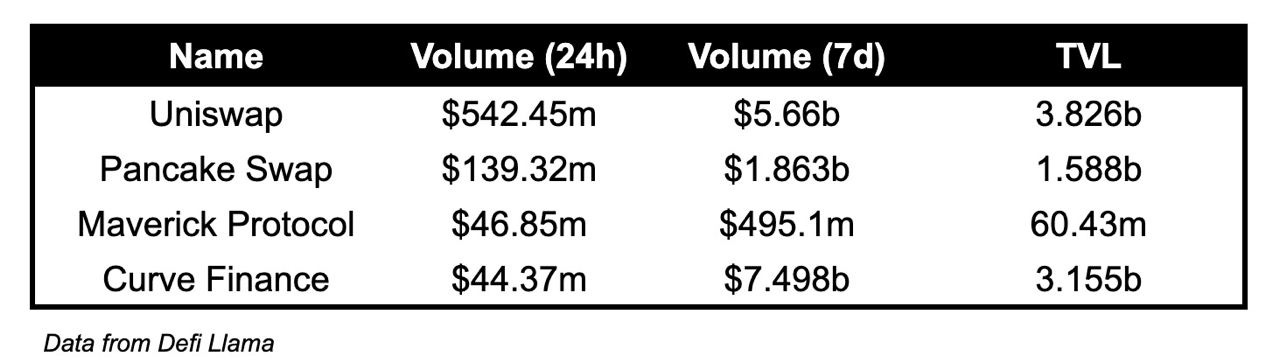

Maverick Surpasses Curve in Trading Volume

Maverick Protocol currently has the third highest volume traded over the past 24 hours.

While Maverick Protocol has only $60.43M in TVL, it has had $46.85M in trading volume.

Comparatively, Curve has $3.16B in TVL, and saw only $44.37M in volume.

Spark Protocol’s DAI Borrows Hits New ATH

Spark Protocol's DAI borrows hit a new ATH and is currently sitting at 14.4M DAI. Spark Protocol is a lending protocol built on MakerDAO.

Worldcoin Launch and Optimistic World NFTs

WLD circulating supply is currently floating around 104.8M. The unlocked supply is 500M.

Community supply of WLD expected to increase to 1.65B by July of 2024. Beginning in July 2024, investor, team and reserve tokens will also start being released.

A total of 2.98M Optimistic World NFT's have been minted (as part of Worldcoin's launch). On average, 350K NFTs was minted per hour, from 8 AM UTC to 1 PM UTC.

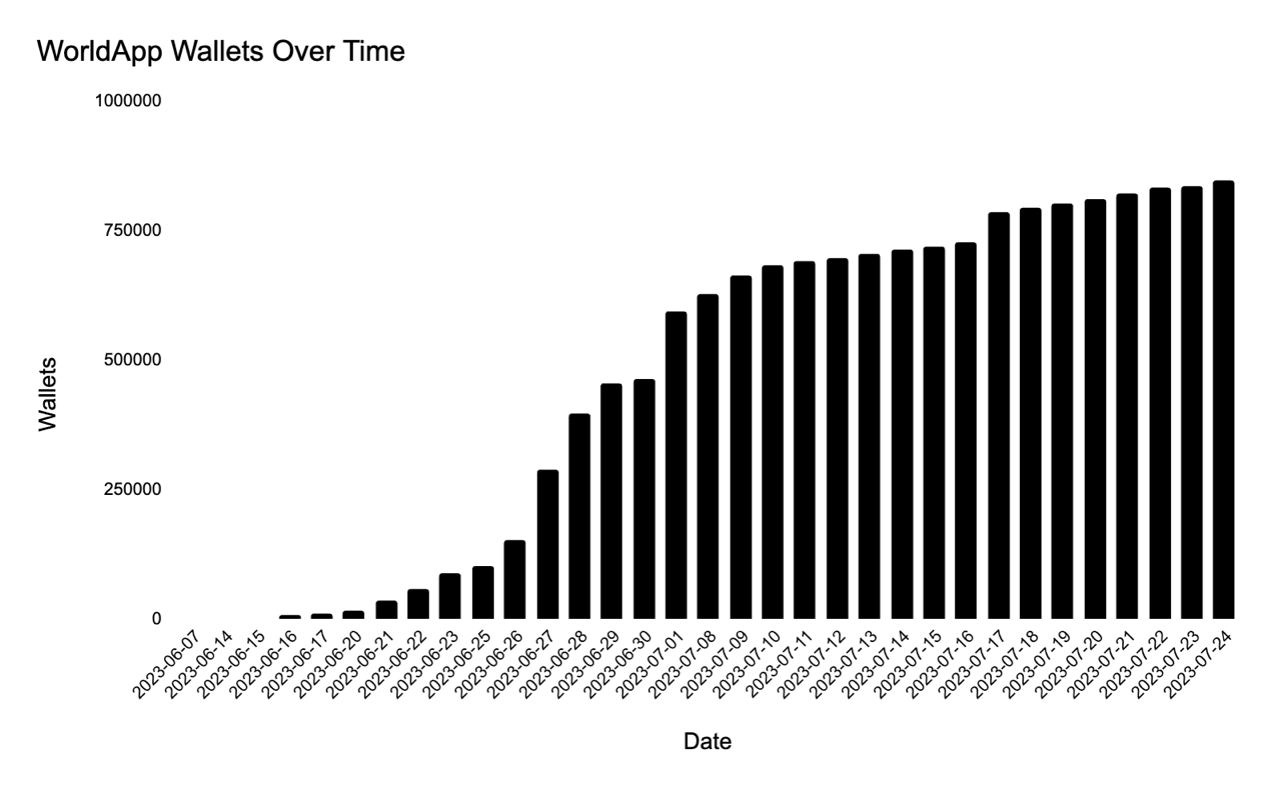

Additionally, the number of WorldApp wallets have surpassed 848K.

Vitalik Publishes Article on Worldcoin

Below is a summary of his article:

What is Worldcoin?

Worldcoin is a ground-breaking project with an ambitious aim to provide Universal Basic Income (UBI) to every human on earth via cryptocurrency. It operates using a unique device, the Orb, which scans people's irises to establish proof-of-personhood, a means of confirming individual identities. However, this innovative approach doesn't come without potential threats and challenges, encompassing issues of privacy, decentralization, and security.

Concepts and Challenges:

Worldcoin's system relies on Orbs, devices capable of scanning irises to generate unique identifiers. The ultimate goal is to decentralize Orb production and management. However, concerns arise about the potential failure to achieve decentralization, perhaps due to dominance by a single manufacturer or security issues stemming from distributed manufacturing mechanisms.

Significant risks include the system's fragility against malicious Orb manufacturers, who could produce unlimited fake iris scan hashes, and potential government interference. Governments could outright ban Orbs or force citizens to scan their irises under duress. There are also general challenges to proof-of-personhood designs such as 3D-printed fake people, selling IDs, phone hacking, and government coercion to steal IDs.

Solutions and Discussion:

Several solutions are proposed to address these challenges. Regular audits on Orbs could ensure they are built correctly, helping to counteract malicious Orb manufacturers. To limit the damage caused by any problematic Orb, World IDs registered with different Orbs should be distinguishable from each other.

Additional proposals include allowing re-registration (making ID selling less viable), running entire applications inside a Multi-Party Computation (MPC), and implementing decentralized registration ceremonies to ensure a trusted registration procedure.

The discussion also involves a comparison between biometric-based proof of personhood and social-graph-based verification, each with their own strengths and weaknesses.

Conclusion:

There's no perfect form of proof of personhood. Biometric-based and social-graph-based methods each come with unique strengths and weaknesses. The ideal solution might involve a combination of all these methods, with biometric solutions for short-term use and social-graph-based techniques for long-term robustness. Despite the inherent risks and challenges in developing a proof-of-personhood system, it's crucial to avoid a world dominated by centralized identity solutions. Vigilance, open-source approaches, and a commitment to privacy-friendly values are strongly advocated for achieving an effective proof-of-personhood system.

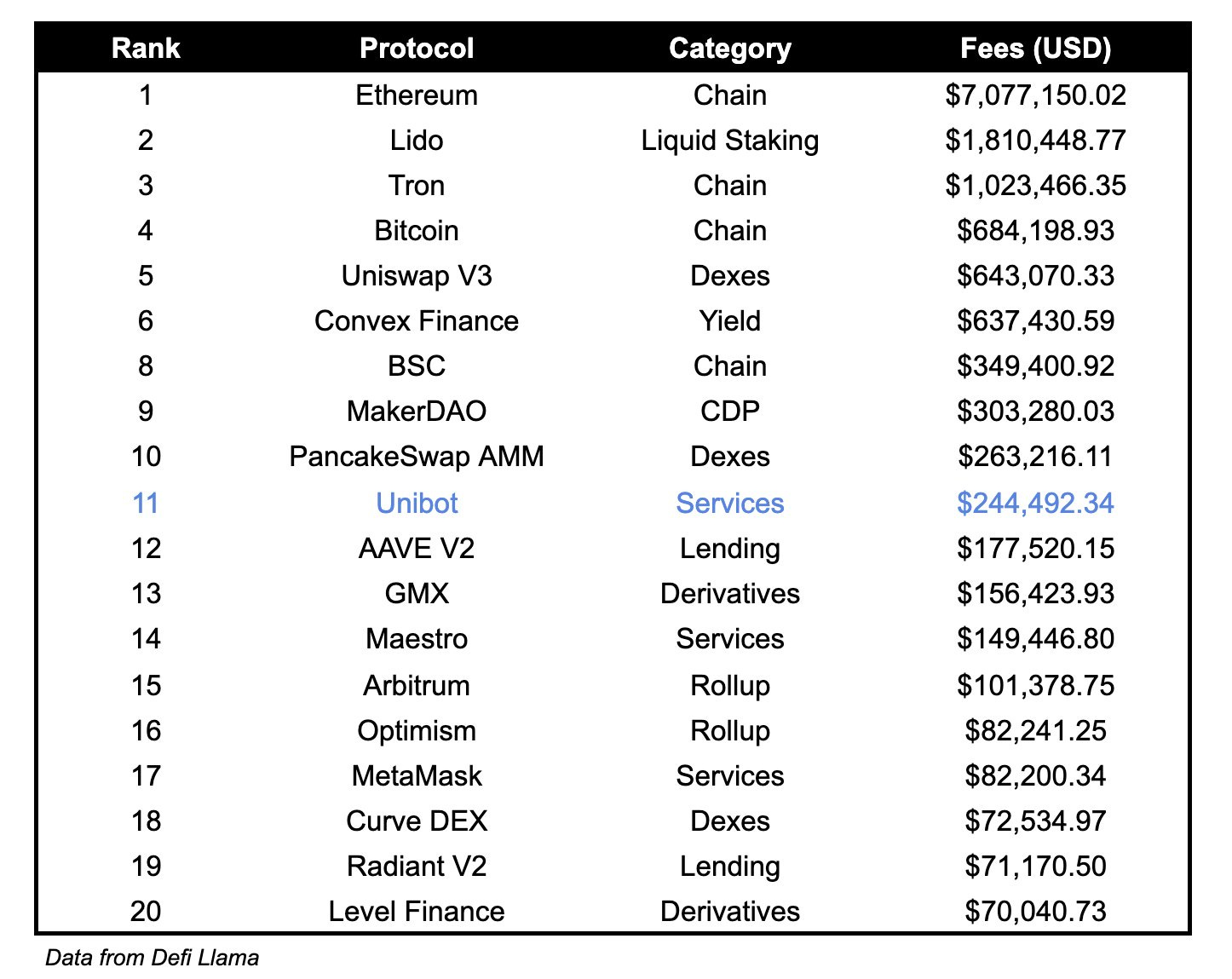

Unibot is currently earning more in fees than Arbitrum, Optimism, MetaMask and GMX over the past 24 hours.

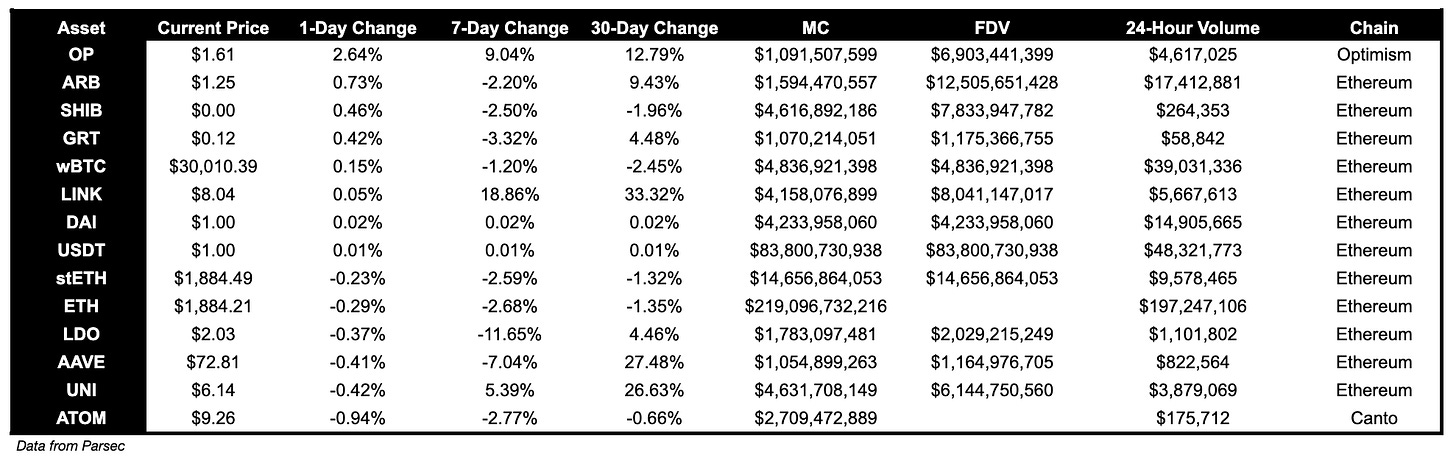

Trending Assets

Below $100M MC by performance, on chain

For tokens below $100M MC on chain, RDNT, up 6.61%, outperformed over the past day.

Above $100M MC by performance, on chain

For tokens above $100M MC on chain, UNIBOT, up 33.63%, GLM, up 4.38%, and DYDX, up 3.67%, outperformed over the past day.

Notably, UNIBOT is up 255.99%, and COMP is up 133.22% over the past 30 days.

Above $1B MC by performance, on chain

For tokens above $1B MC on chain, OP, up 2.64%, followed by ARB, up 0.73%, outperformed over the past day.

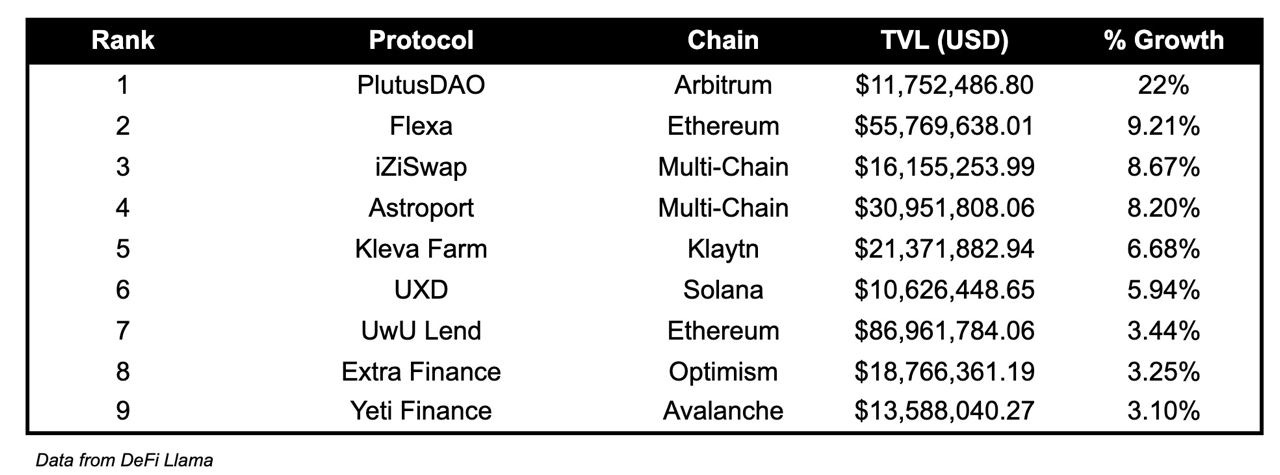

TVL

Protocols with TVL above $10M

Over the past day:

PlutusDAO’s (yield on Arbitrum) TVL grew by 22%.

Flexa’s (payments on Ethereum) TVL grew by 9.21%.

UXD’s (stablecoin on Solana) TVL grew by 5.94%.

Fees

Ethereum earned the highest fees over the past day, at $4.87M. This is 31.08% lower than the day before.

Notably, Bitcoin has the third highest fees earned over the past day. Bitcoin’s fees earned are up 103.05% over the past day. This is the second highest increase, after Unibot, which has earned 171.97% higher fees compared to yesterday.