Daily Notes 23-10-2023

Developments

Blackrock Receive BTC ETF CUSIP

The Blackrock iShares spot Bitcoin ETF has been listed on the DTCC (Depository Trust & Clearing Corporation), and is the first spot ETF to do so. It has received a CUSIP number (all North American / Canadian securities have this 9-digit alphanumeric code identifying it) and will have the ticker $IBTC if approved.

In the most recent iShares s-1 amendment, the application was also altered to suggest that the cash to seed the ETF would be started in October.

The Grayscale spot BTC ETF conversion ruling has been confirmed by US courts today after the SEC announced it would not be appealing last week. A refreshed, new application has been filed by Grayscale to convert the Trust into a ETF which also has to be reviewed by the SEC along with the several other BTC spot ETF applications.

Prisma Finance will be raising the debt cap for their four depositable collaterals tomorrow on Tuesday 24th at 7pm UTC. This is the final debt cap increase before the launch of $PRISMA, the protocol's native token that when locked into vePRISMA will allow users to determine how $PRISMA emissions are distributed within the protocol much like veCRV.

Celestia, a modular blockchain network that provides a scalable data availability layer for developers, is “ready to launch'' the mainnet beta for their network as stated by an official blog post written by the team. Additionally, according to a milestone date on their github repository, “Mainnet” is due by the 31st of October

Yearn Finance, a yield aggregator, has revamped the tokenomics of their native token YFI. Token holders can now lock their $YFI for up to 10 years for veYFI which will allow users to vote on where to allocate previously bought back YFI to pools for an increased reward boost. veYFI will also serve as the protocols governance token. Furthermore, the revamp sees the introduction of dYFI, which will allow holders to redeem 1:1 for YFI in exchange for ETH but at a discounted rate compared to the market.

The Astar Network's zkEVM testnet, zKatana, is now live. The network will aim to empower builders and enterprises to tap into web3 securely.

Worldcoin Change Payment Currency

Worldcoin will be paying their eye-scanning Orb operators in the project's native token WLD instead of USDC. The transition is estimated to be completed by next month.

Trending Assets

Below $100M MC by performance, on chain

ARDVRK, up 54.19%, OX, up 40.68%, and UNIBOT, up 15.15%, are top performers for tokens below $100M MC.

Above $100M MC by performance, on chain

Ticker BITCOIN performer well today, and is up 21.49%. Similarly INJ continues to show strength, is up 14.41%. Top performer for tokens above $100M MC was ELON, up 31.97% over the past day.

Above $1B MC by performance, on chain

AAVE, up 8.32%, LINK, up 6.65%, and MKR, up 5.44%, were top performing large caps over the past day. Notably, LINK is up 41.64% over the past 30 days.

TVL

TVL Above $10M

Over the past day:

Flooring Protocol, NFTFi on Ethereum, TVL grew 263.93%.

MuesliSwap, multichain DEX, TVL grew by 81.26%.

NodeDAO, LSD on Ethereum, TVL grew by 18.86%.

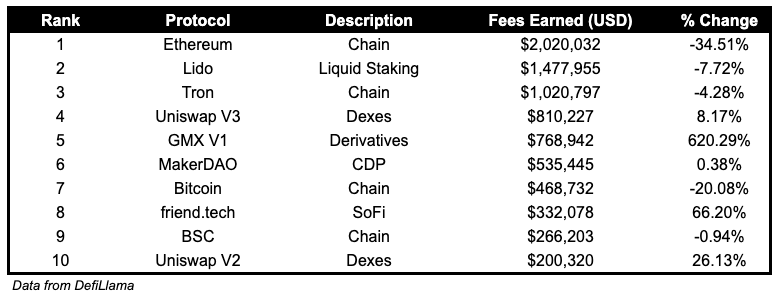

Fees

GMX V1 fees earned are up 620.29% following increased volatility over the past few days.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.