Daily Notes 22-11-2023

Developments

BlackRock & Grayscale Meet With SEC

BlackRock and Grayscale have both met with the SEC to discuss details surrounding their spot BTC ETF applications.

Grayscale met with the SEC’s trading and markets division on Monday to discuss “NYSE Arca, Inc.’s proposed rule change to list and trade shares of the Grayscale Bitcoin Trust (BTC) under NYSE Arca Rule 8.201-E”

BlackRock’s meeting concerned “The NASDAQ Stock Market LLC’s proposed rule change to list and trade shares of the iShares Bitcoin Trust under NASDAQ Rule 5711(d)”.

Heco Bridge & HTX Hacked For Over $100M

Heco Bridge and HTX (previously Huobi), have both suffered a hack which stole $86.6 million and $23.4 million respectively. The attacks are suspected to have been carried out by the same entity. HTX, who has paused deposits and withdrawals, has stated that they will cover all $23.4 million lost from their hot wallets and will resume services once their investigation is complete.

Blast’s deposit contract has exceeded $200 million of crypto deposited in less than 48 hours. One hour ago a single user deposited $20.6 million (10,000 ETH) and $450,000 of stETH into the contract.

unshETH has released their liquid staking token blETH to represent ETH deposits in the Blast bridging contract. Users who send ETH to the blETH contract will be able to mint blETH on a 1:1 basis. However, blETH will take a “small fee” from a user’s farmed points/airdrop.

Coinbase has accused the SEC of “hedging and delaying” its response to Coinbase’s ask for new clear rules for digital assets, and states that “only an order by this Court will make the commission [SEC] act”.

PancakeSwap Introduce veTokenomics

Cake introduces veCAKE and gauges voting. CAKE holders will be able to stake CAKE for veCAKE which will now power PancakeSwap’s governance. Additionally, veCAKE holders will be able to vote on which gauges CAKE emissions are allocated to.

Mt.Gox Will Commence Cash Repayments Before 2024

Mt.Gox has stated they will be commencing “cash repayments” to creditors before the end of 2023 and will continue going into 2024. Mt.Gox still holds a reported 69 billion Japanese Yen. It remains unclear how much cash will be redistributed. The letter, however, suggests that crypto will not be distributed as of yet.

Pyth Network’s native token, PYTH, opened for trading on Monday and saw a 50% price increase in the last 24 hours. It is up 60% from its all time low.

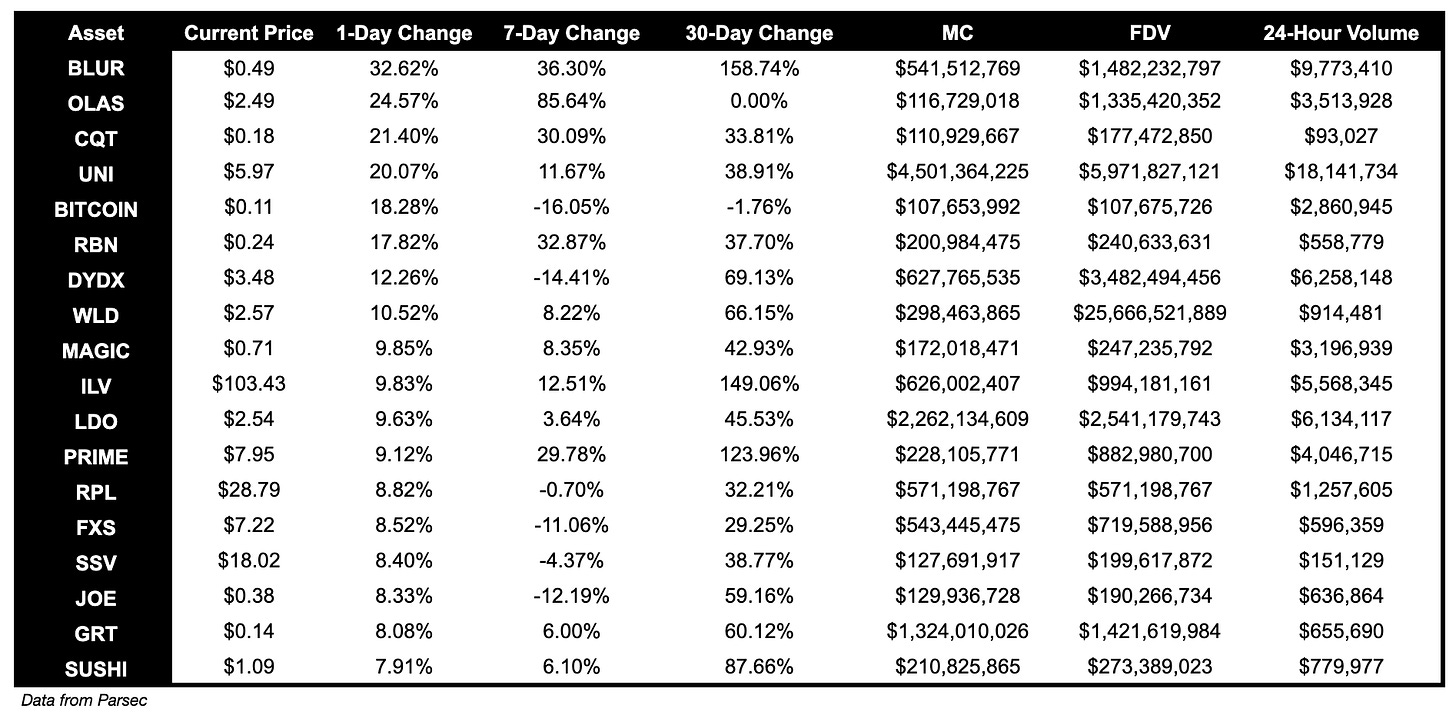

Trending Assets

Below $100M MC by performance, on chain

USH is up 45.84%, following the release of their new LST, blETH. TOKE had a good day, up 30.81%, potentially due to the upcoming launch of their TOKEMAK V2, which will focus on LSDs.

Above $100M MC by performance, on chain

BLUR had a good day, and is up 32.62%. Notably, Blast L2 allows for BLUR to be staked for an airdrop. OLAS, an AI coin, is up 24.57%.

Above $1B MC by performance, on chain

UNI had a good day, is up 20.07%.

Trading Volumes

UNI, MKR, LINK and RLB have increased trading volumes onchain.

TVL

TVL Above $10M

Over the past day:

ether.fi, LSD on Ethereum, TVL is 28.54%.

Helix, DEX on Injective, TVL is up 13.97%.

RenVM, bridge, TVL is up 13.95%.

Fees

PancakeSwap fees earned are up 90.16% over the past day. Synthetix fees earned are up 203.50%.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.