Daily Notes 22-02-2024

Developments

Andreessen Horowitz Invests $100 Million in Crypto Startup EigenLayer

a16z invested $100 million in EigenLayer, reportedly at a valuation around $3B.

Circle's USDC Now Live on Celo Mainnet

Circle’s native USDC is now live on Celo’s mainnet.

Sushi Bonds Launch as Alternative to Traditional Liquidity Mining

Sushi Bonds went live, offering an alternative to traditional liquidity mining by allowing users to buy tokens at a discounted price with a vesting period.

Bitcoin ETF Total Inflows Hit Lowest Point Since Early February

Yesterday, Bitcoin ETF total inflows saw their lowest point of +500 BTC (~$25.8 million) since February 6th.

Alchemy Launches Modular Account Across Multiple Chains Including Ethereum and Polygon

Alchemy launched Modular Account, which is currently deployed on Ethereum, Arbitrum, Optimism, Polygon, and Base.

FalconX to Expand Operations in Hong Kong, Offering OTC and Derivatives Services

FalconX will be expanding into Hong Kong, offering OTC and derivatives services to professional investors.

Binance Invests in Liquid Restaking Protocol Renzo

Binance invested an undisclosed amount in liquid restaking and management protocol Renzo.

Mode Flare, a Layer 3 Powered by Optimism and Celestia, Launched by Mode

Mode launched Mode Flare, a Layer 3 powered by Optimism and using Celestia for data availability.

Gauntlet Terminates Relationship with Aave Citing DAO Dysfunction

Gauntlet, a blockchain risk management firm for Aave, has left Aave citing DAO dysfunction.

Helius Labs Secures $9.5 Million in Series A Funding Led by Foundation Capital

Helius Labs raised $9.5 million in a Series A round led by foundation capital.

Heroes of Mavia to Announce Layer 2 Chain Choice for Game on February 26th

Heroes of Mavia will announce their Layer 2 chain of choice to power their game on February 26th.

Euler Finance's Euler v2 Launch Scheduled for Q2 of 2024

Euler Finance will be launching Euler v2 in Q2 of 2024, featuring vaults on Ethereum used as collateral for other vaults.

Startale Labs Raises $3.5 Million from UOB Venture Management and Samsung in Extended Seed Round

Startale Labs, a web3 infrastructure company, raised $3.5 million from UOB Venture Management and Samsung in an extended seed round.

Team Liquid Partners with Mysten Labs for Fan Loyalty and NFT Collectable Platform on Sui

Team Liquid, an eSports organisation, entered a multi-year strategic partnership with Mysten Labs (Sui creators) and will be building a fan loyalty and NFT collectable platform on Sui.

Nigeria’s Telecom Regulators Order Restriction on Access to Crypto Exchanges Like Binance and Coinbase

Nigeria’s telecom regulators ordered telecom companies to restrict access to crypto exchanges like Binance, Coinbase, and Kraken.

Fxhash Announces Building on Base for Generative NFT Art Platform

Fxhash, a generative NFT art platform, announced they are building on Base.

Superfluid Raises $5.1 Million in Strategic Funding Round

Superfluid, a crypto recurring payments protocol, raised $5.1 million in a strategic funding round.

Sei and Omni Labs Develop 'Code Minimized' Upgrade of ERC-721 Standard for NFT Liquidity

Sei worked with Omni Labs to develop a “code minimized” upgrade of the ERC-721 standard.

Scroll Mainnet Upgrade Completed, Reducing Bridging Costs by Up to 50%

Scroll’s mainnet upgrade was completed, “reducing bridging costs by up to 50%”.

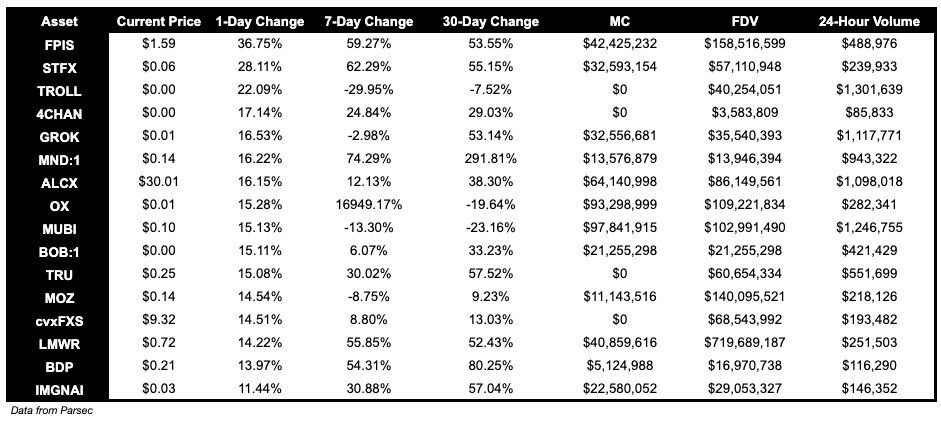

Trending Assets

Below $100M MC by performance, on chain

STFX (social vault trading) had a great day, and is up 28.11%.

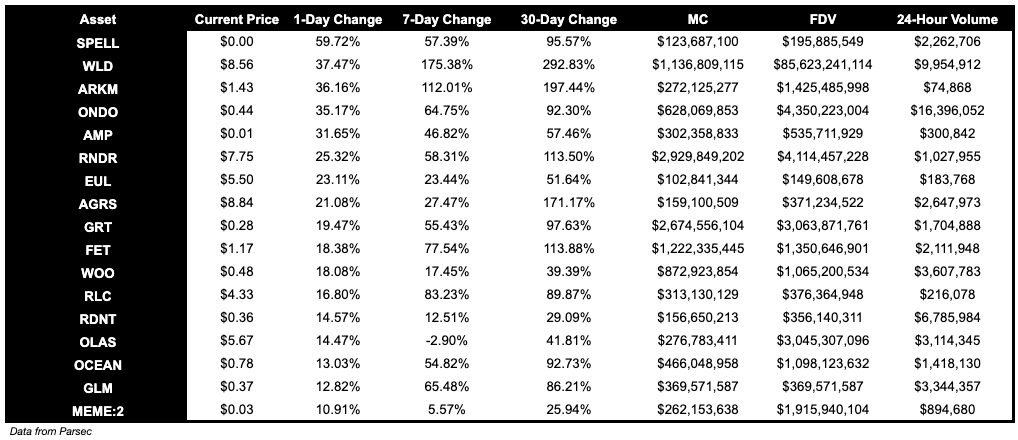

Above $100M MC by performance, on chain

SPELL performed well today, is up nearly 60%. ARKM and WLD, both tokens related to Sam Altman, are up around 37%.

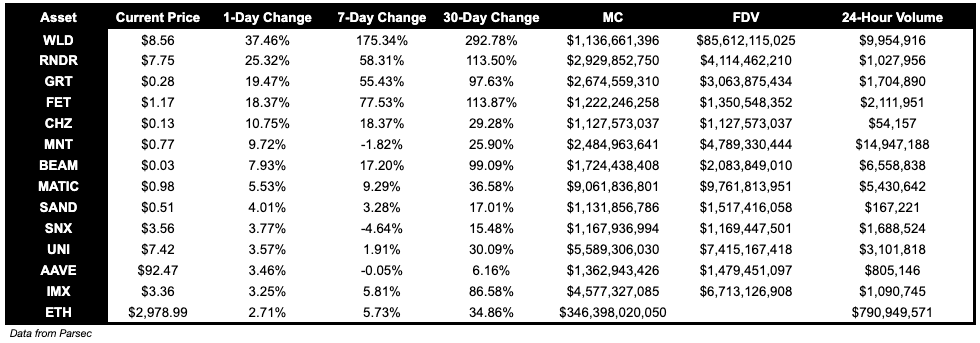

Above $1B MC by performance, on chain

RNDR had a good day, is up 25.32%. FET is up 18.37%.

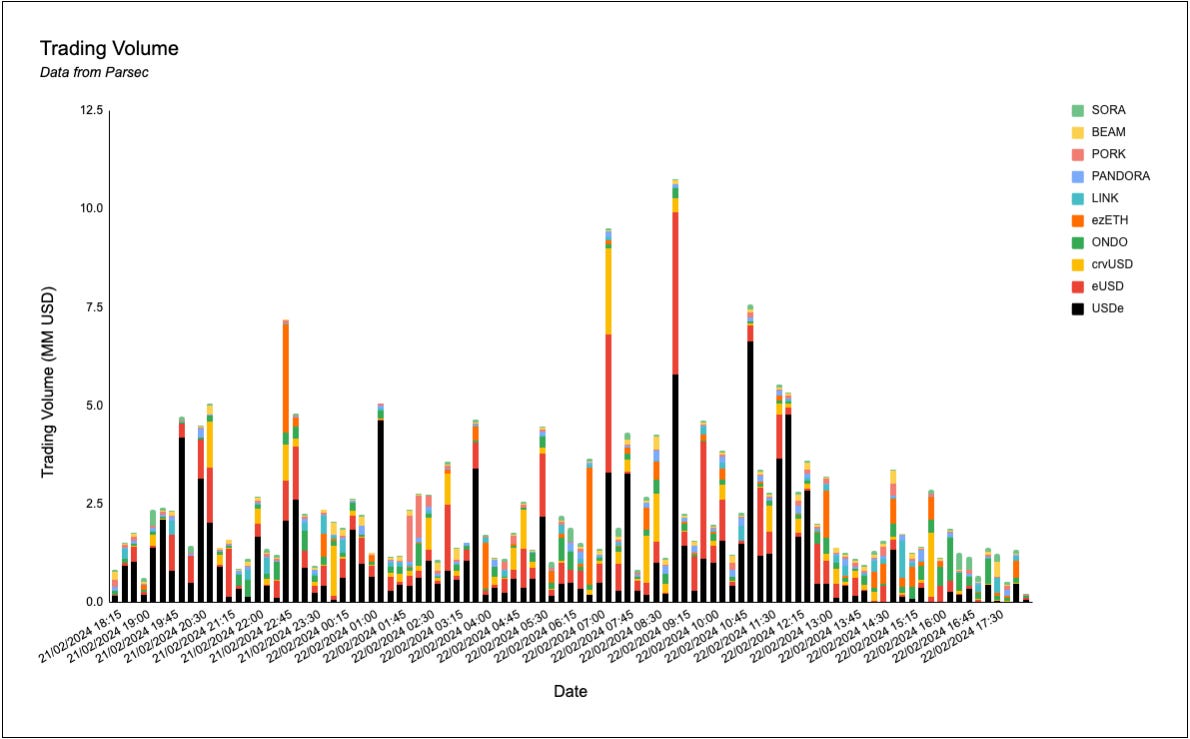

Trading Volumes

USDe, eUSD, crvUSD, ONDO, and ezETH dominated on-chain volumes.

TVL

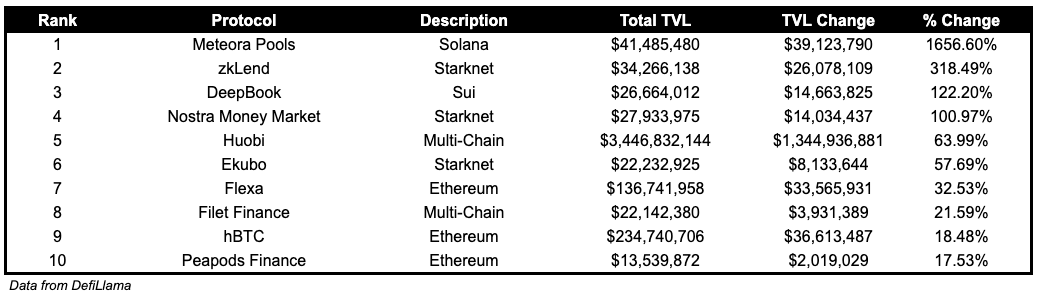

TVL Above $10M

Over the past day:

Meteora Pools, Solana Liquidity protocol founded by the same team behind Jupiter, TVL grew by 1656%.

zkLend, money market on Starknet, TVL grew by 318%. zkLend’s TVL is 65% STRK tokens as they are currently running a ~20% APR STRK incentives program.

DeepBook, CLOB framework on Sui, TVL grew by 122%

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.