Daily Notes 21-09-2023

Developments

Bitcoin Hash Rate Reaches All Time Highs

Bitcoin hash rate has reached a new all-time high at 423.1M Hash Rate TH/S.

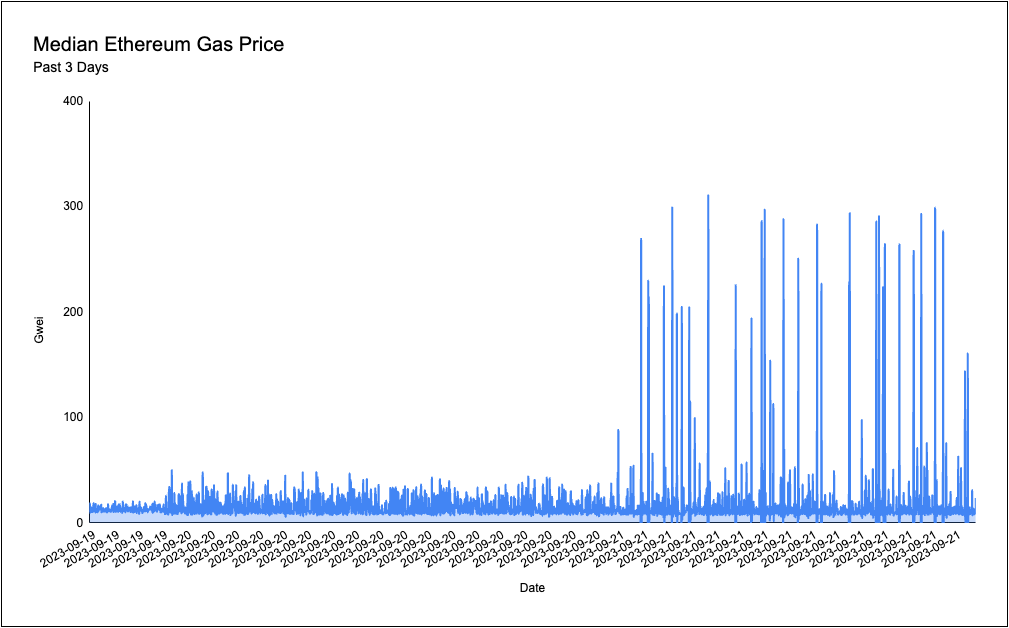

Binance Hot Wallet Address Spikes Ethereum Gas

A Binance address spent 530 ETH, equivalent to $845,000, on Ethereum gas fees in order to consolidate user funds across 140,000 transactions. The spree saw the address use 300 gwei consistently, bringing the Ethereum network’s gas fees from $0.17 to $11.20 a transaction.

The address is a Binance hot wallet address that accumulates user’s crypto that has been deposited onto the exchange and transfers crypto to users when they withdraw from the exchange.

Optimism Sell OP Tokens To VC’s

Optimism has sold a total 116 million $OP tokens, valued at $151,960,000 at today's price, to 7 entities in a private token sale for “treasury management purposes' “. These tokens will be locked for 2 years but the owners will be able to delegate their tokens to third parties that can then participate in Governance.

The 116 million tokens is equivalent to 14.5% of Optimism’s current circulating supply and comes from the 8.8% of unallocated tokens (8.8% of total supply = 377,957,122.048 $OP) from the total supply.

DWF Labs Send LeverFi Tokens to Binance

DWF Labs has sent $3.1 million worth of $LEVER, which was received from a LeverFi multisig earlier this morning, to Binance.

After a $2 test transaction to DWF, DWF Labs sent the $3.1 million of $LEVER tokens on-chain 7 hours ago (10:57:59 AM +UTC) from a Leverfi multisig.

In that same minute DWF received the tokens on chain, $LEVER pumped by 6.33% in 1 minute and then another 6.67% over the next 2 minutes for a total 13% increase to across a 3 minute span on Binance. The token then declined 17% over the next hour and then steadily climbed up 16%.over the early afternoon.

DWF Labs then sent their $LEVER to Binance at 3:52:47 PM +UTC. The same minute the token had a +6.75% candle.

Overall $LEVER’s price has increased 13.3% over the last 24 hours.

Wintermute deposited 7.3 million $BLUR, valued at $1.3 million, to Kraken and Coinbase today.

They have deposited 46.6 million $BLUR (worth $8.5 million) to various exchanges over the last 30 days.

Over the last 7 months, this address has received 105,250,219 $BLUR tokens and distributed 105,250,219 tokens.

94,441,149 of the distributed $BLUR went to other exchanges, 10 million tokens went to a Blur owned multisig (which holds $56 million worth of $BLUR) and 800,000 went to an unknown entity.

Note that these tokens may have been deposited to other exchanges and then withdrawn back to the Wintermute address.

Ripple (XRP) has revealed that they spent a cumulative $200 million on legal fees after winning the lawsuit against them in July of this year, by the SEC (who accused XRP of being a security). Ripple’s troubles may not be over however as the SEC is seeking approval to appeal the result of the lawsuit.

Trending Assets

Top 300 Performers

IMX had another large day, gaining 20.1%. Activity in this name spiked yesterday with a huge increase in volume and OI.

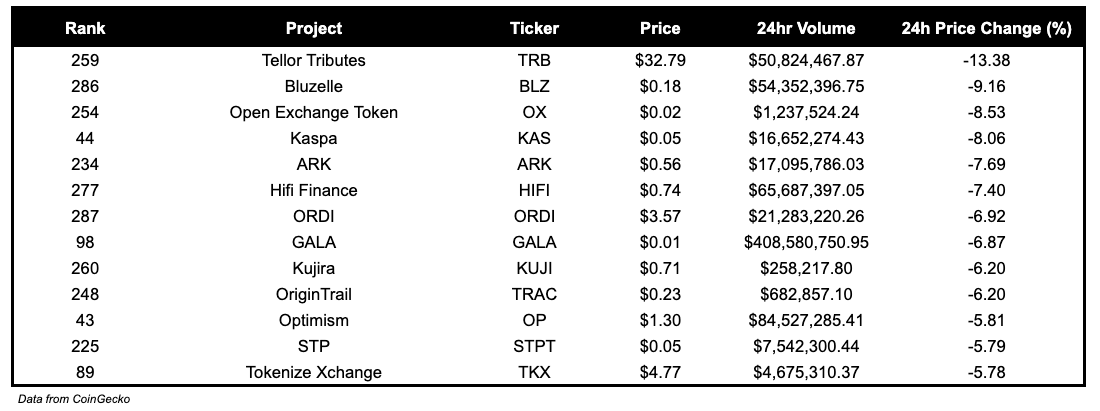

Top 300 Losers

OX has continued to drawdown even post their unlocks, down 8.5% today. Binance centric coins pump and dump coins such as BLZ, TRB and ARK all performed poorly today.

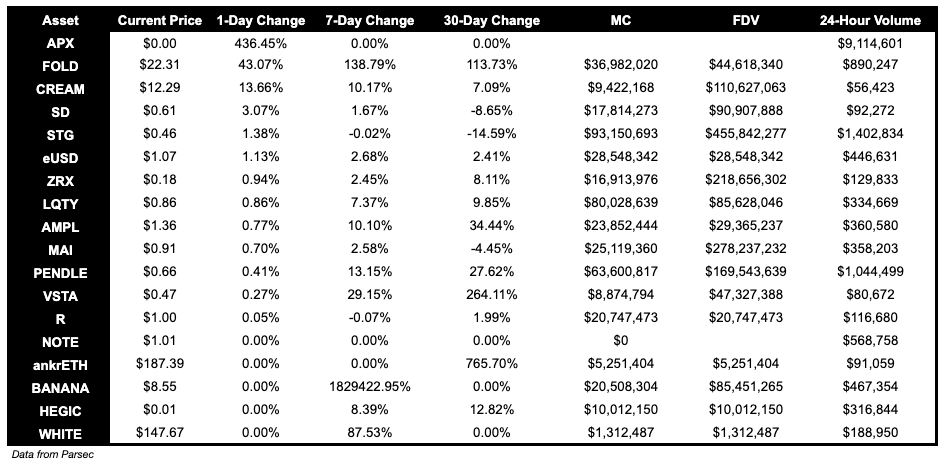

Below $100M MC by performance, on chain

APX, a coin launched using only AI gained 430% in the past day on $9M in volume.

FOLD and CREAM gained 43% and 14%, respectively. This is likely due to the joint launch of their Liquid Staking Token, mevETH. This launch is scheduled for tomorrow.

Above $100M MC by performance, on chain

Merit Circle and IMX were strong today, both coin we highlighted yesterday.

Above $1B MC by performance, on chain

MKR continues to be the strongest large cap, having recently surpassed it’s end of July peak. The re-adjustment of the EDSR max cap to 5% and the sustained high Federal funds rate has made make a cash cow that is buying back and LP’ing the MKR token on-chain.

TVL

TVL Above $10M

Over the past day:

Dual Finance, options on Solana, TVL grew by 31.91%.

Railgun, multichain privacy protocol, TVL grew by 4.79%.

Portal, multichain bridge, TVL grew by 4.14%.

Fees

Fees earned are down for all protocols on the top 10 list today, apart from MakerDAO, whose fees earned has remained constant.

Articles / Threads

Kwenta has released Staking V2 with escrow transferability and an unstaking cooldown period.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.