Daily Notes: 21-07-2023

Developments

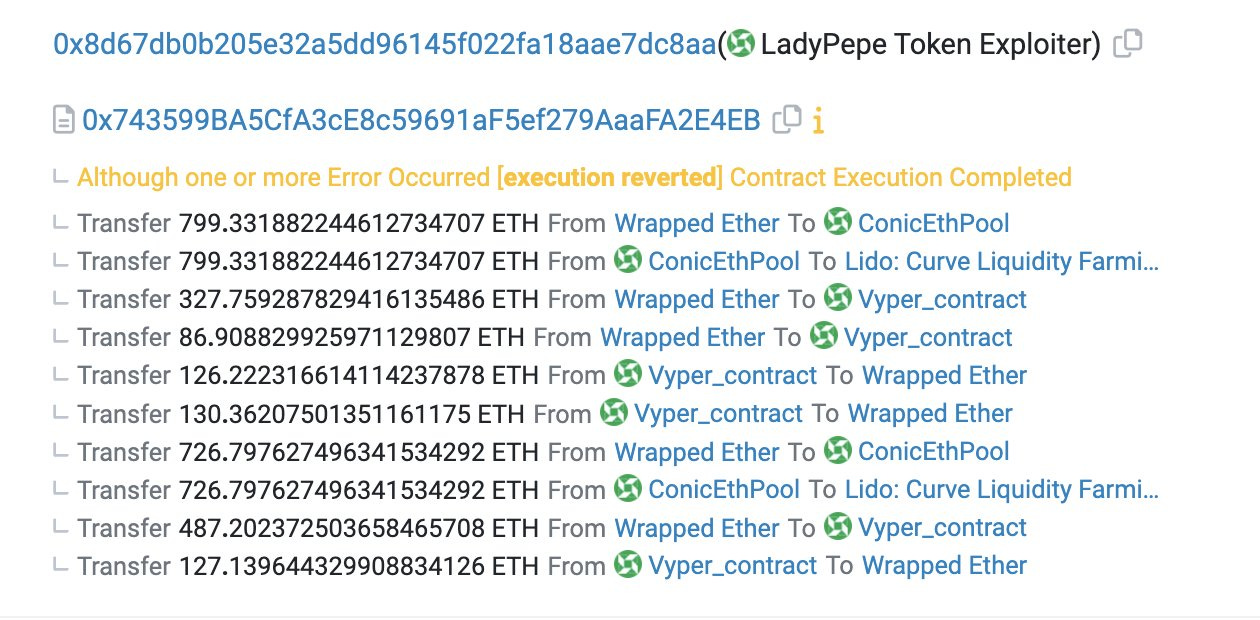

Conic Finance has been exploited for $3M. The team announced that the attack was due to:

“The root cause was a re-entrancy attack that was able to be performed because of a wrong assumption as to what address is returned by the Curve Meta Registry for ETH in Curve V2 pools”

crvUSD, a collateralized-debt-position stablecoin pegged to the USD, has surpassed $140M TVL and $100M in collateral backing it.

Manifold Finance, mevETH and Cream ETH

Cream ETH multisig, where all the underlying ETH for crETH2 is held, moved 2848 ETH (worth approximately $5.4M) to a new multisig largely controlled by Manifold Finance.

This sent ETH is the remainder of the ETH to be deposited to be controlled by Manifold Finance. Manifold Finance recently announced that these deposits will be used for mevETH. mevETH is an MEV-optimized, natively multichain LST.

Optimism has decided to accept and work through two proposals by O(1) Labs and RISC Zero to add zk-proofs to OP chains.

Camelot’s ARB Grant Request Possibly Unsuccessful

The vote, scheduled to conclude on July 21, shows that only 21% are in favor of the grant, while 41% of the cast votes are against and 29% have abstained from granting Camelot $11 million worth of ARB native tokens.

Nexus Mutual, a DeFi coverage protocol, recently conducted one of its largest on-chain swaps, converting 14,390 ETH (equivalent to $27.3 million) from its "safety insurance module" into Rocket Pool's rETH liquid staking token.

The swap was facilitated using the CoW Swap DEX aggregator, as part of Nexus Mutual's strategy to diversify its holdings.

Trending Assets

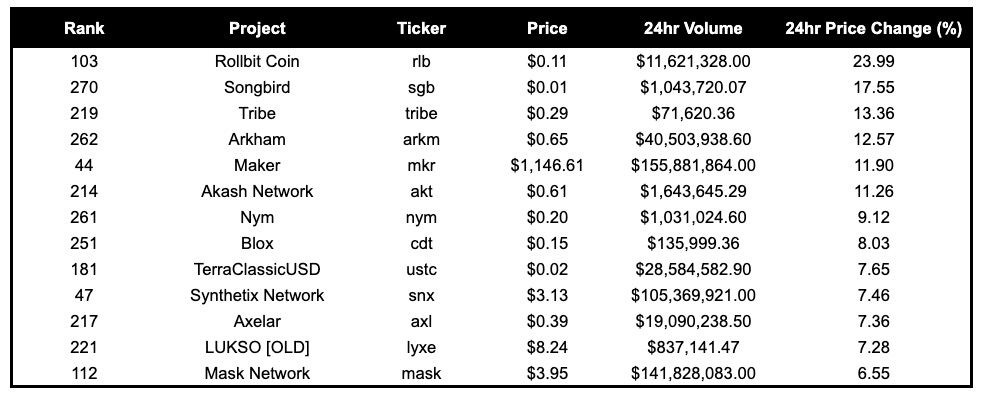

Coingecko Top Winners

RLB, up 23.99%, ARKM, up 12.57% and MKR, up 11.90%, are some relevant top performers of the day.

Coingecko Top Losers

BAND (an oracle coin) which was the top performer yesterday, is down -7.44% today.

Other relevant under performers are GMX, down 5.81% and RPL, down 5.03%.

Below $100M MC by performance, on chain

The top performers for tokens below $100M MC is PC, up 86.63%, and REPv2, up 26.40%.

Relevant top performers for tokens below $100M MC are COLLAB, up 65.28% and UNIBOT, up 8.02%.

Above $100M MC by performance, on chain

For coins above $100M MC, MKR is the top performer, up 12.94% on the day. MKR is followed by RLB, up 9.45% and GNS, up 5.98$.

Notably, GNS release a tokenomics upgrade plan yesterday.

Above $1B MC by performance, on chain

For coins above $1B MC on chain, SNX , up 5.53% and UNI, up 5.11% are top performers.

TVL

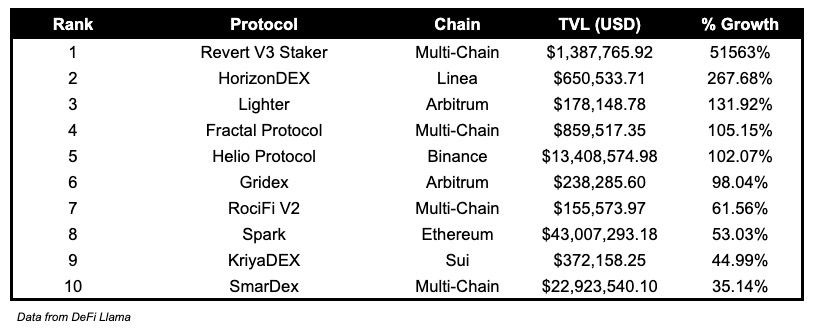

All Protocols

Over the past day:

Lighter, a decentralized order book exchange on Arbitrum, grew its TVL by 131.92%.

Fractal, an omni-chain fixed yield protocol, grew its TVL by 105.15%.

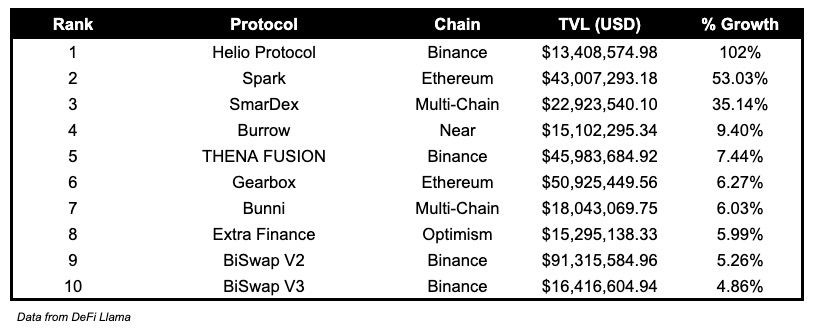

Protocols with TVL above $10M

Over the past day:

Helio Protocol, CDP and stablecoin provider on BSC, grew its TVL by 102%.

Spark, lending using MakerDAO on Ethereum, grew its TVL by 53.03%.

Fees

Ethereum continues to be the highest fee earner ($6.6M), followed by Lido and Tron.

Notably, Convex Finance ($465.4K, up 557%) and Frax Finance’s's frxETH ($336K) are both part of the top 10 highest fee earners of the day.

Governance Proposals

Updating of Grants Management Committee (RPIP-26)

Proposal to eliminate the retrospective award cap, change award cycle updated from quarterly to monthly and establish a part-time grants management committee administrator position