Daily Notes 20-09-2023

Developments

Optimism has entered into a private token sale of approximately 116M OP tokens, split among seven purchasers, for treasury management purposes. The tokens are subject to a two-year lockup.

The tokens come from the Unallocated portion of the OP Token treasury, and are part of the Foundation’s original working budget of 30% of the initial OP token supply.

CoinEx will be resuming deposits and withdrawals on their exchange after suffering a $70 million hack supposedly executed by the North Korean Lazarus group. CoinEx also maintains that no user funds were compromised and that the financial losses will be fully covered by the CoinEx User Asset Security Foundation.

Deposits and withdrawals will be restored for BTC, ETH, USDT (ERC20 and TRC20, USDC (ERC20), TRX, LTC, BCH, DODGE, SHIB and BNB tomorrow on September 21st at “8:00 UTC” and will gradually resume the deposit and withdrawal services for other assets.

The Gro DAO has voted to unwind the Gro protocol and DAO. The $5.37 million treasury will be distributed to all who deposit their $GRO to a redemption contract within 4 weeks.

A $180,000 budget will be allocated to Groda while they focus on unwinding the protocol from October 3rd to January 3rd 2024.

Note that Gro users will be able to withdraw from GVT, PWRD and Pools indefinitely and “All pods support users in exiting the protocol until January and then dissolve together with the Groda Pod.”

Base has open-sourced their security monitoring system, Pessimism, which is designed to quickly detect potential threats and also assess the health of a chain. Pessimism is now available for EVM) compatible chains as well as chains built using the OP stack.

Pessimism allows for the identification and mitigation of security threats and vulnerabilities by detecting unauthorised access attempts, unusual behaviour, and potential breaches.through monitoring smart contract events, withdrawal events (bridging), and enforcing balance boundaries for privileged addresses.

The system can also monitor the performance of a chain through metrics like response time, throughput and error rates to alert developers of malfunctions.

Balancer has regained control of their sites after EuroDNS, their DNS registrar, was socially engineered and compromised. This update comes through Balancer’s Twitter page. So far, $238,000 of Crypto was stolen.

dYdX’s founder, Antonio Juliano, has announced that its mainnet is expected to launch next month. The founder also states the dYdX chain is “pretty much completely built and in its final stages of testing”.

After deciding to migrate from building a Layer 2 on Ethereum to a Layer 1 blockchain built using Cosmos technology, dYdX chain aims to be a decentralised,but off-chain order book and matching engine that will provide unmatchable throughput scalability and TPS to the order of 1000+ transactions per second.

Grayscale Files for ETH Futures ETF

Grayscale has filed for an Ethereum futures ETF with the SEC. The nature of the future contracts will not require a custodian for the Ethereum and will be managed by Grayscale Advisors LLC.

Grayscale has also previously applied for a spot BTC ETF which is still awaiting approval after the SEC’s previous decision to reject it was overturned.

Trending Assets

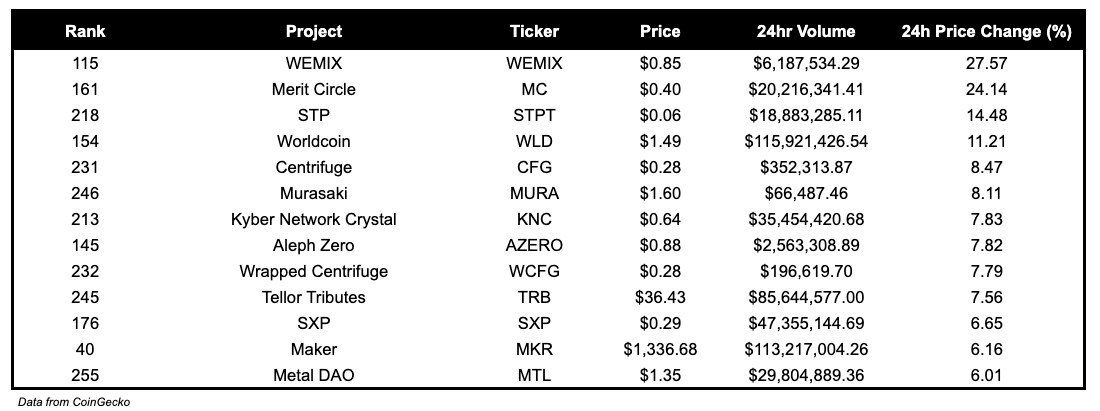

Top 300 Performers

MC had a big day, gaining 24%. This comes as they look set to rebrand to Beam & create their own Avalanche subnet.

Top 300 Losers

Below $100M MC by performance, on chain

ICE, Daniele Sesta’s new project, is up 282.04% over the past day as Daniele Sesta releases ICE tokenomics.

Above $100M MC by performance, on chain

MC, up 18.99%, WLD, up 12.21%, and wCFG, up 11.44%, are the top performers for tokens above $100M MC.

Above $1B MC by performance, on chain

MKR, up 5.17%, performed well today.

TVL

TVL Above $10M

Over the past day:

Octus Bridge, multichain bridge, TVL grew by 36.68%.

Jito, Solana LSD, TVL grew by 13.92%.

Fees

No particularly notable changes in terms of fees earned.

Governance Proposals

Stargate New Oracle Configuration: Google Cloud Oracle

Proposal for Stargate to adopt The Google Cloud Oracle for all of its products (Stargate and TheAptosBridge).

Articles / Threads

GammaSwap is officially live on Arbitrum Mainnet!

GammaSwap which allows users to borrow liquidity from any AMM pool and potentially reduce IL for LPs launched on Arbitrum Mainnet today.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.