Daily Notes: 20-07-2023

Developments

Maker Smart Burn Engine Starts

Makers Smart Burn Engine has been activated. It will purchase MKR tokens using the excess DAI from the Surplus buffer. These acquired MKR tokens are then combined with DAI into a Uniswap v2 liquidity pool.

In the initial three months, the Smart Burn Engine will facilitate buybacks worth an estimated $16 million (485 MKR were bought from the market and added to the LP since Wed 19th July).

Maker had previously paused its buyback and burn program on February 1, 2022. Prior to the termination of the program, the protocol was generating an annual profit of $20 million in the month leading up to the end of the program. Currently, the profit rate has quadrupled to $85 million (thanks to interest rates and Makers RWA allocation), with half of it being allocated for the repurchase of MKR tokens following the proposal of the Smart Burn Engine.

Thirteen hours ago, Dragonfly Capital transferred 12 million $1INCH tokens, worth about $4.12 million, to Coinbase and OKX.

They previously secured 50 million $1INCH tokens in two rounds, on January 3, 2022, and July 18, 2023.

Before these transactions, they had already moved 38 million $1INCH tokens, valued at $15.03 million, to Genesis Trading OTC, Coinbase, and OKEx.

Vertex Protocol Overtakes GMX In the Past 24hrs

Vertex Protocol, a hybrid orderbook-AMM margin DEX on Arbitrum, has overtaken GMX, Synthetix and Kwenta in volume over the past 24 hours.

Vertex had $116.03M volume over the last day, followed by Synthetix ($97.14M), Kwenta ($95.94M) and GMX ($64.74M).

Vertex’s volume has increased by +569% and TVL has increased by 25.95% over the 30 days, likely due to airdrop farmers.

Unibot announced Unibot X, a trading terminal with real-time data powered by Gecko Terminal. Early Access is available to: top 100 UNIBOT Holders, top 100 Users by Bot Txn Volume and 100 random users.

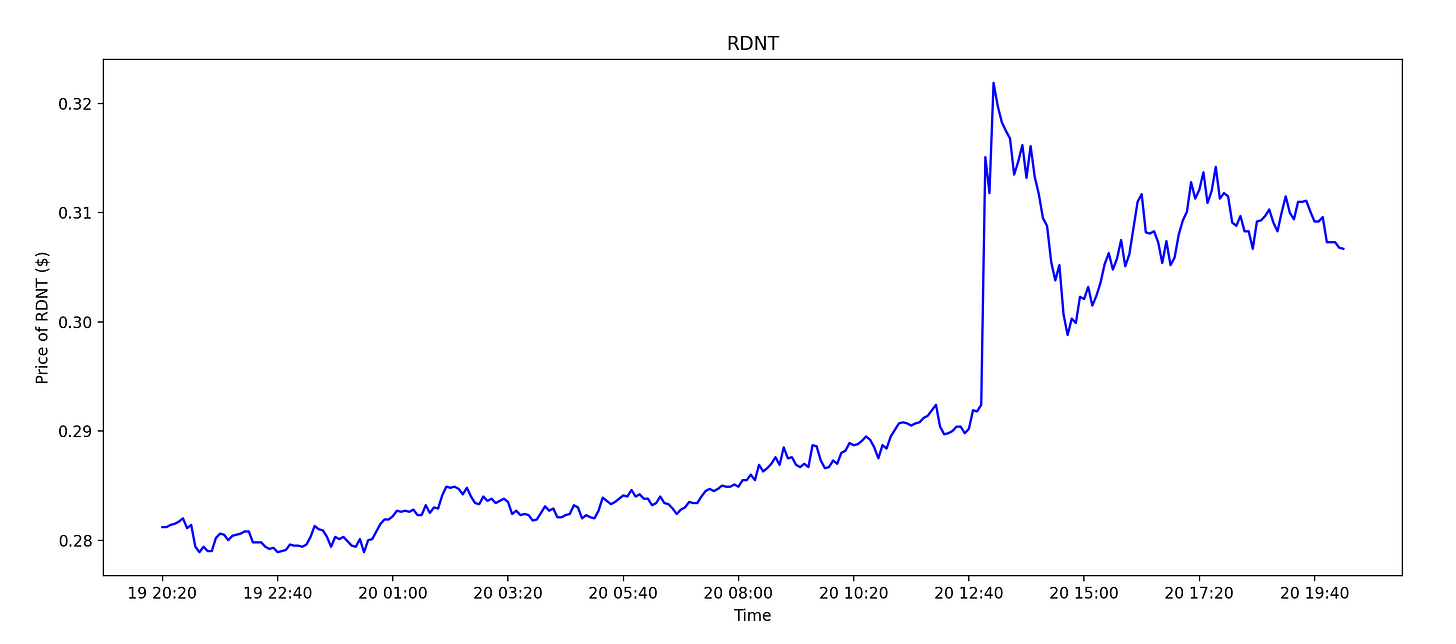

Radiant Capital, an omni-chain lending and borrowing protocol, received a $10 million investment from Binance Labs.

Worldcoin Launches on OP Mainnet

Worldcoins’s World ID and Worldcoin protocol have started their migration to OP Mainnet.

In support of World ID, the Worldcoin protocol has been migrated to Ethereum, with bridges in place for Optimism and Polygon PoS. Most of the Safe wallets have already been rolled out on OP Mainnet, while the remaining wallets will be deployed when users initiate the migration. The World App has started to offer support for Uniswap on OP Mainnet. Furthermore, the World App has been updated to prompt users to start the migration process, which typically takes around 90 seconds on average.

Gains Releases New Tokenomics Plan

Gains has released a new tokenomics plan, targeted to go live in September, where:

Development fund revenue will be redirected to $GNS staking

NFTs and features will be deprecated for $GNS compensation

NFT bot revenues will be redirected to GNS staking (80%) and oracles (20%)

Total supply will increase by 4.36M (up 14%)

$GNS revenue-capture share will increase from 33% to 60%

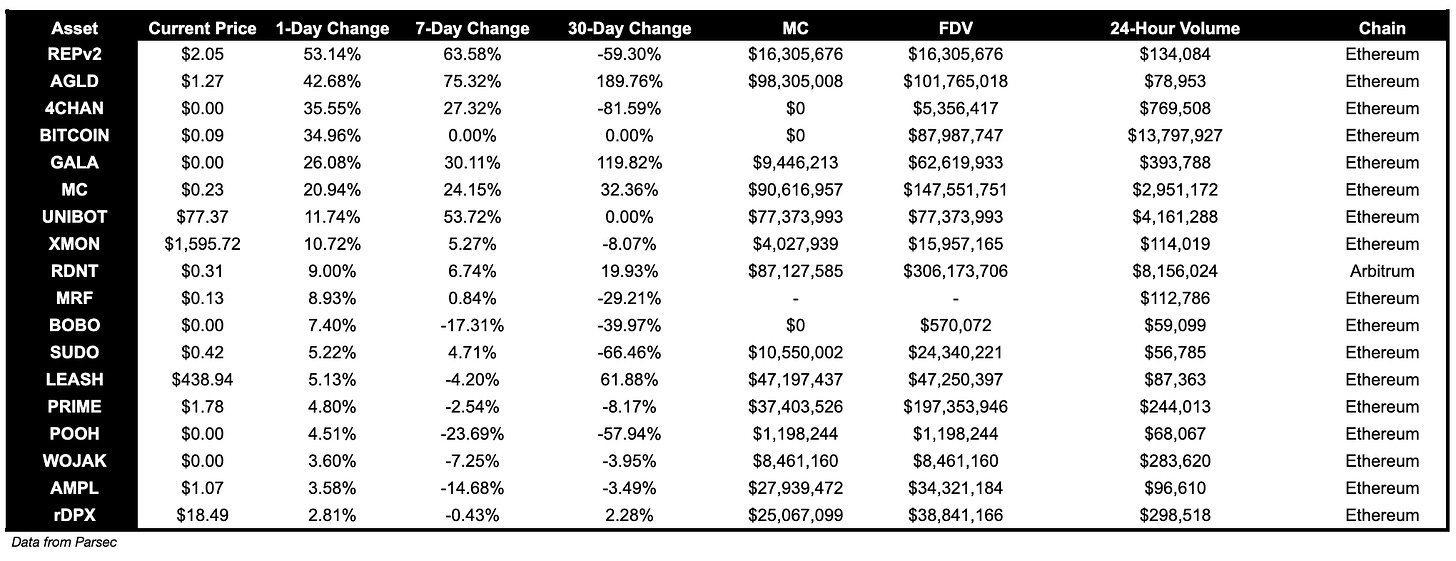

Trending Assets

Below $100M MC by performance, on chain

REPv2, up 42.68%, and AGLD, up 42.68%, are the top performers of the day for coins below $100M MC.

Notably, RDNT is up 9.00% following news that Binance Labs will be investing into Radiant Capital.

Above $100M MC by performance, on chain

BAND (an oracle coin), up 17.44%, is the top performer amongst coins above $100M MC on chain.

Additionally, SNX, up 6.84%, MKR, 5.03%, and DYDX, up 4.50%, have performed well.

Above $1B MC by performance, on chain

LINK, up 17.27%, and MATIC, up 4.15%, are the top performers on chain for coins above $1B MC.

Notably, amongst the top performers, LINK has had the highest volume (excluding stablecoins).

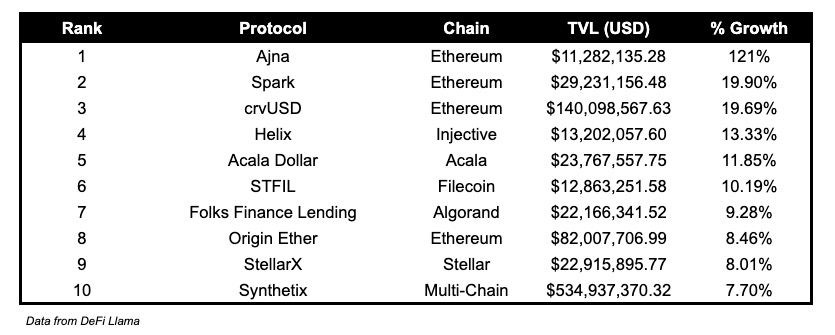

TVL

Protocol with TVL above $10M

Ajna’s (Permissionless Lending, Ethereum), TVL has grown by 121%

Spark’s (lending using MakerDAO, Ethereum), TVL has grown by 19.90%

crvUSD’s TVL has grown by 19.69%.

Fees

Highest fees earned today were by Ethereum, at $7.18M. This is 24.9% higher compared to yesterday. Ethereum is followed by Lido and Tron in fees earned.

Governance Proposals

[TEMP CHECK] GHO Stability Module

Proposal to implement a Peg Stability Module (PSM) (a contract that enables the seamless conversion of two tokens at a predetermined ratio) for Gho.

Articles / Threads

Injective Teams Up with Espresso Systems

Injective is collaborating with Espresso Systems, a protocol helping to create decentralized rollup sequencers.

This collaboration is to decentralize the rollups built within Injective’s ecosystem, most notably Cascade,a Solana SVM rollup for Injective and the broader IBC ecosystem.

Y2K’s ‘GTRADE’ Gains PnL Vault

Y2K is launching their ‘GTRADE’ Vaults, which will be used to protect gDAI holders from losses resulting from big profit wins on Gains.