Daily Notes: 20-06-2023

Developments

BTC Outperformance

BTC had a huge day, rallying 5.5% in 24 hours. Many are speculating this is a delayed reaction to the Blackrock BTC ETF news & there are some confirming data points of an institutional bid:

Large BTC spot volumes on Coinbase, the go-to exchange for US institutions

GBTC discount closing greatly

CME futures basis trading up all day [h/t @thiccythot - post]

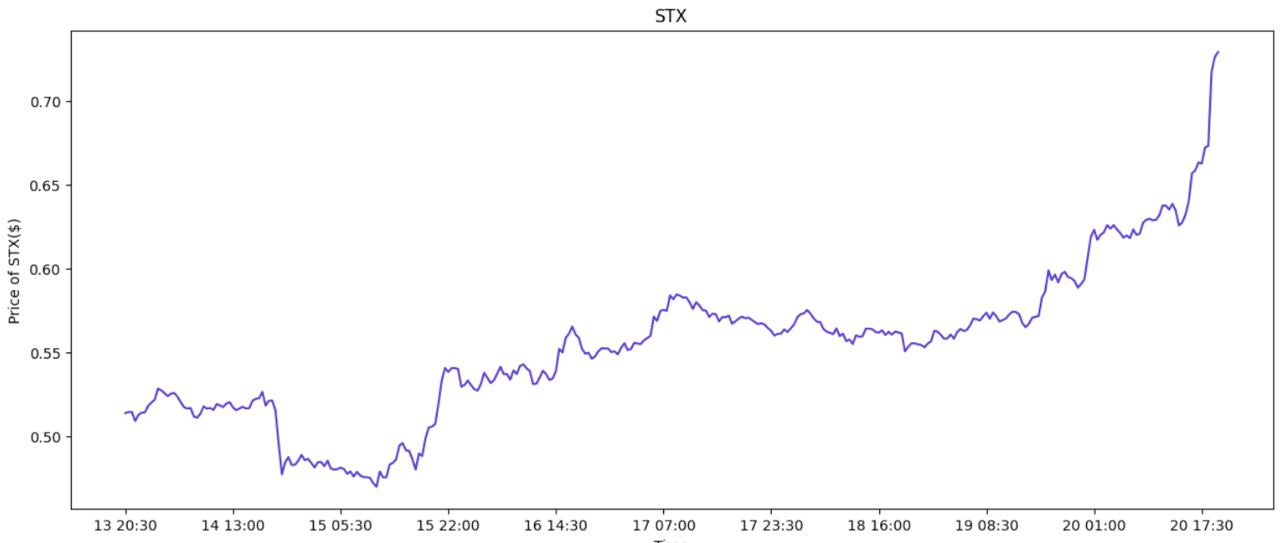

STX, a Bitcoin scaling solution acted as a higher beta asset to this BTC move.

Silk Road Related BTC Movements

A wallet associated with the US Government seized BTC from Silk road / James Zhong moved 1,500 BTC today. We are still trying to confirm whether this was actually the US Govt or a mislabel.

Some useful sources:

https://twitter.com/Dogetoshi/status/1671242496771334144

https://twitter.com/jconorgrogan/status/1671257631384543234

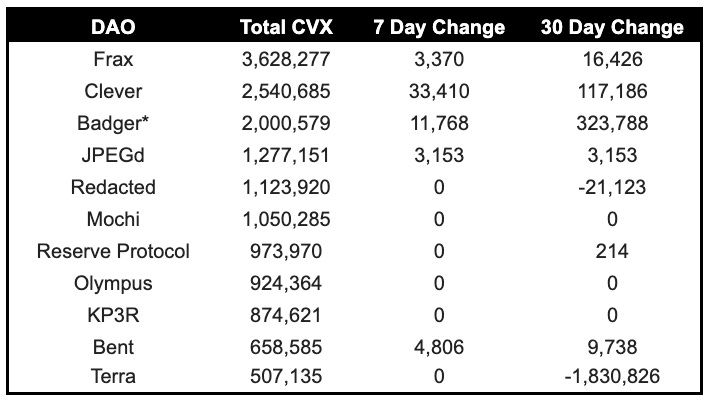

Sam Altman-backed Reserve makes $20m Curve Wars power play

Stablecoin issuer Reserve Protocol has been buying more voting power to increase liquidity for its stablecoins.

The $20M investment is the stablecoin platform’s largest so far.

Reserve is already the 7th largest holder of CVX

stETH Maker Collateral

stETH has started closing in on overtaking ETH as collateral in MakerDAO, as it reaches 933K.

Polygon PoS Upgrade to ZK Validium

A proposal was published to upgrade Polygon PoS to a zkEVM validium.

Validiums are scaling solutions that use off-chain data availability and computation designed to improve throughput by processing transactions off the Ethereum Mainnet.

As a zkEVM validium, Polygon PoS would inherit Ethereum's security

Crypto Exchange Backed by Citadel Securities, Fidelity, Schwab Starts Operations

EDX Markets launched its digital assets market today.

EDX recently concluded a funding round attracting strategic investors such as Miami International Holdings, DV Crypto, Global Trading Strategies, GSR Markets and Hudson River Trading.

EDX currently only offers trading of BTC, ETH, LTC and BCH.

Deutsche Bank applies for digital asset custody license

Deutsche Bank has reportedly applied for a digital asset custody license to the German financial regulator BaFin.

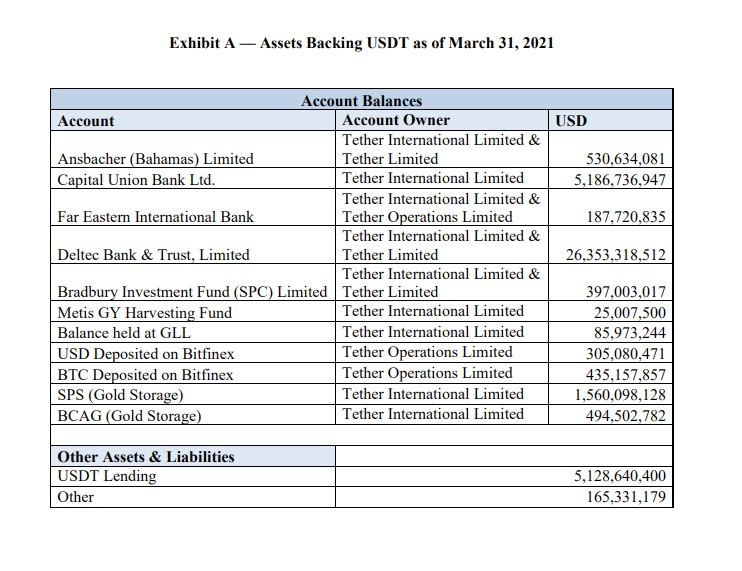

Coindesk’s Tether Report Published

On March 31, 2021, Tether claimed it had more than $35.5 billion in U.S. dollar equivalents at these institutions.

Additionally, $5.1 billion was detailed under "USDT lending" and other assets, totaling $40.6 billion in assets, almost matching the 40.8 billion USDT in circulation at the time.

Trending Assets

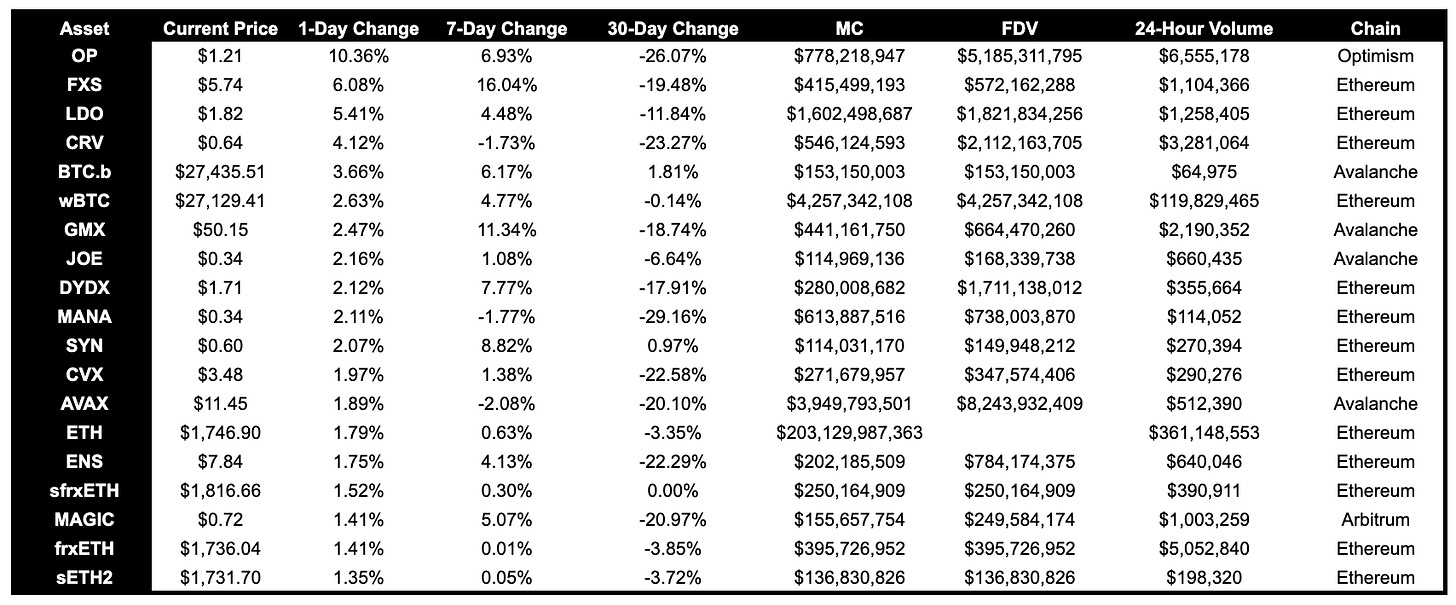

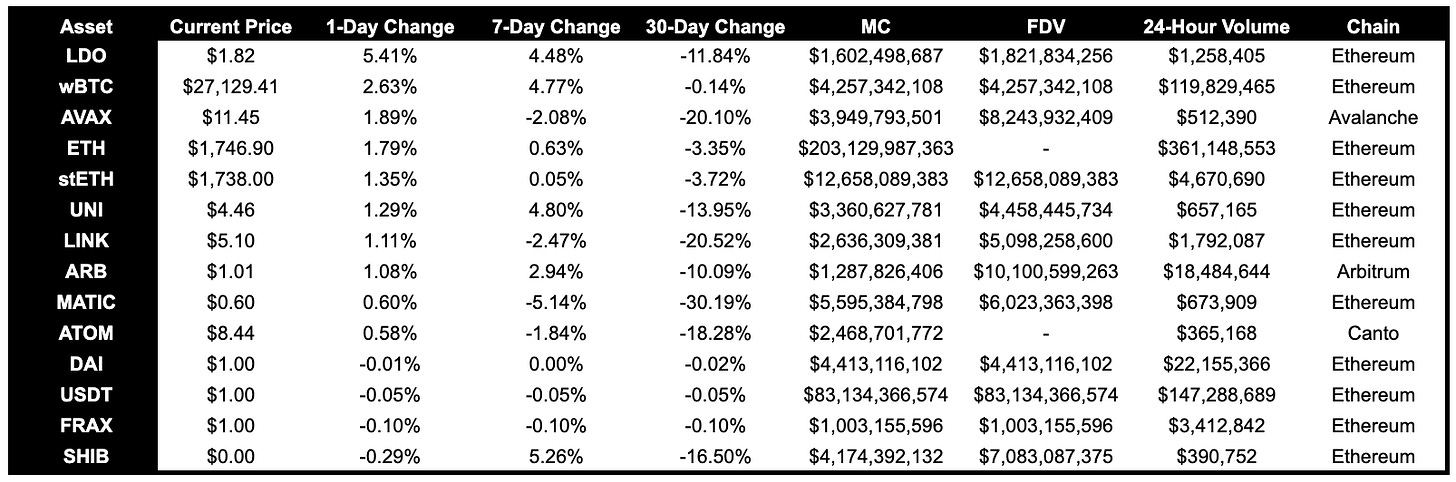

Above $100M MC by performance

OP has been performing strongly today, with a price change of 10.36%. This might be related to BNB Chain building their L2, opBNB, on the OP Stack.

FXS, LDO and CRV have performed well over the past day. Notably, FXS is up 16.04% over the past week.

Above $1B MC by performance

LDO and wBTC have performed well over the past day, with LDO leading the charge, with a price change of 5.41%.

In addition to LDO and wBTC, UNI and SHIB have also performed well over the past week.

Trending Contracts

Nothing particularly notable in trending contracts.

Coingecko Trending Assets

Matic

Blockstack (STX)

Apecoin

Pepe

Trust Wallet Token

Optimism

Sui

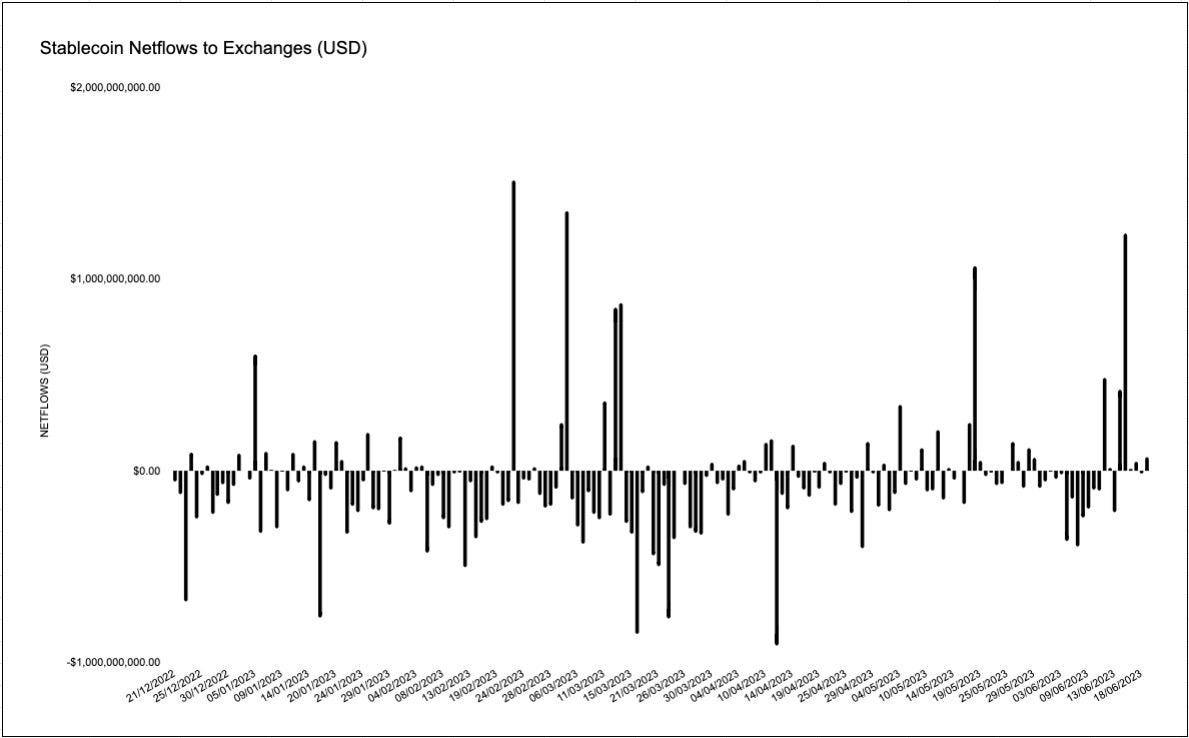

Stablecoin Net Flows

We are seeing small net inflows into exchanges, of $70.8M, after a weekend of large outflows.

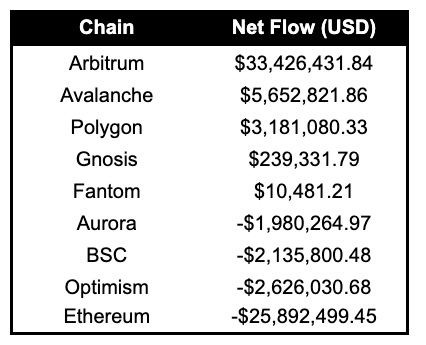

We are seeing high net stablecoin inflows to Arbitrum (+ $33.4M) and moderate net inflows to Avalanche (+ $5.65M) and Polygon (+ 3.181M). There are large net outflows from Ethereum (- $25.9M) and moderate net outflows from BSC (- $2.14M), Aurora ($1.98M) and Optimism (- $2.63M).

TVL Growth

Equilibria, yield boost protocol built on Pendle, continues to grow rapidly in TVL.

Sperax, a stablecoin and yield protocol, Ramses, a ve(3,3) DEX, and Ribbon Earn, Ribbon’s lending product, are some relevant protocols that saw high TVL growth over the past 24 hours.

Governance Proposals

[TEMP CHECK] GHO Liquidity Pools

Proposal to decide on what liquidity pools to support GHO launch.

The proposal states that since the largest trading pairs in DeFi are ETH and USDC, they favor creating a USD stable coin liquidity pool and a LST / GHO liquidity pool.

[GIP-63] Add Curve v2 farms to WETH pool

Proposal is to add Curve v2 pools into the Allowed List / AllowedContracts for Credit Account users, applicable to WETH pool.

GMX: Updating Multiple Point System

Proposal is to adjust multiplier points (MPs), such that MPs accumulated in a wallet beyond a set % of staked esGMX/GMX tokens will accrue in the account but not be eligible for fees.

Articles / Threads

Introducing Maverick Protocol’s Voting-Escrow Model

The MAV token is a utility and governance token that can be used to stake, vote, and direct community and ecosystem incentives.

All of these utilities are based on a voting-escrow model, where MAV holders can stake their MAV to receive veMAV.

Vertex will add spot pools to its interface, where users can select a pool and provide liquidity.

LP Positions can be used as margin for trading and borrowing

New Protocols

Parabol Fi

Description: A new stablecoin ecosystem that natively embeds risk-free return

Twitter: https://twitter.com/parabolfi

Website: parabol.fi

Raman Finance

Description: Raman Finance will release all LSD-backed stablecoin liquidity.

Twitter: https://twitter.com/Raman_Fi

Website: http://raman.finance/

Lumin Finance

Description: A decentralized Peer-to-Peer fixed-rate lending and borrowing protocol launching on Arbitrum.

Twitter: https://twitter.com/LuminProtocol

Website: https://lumin.finance/

Mori Finance

Description: Next-gen stable asset protocol on Ethereum. Generate low vol stable assets without loss by collateralizing ETH.

Twitter: https://twitter.com/Mori_Finance

Website: n/a